Vincent van Gogh Ravine 1889

Negotiate!

• China Warns US ‘Opening Fire’ On World With Tariff Threats (R.)

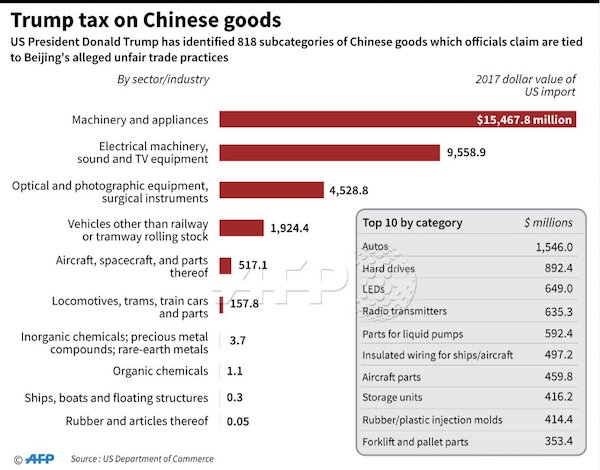

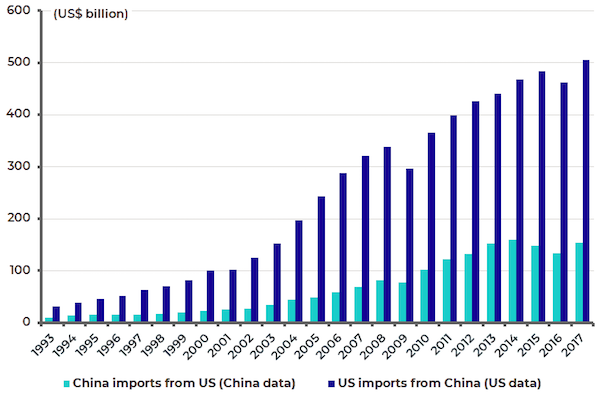

The United States is “opening fire” on the world with its threatened tariffs, the Chinese government warned on Thursday, saying Beijing will respond the instant U.S. measures go into effect as the two locked horns in a bitter trade war. The Trump administration’s tariffs on $34 billion of Chinese imports are due to go into effect at 12.01 am eastern time on Friday (0401 GMT Friday), which is just after midday on Friday Beijing time. U.S. President Donald Trump has threatened to escalate the trade conflict with tariffs on as much as a total of $450 billion in Chinese goods if Beijing retaliates, with the row roiling financial markets including stocks, currencies and global trade of commodities from soy beans to coal.

China has said it will not “fire the first shot”, but its customs agency said on Thursday in a short statement that Chinese tariffs on U.S. goods will take effect immediately after Washington’s tariffs on Chinese goods kick in. Speaking at a weekly news conference, Chinese Commerce Ministry spokesman Gao Feng warned the proposed U.S. tariffs would hit international supply chains, including foreign companies in the world’s second-largest economy. “If the U.S. implements tariffs, they will actually be adding tariffs on companies from all countries, including Chinese and U.S. companies,” Gao said. “U.S. measures are essentially attacking global supply and value chains. To put it simply, the U.S. is opening fire on the entire world, including itself,” he said.

Well, obviously.

• China Denies It Will Be First To Impose Tariffs On $34bn Of US Goods (G.)

China has denied it will fire the opening salvo in an escalating trade dispute with the US, insisting that it would not bring in 25% tariffs on $34bn (£26bn) of American goods before a move from Washington. Both sides have threatened to impose similarly sized tariffs on 6 July, but because of the 12-hour time difference, it was thought the Chinese tariffs on US imports ranging from soybean to stainless steel pipes could take effect earlier. However, China’s finance ministry issued a statement on Wednesday saying that it would not be the first to levy tariffs.

“The Chinese government’s position has been stated many times. We absolutely will not fire the first shot, and will not implement tariff measures ahead of the United States doing so.” The US will implement a 25% tariff on $34bn of Chinese imports – 818 product lines ranging from cars to vaporisers and “smart home” devices – on Friday. There had been hopes the US and China might step away from the measures, but neither side has backed down. Economists have warned that the tariffs will damage economic growth and cost jobs, and could escalate into a full-blown trade war between the world’s two largest economies.

Nonstarter.

• Europe Turns Down Chinese Offer For Grand Alliance Against The US (ZH)

Publicizing its growing exasperation in dealing with president Donald Trump who refuses to halt the tit-for-tat retaliation in the growing trade war with China – which is set to officially begin on Friday when the US slaps $34 billion in Chinese exports with 25% tariffs – but has a habit of doubling down the threatened US reaction to every Chinese trade counteroffer (after all the US imports far more Chinese goods than vice versa)…China has proposed a novel idea: to form an alliance with the EU – the world’s largest trading block – against the US, while promising to open up more of China’s economy to European corporations.

The idea was reportedly floated in meetings in Brussels, Berlin and Beijing, between senior Chinese officials, including Vice Premier Liu He and the Chinese government’s top diplomat, State Councillor Wang Yi, according to Reuters. Willing to use either a carrot or a stick to achieve its goals, in these meetings China has been putting pressure on the European Union to issue a strong joint statement against President Donald Trump’s trade policies at a summit later this month. However, perhaps because China’s veneer of the leader of the free trade world is so laughably shallow – China was and remains a pure mercantilist power, whose grand total of protectionist policies put both the US and Europe to shame – the European Union has outright rejected any idea of allying with Beijing against Washington ahead of a Sino-European summit in Beijing on July 16-17.

Instead, in the tradition of every grand, if ultimately worthless meeting of the G-X nations, the summit is expected to produce a “modest communique”, which affirms the commitment of both sides to the multilateral trading system and promises to set up a working group on modernizing the WTO. Incidentally, the past two summits, in 2016 and 2017, ended without a statement due to disagreements over the South China Sea and trade. Then there is China’s “free-trade” reputation: a recent Rhodium Group report showed that Chinese restrictions on foreign investment are higher in every single sector save real estate, compared to the European Union, while many of the big Chinese takeovers in the bloc would not have been possible for EU companies in China. And while China has promised to open up, EU officials expect any moves to be more symbolic than substantive.

Caving.

• EU Reportedly Considering International Talks To Cut Car Tariffs (CNBC)

European officials are considering holding talks on a tariff-cutting deal between the world’s largest car exporters to prevent an all-out trade war with the U.S., according to the Financial Times who cited diplomats briefed on the matter. The proposal is being looked at by officials in Brussels, the administrative heartland of the European Union, ahead of a meeting between Jean-Claude Juncker, the president of the European Commission, and President Donald Trump in Washington later in July, the report published Wednesday said.

The FT reported that three diplomats, which it did not name, said the European Commission “is studying whether it would be feasible to negotiate a deal with other big car exporters such as the U.S., South Korea and Japan.” Such a move could address Trump’s complaint that the U.S. sector is unfairly treated, while reducing export costs for other participating countries’ auto sectors. “Under such a deal, participants would reduce tariffs to agreed levels for a specified set of products — a concept in international trade known as a ‘plurilateral agreement’ that lets countries strike deals on tariffs without including the entire membership of the WTO,” the FT said.

Even Italy has a big surplus.

• Germany’s Massive Trade Surplus ‘Is Becoming Toxic,’ Ifo Director Says (CNBC)

Germany exporting more than it imports is becoming a big problem for its economy, a director from the country’s closely-watched Ifo Institute said Wednesday. “(The trade surplus) is turning out to be an increasing issue, not just with the U.S. but with other trade partners as well, and also within the European Union,” Gabriel Felbermayr, the director of the Ifo Center for International Economics at the Munich-based institute, told CNBC’s “Squawk Box Europe. “The surplus is becoming toxic, and also within Germany many argue now that we need to do something about it with the purpose of lowering it. It turns out to be a liability rather than an asset.”

Germany’s export-orientated, manufacturing economy and its resulting trade surplus — the value of its exports exceeding that of its imports — has long been a subject of criticism and Berlin has been pressured to encourage more domestic spending and boost imports. Trade surpluses are viewed as encouraging trade protectionism and worsening the economic problems of other countries. Germany’s trade surplus fell in 2017 for the first time since 2009, shrinking to $300.9 billion, data published in February by the country’s Federal Statistics Office showed. Still, its trade surplus with the U.S. was $64 billion.

[..] Eric Lonergan, macro fund manager at M&G, told CNBC on Wednesday that Trump might be mollified by European countries promising to address their current account surpluses. A current account surplus is a broader measure of the trade surplus, plus earnings from foreign investments and transfer payments. “(Regarding the trade surplus) the truth is it’s not just Germany anymore — central and eastern Europe, if you look at Hungary, Poland, the Czech Republic and take them as an aggregate, were running a big current account deficit before, now they’re running a big current account surplus,” he said. “Italy’s running a big current account surplus, the periphery is — so it’s the ‘Germanification’ of the whole of greater Europe.”

Rumor has it that Boris Johnson will resign. Maybe he’ll wait until after England lose to Sweden in the World Cup.

• Tories ‘Toast’ If They Don’t Deliver On Brexit, Theresa May Warned (Sky)

Theresa May has been warned the Tories will be “toast” if they fail to deliver on their Brexit promises, as eurosceptic MPs maintain the pressure on the prime minister ahead of a crunch meeting of her top team. As the PM prepares to gather ministers at her country retreat of Chequers on Friday, she has been put on notice by the European Research Group (ERG) of Conservative backbenchers. Around 40 members of the ERG met with chief whip Julian Smith on Wednesday, reports Sky’s senior political correspondent Beth Rigby. Our correspondent said that they told Mr Smith the party will be “toast” if it “welches” on its previous Brexit promises, adding that the roughly £40bn “divorce bill” should only be paid to Brussels on condition of getting a deal.

After the meeting, Jacob Rees-Mogg, who chairs the ERG, told Sky News that Mr Smith “doesn’t determine policies” and so backbench Brexiteers remain in the dark over the government’s plans beyond media reports. Asked about suggestions the PM could propose a UK-EU deal that keeps regulatory alignment with Brussels for goods, as well as keeping the same level of tariffs as the EU, Mr Rees-Mogg warned such an agreement is “not Brexit”. He insisted continued regulatory alignment would mean the UK “cannot do trade deals with the rest of the world” and would mean “we haven’t really left the EU”. “Indeed, worse than that, we’re a vassal state because we take the EU’s rules and have no say over them,” the Leave supporter added.

Not for the diehards.

• There Is Only Option On The Table: Soft Brexit (G.)

The proverbial can has been kicked down the proverbial road ever since Britain voted to leave the European Union in 2016. Don’t get me wrong. Can-kicking has a necessary place in politics. Theresa May has often had little choice but to resort to it. But the road and the can-kicking must end at Chequers on Friday. That’s when the prime minister and her divided cabinet must finally decide what kind of relationship they seek with the EU after Brexit. In the end, May’s government faces the same two choices at Chequers that it has faced throughout all the twists and turns of the Brexit negotiations.

Either the government must embrace a form of soft Brexit that it can then persuade the rest of Europe to accept as a proper basis for good future relations – the option that May herself and the chancellor, Philip Hammond, both prefer and will put forward – or it must reject that option and prepare for a no-deal Brexit, in which all of Britain’s economic and political relations with Europe and the rest of the world become matters of pure conjecture. There are no other choices on the table. If Brexit is to go ahead, it is simply one or the other. This means, therefore, that only the first of the two choices is in fact a serious option.

If the cabinet rejects May’s and Hammond’s approach and adopts a no-deal option as government policy, there would be both a parliamentary and an extra-parliamentary revolt against it. Large businesses such as British Airways might relocate to Europe. Labour might even find an explicit anti-Brexit voice. One way or another, the no-deal approach would therefore explode on the launch pad. And Brexit might even not take place. Most ministers are neither idiots nor wreckers, so the no-deal option is not going to happen. It is even questionable as to whether any of the no-dealers will resign. The much more serious question, though, is whether the soft Brexit package that May wants to sell to the cabinet is much of a runner either.

If they’re capable of Windrush, they can do this too.

• UK Home Office Separating Scores Of Children From Parents (Ind.)

The Home Office is separating scores of children from their parents as part of its immigration detention regime – in some cases forcing them into care in breach of government policy. Schools, the NHS and social services have written letters to the department begging them to release parents from detention because of the damaging impact it is having on their children. Bail for Immigration Detainees (Bid), a charity that supports people in detention, said they have seen 170 children separated from their parents by the Home Office in the past year – and believes there are likely to be many more.While usually the youngsters remain in the care of their other parent, the charity has seen a number of cases where children are taken into local authority care as a result of the detention.

Case workers highlight that this is in breach of Home Office guidelines, which state that a child “must not be separated from both adults if the consequence of that decision is that the child is taken into care”. In one case, three young children were taken into care for several days after their dad was detained earlier this year – an experience that left them traumatised and fearful that he will be “taken away” again. Kenneth Oranyendu, 46, was detained in March while his wife was abroad for her father’s funeral. Despite the Home Office being aware of this, they kept him in detention and his four young children were forced to go into care.

Japan’s toast without the punch bowl.

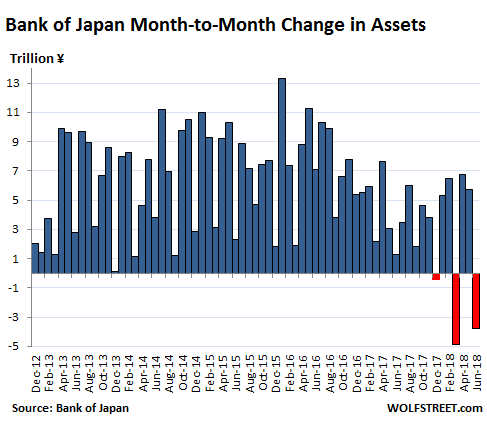

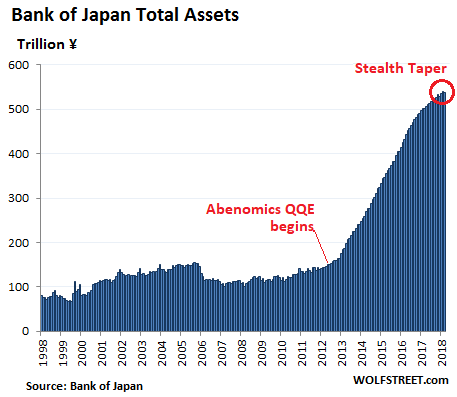

• Bank of Japan Takes Away Punch Bowl, Balance Sheet Declines (WS)

In June, total assets on the Bank of Japan’s balance sheet dropped by ¥3.79 trillion yen ($34 billion) from May, to ¥537 trillion ($4.87 trillion). It was the third month-over-month drop in seven months, and the first such drops since late 2012, when the Abenomics-designed blistering “QQE” (Qualitative and Quantitative Easing) kicked off. So has the “QQE Unwind” commenced? This chart shows the month-to-month changes of the total balance sheet. Note the trend over the past 16 months and the three “QQE unwind” episodes (red):

But this sporadic balance sheet reduction and the overall “tapering” of its growth contradict the official rhetoric. Bank of Japan Governor Haruhiko Kuroda along with most of his colleagues keep insisting that the BOJ would “patiently” maintain its ultra-easy monetary policy and that it would “keep expanding the monetary base until inflation is above 2%.” The blistering asset purchases would add about ¥80 trillion ($725 billion) to the balance sheet every year. And the BOJ has repeatedly affirmed its short-term interest-rate target of a negative -0.1%.

[..][ Under QQE, the BOJ has been buying mostly Japanese government securities (JGBs and short-term bills); it also purchased corporate bonds, Japanese REITs, and equity ETFs. But now, the party appears to be ending, despite the speeches to the contrary. From the distance, however, the flattening out (tapering) of the BOJ’s assets is barely noticeable, given the magnitude of the whole pile that amounts to about 96% of Japan’s GDP (the Fed’s balance sheet amounted to about 23% of US GDP at the peak):

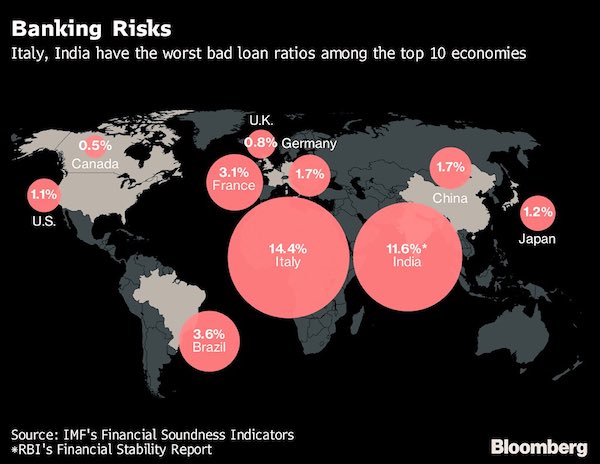

I’d say China is much worse than the graph indicates.

• India Is Emerging As Ground Zero Of The World’s Biggest NPL Crisis (ZH)

While bad loans in the Italian banking system have received a ton of attention from investors who fear that the Italians could inadvertently blow up the European banking union, it’s not the only financial landmine lurking among the world’s ten largest economies. To wit, while Italy has the largest percentage of non-performing loans among the world’s largest economies, India isn’t far behind and India’s economic recovery is built on an even shakier foundation. According to Bloomberg, India’s $1.7 trillion formal banking sector is presently struggling with $210 billion in bad loans, most of which are concentrated within its state-owned banks. During the 2018 fiscal year, growth slowed to 6.7%, down from the previous year’s 7.1%, back to its levels from 2014, before Modi came to power.

The state banks have been so badly mismanaged that some analysts say the country’s banking crisis is an opportunity for private sector banks, as CNBC reported. “If you take a 10-year view, currently the private sector banks’ market share is 30 percent. Probably it will become 60 percent,” Sukumar Rajah, senior managing director at Franklin Templeton Emerging Markets Equity, told CNBC. As a result, he said, “the overall health of the banking system will improve because the better banks will be a bigger portion of the market and the weaker banks will become a smaller portion of the market.”

Some also see opportunities for investment bankers looking to underwrite corporate bond issuance in the country.. “My view is that, incrementally, a lot of long-term financing of corporate India can also be met by the corporate bond market, which has developed reasonably well,” he said. “Between the corporate bond market and the private banks, I think most of the requirements can be met as far as corporate India is concerned.” When it comes to lending directly to individuals, Prasad said that is mostly done by the private banks and non-banking financial companies.

Can’t extradite someone who has broken none of your laws.

• Kim Dotcom Loses New Zealand Extradition Appeal (AFP)

Megaupload founder Kim Dotcom suffered a major setback in his epic legal battle against online piracy charges Thursday when New Zealand’s Court of Appeal ruled he was eligible for extradition to the United States. The German national, who is accused of netting millions from his file sharing Megaupload empire, faces charges of racketeering, fraud and money laundering in the US, carrying jail terms of up to 20 years. Dotcom had asked the court to overturn two previous rulings that the Internet mogul and his three co-accused be sent to America to face charges. Instead, a panel of three judges backed the FBI-led case, which began with a raid on Dotcom’s Auckland mansion in January 2012 and has dragged on for more than six years.

The court said US authorities had “a clear prima facie case to support the allegations that the appellants conspired to, and did, breach copyright wilfully and on a massive scale for commercial gain”. Dotcom is accused of industrial-scale online piracy via Megaupload, which US authorities shut down when the raid took place. They allege Megaupload netted more than US$175 million in criminal proceeds and cost copyright owners US$500 million-plus by offering pirated content including films and music. “We are disappointed with today’s judgment by the NZ Court of Appeal in the Kim Dotcom case,” his lawyer Ira Rothken tweeted, indicating there would be an appeal to the Supreme Court.

“We have now been to three courts each with a different legal analysis – one of which thought that there was no copyright infringement at all.” Dotcom and his co-accused – Finn Batato, Mathias Ortmann, Bram van der Kolk – have denied any wrongdoing and say Megaupload was simply a case of established interests being threatened by online innovation. The website was an early example of cloud computing, allowing users to upload large files onto a server so others could easily download them without clogging up their email systems. At its height in 2011, Megaupload claimed to have 50 million daily users and account for 4% of the world’s internet traffic.

How people are made.

When a baby is born, its parents teach it how to eat solid foods and walk and talk, which generally works out fine. Then they start teaching the baby all the lies their parents taught them, and things start to get messy. When the baby is old enough, they send it to school, where it spends twelve years being taught lies about how the world works so that one day it will be able to watch CNN and say “Yes, this makes perfect sense” instead of “This is ridiculous” or “Why does this whole entire thing seem completely fake?” or “I want to punch Chris Cuomo in the throat.” The baby is taught history, which is the study of the ancient, leftover propaganda from whichever civilization happened to win the wars in a given place at a given time.

The baby is taught geography, so that later on when its country begins bombing another country, the baby’s country won’t be embarrassed if its citizens cannot find that country on a globe. The baby is taught obedience, and the importance of performing meaningless tasks in a timely manner. This prepares the baby for the half century of pointless gear-turning it will be expected to undertake after graduation. The baby is taught that it lives in a free country, with a legitimate electoral system which facilitates meaningful elections of actual representatives in a real government. It is never taught that those elections, representatives and government are all owned and operated by the very rich, who use them to ensure policies which make them even richer while keeping everyone else as poor as possible so that they won’t have to share political power.

It is never taught that highly secretive intelligence and defense agencies form alliances with those rich people to advance murderous and exploitative agendas for profit and power. It is never taught that the things it sees on television are mostly lies. The baby is smoothly, seamlessly funneled from uterus to full-time employment through this system, often with a little religion mixed in to really drive home the importance of obedience and meekness and the nobility of poverty.

Waiting for my man