Vincent van Gogh Ravine 1889

After Danish soccer player Christian Eriksen had a heart attack on the pitch last night at the Eurocup, the urgent issue should be: was he vaccinated? (he was), and if so, what is the link between the vaccine and the cardiac arrest?

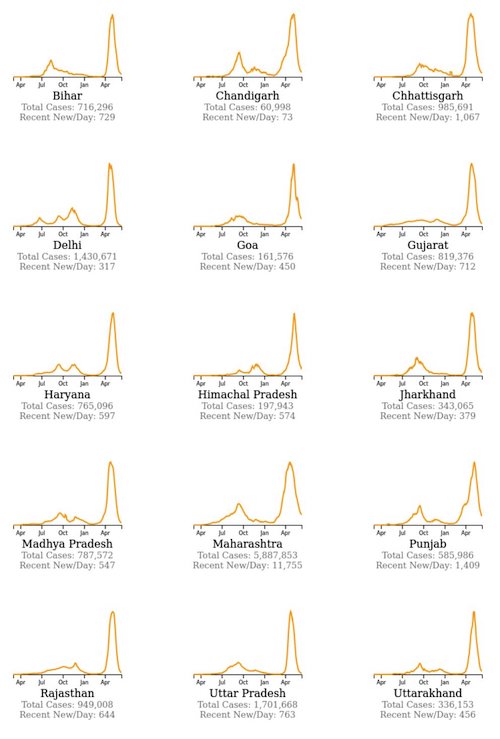

I haven’t seen anyone make the connection thus far, and wonder if anyone will. But what if, g-f forbid, another vaccinated player goes down? With some 800 cases of myocarditis in young men in the US alone, this is a serious risk that requires a serious investigation.

Update: the president of his team, Inter Milan, says he was not vaccinated.

Update 2: a Twitter search for “Inter Milan doctor” appears to indicate Eriksen received his 2nd jab on May 31.

Confused? Did BBC just say that 50% of the people that died were vaccinated? But, but!???? ‘95% efficacy’, right!?

https://twitter.com/i/status/1403830591301242883

“The vaccines have been approved as experimental therapy, nothing more. How many times was it that Edison tested his light bulb before it was successful?”

Before medical technology caught up with our wildest dreams of living forever with no suffering, we had to make do. If a virus came along we were forced to let nature run its course. Before vaccines were discovered with the advent of Dr. Edward Jenner’s incredible work with cowpox, we didn’t have a choice but to grovel at the feet of Mother Nature and let her do her thing. Ultimately it all turned out pretty well; we are still here, aren’t we? — due to, among other things, the miracle of our immune systems. Things are different now, transhumanism is on the rise and is arriving hand in hand with the upcoming technocracy—we may one day actually be able to live forever! Yahoo! Certainly we can fight this war with Covid, with nature, and win the battle — one step closer to conquering nature entirely! We can cheat death, cheat illness, cheat suffering! Pass out the cigars!

What is the price? Humanity? That sounds too close to being ruled by nature — we certainly can give up these “human” things — smiles, touching, hugging, gathering — all things that engage our human bodies, and human hearts. These are things too close to what animals do, with animal bodies, animal instincts. That’s fine to give up, as Fauci says, we should probably never shake hands again — it’s too dangerous being human. Although I would surmise that people who are overly jubilant to get the vaccine do not necessarily believe they are transforming their body to superhuman status due to the gene therapy mechanism in the chemistry of the vaccination (I doubt if most even know what that is), but rather most of them are intrigued by the new technology they have heard it employs.

There is almost nothing in the modern medicine drug pantheon that is 100% effective, safe, or free of side effects, and even though it is clear the Covid vaccines also fall into this disappointment, the general public has indeed been told it is 95% effective and 100% safe (not bothering to be careful to ascertain what exactly it is effective in accomplishing). They are also nearly 100% synthetic, with a synthetic, high tech, mechanism. This view is a predominant one for vaccine lovers created primarily by the bottomless pockets of the manufacturers who spend countless millions in marketing and in successful attempts to show their customers how safe and effective their product is. “Look at how wonderful new technologies can be!” say their targets. “Those scientists are so very clever!”

Yes, technology can be wonderful, and yes, scientists can be very clever. Unfortunately, there have probably been more disasters in the experimental stages of products the big pharmaceutical companies want to market than successes—at least a fair share of them. The vaccines have been approved as experimental therapy, nothing more. How many times was it that Edison tested his light bulb before it was successful? How many times did he think it was going to work after “this one final experiment” — and it didn’t? There is no question that Edison was very clever, but this is the way of science and new discovery, and it always has been. And don’t tell me that mRNA technology has been studied for decades. That doesn’t cut it; Covid-19 had only been with us for about 9 months when the vaccines were rolled out.

“I don’t know how a man of such short stature carries such massive arrogance..”

• If Science Was Never Challenged, We Would Never Make Any Progress (RT)

Dr. Anthony Fauci’s recent suggestion that attacks on him are attacks on science itself is nonsensical. His attitude towards criticism is a prime example of scientism, which treats people in scientific fields with undue reverence. There has been an interesting cultural fight within the culture war over science itself. Many people on the political left have a tendency to place scientific method on a pedestal and not consider it for what it is – which is, purely and simply, scientific method. Rather, they treat science as a sort of dogma which cannot be challenged. In a sense, their attitude towards it is not that different from a Christian’s outlook on the Bible. A Christian believes that the Bible is God’s word, and is static and unchanging because of the nature of God himself.

However, the nature of science is not static because our understanding of the world is not static. As such, it’s appalling when someone who wields as much influence and political power as America’s chief medical adviser Dr. Anthony Fauci speaks in a manner that treats science as a dogma. In a recent interview with Chuck Todd on MSNBC, Fauci recently claimed people who are critical of him are “critical of science itself”, which is clearly preposterous. Science is meant to be questioned. If science was not questioned, scientific progress would be impossible because there would be no prevailing attitude that more must be learned. The attitude and belief that science is some sort of monolith is very disconcerting from a societal perspective.

I have great respect for those who spend their time trying to understand our universe one cell and one atom at a time, but Fauci’s stance seems to spit in the face of those people. Ultimately, every person who works in the sciences can only act on what they know, and whether they admit it or not they’ll never know enough. That, surely, is the name of the game. However, Dr. Fauci comes across as if he is the self-declared face of science and that he cannot be questioned for this very reason. Aside from this being wildly untrue, this is a prime example of scientism. It promotes the idea that his diplomas and governmental position make him someone who cannot be questioned, and that his knowledge has elevated him to a place above us mere mortals. As such if you don’t listen to what he says you’re nothing but a troglodyte. I don’t know how a man of such short stature carries such massive arrogance, but he certainly does not speak as if he is someone who has the proper attitude of a scientist.

“To be “reported” at all you have to wind up in the hospital or similar, so the presumption that these are “mild” is horsecrap.”

• So NOW The CDC Will Look? (Denninger)

When do we take out the trash? First the FDA “approves” an Alzheimer’s drug that, on the data, does not work — but it sure as Hell is expensive. At least one and perhaps two of their advisors quit over that one. Now the CDC is going to meet on the “extremely rare” myocarditis risk to kids getting tard shots. Extremely rare my ass; you never see if you don’t open your eyes, and given the reports in the news and social media there is no way this is “extremely rare.” How many people have heart attacks every day yet that doesn’t make the news unless they’re a celebrity or somesuch. So when nobodies start being reported on, well, folks, it’s not rare. To be “reported” at all you have to wind up in the hospital or similar, so the presumption that these are “mild” is horsecrap.

Nobody with a bit of discomfort goes to the ER; you go to the ER if you have chest pain, and that’s not minor. The big unknown is whether the damage done in these cases is permanent. Nobody knows. But, I remind you, a grand total of eighteen, more or less, kids have died with Covid all the way back to March of 2020. Now tell me exactly how many of the hundreds of those myocarditis events being reported, and that’s an undercount where Covid was an overcount, are acceptable if they produce permanent damage? If your answer is anything other than zero you’re a ghoul. If you gave these shots to kids, or advised kids to get them, well… you ought to have a problem. A big one. And so should Biden, Trump, all public health departments and every single corporation and social media firm that has been advocating these things for young people.

“It is impossible to assess this study fully because 98% of the document was removed in order to protect Pfizer’s intellectual property..”

• Pfizer Vaccine Rubber Stamped, Data Sight Unseen (Doctors for COVID Ethics)

A freedom of information request (FOI) request was made by one of our members in February 2021 to the Australian drugs regulator, the TGA (Therapeutic Good Administration) to ask what should have been simple questions. The TGA is the Australian equivalent of the FDA (US), MHRA (UK) and EMA (Europe) and is held in high regard worldwide. Essentially the FOI questions were: • Did the TGA request the raw data from Pfizer • Did any of the committees approving the vaccine look at the raw data and/or discuss it • What were the “studies” referred to in the approval document relating to teratogenicity (risk of harm to a fetus)

The rationale of the request relates to concern over the validity and verifiability of Pfizer’s data given its legal history (and expressed by Peter Doshi in the BMJ in February) as well as the proven concerns over fraudulent data relating to Covid-19 as seen in the “Lancetgate” scandal of June 2020. The document below is a redacted version of the documents that were sent by the TGA in response to this request. What they show is that the TGA never saw or requested the patient data from Pfizer and simply accepted their reporting of their study as true. This means that when the head of the TGA John Skerritt said that “the safety evidence is pretty thorough” on the 6th February (here) his words would ring hollow to most Australians who have assumed, rightly or wrongly, that the TGA had actually looked at the patient data themselves.

A further concerning aspect of the FOI request is the efforts to which the TGA appeared to go to suppress the request – initially requesting a 6 months extension in view of a “voluminous request” which eventually yielded only one document of 14 pages, heavily redacted. This required an instruction from the Office of the Information Commissioner to the TGA to answer the request by the 26th May, a deadline that the TGA also failed to meet. Eventually the only document that was produced from the FOI request was a heavily redacted single study (not studies, as claimed in the TGA assessment document) showing that the only investigation into the effects on the fetus was performed on 44 rats with no long term data on the offspring. It is impossible to assess this study fully because 98% of the document was removed in order to protect Pfizer’s intellectual property (points 32-44 of the report).

Moscow just declared a non-working week with strict curfews.

• Covid-19 Has Mutated So Much That Proven Treatments Are Often Failing (RT)

Covid-19 has mutated significantly, and the virus is now much harder to treat than it used to be. That’s according to the head of Moscow’s Kommunarka Hospital, which last year became the city’s main coronavirus treatment facility. Speaking to Moscow radio station Ekho Moskvy on Thursday, the hospital’s chief physician, Denis Protsenko, who became a household name in 2020 due to his role at the forefront of the country’s battle against Covid-19, explained that it has become much harder to treat ill patients. “There is a feeling that the virus is changing,” Protsenko explained. “The proven methods of treatment for hyperinflammation or, as we call it, cytokine storms, are often failing.”

“This makes us think that the virus has also changed and has mutated in this year and a half,” he said, before encouraging people to get vaccinated against the disease. According to Protsenko, the Kommunarka hospital is now filled with a large number of elderly patients, as well as people who are overweight or diabetic. Furthermore, collective immunity in the capital is still under 50%, he said. On Wednesday, Deputy Moscow Mayor Anastasia Rakova revealed that the city would open up additional hospital beds in the upcoming days, boosting its capacity by 1,500. That announcement came after Mayor Sergey Sobyanin ordered local authorities to ramp up enforcement of sanitary measures, such as the wearing of masks on public transport. However, he also noted that he had no plans to introduce any new lockdowns.

According to the official numbers, Russia recorded 12,505 new cases nationwide on Friday – the highest figure since February 22. The capital is bearing the brunt of the latest wave, with 5,853 new infections detected in just 24 hours – 47% of all cases recorded. Moscow is home to just 10% of the country’s population. However, perhaps most worryingly, Moscow’s coronavirus spread, measured by the so-called R rate, soared to 1.6 in the past 24 hours – the highest seen since September 30 last year.

It’s getting silly now, it’s like: as long as it comes out of a needle, you’re good to go.

• Greece To Accept All Vaccines For Entry Into The Country (K.)

All vaccines, even if they have not been approved by the European Medicines Agency, will be accepted by Greece for entry into the country, according to the member of the health committee advising the government on the pandemic. More specifically, speaking during a regular briefing of reporters, Vana Papaevangelou said the decision was taken following a recommendation by the committee. The vaccines that will be accepted are Novavax, Sinovac Biotech, Sputnik V, Sinopharm and CanSino Biologics. Papaevangelou also stressed that tourists will be able to enter from the land border, and that specifications for hotels and ships will be updated, while stating that tourism workers will have to undergo a weekly self-diagnostic test and complete their vaccinations. She sounded the alarm for those people who haven t been vaccinated, noting that 98% of deaths in the last week were people who had not completed their vaccinations.

Freeing everyone else to start firing employees for refusing to be guinea pigs.

• Judge Sides With Houston Hospital, Dismisses Claims From Staff Resisters (USAT)

In the first federal ruling on vaccine mandates, a Houston judge Saturday dismissed a lawsuit by hospital employees who declined the COVID-19 shot – a decision that could have a ripple effect across the nation. The case involved Houston Methodist, which was the first hospital system in the country to require that all its employees get vaccinated. U.S. District Judge Lynn N. Hughes said federal law does not prevent employers from issuing that mandate. After months of warnings, Houston Methodist had put more than 170 of its 26,000 employees on unpaid suspension Monday. They were told they would be fired it they weren’t vaccinated by June 21.

The hospital already had made it clear it means what it says: It fired the director of corporate risk – Bob Nevens – and another manager in April when they did not meet the earlier deadline for bosses. In recent weeks, a few other major hospitals have followed Houston Methodist’s lead, including the University of Pennsylvania, University of Louisville, New York Presbyterian and several major hospitals in the Washington, D.C. area. Houston Methodist’s CEO Marc Boom predicts more hospitals soon will join the effort. Many hospitals and employers were waiting for legal clarification before acting. “We can now put this behind us and continue our focus on unparalleled safety, quality, service and innovation,” Boom said after the ruling. “Our employees and physicians made their decisions for our patients, who are always at the center of everything we do.”

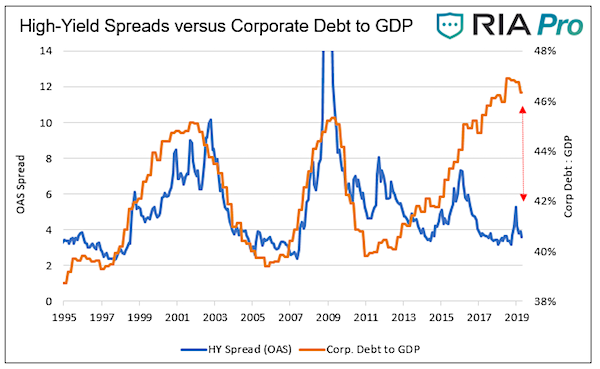

“..the experts forecast dire impacts from the Federal Reserve’s new framework that supports tolerating higher inflation for the benefit of a full recovery ..”

• Deutsche Bank Issues Grim Post-Pandemic Warning For US Economy (RT)

Further disregarding inflation will push the global economy to a major crisis, according to the latest report issued by Deutsche Bank economists who point the finger at the US money-printing policies. Germany’s largest lender warned that the unprecedented levels of cash being injected into the economy while inflation fears are being dismissed will lead to excruciating economic pain if not in the near term then in 2023 and beyond. The report points to the US’ “breath-taking” monetary stimulus that is reportedly comparable with that seen around World War II. “Then, US deficits remained between 15-30% for four years. While there are many significant differences between the pandemic and WWII we would note that annual inflation was 8.4%, 14.6% and 7.7% in 1946, 1947 and 1948 after the economy normalized and pent-up demand was released,” Deutsche Bank notes.

Moreover, the experts forecast dire impacts from the Federal Reserve’s new framework that supports tolerating higher inflation for the benefit of a full recovery of the country’s economy after the slumber caused by the Covid-19 pandemic. “The consequence of delay will be greater disruption of economic and financial activity than would be otherwise be the case when the Fed does finally act,” Deutsche’s economists wrote in the first report of the new series, titled “Inflation: The defining macro story of this decade.” “In turn, this could create a significant recession and set off a chain of financial distress around the world, particularly in emerging markets,” the report added. According to the bank’s analysts, neglecting inflation leaves global economies “sitting on a time bomb.”

“Bitcoin is for when you’re bearish on society and Ethereum is for when you’re bullish”

• Bitcoin Is De-dollarization. Ethereum Is DeFi-nancialization (Jeftovic)

Lately I have been thinking a lot about the difference between Bitcoin and Ethereum while at the same time the world is witnessing the inexorable move to crypto in realtime. Some may question the latter half of that assertion, given that the latest FUD cycle against cryptos has been one of the most intense that I’ve witnessed since getting involved in the space in 2013. Behind the FUD we see actions. We see Russia dumping dollar assets (can you blame them?). We hear Munger making almost childishly uninformed remarks on crypto, yet BRK is investing in one of the world’s most crypto friendly banks. We see El Salvador as the first country in the world to make Bitcoin legal tender. In my mind this has not only sounded the starting gun on de-dollarization in earnest, it goes beyond that. Back in the late 90‘s people like me were about the age of many of the crypto kids today, and we were talking about the Internet Asteroid headed straight at the telecoms and traditional media.

Today, pretty well everybody is aware of Bitcoin. They may have positive or negative opinions on it, but most people are figuring out that it’s here to stay and there is a spectrum of sentiment around that ranging from enthusiasm to denial. But I don’t get the sense that traditional institutional finance sector sees the other asteroid coming, and it’s coming straight at them. Or maybe Ethereum/Bitcoin. Whatever your risk tolerance and investment objectives entail. I’ve been listening to the Bankless podcast lately and in more than one episode they’ve said something about Bitcoin as compared to Ethereum that I think is very helpful. It’s really helped me think about the two in terms of construction of a crypto portfolio. They’ve said, in essence, that Bitcoin is for when you’re bearish on society and Ethereum is for when you’re bullish.

It’s not that I agree with that literally (I don’t), but it really helped me refine the distinction I’ve always had around Bitcoin being the value and Ethereum being the execution in a coming tectonic shift into crypto. In the olden days, bonds and equities had an inverse correlation. Bonds kept your portfolio afloat when the economy hit a soft patch and stocks went down (yes, in the olden days, stocks could experience bear markets, sometimes for months or even years). Conventional wisdom was to have a portfolio mix between equities and bonds, along some rule of thumb like 60/40 adjusted for your age, risk tolerance, etc. We’re headed into a world where Bitcoin and Ethereum will fulfil the roles that bonds and equities did traditionally.

“Moscow, he said, “has no superpower ambitions, regardless of how much people try to convince themselves and everyone else otherwise.”

• Soviet Collapse Taught Russians The Danger Of Being A Messianic Superpower (RT)

Russia has none of the “messianic fervor” of Western states such as the US, its foreign minister said this week, as the nations’ leaders prepare to meet. No longer the Third Rome, Moscow is seeking a more modest role in the world. The author Fyodor Dostoevsky had a grand vision for the country. Russia, he believed, would lead the West back to Christ and bring about “universal, spiritual reconciliation.” This it could do, he felt, because its people supposedly had a “capability for high synthesis, a gift for universal reconcilability.” The Russian, Dostoevsky wrote, “gets along with everyone and is accustomed to all. He sympathizes with all that is human, regardless of nationality, blood, and soil.” By contrast, those on the other side of the continent, the novelist added, “find a universal human ideal in themselves and by their own power, and therefore they altogether harm themselves and their cause.”

Russians, in other words, seek to reconcile all, while Westerners believe their own ideals are universal and seek to spread them everywhere. One may justifiably doubt such sweeping generalizations. But as Russia’s president, Vladimir Putin, prepares to meet the leader of the Western world, Joe Biden, next week, these different approaches to the world were on display in Russian and American public rhetoric. First, on the eve of the G7 summit in London, which begins on Friday, the New York Times noted that Biden is casting his trip to Europe “as an effort to rally the United States and its allies in an existential battle between democracy and autocracy.” “We have to discredit those who believe that the age of democracy is over, as some of our fellow nations believe,” the president said. “I believe we’re at an inflection point in world history,” he added.

“A moment where it falls to us to prove that democracies don’t just endure, but will excel as we rise to seize enormous opportunities in the new age.” An altogether different view, however, came from Russia’s foreign minister, Sergey Lavrov. In a riposte to Biden’s assertion that a struggle between Western liberalism and other systems was inevitable, Lavrov declared that Russia had no interest in a competition for ideological or geopolitical domination. Moscow, he said, “has no superpower ambitions, regardless of how much people try to convince themselves and everyone else otherwise.” The top diplomat claimed that the country simply doesn’t “have the messianic fervor with which our Western colleagues are trying to spread their ‘values-based democratic agenda’ throughout the planet. It has long been clear to us that the imposition of a certain development model from the outside does nothing good.”

Did they also tell him to appoint Putin?

• Boris Yeltsin Had 100 CIA Agents Who Instructed Him How To Run Russia (RT)

The first Russian president, Boris Yeltsin, was surrounded by “hundreds” of CIA agents who told him what to do throughout his tenure as leader. That’s according to Ruslan Khasbulatov, the former chairman of Russia’s parliament. Speaking to radio station Govorit Moskva, Khasbulatov claimed Yeltsin’s entourage was full of Americans. In 1991, he was elected to his leadership post with Washington’s help, it has been alleged, and it is still not yet known to what extent the US remained the voice in his ear throughout his presidency. “There must have been a hundred [CIA employees],” Khasbulatov said. “They determined everything.” He also added that, after winning the presidential election, Yeltsin would send security officials and heads of departments to the US so the Americans could “examine them” and “give conclusions.”

Khasbulatov’s statement comes after former Russian vice president Alexander Rutskoy told online outlet Lenta that 12 full-time employees of the CIA helped carry out the landmark Yeltsin-Gaidar market reforms, systematically dismantling the centrally planned economic system and leading the country into shock capitalism. Rutskoy also claimed that, on one significant occasion, he overheard Yeltsin speaking to a stranger with a foreign accent. However, according to Khasbulatov, everyone knew about Rutskoy’s links to the US, and American officials even influenced the former president to replace a considerable number of his appointees.

“On the whole, Rutskoy is absolutely right – Yeltsin was advised by foreigners,” he continued. “There is no secret here, and a great number of people know about it. I don’t have any detective stories about eavesdropping, but, in general, it’s well known. Yeltsin used to confer very closely on all personnel matters with foreign representatives.” Yeltsin left office in 1999, but not before creating a hyper-presidential system, taking power away from a hostile parliament, and removing almost all checks and balances. This move was supported by Washington, which hoped to keep the Communist Party out of power in the newly formed Russian state.

Carney’s going to claim trillions to save the planet. Few are as dangerous as he is.

• Mark Carney Unveils Dystopian New World To Combat Climate ‘Crisis’ (Foster)

In his book Value(s): Building a Better World for All, Mark Carney, former governor both of the Bank of Canada and the Bank of England, claims that western society is morally rotten, and that it has been corrupted by capitalism, which has brought about a “climate emergency” that threatens life on earth. This, he claims, requires rigid controls on personal freedom, industry and corporate funding. Carney’s views are important because he is UN Special Envoy on Climate Action and Finance. He is also an adviser both to British Prime Minister Boris Johnson on the next big climate conference in Glasgow, and to Canadian Prime Minister Justin Trudeau.

Since the advent of the COVID pandemic, Carney has been front and centre in the promotion of a political agenda known as the “Great Reset,” or the “Green New Deal,” or “Building Back Better.” All are predicated on the claim that COVID, and its disruption of the global economy, provides a once-in-a-lifetime opportunity not just to regulate climate, but to frame a more fair, more diverse, more inclusive, more safe and more woke world. Carney draws inspiration from, among others, Marx, Engels and Lenin, but the agenda he promotes differs from Marxism in two key respects. First, the private sector is not to be expropriated but made a “partner” in reshaping the economy and society. Second, it does not make a promise to make the lives of ordinary people better, but worse.

Carney’s Brave New World will be one of severely constrained choice, less flying, less meat, more inconvenience and more poverty: “Assets will be stranded, used gasoline powered cars will be unsaleable, inefficient properties will be unrentable,” he promises. The agenda’s objectives are in fact already being enforced, not primarily by legislation but by the application of non-governmental — that is, non-democratic — pressure on the corporate sector via the ever-expanding dictates of ESG (environmental, social and corporate governance) and by “sustainable finance,” which is designed to starve non-compliant companies of funds, thus rendering them, as Carney puts it, “climate roadkill.” What ESG actually represents is corporate ideological compulsion. It is a key instrument of “stakeholder capitalism.”

Carney’s Agenda is promoted by the United Nations and other international bureaucracies and a vast and ever-growing array of non-governmental organizations and fora, especially the World Economic Forum (WEF), where Carney is a trustee. Also, perhaps most surprisingly, by its corporate victims. No one wants to become climate roadkill. Carney clearly feels himself to be a man of destiny. “When I worked at the Bank of England,” he writes in Value(s), “I would remind myself each morning of Marcus Aurelius’ phrase ‘arise to do the work of humankind’.” One is reminded of French aristocrat and social reformer Henri de Saint-Simon, the “grand seigneur sans-culotte,” who ordered his valet to wake him with similar words: “Remember, monsieur le comte, that you have great things to do.”

“Best of all, nobody will be subjected to any racist ID checks!”

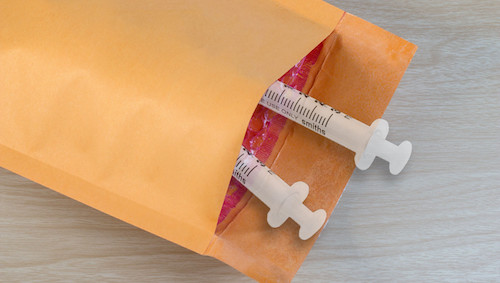

• Republicans Propose Vaccination-By-Mail Program (BBee)

As COVID vaccine delivery continues to decline nationwide, Republican leaders have proposed a radical solution: a vaccination-by-mail program to cover all Americans. “Since voting by mail went so smoothly last year, we wanted to apply those same principles to our COVID vaccination program,” said Senator Mitch McConnell. “Mail-in vaccines will ensure that we have the most secure vaccination process in American history!” The Republican proposal is simple: every American will automatically receive a pre-loaded syringe in the mail, along with a COVID vaccine card. Individuals will then self-administer the vaccine and self-report their vaccination status, all from the comfort of their own homes.

“Everyone will be able to receive the vaccine without having to miss work to travel to a vaccination site where they will wait in line for hours,” McConnell noted. “Best of all, nobody will be subjected to any racist ID checks!” Democrats were quick to criticize the proposal, saying a self-reported mail-in vaccine program was ripe for fraud and dishonesty. McConnell quickly dispelled those notions, saying they were nothing more than a transparent attempt to disenfranchise Republicans from getting vaccinated.

We try to run the Automatic Earth on donations. Since ad revenue has collapsed, you are now not just a reader, but an integral part of the process that builds this site. Thank you for your support.

G7 – Who does this?

Make the G7 Great Again!!! pic.twitter.com/uBaLshKSV8

— il Donaldo Trumpo (@ilSharko) June 13, 2021

Support the Automatic Earth in virustime. Click at the top of the sidebars to donate with Paypal and Patreon.