Harris&Ewing “Congressional Union for Woman Suffrage” 1916

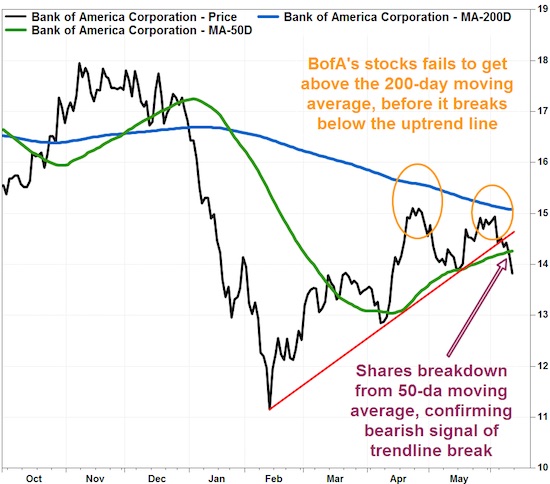

Pretending you can save an economy by buying already overpriced stocks is absolute lunacy.

• Why More QE Won’t Work: Debt Is Cheap But Equity Is Expensive (BBG)

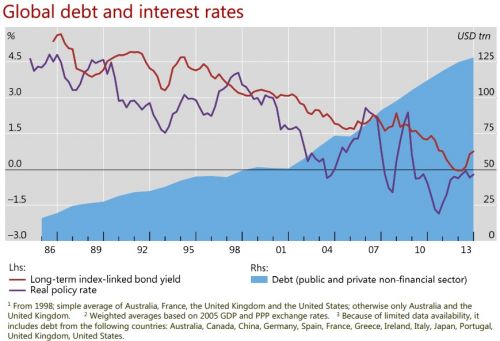

As central banks in Europe and Japan gear up to further expand quantitative-easing policies, market participants have issued a flurry of stark warnings about the potentially-negative unintended consequences, from the hit to pension funds to the risk of fueling market bubbles. But the more-prosaic prognostication — that further easing simply won’t stimulate slowing economies by reviving enfeebled corporate investment — may be the hardest-hitting retort from the perspective of central banks in the U.K., euro-area and Japan. While a clutch of reasons for moribund business investment in advanced economies have been advanced, central banks would do well to wake up to another typically over-looked cause, according to a new report from Citigroup.

Corporate investment faces a financing hurdle as the weighted-average cost of capital for companies (known as WACC) remains elevated thanks to the stubbornly high cost of equity, Hans Lorenzen, Citi credit analyst, said in a report published this week. The report pleads with central banks to forgo further asset purchases, citing diminishing returns from such stimulus programs and their questionable efficacy more generally. Corporates aren’t feeling the financing benefits offered by the global fall in real long-term interest rates thanks to a historically-high equity risk premium — which, in simple terms, is the excess return the stock market is expected to earn over a perceived risk-free rate, Lorenzen said.

Although companies typically aren’t dependent on equity issuance to fund investment programs – relying instead on fixed-income markets – the equity risk premium is an important factor influencing investment decisions made by company boards. The higher the cost of equity, the higher the theoretical overall cost of capital for corporates. In other words, investments that don’t on paper appear to make returns materially greater than the company’s WACC will face financing challenges.

Only thing is, we know it’s useless-at least for what it purports to be aimed at.

• ECB Set To Extend QE Well Into Next Year As It Fights Deflation (CNBC)

The ECB is expected to extend its trillion-euro bond-buying program beyond March 2017 and announce to expand the universe of eligibile bonds as part of its seemingly never-ending struggle to kickstart the euro zone’s economy. The central bank and its President Mario Draghi has been trying to push inflation back to its goal of below but close to 2 percent with a plethora of measures and instruments ranging from negative deposit rates to spur lending, a QE program that has been buying €80 billion ($89 billion) in bonds every month and interest rates close to zero – but without a breakthrough success. Analysts believe the ECB’s governing council has its work cut out when it meets to decide on monetary policy Thursday.

The headline rate of inflation remained unchanged at 0.2% in August. Core, or underlying inflation, which excludes energy, goods, alcohol and tobacco, fell from 0.9% in July to 0.8%, according to Eurostat. The eurozone economy slowed slightly in August as Germany’s services sector faltered, according to surveys of purchasing managers, expanding at the weakest pace in 19 months. Amid the factors for the cooling of the economy is the UK’s decision to leave the EU which may have dampened the currency area’s modest recovery. “We think the ECB will expand the duration of its QE programme from March 2017 currently to September 2017,” Nick Kounis at ABN Amro writes. “The ECB will most likely also need to announce changes to its QE programme to increase the universe of eligible assets as it will not be able to meet even its current targets under the current structure.”

It could, but it’s the worst thing it could do.

• Could the ECB Start Buying Stocks? (WSJ)

Central banks have become some of the biggest investors in bond markets. Now some in the financial markets think stocks should benefit more from their largess. Some economists say the ECB, which meets Thursday to decide if it should expand its current bond-buying program, should invest in equities. The reason: It is running out of bonds to buy. A move by the ECB into equities would have big implications for Europe’s stock markets, which have been rocked by a series of shocks this year, from volatility in China to Britain’s vote to leave the EU. The prospect of billions of euros flowing into equities could prop up prices, much as ECB bond purchases have done for debt securities. The signaling effect from the ECB’s unlimited money-printing power may also limit downturns in equities.

Stock purchases don’t appear to be on the near-term agenda. But ECB officials haven’t ruled them out, and the idea could gain steam if they continue to undershoot their 2% inflation target. Some central banks already invest in equities. Switzerland’s central bank has accumulated over $100 billion worth of stocks, including large holdings in blue-chip U.S. companies such as Apple and Coca-Cola. If the ECB decides to raise its stimulus by extending its current bond program, as many analysts expect, fresh questions will be raised about how it will continue to find enough bonds to buy. The bank is already purchasing €80 billion a month of corporate and public-sector bonds to reduce interest rates across the eurozone. Its holdings of public-sector debt reached €1 trillion last week, the ECB said Monday.

The ECB is keeping sick companies alive, destroying price discovery in the process.

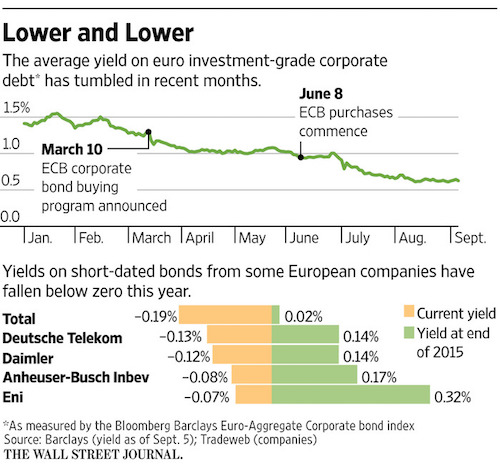

• Now Companies Are Getting Paid to Borrow (WSJ)

Investors are now paying for the privilege of lending their money to companies, a fresh sign of how aggressive central-bank policy is upending conventional patterns in finance. German consumer-products company Henkel AG and French drugmaker Sanofi each sold no-interest bonds at a premium to their face value Tuesday. That means investors are paying more for the bonds than they will get back when the bonds mature in the next few years. A number of governments already have been able to issue bonds at negative yields this year. But it is a rare feat for companies, which also ask investors to bear credit risk.

Yields on corporate debt have plunged in recent months as investors have pushed up prices in the scramble for returns. Roughly €706 billion of eurozone investment-grade corporate bonds traded at negative yields as of Sept. 5, or over 30% of the entire market, according to trading platform Tradeweb, up from roughly 5% of the market in early January. [..] Tuesday’s deals, however, are among just a handful of corporate offerings that have actually been sold at negative yields. They include offerings of euro-denominated bonds earlier this year by units of British oil giant BP and German auto maker BMW, according to Dealogic. Germany’s state rail operator, Deutsche Bahn, also has issued euro-denominated bonds at negative yields.

The ECB launched its corporate bond-buying program in early June and had bought over €20 billion of corporate bonds as of Sep. 2. Most of its purchases came in secondary markets, where investors buy and sell already issued bonds. The central bank meets Thursday and will decide if it should expand its current bond-buying program. The purchases have helped set off a burst of issuance following the traditional summer lull in local capital markets. Last month was the busiest August on record for new issuance of euro-denominated, investment grade corporate debt, according to Dealogic.

Kansas is all they know.

• Message to the Fed: We’re not in Kansas Anymore (Farmer)

There is a lasting and stable connection in data between changes in the interest rate and changes in the unemployment rate. Past data suggest that if the Fed were to raise the interest rate at its next meeting, unemployment would increase and output growth would slow. It is fear of that outcome that causes central bank doves to be reluctant to raise the interest rate. But although an interest rate increase has preceded a slowdown by approximately three months in past data, there is a connection at longer horizons between inflation and the T-bill rate. That connection, sometimes called the Fisher relationship after the American economist Irving Fisher, arises from the fact that, risk-adjusted, T-bills and equities should pay the same rate of return.

The one-year real return on a T-bill is the difference between the interest rate and the expected one-year inflation rate. The one-year real return on holding the S&P 500 is the gain you can expect to make from buying the market today and selling it one year later. Economic theory suggests that the gap between those two expected returns arises from the fact that equities are riskier than T-bills, and importantly, the gap cannot be too big. Therein lies the policy maker’s conundrum. To hit an inflation target of 2%, the T-bill rate must be 2% higher than the underlying risk adjusted real rate: policy makers call this rate r*. There is some evidence that r* is currently very low currently, possibly zero or even negative. But if the Fed were to raise the policy rate to 2% at the next meeting, they are terrified that they might trigger a recession.

Let’s examine that argument. The fact that a rate rise caused a slowdown in past data does not mean that a rate rise will cause a slowdown in future data. This time really is different. It is different because in 2008 the Fed expanded its policy options. Before 2008 the interest rate set by the Fed was the Federal Funds Rate (FFR). That is the overnight rate at which commercial banks can borrow or lend to each other. Before 2008, there was a large and active Fed funds market used by commercial banks to meet reserve requirements. Commercial banks are required to hold roughly 10% of their balance sheets in the form of reserves. In the past, because reserves did not pay interest, banks kept them to a minimum. Excess reserves for much of the post-war period were essentially zero. Firms and households hold cash because they need liquid assets to facilitate trade. But cash is costly to hold because a firm must forgo investment opportunities. In the parlance of economic theory, we say that the FFR is the opportunity cost of holding money.

Trade wars and currency wars a-coming.

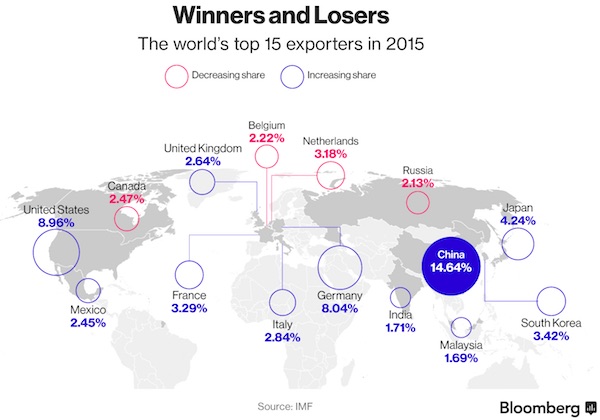

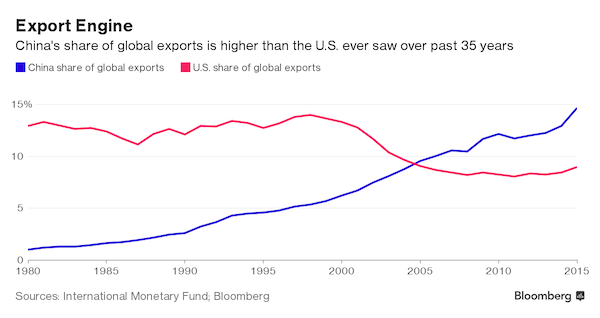

• China Grabs Bigger Slice Of Shrinking Global Trade Pie (BBG)

China is eating up a larger chunk of the world’s shrinking trade pie. Brushing off rising wages, a shrinking workforce and intensifying competition from lower cost nations from Vietnam to Mexico, China’s global export share climbed to 14.6% last year from 12.9% a year earlier. That’s the highest proportion of world exports ever in IMF data going back to 1980. Yet even as its export share climbs globally, manufacturing’s slice of China’s economy is waning as services and consumption emerge as the new growth drivers. For the global economy, a slide in China’s exports this year isn’t proving any respite as an even sharper slump in its imports erodes a pillar of demand.

Those trends are likely to be replicated in August data due Thursday. Exports are estimated to fall 4% from a year earlier and imports are seen dropping 5.4%, leaving a trade surplus of $58.85 billion, according to a survey of economists by Bloomberg News as of late Tuesday. While China’s advantage in low-end manufacturing has been seized upon by Donald Trump’s populist campaign for the U.S. presidency, the shift into higher value-added products from robots to computers is also pitting China against developed-market competitors from South Korea to Germany. A weaker yuan risks exacerbating global trade tensions, which became a hot button issue at the G-20 meeting in Hangzhou over cheap steel shipments.

“All the talk we have heard over the last few years about China losing its global competitive advantage is nonsense,” said Shane Oliver, head of investment strategy at AMP Capital Investors in Sydney. “This will all further fuel increasing trade tensions as already evident in the U.K. with the Brexit vote and in the U.S. with the support for Trump’s populist protectionist platform.”

Many voices proclaim that China’s foray into SDRs will lead to the end of the USD. Balding sees it differently. SDRs signal China’s weaknesses.

• Why China Isn’t a Financial Center (Balding)

Amid all the buzz about China’s hosting the G-20 summit in Hangzhou – all the accords, arguments and alleged snubs – another symbolically significant event was largely obscured. Last week, the World Bank issued bonds denominated in Special Drawing Rights, or SDRs, in China’s interbank market. Beginning in October, the yuan will be included in the basket of currencies used to set the SDRs’ value. To China, this symbolizes its status as a rising power. I’d argue that it instead symbolizes why China is struggling to become a global financial center. Beijing conceived of SDRs as something of a compromise. It would like the global monetary system to be less reliant on the U.S. dollar and more favorable toward its own currency.

Yet it continues to impose capital controls, which limit the yuan’s usage overseas, and it doesn’t want to let the yuan’s value float freely, which would be a prerequisite to its becoming a true reserve currency. China saw SDRs as a way to split the difference, to create a competitor to the dollar and maintain a fixed exchange rate at the same time. The problem is that there’s almost no conceivable reason to use them. SDRs were created as a synthetic reserve asset by the IMF decades ago, under the Bretton Woods system. No country uses them for normal business, and no government is likely to issue bonds denominated in them except for political reasons, as the World Bank is doing. Companies won’t use them either. If a firm wants to borrow to build a plant in Japan, it will issue a bond in yen so it can repay in yen.

If its customers are global, surely an ambitious investment bank would be willing to build a customized currency portfolio index that would match its needs. Rather than using the SDR’s weighting of currencies, the company could sell a bond in a synthetic index of anything: a 25% split between dollars, euros, yen and reals, say. No customer pays in SDRs; why bind yourself to repaying debts in them? The reason China is pushing SDRs is that it hopes to gain the prestige of a global currency without facing the financial pressure to let the yuan float freely or to loosen capital controls. It wants the benefits of global leadership, in other words, but would prefer to avoid the drawbacks. This is precisely the attitude that’s hindering China’s rise as a global financial center.

Distortion is all we have left.

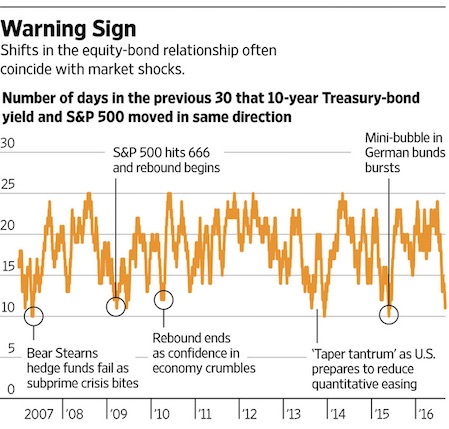

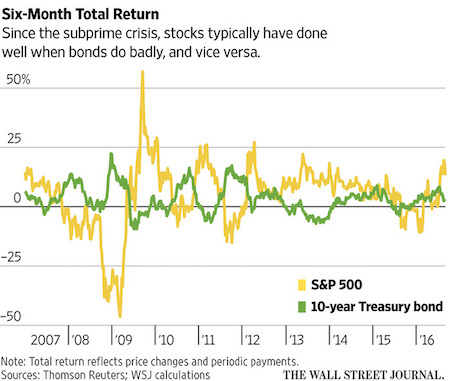

• Time to Worry: Stocks and Bonds Are Moving Together (WSJ)

Wall Street traders and fund managers returning from the summer break are likely to focus on the obvious: a series of central-bank meetings in coming weeks and the imminent U.S. election. They also should be paying close attention to some unusual behavior in the market, where the changing relationship between bonds and stocks may be a sign of trouble ahead. A generation of traders have grown up with the idea that stock prices and bond yields tend to rise and fall together, as what is good for stocks is bad for bonds (pushing the price down and yield up), and vice versa. This summer, the relationship seems to have broken down in the U.S. Share prices and bond yields moved in the same direction in just 11 of the past 30 trading days, close to the lowest since the start of 2007.

This is far from unprecedented. But since Lehman Brothers failed in 2008, such a swing in the relationship has been unusual and suggests prices are being driven by something other than the balance of hope and fear about the economy. It has tended to coincide with times of deep discontent in markets, notably the 2013 “taper tantrum,” when bond yields briefly surged after Federal Reserve officials signaled they would soon end stimulus, and last year’s brief bubble in German bunds. The simplest explanation is that expectations of interest rates being lower for longer—some central bankers have suggested lower forever—pushes the price of everything up, and yields down.

When the focus is on the discount rate used to value all assets, bond and stock prices rise and fall together, creating the inverse relationship between bond yields and shares. Such a focus on monetary policy isn’t healthy. It leaves markets more exposed to sudden shocks, both from changes in policy and from an economy to which less attention is being paid. “It’s a somewhat mercurial thing, but there are big shifts [in correlations], and being on the right side of those big shifts is important,” said Philip Saunders at Investec Asset Management. “You do see some brutal price action at these correlation inflection points.”

What? We have enough waiters?

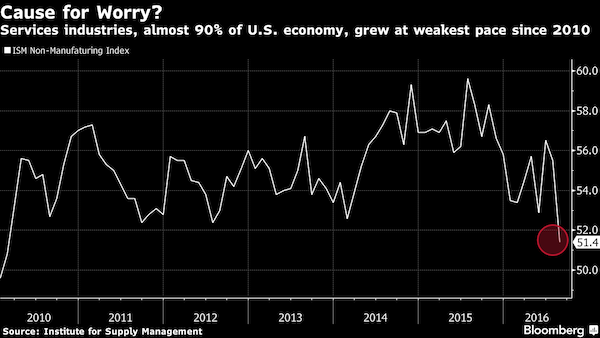

• First Factories, Now Services Signal Cracks in US Economy (BBG)

Some cracks could be starting to appear in the picture of an otherwise resilient U.S. economy. An abrupt drop in the Institute for Supply Management’s services gauge on Tuesday to a six-year low is the latest in a string of unexpectedly weak data for August. Other less-than-stellar figures include an ISM factory survey showing a contraction in manufacturing; a cooling of hiring; automobile sales falling short of forecasts; and an index of consumer sentiment at a four-month low. While there is hardly any evidence that growth is falling off a cliff, the run of disappointing figures make it tougher to argue that the underlying momentum of the world’s largest economy is holding up.

It also potentially complicates the task of Federal Reserve policy makers, who are debating whether to raise interest rates as soon as this month; traders’ bets on a September move faded further after the report on service industries, which make up almost 90% of the economy. “The latest set of ISM numbers is shockingly weak,” said Joshua Shapiro, chief U.S. economist at Maria Fiorini Ramirez Inc. in New York. “It certainly gives the doves at the Fed more ammunition. It makes the Fed’s conversation at the September meeting that much more contentious.” The ISM’s non-manufacturing index slumped to 51.4, the lowest since February 2010, from 55.5 in July, the Tempe, Arizona-based group reported. The figure was lower than the most pessimistic projection in a Bloomberg survey.

The ISM measures of orders and business activity skidded by the most since 2008, when the U.S. was in a recession. Readings above 50 indicate expansion. Stocks fell, bonds climbed and the dollar weakened against most of its major peers after the data were released.

AKA New Zealand has world’s biggest housing bubble.

• New Zealand Tops World House Price Increase (G.)

New Zealand has the world’s most frenetic property market, with prices in Auckland now outstripping London, and possibly dashing the hopes of British buyers hoping to escape Brexit. In a global ranking of house price growth by estate agents Knight Frank, New Zealand was second to Turkey, but once the impact of inflation was stripped out it came top with 11% annual growth. Canada was the only other country to see price growth of 10% or more over the past year. It also recorded the fastest price rises of any country over the past three months. Meanwhile once white-hot property markets in the far east are cooling fast. Taiwan saw price falls of 9.4% over the past year, putting it at the bottom of Knight Frank’s ranking. Hong Kong and Singapore have also seen significant reductions in house prices.

Auckland is at the centre of an extraordinary property boom, with separate data revealing that the city’s average house price last month hit NZ$1m (£550,000) for the first time. The country’s QV house price index found that the typical Auckland home was valued at NZ$1,013,632 in August, an increase of 15.9% over the year. That’s just under £560,000 and higher than the average London property price of £472,384 according to data. Spiralling prices – up NZ$20,000 a month over the past quarter – and the falling pound are likely to deter Britons hoping to emigrate.

After the fact.

• EU Ethics Watchdog Intervenes Over Former EC Chief Barroso’s Goldman Job (G.)

The EU’s ethics watchdog is to look into the former European commission president José Manuel Barroso’s new job with Goldman Sachs, which includes advising the investment bank and its clients on Brexit. In a letter to Barroso’s successor, Jean-Claude Juncker, the EU ombudsman, Emily O’Reilly, said Barroso’s appointment as non-executive chairman of Goldman raised widespread concerns. She cited “understandable international attention given the importance of his former role and the global power, influence, and history of the bank with which he is now connected”. Her intervention comes after EU staff launched a petition calling on EU institutions to take “strong exemplary measures” against Barroso including the loss of his pension while he works for Goldman.

The petition now has more than 120,000 signatures. O’Reilly told Juncker that public unease will be exacerbated by the fact that Barroso is to advise Goldman Sachs on Britain’s exit from the EU. She warned of the danger of a breach of ethics in his interaction with former colleagues, including the EU’s chief Brexit negotiator, Michel Barnier, a former special adviser to Barroso. O’Reilly said new guidance was needed to ensure that EU staff were “not affected by any possible failure on Mr Barroso’s part to comply with his duty to act with integrity”. Barroso joined Goldman less than two years after leaving office at the European commission, but after the 18-month cooling-off period stipulated by European rules.

Great story from an unlikely source, Canada’s right-wing National Post.

Edward Snowden, a former U.S. intelligence contractor, became the most wanted fugitive in the world after leaking a cache of classified documents to the media detailing extensive cyber spying networks by the U.S. government on its own citizens and governments around the world. To escape the long arm of American justice, the man responsible for the largest national security breach in U.S. history retained a Canadian lawyer in Hong Kong who hatched a plan that included a visit to the UN sub-office where the North Carolina native applied for refugee status to avoid extradition to the U.S.

Fearing the media would surround and follow Snowden — making it easier for the Hong Kong authorities to arrest the one-time CIA analyst on behalf of the U.S. — his lawyers made him virtually disappear for two weeks from June 10 to June 23, 2013, before he emerged on an Aeroflot airplane bound for Moscow, where he remains stranded today in self-imposed exile. “That morning, I had minutes to figure out how to get him to the UN, away from the media, and out of harm’s way with the weight of the U.S. government bearing down on him. I did what I had to do, and could do, to help him,” Robert Tibbo, the whistleblower’s lead lawyer in Hong Kong told the Post in a wide-ranging interview, the first detailing the chaotic days of Snowden’s escape three years ago. “They wanted the data and they wanted to shut him down. Our greatest fear was that Ed would be found.”

The covert scheme to dodge U.S. attempts to arrest Snowden could have been ripped from the pages of a spy thriller. The fugitive was disguised in a dark hat and glasses and transported by car at night by two lawyers to safe houses on the crowded and impoverished fringes of Hong Kong. Snowden hunkered down in small, cluttered, dingy rooms where as many as four people shared less than 150 square feet. Batteries were removed from cellphones when they gathered, burner phones were used to place calls, SIM cards were exchanged and sophisticated computer encryption was used to communicate when face-to-face meetings were not possible. Snowden rarely ventured out, and only at night where he could easily be lost among the many other asylum seekers. “Nobody would dream that a man of such high profile would be placed among the most reviled people in Hong Kong,” recalled Tibbo, a Canadian-born and educated barrister who has practiced law for 15 years. “We put him in a place where no one would look.”

It is criminal that Europe doesn’t reach out to help. But we still do. Click here and Please Help The Automatic Earth Help The Poorest Greeks And Refugees! This works! No governments, no NGOs. Thats means no overhead, no salaries, just help.

• Greece Overhauls Refugee Center Planning As Islands Appeal For Help (Kath.)

Government officials on Tuesday determined which reception centers for migrants across the country are to close and where new, improved facilities are to open but did not determine a time-frame, even as authorities on the Aegean islands warn of dangerously cramped and tense conditions in local camps. More than 12,500 migrants are currently living in reception centers on five Aegean islands – Lesvos, Chios, Kos, Leros and Samos – and hundreds more are arriving every day from neighboring Turkey. Spyros Galinos, the mayor of Lesvos, which is hosting 5,484 migrants, wrote to Alternate Migration Policy Minister Yiannis Mouzalas on Tuesday to express his concern about the “extremely dangerous conditions” on the island.

He asked the minister for the immediate transfer of migrants from Lesvos to other facilities on the mainland “to avert far worse developments.” However, decongesting facilities on the islands is part of the government’s broader overhaul of a network of reception centers spread across the country. An aide close to Mouzalas determined on Tuesday which camps in northern Greece will close and which will be improved but did not say when this would happen. Among the facilities that are to close are those in Sindos and Oraiokastro, near Thessaloniki, and in Nea Kavala, near Kilkis. Reception centers in Diavata and Vassilika, also in northern Greece, are to be upgraded.

A new reception center for minors is to start operating at the Amygdaleza facility, north of the capital, next Monday. Meanwhile, sources said on Tuesday that child refugees will start attending Greek schools at the end of this month. The 22,000 child refugees currently in Greece will be inducted into the school system in groups. Those aged between 4 and 7 will attend kindergartens to be set up within migrant reception centers. Children aged 7 to 15 will join classes at public schools near the reception centers where they are staying. And unaccompanied minors aged 14 to 18 will be able to join vocational training classes if they so desire.

A tangible monument to incompetence and spectacular failure.

• UK Immigration Minister Confirms Work To Start On £1.9 Million Calais Wall (G.)

Work is about to begin on “a big, new wall” in Calais as the latest attempt to prevent refugees and migrants jumping aboard lorries heading for the Channel port, the UK’s immigration minister has confirmed. Robert Goodwill told MPs on Tuesday that the four-metre high wall was part of a £17m package of joint Anglo-French security measures to tighten precautions at the port. “People are still getting through,” he said. “We have done the fences. Now we are doing the wall,” the new immigration minister told the Commons home affairs committee. Building on the 1km-long wall along the ferry port’s main dual-carriageway approach road, known as the Rocade, is due to start this month.

The £1.9m wall will be built in two sections on either side of the road to protect lorries and other vehicles from migrants who have used rocks, shopping trolleys and even tree trunks to try to stop vehicles before climbing aboard. It will be made of smooth concrete in an attempt to make it more difficult to scale, with plants and flowers on one side to reduce its visual impact on the local area. It is due to be completed by the end of the year. The plan has already attracted criticism from local residents who have started calling it “the great wall of Calais”.

What do you call a world that refuses to protect its children?

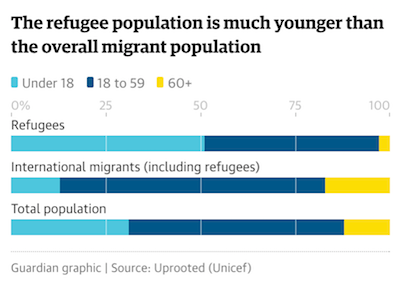

• Nearly Half Of All Refugees Are Now Children (G.)

Children now make up more than half of the world’s refugees, according to a Unicef report, despite the fact they account for less than a third of the global population. Just two countries – Syria and Afghanistan – comprise half of all child refugees under protection by the United Nations High Commissioner for Refugees (UNHCR), while roughly three-quarters of the world’s child refugees come from just 10 countries. New and on-going global conflicts over the last five years have forced the number of child refugees to jump by 75% to 8 million, the report warns, putting these children at high risk of human smuggling, trafficking and other forms of abuse.

The Unicef report – which pulls together the latest global data regarding migration and analyses the effect it has on children – shows that globally some 50 million children have either migrated to another country or been forcibly displaced internally; of these, 28 million have been forced to flee by conflict. It also calls on the international community for urgent action to protect child migrants; end detention for children seeking refugee status or migrating; keep families together; and provide much-needed education and health services for children migrants. “Though many communities and people around the world have welcomed refugee and migrant children, xenophobia, discrimination, and exclusion pose serious threats to their lives and futures,” said Unicef’s executive director, Anthony Lake.

“But if young refugees are accepted and protected today, if they have the chance to learn and grow, and to develop their potential, they can be a source of stability and economic progress.”