Stanley Kubrick Laboratory at Columbia University 1948

Headline of the day. Will they actually get their inquiry?

• Banks Show An Almost Autistic Disregard For The Law – Australia Senator (Abc)

Pressure for a commission of inquiry into the banking sector is growing, with Nationals senator Barry O’Sullivan warning he might have the numbers to push his private members bill through Parliament. The banks “show an almost autistic disregard for prudential regulation and law and it’s time for these people to have their day in court”, the senator told ABC’s RN Breakfast on Monday. Senator O’Sullivan said he has support from as many as four colleagues. These include maverick Liberal National (LNP) MP George Christensen, who has already threatened to cross the floor, and fellow Queensland LNP MP Llew O’Brien, who has indicated “50-50” support. While a commission of inquiry would be an embarrassment for the Turnbull Government given its resistance to a royal commission, Senator O’Sullivan said it was time for the Prime Minister to listen.

“There’s no more important piece of business — millions and millions of Australians have been affected by the behaviour of the banks over time,” he said. “If both houses of Parliament think this is a good thing to do … then I think the Prime Minister has to … sit up and take note of that, and support the parliamentary decision.” But Senator O’Sullivan refused to comment on whether his move would embarrass and further destabilise the Prime Minister. “I am not going to be drawn on the question of the impacts on the Prime Minister and the Government — this is about democracy at work.” The proposed commission of inquiry would have similar powers to a royal commission. It would also look beyond banking and include superannuation, insurance and services associated with the scandal-plagued sector.

Time to be afraid in Europe.

• ECB Proposes End To Deposit Protection (GC)

It is the ‘opinion of the European Central Bank’ that the deposit protection scheme is no longer necessary: ‘covered deposits and claims under investor compensation schemes should be replaced by limited discretionary exemptions to be granted by the competent authority in order to retain a degree of flexibility.’ To translate the legalese jargon of the ECB bureaucrats this could mean that the current €100,000 (£85,000) deposit level currently protected in the event of a bail-in may soon be no more. But worry not fellow savers, as the ECB is fully aware of the uproar this may cause so they have been kind enough to propose that: “…during a transitional period, depositors should have access to an appropriate amount of their covered deposits to cover the cost of living within five working days of a request.”

So that’s a relief, you’ll only need to wait five days for some ‘competent authority’ to deem what is an ‘appropriate amount’ of your own money for you to have access to in order eat, pay bills and get to work. The above has been taken from an ECB paper published on 8 November 2017 entitled ‘on revisions to the Union crisis management framework’. It’s 58 pages long, the majority of which are proposed amendments to the Union crisis management framework and the current text of the Capital Requirements Directive (CRD). It’s pretty boring reading but there are some key snippets which should be raising a few alarms. It is evidence that once again a central bank can keep manipulating situations well beyond the likes of monetary policy. It is also a lesson for savers to diversify their assets in order to reduce their exposure to counterparty risks.

According to the May 2016 Financial Stability Review, the EU bail-in tool is ‘welcome’ as it: “…contributes to reducing the burden on taxpayers when resolving large, systemic financial institutions and mitigates some of the moral hazard incentives associated with too-big-to-fail institutions…” As we have discussed in the past, we’re confused by the apparent separation between ‘taxpayer’ and those who have put their hard-earned cash into the bank. After all, are they not taxpayers? This doesn’t matter, believes Matthew C.Klein in the FT who recently argued that “Bail-ins are theoretically preferable because they preserve market discipline without causing undue harm to innocent people.” Ultimately bail-ins are so central banks can keep their merry game of easy money and irresponsibility going. They have been sanctioned because rather than fix and learn from the mess of the bailouts nearly a decade ago, they have just decided to find an even bigger band-aid to patch up the system.

Feels like the FDP never wanted the talks to succeed. But they will support a minority government.

• Europe Faces a Hamstrung Germany as Merkel’s Coalition Bid Fails (BBG)

Angela Merkel may be running out of road after 12 years at the helm in Germany. With the chancellor’s attempt to form a fourth-term government in disarray, Merkel’s once unquestioned ability to steer Europe is waning as the region’s biggest economy heads into uncharted waters and possibly a protracted political stalemate. Markets reacted with unease, with the euro slumping the most in three weeks against the dollar. The breakdown in coalition talks late Sunday – amid disputes over migration and other policies between a grab-bag of disparate parties – raised the prospect of fresh elections, which probably would be held next spring. Relying on a minority administration with shifting alliances to pass legislation would run counter to Merkel’s promise to provide a stable government.

However she attempts to move forward, European decisions on everything from Brexit and Greece to Russian sanctions and French President Emmanuel Macron’s proposals for strengthening the euro will now be hemmed in by Merkel’s weakened role as a caretaker chancellor. “What it means is that Germany is pulled inward because it has to manage its political transition,” said Daniel Hamilton, executive director of the Center for Transatlantic Relations at Johns Hopkins University in Washington. “So the state of drift in Europe continues and now Germany, which has been the stabilizer of the last number of years, is part of that.” Merkel, 63, said she plans to stay on as acting chancellor and will consult with Germany’s president later Monday on what comes next.

We can all name 27 more.

• 3 Things That Could Destroy One Of The Greatest Stock Rallies Of All Time (BI)

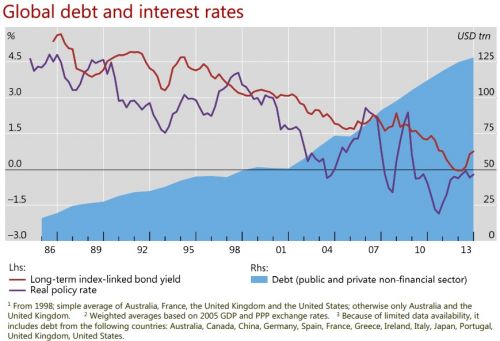

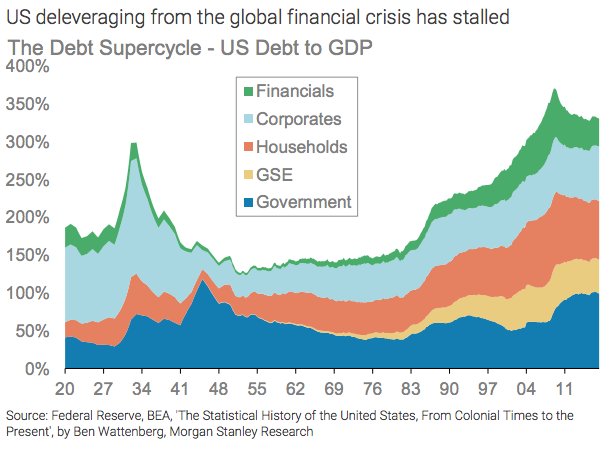

Extreme leverage build-up Morgan Stanley points out that previous comparable cycles have been derailed by steep increases in a measure of US debt to GDP. While the firm doesn’t see conditions as dire as they were around the Great Depression or the most recent financial crisis, it notes that deleveraging has stalled. While this situation may be sustainable in the near-term, since interest rates are still locked near zero, that could soon change with the Federal Reserve signaling multiple rate hikes by the end of 2018. Morgan Stanley also notes that interest coverage — or the ability to service debt — has been declining for both US investment-grade and junk debt since 2015. The chart below shows the ratio of debt/GDP, which has gone sideways in the past few years, implying that companies are no longer reducing debt burdens like they did when they were trying to dig out of the last market crash.

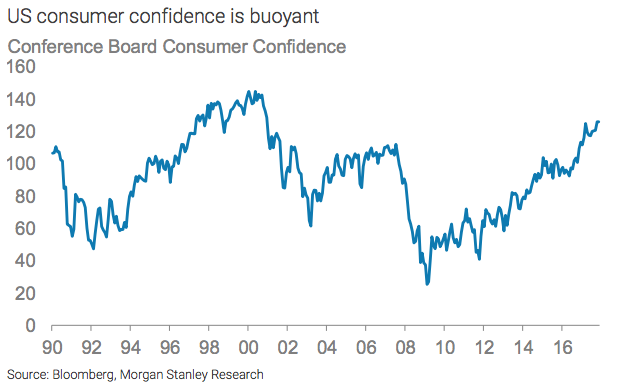

Exuberant sentiment This next driver is one that was briefly addressed in the introduction: investor overconfidence. The thinking here is that when the market gets too cocky, it becomes blind to potential risks and therefore more susceptible to downward shocks. As Morgan Stanley puts it, when there’s a “descent from thinking to feeling,” that could spell trouble. Morgan Stanley doesn’t think the market is too exuberant quite yet. While one measure shows that expectations around the economy have gotten overly optimistic, it’s still lower than where it was during the last financial crisis or the dotcom bubble. Still, the chart below shows that US consumer confidence is the highest it’s been since 2000, including a precipitous surge since the start of the bull market in 2009.

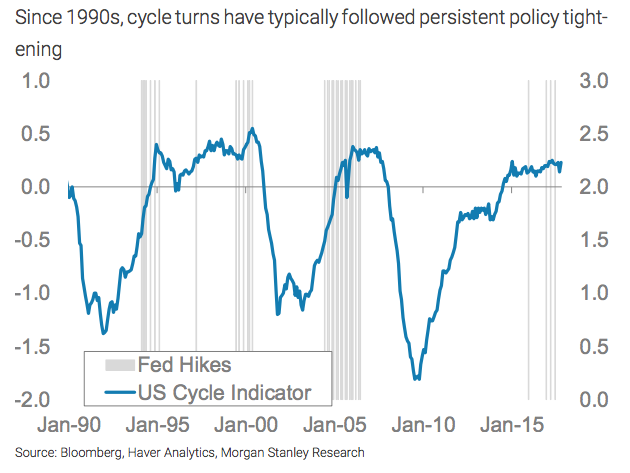

Excessive policy tightening When Morgan Stanley says that cycle downturns follow prolonged periods of monetary policy tightening, it speaks from experience. After all, the Federal Reserve persistently hiked interest rates in the periods leading up to both the dotcom bubble and the financial crisis. And while the firm doesn’t see excessive tightening yet, it warns that it could be right around the corner. “We have a bit of a ‘runway’ to the cycle peak, but not much,” a group of Morgan Stanley strategists wrote in a recent client note. “Over the next 12 months, our US economists expect further hikes in excess of core inflation, which would take us to ~190bp of cumulative hikes over 24 months, in line with the typical end-of-cycle policy environment.”

But before you start to panic, Morgan Stanley would like to remind you that the stock market can continue to soar, even in the final year of an expansion cycle. They point out that in the past, the S&P 500 has rallied an average of 15% in the last 12 months of an equity bull market. “The final year of the bull market can still be uncomfortably profitable,” the Morgan Stanley strategists wrote. “Timing is everything.”

A thin line.

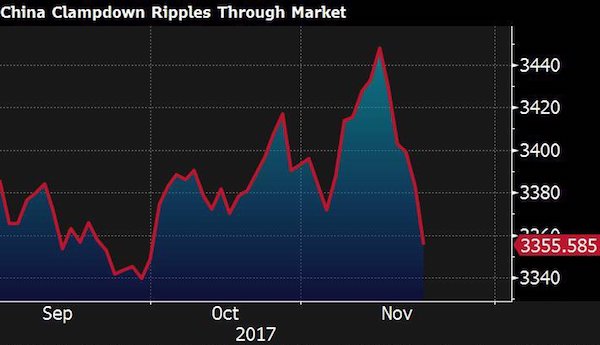

• China’s Clampdown On Shadow Banking Hits The Stock Market (BBG)

China’s sweeping new plan to rein in its shadow banking industry rippled through the nation’s stock market on Monday, sending the Shanghai Composite Index to a two-month low. Investors pushed the benchmark gauge down as much as 1.4% amid concern that the government’s latest attempt to tighten supervision of $15 trillion in asset-management products will siphon funds from the market. Developers and brokerages paced losses. While analysts applauded the plan as an important step toward curbing risk in China’s financial system, they also warned of turbulence as markets adjust to outflows from popular shadow-banking products. The government directives, which are set to take effect in 2019, add to signs that President Xi Jinping is willing to sacrifice growth as he tries to put the world’s second-largest economy on a more stable financial footing.

“The rules dealt a blow to the market,” said Zhang Gang, a Shanghai-based strategist with Central China Securities Co. “A lot of such products had positions in the equity market, and those that don’t qualify under new rules may choose to exit some small and medium caps.” The Shanghai Stock Exchange Property Index dropped 1.3%, with Gemdale Corp. losing as much as 2.6% and Poly Real Estate Group Co. declining 3.2%. China Vanke Co. sank as much as 4.9% in Shenzhen. A measure of securities firms fell to a five-month low, with Citic Securities Co. tumbling 3.7%.

He reportedly has just agreed to step down.

• Mugabe Faces Impeachment as He Holds on as Zimbabwe Leader (BBG)

President Robert Mugabe shocked Zimbabwe on Sunday night with a televised address that failed to announce his highly anticipated resignation, a dramatic twist that means the 93-year-old may face immediate impeachment hearings. Whether the final act of defiance was planned or simply the result of reading the wrong remarks, three senior party officials who spoke on the condition of anonymity said Mugabe deviated from an agreed-upon-text announcing he was leaving office. His ruling Zimbabwe African National Union-Patriotic Front will start a bid in parliament on Monday to force an end to this 37 years in power, the officials said. Delivering the nationally televised address with the armed forces commanders who took power last week looking on, Mugabe, who is the world’s oldest serving leader at 93, frequently lost his place and had to repeat himself.

He said the southern African nation must not be guided by “bitterness” and urged Zimbabweans to “move forward.” “Mugabe is dragging down the process as he tries to look for a dignified exit on his own terms,” Rashweat Mukundu, an analyst with the Harare-based Zimbabwe Democracy Institute, said by phone. “The impeachment process will still go ahead while on the other hand he will try and resign on his own terms.” Earlier Sunday, Zanu-PF central committee decided to fire Mugabe as its leader and ordered him to step down. Emmerson Mnangagwa, who Mugabe dismissed as vice president this month, will be reinstated, take over as interim president and be Zanu-PF’s presidential candidate in elections next year, the party said. It also expelled the president’s wife, Grace, the nation’s other vice president, Phelekezela Mphoko, along with several other senior officials.

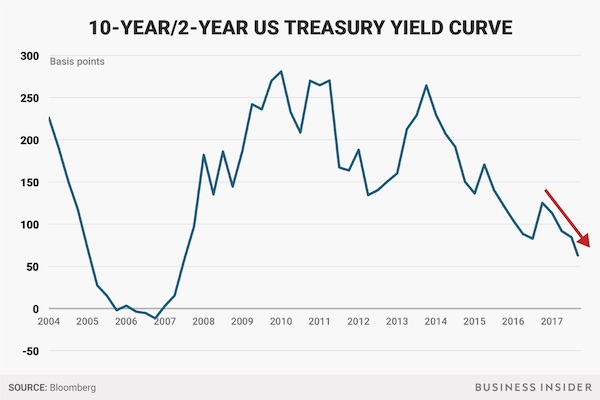

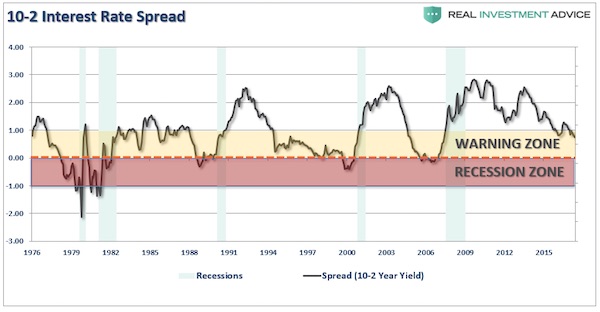

“..an inverted yield curve, where long-term interest rates fall below their short-term counterparts, has been a reliable predictor of recessions.”

• Yield Curve Flattening Could Derail Fed Interest Rate Hikes (BI)

The Federal Reserve’s plan to keep raising interest rates could soon run into a wall of its own making: low long-term borrowing costs that signal expectations for weak economic growth and anemic investment returns for the foreseeable future. Why is the Fed to blame? They’re not the only culprits, but the subdued economic recovery from the Great Recession and continued expectations for weakness stem in part from an insufficient, halting policy reaction to the deepest downturn in generations — both from monetary, and importantly, fiscal policy. In the past, including before the Great Recession of 2007-2009, an inverted yield curve, where long-term interest rates fall below their short-term counterparts, has been a reliable predictor of recessions.

The bond market is not there yet, but a sharp recent flattening of the yield curve has many in the markets watchful and concerned. The US yield curve is now at its flattest in about 10 years — in other words, since around the time a major credit crunch of was gaining steam. The gap between two-year note yields and their 10-year counterparts has shrunk to just 0.63 percentage point, the narrowest since November 2007. In fact, Shyam Rajan, Carol Zhang, and Olivia Lima, rate strategists at Bank of America Merrill Lynch, think low long-term bond yields could actually prevent the central bank from hiking interest rates further, as it plans to do. “We believe a precondition for the Fed to continue its hiking cycle in 2018 should be higher intermediate and long term rates,” they wrote in a research note to clients. “Without the latter, we would have doubts on the former.”

Eric Peters gets the style price again.

• Everything Is Overvalued And Implicitly Overleveraged (Peters)

“People ask, ‘Where’s the leverage this time?’” said the investor. Last cycle it was housing, banks. “People ask, ‘Where will we get a loss in value severe enough to sustain an asset price decline?’” he continued. Banks deleveraged, the economy is reasonably healthy. “People say, ‘What’s good for the economy is good for the stock market,’” he said. “People say, ‘I can see that there may be real market liquidity problems, but that’s a short-lived price shock, not a value shock,’” he explained. “You see, people generally look for things they’ve seen before.” “There’s less concentrated leverage in the economy than in 2008, but more leverage spread broadly across the economy this time,” said the same investor. “The leverage is in risk parity strategies. There is greater duration and structural leverage.”

As volatility declines and Sharpe ratios rise, investors can expand leverage without the appearance of increasing risk. “People move from senior-secured debt to unsecured. They buy 10yr Italian telecom debt instead of 5yr. This time, the rise in system-wide risk is not explicit leverage, it is implicit leverage.” “Companies are leveraging themselves this cycle,” explained the same investor, marveling at the scale of bond issuance to fund stock buybacks. “When people buy the stock of a company that is highly geared, they have more risk.” It is inescapable. “It is not so much that a few sectors are insanely overvalued or explicitly overleveraged this time, it is that everything is overvalued and implicitly overleveraged,” he said. “And what people struggle to see is that this time it will be a financial accident with economic consequences, not the other way around.”

For some reason, people fail to apply Gresham’s law to all assets.

There is a tale told by a lesser known Nobel laureate, Kenneth Arrow. As a World War II weather officer, he was tasked with analyzing the reliability of the army’s long-range weather forecasts. His conclusion: statistically speaking, the forecasts weren’t worth the paper they were printed on. Captain Arrow sent along his report only to be told, “Yes, the General is well-aware the forecasts are completely unreliable. But, he needs them for planning his military operations.” Okay, maybe you don’t actually need a Nobel prize to know that rationality in the decision-making department is often lacking. Case in point: the capital markets. While subtle and ingenious in construction, the capital markets are, nonetheless, driven by the mass action of millions. They are a reflection of ourselves and necessarily express both the summit of our knowledge as well as the pit of our fears, and everything else in-between.

And, this brings us to the subject at hand: Gresham’s Law. Sir Thomas Gresham was a financier in the time of King Henry VIII and his name is, of course, attached to the principle that “bad money drives out good money.” Coin collectors of a certain age are familiar with the near immediate disappearance from circulation of all silver American coins once Congress had mandated the use of base metals beginning with the 1965 vintage. While all coins – silver and copper alike – carried identical legal tender value, it was the silver coins that vanished. Perhaps you are wondering what this has to do with bond investing? Everything! Consider the state of financial markets as witnessed by metrics of implied volatility:

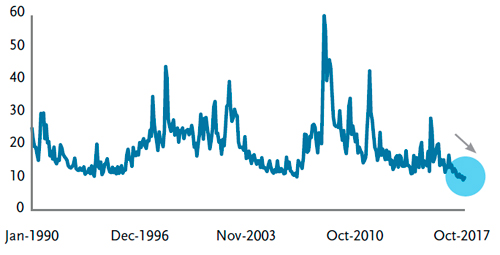

VIX Index

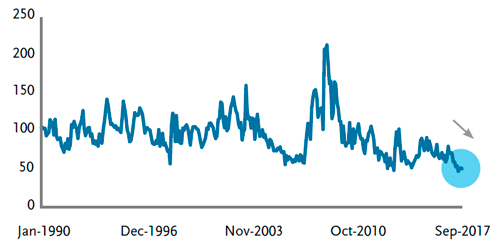

MOVE Index

Both indices hover at generational low levels. If markets were “run” today by humanity’s better angels of wisdom and rationality, you would have to conclude that Mr. Market has drawn on his collective insight and pronounced the capital markets to be safer now than at any other time in the past quarter-century. That is a stunning conclusion! But if rationality can’t explain a 25-year trough in expected risk, then we must necessarily conclude that there must be some other, less rational explanation. How about this: investors are, by and large, famished for yield and willing to underwrite most any risk to get some income. In short, the marginal price setter is “irrationally exuberant”, or dare we say it out loud? “Greedy.”

It’s productivity.

• Britain’s Gravest Economic Challenge Isn’t Brexit (R.)

Few British budgets have mattered as much as the one that Philip Hammond will deliver to the House of Commons on Nov. 22. The chancellor of the exchequer must shore up Theresa May’s perilously shaky government ahead of a vital Brexit summit of European leaders in mid-December. At the same time Hammond has to keep a grip on the public finances. But the gravest challenge he faces is economic: Britain’s persistent productivity blight.Productivity – output per hour worked – is the mainspring of economic growth. In the decade before the financial crisis of 2007-08 productivity was increasing in Britain by just over 2% a year, outpacing the average for the other economies of the G7. But since the crisis British performance has been dismal. Although productivity jumped in the third quarter of 2017, prolonged weakness means that it is barely higher than its pre-crisis peak a decade ago.

The recovery in GDP has been driven overwhelmingly by more labor input, a source of growth that is running dry – not least since the vote to leave the European Union delivered a message to curb immigration. Other advanced economies have also experienced setbacks to productivity growth following the financial crisis. Where Britain stands out is in the severity of its reverse. The shortfall in productivity is the main reason real wages are now 4% lower than 10 years ago, a potent reason why the leave campaign prevailed in the Brexit referendum. Productivity is so central to prosperity and to macroeconomic management – by determining how fast the economy can sustainably grow – that a gaggle of economic researchers have been busy in their labs trying to diagnose the now decade-long disease.

It could be disastrous.

• UK Christmas Spending Expected To Fall For First Time Since 2012 (Ind.)

Christmas spending across the UK is expected to fall for the first time since 2012, research by Visa and IHS Markit shows. According to a report published on Monday, a challenging economic environment, in which real wages are falling and economic growth is sluggish, will likely lead to a 0.1% fall in consumer spending during the 2017 festive season. That’s in sharp contrast to last year, when spending increased by 2.8% over the Christmas period. “While it still looks likely that consumers will be hitting stores and websites in search of bargains this Black Friday and Cyber Monday, we expect spending for the duration of the festive season to be lower in comparison to last year,” said Mark Antipof, chief commercial officer at Visa.

“Looking back, consumers were in a sweet spot in 2016 – low inflation and rising wages meant there was a little extra in household budgets to spend on the festive period,” he said. “2017 has seen a reversal of fortunes – with inflation outpacing wage growth and the recent interest rate rise leaving shoppers with less money in their pockets.” The research anticipates that high street spending will be particularly hard hit, falling by 2.1% compared to equivalent figures for last year – the biggest contraction since 2012. Online spending, however, is still expected to rise – by 3.6% over this Christmas period – meaning that it will account for a record share of this year’s Christmas spend. Visa said that of every £5 spent during the period, almost £2 will likely be spent online.

There’ll be more next Christmas.

• Many Americans Are Still Paying Off Debt From Last Christmas (CNBC)

As the holiday season approaches, the pressure to spend spikes. This year, gift-buying Americans plan to spend $660 on average. That’s according to new data from NerdWallet’s 2017 Consumer Holiday Shopping Report, which analyzed spending and behavior trends of more than 2,000 Americans aged 18 and over. And holiday-induced debt is a growing problem. Although survey respondents say they plan to spend roughly the same amount as they spent last year, 24% of shoppers say they overspent in 2016, while 27% admit to not making a budget at all. Even a budget is only a good start.

“There’s this myth that planning ahead and budgeting always ensures you don’t overspend. But in reality, creating and even sticking to a budget won’t make you immune to holiday debt,” Courtney Jespersen, a consumer savings expert at NerdWallet, says in the survey. “It’s so important to set a realistic ceiling for your spending.” During the 2016 season, boomers proved most likely to take on debt to finance their purchases, with 63% of respondents copping to the habit. Other generations took on debt as well, including 58% of Gen-Xers and 40% of millennials. What’s alarming about this pattern is that many Americans are still carrying last year’s debt as they head into yet another holiday season. Millennials are the worst culprits here: 24% still haven’t paid off credit card debt incurred during the 2016 shopping season, while 16% of Gen-Xers haven’t and only 8% of boomers haven’t.