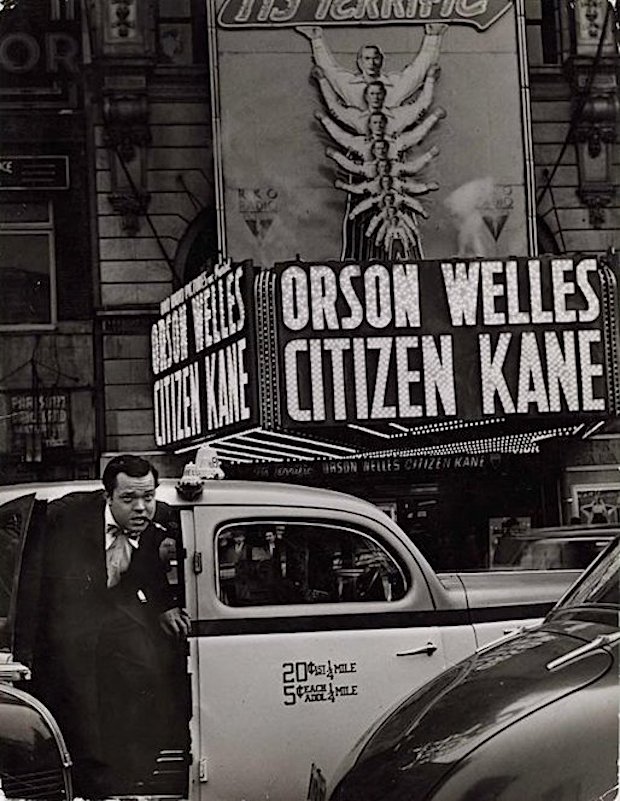

W. Eugene Smith Orson Welles 1941

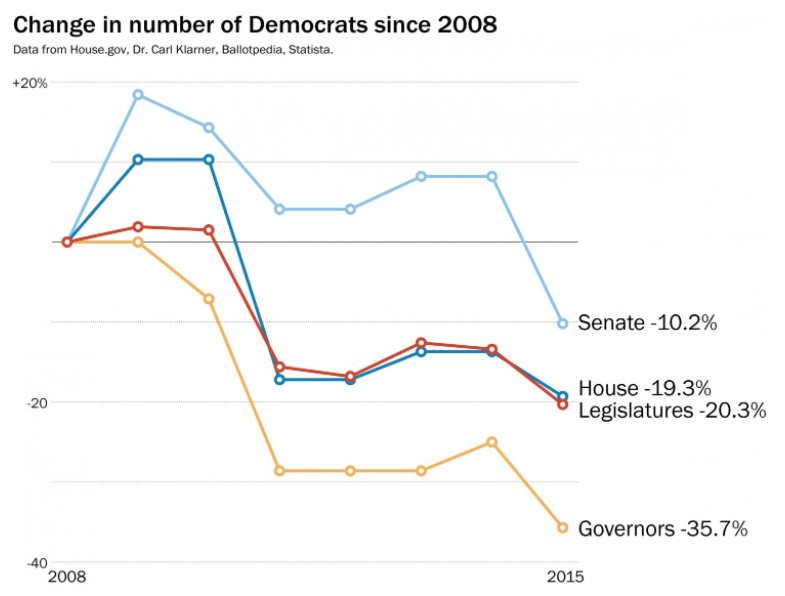

Every single thing about the US will from now on in evolve around party politics. But not in any way that you’ve ever seen.

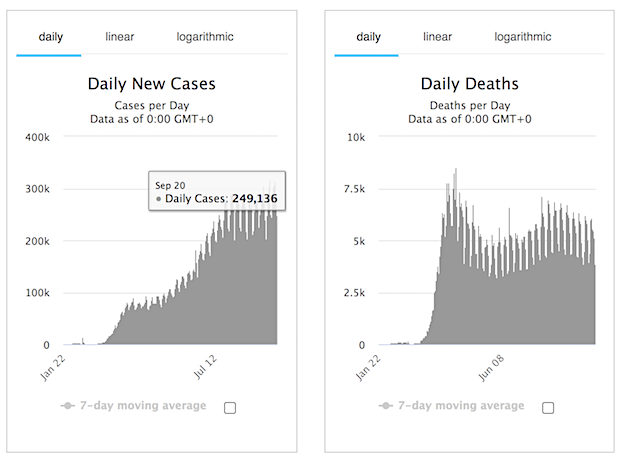

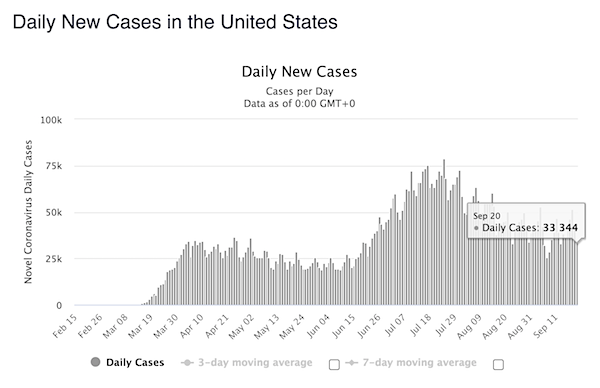

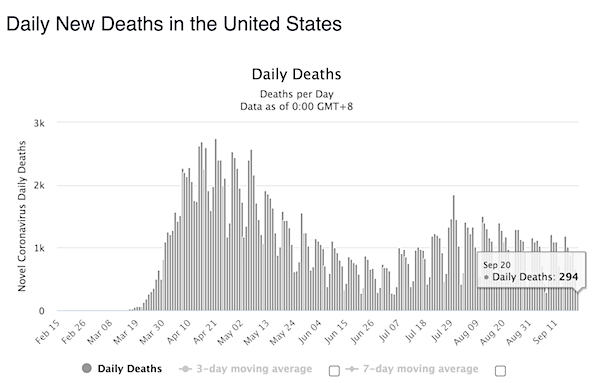

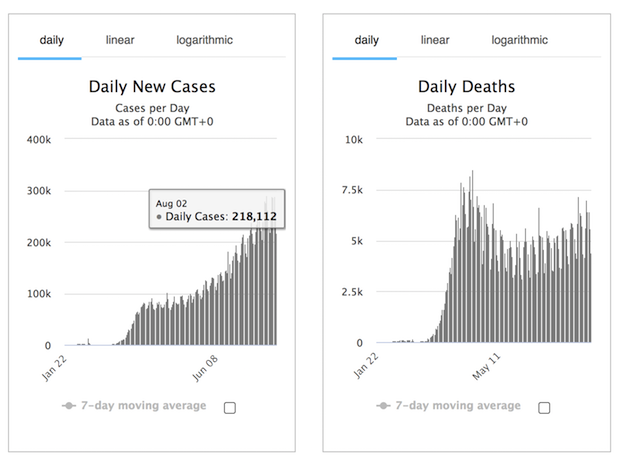

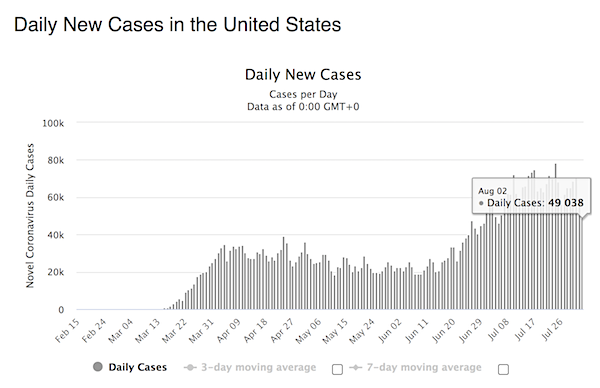

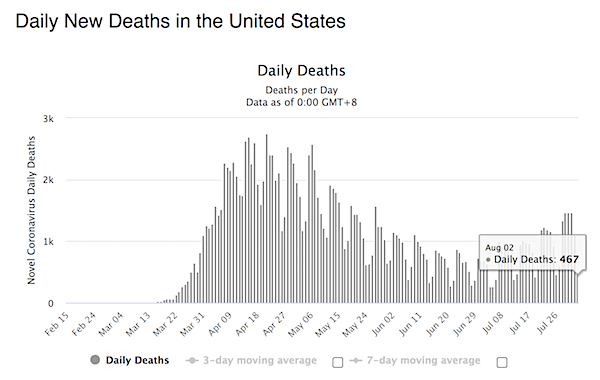

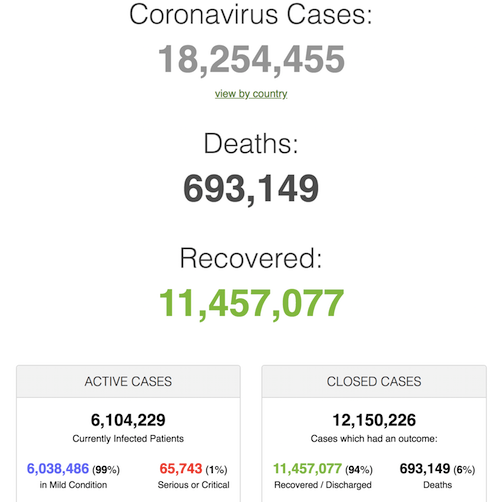

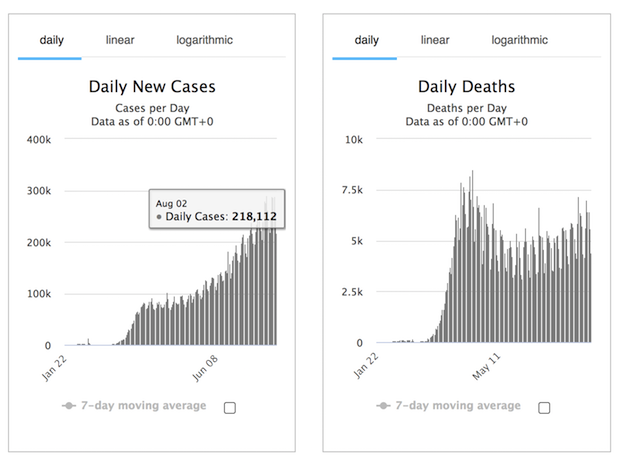

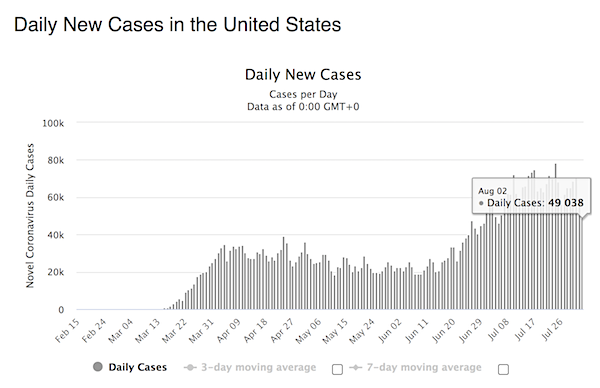

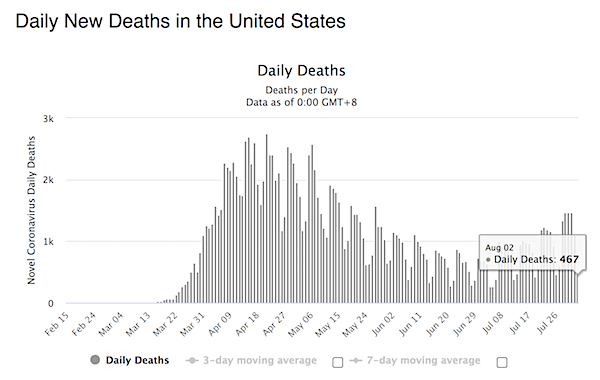

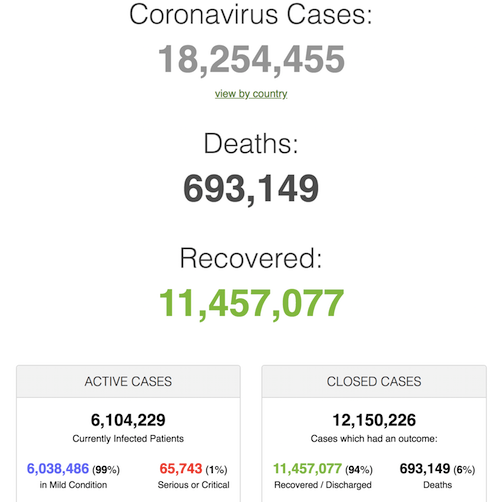

Sunday numbers were quite low. But not every state and country reports anymore in the weekend.

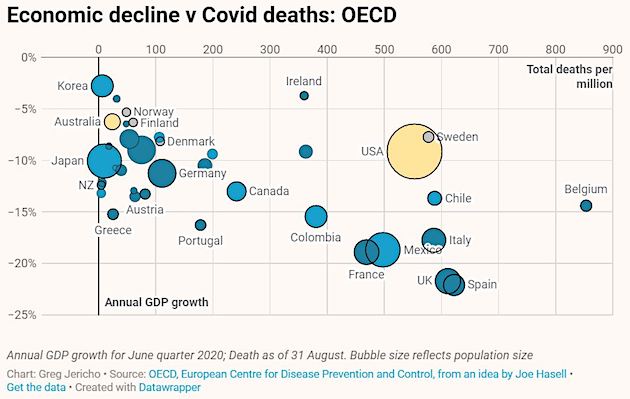

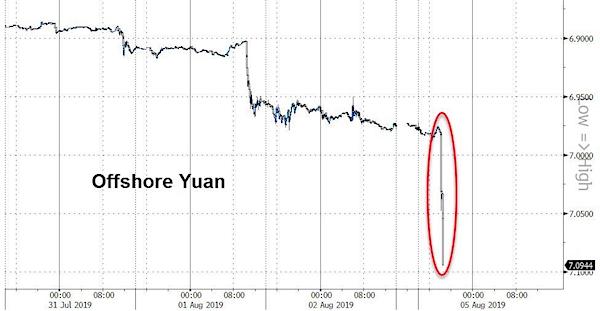

Ben Hunt Sweden

They would like that, but debates are a solid tradition. So they’ll try for just the one debate, they’ll try for a format that includes a teleprompter, they’ll try for factcheckers that can interrupt Trump all the time in the same way the House did with Bill Barr.

This piece even implies that Trump beat Hillary only because he was telling lies all the time.

• Supporters Urge Joe Biden Not to Debate Trump (NW)

Democratic strategists and supporters of Vice President Joe Biden are urging him not to debate President Donald Trump in the lead-up to Election Day, citing Trump’s publicity stunts and disregard for the rules in 2016. Meanwhile Biden backers, including some conservatives, applauded the University of Notre Dame and the University of Michigan for cancelling their scheduled debates over COVID-19 concerns. Former White House Press Secretary Joe Lockhart joined several Democratic Party strategists in bluntly advising Biden, “whatever you do, don’t debate Trump.” Speaking on CNN Saturday, Lockhart said Trump shouldn’t be given another platform which will enable him to “repeat lies,” which he said occurred in the 2016 debates against Hillary Clinton.

The Trump campaign has pushed the other way and urged the nonpartisan Commission on Presidential Debates, which officially oversees the events, to hold even more debates. “We saw in the debates in 2016 Hillary Clinton showed a mastery of the issues, every point she made was more honest and bested Trump,” Lockhart told CNN. “But Trump came out of the debates doing better I think because he just kept repeating the same old lies: ‘we’re going to build a wall and Mexico is going to pay for it,’ ‘we’re going to keep all those Mexican rapists out of the country,’ and ‘we’re going to make great trade deals’ — none of these things have come to pass.” “Giving him that national forum to continue to spout — get him to 21,000 or 22,000 lies — I think just isn’t worth it for the Democrats or for Biden,” Lockhart continued.

Several opinion columns published in recent months have called for an outright cancellation of the debates, describing them — alongside the party conventions — as outdated political rituals designed purely for TV ratings. Longtime Democratic strategist and former Hillary Clinton senior adviser Zac Petkanas agreed with calls for Biden to back out of any and all debates with Trump in the coming months. As it stands currently, there are three presidential debates and one vice presidential debate scheduled between September 29 and October 22. “Biden shouldn’t feel obligated to throw Trump a lifeline by granting him any debates at all. This is not a normal presidential election and Trump is not a legitimate candidate,” Petkanas tweeted last week, expressing his “opinion that no one asked for.”

Mussolini

Read more …

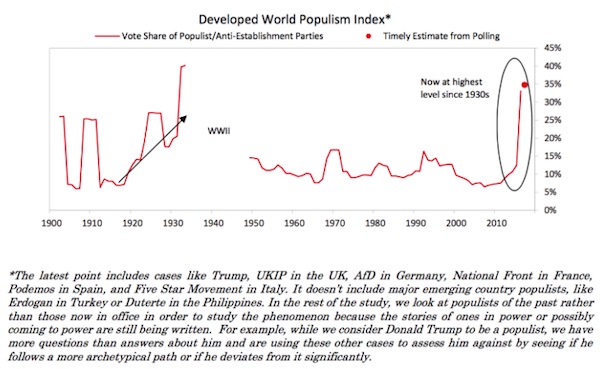

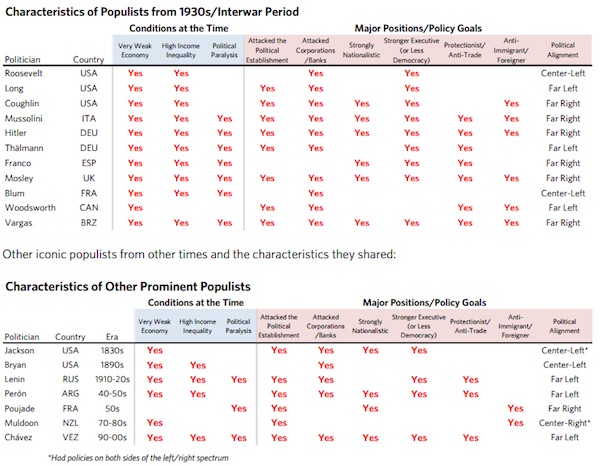

“The difference today is that enlightened liberals are the ones mouthing this age-old anti-populist catechism.”

Thomas Frank published What’s the Matter with Kansas? in 2004. His new book is The People, No: A Brief History of Anti-Populism.

• Kansas Should Go F— Itself (Matt Taibbi)

The new conception of populism, as popularized by historians like Richard Hofstadter, pitted the common run of voters against a growing class of elite-educated managerial professionals, philosopher-kings who set correct policy for the ignorant masses. The model of enlightened government for this new “technocratic” class of “consensus thinkers” was John Kennedy’s “Camelot” cabinet of Experts in Shirtsleeves, with Robert McNamara’s corporatized Pentagon their Shining Bureaucracy on a Hill. This vision of ideal democracy has dominated mainstream press discourse for almost seventy years.

Since the establishment of this template, Frank notes, “virtually everyone who writes on the subject agrees that populism is ‘anti-pluralist,’ by which they mean that it is racist or sexist or discriminatory in some way… Populism’s hatred for ‘the elite,’ meanwhile, is thought to be merely a fig leaf for this ugly intolerance.” Trump and Bernie Sanders both got hit with every cliché described in Frank’s book. Both were depicted as xenophobic, bigoted, emotion-laden, resistant to modernity, susceptible to foreign influence, and captured by “unrealistic” ideas they lacked the expertise to implement. At the conclusion of The People, No, Frank sums up the book’s obvious subtext, seeming almost to apologize for its implications:

“My point here is not to suggest that Trump is a “very stable genius,” as he likes to say, or that he led a genuine populist insurgency; in my opinion, he isn’t and he didn’t. What I mean to show is that the message of anti-populism is the same as ever: the lower orders, it insists, are driven by irrationality, bigotry, authoritarianism, and hate; democracy is a problem because it gives such people a voice. The difference today is that enlightened liberals are the ones mouthing this age-old anti-populist catechism.”

[..] The book’s concept also reflects the Sovietish reality of post-Trump media, which is now dotted with so many perilous taboos that it sometimes seems there’s no way to get audiences to see certain truths except indirectly, or via metaphor. The average blue-state media consumer by 2020 has ingested so much propaganda about Trump (and Sanders, for that matter) that he or she will be almost immune to the damning narratives in this book. Protesting, “But Trump is a racist,” they won’t see the real point – that these furious propaganda campaigns that have been repeated almost word for word dating back to the 1890s are aimed at voters, not politicians.

In the eighties and nineties, TV producers and newspaper editors established the ironclad rule of never showing audiences pictures of urban poverty, unless it was being chased by cops. In the 2010s the press began to cartoonize the “white working class” in a distantly similar way. This began before Trump. As Bernie Sanders told Rolling Stone after the 2016 election, when the small-town American saw himself or herself on TV, it was always “a caricature. Some idiot. Or maybe some criminal, some white working-class guy who has just stabbed three people.”

Read more …

But there’s still only one war party, which sits its fat ass across the aisles.

“Glenn Greenwald gave an hour-long lecture on how America’s billionaires control the U.S. Government..”

• How Congress Maintains Endless War (Zuesse)

The Intercept, 9 July 2020 – 2:45: There is “this huge cleavage between how members of Congress present themselves, their imagery and rhetoric and branding, what they present to the voters, on the one hand, and the reality of what they do in the bowels of Congress and the underbelly of Congressional proceedings, on the other. Most of the constituents back in their home districts have no idea what it is that the people they’ve voted for have been doing, and this gap between belief and reality is enormous.” Four crucial military-budget amendments were debated in the House just now, as follows: • to block Trump from withdrawing troops from Afghanistan. • to block Trump from withdrawing 10,000 troops from Germany • to limit U.S. assistance to the Sauds’ bombing of Yemen • to require Trump to explain why he wants to withdraw from the Intermediate Nuclear Forces Treaty

On all four issues, the pro-imperialist position prevailed in nearly unanimous votes — overwhelming in both Parties. Dick Cheney’s daughter, Republican Liz Cheney, dominated the debates, though the House of Representatives is now led by Democrats, not Republicans. Greenwald (citing other investigators) documents that the U.S. news-media are in the business of deceiving the voters to believe that there are fundamental differences between the Parties. “The extent to which they clash is wildly exaggerated” by the press (in order to pump up the percentages of Americans who vote, so as to maintain, both domestically and internationally, the lie that America is a democracy — actually represents the interests of the voters).

16:00: The Chairman of the House Armed Services Committee — which writes the nearly $750B annual Pentagon budget — is the veteran (23 years) House Democrat Adam Smith of Boeing’s Washington State. “The majority of his district are people of color.” He’s “clearly a pro-war hawk” a consistent neoconservative, voted to invade Iraq and all the rest. “This is whom Nancy Pelosi and House Democrats have chosen to head the House Armed Services Committee — someone with this record.” He is “the single most influential member of Congress when it comes to shaping military spending.” He was primaried by a progressive Democrat, and the “defense industry opened up their coffers” and enabled Adam Smith to defeat the challenger.

That’s the opening. Greenwald went on, after that, to discuss other key appointees by Nancy Pelosi who are almost as important as Adam Smith is, in shaping the Government’s military budget. They’re all corrupt. And then he went, at further length, to describe the methods of deceiving the voters, such as how these very same Democrats who are actually agents of the billionaires who own the ‘defense’ contractors and the ‘news’ media etc., campaign for Democrats’ votes by emphasizing how evil the Republican Party is on the issues that Democratic Party voters care far more about than they do about America’s destructions of Iraq and Syria and Libya and Honduras and Ukraine, and imposing crushing economic blockades (sanctions) against the residents in Iran, Venezuela and many other lands.

Read more …

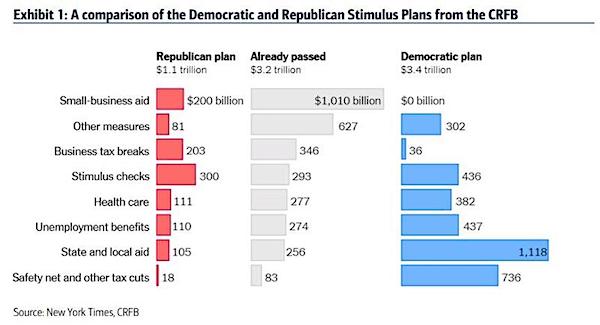

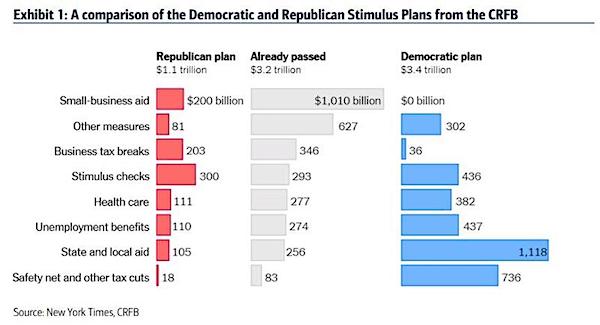

We saw this coming from miles away: no better opportunity for both sides to blame the other. Screw the people, it’s about power.

• White House Says Not Optimistic On Near-Term Deal For COVID Relief Bill (R.)

White House Chief of Staff Mark Meadows said on Sunday he was not optimistic on reaching agreement soon on a deal for the next round of legislation to provide relief to Americans hit hard by the coronavirus pandemic. “I’m not optimistic that there will be a solution in the very near term,” Meadows said on CBS’ “Face the Nation” as staff members from both sides were meeting to try to iron out differences over the bill. Democrats were standing in the way of a separate agreement to extend some federal unemployment benefits in the short-term while negotiations continue on an overall relief package, he said. “We continue to see really a stonewalling of any piecemeal type of legislation that happens on Capitol Hill,” Meadows said. “Hopefully that will change in the coming days.”

Lawmakers and the White House have been unable to reach an accord for a next round of economic relief from a pandemic that has killed more than 150,000 Americans and triggered the sharpest economic collapse since the Great Depression. Both sides said on Saturday they had their most positive talks yet. But there was no sign of movement on the biggest sticking point – $600 per week in extra federal unemployment benefits for Americans that has been a lifeline for millions of jobless Americans and expired on Friday. Asked about efforts to renew the expired emergency federal jobless benefits, Pelosi said, referring to Trump: “He’s the one standing in the way of that.”

Read more …

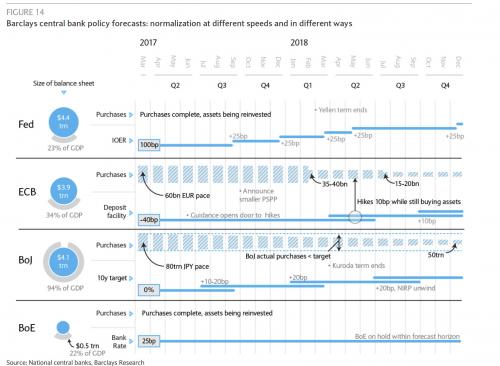

Because we badly need central bakers to interfere in politics. How far away are we from MMT here?

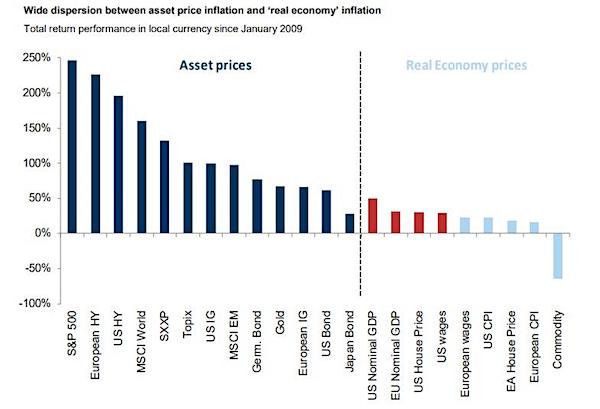

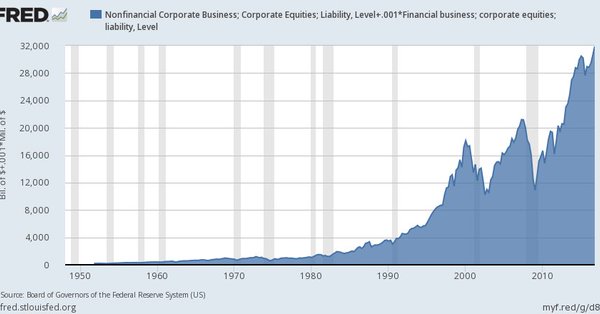

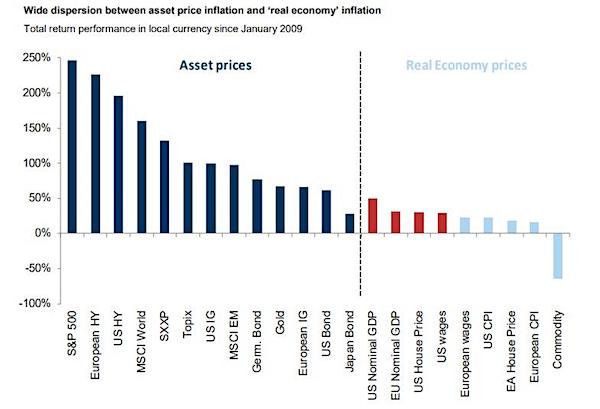

• The Fed Is Planning To Send Money Directly To Americans In Next Crisis (ZH)

Over the past decade, the one common theme despite the political upheaval and growing social and geopolitical instability, was that the market would keep marching higher and the Fed would continue injecting liquidity into the system. The second common theme is that despite sparking unprecedented asset price inflation, price as measured across the broader economy (at least using the flawed CPI metric) would remain subdued (as a reminder, the Fed is desperate to ignite broad inflation as that is the only way the countless trillions of excess debt can be eliminated and yet it has so far failed to do so).

The Fed’s failure to reach its inflation target has sparked broad criticism from the economic establishment, even though as we showed in June, deflation is now a direct function of the Fed’s unconventional monetary policies as the lower yields slide, the lower the propensity to spend. In other words, the harder the Fed fights to stimulate inflation, the more deflation and more saving it spurs as a result (incidentally this is not the first time this “discovery” was made, in December we wrote “One Bank Makes A Stunning Discovery – The Fed’s Rate Cuts Are Now Deflationary”). In short, ever since the Fed launched QE and NIRP, it has been making the situation it has been trying to “fix” even worse, all the while blowing a massive asset price bubble.

And having recently accepted that its preferred stimulus pathway has failed to boost the broader economy, the blame has fallen on how monetary policy is intermediated, specifically the way the Fed creates excess reserves which end up at commercial banks instead of “tricking down” all the way to the consumer level. To be in the aftermath of the covid pandemic shutdowns the Fed has tried to short-circuit this process, and in conjunction with the Treasury it has launched “helicopter money” which has resulted in a direct transfer of funds to US corporations via PPP loans, as well as to end consumers via the emergency $600 weekly unemployment benefits which however are set to expire unless renewed by Congress as explained last week, as Democrats and Republicans feud over which fiscal stimulus will be implemented next.

And yet, the lament is that even as the economy was desperately in need of a massive liquidity tsunami, the funds created by the Fed and Treasury (now that the US operates under a quasi-MMT regime) did not make their way to those who need them the most: end consumers. Which is why we read with great interest a Bloomberg interview published on Saturday with two former central bank officials: Simon Potter, who led the Federal Reserve Bank of New York’s markets group i.e., he was the head of the Fed’s Plunge Protection Team for years, and Julia Coronado, who spent eight years as an economist for the Fed’s Board of Governors, who are among the innovators brainstorming solutions to what has emerged as the most crucial and difficult problem facing the Fed: get money swiftly to people who need it most in a crisis.

The response was striking: they two propose creating a monetary tool that they call recession insurance bonds, which draw on some of the advances in digital payments, which will be wired instantly to Americans. As Coronado explains the details, Congress would grant the Federal Reserve an additional tool for providing support—say, a percent of GDP [in a lump sum that would be divided equally and distributed] to households in a recession.

Read more …

And while we’re at it, let the Fed regulate the lockdowns too. Such monetary wizards must be good at everything.

• Fed’s Kashkari Suggests 4-6 Week Shutdown (R.)

The U.S. economy could benefit if the nation were to “lock down really hard” for four to six weeks, a top Federal Reserve official said on Sunday, adding that Congress can well afford large sums for coronavirus relief efforts. The economy, which in the second quarter suffered its biggest blow since the Great Depression, would be able to mount a robust recovery, but only if the virus were brought under control, Neel Kashkari, president of the Minneapolis Federal Reserve Bank, told CBS’ “Face the Nation.” “If we don’t do that and we just have this raging virus spreading throughout the country with flare-ups and local lockdowns for the next year or two, which is entirely possible, we’re going to see many, many more business bankruptcies,” Kashkari said.

“That’s going to be a much slower recovery for all of us.” He said Congress is positioned to spend big on coronavirus relief efforts because the nation’s budget gap can be financed without relying on foreign borrowing, given how much Americans are saving. “Those of us who are fortunate enough to still have our jobs, we’re saving a lot more money because we’re not going to restaurants or movie theaters or vacations,” Kashkari said. “That actually means that we have a lot more resources as a country to support those who have been laid off,” he said.

Read more …

When you let this continue, you’re not trying to let the economy recover.

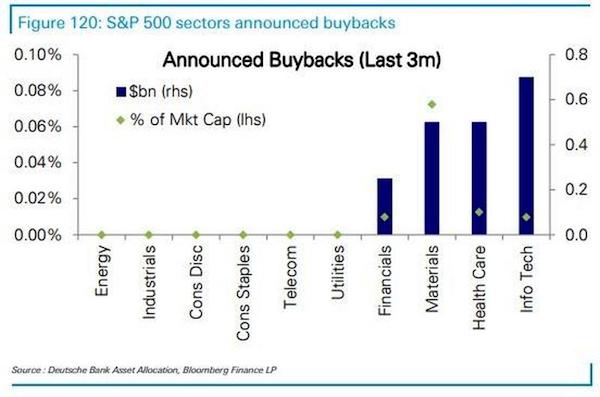

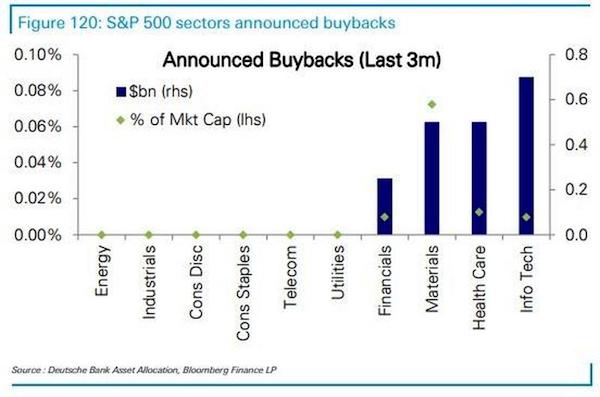

• Tech Stock Buybacks Are Surging (ZH)

Two months ago, we showed that contrary to conventional wisdom and corporate reps and warrants that buybacks had effectively been put on hold for the duration of the covid pandemic, not only were companies still repurchasing their shares but it was the tech names – those who have stormed higher since the March lows – that were the biggest culprits. Now, two months after we first revealed Wall Street’s worst kept secret, the Financial Times has also noticed that Corporate America is finding it hard to kick the share buyback habit, even after the US slipped into its worst recession in decades.

While total buybacks are indeed expected to drop this year as the downturn caused by coronavirus saps corporate profits, companies in the S&P 500 that have reported second-quarter earnings so far have reduced the number of their outstanding shares by an average of 0.3 per cent from the previous quarter, according to calculations from Credit Suisse. Furthermore, updates showed that some of the largest US multinationals continued to buy back their own stock or even accelerated stock repurchases and nowhere more so than the tech names we first highlighted at the end of May. Take Google’s parent company Alphabet, which spent $6.9bn on buybacks for the quarter, up 92% from a year prior, the company revealed in its earnings results last Thursday.

Microsoft, the second-largest listed US company, purchased $5.8bn of its own stock in the period, up 25% from a year earlier, and likely among the chief reasons for the stock’s amazing surge. Elsewhere, Biogen spent $2.8bn on buybacks for the period, up 17% from last year, WR Berkley, an insurer, did not buy any of its shares in the second quarter last year, but spent $97m on its stock in the period this year, and Celanese increased its planned buybacks for the year by $500m to $1.5bn in July, after selling its stake in a Japanese joint venture. Of course, the biggest source of buybacks was once again Apple, which repurchased $16BN in the second quarter, down 6% on the period last year, though by far the biggest stock repurchaser among S&P 500 companies in recent years.

Read more …

Preventing monopolies was once one of Washington’s main preoccupations.

• America’s Monopoly Problem Goes Way Beyond the Tech Giants (Dayen)

The truth is that, even if Congress somehow decreed the breakup of all four tech giants, the U.S. would still have an astounding number of industries controlled by a tiny number of firms. That’s because the structure of modern capitalism favors companies that operate at once-unimaginable scale, in the absence of a government will to prevent monopolies from forming. Lawmakers and the public should be concerned about the surveillance networks by which Facebook and Google—which dominate the digital-advertising market—track users, build data profiles on them, and serve them customized ads. But millions of rural Americans cannot access the internet to begin with, in part because telecom companies harass, fight, and induce state legislatures to pass laws restricting municipal broadband.

Across America, people send their kids to Starbucks parking lots to piggyback on the wifi and complete their homework. Amazon’s rapidly expanding e-commerce empire—and the potential consequences for Main Streets and municipal tax bases across the country—is definitely worth worrying about. But among the other forces squeezing out small retailers are dollar stores, a market segment dominated by two firms that together have about six times more outlets in America than Walmart. Last summer in Marlinton, West Virginia, I saw a Dollar General right next door to a Family Dollar. Despite the pandemic, Dollar General still plans to open 1,000 new stores in 2020. Software developers who want to sell apps to iPhone users must do so through Apple’s App Store, which spells out rules that they must follow and collects up to 30 percent of sales.

This is little different from the situation of small farmers, who must raise livestock to the exacting specifications of the meatpacking giants and can lose their livelihoods on those companies’ whims. And just as Amazon sometimes undercuts the smaller third-party sellers that use its platform, Big Agriculture competes directly with smaller suppliers; the top four hog firms, which control around two-thirds of the market, typically own farms, slaughterhouses, warehouses, and distribution trucks, every step from the pig trough to the dinner table. Whether you are shopping for pacemakers, sanitary napkins, or wholesale office supplies, you will find very few sellers. You think you have choices in grocery aisles or at car-rental counters, but the majority of consumer products come from a handful of companies.

Competition is hardly stiff when even many store brands are just renamed versions of market-leading products; at Costco, the batteries come from Duracell and the coffee from Starbucks. To focus the discussion of monopoly on the tech sector is to minimize the scope of a problem long in the making. Forty years ago, the government essentially stopped policing industry concentration. The conservative legal theorist Robert Bork—later a failed Supreme Court nominee—and his allies in the law-and-economics movement argued that any merger making businesses more efficient must be approved, and that a larger scale generally increases efficiency. Bork’s analysis gained enormous power in the courts and the Reagan administration. The lawyers and the bankers who handled mergers and acquisitions loved it.

Read more …

Pelosi and Schumer agree.

• White House Puts Chinese Apps On Notice (SCMP)

US President Donald Trump will take action against TikTok, WeChat and “countless” Chinese software companies that pose a national security threat to America, US Secretary of State Mike Pompeo said on Sunday, apparently widening the scope of attention the US government is paying to online tech platforms developed in China. “These Chinese software companies doing business with the United States, whether it’s TikTok or WeChat, there are countless more … are feeding data directly to the Chinese Communist Party their national security apparatus,” Pompeo said in a Fox News interview. “It could be their facial recognition pattern, it could be information about their residence, their phone numbers, their friends who they’re connected to.”

“Those are the issues President Trump’s made clear we’re going to take care of,” Pompeo said. “He will take action in the coming days with respect to a broad array of national security risks that are presented by software connected to the Chinese Communist Party.” Focusing on TikTok specifically, US Treasury Secretary Steven Mnuchin, whose department is overseeing a national security review of the company, said on Sunday that the company will need to be blocked in the US or sold to another company. Pompeo’s warning to Chinese software companies came as Trump agreed to give the Chinese internet giant ByteDance 45 days to negotiate a sale of the popular short-video app to Microsoft, according three people familiar with matter, Reuters reported.

[..] The mobile platform, which lets users create and share 15 second videos with custom music clips, has built a huge user base in the US, particularly within younger age brackets. Mnuchin added that he had spoken with Chuck Schumer, the most senior Democrat in the Senate, and House Speaker Nancy Pelosi, also a Democrat, about the issue and that they all agree that a sale or a block on the site would be necessary, using the authority of International Emergency Economic Powers Act, if needed. Responding to the drumbeat of comments about TikTok over the past week, the company’s general manager for US operations, Vanessa Pappas, told users on Saturday that the company was working to give them “the safest app” and that “We’re not planning on going anywhere”.

Read more …

Too much repetition makes people look away.

• Humanity Likely Faces Rapid ‘Catastrophic Collapse’ – Study (NYP)

It’s not the news you want to hear during a global health crisis. In a new theoretical study appearing in Nature Scientific Reports, a pair of statistical researchers have warned that rampant human consumption has sent us on a tailspin towards a rapid “catastrophic collapse” — which could happen in the next two to four decades. Forest density, or the current lack thereof, is considered the cataclysmic canary in the coal mine, according to the report. By comparing the rate of deforestation against humanity’s rate of consumption, study authors Mauro Bologna and Gerardo Aquino have determined there’s a 90% chance our species will collapse within decades — calling this estimate an “optimistic” measure.

“Based on the current resource consumption rates and best estimate of technological rate growth our study shows that we have very low probability, less than 10% in most optimistic estimate, to survive without facing a catastrophic collapse,” they wrote. While much attention has been paid to the ways in which greenhouse gases have contributed to the demise of our species, Aquino focused mathematical models on the “undeniable fact” of human-driven deforestation. “Before the development of human civilizations, our planet was covered by 60 million square kilometers [37 million square miles] of forest,” according to the article. “As a result of deforestation, less than 40 million square kilometers [25 million square miles] currently remain.”

The researchers set out to “evaluate the probability of avoiding the self-destruction of our civilization” based on numerical simulations — charts and graphs that don’t look like much to us laymen, but for two theoretical physicists, they amount to disaster. They also call into play “Fermi’s paradox,” which refers to the theoretical discussion of extraterrestrial life from Enrico Fermi, an Italian physicist who once asked, “Where is everybody?” One aspect of the discourse is the idea that self-destruction caused by unsustainable environmental exploitation may be an inevitability of intelligent life — and thus a potential reason why we have not yet had the opportunity to meet our galactic neighbors.

Read more …

From February, but highly relevant today.

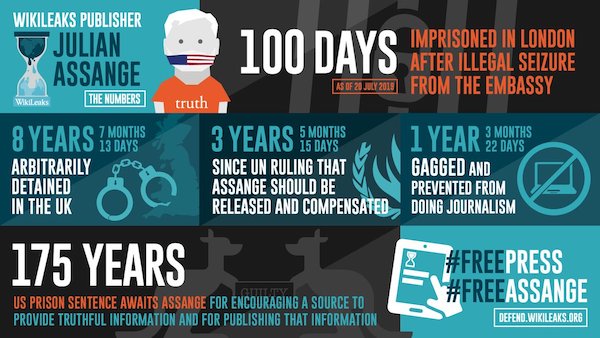

• How The Guardian and New York Times ‘Set Up’ Julian Assange (M.)

[..] as the War Logs’ mutually-agreed publication deadline loomed, both the Times and Guardian grew increasingly anxious about being associated with the material. His film, shot just prior to the release, documents this transformation in real-time — in one highly illuminating segment, Assange informs Gavin MacFayden, then-director of the University of London’s Centre for Investigative Journalism, the New York Times has requested WikiLeaks ‘scoop’ them by publishing analysis of the Afghan War Logs first. The ‘naivety’ Davis referenced is palpably on display — “they want to report on our reporting, so they can claim they’re not involved!” Assange splutters bemusedly, in evident disbelief a newspaper would be actively resistant to publishing a seismic exclusive.

As Davis attested, the footage makes for thoroughly “chilling” viewing in the present day, given Assange is “now in jail as a result of that subterfuge”. Simultaneously, Assange himself was also growing increasingly anxious, in his case about the identities of informants and other individuals featured in the logs being revealed — no effort had been made by Guardian journalists to remove a single one, and despite repeated requests he wasn’t provided with staff or technical support to redact them. As a result, the WikiLeaks chief took up the “moral responsibility” for the files — his requests for publication to be delayed in order to give him enough time to adequately “cleanse” the documents were ignored, so he was compelled to “literally work all night” to redact around 10,000 names, Davis said.

In a perverse irony, the documentarian also exposed how despite Assange ultimately acquiescing to publishing the Logs Sunday 25th July 2010 in order to allow The Guardian and Times to ‘report’ on the story the next day, the plan was disrupted by technical issues with the WikiLeaks website. As Assange struggled to get the content online, Davis said he was inundated with “panicked, hysterical calls” from The Times and Guardian, which grew more frenzied as the day wore on — the two outlets were literally on the verge of ‘stopping the presses’, as the front-page splashes on the Afghan War Logs were entirely predicated on the notion WikiLeaks had published the documents the day prior.

It would take several days for WikiLeaks to publish the War Logs — The Guardian and Times nevertheless ran their scheduled stories on 26th July 2010, reporting on the release of the logs, despite the fact they hadn’t actually appeared on the WikiLeaks website. “Julian was their fall guy. They printed a lie. These two high priests of journalistic integrity very happily colluded, reporting on something that hadn’t happened. The entire searchable Afghan War Logs interface was the sole creation of The Guardian, they promoted it on their website and in the paper, but then they turned round and said ‘we didn’t publish this, Julian did’. They set him up from the start. They should be in jail too,” Davis concluded.

Read more …

We try to run the Automatic Earth on donations. Since ad revenue has collapsed, your support is now an integral part of the process.

Thank you.

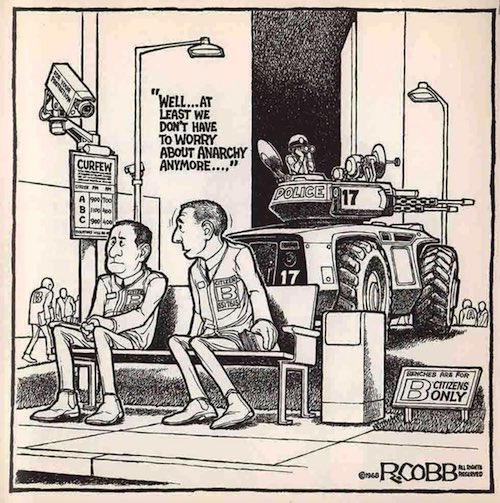

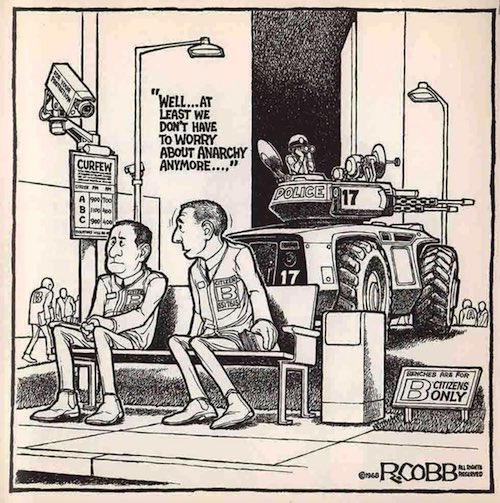

A 1968 cartoon.

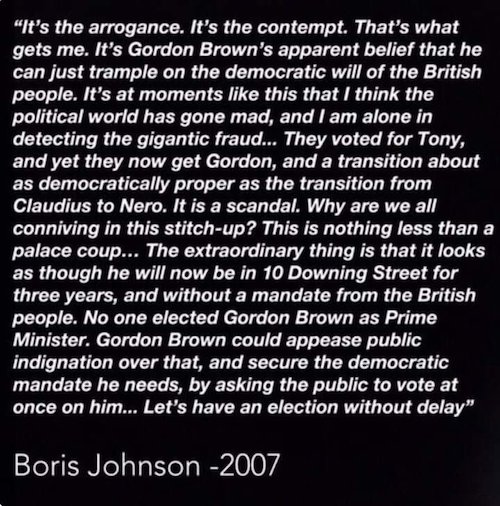

Easily Tweet of the day. Hands down.

Support the Automatic Earth in virustime.