Francesco Hayez The Death of the Doge Marin Faliero 1867

O’Leary

BREAKING: “Mr. Wonderful” from Shark Tank, Kevin O’Leary, says Trump trial is sheer stupidity.

“This is about the American brand… We look like clowns. I hate this.”pic.twitter.com/U42iqXXuHC

— Leading Report (@LeadingReport) April 18, 2024

Bragg

https://twitter.com/i/status/1780977235949711525

Ritter

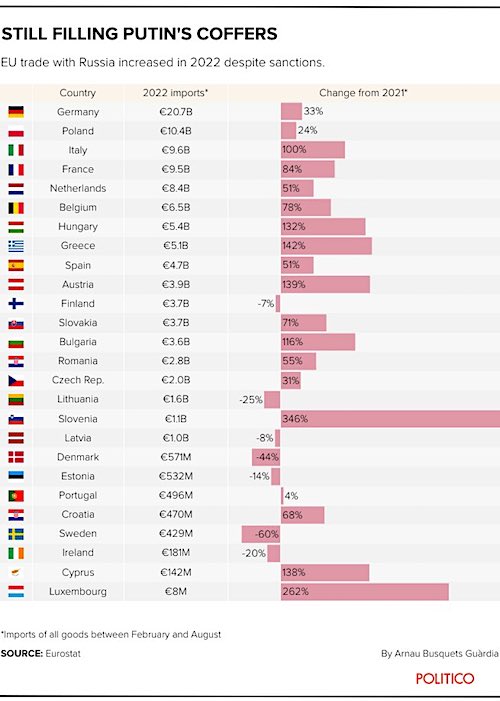

Scott Ritter The End of the War in Ukraine Approaches as NATO is Completely Defeated

Ukraine is going to die a miserable death thanks to the West.

Ukraine will never be a part of NATO.Ukraine will never be a member of the European Union.

The ultra-nationalists will be… pic.twitter.com/fn7an8bvIr

— Ignorance, the root and stem of all evil (@ivan_8848) April 17, 2024

Samson

WATCH: How long before Israel uses its Samson Option and takes the world down with it? #Gaza #Iranhttps://t.co/yiE7NuXqDe pic.twitter.com/9M4uf05WlI

— Gerald Celente (@geraldcelente) April 18, 2024

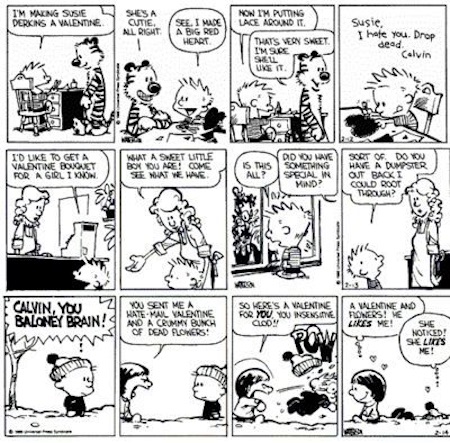

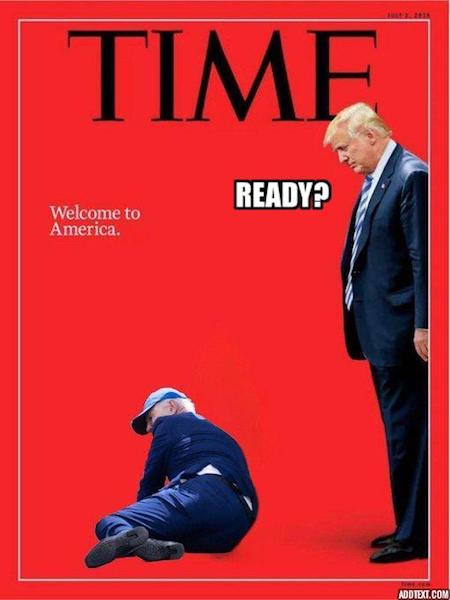

America is undergoing a political show trial. For the whole world to see. There are three more waiting in the wings. The legal system should never allow for this. It is now on trial as much as Trump is.

• Why the Fix Is in for Trump (Victoria Taft)

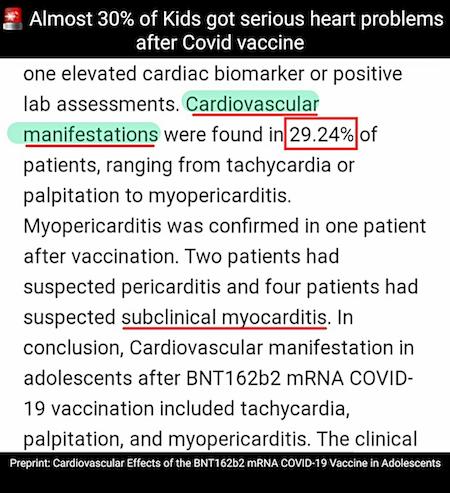

Judging by the way the entire array of Democrat operatives at the federal, state, and local levels of law enforcement have scraped the bottom of the local pond, liberated copious amounts of scum, loaded DNC slingshots, and heaved the slime at former President Donald Trump, I’m thinking you might have low expectations for New York City trial, too. We can’t imagine why you’d feel that way.The 34 charges against Trump were magicked into felonies by the Manhattan District Attorney Alvin Bragg, who contends there’s an overarching federal election crime at play. That’s how he reanimated these misdys that had already run their statute of limitations. The judge in the case, Juan Merchan, then re-jiggered the statute of limitations, blaming COVID to add another year to the statute of limitations so Bragg could bring these charges against Trump. The New York State legislature made a similar move for E. Jean Carroll so the founder of LinkedIn and ardent leftist Reid Hoffman could bankroll a new round of lawfare. The move revived her ability to bring a sexual assault case against Trump for assaulting her in a dressing room sometime in the ’90s in a dress she swore she wore but which hadn’t been designed yet.

In the fraud case that isn’t fraud and which defrauded no one, Gov. Kathy Hochul assured New York businesses afraid the Jacobins would come for their businesses and assets that “New Yorkers who are business people have nothing to worry about because they’re very different than Donald Trump…” Attorney General Letitia James had never used this law to do to anyone what they’re doing to Trump. She also used another one-off law to pile on the penalties for the victimless non-crime. The judge in that case, who probably wears no underwear under that robe, pronounced Trump guilty before the trial began. And we haven’t even touched on the FBI’s Mar-a-Lago raid over documents Trump is allowed to have under the Presidential Records Act. Or the attempt to get Trump off the ballot using the 14th Amendment. Even the U.S. Constitution is fungible to these leftists. And now we’re in jury selection in Trump’s latest case, which is literally a bookkeeping case in which Trump paid his attorney over time for services rendered that included making sure Stormy Daniels and another woman signed non-disclosure agreements (NDAs) and were paid for them.

Daniels has never been charged with extortion for breaking her NDA and demanding more money or she’d tell the media that she had a tryst or something with Trump. But Bragg lets murderers run the streets, so why are we surprised? Bragg doesn’t include his boffo legal theory in the 34-count indictment, but in his accompanying statement contends that Trump stole the 2016 election from Hillary Clinton. Hillary won New York in the 2016 election by a nearly two-to-one margin, but why let a fact like that get in the way of a great election-year lawfare effort on behalf of Democrats? Indeed, each of these prosecutors and their offices should be required to file with the Federal Elections Commission for in-kind donations to Joe Biden. We also might wonder why Bragg and his fellow conspirators haven’t been swooped up by the FBI and charged with whatever is the opposite of a 1512 c2 offense for starting an official proceeding — this trial — to carry out his violence upon a former president and current presidential candidate.

Trump’s being publicly humiliated and kept off the campaign trail — a feature, not a bug of this lawfare — because he booked payments to his lawyer in 2017, which, let’s note for clarity, is after the 2016 election. Bragg contends these payments were in furtherance of stealing an election. Hillary’s 2016 Russia collusion efforts in conspiracy with the CIA, FBI, DOJ, and White House somehow were left out of Bragg’s election-stealing bill of particulars, but He’s With Her so it’s just fine, whatareyoulookingat? The Federal Elections Commission, Justice Department, and Bragg’s own office have previously declined to pursue this lunacy. However, when George Soros poured money into his campaign, Bragg, like AG Letitia James, promised if he were elected by the Manhattan jury pool, he’d use any tool at his disposal to Get Trump. And now jury selection is underway, and we’ve got a couple of clunkers in that box of rocks that may be professional Trump haters.

Not that Trump can say anything about his latest case since Judge Merchan has put what looks to be a constitutionally suspect gag order on the former president. He’s been admonished by the judge that he should say nothing about his “child,” a grown-ass woman who works for a Democrat political consulting firm and does work for Joe Biden and Chuck Schumer and used the trial as a fundraising tool. Nothing to see here, obviously, so Trump should shaddup already. You can see what’s going on. The left has put what is tantamount to a gag order on us, too. At PJ Media, we’ve been censored, excoriated, “fact-checked” by feedback-loop lefties, and all but killed from social media. The Google gods demonetize us for their latest government-bankrolled censorship program—going after “mal” information. That’s information that is true but which they don’t like because it makes them look bad.

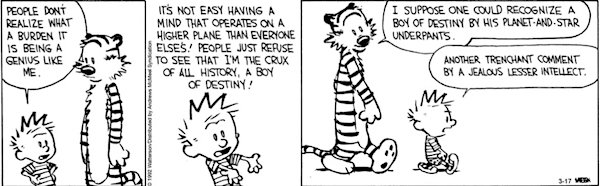

“..the whole point of the exercise was to lop off the head of someone who stood in the way of the regime’s continuity..”

• N.Y. Gives Trump The Anne Boleyn Treatment (Porter)

Jury selection is now complete in the case of The People of the State of New York vs. Donald J. Trump, which alleges that the defendant lied to his own check register, and lied to the general ledger of his own company, when the invoice given to him by his lawyer was paid and recorded by someone else, and that the misstatement he made to himself in his own records was done “with the intent to defraud and intent to commit another crime and aid and conceal the commission thereof.” [..] The prosecutor elected in New York County of New York state indicted Trump, after Trump announced his 2024 run for president, for allegedly violating New York Penal Laws 175.05 and 175.10 seven years ago.

That local prosecutor, Alvin Bragg, is a member of the Democratic Party – and the voters who elected Bragg and from whom the jury will be chosen support the Democratic Party. In 2016, the people of New York County voted 87% for Hillary Clinton and 10% for Donald Trump, and in 2020, 87% for Joe Biden and 12% for Donald Trump. In other words, the jury pool is chosen from one of the most partisan jurisdictions in the country – a place where almost all the judges are Democrats as well. So the Democratic prosecutor elected in the second most Democratic county in the United States will try the former Republican president and current putative Republican Party presidential nominee before a Democrat-appointed judge and a jury drawn from a pool 87% of whom voted against him (and who are being asked if they watch Fox News or listen to talk radio in the screening process).One wonders if the law even matters. But let’s review the two statutes at issue to highlight what the law requires the prosecution to prove.

First, the prosecutor must prove that Trump violated the relevant statute, which requires a finding that he falsified business records with intent to defraud – that he “makes or causes a false entry in the business records of an enterprise.” By the way, falsifying business records in the second degree is a misdemeanor, not a felony. Moreover, New York’s statute of limitations requires that misdemeanor prosecutions be commenced within two years of the commission of the act, meaning that under the last provision, this case should never have been filed. Bragg elevated this misdemeanor into a felony by including New York Penal Law 175.10 in the indictment – falsifying business records in the first degree. That statute reads this way: “A person is guilty of falsifying business records in the first degree when he commits the crime of falsifying business records in the second degree, and when his intent to defraud includes an intent to commit another crime or to aid or conceal the commission thereof.”

There are other obvious difficulties with this case beyond the credibility of the witnesses (a porn star who denied any affair numerous times and a disbarred lawyer convicted of perjury). For example, why does the entry in the check register or the general ledger matter at all? When would those entries, as opposed to the allegedly false invoices, be shown to anyone for any nefarious purpose? And were the entries even false? Was there any intent to fool someone to obtain something in making the entries – who was the target of the allegedly false entry in private books and records? If there’s no mark, no victim, then how could there be an “intent to defraud”? Defraud whom? And what is the other crime that the person making the book entry intended to commit or hide? If the other crime is not a New York crime but a federal crime, does every county prosecutor in the United States, including Alvin Bragg, have the jurisdiction to enforce an alleged federal crime indirectly through a state crime?

We shall see. The political nature of this trial is obvious, and unprecedented in the United States. Even with irrefutable DNA evidence that Bill Clinton committed perjury, the special prosecutor declined to press criminal charges against him. In America’s recent past, prosecutors tended to exhibit a modicum of restraint. Those days are apparently gone. I reviewed an interesting law review article of political show trials down through history, from the trial of Socrates in Athens to the famous show trials in the 1930s Stalinist Soviet Union, curious to see if I could find historical precedent for this trial. The closest precedent is probably Anne Boleyn’s trial for adultery in 1536. It was about sex, the trial was in a hostile jurisdiction controlled by her accuser, and the whole point of the exercise was to lop off the head of someone who stood in the way of the regime’s continuity. But that’s what Democrats have lusted for since Donald Trump first arrived on the scene, isn’t it? They made no secret of it.

“..Ciaramella effectively helped cover up a scandal far worse than what Trump was impeached over..”

• Ciaramella in the Loop of Biden-Ukraine Affairs Trump Wanted Probed (Sperry)

The ‘whistleblower’ who sparked Donald Trump’s first impeachment was deeply involved in the political maneuverings behind Biden-family business schemes in Ukraine that Trump wanted probed, newly obtained emails from former Vice President Joe Biden’s office reveal. In 2019, then-National Intelligence Council analyst Eric Ciaramella touched off a political firestorm when he anonymously accused Trump of linking military aid for Ukraine to a demand for an investigation into alleged Biden corruption in that country. But four years earlier, while working as a national security analyst attached to then-Vice President Joe Biden’s office, Ciaramella was a close adviser when Biden threatened to cut off U.S. aid to Ukraine unless it fired its top prosecutor, Viktor Shokin, who was investigating Ukraine-based Burisma Holdings. At the time, the corruption-riddled energy giant was paying Biden’s son Hunter millions of dollars.

Those payments – along with other evidence tying Joe Biden to his family’s business dealings – received little attention in 2019 as Ciaramella accused Trump of a corrupt quid pro quo. Neither did subsequent evidence indicating that Hunter Biden’s associates had identified Shokin as a “key target.” These matters are now part of the House impeachment inquiry into President Biden. “It now seems there was material evidence that would have been used at the impeachment trial [to exonerate Trump],” said George Washington University law professor Jonathan Turley, who has testified as an expert witness in the ongoing Biden impeachment inquiry. “Trump was alleging there was a conflict of interest with the Bidens, and the evidence could have challenged Biden’s account and established his son’s interest in the Shokin firing.” Ciaramella’s role – including high-level discussions with top Biden aides and Ukrainian prosecutors – is only now coming to light thanks to the recent release of White House emails and photos from the National Archives.

The emails show Ciaramella expressed shock – “Yikes” is what he wrote – at Biden’s move to withhold the $1 billion in aid from Kyiv, which represented a sudden shift in U.S. policy. They also show he was drawn into White House communications over how to control adverse publicity from Hunter taking a lucrative seat on Burisma’s board. Yet there is no evidence Ciaramella raised alarms about the questionable Biden business activities he witnessed firsthand, which is in sharp contrast to 2019. In that instance, he was galvanized into action after being told by White House colleague Alexander Vindman of an “improper” phone call between President Trump and Ukrainian President Volodymyr Zelensky. During the call, Trump solicited Zelensky’s help in investigating Burisma and Hunter Biden’s role in the company.

Some former congressional investigators say Ciaramella effectively helped cover up a scandal far worse than what Trump was impeached over. What’s more, he failed to disclose that he had a potential conflict of interest stemming from his connection to the matter Trump asked Zelensky to probe when he lodged his complaint against Trump. RealClearInvestigations was the first to identify the then-33-year-old Ciaramella as the anonymous impeachment “whistleblower,” something major media continue to keep under tight wraps.

X thread. News will keep coming in through the day.

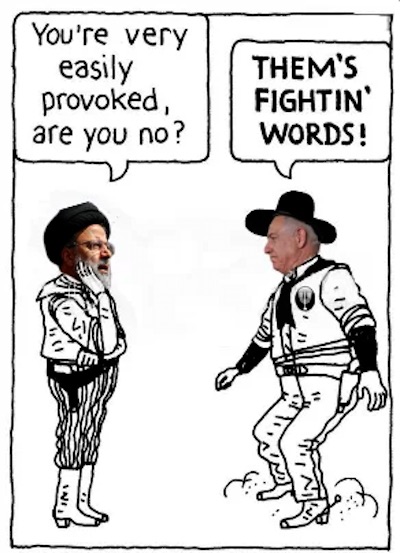

• Israeli Retaliatory Strike On Iran (Scott Ritter)

Reports of an Israeli retaliatory strike on Iran appear to be related to a very limited attack in the vicinity of the Iranian city of Isfahan on military targets not related to Iran’s nuclear program. The weapons used in this strike are unknown at this point, although Iran claims to have shot down at least three drones of an undetermined type. Israel has not taken public credit for the attack. Indeed, the only link to Israel comes from anonymous statements from sources claimed to be US officials.

While Iran has stated it would strike Israel with immediate and decisive force if Israel were to attack, the extremely limited and anonymous nature of this attack may provide Iran with the opportunity to dismiss this attack as nothing of consequence, thereby eliminating the necessity of an Iranian retaliation. The Iranian Foreign Minister had issued a statement about decisive retaliation at the UN which constitutes official declaratory policy on Iranian deterrence policy which may be deemed sufficient for the moment. If the action in Isfahan is the limit of the Israeli action, then this matter may be concluded.

“..there should be no counting by the Israeli and US side on a divine miracle to keep Jerusalem’s lights burning..”

• Which Side God Is On Now (Helmer)

Israel is rattled. It’s now up to Iran, leader of the Arab resistance and warfighting alliance – Hamas, Hezbollah, Ansar Allah (Houthis), and the Syrian and Iraqi groups – to demonstrate that they can stop the genocidal schemes of the Israel Defence Forces (IDF), and the Jewish theocracy it enforces as a state; or failing that, to neutralize Israel’s capacities to fight a war of attrition over everything states must have – electricity, ports, money, firepower, defences. The Arab leadership understood this before the Iranians. In 1983 Saddam Hussein told a meeting of Iraqi Army generals: “Human nature represented by the heart of the families and sisters of the Iraqi martyrs in their own weeping and mourning will always be felt; but the Iraqis are better prepared than ever to deal with it. If it ever happens that the Iraqi people were in a conflict with their Israeli enemy, then the Iraqis would be able to withstand three years of fighting in a war. However, the Israelis cannot withstand one year of fighting in a war.”

Seven years later in 1990, Hussein was talking in Baghdad with Yasser Arafat of the Palestine Liberation Organization: “[Arafat]: [Israel] has 240 nuclear warheads, 12 out of them for each Arab capital…[Hussein]: I say this and I am very calm and wearing a civil suit [everyone laughs]. But I say this so that we can get ready at this level.” Readiness at this level was not achieved by the Iraqis, or by Hussein himself. Hamas has demonstrated since last October that the Israelis are unready. Iran demonstrated this again last weekend, despite what Israel claims to have been a near-perfect interception rate: enough missiles got through to strategic targets to prove that with hypersonic speed, higher yield warheads, and better accuracy, the next round of Iranian missiles will be unstoppable. This prospect is what is rattling the Israelis now. As of today’s broadcast on Gorilla Radio and writing this, it is 3:30 on Thursday morning in Tehran: the Israeli attack which has been telegraphed through the British foreign minister, Baron Cameron, has not yet materialized.

When it happens – if it happens — the evidence to gather, before the scope of the Iranian response can be calculated, includes what types of targets were struck, military or civil; where the attack was launched from; what role US intelligence and military support played in execution of Israel’s operation; and what role Russia is playing in early warning, missile tracking, electronic countermeasures, and defence on the Iranian side. When the Iranian counterattack happens, if it happens, there should be no counting by the Israeli and US side on a divine miracle to keep Jerusalem’s lights burning. The last one of those, according to the religion of the Israeli state (and also of presidential candidate Donald Trump), was the Chanukah one. That was in 164 BC, when the Judaean rebels recaptured the Temple in Jerusalem from the Seleucid Greek army. In trying to relight the menorah they found they had only one container of oil — enough fuel for one candle for one day.

God was asked for resupply, so Prime Minister Netanyahu and General Gallant believe. He then delivered by stretching the one-day fuel stock to last for eight days – enough divine miracle time for the Judaeans to refine a new supply for themselves.

“..special mechanisms have been used over the last few years to shield Israel from US human rights laws.”

• Blinken Shelves Special Request To Probe Israeli War Crimes (Cradle)

US Secretary of State Anthony Blinken has failed to act on a State Department proposal to bar certain Israeli police and army units from receiving US funds over human rights abuses of Palestinians. Blinken has disregarded this despite the growing concern over Israeli army conduct in Gaza, according to current and former State Department officials. A special panel at the State Department made the proposal months ago. Recommendations for action against Israeli units were sent to Blinken in December but have “been sitting in his briefcase since then,” one official told ProPublica on 17 April. The Israeli rights abuses in question mainly took place in the occupied West Bank before Operation Al-Aqsa Flood on 7 October. They include the execution of Palestinians by Israeli border police, as well as torture and rape during interrogation.

“This process is one that demands a careful and full review … and the department undergoes a fact-specific investigation applying the same standards and procedures regardless of the country in question,” ProPublica cites a State Department spokesman as saying. “Blinken’s inaction has undermined Biden’s public criticism [of Israel], sending a message to the Israelis that the administration was not willing to take serious steps,” according to several officials at the department who have worked on Israeli relations. US President Joe Biden has publicly expressed frustration with the unprecedented number of Palestinian civilians killed in the Gaza Strip. However, US funds and arms continue to fuel the Israeli war effort, and no formal effort has been made to investigate the growing number of documented war crimes committed by Israel against Palestinians in the strip. On Tuesday, the Washington Post published an in-depth investigation detailing Israel’s role in the killing of a six-year-old and her family who were trapped in a car in northern Gaza.

State Department spokesman Matthew Miller said Washington will ask Tel Aviv “for further information” on the matter. The US has said it would look into several incidents, including late February’s Flour Massacre against dozens of starving and desperate aid seekers. Yet no US probe has been launched into the matter since an internal Israeli army investigation absolved Israel of blame, and Washington refused to condemn the killings. The Guardian reported in January, citing interviews and State Department documents, that “special mechanisms have been used over the last few years to shield Israel from US human rights laws.” The ProPublica report comes days after dozens of Palestinians detained by Israel in Gaza were released, with many giving testimonies of horrific treatment by Israeli forces, including humiliation and torture.

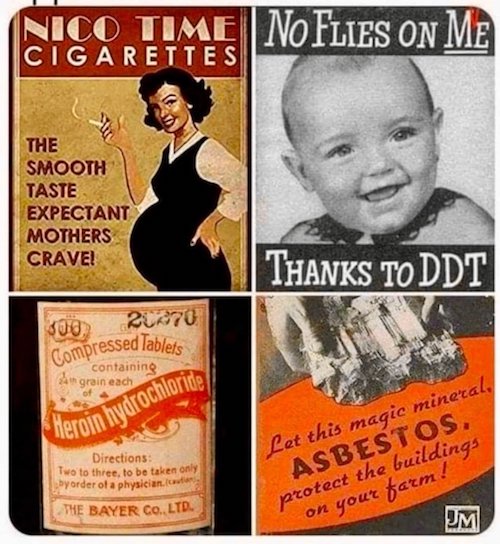

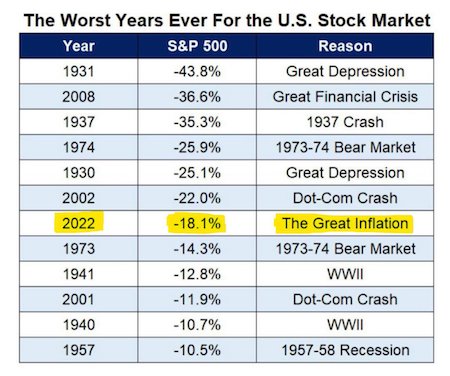

“..many Americans still vote Democrat. When a people vote for their own-self destruction, it is clear that the country is finished..”

• Texas Is Being Turned Into a Woke Democrat State (Paul Craig Roberts)

The Biden Regime is using federal money to bribe the Aggies, Texas A&M University, to come up with ways to advance “race-based hiring” in public schools. Possible you remember or have heard that Martin Luther King and the civil rights movement was about judging “people by their character and not the color of their skin.” Once perhaps, but it has been a long time since. For half a century skin color has had preference, if it is non-white, in university admissions, employment and promotion. Feminists latched onto the scheme and the female gender was also privileged. This is not to say that no blacks and no females are qualified for their position. Many of them are. It is to say that they are in their position despite their qualifications because they constitute a privileged category before the law, a total violation of the US Constitution and its 14th Amendment.

The emphasis on “diversity” has prevailed over the merit-based system into which I was born and grew up. Today merit is considered racist, a white supremacy tool. Many gifted student programs and high schools for the exceptional have been shut down because two few blacks are qualified, and small presence of blacks violates the sacredness of “diversity” and “equity.” A country whose education, employment and promotion is based on diversity and not on merit is a country that is failing, and most certainly America has long been a failing country. For example, we now have “diversity” appointments to prosecutorial offices such as prosecutors and attorney generals and as judges who have no understanding of law as a shield of the people, but who see it is a weapon to be used against disapproved parties. We see the total collapse of justice in America in the many examples of the Democrats’ Stalin show trials against President Trump and against the alleged “insurrectionists” who attended the Trump rally..

To the few remaining people of my generation it is astonishing that merit, which made America great and a ladder of upward mobility, has been officially cast aside for “diversity” in which advance is based on skin color, gender or self-proclaimed, non-biological gender. Have the people who have created this deplorable situation ever wondered how a non-merit based mediocre society can be a superpower, an unipolar, a hegemony whose exceptional and indispensable existence gives it right to hegemony over the world? China, the host of most of American manufacturing must wonder at the American Delusion. Russia, whose power and economy have been greatly elevated by the mindless American sanctions, must wonder if the USA even qualifies as an opponent. Even Iran no longer fears the US. If you are so unfortunate as to live in New York City or other blue cities, your home and your rental properties can be stolen from you by the Democrats’ massive and ongoing wave of immigrant-invaders who can occupy your property in your absence and occupy your rental property between leases and you cannot evict them.

Regardless of the reality in which they live, many Americans still vote Democrat. When a people vote for their own-self destruction, it is clear that the country is finished.

“..it is first, last and only about a Cabinet official’s deliberate refusal to enforce laws as written..”

• On The Mayorkas Impeachment (Denninger)

The Senate appears to have a rather odd view of the Executive — then again so does the House, and both are not only toxic they’re demonstrably false. Mayorkas is the first Cabinet secretary to be impeached in almost 150 years. House Republicans voted to impeach Mayorkas in February over his handling of the southern border by a narrow margin after failing to do so on their first try. Democrats have slammed the impeachment as a political stunt, saying that Republicans had no valid basis for the move and that policy disagreements are not a justification for the rarely used constitutional impeachment of a Cabinet official. The impeachment of Mayorkas has nothing to do with “policy disagreements”; it is first, last and only about a Cabinet official’s deliberate refusal to enforce laws as written, including 8 USC §1324.

That statute mandates felony criminal penalties carrying prison sentences for anyone who assists, harbors or transports illegal immigrants. Other sections of US law forbid the Federal Government and its agencies from “paroling” into the United States an illegal immigrant unless that have a facially-reasonable claim to asylum. There is no capacity in the law to permit DHS to do so simply because there are a lot of people illegally crossing. Policy is defined by legislation and thus has to pass both House and Senate and either be signed by the President or a veto must be overridden. It is absolutely true that different Administrations will have different policies but the Constitution is clear and each person in all three branches of Government takes an oath to uphold and enforce all of the laws and thus the means to express policy isn’t to ignore laws you don’t like but rather to work to change them through the legislative process.

If you can’t find agreement via that process then until you can the existing policy stands whether you agree with it or not and if you take an oath to enforce the law as written and you refuse to do so on a deliberate basis impeachment is the peaceful and appropriate action to remove you from said office. Neither the House or Senate acting alone can change policy, no matter which party controls said chamber. Only both, acting in concert, can do so. This is intentional in the design of our Republic; policy changes of significant importance to society are described in our laws, and it is both wildly unreasonable and destructive to civil order to change them on a whim when one person wins or loses an office, no matter the office.

The Senate’s Schumer led his caucus to toss the entire thing as “unconstitutional” on a part-line vote. Big shock, right? When you boil it down essentially everything wrong with this nation comes down to this same issue: Various politicians and paid employees of the government simply ignore any law they disagree with either in its entirety or as applies to some favored group while using it as a cudgel against anyone they dislike. Our national foundation rests on that never being tolerated by anyone, anywhere and for any reason.

I fully understand that these policy matters have serious and vehemently-expressed opinions on all sides. That’s a good thing: Freedom of expression is in fact also a foundation of America. But no public official is empowered to take that disagreement and turn it into a malicious abuse of existing law whether by intentional omission or weaponization against disfavored persons or those who hold a different point of view. Down that road lies a line that cannot be foreseen in advance in that the people may, at some point, determine that the strictures of polite society no longer apply to them by that very example set by our officials. You do not want this; it is precisely through that road that essentially every civil conflict and social destruction has occurred and if you believe you’ll be immune to it if it happens, no matter how wealthy or poor you might be, you’re wrong.

“..lawyers for Lloyd’s and Arch suggest that even if they were required to pay up, anti-Russian sanctions would leave their hands tied..”

• UK Insurers Won’t Pay Nord Stream Because Blasts Were ‘Government’ Backed (GZ)

The legal team representing high-powered insurers Lloyd’s and Arch says that since the Nord Stream explosions were “more likely than not to have been inflicted by… a government,” they have no responsibility to pay for damages to the pipelines. To succeed with that defense, the companies will presumably be compelled to prove, in court, who carried out those attacks. ritish insurers are arguing that they have no obligation to honor their coverage of the Nord Stream pipelines, which were blown up in September 2022, because the unprecedented act of industrial sabotage was likely carried out by a national government. The insurers’ filing contradicts reports the Washington Post and other legacy media publications asserting that a private Ukrainian team was responsible for the massive act of industrial sabotage.

A legal brief filed on behalf of UK-based firms Lloyd’s Insurance Company and Arch Insurance states that the “defendants will rely on, inter alia, the fact that the explosion Damage could only have (or, at least, was more likely than not to have) been inflicted by or under the order of a government.” As a result, they argue, “the Explosion Damage was “directly or indirectly occasioned by, happening through, or in consequence of” the conflict between Russia and Ukraine” and falls under an exclusion relating to military conflicts. The brief comes a month after Switzerland-based Nord Stream AG filed a lawsuit against the insurers for their refusal to compensate the company. Nord Stream, which estimated the cost incurred by the attack at between €1.2 billion and €1.35 billion, is seeking to recoup over €400 million in damages. Swedish engineer Erik Andersson, who led the first private investigative expedition to the blast sites of the Nord Stream pipelines, describes the insurers’ legal strategy as a desperate attempt to find an excuse to avoid honoring their indemnity obligations.

“If it’s an act of war and ordered by a government, that’s the only way they can escape their responsibility to pay,” Andersson told The Grayzone. Following a report by Pulitzer Prize-winning journalist Seymour Hersh which alleged that the US government was responsible for the Nord Stream explosion, Western governments quickly spun out a narrative placing blame on a team of rogue Ukrainian operatives. Given the lack of conclusive evidence, however, proving that the explosions were “inflicted by or under the order of a government” would be a major challenge for defense lawyers. Even if the plaintiffs in the case are able to wrest back the funds in court, they are likely to face other serious hurdles. Later in the brief, lawyers for Lloyd’s and Arch suggest that even if they were required to pay up, anti-Russian sanctions would leave their hands tied.

“In the event that the Defendants are found to be liable to pay an indemnity and/or damages to the Claimant,” the brief states, “the Defendants reserve their position as to whether any such payment would be prohibited by any applicable economic sanctions that may be in force at the time any such payment is required to be made.” After they were threatened with sanctions by the US government, in 2021 Lloyd’s and Arch both withdrew from their agreement to cover damages to the second of the pipelines, Nord Stream 2. But though they remain on the hook for damages to the first line, the language used by the insurers’ lawyers seems to be alluding to a possible future sanctions package that would release them from their financial obligations. “Nord Stream 1 was not affected by those sanctions, but apparently sanctions might work retroactively to the benefit of insurers,” observes Andersson.

The plaintiffs may face an uphill battle at the British High Court in London, the city where Lloyd’s has been headquartered since its creation in 1689. As former State Department cybersecurity official Mike Benz observed, “Lloyd’s of London is the prize of the London banking establishment,” and “London is the driving force behind the transatlantic side of the Blob’s “Seize Eurasia” designs on Russia.”

“..hardline Republicans may force a vote on the motion to vacate shortly before the aid bills for Ukraine, Israel and Taiwan hit the House floor..”

• Aid to Ukraine May Deep-Six Another House Speaker (Sp.)

Despite his repeated pledges to bring foreign aid bills to the House floor only when a solution to the border crisis is found, Speaker Johnson unveiled three separate funding packages, namely $26 billion for Israel, $61 billion for Ukraine, and $8 billion for Taiwan and allies in Indo-Pacific, at the time when the US southern frontier still remains wide open. “Republican speaker Mike Johnson went into that secured room with a bunch of guys in gray suits from the deep state, and he came out of that room after the meeting as Uniparty speaker Mike Johnson and no longer a Republican,” Michael Shannon, a political commentator and Newsmax columnist, told Sputnik. “That’s the only explanation for it that makes sense, because he’s completely turned around, and now he’s on the Washington agenda of the Uniparty and no longer listens to or tries to do what the base wants,” the commentator continued. “That’s what’s happening here. Once they get into a position of leadership, they abandon the base,” he maintained.

Shannon explained that Ukraine is obviously not on the GOP’s base priority list right now, given that Republican voters are much more concerned about the influx of illegals into the US, inflation, and budget deficit spending. A recent YouGov survey indicated that 61% of Republicans don’t approve of sending more weapons and other military assistance to Ukraine. Among them, 69% of self-identified MAGA Republicans and 55% of non-MAGA Republicans said they don’t want to send more military aid to the Kiev regime. A group of House conservatives confronted Mike Johnson on Thursday, namely, Marjorie Taylor Greene (R-Ga.), Matt Gaetz (R-Fla.), and Thomas Massie (R-Ky.) advocating the motion to vacate in order to sack the incumbent speaker in the same way they ousted his predecessor, Kevin McCarthy. Massie told journalists that there would be more Republican votes to remove Speaker Johnson than there were to boot out McCarthy last October.

“If I had my wish, MTG’s motion to vacate the speakership, which I believe Representative Chip Roy from Texas also supports, would be successful, and the speaker’s chair would be vacated, and it would stay vacated until after the election,” said Shannon. “It’s obvious we can’t pass any conservative legislation with this House and this Senate. So not passing any bad legislation as far as I’m concerned, and as Daniel Horowitz of the Conservative Review mentioned, is probably the most viable alternative. That being said, I don’t know if MTG has the votes to vacate the speakership. I think we’ll just have to see how that develops.” According to Axios, hardline Republicans may force a vote on the motion to vacate shortly before the aid bills for Ukraine, Israel and Taiwan hit the House floor.

Some Democrats, who hailed Johnson’s maneuver regarding the Ukraine aid bill, said they would help the speaker save his job. For his part, Johnson said he would not resign and branded the effort to oust him as “absurd”. However, the timing is crucial, a senior House Democrat said, as quoted by the media outlet: the Dems are much more likely to “save” Johnson after the aid bills are passed, not before that. Massie warned Johnson against relying on Democrats, stressing that the speaker would become “toxic to the conference.” “For every Democrat who comes to his aid, he’ll lose 2-3 more Republicans,” the congressman said, as quoted by NBC News’ Sahil Kapur.

Massie

GOP Gives up on Johnson: @RepThomasMassie says Mike Johnson has betrayed the Republican conference on 2 big occasions and he is about to do it a third time. Massie has called on Johnson to resign as John Boehner did and allow the GOP to elect a new speaker. #TheGreatAmericaShow pic.twitter.com/Xz2RY2kJAG

— Lou Dobbs (@LouDobbs) April 18, 2024

Petulant child.

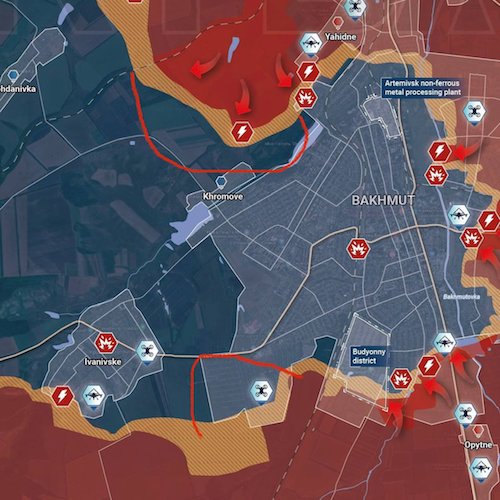

• Zelensky Blames EU For Russian Advance (RT)

A shortage of Western arms supplies and unkept promises by EU members have allowed Russia to advance on the battlefield, Ukrainian President Vladimir Zelensky told senior European officials on Wednesday. Zelensky made the claims during a video conference address to national leaders and senior members of the EU bureaucracy, who have convened for a two-day summit in Brussels. The Ukrainian leader reiterated that his country needs more Western material and financial assistance to continue its armed conflict with Russia. “Now the Russian army feels its strength in almost everything related to the armed component. And it is precisely because of this strength – in artillery, in equipment, in the ability to operate in the sky – that they are putting pressure on us at the front and are gradually moving,” he said.

Although he thanked Kiev’s donors for their aid, Zelensky also complained of unfulfilled promises. “Unfortunately, we have not yet seen a million artillery shells from the European Union that were discussed so much. Also, some other initiatives have not yet been fully implemented, and this is primarily reflected in what our soldiers can use at the front,” he stated. Russian President Vladimir Putin believes “he will succeed in his counteroffensive,” Zelensky claimed, adding that “the only root of this hope is the shortage of weapons among our soldiers.” In addition to offensive systems, Kiev wants more Western air defenses to protect its industrial base, as well as investment and technology to launch domestic arms production. It also requires electricity to compensate for the destruction of power facilities destroyed by Russian precision strikes, and according to Zelensky needs “energy of spirit” in the form of accelerated accession to the EU.

“We need the European Union to deliver what it had promised, and our people need to see Ukraine moving closer to full membership,” Zelensky insisted, urging Brussels to progress to the next phase of talks in June. Analysis published by Politico on Wednesday cited the refusal of Ukrainians to enroll into the military as a major problem for Kiev. EU statistics body Eurostat estimates the number of fighting age Ukrainian men living in member states at some 650,000. Most of them arranged to be smuggled across the border, the outlet said. This week, Zelensky signed into law a bill that makes it easier for conscription officials to issue summonses and imposes harsh punishments for avoiding the draft.

“..breaking the international order that you want to protect; that you would want Russia to respect..”

• ECB Fires Back At Plans To Seize Russian Assets (RT)

US-backed proposals to seize frozen Russian assets could undermine the international order, European Central Bank (ECB) President Christine Lagarde has cautioned. Her comments came during a meeting in Washington on Wednesday, where the G7 finance ministers and central bank governors were discussing the issue of using the immobilized assets of the Russian central bank to support Ukraine. In a joint statement, the finance ministers and regulators said they would continue working on “all possible avenues” to make use of Russian sovereign assets, according to Reuters. The push to seize Moscow’s money has been led by the US and has caused a rift among the G7 and the EU political elite. Washington and its allies have blocked some $300 billion of Russian central bank assets due to sanctions adopted in response to the launch of Moscow’s special military operation against Kiev in February 2022.

Around $200 billion of that money is held in the EU. The US has been insisting for months that international law allows for the confiscation of the funds, but Germany and France have expressed concerns that such a move could set a dangerous precedent. ”I have seen four different schemes or proposals to circumvent what many other jurists or lawyers… regard as a very serious legal obstacle that can be construed as a violation of the legal international order,” Lagarde, a former lawyer, said, as quoted by the Financial Times. Moving from freezing the assets to confiscating them could entail “breaking the international order that you want to protect; that you would want Russia to respect,” she added. During the meeting in Washington, a senior US Treasury official outlined the options the finance ministers were “doing technical work” on.

”One of them is seizure, but another is collateralizing, or even using the windfall profits or the interest from these assets to fund a loan,” Deputy US Treasury Secretary Wally Adeyemo said, as quoted by Reuters. The outlet reported earlier that the US and its allies were considering using the interest due on the frozen Russian assets as collateral for loans or bonds issued to help Ukraine. Moscow has repeatedly said that the seizure of its funds would amount to theft and would further undermine global trust in the Western financial system. Russia has also warned that if necessary, it might respond in kind to such a move by the US and its allies.

The mess gets bigger by the day. We need Liz Cheney under oath.

• Top Military Official Lied About Jan. 6: Whistleblowers (ET)

The secretary of the Army on Jan. 6, 2021, lied about multiple details regarding what unfolded as the U.S. Capitol was breached, National Guard whistleblowers said during a congressional hearing on April 17. Then-Army Secretary Ryan McCarthy made multiple false claims, including that he spoke to the commanding general of the District of Columbia National Guard on two separate occasions after officials requested that the Guard be deployed to the Capitol, the whistleblowers said. After Maj. Gen. William Walker conveyed a request from the U.S. Capitol Police for Guard personnel, Mr. McCarthy called Maj. Gen. Walker at 2:14 p.m. and instructed the Guard to stand by, according to a Guard timeline of Jan. 6, 2021. But that call and others that Mr. McCarthy or one of his top advisers were said to have made later authorizing the Guard for mobilization and deployment did not happen, according to the Guard officials.

“At no time did Gen. Walker take any calls, nor did we ever hear from the secretary on any of the ongoing conference calls or the secure video teleconferencing throughout the day,” Capt. Timothy Nick, who served as Maj. Gen. Walker’s personal assistant on Jan. 6, 2021, said during the hearing. “This I know because I was with the command general the entire time recording the events.” Capt. Nick has not previously discussed publicly what transpired on Jan. 6, 2021, and neither has Brig. Gen. Aaron Dean, who was the National Guard’s adjutant general on the day that the Capitol was breached. The Department of Defense (DOD) inspector general report on Jan. 6, 2021, which relied heavily on Mr. McCarthy and other military officials, was rife with “inaccuracies,” Brig. Gen. Dean said. “I believe it is my duty and moral obligation to stand before you today and illuminate the truth,” he told the hearing, which was held by the House Administration Committee’s Subcommittee on Oversight.

Despite Mr. Walker conveying the request for assistance at about 1:50 p.m., the Guard was not deployed to the Capitol until about 5:10 p.m. “This was a dereliction of duty by the secretary of the Army,” Rep. Greg Murphy (R-N.C.), one of the members of the committee, said. Mr. McCarthy refused to appear before the panel, Dr. Murphy said. Christopher Miller, the acting secretary of defense at the time, authorized Guard deployment at 3:11 p.m., but Mr. McCarthy took the order and decided to draw up a plan before ordering the deployment, according to military timelines and testimony from Mr. McCarthy and others. “You never would employ our personnel, whether it’s on an American street or a foreign street, without putting together a [plan],” Mr. McCarthy told the now-disbanded House Jan. 6 committee.

The whistleblowers also testified that Army officials Lt. Gen. Walter Piatt and Gen. Charles Flynn, during a 2:30 p.m. conference call on Jan. 6, 2021, expressed concern about the optics of having the Guard at the Capitol. “I did hear the word optics. And they did use it. Specifically, Gen. Piatt said ‘optics.’ And his concern was that he did not want soldiers or airmen on Capitol grounds, with the Capitol in the background,” Brig. Gen. Dean said. “They were giving every other reason why we should be around the Capitol, away from the Capitol, and not responding to the Capitol.”

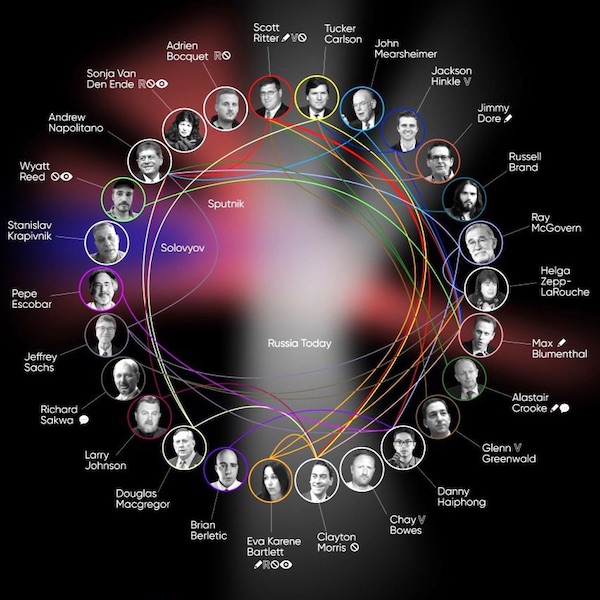

“..von der Leyen has conceded that there is no proof of a Russian bribery network. “They have carried [Putin’s] propaganda into our societies,” she said. “Whether they have taken bribes for it or not.”

• Desperation Behind European Politicians’ Latest Russiagate Hoax (Public)

European politicians claimed late last month that Russia bribed European politicians to spread disinformation and interfere in the upcoming June elections. “Russian influence scandal rocks EU,” screamed a March 30 Politico headline. Russia “is using dodgy outlets pretending to be media [and] using money to buy covert influence,” claimed European Commission Vice President Vera Jourova. The BBC agreed: “Russian network that ‘paid European politicians’ busted, authorities claim.” Heads of state hyped the alleged scandal. “We uncovered a pro-Russian network,” claimed Petr Fiala, the Prime Minister of the Czech Republic, “that was developing an operation to spread Russian influence and undermine security across Europe.” Poland’s intelligence agency said it had conducted searches in the Warsaw and Tychy regions and seized €48,500 (£41,500) and $36,000 (£28,500).

However, following an investigation by Public, the head of the Czech Intelligence Agency (BIS), Michal Koudelka on Monday admitted that his agency has no information about any bribery scheme. “I cannot confirm anything,” he said. It’s true that Russia’s media influence in Europe intensified considerably during the Covid-19 pandemic. At that time, a number of marginalized voices found space on the German broadcasts of the Kremlin’s propaganda television, Russia Today, which the president of the European Commission, Ursula von der Leyen, promptly shut down in 2022. But von der Leyen has conceded that there is no proof of a Russian bribery network. “They have carried [Putin’s] propaganda into our societies,” she said. “Whether they have taken bribes for it or not.” Public asked von der Leyen what evidence she has for her allegations. What was the misconduct or illegal activity if there were no bribes? Von der Leyen did not respond to Public’s requests for comment.

“..one of the things that the British courts don’t understand is the U.S. doctrine of separation of powers..”

• US Issues Assurances on Assange (Lauria)

The United States Embassy on Tuesday filed two assurances with the British Foreign Office saying it would not seek the death penalty against imprisoned WikiLeaks‘ publisher Julian Assange and would allow Assange “the ability to raise and seek to reply upon at trial … the rights and protections given under the First Amendment,” according to the U.S. diplomatic note. Assange’s wife Stella Assange said the note “makes no undertaking to withdraw the prosecution’s previous assertion that Julian has no First Amendment rights because he is not a U.S citizen. Instead,” she said, “the US has limited itself to blatant weasel words claiming that Julian can ‘seek to raise’ the First Amendment if extradited.” The note contains a hollow statement, namely, that Assange can try to raise the First Amendment at trial (and at sentencing), but the U.S. Department of Justice can’t guarantee he would get those rights, which is precisely what it must do under British extradition law based on the European Convention on Human Rights.

The U.S. Department of Justice is legally restricted to assure a free speech guarantee to Assange equivalent to Article 10 of the European Convention, which the British court is bound to follow. But without that assurance, Assange should be freed according to a British Crown Prosecution Service comment on extraditions. In USAID v. Alliance for Open Society, the U.S. Supreme Court ruled in 2020 that non-U.S. citizens outside the U.S. don’t possess constitutional rights. Both former C.I.A. Director Mike Pompeo and Gordon Kromberg, Assange’s U.S. prosecutor, have said Assange does not have First Amendment protection. Because of the separation of powers in the United States, the executive branch’s Justice Department can’t guarantee to the British courts what the U.S. judicial branch decides about the rights of a non-U.S. citizen in court, said Marjorie Cohn, law professor and former president of the National Lawyers’ Guild.

“Let’s assume that … the Biden administration, does give assurances that he would be able to raise the First Amendment and that the [High] Court found that those were significant assurances,” Cohn told Consortium News‘ webcast CN Live! last month. “That really doesn’t mean anything, because one of the things that the British courts don’t understand is the U.S. doctrine of separation of powers,” she said. “The prosecutors can give all the assurances they want, but the judiciary, another [one] .. of these three branches of government in the U.S., doesn’t have to abide by the executive branch claim or assurance,” Cohn said. In other words, whether Assange can rely on the First Amendment in his defense in a U.S. court is up to that court not Kromberg or the Department of Justice, which issued the assurance on Tuesday. “The United States has issued a non-assurance in relation to the First Amendment,” said Stella Assange.

Japan

https://twitter.com/i/status/1781068681931293121

Huajiang

https://twitter.com/i/status/1780929621610955001

Emperors

How Roman emperors would’ve looked like in real life.

According to Netflix, they must look different. pic.twitter.com/bB63dC9hOm

— iamyesyouareno (@iamyesyouareno) April 18, 2024

Family

https://twitter.com/i/status/1780913695993852363

Parrots

Group of parrots in a palm tree. pic.twitter.com/mB00qMUuUw

— Nature is Amazing ☘️ (@AMAZlNGNATURE) April 18, 2024

Hedgehogs

Baby hedgehogs look pretty much different from the grown up ones.

They are born a pale pink colour, and over the first few weeks of life, fur grows, and the skin gradually darkens as the brown spines come through.pic.twitter.com/irEuwwIVI6

— Massimo (@Rainmaker1973) April 18, 2024

Tiger

https://twitter.com/i/status/1780890045454471561

Bald Eagle Walking

Bald Eagle Walking pic.twitter.com/wn9qTcwqEA

— Nature is Amazing ☘️ (@AMAZlNGNATURE) April 18, 2024

Support the Automatic Earth in wartime with Paypal, Bitcoin and Patreon.