Jack Delano Shopton locomotive shops, Fort Madison, Iowa March 1943

The insanity doesn’t just continue, it intensifies. The overriding idea is still that the more companies and individuals borrow, the better the economy goes. But that is nowhere near true. It may have been at some point in the past, but not now, not with debt levels at historic highs. Today’s problem is not that there is not enough credit or money available, as central banks try to make you believe, but that people are not spending what they have. Individuals are either maxed out or scared to be left with nothing, and companies see no opportunities for investing in productive projects (besides, they may well be maxed out too).

Credit can play a functional and beneficial role in a society if an individual or company borrows at 5% and puts the money to work towards the production of something with an added value of 10%. That works, because the risk is real. At a 5% rate, you know you will need to do actual work to pay back your loan. And a 10% return means there are things to invest in that are productive. A 1% rate only papers over the fact that there are no productive investment opportunities left, and that they need to be created artificially to prevent the public from finding that out. The entire economy seems to take place on paper – or screens – only. But that’s of course an illusion. We need physical food and physical shelter.

Credit is neither beneficial not functional when companies borrow at 1% and only buy back their own shares or purchase/merge with competitors. Companies today don’t borrow because they feel optimistic about the economy, they don’t borrow because they see productive opportunities at the horizon. They do so only because, to paraphrase Obama, they can. And because financial trickery is the only way to make people think they are healthy.

In the present circumstances what this means is that because debt nevertheless increases at a rapid clip, the economy deteriorates just as fast. And you won’t like what you see when we come out at the other end. The economy is completely hollowed out from the inside, while we’re looking only at the facade. That’s why there no longer is a connection between economic performance and stock markets. In fact the stock markets have become the de facto economic performers. But nothing is being produced, or at least not nearly enough. And not nearly enough is being bought to keep the wheels spinning either.

Today it was announced that Eurozone industrial production fell 1.1%, but stocks just keep on rising. And much more of the same is in the pipeline:

Draghi Seen Delivering $1 Trillion Free Lunch to Banks

Mario Draghi’s newest stimulus tool will hand banks more than €700 billion ($950 billion) of cheap funding, economists say. The European Central Bank president’s targeted lending program for banks will boost credit for the real economy as planned, and at the same time help keep the financial system flush with cash, according to the Bloomberg Monthly Survey of 45 economists. Draghi may address the topic today when he testifies at the European Parliament in Strasbourg for the first time since elections in May. The ECB has identified lending to companies and households as a key weakness in the euro area’s fragile recovery.

The so-called TLTRO program, part of a wider package of measures announced in June, offers as much as four years of low-cost funding tied to bank lending that Draghi said this month could ultimately provide as much as €1 trillion. “The take-up should be large – the money is cheap and banks should feel no stigma about accepting a free lunch,” said Alan McQuaid, chief economist at Merrion Capital in Dublin, who predicts banks will take the maximum available. “With any luck, Draghi’s next problem will not come until 2018, when €1 trillion needs refinancing.”

The ECB is blind or borderline criminal. Blind, because lending is not the key weakness, spending is. Borderline criminal, because by treating lending the way it does, it pushes European economies ever further into their separate and shared quagmires. The net effect of its actions is that what it has labeled ‘systemic banks’ get to survive for another day, but with the trillions of debt hidden in these banks, that survival, if you want to call it that, can – of necessity – only be temporary. And that temporary extension of ‘life’ comes at a great price to the rest of the economy, where people such as you and I reside.

The reason the ECB and the Fed are involved in these highly dubious actions, and have been from 7 years running now, can only be this: they know – or at least strongly fear – that the debts in the banks are so enormous they could make the entire economic system wobble if not crumble, and the ‘leaders’ don’t want to touch that with a 10-lightyear pole. In doing what they do, however, they are throwing away a bit more of your children’s futures every day. For 7 years now.

China’s policies are much like those in the west, but the underlying reasoning in somewhat different. China has undertaken its $25+ trillion stimulus not just for its – state-owned – banks, but for its entire economic system. Catching the fall of an economy that grows, or used to grow, at double digit annual rates is not the same as propping up one that used to grow at 2-3%. The difference lies in the expansion. China’s meteoric expansion brought it a lot of seemingly positive things, but much of it was realized through a highly leveraged and increasingly shadow bank financed system (if you can call it a system).

When Lehman and Bear Stearns happened, Beijing decided to open the spigots, and it hasn’t looked back since. And why should it when Europe and the US didn’t either? There are tens of thousands of Xi’s and Li’s who have nightmares of having their heads chopped off by angry mobs when the latter find out that the whole expansion was nothing but a magic trick from the very start. Like Draghi and Yellen and Merkel and Obama, they’re hell bent on keeping up appearances as long as they can, or at least until they’re out of office.

China exports the inflationary expansion of its money supply, and the Chinese use this virtual yuan to buy up real assets in the real economies of America, Europe and Africa. In the rich world, the idea is that this is alright, because it drives up general price levels, and therefore leaves the impression that economies are doing well. But in the meantime, your world, and the homes and companies around you, are being bought up with what amounts to little more than Monopoly money. Then again, that’s what your own money has become too.

Secret Path Revealed for Chinese Billions Overseas

For years, wealthy Chinese have been transferring billions worth of their money overseas, snapping up pricey real estate in markets including New York, Sydney and Vancouver despite their country’s currency restrictions. Now, one way they could be doing it is clearer. Last week, when China Central Television leveled money-laundering allegations against Bank of China Ltd., the state-run broadcaster’s report prompted the revelation of a previously unannounced government program that enables individuals to transfer their yuan and convert it into dollars or other currencies overseas.

Offered by some banks in the southern province of Guangdong, across the border from Hong Kong, the trial program was introduced in 2011 for overseas property purchases and emigration and doesn’t constitute money laundering, Bank of China said in a July 9 statement. The transfers were allowed by regulators and reported to them, the bank said. “What it shows is the government has been trying to internationalize the renminbi for a lot longer than we thought,” Jim Antos, a Hong Kong-based analyst at Mizuho Securities Ltd., said by phone, using the official name for China’s currency and referring to policy makers’ long-stated goal of allowing the yuan to become freely convertible with other currencies. “I’m rather encouraged by this news because this is the way they need to go.”

Even the BIS, Bank for International Settlements, which should certainly not,at any time and in any way, be confused with the Salvation Army, starts waving bright red alarm banners about what goes on. And though I do know that they’re much closer to Draghi and Yellen then they are to you and me, it’s still interesting to see some of what they have to say, courtesy of Ambrose Evans-Pritchard:

BIS Chief Fears Fresh Lehman From Worldwide Debt Surge (AEP)

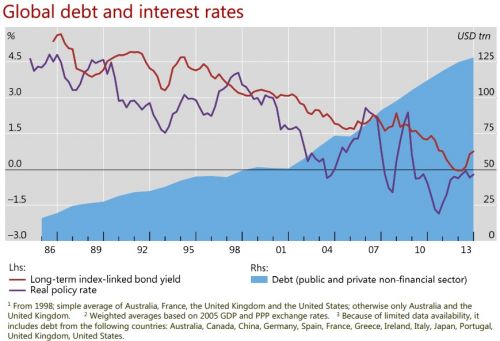

The world economy is just as vulnerable to a financial crisis as it was in 2007, with the added danger that debt ratios are now far higher and emerging markets have been drawn into the fire as well, the Bank for International Settlements has warned. Jaime Caruana, head of the Swiss-based financial watchdog, said investors were ignoring the risk of monetary tightening in their voracious hunt for yield. [..]

Mr Caruana said the international system is in many ways more fragile than it was in the build-up to the Lehman crisis. Debt ratios in the developed economies have risen by 20 percentage points to 275% of GDP since then.

Companies are borrowing heavily to buy back their own shares. The BIS said 40% of syndicated loans are to sub-investment grade borrowers, a higher ratio than in 2007 [..] The disturbing twist in this cycle is that China, Brazil, Turkey and other emerging economies have succumbed to private credit booms of their own, partly as a spill-over from quantitative easing in the West.

Their debt ratios have risen 20 percentage points as well, to 175%. Average borrowing rates for five-years is 1% in real terms. This is extremely low, and could reverse suddenly. “We are watching this closely. If we were concerned by excessive leverage in 2007, we cannot be more relaxed today,” he said.

Volatility has dropped to an historic low. European equities have risen 15% in a year despite near zero growth and a 3% fall in expected earnings. The cyclically-adjusted price earnings ratio of the S&P 500 index in the US reached 25 in May, six points above its half-century average.

Emerging markets have racked up $2 trillion in foreign currency debt since 2008. They are a much larger animal than they were during the East Asia crisis of the late 1990s, so any crisis would do more damage. “The ramifications would be particularly serious if China, home to an outsize financial boom, were to falter,” it said. BIS officials doubt privately whether China can avoid a ‘hard landing’, fearing that the extreme credit growth over the last five years must lead to a financial reckoning.

“Systemic financial crises do not become less frequent or intense, private and public debts continue to grow, the economy fails to climb onto a stronger sustainable path, and monetary and fiscal policies run out of ammunition. Over time, policies lose their effectiveness and may end up fostering the very conditions they seek to prevent,” it said.

Basel’s lonely call for discipline pits it against the Fed, the Bank of Japan, the Bank of England, and even Frankfurt these days. It prompted an unusually piquant riposte from London earlier this month. “Has monetary policy aided and abetted risk-taking? I hope so. That’s why we did it,” said the Bank of England’s chief economist Andy Haldane. “It is good to have the debate,” said Mr Caruana gamely. Yet he refuses to back down. “There is something strange about fighting debt by incentivizing more debt.”

Just as vulnerable to a financial crisis as in 2007, but with far higher debt ratios. In many ways more fragile than in the build-up to the Lehman crisis. 40% of syndicated loans are to sub-investment grade borrowers (i.e. a hair short of subprime). And indeed, “There is something strange about fighting debt by incentivizing more debt.” In fact, not so much strange as it is stupid, blind, or criminal.

It would be good if we all realize one thing: there is no economic growth; the only thing that grows is the debt (aka credit). If time is money, then we are borrowing money to borrow time. But time is not money: it doesn’t grow, you can’t get more of it, and when you waste it, you can’t get more of it; once spent, it’s gone.

In other words, we can’t really borrow time, that’s as much of a delusion – intentional or not – as debt being able to cure or economic ills today. And because we continue to borrow more, and then even more, anyway, our economies must necessarily deteriorate as fast as we borrow. Just not at the same rate for everyone: corporations can borrow at 1%, but you can’t.

So if present policies serve one purpose after all, it’s to increase inequality. Still, when it comes to inequality, you ain’t seen nothing yet; just wait and see what happens when interest rates start to rise and all the debt must be serviced. The too big to fail banks won’t be called upon to do that, it would make them fail; instead, you and yours will have the honor.

• BIS Chief Fears Fresh Lehman From Worldwide Debt Surge (AEP)

The world economy is just as vulnerable to a financial crisis as it was in 2007, with the added danger that debt ratios are now far higher and emerging markets have been drawn into the fire as well, the Bank for International Settlements has warned. Jaime Caruana, head of the Swiss-based financial watchdog, said investors were ignoring the risk of monetary tightening in their voracious hunt for yield. “Markets seem to be considering only a very narrow spectrum of potential outcomes. They have become convinced that monetary conditions will remain easy for a very long time, and may be taking more assurance than central banks wish to give,” he told The Telegraph. Mr Caruana said the international system is in many ways more fragile than it was in the build-up to the Lehman crisis. Debt ratios in the developed economies have risen by 20%age points to 275pc of GDP since then.

Credit spreads have fallen to wafer-thin levels. Companies are borrowing heavily to buy back their own shares. The BIS said 40pc of syndicated loans are to sub-investment grade borrowers, a higher ratio than in 2007, with ever fewer protection covenants for creditors. The disturbing twist in this cycle is that China, Brazil, Turkey and other emerging economies have succumbed to private credit booms of their own, partly as a spill-over from quantitative easing in the West. Their debt ratios have risen 20%age points as well, to 175pc. Average borrowing rates for five-years is 1pc in real terms. This is extemely low, and could reverse suddenly. “We are watching this closely. If we were concerned by excessive leverage in 2007, we cannot be more relaxed today,” he said. “It may be the case that the debt is better distributed because some highly-indebted countries have deleveraged, like the private sector in the US or Spain, and banks are better capitalized. But there is also now more sensitivity to interest rate movements.”

Old Buddhist conundrum: if traders are broke, are they still traders?

• Traders Flood US With $3.4 Trillion of Bond-Auction Demand (Bloomberg)

The intensifying debate over when the Federal Reserve raises interest rates is little more than a sideshow when it comes to the ability of the U.S. to borrow. For all the concern fixed-income assets will tumble once the central bank boosts rates, the Treasury Department still managed to get investors to submit $3.4 trillion of bids for the $1.12 trillion of notes and bonds sold this year, according to data compiled by Bloomberg. That represents a bid-to-cover ratio of 3.06, the second-highest on record and up from 2.88 in all of last year. Attracting investors is critical for the U.S. as it finances a debt load that has more than doubled to almost $18 trillion since before the financial crisis. The appeal of Treasuries was on display last week as benchmark 10-year notes rallied the most since March while investors sought a haven amid rising concern over the health of a Portuguese bank.

“There are still plenty of needy buyers,” William O’Donnell, head U.S. government bond strategist at Royal Bank of Scotland Group Plc’s RBS Securities unit in Stamford, Connecticut, said in a July 8 telephone interview. “We’ve seen it from all sources,” said O’Donnell, whose firm one of the 22 primary dealers of U.S. debt obligated to bid at Treasury auctions. Behind the demand is speculation the global economy isn’t growing fast enough to allow central banks to easily withdraw from loose monetary policies that have supported bond markets around the world. Barclays Plc, another primary dealer, cut its forecast for worldwide gross domestic product on July 11 to an increase of 3.1% at an annual rate this quarter from 3.4%. U.S. banks own more than $1.9 trillion of U.S. government and agency securities, up from $1.2 trillion in 2008, Fed data show. Foreign investors hold a record $5.96 trillion, more than double their stake of six years ago.

• Draghi Seen Delivering $1 Trillion Free Lunch to Banks (Bloomberg)

Mario Draghi’s newest stimulus tool will hand banks more than €700 billion ($950 billion) of cheap funding, economists say. The European Central Bank president’s targeted lending program for banks will boost credit for the real economy as planned, and at the same time help keep the financial system flush with cash, according to the Bloomberg Monthly Survey of 45 economists. Draghi may address the topic today when he testifies at the European Parliament in Strasbourg for the first time since elections in May. The ECB has identified lending to companies and households as a key weakness in the euro area’s fragile recovery. The so-called TLTRO program, part of a wider package of measures announced in June, offers as much as four years of low-cost funding tied to bank lending that Draghi said this month could ultimately provide as much as €1 trillion.

“The take-up should be large – the money is cheap and banks should feel no stigma about accepting a free lunch,” said Alan McQuaid, chief economist at Merrion Capital in Dublin, who predicts banks will take the maximum available. “With any luck, Draghi’s next problem will not come until 2018, when €1 trillion needs refinancing.” Lenders probably won’t take the full amount, the survey shows. They’ll borrow €305 billion in the first TLTRO rounds this year, compared with an ECB cap of about €400 billion, according to the median estimate of economists. That’ll rise to €710 billion after quarterly operations in 2015 and 2016 tied to new loans, the survey shows. Three-quarters of respondents said the measure will increase credit provision to companies and households in the euro-area periphery. The loans are charged just above the ECB’s benchmark interest rate, currently at a record-low 0.15%.

Yada yada.

• Europe Needs $795 Billion Problem Property Loan Solution (Bloomberg)

European banks and asset managers plan to sell or restructure €584 billion ($795 billion) of riskier real estate as they try to clean up their balance sheets, Cushman & Wakefield Inc. said. The region’s lenders, asset managers and bad banks, such as Spain’s Sareb, sold €40.9 billion of loans tied to property in the first six months, 611% more than a year earlier, the New York-based broker said in a report today. Transactions will reach a record €60 billion this year, Cushman & Wakefield estimates. Lenders such as Royal Bank of Scotland Plc are accelerating loan-portfolio sales as borrowing costs fall from a year ago and economic sentiment improves. Lone Star Funds and Cerberus Capital Management LP are among U.S. investors that are taking advantage as sellers opt to offer bigger groups of loans, making it more difficult for smaller firms to make purchases, Cushman & Wakefield said.

“U.S. investors have raised an enormous volume of capital targeting opportunistic real estate,” Frank Nickel, executive chairman of Cushman & Wakefield’s EMEA corporate finance group, said in a statement. “‘Mega-deals’ prove popular to these buyers since they offer a chance to gain large exposures to key assets and markets in one transaction, saving on both costs and time.” The average size of loan-sale transactions in the region increased to €621 million in the first half from €346 million a year earlier, according to the report.

Done deal.

• Gallup Slams Lid On Hopes For US Economy (WolfStreet)

Consumers are “straining against rising prices on daily essentials” and are cutting back on things they want to buy. “If there was any doubt that the US economy is still struggling to get back on its feet, the results of this poll reinforce that reality.” Consumers are “straining against rising prices on daily essentials to afford summer travel, dining out, and discretionary household purchases – the kinds of purchases that ordinarily keep an economy humming.” That’s what Gallup found when it used a new survey to dive deeper into consumer spending.

Its regular monthly survey has been mixed. The average dollar amount consumers spent in June swooned to $91 per day from $98 in May, after a crummy January-April period ranging from $78 to $88 per day. The May spurt seems to have been an outlier that had given rise to a lot of speculation consumers would finally hit “escape velocity,” now obviated by events. But from 2012 until late last year, the averages had been rising. So Gallup dove deeper into the issue with its new survey conducted in mid-June to sort through what consumers are spending more or less money on. And what it found was that they’re buying a little more – “just not the things they want.” They’re spending more on things they have to buy, and in many instances they’re spending more in these categories because prices have jumped. At the top of the list: groceries.

Groceries: 59% spent more, 10% spent less.

Gasoline: 58% spent more, 12% spent less

Utilities: 45% spent more, 10% spent less

Healthcare: 42% spent, 8% spent less

Toilet paper and other household goods: 32% spent more, 5% spent less

Rent, the biggie: 32% spent more, 9% spent less.These categories are household essentials. They’re on top of the priority list. And in order to meet the requirements of these items, consumers are cutting back where they can. Gallup found that “the increasing cost of essential items is further constraining family budgets already hit hard by the Great Recession and still reeling from a stagnant economy.” Hence, the less essential the expense, the more it got cut. Here is the bottom of the list, which explains part of the recent retail woes:

Retirement savings: 18% spent more, 17% spent less.

Leisure activities: 28% spent more, 31% spent less

Clothing: 25% spent more, 30% spent less

Consumer electronics: 20% spent more, 31% spent less

Travel: 26% spent more, 38% spent less

Dining out: 26% spent more, 38% spent less

That’s one way to put it.

• Americans Are Living The Dream, But Not Loving It (CNBC)

A new survey shows most Americans feel they aren’t living the American dream, despite being wealthier and more educated than ever. The study, conducted by the marketing firm DDB, found that only 40% of American adults believed they were living the dream. However, 66% of Americans owned a home, 78% received a good education, and 74% said they’ve found a decent job—all widely believed to be part of the American dream. The disconnect may be because achieving and maintaining the American dream have become so difficult that people are not enjoying it, said Mosche Cohen, former professor at Columbia Business School. People are trying to “shoehorn themselves into this concept of the American dream, and they are losing the freedoms it’s supposed to provide,” he said in an interview with CNBC’s “Power Lunch.”

Americans may work hard in school, get a good job, marry, and buy a home, but fast-forward a few years and they may find themselves with children, living in a home that is now too small, clinging to a job they don’t love anymore, and living paycheck to paycheck. “They’re living the dream, but they’re not loving it anymore,” Cohen said. According to Diana Elliott from Pew Charitable Trusts, which conducts similar studies, achieving the American Dream comes down to financial security and wealth. “Americans are not feeling as [financially] secure as perhaps they were before the Great Recession,” she said. “The American dream is really about having a little bit extra at the end of the month and being able to springboard … your children into the future.”

Sign of the end?!

• Individuals Pile Into Stocks as Pros Say Bull Is Spent (Bloomberg)

Main Street and Wall Street are moving in opposite directions. Individual investors are plowing money back into the U.S. stock market just as professional strategists say gains for this year are over. About $100 billion has been added to equity mutual funds and exchange-traded funds in the past year, 10 times more than the previous 12 months, according to data compiled by Bloomberg and the Investment Company Institute. The growing optimism contrasts with forecasters from UBS AG to HSBC Holdings Plc, who say the stock market will be stagnant with valuations at a four-year high. While the strategists have a mixed record of being right, history shows the bull market has already lasted longer than average and individuals tend to pile in at the end of the rally.

“If Wall Street, after poring over all known data, comes up with a target and we’re already there, and you still see individual investors buying and they’re typically the ones that are late to the party, it would seem there is limited upside,” Terry Morris, a senior equity manager who helps oversee about $2.8 billion at Wyomissing, Pennsylvania-based National Penn Investors Trust Co., said in a July 8 phone interview. U.S. stocks slid from record highs last week, sending the Standard & Poor’s 500 Index to the biggest drop since April, amid concern over financial stress in Europe and the timing of higher U.S. interest rates. The Chicago Board Options Exchange Volatility Index jumped 17% from a seven-year low.

But they’re broke.

• Economy Needs Consumers To Chip In (MarketWatch)

The U.S. economy is revved up and ready to go by most measures except for, perhaps, the most critical one: The consumer. And that’s a problem. Consumer spending is the fuel that runs a modern economy. Oh sure, businesses have to invest and hire to get the party going, but consumer spending generates more than two-thirds of the nation’s economic activity. When they spend more, businesses hire and invest more. Yet since the recession ended in mid-2009, consumers have been unusually shy. Americans are only spending about two-thirds as much as they used to and that’s kept U.S. growth well below its historical norm. Meager wage gains, a devastated labor market and deep scars from the Great Recession clearly played a part in suppressing the urge or ability to spend.

As of May consumer spending is climbing at just a 2.9% annual pace, the slowest rate in five years. And a key bellwether of whether Americans are spending more, retail sales, hasn’t show much pop. “For the economy to really kick into the next gear, we need the consumer to do more of the heavy lifting,” said Ryan Sweet, senior economist at Moody’s Analytics. “For many consumers it still feels like a recession.” The retail sales report for June, released Tuesday, could offer further clues on whether consumers are starting to feel more optimistic. Economists predict sales will rise by a healthy 0.6%, but more important is whether other sectors aside from fast-growing auto and Internet retailers show renewed strength. Many of them have lagged behind in 2014.

Very interesting.

• How Capital Captured Politics (Guardian)

In May, an international trade agreement was signed that effectively serves as a kind of legal backbone for the restructuring of world markets. While the Trade in Services Agreement (Tisa) negotiations were not censored outright, they were barely mentioned in our media. This marginalisation and secrecy was in stark contrast to the global historical importance of what was agreed upon. In June, WikiLeaks made public the secret draft text of the agreement. It covers 50 countries and most of the world’s trade in services. It sets rules that would assist the expansion of financial multinationals into other nations by preventing regulatory barriers. It prohibits more regulation of financial services, despite the fact that the 2007-08 financial meltdown is generally perceived as resulting from a lack of regulation. Furthermore, the US is particularly keen on boosting cross-border data flow, including traffic of personal and financial data. Despite all this, we heard little about it. [..]

The main culprits of the 2008 financial meltdown now impose themselves on us as experts leading us on the painful path to financial recovery. Their advice should trump parliamentary politics. Or, as Mario Monti put it: “Those who govern must not allow themselves to be completely bound by parliamentarians.” What, then, is the higher force whose authority can suspend the decisions of the democratically elected representatives of the people? As far back as 1998, the answer was provided by Hans Tietmeyer, the then governor of the Deutsche Bundesbank, who praised national governments for preferring “the permanent plebiscite of global markets” to the “plebiscite of the ballot box”. Note the democratic rhetoric of this obscene statement: global markets are more democratic than parliamentary elections, since the process of voting goes on in them permanently (and is permanently reflected in market fluctuations) and at a global level, not only within the limits of a nation state.

This, then, is where we stand with regard to democracy, and the Tisa agreement is a perfect example. The key decisions concerning our economy are negotiated and enforced in secret, and set the coordinates for the unencumbered rule of capital. In this way, the space for decision-making by the democratically elected politicians is severely limited, and the political process deals predominantly with issues towards which capital is indifferent (like culture wars). This is why the release of the Tisa draft marks a new stage in the WikiLeaks strategy: until now its activity has been focused on making public how our lives are monitored and regulated by the intelligence agencies – the standard liberal topic of individuals threatened by oppressive state apparatuses. Now another controlling force appears – capital – which threatens our freedom in a much more twisted way: by perverting our very sense of what the word means.

Interesting.

• ‘Politics and Mafia Are Same Thing’ (Quijones)

Recent years have not exactly been kind to Luís Bárcenas Gutiérrez. For decades he served as treasurer of the governing People’s Party, a position which afforded him de facto control over the party’s accounts and money movements. In 2009, however, a money laundering investigation by Swiss authorities discovered more than €30 million spread across an assortment of Swiss bank accounts, all under his name. It soon came to light that for almost 20 years Bárcenas had “allegedly” been paying under-the-table bonuses to senior figures in the Popular Party (PP), including, allegedly, the former and current prime-ministers José Maria Aznar and Mariano Rajoy. During that time large construction companies gave the party millions of euros in undeclared donations, which were promptly redirected by Bárcenas into the deep pockets of senior party members and the bank accounts of the party’s regional offices.

Although these illegal practices appear to have been common knowledge to the party leadership since 1990, Bárcenas has been made the solitary fall guy in the affair. In January 2013 he was sentenced to jail without bail. As he awaits his sentence in the rather austere surroundings of Madrid’s El Soto prison, Bárcenas’s once-fine name, now synonymous with political corruption in Spain, is once again being dragged through the press-grinder. The reason? According to Spain’s finance website El Confidencial, a taped phone conversation between two members of the Neapolitan mafia, la Camorra. It reads like a scene out of a Scorcese movie: On March 25th Ciro Rovai, the leader of the “Rovai clan,” who was arrested by Spanish police this Tuesday, was caught on tape telling a fellow Camorra member that he had been in contact with the former PP treasurer about the possibilities of “investing” in Madrid’s now-doomed Eurovegas project. “He (Barcenas) told me that the mafia and politics are one and the same”, Ravai recounted.

• Secret Path Revealed for Chinese Billions Overseas (Bloomberg)

For years, wealthy Chinese have been transferring billions worth of their money overseas, snapping up pricey real estate in markets including New York, Sydney and Vancouver despite their country’s currency restrictions. Now, one way they could be doing it is clearer. Last week, when China Central Television leveled money-laundering allegations against Bank of China Ltd., the state-run broadcaster’s report prompted the revelation of a previously unannounced government program that enables individuals to transfer their yuan and convert it into dollars or other currencies overseas.

Offered by some banks in the southern province of Guangdong, across the border from Hong Kong, the trial program was introduced in 2011 for overseas property purchases and emigration and doesn’t constitute money laundering, Bank of China said in a July 9 statement. The transfers were allowed by regulators and reported to them, the bank said. “What it shows is the government has been trying to internationalize the renminbi for a lot longer than we thought,” Jim Antos, a Hong Kong-based analyst at Mizuho Securities Ltd., said by phone, using the official name for China’s currency and referring to policy makers’ long-stated goal of allowing the yuan to become freely convertible with other currencies. “I’m rather encouraged by this news because this is the way they need to go.”

Abenomics

• What Happened To Japan’s Yen-Driven Export Boom? (CNBC)

When Japan’s Prime Minister Shinzo Abe came to power in late 2012, he hoped a weaker yen would give exporters a much-needed boost as well as spur the inflation needed to revive the world’s third biggest economy. Eighteen months on and after an almost 30% decline in the yen’s value driven by massive monetary stimulus from the Bank of Japan, the currency has failed to lead to the export boom the government had hoped for. Japan’s annual exports declined in May for the first time in 15 months, latest data show. More disturbingly, say economists, is that the yen’s decline has failed to boost export volumes, which peaked in 2007 and fell for a third year running in 2013.

Certain to screw up.

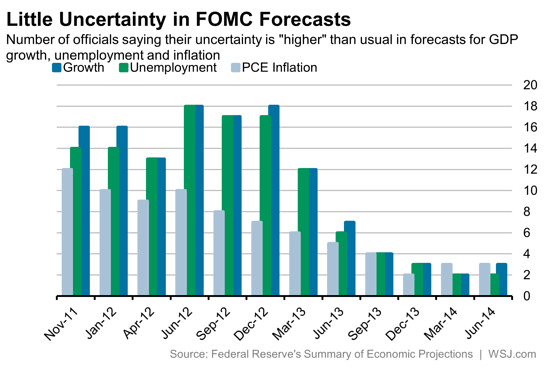

• Fed Has Little Uncertainty, Despite Forecasting Misses (WSJ)

Federal Reserve policy makers have been consistently too optimistic about economic growth and too pessimistic about the falling unemployment rate. But ask them if they’re uncertain about their forecasts and this is their answer: no more than usual. In 2012, Fed officials said they were more uncertain than usual about their forecasts for growth, unemployment and inflation. But over the course of 2013 their uncertainty has declined, and now almost all Fed officials are confident in their forecasts, according to the Fed’s self-assessment of uncertainty which was released Wednesday as part of Fed’s June meeting minutes. Fed officials have recently been concerned that markets have grown too complacent. Yet even at the Fed, only three officials rank their uncertainty about growth as high, and only two are more certain than usual about their unemployment forecasts. (The minutes do not identify by name which Fed official makes which forecast.)

For the record, most Fed officials see growth of 2.1% to 2.3% this year and unemployment at the end of 2014 between 6% and 6.1%. Those forecasts were made in advance of their June 17-18 policy meeting, and already they’re beginning to look a little suspect. The economy contracted at an annualized rate of 2.9% in the first quarter of 2014, according to a Commerce Department report released the week after the Fed meeting. That’s going to make 2.3% growth over all of 2014 a difficult target to reach. (As we noted earlier, downward growth revisions at the Fed have been inexorable.) And the unemployment rate dropped to 6.1% in June from 6.3% in May according to the Labor Department‘s July 3 report. Another month or two with an unemployment rate decline and the Fed will have blown its unemployment forecast as well.

Huh? I thought they make the curve?!

• Are The Fed And The ECB Falling Behind The Curve? (CNBC)

If you believe some of the U.S. Federal Reserve (Fed) governors’ forecasts, the answer for the Fed’s case is a resounding “yes.”Speaking at the Sixth Annual Rocky Mountain Economic Summit in Jackson Hole, Wyoming, last Friday these Fed officers confidently predicted that the U.S. economy would be growing at a rate of more than 3% over (an unspecified number of) next quarters. At the same time, they announced that an increase in interest rates was likely to begin in late 2015 or sometime in 2016. Here is why these forecasts clearly imply that the Fed is already behind the curve. With an estimate of U.S. economic growth potential somewhere in the range of 2 to 2.25%, an actual growth rate of more than 3%, sustained over several quarters, would create labor and product market pressures that would lead to accelerating inflation. Obviously, if such a scenario were to pass, interest rates would begin rising much before the second half of 2015.

And, as always in similar situations, the prospect of an open-ended credit tightening would create serious problems in asset markets, without any guarantees of promptly reestablishing market stability and inflation control. That is what is meant by the monetary policy falling behind the curve. This also clarifies that the furious debate we are now witnessing about the policies conducted by the American and European monetary authorities must be based on thoughtful forecasts about the economic conditions likely to prevail over the next twelve months rather than on what we see at the moment. That is tough. And to make things even more difficult, this particular forecasting exercise has to contend with additional uncertainties, which are technically called “lags in the effect of monetary policy.” In other words, we don’t know exactly how long it takes for a change in monetary policy to affect demand, output, employment and inflation. That, too, has to be estimated.

Update Befuzzle.

• America’s Six Largest Banks Prepare To Update Investors (Guardian)

America’s biggest banks will update investors this week amid expectations that the financial services sector has been hit once more by lacklustre lending, poor trading and the soaring cost of legal expenses tied to a series of fines and investigations. The six largest US banks – Bank of America, Citigroup, Goldman Sachs, JP Morgan Chase, Morgan Stanley and Wells Fargo – are expected to show quarterly revenue declined by 5.6% from the previous year, according to the analyst estimates. Profits are expected to drop as banks face a tough comparison with a strong second quarter last year. The results come as regulators are negotiating settlements with some of the banks and continue to investigate others over a variety of issues. Citigroup, which reports on Friday, is believed to be close to a $7bn (£4.1bn) settlement over the sale of risky mortgages in the runup to the financial crisis. The justice department reached a similar agreement with JP Morgan, reporting Tuesday, last year.

The justice department is also in talks with Bank of America about alleged wrongdoing in its mortgage business ahead of the crisis. The talks with the bank, which reports on Wednesday, have apparently stalled. Reuters reported earlier this month that the attorney general, Eric Holder, had refused to meet Bank of America chief executive Brian Moynihan because the two sides remain too far apart. Alongside legal woes the banks are also experiencing continued problems on their trading desks, once the main driver of growth, now held back by new regulations aimed at tamping down excessive risk taking and lack of appetite among investors. Foreign exchange and fixed income trading revenues have fallen at the investment banks this year. Bond trading income declined by 11% at Goldman Sachs in the first quarter and investors will be watching closely for signs of improvement when the bank reports on Tuesday.

Don’t count out Vlad.

• US, EU Sanctions Aid Putin’s Master Plan (WolfStreet)

London is, according to Bloomberg, “the undisputed foreign hub for Russian business.” That’s where Russian companies hire law firms and investment bankers to handle takeovers. That’s where rich Russians like to live with their families or just hang out and have fun. That’s where they like to spend lots of money. But the sanction spiral has already – and very inadvertently – accomplished one of the big goals, not of President Barak Obama or Chancellor Angela Merkel, but of President Vladimir Putin: keep Russian money in Russia, and perhaps even bring back some of the money that has wandered astray over the years to seek greener pastures elsewhere. Capital flight, particularly from the vast underground economy, is one of Russia’s most pressing economic problems. And Putin’s angle of attack has been, well, brutal in its own way:

The spectacular collapse of the Cypriot banks last year took down much of the “black money” Russians and their mailbox companies – there were over 40,000 of these outfits in Cyprus – had on deposit there. Instead of bailing out the cesspool of corruption that these banks were, or even the nation with another emergency loan, as Russia had already done before, he just smiled and let it happen. And much of the money of his compatriots was allowed to evaporate. Perhaps he’d read Global Financial Integrity’s report – designed to advise the Russian government on these issues – that called Cyprus “a Money Laundering Machine for Russian criminals.” And so the sanction spiral against Russian oligarchs and their companies fits neatly into his overall long-term design. It includes the de-dollarization of world trade – an endeavor where he found new friends even in France, after French megabank BNP-Paribas agreed to pay a $8.9 billion penalty to the US Government.

China has been working furiously to elevate its own currency to a world-trade currency to rival the dollar and the euro, though it still has a long ways to go. Putin has been eager to switch the oil and gas trade with China away from the dollar, and progress is being made on a daily basis. And it includes getting Russian companies and rich individuals, by hook or crook, to leave at least some of their money in Russia and perhaps even repatriate some of the money now invested elsewhere so that it can do its magic for the economic development of Russia, and propel the country forward. Once in Russia, the money would presumably remain more accessible to the Russian government, which these very oligarchs have seen is not a great situation to be in, if they end up on the wrong site of Putin. Russia’s legal system can be a hazard to their health and wealth, and banks can be iffy. Hence the prevailing wisdom to send overseas every ruble, dollar, or euro that isn’t totally nailed down.

An ancient Buddhist conundrum: if there is no recovery, how can it falter?

• Eurozone Recovery Falters As Industrial Production Shrinks 1.1% (CAM)

Further evidence that the fragile Eurozone recovery could be beginning to splutter emerged today. Industrial production in the 18-member euro area fell sharply by 1.1% in May, the largest monthly drop since September 2012, according to figures released by the EU’s statistics agency Eurostat this morning. The data confirmed analyst fears that a significant shrink in industrial output had been coming, especially as the economic powerhouses of Germany, France and Italy had already reported some surprisingly large contractions in May. Economists had actually predicted a slightly bigger dip of 1.2%. May’s figures were up 0.5% from the same month last year. EU industrial production has been volatile in 2014 and analysts acknowledge that these figures can be erratic from month to month. April numbers had shown a 0.7% increase, rebounding from a 0.4 dip in March. However the marked fall in industrial output is stoking fears that the Eurozone recovery is stalling before it has even begun to really gain steam.

Oh, bugger!

• Draghi Faces Age-Old Problem in Trying to Spur Europe Inflation (Bloomberg)

Mario Draghi faces an age-old problem as he tries to revive euro-area inflation. A rapid rise in the importance of older workers in the currency bloc’s labor market over the next five years is set to prove a drag on inflation already about a quarter of the European Central Bank’s target of just below 2%, according to Marchel Alexandrovich, an economist at Jefferies International Ltd. in London. Since 2008 the number of workers aged between 50 and 64 has gained in the main euro-area nations and now account for 26% to 31% of total employment, up from 20% to 25% previously. Employees aged more than 65 have also increased, yet the amount still lags the U.S. and U.K., suggesting to Alexandrovich that the “euro-area economics may only be at the start of what is a long-term structural shift toward increased importance of older workers.”

If so, then ECB President Draghi has another structural factor to worry about as he tries to prevent deflation with easy monetary policy. That’s because older workers tend to defer consumption and save for the future, while youngsters entering the labor market are more likely to consume today. While data are hard to find for the euro area, an Institute for Fiscal Studies analysis of the U.K. suggests that from 2000 and 2005, British workers aged 55 to 59 had an average annual saving rate of about 5.5%, while those less than 34 ran up no savings. “So a recovery where jobs are going predominantly to older workers, which is what is happening today, will look very different than that where younger workers are getting jobs for the first time,” said Alexandrovich in a report to clients. “All things being equal, it would imply weaker consumption and a softer profile for inflation.” The higher propensity to save also implies downward pressure on interest rates, which Draghi cut to record lows last month to encourage economic growth, Alexandrovich said.

The US saved GM with many billions; can’t let it collapse now.

• Prosecutors’ Case Against GM Focuses On Misleading Statements (Reuters)

Federal prosecutors are developing a criminal fraud case hinged on whether General Motors made misleading statements about a deadly ignition switch flaw, and are examining activity dating back a decade, before GM’s 2009 bankruptcy, according to multiple sources familiar with the investigation. At the same time, at least a dozen states are investigating the automaker. Two state officials said that effort is likely to focus on whether GM broke consumer protection laws. Both federal and state investigations into the switch, which is linked to at least 13 deaths and 54 crashes, are at early stages, and it is possible that cases may not be brought. Sources said federal criminal prosecutors are working on a set of mail and wire fraud charges, similar to the criminal case Toyota Motor Corp settled earlier this year over misleading statements it made to American consumers and regulators about two different problems that caused cars to accelerate even as drivers tried to slow down.

Delphi Automotive, the maker of the GM switch, is not a target of criminal charges, the people said, because it did not make substantial public statements about the safety of the vehicles or the part. That would make it difficult to build a case under the main federal fraud laws, the wire and mail fraud statutes. Greg Martin, a spokesman for GM, said his company continued to work with investigators, declining to comment further, and a spokeswoman for Delphi said the company had been told it was not a target of investigations and was working cooperatively with all government officials. A spokesman for Manhattan U.S. Attorney Preet Bharara, who is leading the criminal probe, declined to comment. Prosecutors are not limiting their inquiries to events that occurred after GM emerged from bankruptcy in 2009, sources said. Legal experts said bankruptcy does not release GM from criminal liability in a fraud case.

It’s strange how strong the pressure is to deny even this most obvious fact.

• Study of Organic Crops Finds Fewer Pesticides, More Antioxidants (NY Times)

Adding fuel to the debates over the merits of organic food, a comprehensive review of earlier studies found substantially higher levels of antioxidants and lower levels of pesticides in organic fruits, vegetables and grains compared with conventionally grown produce. “It shows very clearly how you grow your food has an impact,” said Carlo Leifert, a professor of ecological agriculture at Newcastle University in England, who led the research. “If you buy organic fruits and vegetables, you can be sure you have, on average, a higher amount of antioxidants at the same calorie level.” However, the full findings, to be published next week in the British Journal of Nutrition, stop short of claiming that eating organic produce will lead to better health. “We are not making health claims based on this study, because we can’t,” Dr. Leifert said.

The study, he said, is insufficient “to say organic food is definitely healthier for you, and it doesn’t tell you anything about how much of a health impact switching to organic food could have.” Still, the authors note that other studies have suggested some of the antioxidants have been linked to a lower risk of cancer and other diseases. The conclusions in the new report run counter to those of a similar analysis published two years ago by Stanford scientists, who found few differences in the nutritional content of organic and conventionally grown foods. Those scientists said the small differences that did exist were unlikely to influence the health of the people who chose to buy organic foods, which are usually more expensive. The Stanford study, like the new study, did find pesticide residues were several times higher on conventionally grown fruits and vegetables, but played down the significance, because even the higher levels were largely below safety limits.