Arthur Gerlach Children point towards Christmas toys at The Fair Department Store, Chicago 1940

The world is facing the “first lost decade since the 1860s”, said Bank of England governor Mark Carney this week. Arguably good for soundbite of the day, but the buck stops there. The only way that buck could have kept rolling would have been for Carney to take a critical look at himself and his employer(s), but there was none of that.

The Canadian import governor has no doubts about anything he’s done, or if he does he shows none. Instead he puts the blame for all that’s gone awry, on some -minor- elements of what he think globalization means, not with the phenomenon itself, or his enduring support for, and belief in, it. The problem with that is it’s indeed belief only; he can’t prove an inch of what he says.

Globalization is an act of faith inside a politico-economic belief system, and all it needs according to Carney and many others in his ‘church’ is a little tweaking. That globalization itself could be the driving force behind Brexit, Trump and the defeat of Italian PM Renzi does not enter into the faith’s ‘thought’ system.

Neither does the possibility that globalization is what it is, in and of itself, a process that in the end cannot be tweaked. That globalization is simply yet another form of centralization that follows the same rules and laws all other forms do, where power and wealth always, of necessity, wind up in the hands of a few, through pretty basic centrifugal forces.

Carney Lays Out Vision to Revive Benefits of Globalization

Mark Carney launched a defense of globalization and set out a manifesto for central bankers and governments to boost growth and make the world economy more equal. The Bank of England Governor said they must acknowledge that gains from trade and technology haven’t been felt by all, improve the balance of monetary and fiscal policy, and move to a more inclusive model where “everyone has a stake in globalization.” Carney’s speech in Liverpool, England, comes amid rising disquiet about the state of the world economy and political status quo that helped propel Donald Trump to victory in the U.S. presidential election and boost support for the U.K.’s exit from the European Union.

Trump isn’t right to favor more protectionist policies in response to globalization , Carney said in a television interview broadcast after his speech. The answer is to “redistribute some of the benefits of trade” and ensure that workers are able to acquire new skills. “Weak income growth has focused growing attention on its distribution,” Carney said in the speech.

“Inequalities which might have been tolerated during generalized prosperity are felt more acutely when economies stagnate.” Describing the world as facing the “first lost decade since the 1860s,” the BOE governor said public support for open markets is under threat and rejecting them would be a “tragedy, but is a possibility.”

Carney also defended the central bank’s current policy stance. The BOE has faced criticism from politicians after officials took measures including cutting interest rates and expanding asset purchases in August to support the economy after Britain’s June vote to leave the EU. “Low rates are not the caprice of central bankers, but rather the consequence of powerful global forces, including debt, demographics and distribution,” he said, adding that they helped to prevent a deeper economic downturn.

People like Carney will insist that globalization spurs growth, right up to the moment where they’re either voted out or fired. And they’ll probably keep on insisting until their dying days. But why are we in that “first lost decade since the 1860s” then? Is that really only because ‘we’ failed to “redistribute some of the benefits of trade”, something that can allegedly be easily rectified by enabling workers to ‘acquire new skills’?

Where is the proof for that? And why have economies stagnated in the middle of the entire process of globalization? Is that solely because ‘some of’ the benefits were not distributed well enough? If that is so, and wealth distribution is the only problem with globalization, at what point do we redistribute ourselves into the realm of communism? Where’s the dividing line? It all feels mighty vague and unsatisfactory, and not a little goal-seeked.

Like a large part of the Brexit voters in Britain, millions of Italians have been on the losing side of globalism’s ‘benefits distribution’. And this weekend they found an outlet for their frustration about it. Like Brexiteers voted against Cameron and Osborne much more than they voted for anything in specific, and Trump won because Americans are fed up with the Obama/Clinton/GOP model, Italians voted against PM Renzi and his idea to take power away from parliament and give it to him.

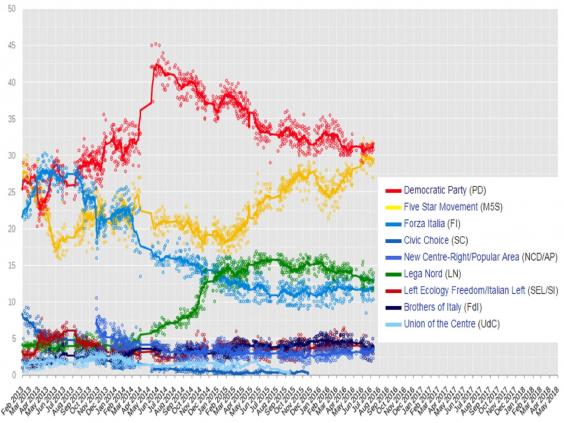

Judging from poll numbers, they also seem to have gained confidence in Beppe Grillo’s, and the Five Star Movement’s, ability to do something real in politics. It has taken a while, and that makes sense because the movement doesn’t fit the model of politics as they’ve known it all their lives.

Wikipedia

Also, there are many Italians who have largely agreed with much of what Grillo has been saying all along, but were deterred by the way he delivered it. Ask an Italian and they’re likely to say “too angry, too rude” when it comes to Grillo. And it’s true, his style doesn’t seem to fit in with the rest. But then that’s also exactly his forte. Because there comes a point when everything that does fit in, becomes suspect.

The old guard, from Renzi to Berlusconi to the socialists, will double their efforts to keep Grillo out of the center of power now. President Mattarella is in on it: he asked Renzi to stay on as PM until after the budget has been pushed through, and is then likely to install another technocrat government, tasked with changing laws with the express intent of making it harder for Grillo to get into power.

And Renzi, of course, is on the same wavelength as Carney, and the entire EU -and global- cabal: globalize, reform, re-distribute ‘some benefits’, execute more austerity, rinse and repeat.

What’s particular about Italy in this sense is what it has been able to preserve, unlike most other nations. That is, Italy has a lot of small enterprises, often family owned, with highly skilled workers. That doesn’t fit today’s globalization model, since it’s deemed not competitive enough when you’re forced to fight for market share.

But if globalization, and the entire growth model, is over anyway, as I’ve often asserted, it’s a whole different story. If that is true, the country had better save what’s left of its business model, because it’s ideal for a post-centralized world. ‘Workers’ wouldn’t have to ‘acquire new skills, and leave old and proven skills to be forgotten and gather dust.

The world is changing rapidly and that will become even a lot more evident in 2017. The incumbent economic and political systems, as well as their proponents and cheerleaders, are on the way out. They have all failed miserably. What comes next will be profoundly chaotic for quite a while, and that will be perilous. There is not one single (belief) system to replace them, there will be many and they will often clash.

In some places, the political right will prevail, in others the left. In most, from the look of things, neither will, if only because at the end of the day both left and right are still part of incumbent systems. Europe has a number of elections coming up and in at least some of these, parties from outside the incumbent systems will come out on top.

Whether they can then go on to form governments is perhaps another story; the system will not give up easily. But it is done. Carney’s recipe of ‘some’ redistribution of wealth and acquiring new skills is widely shared in power circles, and that will be the system’s undoing. All it has to offer is more talk about more growth and more globalization, and while people protest only the latter, neither is on offer.

One of the tools the media use to discredit anything that comes from outside the system is to label it all ‘populist’. It’s a miracle it hasn’t become a honor label yet. In Europe, all new rightwing parties (a label in itself) get called populist, Le Pen, Wilders, Frauke Petry in Germany, the Lega Nord in Italy. But so does someone like Beppe Grillo, who politically has nothing in common with these people.

Moreover, many of their ideas are not to the right of existing parties at all. Despite some of his views, new French Republican candidate François Fillon is not called a populist, ostensibly because he’s from a large incumbent party, but so are Trump and Sanders in the US, and they do get called populist.

Empty labels, fake news and oceans of debt keep the systems -somewhat- going for now. But the genie’s long left the bottle. The ‘incumbents’ have failed their people for far too long, most of all economically. And they keep on claiming that everything will be alright, everyone will be better off if only we execute more globalization, and give them all a few pennies more.

It really is too silly to be true that that is what existing systems and their servants are still trying to make everyone believe. While it is so obvious that so many have long stopped believing. You would think they’d change their messages to reflect that change in society. But they don’t know how. And it’s that very inability that feeds those pesky ‘populists’.

The same François Fillon could be a contender in France against anti-EU Le Pen because he’s expressed doubts on Brussels. Dutch PM Rutte has cautiously critiqued the union too. But those shifts in words if not real opinions come far too late. Britain has said No and there’s zero chance that more nations will not do the same. Just give them the option, give them a vote.

The only way to keep Europe from descending into chaos is to abandon the EU, lock the doors and throw away the keys. The same is true on a global scale, with all the globalist trade agreements that most people have long lost faith in. We will either see a peaceful transition to a system not based on centralization, or we will not see peace, period.

And to think economic meltdown hasn’t even truly started yet, has been kept hidden behind a wall of debt, and so many people are already so fed up with the whole shebang.