Balthus Girl at the window 1955

“Tough times never last but tough people do.”

~Robert H. Schuller

Tucker fair fight

Tucker on @ElonMusk: “The richest man in the world is risking it all to save Free Speech. Whatever you think of Elon Musk and however this ends, that’s a remarkable thing to watch.” pic.twitter.com/g4jpFCSkfc

— Benny Johnson (@bennyjohnson) October 29, 2022

Clare Daly

Methane is 80 times more potent as a greenhouse gas than CO2.

The #NordStream sabotage released 300,000 metric tonnes of it into our atmosphere – a climate & environmental crime.

It must be independently investigated and there must be consequences for the vandals who did it. pic.twitter.com/JAeKQc2QGH

— Clare Daly (@ClareDalyMEP) October 28, 2022

Twitter just reinstated Peter McCullough, but there’s more:

Senator Ron Johnson @SenRonJohnson:

“Hearing Dr. Peter McCullough has been stripped of his medical certifications. On what basis did this occur? He has dedicated his life to saving others. This is outrageous and must be reversed.”

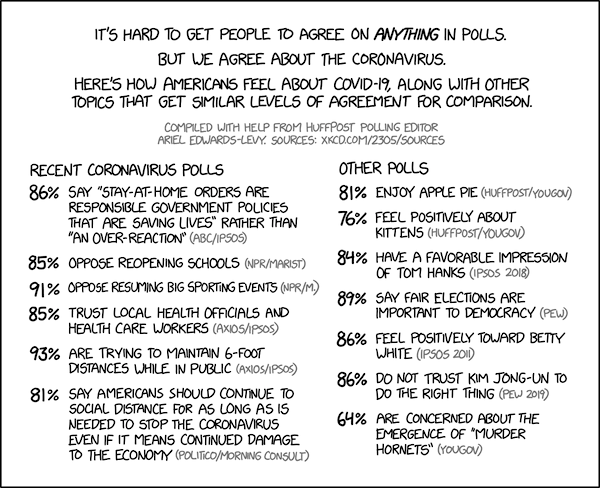

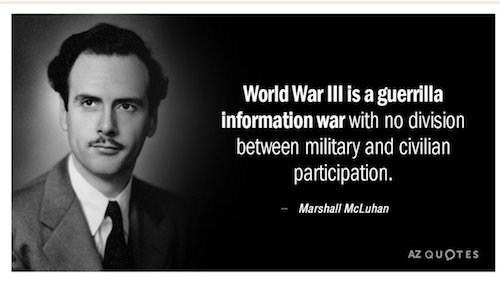

You read this, you think: a voice of reason. But they still have to resort to blatant lies: “The poll’s release comes after Vladimir Putin doubled down on Russia’s war in Ukraine by mobilizing reserves and issuing threats to use nuclear weapons after recent gains by the Ukrainian military near the country’s eastern border with Russia.”

Putin mentioned nukes exactly once, and that was long before Ukraine’s “recent gains”. It was also not a threat. It was a statement.

• Americans Support Quick Diplomatic End To War In Ukraine (ReSt)

Nearly 60 percent of Americans would support the United States engaging in diplomatic efforts “as soon as possible” to end the war in Ukraine, even if that means Ukraine having to make concessions to Russia, according to a new poll. The survey, conducted by Data for Progress on behalf of the Quincy Institute for Responsible Statecraft, also found that a plurality (49 percent) said the Biden administration and Congress have not done enough diplomatically to help end the war (37 percent said they had). The poll’s release comes after Vladimir Putin doubled down on Russia’s war in Ukraine by mobilizing reserves and issuing threats to use nuclear weapons after recent gains by the Ukrainian military near the country’s eastern border with Russia.

Moscow has also recently orchestrated referendums in some Russian-controlled areas of Ukraine on whether citizens there want to secede and become part of the Russian Federation, leading experts to believe that regardless of the outcome, Putin plans to illegally annex parts of Ukraine. The survey also found that 47 percent said they support the continuation of U.S. military aid to Ukraine only if Washington is involved in ongoing diplomacy to end the war, while 41 percent said they would support aid regardless of whether the United States is engaged in negotiations. Just six percent said Russia’s war in Ukraine is among the top three most important issues facing the United States today, with the top three being inflation (46 percent), jobs and the economy (31 percent), and gun violence (26 percent).

Fatih Birol has been issuing nonsense for many years. That’s precisely why he’s kept his job all this time.

But it’s very simple: if you have all the “energy”, you cannot lose the battle for it.

• ‘Russia Will Lose The Energy Battle,’ Says IEA Chief Fatih Birol (EN)

Russia will lose the energy battle it is waging against the West, according to Fatih Birol, the executive director of the International Energy Agency (IEA). “Just before the invasion [of Ukraine], about 65% of the Russian total gas exports went to Europe and 55% of the Russian oil export went to Europe,” Birol told Euronews on Friday afternoon. “Europe was by far the largest market, the largest client for Russia, and Russia lost this client forever. The biggest client.” Birol’s comments appeared to refer to the retaliatory action that the European Union has taken in response to the Ukraine war: a near-total oil embargo of Russian gas and a highly expensive push to diversify gas suppliers, mainly through liquefied natural gas (LNG).

Asked if Russia could replace European clients with other regions, Birol said that would not be easy because “a big chunk” of Russian gas originates in Western Siberia and then flows to Europe via pipelines. Building brand-new pipelines to China or India could take up to 10 years, he predicted, and a significant amount of technology and investment. “You are not selling onions in the market, you are selling natural gas. It’s a different business,” Birol said. “So to replace the natural gas exports to Europe with Russia is, in the short term, a pipe dream.” But Russia is not the only country going through troubled times. In his interview with Euronews, recorded at the IEA’s headquarters in Paris, Birol spoke of an international crisis of unprecedented scope and reach, wreaking havoc in all corners of the world.

“We are in the middle of the first truly global energy crisis. Our world has never, ever witnessed an energy crisis with this depth and with this complexity,” he said. “In the 1970s, we had an oil crisis, but it was only oil. Now we have oil, natural gas, coal, electricity. The reason is very simple: Russia, the country that invaded Ukraine, is the largest energy exporter of the world.” Birol described Europe as the “epicentre” of the storm and characterised its decades-long reliance on cheap Russian fuels as a “mistake” at the root of the present crisis. The IEA chief predicted the continent will be able to make it through the upcoming winter with just some “economic and social bruises” and no major damage — but only if the winter “is not too long and not too cold, and if there are no major surprises.”

Birol, however, expressed greater concern about the 2023-2024 winter, citing three key factors: Europe’s absence of Russian gas, China’s economic recovery and tighter conditions in the LNG markets. “In the next few years, we have to be ready [to deal] with volatile and high energy prices and we have to find solutions,” he said. “But to be very frank, this winter is difficult and next winter may be even harder.”

More Birol.

• Russian Energy ‘Will Never Return’ – IEA (RT)

Russia may “never” regain its position in the global energy market due to Western sanctions in response to the country’s military operation in Ukraine, the International Energy Agency (IEA) said in its yearly World Energy Outlook, published on Thursday. The events in Ukraine are prompting a wholesale reorientation of global energy trade, leaving Russia with a much diminished position.All Russia’s trade ties with Europe based on fossil fuels had ultimately been undercut by Europe’s net zero ambitions, but […] now the rupture has come with a speed that few imagined possible … Russian fossil fuel exports will never return – in any of our scenarios – to the levels seen in 2021,” the agency said. It predicts that Russian oil and gas revenues will drop by more than half in the coming years, from around $75 billion last year to less than $30 billion in 2030.

Western sanctions prompted Russia, which previously supplied around 20% of the globe’s fossil fuels, to reorient its energy exports toward Asian markets, but according to the IEA the country is unsuccessful in finding markets for all of the flows that previously went to Europe. Longer term prospects are weakened by uncertainties over demand, as well as restricted access to international capital and technologies to develop more challenging fields and LNG projects, the agency explained. Overall, according to the IEA the world is facing a crisis of unprecedented depth and complexity in terms of energy, with a profound reorientation of international energy trade already underway. The agency predicts that the energy crisis is likely to force countries to speed up their energy transition, as solar and wind power, as well as electric vehicles, are deemed less vulnerable to political crises and sanctions than fossil fuels.

Not even close.

• US LNG Cannot Replace The Russian Natural Gas That Europe Has Lost (OP)

Europe cannot rely solely on imports of U.S. LNG to offset the pipeline gas supply it will have lost from Russia when it starts rebuilding inventories after the end of this winter, according to BloombergNEF. So far this year, American LNG has been crucial in meeting demand in Europe, which is scrambling for gas supply and willing to pay up for spot deliveries, outbidding most of Asia. The United States is shipping record volumes of LNG to Europe to help EU allies and nearly 70% of all American LNG exports were headed to Europe in September, according to Refinitiv Eikon data cited by Reuters. However, the significant drop in Russian gas supply this year occurred only in June, meaning that Europe could still stock up on some Russian gas earlier this year.

Ahead of the 2023/2024 winter, however, the gap in gas supply in Europe will be much wider without Russian gas. Europe will not be importing much Russian gas—or none at all if Russia cuts off deliveries via the one link left operational via Ukraine and via TurkStream—compared to relatively stable imports from Russia in the first half of this year, before Moscow started gradually cutting volumes via Nord Stream in June until shutting down the pipeline in early September. “The year-on-year increase is not sufficient to offset a total cut in Russian piped supply with under half of these volumes met by LNG increases,” BNEF analyst Arun Toora said.

“The good news is that Russia looks close to having played its last card in terms of gas leverage over Europe. However Europe’s challenges will not disappear with the daffodils next spring,” London-based consultancy Timera Energy said in a winter gas market outlook at the beginning of October. Without most of the Russian gas supply, Europe will likely need to offset around 40 bcm of additional lost Russian flows next year. LNG alone cannot meet this volume, considering a lack of new global liquefaction capacity in the short-term, including in the U.S., limited further demand elasticity in Asia, and European regasification capacity constraints. Therefore, European demand will need to fall, Timera Energy said.

“Putin in fact did nail where we are: on the edge of a Revolution.”

• Putin: “The Situation Is, To A Certain Extent, Revolutionary” (Escobar)

[..] the heart of the matter at Valdai is its 2022 report, “A World Without Superpowers”. The report’s central thesis – eminently correct – is that “the United States and its allies, in fact, no longer enjoy the status of dominant superpower, but the global infrastructure that serves it is still in place.” Of course all major interconnected issues at the current crossroads were precipitated because” Russia became the first major power which, guided by its own ideas of security and fairness, chose to discard the benefits of ‘global peace’ created by the only superpower.” Well, not exactly “global peace”; rather a Mafia-enforced ethos of “our way or the highway”.

The report quite diplomatically characterizes the freezing of Russia’s gold and foreign currency reserves and the “mop up” of Russia’s property abroad as “Western jurisdictions”, “if necessary”, being “guided by political expediency rather than the law”. That’s in fact outright theft, under the shadow of the “rules-based international order”. The report – optimistically – foresees the advent of a sort of normalized “cold peace” as “the best available solution today” – acknowledging at least this is far from guaranteed, and “will not halt the fundamental rebuilding of the international system on new foundations.” The foundation for evolving multipolarity has in fact been presented by the Russia-China strategic partnership only three weeks before imperially-ordered provocations forced Russia to launch the Special Military Operation (SMO).

The Valdai report duly acknowledges the role of Global South medium-sized powers that “exemplify the democratization of international politics” and may “act as shock absorbers during periods of upheaval.” That’s a direct reference to the role of BRICS+ as key protagonists. On the Big Picture across the chessboard, the analysis tends to get more realistic when it considers that “the triumph of ‘the only true idea’ makes effective dialogue and agreement with supporters of different views and values impossible by definition.” Putin alluded to it several times in his address. There’s no evidence whatsoever the Empire and its vassals will be deviating from their normative, imposed, value-laden unilateralism.

As for world politics beginning to “rapidly return to a state of anarchy built on force”, that’s self-evident: only the Empire of Chaos wants to impose anarchy, as it completely ran out of geopolitical and geoeconomic tools to control rebel nations, apart from the sanctions tsunami. So the report is correct when it identifies that the childish neo-Hegelian “end of history” wet dream in the end hit the wall of History: we’re back to the pattern of large scale conflicts between centers of power. And it’s also a fact that “simply changing the ‘operator’ as it happened in earlier centuries” (as in the US taking over from Britain) “just won’t work.” China might harbor a desire to become the new sheriff, but the Beijing leadership definitely is not interested.

And even if that happened the Hegemon would fiercely prevented it, as “the entire system” remains “under its control (primarily finance and the economy).” So the only way out, once again, is multipolarity – which the report characterizes, rather vaguely, as “a world without superpowers”, still in need of “a system of self-regulation, which implies much greater freedom of action and responsibility for such actions.” Stranger things have happened in History. As it stands, we are plunged deep into the maelstrom of complete collapse. Putin in fact did nail where we are: on the edge of a Revolution.

“..in recent days, Kyiv has accused Moscow of deliberately delaying the passage of ships, creating a queue of more than 170 vessels.”

How does a massive attack solve this?

• ‘Massive’ Drone Attack On Black Sea Fleet – Russia (BBC)

Russia has accused Ukraine of carrying out a “massive” drone attack on the Black Sea Fleet in the Crimean port city of Sevastopol. The attack began at 04:20 (01:20 GMT) and involved nine aerial and seven marine drones, Russian officials said. At least one warship is said to have been damaged in the strikes. Ukraine has not yet acknowledged the incident. Ukrainian troops have been successfully retaking territory occupied by Russians recently. Russia has replied by launching large-scale attacks on Ukrainian infrastructure, particularly on the country’s energy grid. Mikhail Razvozhaev, the Russian-installed governor of the Sevastopol, said Russia’s navy had repelled the latest attack. The strikes were the “most massive” on the city since Russia launched the invasion of Ukraine in February, Russian state media quoted the governor as saying.

He said that all unmanned aerial vehicles (UAV) had been shot down and no “civilian infrastructure” had been damaged. At least one vessel sustained minor damage, the Russian Ministry of Defence said. “In the course of repelling a terrorist attack on the outer roadstead of Sevastopol, the use of naval weapons and naval aviation of the Black Sea Fleet destroyed four marine unmanned vehicles, three more devices were destroyed on the internal roadstead,” a statement from the ministry read. Russia also claimed the ships targeted on Saturday morning were involved in ensuring the “grain corridor” as part of the international initiative to export agricultural products from Ukrainian ports.

The agreement, brokered by the UN and Turkey, allowed Ukraine to resume its Black Sea grain exports, which had been blocked when Russia invaded the country. It was personally negotiated by the UN secretary general and celebrated as a major diplomatic victory that helped ease a global food crisis. But Russia complains that its own exports are still hindered, and has previously suggested it might not renew the deal. In recent days, Kyiv has accused Moscow of deliberately delaying the passage of ships, creating a queue of more than 170 vessels.

“Russia “is suspending its participation in the implementation of agreements on the export of agricultural products from Ukrainian ports..“

• Russia Suspends Its Participation In Grain Deal (RT)

Moscow has halted its compliance with a grain deal with Kiev, brokered by the UN and Türkiye, after Ukraine launched a major drone attack on ships involved in securing safe passage for agricultural cargo, the Russian Defense Ministry announced on Saturday.In a post on its Telegram channel, the ministry said Russia “is suspending its participation in the implementation of agreements on the export of agricultural products from Ukrainian ports”. It explained that the move was prompted by “a terror attack” against the ships of the Black Sea Fleet and civilian vessels involved in ensuring the security of the grain corridor. The ministry also alleged that the bombing was organized with the involvement of British military.

Still no investigation results. Top secret.

• British Navy Involved In Nord Stream 2 ‘Terrorist Attack’ – Russia (RT)

Britain’s Royal Navy played a part in orchestrating and staging the sabotage of the Nord Stream gas pipelines in the Baltic Sea, the Russian Defense Ministry said on Saturday. The accusation follows the Russian Foreign Ministry’s claim that NATO conducted a military exercise during the summer, close to the location where the undersea explosions occurred. Writing on its official Telegram channel, the ministry alleged that Royal Navy operatives “took part in planning, supporting and implementing” a “terrorist attack” to blow up the gas pipelines on September 26. According to the Defense Ministry, the same British operatives were involved in the training of Ukrainian military personnel who recently attacked ships of Russia’s Black Sea fleet, which were implementing a grain deal between Russia and Ukraine, brokered by the UN and Türkiye.

The pipelines, which were built to deliver Russian natural gas directly to Germany, abruptly lost pressure on September 26, following a series of underwater explosions off the Danish island of Bornholm. Both Western countries and Russia sounded the alarm about the incident, with Moscow denouncing it as a terrorist attack and calling for an investigation into the matter. In late September, Russian Foreign Ministry spokeswoman Maria Zakharova noted that this summer, NATO conducted military drills not far from Bornholm, which featured intensive use of “deep-sea equipment’’. Earlier this month the Wall Street Journal, citing German officials familiar with the investigation, reported that the blasts which damaged the pipelines were caused by sabotage.

While the officials stopped short of naming the culprit, they were said to be “working under the assumption that Russia was behind the blasts.” Moscow has repeatedly denied that it had anything to do with the incident. Meanwhile, Sky News has cited a UK defense official as saying Nord Stream 1 and 2 could have been damaged by a remotely detonated underwater explosive device. At the time, the broadcaster said the pipelines might have been breached by mines lowered to the seabed, or explosives dropped from a boat or planted by an undersea drone.

Putin: “Gas pipeline systems were blown up-they are not only ours, they are pan-European, there are 5 European companies represented in Nord Stream 1….Everyone is silent, as if it should be so. And they still have enough impudence to say that maybe Russia blew it up?” pic.twitter.com/xHjG3Cqqik

— The Convo Couch (@theconvocouch) October 28, 2022

At some point, someone will say that is an awful lot of money to keep a bunch of neo-nazis in power.

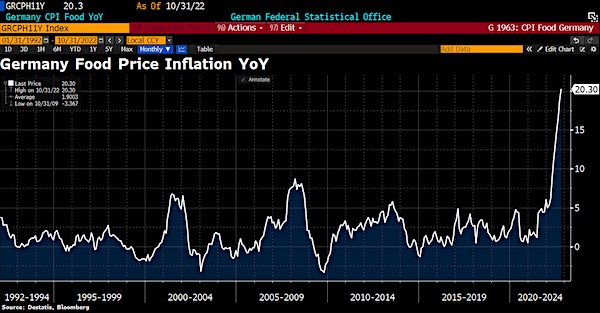

• German Bailout Of Struggling Energy Giant May Reach €60 Billion – BBG (RT)

Berlin is getting ready to boost financial aid to Uniper, the country’s largest gas supplier, which has been brought to the brink of insolvency due to rising energy prices, Bloomberg reported citing sources familiar with the matter. According to the report, the government may up the aid to €60 billion ($60 billion). The plan comes as the company’s financial situation is quickly worsening due to growing wholesale gas prices prompted by diminishing flows from Russia. Uniper’s adjusted net loss for the first nine months of the year reportedly amounted to €3.2 billion ($3.2 billion). And if gas prices do not subside, which is unlikely due to the approaching winter and the subsequent growth in demand, the government will have to spend twice as much to bail out the energy giant than previously expected.

German authorities announced plans to nationalize Uniper last month as part of efforts to keep the energy industry afloat amid the crisis. Uniper has been promised around €31 billion in aid from Berlin’s €200 billion energy aid package. In exchange, the government will acquire a 98.5% stake in the firm, which effectively means its full nationalization. The law cementing the deal is reportedly scheduled to be confirmed by the German Senate on Friday, and the funds could be transferred to Uniper next week, Bloomberg sources said. In an interview with Bloomberg, German Deputy Finance Minister Florian Toncar said Berlin will do all in its power to ensure Uniper remains operational but did not comment on the size of the aid.

“Uniper is a crucial company for the gas supply in Germany, otherwise we wouldn’t jump to such high stakes,” he was cited as saying. While European benchmark gas futures have fallen about 70% from their August highs on nearly full storage and liquefied natural gas (LNG) deliveries, gas prices remain around three times higher than the five-year average. According to Uniper, the company is forced to pay much more for gas now than it did for the pipeline supplies from Russia.

The Guardian found an anti-Orban Hungarian.

• Orbán Says Hungary Is ‘Exempt’ From The Conflict (Dalos)

The invasion of Ukraine on 24 February 2022 will go down in the annals of European history. Russia’s undeclared war has cast an almost apocalyptic shadow. And it has dramatically altered the relationships that had prevailed between east and west since the collapse of the USSR. Whenever or however this armed conflict ends, it will undoubtedly take a long time for a new peace-guaranteeing equilibrium to be established. At the very least, the European Union and Nato now have to reckon with a hostile power on their borders and to prepare for a new phase of the cold war. Hungarians voted in general elections just weeks after the invasion, in April, and it seems reasonable to assume that the war next door had an influence on the result.

Given the climate of fear that the devastating “special military operation” created, Hungarians voted to keep Viktor Orbán’s Fidesz in power rather than risk an untested six-party coalition. This assumption also underlies Orbán’s response, which is to stay out of the conflict to the point of being “exempted”, a position that has been condemned as a betrayal by Hungary’s western allies. Hungary refuses to allow arms shipments destined for Kyiv to transit Hungarian territory and blocks the extension of EU sanctions against Russia to the energy sector. This latter stance is intended to enable an already controversial Russian-Hungarian project to build a nuclear power plant on the Danube (Paks II) to go ahead unaltered. The exemption clearly goes too far, even if Hungary does have special interests that merit consideration.

It has a 136km (84-mile) border with Ukraine and there are roughly 150,000 ethnic Hungarians living in the Transcarpathian oblast in south-west Ukraine, many of them married to Ukrainians. It should be remembered that, while in purely geographical terms, Hungary stayed the same after 1989: the former Hungarian People’s Republic now borders five countries that owe their statehood to the end of the USSR and the dissolution of larger, multi-ethnic entities. To the south, the collapse of the former Yugoslavia led to the creation of Serbia, Croatia and Slovenia. Its northern border is no longer with the former Czechoslovak Socialist Republic but with Republic of Slovakia and independent Ukraine. What now connects most of these newer political entities with Hungary, and indeed its old neighbours, Romania and Austria, is EU membership.

Serbia is on the waiting list, Ukraine has been awarded candidate status. But in the 1990s, all these countries made the transition to parliamentary democracy, during which the rivalries between the various political groups played out openly and, not infrequently, violently. Every twist and turn and every internal conflict in these republics still affects Hungary’s interests because of the Hungarian minorities living there: 1.5 million in Romania, 500,000 in Slovakia, 300,000 in Serbia, 16,000 in Croatia, 15,000 in Slovenia and 150,000 in Ukraine.

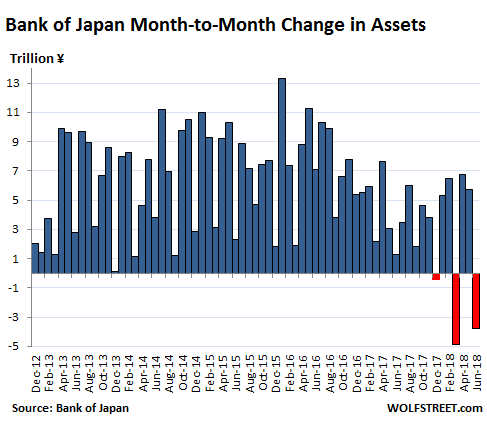

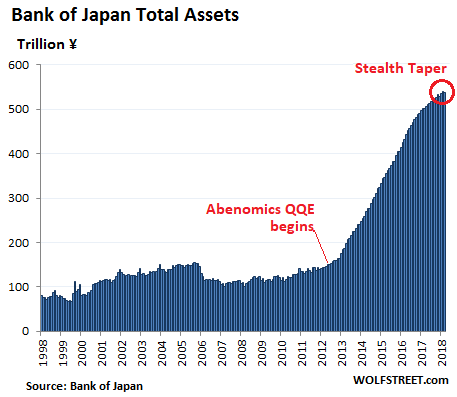

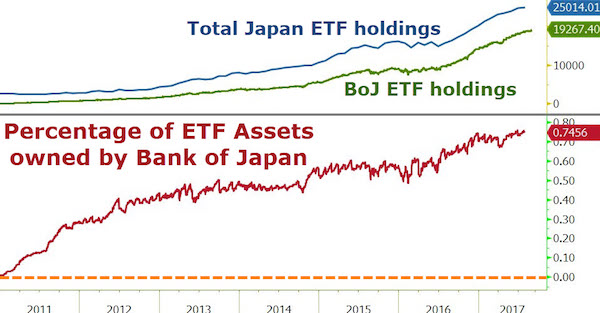

Japanese govt bonds are bought by the BOJ AND the citizens. A closed loop.

• Japan Unveils Massive Spending Package (RT)

The Japanese government has announced an economic package worth around 39 trillion yen (nearly $270 billion) to support the economy amid rising inflation and a weakening national currency, broadcaster NHK reported on Friday. The package includes local and central government spending, and is “aimed at overcoming rising prices and reviving the economy… to protect people’s livelihoods and businesses,” Prime Minister Fumio Kishida told reporters in Tokyo. The government plans to lower utility bills to help households save an equivalent of $19 a month on electricity and $6 a month on gas, according to Kyodo News.

Inflation in Japan has seen its sharpest increase in 40 years, with core consumer prices in Tokyo, a leading indicator of nationwide figures, rising 3.4% in October from a year earlier, according to official figures. The increase has been attributed to rising energy, raw material and food prices amid the economic fallout of the conflict between Russia and Ukraine, as well as other factors, the Kyodo News said. The Bank of Japan, however, has been swimming against the global current of increasing interest rates as it kept its short-term interest rate at -0.1% on Friday. Last week, the Japanese yen fell to its weakest level against the dollar since August 1990, having lost more than a fifth of its value against the greenback this year alone.

“..Twitter, is owned as of yesterday by the CEO and largest shareholder of Tesla. And the automakers that compete with Tesla, and are getting their clocks cleaned by Tesla, are now finding themselves advertising on Elon Musk’s platform.”

• GM “Paused” Ads on Musk’s Twitter (WS)

Automakers spend lavishly on advertising, and they advertise heavily in the social media. But now, one of the social media platforms, Twitter, is owned as of yesterday by the CEO and largest shareholder of Tesla. And the automakers that compete with Tesla, and are getting their clocks cleaned by Tesla, are now finding themselves advertising on Elon Musk’s platform. And when you think about it, that’s kind of a hoot. No one likes to advertise on a competitor’s platform, for all sorts of reasons, but particularly because on a social-media platform, the competitor gathers the consumer tracking data and can get important insights into current and potential customers and their reactions to the products and ads – without even passing on those insights to the automaker.

Advertising on a competitor’s social media platform is a particular problem because of the vast amount of user data that those platforms collect – data on your customers and potential customers that you may actually not see yourself, unless the platform decides to share it with you. General Motors is the first automaker out the gate: It announced on the first day after Musk closed the acquisition of Twitter that it “paused” its paid advertising on Twitter. “We are engaging with Twitter to understand the direction of the platform under their new ownership. As is normal course of business with a significant change in a media platform, we have temporarily paused our paid advertising. Our customer care interactions on Twitter will continue,” GM said in a statement emailed to CNBC.

Stellantis, which owns the Chrysler, Dodge, Jeep, and Ram brands, among a bunch of other brands, tweeted this morning via its Citroën account, pointing specifically at the issue: “Hello to the social media platform owned by one of our competitors.” This isn’t about advertisers’ concerns, if any, with Musk’s potential content moderation policies. Musk already tried to soothe those fears with his open letter, addressed to advertisers, that was suddenly full of lovey-dovey language, posted on Twitter, of course. “In addition to adhering to the laws of the land, our platform must be warm and welcoming to all.” And he said, “I very much believe that advertising, when done right, can delight, entertain, and inform you.” And he said, “Twitter aspires to be the most respected advertising platform in the world that strengthens your brand and grows your enterprise.”

“The focus of the letter is the fact that Barrett voted with the majority in the Dobbs decision to overturn Roe v. Wade.”

• Writers, Publishers, Editors Call for Termination of Barrett Book Deal (Turley)

We have been discussing the rising support for censorship on the left in the last few years. Silencing opposing views has become an article of faith for many on the left, including leading Democratic leaders from President Joe Biden to former President Barack Obama. What is most distressing is how many journalists and writers have joined the call for censorship. However, even with this growing movement, the letter of hundreds of “literary figures” this week to Penguin Random House is chilling. The editors and writers call on the company to rescind a book deal with Supreme Court Justice Amy Coney Barrett because they disagree with her judicial philosophy. After all, why burn books when you can simply ban them?

The public letter entitled “We Dissent” makes the usual absurd protestation that, just because we are seeking to ban books of those with opposing views, we still “care deeply about freedom of speech.” They simply justify their anti-free speech position by insisting that any harm “in the form of censorship” is less than “the form of assault on inalienable human rights” in opposing abortion or other constitutional rights. Yet, the letter is not simply dangerous. It is perfectly delusional. While calling for the book to be blocked, the writers bizarrely insist “we are not calling for censorship.” While the letter has been described as signed by “literary figures,” it actually contains many who are loosely connected to the “broader literary community” like “Philip Tuley, Imam” and “Barbara Hirsch, Avid reader.” It also includes many who are simply identified by initials or first names like “Leslie” without any stated connection.

Nevertheless, there are many editors and publishing figures who list their companies (including HarperCollins, Random House and other companies) and university presses (including Cambridge, Harvard, Michigan Northwestern, Oxford) with their titles in calling for censorship. The list speaks loudly to why dissenting or conservative authors find it more difficult to publish today. These are editors who are publicly calling for banning the publication of those who hold opposing views from their own. It also includes academics like Ignacio Leopoldo Götz Römer, Stessin Distinguished Professor Emeritus, New College of Hofstra University and Carole DeSanti, Elizabeth Drew Professor of English Language and Literature, Smith College (and former VP and Exec Ed, PenguinRandomHouse).

The focus of the letter is the fact that Barrett voted with the majority in the Dobbs decision to overturn Roe v. Wade. Barrett has been the singled out in the past due to her judicial philosophy (which is shared by many federal judges and millions of citizens). Her home has been targeted and activists have published school information on her young children. Recently, Rhodes College alumni sought to strip references to Barrett from the college because they disagree with her views. Her college sorority was even forced to apologize for simply congratulating her for being one of a handful of women to be nominated to the high court. No attack appears to be beyond the pale for media or the left. Barrett sat through days of such baseless attacks on her character, but even had to face attacks referencing her children. Ibram X. Kendi, the director of the Center for Antiracist Research at Boston University, claimed that her adoption of two Haitian children raised the image of a “white colonizer” and suggested that the children were little more than props for their mother.

We’re rich!

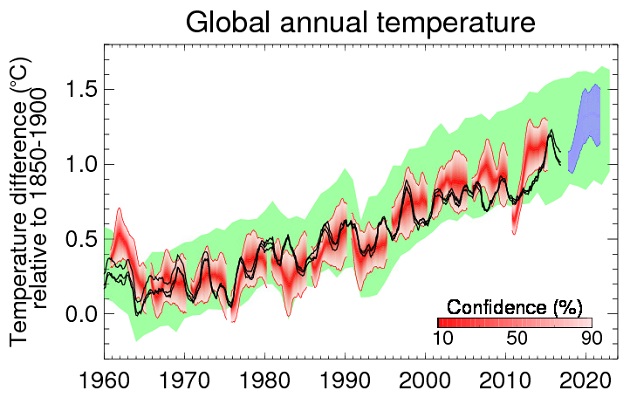

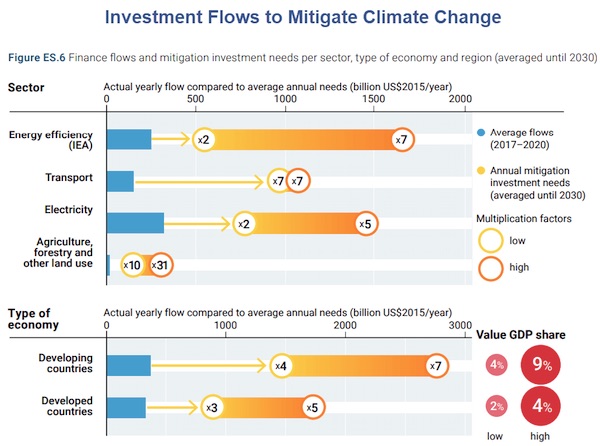

• UN Seeks $4 to 6 Trillion Per Year to Address Climate (Mish)

The Guardian reports UN finds ‘no credible pathway to 1.5C in place’: “The UN environment report analysed the gap between the CO2 cuts pledged by countries and the cuts needed to limit any rise in global temperature to 1.5C, the internationally agreed target. Progress has been “woefully inadequate” it concluded. Current pledges for action by 2030, if delivered in full, would mean a rise in global heating of about 2.5C and catastrophic extreme weather around the world. A rise of 1C to date has caused climate disasters in countries from Pakistan to Puerto Rico. If the long-term pledges by countries to hit net zero emissions by 2050 were delivered, global temperature would rise by 1.8C. But the glacial pace of action means meeting even this temperature limit was not credible, the UN report said. A study published this week found “large consensus” across all published research that new oil and gas fields are “incompatible” with the 1.5C target.”

What Would It Cost? Hooray! Only $4 trillion to 6 trillion per year. “A global transformation from a heavily fossil fuel- and unsustainable land use-dependent economy to a low-carbon economy is expected to require investments of at least US$4–6 trillion a year,” stated the UN report (page 26 of 132).

Q: US$4–6 trillion a year for how many years?

A: Based on figure ES.6 (lead chart) least eight years.

Q: What Percent of GDP?

A: 4 to 9 percent for developing countries, and 2 to 4 percent for developed countries. And developing countries will gladly fork over up to 9 percent of GDP every year for eight years. Yeah, right. Meanwhile, the EU is burning more trees and coal. Burning trees is magically deemed environmentally neutral.

Elephant drum

https://twitter.com/i/status/1586018731385397248

Steller’s sea eagle

https://twitter.com/i/status/1586251819071590400

Good boi

Still a very good boi…. pic.twitter.com/F5coX6ElaD

— Heckin Good Dogs (@HeckinGoodDogs) October 29, 2022

Lyrebird

A lyrebird is a species of ground-dwelling Australian birds. They are notable for their ability to mimic natural and artificial sounds from their environment, and the striking beauty of the male bird's huge tail pic.twitter.com/TRH5BWgARG

— Fascinating (@fasc1nate) October 29, 2022

Support the Automatic Earth in virustime with Paypal, Bitcoin and Patreon.