Mark Chagall I and the village 1911

Lavrov

https://twitter.com/i/status/1652184461302276096

Doctorow

Net zero

“..why China would “help Russia, which is experiencing the collapse of its civilization?”

• Zelensky’s Top Adviser Threatens China With Economic Ruin (RT)

Ukrainian President Vladimir Zelensky’s main adviser, Mikhail Podoliak, has claimed that China must follow the West’s position on Ukraine or “lose its influence, including economic influence.” Beijing has given no indication that it intends to take his advice. “Now China has to make a choice,” Podoliak said on Ukraine’s Rada TV on Friday. “Either it works within the framework defined by international law, and then replaces Russia in the full sense of the word, or China continues to stand aside and then it will gradually lose its influence, including economic influence.” Podoliak’s statement came two days after Zelensky and Chinese President Xi Jinping spoke by phone, their first known conversation since Russia’s military operation in Ukraine began last February.

According to the Chinese side, Xi stressed that Beijing’s “core position” on the conflict is that “dialogue and negotiations are the only viable way out.” The US has repeatedly called on China to condemn Russia over the conflict, which Beijing has refused to do. Instead, China and Russia have deepened their diplomatic and trade links, and officials from both countries have repeatedly condemned the US for attempting to impose what it calls a “rules-based international order” upon the world through military force and sanctions. China and Russia have instead called for the construction of a multipolar system based on the rule of international law and respect for the UN charter. “Right now there are changes – the likes of which we haven’t seen for 100 years – and we are the ones driving these changes together,” Xi told Russian President Vladimir Putin in Moscow last month.

Podoliak has attempted to drive a wedge between Moscow and Beijing before. Late last month he asked the Italian Corriere della Sera newspaper why China would “help Russia, which is experiencing the collapse of its civilization?” “It would be an irreversible investment, and China is too pragmatic to make such mistakes,” he added. However, even if China were to break from Russia, it would still face a United States hostile to its interests. The Pentagon’s most recent National Defense Strategy lists countering the supposed “threat posed by China” as its number one priority, while Washington has blocked the sale of some semiconductor manufacturing hardware to China and rallied its Asian allies to shut Beijing out of this vital industrial sector. Meanwhile, US President Joe Biden has said on several occasions that he would use the US military to defend Taiwan – which China considers its territory – from a potential Chinese invasion.

Read more …

“It’s simply impossible to sustain the pace, scale, and scope of the West’s multidimensional aid to Ukraine if the conflict drags on.”

“..Russia can continue conducting its special operation for 1-2 more years before it begins to feel any structural pressure to curtail its activities.”

“We just don’t have ammunition. The industry is not ready not only to send equipment to Ukraine, but also to replenish our stocks, which are melting.”

• Poland’s Top General Has Some Unpopular Truths About The Ukraine Proxy War (ZB)

The last time that Chief of the General Staff of the Polish Armed Forces General Rajmund Andrzejczak generated media attention was in late January after he elaborated on how formidable Russia remained at the time, but now he’s once again making headlines for building upon this assessment. Poland’s Do Rzecy reported on his recent participation in a strategy session with the National Security Bureau, during which time he shared some unpopular truths about the NATO-Russian proxy war in Ukraine. Andrzejczak said that the situation doesn’t look good for Kiev at all when considering the economic dynamics of this conflict, with him drawing particular attention to finance, infrastructure issues, social issues, technology, and food production, et al. From this vantage point, he predicts that Russia can continue conducting its special operation for 1-2 more years before it begins to feel any structural pressure to curtail its activities.

By contrast, Kiev is burning through tens of billions of dollars’ worth of aid, yet it still remains very far away from achieving its maximum objectives. Andrzejczak candidly said that Poland’s Western partners aren’t properly assessing the challenges that stand in the way of Ukraine’s victory, including those connected to the “race of logistics”/ war of attrition” that the NATO chief declared in mid-February. Another serious problems concerns refugees’ unwillingness to return to their homeland anytime soon. These economic, logistical, and population factors combined to convince him that he must urgently raise the greatest possible awareness of these problems in order to “give Ukraine a chance to build its secure future”, which in the context that he shared this motivation, is a euphemism for even more Western aid. He elaborated by adding that “As a soldier, I am also obliged to present the most unfavorable and difficult to implement variant, giving a field to all those who can and should help Ukraine.”

Nobody should therefore doubt Andrzejczak’s intentions or suspect that he’s a so-called “Russian agent” since he sincerely wants the West to win its proxy war with Russia in Ukraine, but he’s also very worried that it might lose unless his side acknowledges the unpopular truths that he just shared. In his view, their failure to do so could doom Kiev to defeat, though the argument can also compellingly be made that indefinitely perpetuating this conflict like Poland seeks to do might be even more disastrous. After all, none of the three challenges that he drew attention to can be overcome anytime soon. The only exception might be the population one, but that would entail changing EU legislation in order to allow the expulsion of refugees, which is unlikely to happen. The economic and logistical factors are systemic ones, which affect not only Ukraine, but the entire West in general. It’s simply impossible to sustain the pace, scale, and scope of the West’s multidimensional aid to Ukraine if the conflict drags on.

As Andrzejczak himself admitted, “We just don’t have ammunition. The industry is not ready not only to send equipment to Ukraine, but also to replenish our stocks, which are melting.” Considering that Poland is Ukraine’s third most important patron behind the Anglo-American Axis, this strongly suggests that all other NATO members are struggling just as much as it is to keep up the pace, scale, and scope of support, if not more since many are a lot smaller and thus less capable of contributing in this respect. Accordingly, this observation means that Kiev’s upcoming counteroffensive will likely be its “last hurrah” prior to resuming peace talks with Russia since the West won’t be able to keep up its assistance for much longer. Andrzejczak seems keenly aware of this “politically inconvenient” fact, hence why he wants his side to give its proxies as much as possible until the end of that operation in the hopes that they can then be in a comparatively more advantageous position by the time these talks recommence.

Cavoli

https://twitter.com/i/status/1652039270784180246

Read more …

“Otherwise, they will not calm down, and the drug-addled nonsense can turn into reality and the war will drag on for a long time. Our country does not need that..”

• Medvedev Calls For ‘Complete’ Dismantling Of ‘Kiev Regime’ (RT)

Former Russian President Dmitry Medvedev has called for the “complete dismantling” of the “Kiev regime,” as well as for inflicting “mass destruction” on the country’s military personnel and hardware. Medvedev, who currently serves as deputy chair of Russia’s National Security Council, made the remarks in a Telegram post on Friday, commenting on an interview Ukrainian President Vladimir Zelensky recently gave to several Nordic media outlets. He summarized Zelensky’s comments as consisting of demands for more weapons from Kiev’s Western backers and promises of a successful counteroffensive, including an attack on Crimea, while also warning that the conflict may drag on for “decades.” While the interview appeared to be “contradictory” and “delusional,” even such statements should not be underestimated, Medvedev warned.

“One should not underestimate even delusional speeches. This is a hysterical manifesto of the Kiev regime, which is seeking to consolidate its Nazi elites, maintain the morale of the troops and receive additional support from its sponsors.” To successfully foil Kiev’s plans, Russia must inflict “mass destruction of personnel and military equipment” during the much-hyped Ukrainian counteroffensive and inflict a “maximum military defeat” on Kiev’s military, Medvedev said. Ultimately, the “Nazi regime in Kiev” must be “completely dismantled” and demilitarized throughout the entire territory of “former Ukraine,” he added. Apart from that, Russia must pursue those who manage to flee, and seek “retribution” against the “key figures of the Nazi regime, regardless of their location and without statute of limitations,” Medvedev stressed. Anything short of that would not suffice, the ex-president believes.

“Otherwise, they will not calm down, and the drug-addled nonsense can turn into reality and the war will drag on for a long time. Our country does not need that,” Medvedev said. The ex-president has repeatedly warned Kiev against any attempts to seize the Crimean peninsula, which broke away from Ukraine in the aftermath of the 2014 Maidan coup and joined Russia after locals overwhelmingly supported such a move during a referendum. Last month, Medvedev issued a nuclear warning to Kiev, cautioning that any attempt at a “serious offensive” targeting the peninsula would be “the basis for the use of all means of protection, including those provided for by the fundamentals of the Doctrine of Nuclear Deterrence.”

Read more …

“This state must not exist for us while there is no one but Russophobes in power and Ukraine is full of Polish mercenaries..”

• Medvedev Sees No Point In Maintaining Diplomatic Relations With Poland (TASS)

Russia sees no sense in maintaining diplomatic relations with Poland as long as anti-Russian forces remain in power, Russian Security Council Deputy Chairman Dmitry Medvedev wrote on his Twitter page on Saturday. “I see no point in maintaining diplomatic relations with Poland. This state must not exist for us while there is no one but Russophobes in power and Ukraine is full of Polish mercenaries, who should be ruthlessly exterminated like stinky rats,” Medvedev wrote in English and Polish.

Medvedev’s tweet was posted in the wake of the situation with the school at the Russian embassy in Warsaw. Andrey Ordash, Minister-Councilor at the Russian embassy in Poland, told TASS that the Polish authorities had demanded that the staff of the Russian school at the embassy in Warsaw vacate the building by 7 p.m. on Saturday. The Russian Foreign Ministry said that Russia deems the Polish authorities’ intrusion into the Russian embassy school in Warsaw as a blatant violation of the 1961 Vienna Convention and another encroachment on Russian diplomatic property in Poland. The Foreign Ministry said that Warsaw’s steps would not remain without Moscow’s firm response and consequences for Poland.

Read more …

It won’t be their last new toy.

• Russian Next-Gen T-14 Tank Makes Ukraine Debut (ZH)

While Western nations are working to upgrade Ukraine’s ground game with US M-1 Abrams and German Leopard 2 tanks, Russia has now introduced its latest-generation tank into the war in Ukraine, according to Russia’s state-owned RIA. The new Russian tank is the T-14 Armata, which features an unmanned turret, with a three-man crew operating the vehicle from what RIA describes as an “isolated armored capsule located at the front of the hull.” The tank has a maximum highway speed of 50 miles per hour. It’s equipped with a 125mm smoothbore main gun with a reported range of 8 kilometers. The gun is fed by an automated loader with a 45-round capacity, and can also fire laser-guided missiles.

On defense, it has both reactive armor that explodes outward upon a projectile’s impact, and an “active protection system” (APS), which BBC has described as “essentially an anti-missile system for tanks, with radars capable of tracking the incoming anti-tank missile, and projectiles that are launched to disrupt or destroy it.” The T-14 is additionally distinguished from predecessor T-90 tanks by having higher ground clearance. A developer also claimed the tank would have technology to hide it from radar- and heat-seeking targeting systems: “We essentially made the tank invisible.” RIA reports the deployed T-14s have received “additional side protection from anti-tank ammunition.”

Until now, T-14 appearances have been largely limited to a series of Moscow Victory Day parades stretching all the way back to 2015, though RIA says they have been “tested in Syria.” [..] The initial order called for 2,300 of them to be delivered by 2020. However, the UK claims “production is probably only in the low tens, while commanders are unlikely to trust the vehicle in combat,” and suggested its introduction in Ukraine may largely be for propaganda purposes. Of course, that jab may itself be propaganda.

Read more …

Mutti knew exactly what was going on with the Misk agreements. No use denying it.

• Merkel Says She Used Everything To Try To Prevent Conflict In Ukraine (TASS)

Former German chancellor Angela Merkel said she used every means at her disposal to try to prevent the current conflict in Ukraine. “I used everything at my disposal to try to prevent this situation,” Merkel said, commenting on the Russian special operation in Ukraine on Saturday in an interview with the German daily Die Zeit. “The fact that it failed is not proof that it was wrong to try,” she stressed. Diplomacy is a “necessity,” as the ex-Chancellor noted.However. Merkel repeatedly defended her policy towards Russia. She called the efforts to resolve the conflict in eastern Ukraine after the events in Crimea in 2014 as part of the so-called Minsk agreements correct.

“I support these diplomatic efforts,” the former head of the German government said, adding that she was “very worried” about Ukraine. “To my great chagrin, there were quite a few who were not interested in this,” Merkel admitted. According to her, in the European Council Germany and France, made efforts to resolve the conflict in eastern Ukraine.= The ex-Chancellor of Germany said that she talked a lot with the former President of Ukraine Pyotr Poroshenko and the current President Vladimir Zelensky. “President Zelensky was very critical of the Minsk agreements. He already said this during his election campaign and noted that he considers it unfeasible,” Merkel stated.

She noted that, according to Ukrainian political leaders, this agreement is not popular in Ukraine, and it was very difficult to implement it politically. In an interview with Die Zeit, published on December 7, 2022, Merkel stated that the 2014 Minsk agreements were an attempt to let Ukraine gain time. She said “it was clear to everyone” that the conflict had been frozen and the problem had not been resolved. Russian President Vladimir Putin later said that he found Merkel’s statement completely unexpected and disappointing.

Read more …

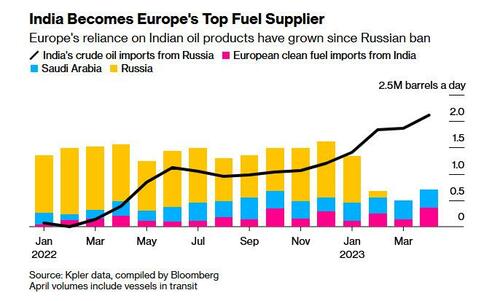

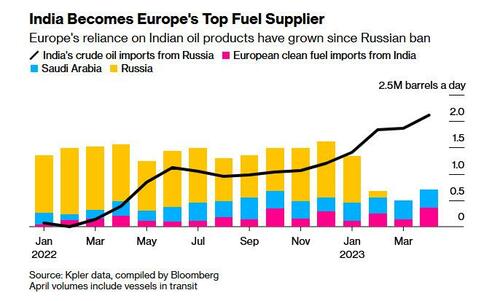

“..the Asian country is on track to become Europe’s largest supplier of refined fuels this month..”

• Europe Is Buying Record Amounts Of Refined Russian Fuels Through India

Last August, we were the first to show how Russia was bypassing Europe’s so-called commodities embargo: it was selling LNG to China which was then re-selling it to Europe at a substantial mark up. And while we also frequently reported that Russia was using a similar sanctions bypass for oil, this time using India instead of China, few were willing to confirm as much: after all, it would seem very shortsighted if European consumers were paying an extra surcharge to India, while Russia was not suffering any adverse consequences from Europe’s laughable “sanctions.” Not any more: on Friday, Bloomberg reported that for all of Europe’s fire and brimstone about an embargo (which has gotten decidedly quieter in recent months), “Russian oil is still powering Europe just with the help of India.”

As we reported at the time, last December the EU barred almost any seaborne crude oil imports from Russia. It extended the prohibition to refined fuels two months later. However, the rules didn’t stop countries like India from snapping up cheap Russian crude, turning it into fuels like diesel, and shipping it back to Europe at a big markup: as shown in the chart below, just the Brent to Urals price differential, a byproduct of the Russian sanctions, is about $25/bbl, almost a third of the price of a barrel of crude. The markups on Russian product are even greater when dealing with refined products such as gasoline or diesel. In fact, India has become so good at reselling Russian oil to the same Europeans who refuse to buy it directly from Moscow for a much lower price, that the Asian country is on track to become Europe’s largest supplier of refined fuels this month while simultaneously buying record amounts of Russian crude, according to data from analytics firm Kpler.

In other words, Europe is still buying Russian oil, keeping Putin’s military machine well-funded, but because of the virtue signaling exercise of buying Russian oil though a mediator, the transaction ends up costing Europeans billions more than if they simply had purchased the oil directly. “Russian oil is finding its way back into Europe despite all the sanctioning and India ramping up fuel exports to the west is a good example of it,” said Viktor Katona, lead crude analyst at the firm. “With India taking in so much Russian barrels, it’s inevitable.”

Read more …

They all do it.

• Morocco Supplies Spain With Russian Diesel – El Mundo (RT)

Morocco is purchasing Russian diesel and other refined products at discounted prices and re-exporting the fuel to Spain, El Mundo reported on Friday, citing ship tracking sources. Data from navigation tracking portal Vesselfinder showed that, on April 28, at least three tankers were heading from Russia’s Baltic ports to Morocco carrying approximately 170,000 tons of oil products on board. The North African country, which bought about 600,000 barrels of Russian diesel throughout 2021, ramped up imports of the product to 2 million barrels in January 2023, with another 1.2 million barrels arriving in the country in February, according to tracking sources. Morocco’s fuel exports almost stopped after its only processing plant was shut down in 2015 over unpaid taxes and legal hurdles, leaving the country dependent on refined oil imports.

In the beginning of the year, Rabat resumed fuel supplies and expanded exports of diesel from its Horizon Tanger terminal to Spain, Türkiye, Ghana, and southern Africa, the outlet said. In January, the country sent 280,000 barrels of diesel to the Spanish Canary Islands and another 270,000 barrels to Türkiye. “At the end of 2022, Morocco began to buy diesel fuel from Moscow at an average of more than 7 million liters per day. In parallel, Rabat began to export it to Spain,” the outlet wrote. According to ship tracking data, Moroccan deliveries now account for 10% of monthly Spanish demand for diesel, estimated at $60 million. According to some media reports, in March, Morocco, Tunisia, and Algeria accounted for 30% of Russia’s diesel exports.

Meanwhile, the Spanish government has pledged to ensure that no Russian fuel enters the kingdom. “Our obligation is to investigate what happens with the fuel [supplies],” Spanish Deputy Prime Minister Teresa Ribera told reporters on Friday. “Initially, it comes with documents confirming its appropriate origin,” she added. Russia has been diversifying its energy supplies in response to Western sanctions after the EU stopped accepting the country’s oil transported by sea. In December, the EU, G7, and allied countries imposed an embargo and a $60-per-barrel price cap on Russian crude. Similar restrictions were introduced in February for exports of petroleum products.

Read more …

Posturing.

• US Troops Drill For Taiwan War – Media (RT)

The US Army Special Operations Command (USASOC) has reportedly carried out drills simulating its response to a Chinese seizure of Taiwan for the first time, reflecting rising concern in Washington that Beijing may try to seize control of the self-governing island by force. The Taiwan scenario was played out as part of the USAOC’s annual capabilities exercise, known as CAPEX, at North Carolina’s Fort Bragg, Military.com reported on Saturday. Troops practiced being inserted into Taiwan to help defend against a Chinese offensive, using a concrete mock-up on the base to simulate the environment in which they would fight the People’s Republic of China (PRC). “The PRC, in accordance with our national defense strategy, is our true pacing challenge out there,” Lieutenant General Jonathan Braga, commander of USASOC, said in a speech before the exercise on Thursday. “Ultimately, what we’re trying to do is prevent World War III. That’s our job.”

The drills included firing recoilless rifles, breaching tunnels and operating Switchblade drones, the media outlet said. The special forces used some of the same weaponry and tactics employed during Washington’s so-called War on Terror, along with “other tools reflecting a seismic shift for the command as it prepares for potential conflict against major military rivals.” It’s unusual for USASOC to identify the opposition force so directly during APEX, “given the military’s hesitancy to overtly suggest conflict,” according to Military.com. US-China relations have deteriorated in the past year amid Beijing’s refusal to join in a Western sanctions campaign against Russia over the Ukraine crisis. Chinese officials have accused US leaders of emboldening separatists in Taiwan, such as when then-House Speaker Nancy Pelosi traveled to Taipei last August. China responded by breaking off defense and climate ties with Washington and launching massive military drills in the Taiwan Strait.

The US government recognizes, without endorsing, China’s claim to sovereignty over Taiwan. For decades, Washington has maintained a policy of “strategic ambiguity,” keeping Beijing and Taipei guessing as to whether, and to what extent, the US military would intervene if China invaded Taiwan. However, President Joe Biden has repeatedly hinted that Washington would come to Taiwan’s aid militarily in the event of a Chinese offensive. Washington think tanks have conducted wargaming exercises in recent months to simulate how a war over Taiwan might play out. One such study was done for a congressional committee by the Center for New American Security, which found earlier this month that US forces would be unable to resupply Taiwan with weapons and equipment once a Chinese offensive began. An exercise done by the Center for Strategic and International Studies found that although US and Japanese forces would be able to successfully repel Beijing’s offensive, they would lose dozens of warships, hundreds of planes, and thousands of troops.

Read more …

“Such restrictions, for whatever reason, do not comply with the Ukraine-EU Association Agreement and the principles and norms of the EU Single Market..”

• Kiev Decries EU Restrictions On Ukrainian Imports (RT)

The Ukrainian authorities have sent notes of protest to the Polish and EU embassies, decrying the restrictions on imports of the country’s agricultural products to the bloc. This was announced on Saturday by Ministry of Foreign Affairs spokesman Oleg Nikolenko in a Facebook post. According to Nikolenko, Ukraine considers the restrictions “utterly unacceptable.” “Such restrictions, for whatever reason, do not comply with the Ukraine-EU Association Agreement and the principles and norms of the EU Single Market,” he wrote. The minister noted that Kiev has “all legal grounds” to immediately resume its exports to Poland, Romania, Hungary, Slovakia, and Bulgaria and continue uninterrupted transit of all Ukrainian products to other countries both inside and outside of the EU. “The Ukrainian Foreign Ministry urged its [EU] partners to find a balanced solution based on EU legislation, the Association Agreement, and in the spirit of solidarity,” he added.

Earlier this month, Poland, Hungary, Slovakia, and Bulgaria unilaterally banned the import of agricultural products from Ukraine in a bid to protect their domestic markets, which has been overflowing with cheap Ukrainian products. Romania did not impose an import ban, but joined the other four in calls for Brussels to free the region of Ukrainian goods. After two weeks of discussions, the European Commission and the five member states struck a deal on Friday, which involves replacing the individual bans placed by the countries on Ukrainian imports with “emergency safeguard measures” for four major staples – wheat, maize, rapeseed, and sunflower seeds. Sources claim that imports of these crops into the five Eastern European countries will likely be blocked unless for transit.

Read more …

They treat Ukraine like a member. It’s not.

• EU Reaches Deal On Ukrainian Food Imports (RT)

The European Commission on Friday struck an agreement with five EU member-states to help clear the supply glut caused by Ukrainian agricultural imports. The announcement was made on Twitter by EU trade chief Valdis Dombrovskis. “The European Commission has reached an agreement in principle with Bulgaria, Hungary, Poland, Romania & Slovakia regarding Ukraine agri-food products. We have acted to address concerns of both farmers in neighboring EU countries and Ukraine,” Dombrovskis wrote on the social media platform. According to the official, the key elements of the new deal include the withdrawal of unilateral import restrictions previously placed by the countries on Ukrainian agricultural produce, a €100 million ($110 million) support package for the member-states’ farmers, and “emergency safeguard measures” for four Ukrainian staples – wheat, maize, rapeseed and sunflower seeds.

Dombrovskis did not elaborate on what these emergency measures would entail, but sources claim that the imports of these crops into the five Eastern European countries will likely be blocked unless for transit. European Commission President Ursula von der Leyen welcomed the deal, saying that it would help guarantee the transit of Ukrainian produce. “This agreement preserves both Ukraine’s export capacity so that it continues to feed the world, and the livelihoods of our farmers,” she tweeted. In June last year, the EU lifted tariffs and quotas for Ukrainian agricultural imports for one year in order to enable grain from Ukraine to be shipped to global markets amid the conflict with Russia. Many of the shipments, however, ended up in Eastern European countries, flooding their markets with cheap produce and sparking protests among local farmers.

Earlier this month, Poland, Hungary, Slovakia, and Bulgaria unilaterally banned agricultural products imported from Ukraine in bid to protect their markets. While Romania had not imposed its own import ban, it joined the other four in urging Brussels to find a solution to the glut of Ukrainian produce. Import bans were deemed “unacceptable” by Brussels, as they undermined the bloc’s single market rules. The news of a deal on Ukrainian food imports followed a decision by EU ambassadors to extend Ukraine’s tariff-free access to the bloc’s market by another year. However, the extension is still subject to formal approval by the European Parliament and EU countries in the coming weeks.

Read more …

“The connection between Joe Biden and Hynansky’s business ventures dates back to 2009, when the then-vice president made his first visit to Ukraine..”

• War Threatens Ukraine Auto Empire of Biden Megadonor (Sperry)

Ukrainian President Volodymyr Zelensky isn’t the only one demanding more military assistance from President Biden to protect Kiev from Russian forces. So too is a close Delaware friend and financial backer of Biden, who owns several luxury car dealerships around the Ukrainian capital. By sending billions of dollars in weapons and other military aid to help defend Ukraine, Biden also is securing the investments of millionaire car magnate John Hynansky, a Ukrainian American and longtime supporter of the president. Over the course of Biden’s political career, Hynansky and his family have contributed more than $100,000 to his campaigns, including $8,000 in 2020, Federal Election Commission records show. Hynansky family members have been guests at the White House, and Hynansky has floated hundreds of thousands of dollars in loans to Biden family members, property records show.

Hynansky’s son, Michael, who helps run his car empire, lent the use of his Lear jet to Biden when he was a senator. Since Russia started shelling the area around Kiev in February 2022, the U.S. government has spent $77 billion to help Ukraine rebuild and repel future attacks. Government ethics watchdogs say the president’s friendship poses a potential conflict of interest that demands a full accounting of how the massive foreign aid, which includes open-ended humanitarian and economic assistance, has been used and who has benefited from it. On the military side, moreover, billions of dollars have gone to unspecified areas, such as “security,” “intelligence,” and “training.” In the past, Hynansky has supplied the police cars and ambulances in several regions of Ukraine.

[..] The connection between Joe Biden and Hynansky’s business ventures dates back to 2009, when the then-vice president made his first visit to Ukraine. In a speech in Kiev to government officials, Biden singled out Hynansky for praise, noting that he had just had breakfast with “my very good friend, John Hynansky.” (The previous year, Hynansky had individually contributed more than $33,000 to the Obama-Biden ticket primarily through the Obama Victory Fund, according to FEC records.) Within months of his hobnobbing with the vice president and local officials in the Ukrainian capital, Hynansky scored his first international development loan from the U.S. Overseas Private Investment Corporation, or OPIC, a federal body whose board was appointed by President Obama.

Hynansky used the $2.5 million to break ground on a new headquarters and massive distribution center outside Kiev that prepares 8,000 cars for sale every year. In 2012, Hynansky landed another $20 million in OPIC funding to expand his dealership facilities, federal records show, helping him corner roughly 25% of the luxury car market in Ukraine. “The proceeds of the loan will be used to construct and operate two new, state-of-the-art dealership facilities for Porsche and Land Rover/Jaguar automobiles, and repay any outstanding balance of an existing OPIC loan,” according to a 2012 OPIC financing document.

Read more …

Without implicating the Big Guy?

• Hunter’s Collapsing World: A Criminal Plea Could Now Be Best Option (Turley)

This week, Hunter Biden’s defense team traveled to Delaware seeking an update on the federal criminal investigation that has dragged on for almost five years. The reason seems clear: Time is running out on Hunter and the Biden family. After years of delaying disclosures and admissions, Hunter could now be pushing to cap off the criminal side of the scandal before more information is released in Arkansas and Washington. For the White House, even a criminal plea is preferred if they can avoid one particular claim — and they may be succeeding. For years, the Bidens have worked (with the media’s help) to delay any recognition of the influence peddling and corruption that may be revealed on Hunter Biden’s laptop. Even this week, in child support proceedings in Arkansas, Hunter’s counsel continued to refuse to admit ownership of the laptop abandoned at The Mac Shop in Wilmington, Del., in April 2019.

It won’t work any more than his long refusal to acknowledge his fathering of his four-year-old child, Navy. Just as Hunter could not deny DNA, forensic and other evidence will soon make his laptop denials untenable in proceedings in which he and his counsel are required to tell the truth. These proceedings are now colliding for the Bidens. With the laptop being raised in Arkansas and being investigated in Washington by House committees, time is up and the Biden team knows it. An establishment of the laptop’s authenticity in one forum could produce cascading effects in the other forums. There has already been a recent shift to a scorched-earth strategy, including reportedly threatening possible witnesses and calling for the IRS to investigate critics.

New leaks from the Justice Department investigation have indicated that prosecutors are considering four charges: two misdemeanor counts for failure to file taxes, a single felony count of tax evasion related to a business expense for one year of taxes and a potential felony count on falsifying a form linked to a gun permit. Those four charges could well result in jail time, but the situation is likely to get worse for Hunter if the House reveals new evidence of foreign dealings and payments. That is why a capstone plea could control the damage for both Hunter and his father. A capstone is designed to protect against erosion and even help to hold together an arch that might otherwise collapse. This capstone plea could avoid a worst scenario (and charge) that would undermine years of denials by both Bidens.

However, there was one conspicuous omission from the list of potential charges that may also indicate a reason to push toward a plea. There is no mention of a charge as an unregistered foreign agent under the Foreign Agent Registration Act (FARA). The Justice Department aggressively used this charge against Trump figures like Paul Manafort and, if the same standard is applied, it is hard to see the basis for discarding the charge in the Hunter Biden case. The laptop shows emails from various foreign sources, including some with close connections to foreign governments and intelligence services. There are also records of visits of clients and business associates to the White House as well as pictures with then-Vice President Joe Biden. Finally, there are emails showing Hunter reached out to high-ranking officials like Antony Blinken for “advice.” Now our secretary of state, Blinken was then deputy secretary of state.

Read more …

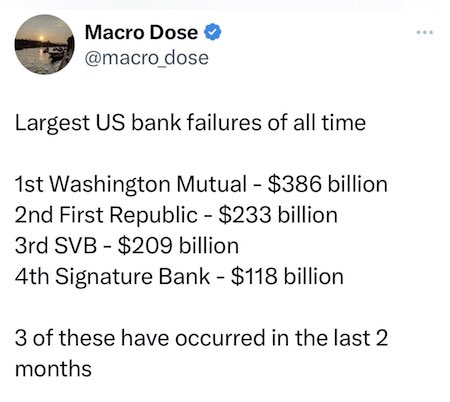

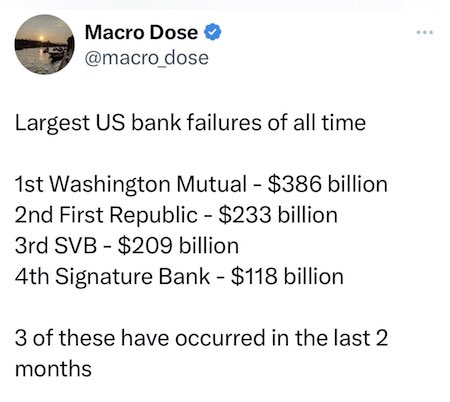

“..merger accounting rules would require a buyer to immediately mark down FRC’s assets to fair value..”

• No Buyer for First Republic Bank at Any Price (Mish)

In one of the biggest bank collapses ever, First Republic Bank is down 96 percent in two months. But look on the bright side. Silicon Valley Bank (SVB) fared even worse. At least FRC is still kicking. It rose 8.79 percent on Thursday. You likely can’t give FRC away. There would be no takers. Its assets are worth less than zero. That’s because merger accounting rules would require a buyer to immediately mark down FRC’s assets to fair value. FRC lost $100 billion in deposits. And unlike SVB, it is stuck with severely underwater mortgage loans. The FRC business model was to give ridiculously cheap mortgage loans to high-wealth clients in return for their business. When that model started blowing up, clients pulled their deposits.

Given all around silliness by banks chasing yield, any buyer would likely have to raise capital which would hammer their own share price. According to the WSJ, Autonomous Research analyst David Smith commented “It might cost you $30 billion of capital to buy the bank for free.” If the run on assets continues, either the Treasury or the Fed is likely to step in. Elizabeth Warren would then moan about the Fed bailing out the wealthy. If the bank went under, she would moan about something else. Meanwhile, Treasury Secretary Janet Yellen repeated her comment that the U.S. banking system remains sound and the U.S. government will take “any necessary steps” to keep it the strongest and safest financial system in the world.

Read more …

“envisage our future utopia”, suggesting that Ireland must “rebalance economy, ecology and ethics..”

• Irish President Condemns ‘Obsession’ With Economic Growth (Leahy)

President Michael D Higgins has condemned the “obsession” with achieving economic growth in a speech on Friday that was implicitly critical of the economic policies pursued by successive governments. In a reception at Áras an Uachtaráin for Tasc, a think tank dedicated to social change, the President delivered a typically wide-ranging speech that featured a strong critique of economic policy that seeks to prioritise growth, a condemnation of “neoliberalism” and an evaluation of the shortcomings of the teaching of economics at universities. He also urged those present to “envisage our future utopia”, suggesting that Ireland must “rebalance economy, ecology and ethics”. And he insisted that the current exchequer surplus was not just the product of corporation tax receipts from multinationals, but “has been made possible by an educated and hard-working population”.

“Many economists remain stuck in an inexorable growth narrative, or at best a ‘green growth’ narrative,” he said. “A fixation on a narrowly defined efficiency, productivity, perpetual growth has resulted in a discipline that has become blinkered to the ecological challenge – the ecological catastrophe – we now face. “That narrow focus constitutes an empty economics which has lost touch with everything meaningful, a social science which no longer is connected, or even attempts to be connected, with the social issues and objectives for which it was developed over centuries. It is incapable of offering solutions to glaring inadequacies of provision as to public needs, devoid of vision.” Later he added: “Our obsession with inexorable economic expansion expresses, perhaps, a desire to transcend our material limits and rise above the state of nature. Yet this growth fixation paradoxically increases the potency of those very limits. “A deadly cocktail of exploding inequalities, massive deregulation and a globalisation defined solely by trade densities has precipitated this ecological crisis.”

Read more …

Fern

https://twitter.com/i/status/1652411867732557825

Greta oto, also known as glasswinged butterfly, has transparent wings with a span of 5.6 to 6.1 cm

Support the Automatic Earth in virustime with Paypal, Bitcoin and Patreon.