Juan Gris Guitar on a chair 1913

Just so you know.

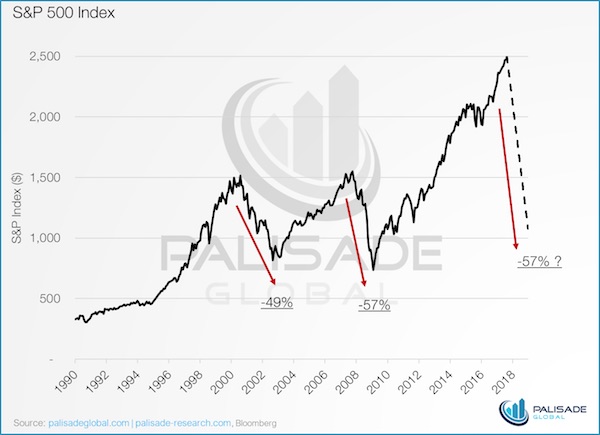

• S&P 500 Poised To Lose $10 Trillion In Value (Pal.)

The last two recessions were devastating for the S&P 500. The dot-com bubble during March 2000 to October 2002 saw the Index drop -49%, while the Global Credit Crisis from October 2007 to March 2009 saw an even greater drop of -57%. Since then, the S&P 500 has been on fire, gaining 250% and breaking record highs almost daily. As the old adage goes, “the bigger they are, the harder they fall”. If the S&P loses 57% in the next market crash, that would represent $10 trillion in value lost, and would take the Index down to 1,077. As the more cyclical sectors begin to decline, portfolio managers will begin to reallocate capital to more attractive sectors. As we noted in our previous write-up, Gold Stocks To Explode When The S&P Implodes, in the current bull market, the S&P is up 247%, while gold stocks are down -30%.

If the pattern holds, the succeeding bear market in the S&P will trigger a major gold rally, which we predict will continue into the next S&P bull. Portfolio managers will look for undervalued stocks in sectors considered safe havens. Gold stocks check all the boxes and a surge of capital will soon find its way into them. Using the materials sector as proxy to gold stocks, we saw in each of the last two bears the weighting of the sector increase. The total value drop was also less in terms of percentage compared to the overall market. We calculate inflows of $206 billion in 2000-2002, and $270 billion in 2007-2009. If the coming drop follows that of the recent recession, we can expect an inflow of at least $440 billion into gold stocks. That is a lot of money on the sidelines. And when it begins to pour in, gold stocks will explode.

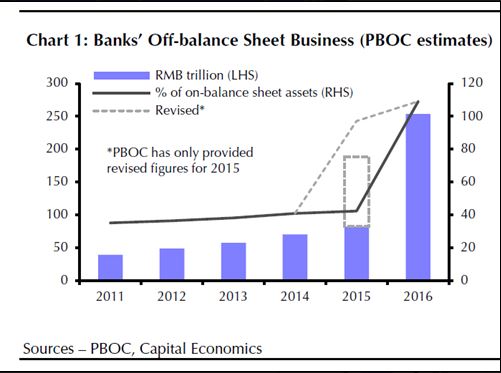

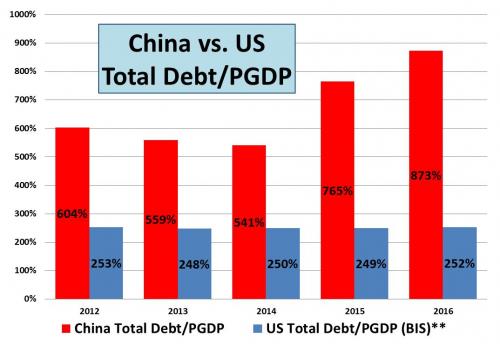

I’ve warned a thousand times on China’s shadow system. This is excellent from ‘Deep Throat’. As I’ve suggested, the shadow system is now bigger than the official one.

• The Sum of All Fears: China Shadow Banking Hits $40 Trillion (DT)

Unfortunately, per the People’s Bank of China (PBOC), Shadow Bank lending has reversed course abruptly and skyrocketed since the 2015 McKinsey report. Nobody really knows how big China’s Shadow Bank ecosystem is, but the PBOC recently offered a rather shocking guess in their 2017 Financial Stability Report (pg.48). China’s Off-Balance-Sheet, un-regulated, “Shadow” loans have grown to nearly US $37 Trillion (RMB 252.3 Trillion) and have surpassed China’s US$34 Trillion, “On-Balance Sheet” bank assets as of the close of 2016. They also restated the 2015 numbers, increasing the 2015 figures to US$ 28 Trillion (RMB 189 Trillion), roughly doubling the 2015 figure.

Keep in mind, the PBOC estimating Non-Bank Shadow loans is a bit like the local Sheriff estimating “unreported financial crime”. He doesn’t have authority over the mechanics of the activity, lacks enforcement resources and therefore can’t do much about preventing the crime(s). Even if he had authority and resource, he’d have a hard time zeroing in on the metric….criminals generally don’t respond to surveys or self-report their schemes. Moreover, the Sheriff would have an incentive to under-estimate the problem and hope everything works out, since, at some point, someone is going to be held accountable. As history shows, and Chinese Bankers are well aware of this, financial scoundrels are normally exiled to horrific disgrace on a private tropical island with access to boatloads of Cayman Islands money…..so it goes.

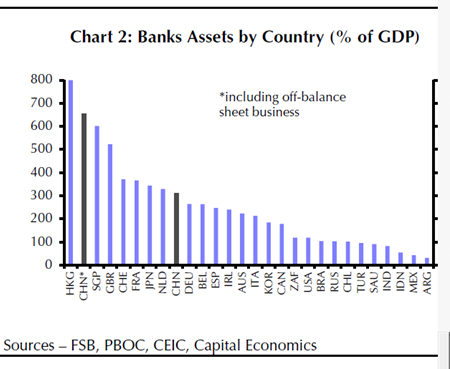

Again, based solely on the usual, limited transparency inherent in PBOC reporting (good things are trumpeted and bad things are swept under the rug), a disclosure like this would indicate that the problem is potentially much larger than they are letting on. In the 2017 Financial Stability Report (an oxymoron if I’ve ever heard one) the PBOC restates the Shadow Bank Assets for 2014 and 2015 (as shown by the dotted line in the chart below). To my knowledge, no other major economy has ever experienced an acceleration anywhere near these levels of Non-Bank, Shadow debt relative to GDP, much less restated it in a gigantic “ooppps….our bad” buried in a couple of paragraphs in the bowels of a report. In China….they do things big. The bigger the better. The two Charts below, prepared by Capital Economics illustrate that we’ve apparently entered uncharted waters.

Although the fiercely independent citizens, politicians and bankers of Hong Kong and Singapore might disagree, we can generalize that the leverage in those economies (tall bars on the left of the chart) is inextricably linked to the Chinese financial system. If there were ever a potential “ground-zero” for a default-induced financial contagion Shang-Hong-apore would be it. Moreover, when we examine the PBOC/CE Charts above, it wouldn’t be much of a reach to conclude that Shadow/Non-Bank Credit has become an absolutely essential tool for keeping all of the financial balls in the air. [..] Jahangir Aziz and Haibin Zhu from JP Morgan said the debts of the state-owned entities (SOEs) have alone reached 90pc of GDP or $13.3 trillion. Nearly 60pc of new credit this year is being used to repay old loans. It takes four times as much new credit to generate a given amount of extra of GDP as it did a decade ago.

The EU leadership doesn’t give a shit what Europeans think of them (they’re not elected). Wave bye bye.

• EU Parliament Defends ‘Proportionate Force’ in Catalonia (RT)

EU member states have the right to use “proportionate” force to defend the rule of law, Frans Timmermans, European Commission First Vice President, said three days after hundreds were injured by Spanish police trying to stop an independence vote in Catalonia. “It is a duty for any government to uphold the rule of law, and this sometimes requires the proportionate use of force,” Timmermans told the European Parliament in Strasbourg during a debate on Catalonia. “Respect for the rule of law is not optional – it’s fundamental,” he said. An independence referendum was held in the relatively prosperous Spanish region of Catalonia on Sunday, despite Madrid labeling it “unconstitutional.” A brutal mass police crackdown during the vote saw over 800 people, including women and the elderly, injured in Barcelona and elsewhere across the region.

“If the law does not give you what you want, you can oppose the law, you can work to change the law, but you cannot ignore the law,” Timmermans said. For the EU, “it is fundamental that the constitutions of every one of our member states are upheld and respected,” he added. According to Timmermans, the Catalan regional government “has chosen to ignore the law in organizing the referendum of last Sunday.” The leader of the largest European Parliament group, the European People’s Party, Manfred Weber, has also decried the Catalan referendum as invalid during the debate. “Who leaves Spain, leaves the European Union,” including the eurozone and the single market, Webber warned the Catalan authorities.

“..the Rajoy administration dispatched two military convoys to Barcelona today to beef up its coercive capabilities in the city..”

• Catalonia Chaos Begins to Squeeze Spain’s Financial Markets (DQ)

Spain’s biggest political crisis of a generation, which has led to the complete breakdown of communication and understanding between its government in Madrid and the separatist region of Catalonia, is finally beginning to take its toll on the country’s financial markets. Spain’s benchmark index, the Ibex 35, slumped nearly 3% following its worst day of trading since the Brexit vote last June. Spain’s 10-year risk premium — the differential between the yield on its 10-year bonds and the yield on Germany’s 10-year bonds — soared to 129 basis points. And that’s despite the fact that the ECB continues to buy Spanish debt hand over fist. But it is the banks that have borne the brunt of the pain this week. On Monday, the first trading day after the independence referendum, they lost €4.84 billion in market value.

Over the past five trading days, shares of the two biggest Catalan-based banks, Caixabank and Banco de Sabadell, have plunged respectively, 9% and 13%. So tense is the situation that the CEOs of each bank felt compelled to release a statement today reassuring customers that they have all the means and tools necessary to protect their interests. Their contingency plans include the option of abandoning their base of operations in Catalonia and moving elsewhere — to Madrid in the case of Sabadell and Mallorca in the case of Caixabank. But it wasn’t just Catalan banks that were caught up in today’s rout. Important Spanish banks with somewhat less exposure to Catalonia also saw their shares plunge.

Santander, Spain’s only global systemically important bank, was down 3.8% on the day’s trading; BBVA, Spain’s second bank which has important operations in Catalonia after acquiring the failed saving bank Catalunya Caixa in 2015, fell 3.6%; and Bankia was also down 3.6%. Standard & Poor’s today put Catalonia’s credit rating — at B+/B, it’s already deep into junk — on review for a downgrade of one notch or more, “if we believed that escalating political tensions between Catalonia’s government and Spain’s central government could put in question the full and timely refinancing of Catalonia’s short-term debt instruments or undermine the effectiveness of the central government’s financial support to Catalonia.” The threat of default moves a step closer.

$1 trillion and now they start counting?!

• ECB To Banks: Set Aside More Cash For Bad Debt Amid €1 Trillion Problem (G.)

The ECB is attempting to put a lid on the near €1tn of bad debts stored in eurozone banks by asking lenders to be more prudent about the way they handle new customers falling behind on repayments. The Frankfurt-based institution issued guidance on Wednesday intended to stop a new pile of problem debts being built up inside eurozone banks by setting out how much cash it wanted lenders to set aside for bad debts incurred from January 2018. The measures are not applicable to the existing €1tn of bad debts, which are largely a legacy of Europe’s financial problems in the aftermath of the 2008 crash and languishing on the balance sheets of banks in countries such as Greece, Cyprus and Italy. The ECB wants lenders to set aside 100% of the value of an unsecured loan within two years and gives lenders seven years to put aside the full amount of a secured loan, such as a mortgage.

The aim is to set a formal guideline for how to tackle problem loans – known as non-performing loans (NPLs) – in contrast to the current situation where there are a variety of approaches across eurozone countries. Policymakers are concerned that bad debts inside banks not only weaken lenders but also make it difficult for them to grant more loans, which in turn can impede economic growth. But they are sensitive to announcing new measures that would make banks more cautious about issuing new loans or push up the cost of borrowing. Sharon Donnery, deputy governor of the Central Bank of Ireland, who presented the latest plan by the ECB to tackle bad debts, said: “We want to prevent a build-up of insufficiently covered NPLs in the future.” The new measures are not applicable to the existing stock of bad debts for which lenders have set aside 45% of the value of their problem loans, so if the new rules had been applied it could have led to multibillion-euro provisions for lenders.

Who did that headline?

• Investors Are Too Inured to Markets’ Repeated Records (DDMB)

After several boom-and-bust cycles it’s clear many investors have exhausted the term “bubble.” Instead, they will recall this cycle with another word: “record.” The question is: Will the memories be tinged with regret? The answer is an unequivocal “yes.” The stock market closes at a fresh high with such frequency it no longer triggers news flashes. The mirror image of these daily records is found in volatility, which has cascaded to record lows. The bond market, though, is where the real action has been since 2011. If the current pace of sales persists through the final quarter of this year, 2017 will mark the seventh consecutive year of record U.S. corporate bond issuance. In exchange, investors are extending issuers record lax lending terms and receiving near-record low returns. It is no longer uncommon for bonds to price at yields that are beneath an issuer’s leverage as gauged by debt as a multiple of earnings.

Moreover, three-quarters of loans sold into the $1 trillion leveraged loan market are of the “covenant-lite” variety, meaning they do not give investors protection against issuers loading themselves up with debt. Buyers have responded by pushing leveraged loan volumes up by more than half this year compared with 2016; issuance is on pace to surpass 2007’s record $534 billion. And while it isn’t at record lows, the yield spread over comparable Treasury bonds that investors receive for investment grade-rated credits has only been lower 20% of the time since 2000. In the case of high-yield credit, the spread has only been lower 14% of the time in the past 17 years.

The differentiating factor in the years 2004 through 2007, when spreads were at their tightest on record, is the relative dearth of securitization, a process by which pools of loans were divvied up into tranches engineered to disperse risk. Investors learned the hard way as the credit crisis unfolded that these “collateralized” vehicles did not perform as well as the underwriters advertised. And yet, while there’s no question the collateralized mortgage obligation, or CMO, hasn’t even flirted with a comeback, the same cannot be said of its cousin, the collateralized loan obligation. In September, CLO issuance volumes surpassed $82 billion, well past the $75 billion high end of what analysts had been forecasting for the full year. Volumes are running at twice last year’s pace and could easily surpass 2007’s record $89 billion level.

Tax-free is not risk-free.

• Puerto Rico’s Debt Is Quietly Sitting in Mom and Pop Mutual Funds (Martens)

There was likely a collective gasp at OppenheimerFunds Inc. yesterday when President Donald Trump made another of those market-moving pronouncements, telling Fox News that Puerto Rico’s debt would have to be wiped out. The President’s remarks suggested he thought the losers would be Wall Street banks. The President stated: “You know they owe a lot of money to your friends on Wall Street. We’re gonna have to wipe that out. That’s gonna have to be — you know, you can say goodbye to that. I don’t know if it’s Goldman Sachs but whoever it is, you can wave good-bye to that.” The reality is that a large percentage of Puerto Rico’s debt is held in tax-free municipal bonds and municipal bond mutual funds, owned not by Wall Street banks or tycoons, but by mom and pop investors seeking tax-free income.

(As a result of Congressional legislation, the interest on municipal bonds issued by the Commonwealth of Puerto Rico, its political subdivisions and public corporations, is not subject to Federal, state or local taxes. This has made the individual bonds and mutual funds particularly attractive in places like New York City and to residents of New York counties with high local taxes.) According to a semi-annual report made last month at the Securities and Exchange Commission, Oppenheimer Rochester Fund Municipals, a popular tax-free fund held by many New York investors, was sitting on a boatload of Puerto Rico municipal bonds as of June 30, 2017. The SEC filing shows over 100 different Puerto Rico bonds, issued by the Commonwealth and numerous other Puerto Rico issuers like the Puerto Rico Electric Power Authority and the Puerto Rico Sales Tax Financing Corp. (The fund, of course, holds a widely diversified portfolio of other bonds as well.)

MMT.

• The Cost Of Not Understanding Sovereign Currencies (Bill Black)

Jared Bernstein, Senior Fellow at the Centre on Budget and Policy Priorities and former chief economist to former Vice President Joe Biden, recently published an op ed in the New York Times entitled ‘Do Republicans Really Care About the Deficit?’. Republican elites, of course, have not really cared about federal budget deficits for decades. That is a good thing that Democrats should embrace in a bipartisan spirit. Bernstein, of course, is correct that the Republicans are hypocrites about federal budget deficits, pretending to care about them when the Democrats hold power and displaying their lack of any real care when Republicans hold power and the context is tax cuts for the wealthy.

Democrats display a similar hypocrisy. Even Democrats like Bernstein who know that the Republicans proposed expansion of the federal budget deficit through tax cuts is not a real economic problem are primed to attack Republican hypocrisy by falsely asserting that the Republican deficits would harm the Nation. Democrats should embrace honesty as the best policy and stop embracing the politically attractive pose of claiming to be the Party that “really cares” about the federal budget deficit. That politically attractive pose is not simply dishonest and financially illiterate, it is also a trap. The Republican and New Democrat deficit strategy is to force Democrats to make an endless series of “Sophie’s choices.” Choose which excellent program to kill in order to save (temporarily) another from the chopping block because we supposedly cannot afford to provide both.

Then repeat the process. The Republicans and New Democrats constantly, and falsely, claim that the federal government cannot afford to provide medical care availability that is routinely provided in most of Europe and Canada. It is a pure myth that the United States cannot afford to provide the safety net of Social Security, Medicare, and Medicaid. We need to start with first principles. In a nation with a sovereign currency like the United States, federal tax revenues do not fund federal expenditures. If that sentence, which is indisputably correct, strikes you as bizarre then it is a measure of the force of the propaganda you have been fed throughout your life. Today would be an excellent day to free yourself from the hold of that destructive lie.

“There is nothing more reckless and irresponsible than convincing a nuclear power that you are going to attack. ”

• Whose Bright Idea Was RussiaGate? (PCR)

The answer to the question in the title of this article is that Russiagate was created by CIA director John Brennan.The CIA started what is called Russiagate in order to prevent Trump from being able to normalize relations with Russia. The CIA and the military/security complex need an enemy in order to justify their huge budgets and unaccountable power. Russia has been assigned that role. The Democrats joined in as a way of attacking Trump. They hoped to have him tarnished as cooperating with Russia to steal the presidential election from Hillary and to have him impeached. I don’t think the Democrats have considered the consequence of further worsening the relations between the US and Russia.

Public Russia bashing pre-dates Trump. It has been going on privately in neoconservative circles for years, but appeared publicly during the Obama regime when Russia blocked Washington’s plans to invade Syria and to bomb Iran. Russia bashing became more intense when Washington’s coup in Ukraine failed to deliver Crimea. Washington had intended for the new Ukrainian regime to evict the Russians from their naval base on the Black Sea. This goal was frustrated when Crimea voted to rejoin Russia. The neoconservative ideology of US world hegemony requires the principal goal of US foreign policy to be to prevent the rise of other countries that can serve as a restraint on US unilateralism. This is the main basis for the hostility of US foreign policy toward Russia, and of course there also is the material interests of the military/security complex.

Russia bashing is much larger than merely Russiagate. The danger lies in Washington convincing Russia that Washington is planning a surprise attack on Russia. With US and NATO bases on Russia’s borders, efforts to arm Ukraine and to include Ukraine and Georgia in NATO provide more evidence that Washington is surrounding Russia for attack. There is nothing more reckless and irresponsible than convincing a nuclear power that you are going to attack. Washington is fully aware that there was no Russian interference in the presidential election or in the state elections. The military/security complex, the neoconservatives, and the Democratic Party are merely using the accusations to serve their own agendas. These selfish agendas are a dire threat to life on earth.

Lots of changes.

• Who Really Holds Power at the Fed (BBG)

To the casual observer, the Federal Open Market Committee September meeting in Washington might have looked like any other. But when San Francisco’s John Williams, Minneapolis’s Neel Kashkari, and the other regional Fed presidents took their seats at the big oval table, an historical anomaly glared back from the other side. In a rare alignment of events, the five voting presidents outweighed Board of Governors voters, who include Federal Reserve Chair Janet Yellen. It’s a gap that opened up earlier this year and which looks poised to persist, at least for the near future. This matters. There are 12 Fed presidents, chosen for five-year terms by their regional boards. The seven governors are appointed by the U.S. president and confirmed by the Senate for staggered 14-year terms.

Because of the retirement of Daniel Tarullo, the governor informally tasked with heading financial regulation, the Fed board has been down to four voters since May, and with Vice Chairman Stanley Fischer leaving, it’s possible the number could be down to three by the next FOMC meeting. It looks likely that Randal Quarles, Trump’s first nominee, could be confirmed before that, holding the Governors steady at four. The regional contingent, meanwhile, remains near full force, with only the Richmond Fed currently looking for a new president. At a time when the current occupant of the Oval Office could choose at least four new governors, the power of the regional presidents amounts to a stabilizing backbone and bastion of independence in an era of transition at the Fed. Yellen, Lael Brainard, and Jerome Powell are the holdouts on the board in Washington, and President Trump isn’t expected to reappoint Yellen when her term ends in February.

Thus it could fall to the Fed’s arcane system, born of populist angst, to protect monetary policy from massive upheaval. The current state of affairs underscores how this uniquely American setup, erected in stages beginning in the years before World War I, remains relevant a century later, even though many of the functional duties of the world’s most powerful central bank have changed. “The regional banks are a bizarre set of entities,” says Aaron Klein, a Brookings Institution fellow who studies the central bank. “In some ways the mission of the regional system is to bring in diverse viewpoints that challenge the political board.”

“Prior to the rule, an estimated $100m in taxpayer-owned natural gas was wasted each year from oil and gas wells operating on public lands in New Mexico..”

• Court Orders Trump Administration Reinstate Obama Emissions Rule (AP)

Rebuffing the Trump administration, a federal judge on Wednesday ordered the Interior Department to reinstate an Obama-era regulation aimed at restricting harmful methane emissions from oil and gas production on federal lands. The order by a judge in San Francisco came as the Interior Department moved to delay the rule until 2019, saying it was too burdensome to industry. The action followed an earlier effort by the department to postpone part of the rule set to take effect next year. US Magistrate Judge Elizabeth Laporte of the northern district of California said the department had failed to give a “reasoned explanation” for the changes and had not offered details why an earlier analysis by the Obama administration was faulty. She ordered the entire rule reinstated immediately.

The rule, finalized last November, forces energy companies to capture methane that’s burnt off or “flared” at drilling sites on public lands during production because it pollutes the environment. An estimated $330m a year in methane is wasted through leaks or intentional releases on federal lands, enough to power about 5m homes a year. Methane, the primary component of natural gas, is a leading contributor to global warming. It is far more potent at trapping heat than carbon dioxide but does not stay in the air as long. [..] Democratic senator Tom Udall from New Mexico said the methane rule provides badly needed revenue to states such as New Mexico for public education and other services.

Prior to the rule, an estimated $100m in taxpayer-owned natural gas was wasted each year from oil and gas wells operating on public lands in New Mexico, Udall said, adding that the rule has helped to reduce dangerous air pollution across the west, including a methane cloud the size of Delaware that hangs over the Four Corners region of New Mexico, Utah, Arizona and Colorado.

What Happens If the Honeybees Disappear?

• US Honeybee Queen Life Expectancy Halves In 10 Years (NatGeo)

A honeybee queen, when all is right in her world, should live for two to three years. But in the United States, beekeepers have seen that life span drop by more than half over the past decade, and researchers are trying to determine why. It’s one of many questions surrounding the mystery of honeybee mortality, a disturbing phenomenon that’s linked to a mix of factors, including parasites, pesticides, and habitat loss. Aside from making a delicious natural sweetener, honeybees—which are not native to the U.S.—also provide a crucial service to agriculture: pollination. From apples to almonds, many crops would suffer without honeybees. And while about 90% of beekeepers in this country are hobbyists, the majority of hives belong to large-scale, commercial operations, says North Carolina State University entomologist David Tarpy.

Colony collapse in general could be devastating to food production. So scientists are looking for alternatives. Most honeybees in the U.S. today are of Italian heritage and vulnerable to a pest called the varroa mite. But Russian bees are more resistant to it, and backyard beekeepers have had success with them. The problem, says Tarpy, is that Russian honeybees don’t make as much honey as their Italian counterparts and “aren’t as amenable” to the migratory nature of pollinating large-scale farms. Another option, says wildlife biologist Sam Droege of the U.S. Geological Survey, is to embrace the thousands of North American wild bee species, which are excellent pollinators, rarely sting, and are typically the size of a grain of rice. The drawback for some people is that none of the wild bee species produce honey. But, says Droege, “we can always get honey from other countries.”

I’ve always been in awe of 5000 year old trees. They ‘saw’ the pyramids being built.

• Ancient Bristlecone Pine Forests Overwhelmed By Climate Change (LAT)

For thousands of years, wind-whipped, twisted bristlecone pines have been clinging to existence on the arid, stony crests of eastern California’s White Mountains, in conditions inhospitable to most other life. Their growth rings provide a year-by-year account of the struggle to survive: It’s a tortuous cycle of dying off almost entirely, leaving only a few strips of bark that then continue to grow diagonally skyward or sideways along the ground. But the world’s oldest trees may never have experienced temperature increases as rapid as those of recent decades. The climatic changes have triggered a struggle for dominance, in very slow motion, between the ancient bristlecones and the younger limber pines that have been able to charge up-slope as conditions become warmer and wetter.

Scientists know that bristlecone pines will remain standing for centuries to come. But how will they cope with the intrusion of limber pines competing for sunlight, moisture, nutrients and room to grow? Which plants and animals will be first to adapt to niches in the increasingly diverse forests at elevations above 11,000 feet? [..] average ambient temperatures have risen nearly 2 degrees Fahrenheit in the last century, altering the precarious balance of life in the region long dominated by ancient bristlecone pines — regarded as symbols of longevity, strength and perseverance. “Whenever conditions change, there are winners and losers. And in this case, we won’t know the ultimate outcome for several thousand years,” Smithers said. “But some bristlecone pine forests could face a reduction in range if they’re crowded out … by limber pines moving into their turf.”

Bristlecone pines — named for their bottlebrush-like branches with short needles — are found in other parts of the semiarid Great Basin, which extends from California’s Sierra Nevada east to the Rockies. But the ones found in the White Mountains are the oldest. The slow growers are only about 25 feet tall and expand about 1 inch in diameter every 100 years. One of the oldest of the bunch is Methuselah, at about 4,768 years old. Its precise location is carefully guarded to avert vandalism.

Animal feed.

• 60% Of Global Biodiversity Loss Is Down To Meat-Based Diets (G.)

The ongoing global appetite for meat is having a devastating impact on the environment driven by the production of crop-based feed for animals, a new report has warned. The vast scale of growing crops such as soy to rear chickens, pigs and other animals puts an enormous strain on natural resources leading to the wide-scale loss of land and species, according to the study from the conservation charity WWF. Intensive and industrial animal farming also results in less nutritious food, it reveals, highlighting that six intensively reared chickens today have the same amount of omega-3 as found in just one chicken in the 1970s.

The study entitled Appetite for Destruction launches on Thursday at the 2017 Extinction and Livestock Conference in London, in conjunction with Compassion in World Farming (CIFW), and warns of the vast amount of land needed to grow the crops used for animal feed and cites some of the world’s most vulnerable areas such as the Amazon, Congo Basin and the Himalayas. The report and conference come against a backdrop of alarming revelations of industrial farming. Last week a Guardian/ITV investigation showed chicken factory staff in the UK changing crucial food safety information. Protein-rich soy is now produced in such huge quantities that the average European consumes approximately 61kg each year, largely indirectly by eating animal products such as chicken, pork, salmon, cheese, milk and eggs.

In 2010, the British livestock industry needed an area the size of Yorkshire to produce the soy used in feed. But if global demand for meat grows as expected, the report says, soy production would need to increase by nearly 80% by 2050. “The world is consuming more animal protein than it needs and this is having a devastating effect on wildlife,” said Duncan Williamson, WWF food policy manager. “A staggering 60% of global biodiversity loss is down to the food we eat. We know a lot of people are aware that a meat-based diet has an impact on water and land, as well as causing greenhouse gas emissions, but few know the biggest issue of all comes from the crop-based feed the animals eat.”

Author Ethan Siegel ends up being disappointed.

• Are Space, Time, And Gravity All Just Illusions? (F.)

The Universe, as we know it, has a fundamental flaw staring us right in our faces, letting us know that our knowledge is incomplete. The four fundamental forces are described by two different and mutually incompatible frameworks: General Relativity for gravitation, and Quantum Field Theory for the electromagnetic and nuclear forces. Einstein’s theory on its own is just fine, describing how matter-and-energy relate to the curvature of space-and-time. Quantum field theories on their own are fine as well, describing how particles interact and experience forces. But where gravitational fields are strongest, and on the smallest of scales, we have no way of describing nature. The physics of our greatest theories breaks down. Under conventional circumstances, quantum field theory calculations are done in flat space, where spacetime isn’t curved.

We can do them in the curved space described by Einstein’s theory of gravity as well, although the calculations are far more difficult. This semi-classical approach gets us far, but it doesn’t get us everywhere. In particular, there are a few strong-field situations where we simply cannot obtain sensible answers using our current theories: • What happens to the gravitational field of an electron when it passes through a double slit? • What happens to the information of the particles that form a black hole, if the black hole’s eventual state is thermal radiation? • And what is the behavior of a gravitational field/force at and around a singularity? These questions all go unanswered without a quantum theory of gravity. The assumption we normally make is that there is a quantum theory of gravity, and we just haven’t found it yet.

Perhaps it’s string theory; perhaps it’s an alternative approach like loop quantum gravity, causal dynamical triangulations, or asymptotic safety. But since 2009, a new, exciting, and assumption-challenging approach has taken the scene by storm: the idea that gravity itself isn’t a real, fundamental force, but an illusory, emergent one. Pioneered by Erik Verlinde, the idea is that gravity emerges from a more fundamental phenomenon in the Universe, and that phenomenon is entropy. Sound waves emerge from molecular interactions; atoms emerge from quarks, gluons and electrons and the strong and electromagnetic interactions; planetary systems emerge from gravitation in General Relativity. But in the idea of entropic gravity — as well as some other scenarios (like qbits) — gravitation or even space and time themselves might emerge from other entities in a similar fashion.