Vincent van Gogh The good Samaritan (after Delacroix) 1890

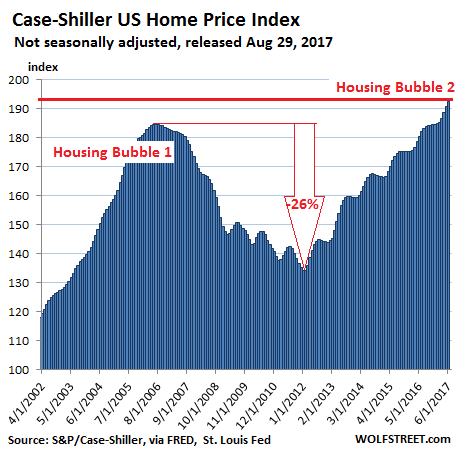

Shifting priorities. Homes are no longer places to live.

• UK House Prices Have Soared 100-Fold Since 1966 (CityAM)

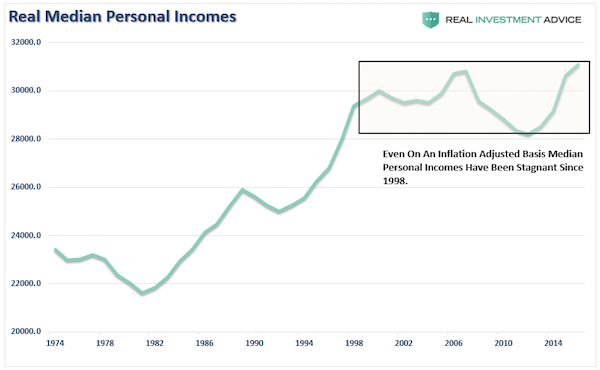

UK house prices are 106 times higher than they were when England won the World Cup in 1966, according to research from online mortgage broker Trussle. Average house prices have gone up from £2,006 to £211,000, the company found, while wages have risen at around a third of the rate, moving from £798 to £26,500. But for the country’s footballers, the story is somewhat different. On average Premier League footballers earn 1,136 times more than top-flight stars like Bobby Moore and George Best did back in 1966. It’s estimated that the average wage of the current England squad is just below £80,000 per week – more than 3 times the annual UK average wage.

Ishaan Malhi, CEO and founder of Trussle, said: “A lot of has changed since England won the World Cup. We’ve put a man on the moon, invented the internet and we’ve seen technology transform almost every aspect of our lives. “We’ve also seen the UK housing market change dramatically. Prices have soared in the last 52 years, wages have struggled to keep pace and for young people, the chances of getting on the property ladder today will feel a lot slimmer than they did in 1966.” The research from Trussle comes as analysis from trade union GMB published yesterday showed that rents in London are far outpacing wage growth. Analysing data from the Valuation Office Agency, GMB found that between 2011 and 2017, rent prices for two-bedroom flats in London increased by 25.9%, whilst over the same period, monthly earnings increased by just 9.1%.

European ties to Russia are old and deep.

• No Need To Buy US Gas At Triple The Price, Will Buy From Russia – Austria (RT)

The US is force-feeding Europe its liquefied natural gas, which is three times more expensive that buying it from Russia, Austrian President Alexander Van der Bellen said after signing a gas-supply contract with Moscow until 2040. While US politicians are accusing Europe of being dependent on Russian gas, they forget that “American liquefied gas is two or three times more expensive than Russian gas. Under such circumstances, it makes little sense in purely economic terms to replace Russian gas with American LNG,” Van der Bellen said at a press conference after meeting Russian President Vladimir Putin in Vienna on Tuesday.

Putin noted that Austria is a major transportation hub for Russian gas being exported to Europe. “Austria has become one of the key, if not to say, one of the most important units of Russian gas transportation to Western Europe and plays an important role in ensuring the energy security of the entire European continent,” Putin said. He recalled that Russia has exported more than 200 billion cubic meters of natural gas to Austria in the past 50 years. After the meeting, Russia’s Gazprom and Austria’s OMV signed a gas supply contract until 2040.

Trade deals can be bitches.

• European Businesses Advised To Avoid Using British Parts Ahead Of Brexit (Sky)

European governments are advising businesses not to use British parts in goods for export ahead of Brexit, Sky News has established. In its advice rolled out to all Dutch businesses, the Dutch government has told its exporters that “if a large part of your product consists of parts from the UK” domestic exporters may lose free trade access under existing deals. The advice says: “Brexit will have consequences for exports outside the EU. “After Brexit, parts made in the UK no longer count towards this minimum production in the European Union.” This is a reference to what are known as “rules of origin” and “local content” under international trade rules. In order to qualify for EU free trade deals, a certain proportion, typically 55% of a product’s parts, needs to come from the EU.

The Dutch government says UK parts “no longer count towards EU origin” in its official “Brexit impact scan” advice to Dutch businesses. That warning has also been underpinned by the EU’s own technical notice on this issue. “As of withdrawal date, the UK becomes a third country. UK inputs are considered ‘non-originating’,” it says. A leading car industry executive told Sky News that not using UK parts for EU exports would be a “catastrophe” for the British industry. “The hard Brexiteers have built a bomb under the UK automotive industry and the EU have lit it,” said one chief executive. Sky News has also heard of major UK automotive suppliers now ceasing UK supply of major components to cars for export to countries currently covered by EU Free Trade Areas – countries such as South Korea, South Africa and Canada.

A new day.

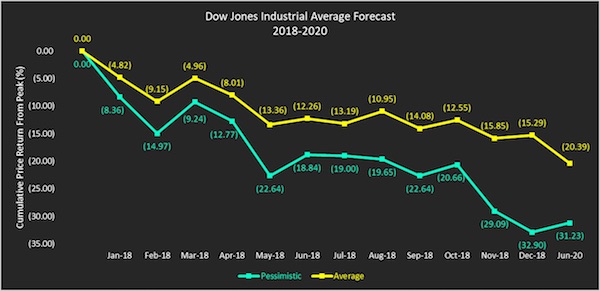

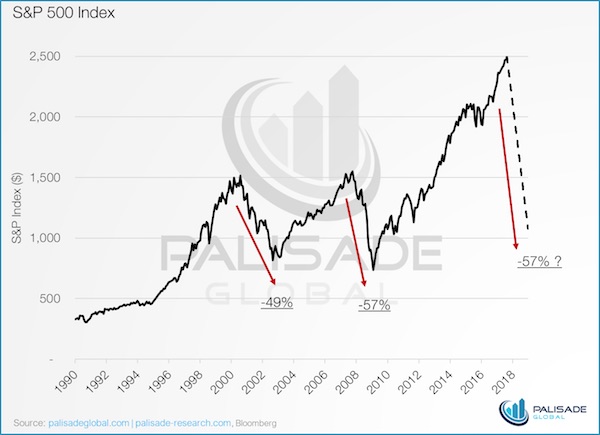

• Volatility May Hit Wall Street As Alphabet, Facebook Leave Tech Sector (R.)

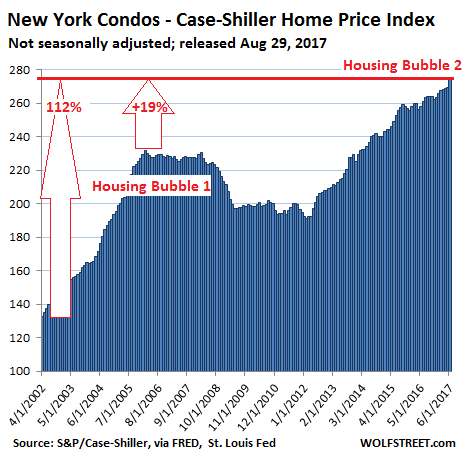

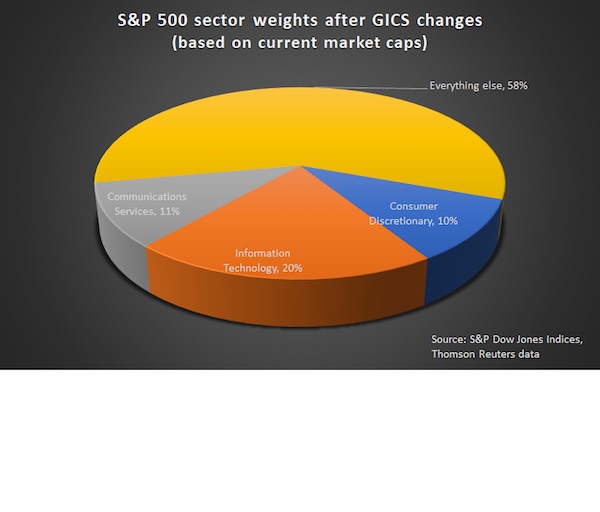

Volatility could well be in the cards for Wall Street again early this fall, but not for the same reason stocks got rattled in February. This time the culprit would be the largest-ever shakeup of the stock market’s broad business sectors, which will mean some of the hottest stocks, like Facebook and Google parent Alphabet, will shift from their traditional homes in the top-performing technology sector and into a deepened pool of telecommunications and media stocks. The sweeping reorganization of the Global Industry Classification Standard, or GICS, means that funds tracking the telecom, tech and consumer discretionary sectors will be forced to trade billions of dollars of stock to realign their holdings by a Sept. 28 effective date.

While the choppiness many investors expect to see is unlikely to hit stocks in quite the same way that wave of the global uncertainty did in early 2018, the fact that so much money must be shifted among index funds in a short time will cause a stir. In a bid to ensure a smooth transition, leading fund provider Vanguard Group has have already started adjusting its sector exchange-traded funds, or ETFs, while State Street Global Advisors is launching an entirely new fund. Other investors predict price swings and commotion on trading desks if last-minute sales of Alphabet and Facebook shares by heavyweight technology index funds dwarf demand from a handful of telecom funds buying those stocks.

“There’s probably going to be net selling,” said Andrew Bodner, president of Double Diamond Investment Group in Parsippany, New Jersey. “That will be a temporary scenario, and it could be a good buying opportunity for a lot of those stocks.” Maintained by S&P Dow Jones Indices and MSCI since 1999 and widely used by portfolio managers, the GICS classifies companies across 11 sectors. The newest, real estate, was split off from financials in 2016. The upcoming changes, which have yet to be finalized, are meant to reflect evolving industries. Facebook and Alphabet will move from information technology and sit alongside AT&T Inc and Verizon Communications in a broadened telecommunication services sector that will be renamed communications services.

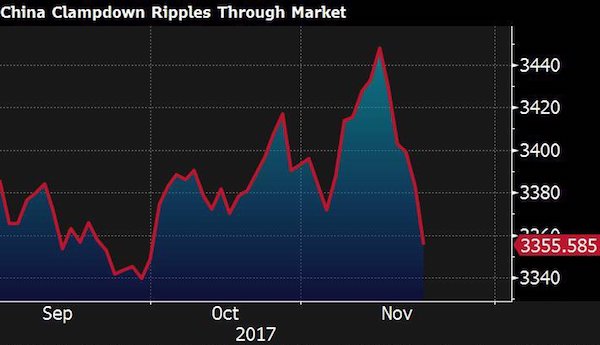

Who’s the boss in China? Xi or the shadows?

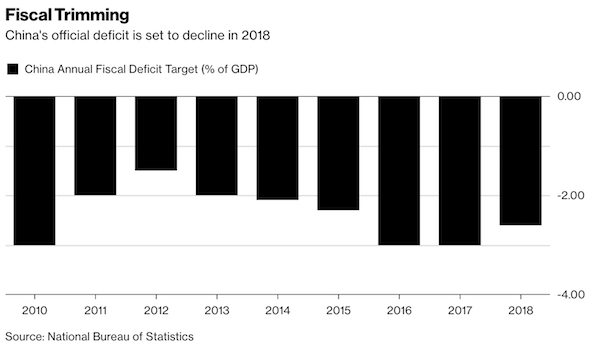

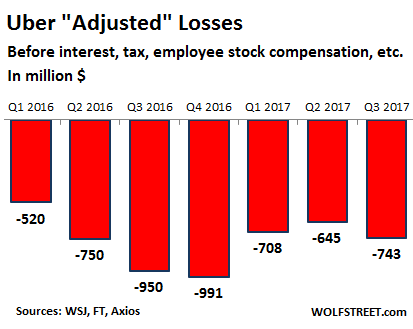

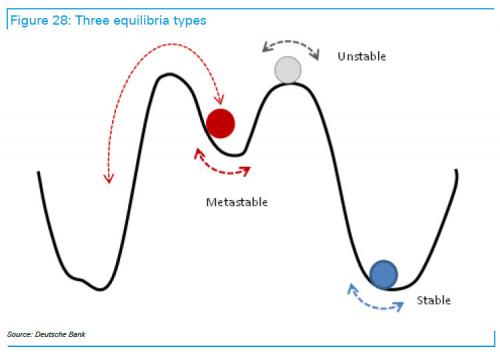

• China’s Debt Default Avalanche (ZH)

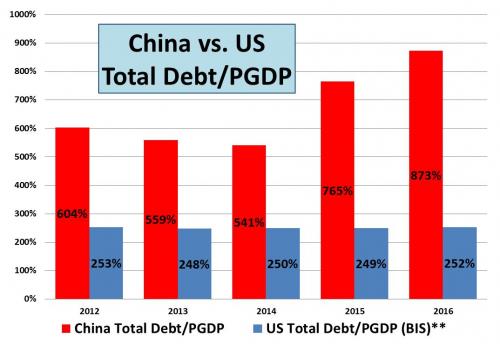

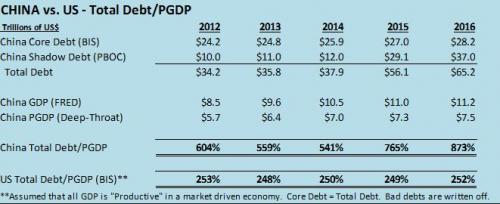

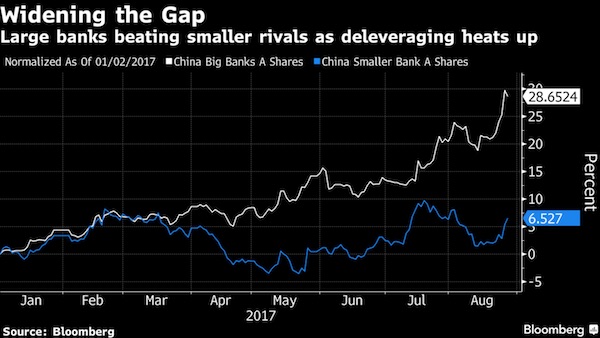

[..] what if the first domino to fall in the coming corporate debt crisis is not in the US, but in China? After all, as part of China’s aggressive deleveraging campaign, there has already been a spike of corporate bankruptcies as banks shed more of their massive note holdings and de-risk their balance sheets. According to Logan Wright, Hong Kong-based director at research firm Rhodium, there have already been least 14 corporate bond defaults in China in 2018; a separate analysis by Economic Information Daily, as of May 25, there had already been no less than 20 corporate defaults, involving more than 17 billion yuan, a shockingly high number for a country which until recently had never seen a single corporate bankruptcy, and a number which is set to increase as Chinese banks pull pull back from lending to other firms that use the funds to buy bonds, exacerbating the pressure on the market.

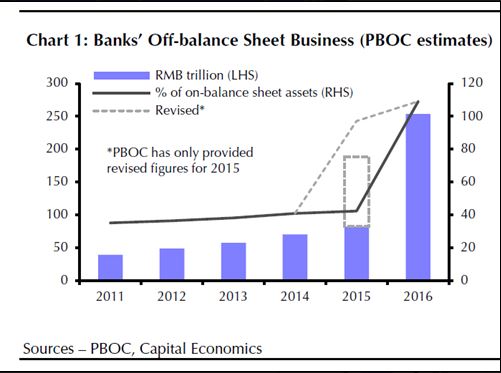

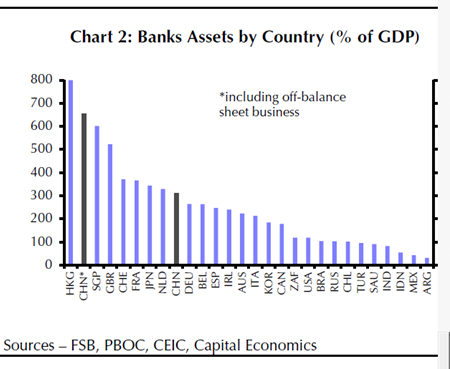

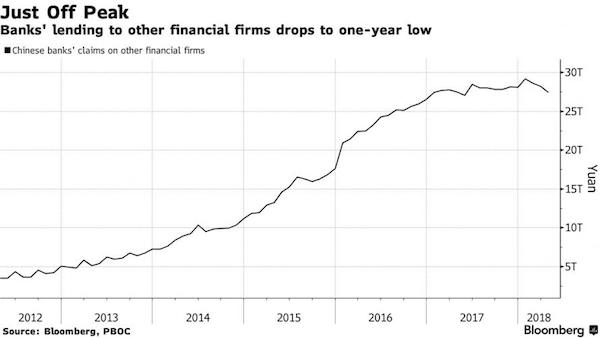

“You have seen banks redeeming funds placed with non-bank financial institutions that have reduced the pool of funds available for corporate bond investment overall,” Wright told Bloomberg, adding that additional bond defaults are especially likely among those property developers and local-government financing vehicles which have relied on shadow banking sources of funds. As we discussed last year, as part of Beijing’s crackdown on China’s $10 trillion shadow banking sector, strains have spread from high-yield trust products to corporate bonds as the lack of shadow funding has choked off refinancing for weaker borrowers. Separately, Banks’ lending to other financial firms, a common route for funds and securities brokers to add leverage for corporate bond investments, declined for three straight months, or a total of 1.7 trillion yuan ($265 billion), since January according to Bloomberg calculations.

The deleveraging campaign is also depressing bond demand: “Unlike the U.S., where the majority of buyers of bonds are mutual funds, individuals and investment companies, in China, the key holders of bonds are bank on-and off-balance sheet positions,” said Jason Bedford at UBS, who noted that Chinese banks are buying far fewer bonds as a result. Putting the number in context, according to Bloomberg, China’s four largest banks held about 4.1 trillion yuan in bonds issued by companies and other financial institutions at the end of 2017, nearly 20% below 5.1 trillion yuan a year earlier; all Chinese banks held about 12 trillion yuan of corporate bonds on or off their balances sheets, some 70% of outstanding issuance, according to Citic.

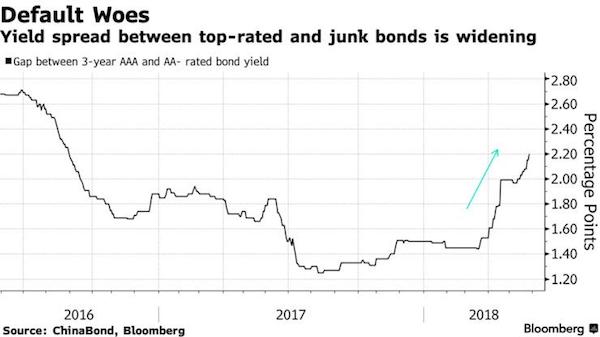

It is therefore hardly surprising to see that Chinese corporate bonds, especially riskier issues, have been getting slammed in recent weeks. According to Chinabond data, as noted first by Bloomberg, the yield premium of three-year AA- rated bonds over similar-maturity AAA notes has blown out 72 bps since March to 225 basis points, the highest level since August 2016, an indication of the recent pressures on weaker firms. One can imagine what is going on with deep junk-rated corps.

Under heavy police protection in Greece. Because the Turks may come and get them. Elections June 24.

• Turkey Escalates Row With Greece Over ‘Putschist’ Soldiers (G.)

Turkey has sent fighter jets roaring into Greek airspace as tensions mount between the two neighbours following the release from pre-trial detention of eight Turkish army officers described as traitors by Ankara. Formations of F-16s flew at low altitude over Aegean isles for more than 20 minutes on Tuesday as Turkey furiously accused Greece of sheltering terrorists. Ankara vowed to trace the commandos who it claimed participated in the failed July 2016 coup against the president, Recep Tayyip Erdogan and his government. “It is our duty to find these ‘putschist’ soldiers wherever they are, pack them up and bring them to Turkey,” the country’s deputy prime minister, Bekir Bozdag, said late on Monday.

He personally criticised the Greek prime minster, Alexis Tsipras, for failing to hand the soldiers over to Turkey after they flew into Greek airspace. “From statements made in Greece by its prime minister right after the coup, we were of the positive opinion that they would be extradited to Turkey,” he said. “We thought that Mr Tsipras would keep his word. With time, though, we saw that the judicial authorities were mobilised and these ‘putschists’ were not extradited.” The fate of the eight has been in Greek hands ever since the army officers took local authorities aback, landing their helicopter outside the northern border town of Alexandroupolis a day after the abortive coup.

[..] On Monday Greek authorities moved the military personnel out of police custody; following expiry of the 18-month pre-trial period they are legally allowed to be detained while they apply for asylum. They have been placed in top-secret locations under heavy police protection. “Given Turkey’s mindset, the situation is very dangerous,” said a senior judicial source. “But this is an issue of justice and we feel strongly that we must stand up for it.”

Competition for NATO?!

• Merkel Backs Macron’s European Defense Force Initiative (RT)

Chancellor Angela Merkel has supported “in principle” the idea of a joint European Defense Force proposed by French President Emmanuel Macron. Germany’s opposition had been the main stumbling block for the much-discussed project. “I am in favor of President Macron’s proposal for an intervention initiative,” the German chancellor told Frankfurter Allgemeine newspaper on Sunday. “However, such an intervention force with a common military-strategic culture must fit into the structure of defense cooperation,” she said. Merkel said that the German military, the Bundeswehr, “must, in principle, be part of such an initiative,” but added that her statement “doesn’t mean that we are to be involved in every mission.”

During his key speech at Sorbonne University last September, Macron proposed a European military “intervention force” that would protect the continent by taking action in hotspots around the globe. It’s a crucial element of the French leader’s defense reform, which is aimed at integrating European defense capacities. But the talks on implementing the European Defense Force have so far been complicated due to Berlin’s cautions approach to the initiative. “European defense cooperation is very important. Of the 180 weapon systems that currently co-exist in Europe, we must move to a situation like the United States, which has only about 30 weapons systems,” Merkel said.

Still a pretty weak law.

• Airbnb Culls Japan Listings Ahead Of New Rental Law (AFP)

Rental platform Airbnb has suspended a large majority of its listings in Japan ahead of a new law that goes into effect next week regulating short-term rentals in the country. The law, which will comes into force on June 15, requires owners to obtain a government registration number and meet various regulations that some have decried as overly strict. “This weekend we reached out to those hosts who have not yet obtained their notification number to let them know that they will need this to accept any new bookings,” Airbnb spokesman for Asia-Pacific Jake Wilczynski told AFP. “We have informed those hosts that we are in the process of turning off future listing capabilities.”

He declined to confirm the exact number of listings affected, but local media reports and sources put the figure at about 80 percent of the rentals available on the site across Japan. Wilczynski said many Airbnb hosts had already obtained their registration, and others were “going through or finalising” the process. “We are on course to register tens of thousands of new listings in Japan in the months ahead,” he added. [..] The law limits stays to 180 days a year, and allows local governments to impose additional restrictions, with the tourist magnet of Kyoto only permitting rentals in residential areas between mid-January and mid-March, the low season for tourists.

Two excellent pieces from Caitlin Johnstone.

• Whoever Controls The Narrative Controls The World (CJ)

MSNBC host Joy Reid still has a job. Despite blatantly lying about time-traveling hackers bearing responsibility for bigoted posts a decade ago in her then-barely-known blog, despite her reportedly sparking an FBI investigation on false pretenses, despite her colleagues at MSNBC being completely fed up with how the network is handling the controversy surrounding her, her career just keeps trundling forward like a bullet-riddled zombie. To be clear, I do not particularly care that Joy Reid has done any of these things. I write about war, nuclear escalations and the sociopathy of US government agencies which kill millions of people; I don’t care that Joy Reid is or was a homophobe, and I don’t care that she lied to cover it up.

The war agendas that MSNBC itself promotes on a daily basis are infinitely worse than either of these things, and if that isn’t obvious to you it’s because military propaganda has caused you to compartmentalize yourself out of an intellectually honest understanding of what war is. What is interesting to me, however, is the fact that Reid’s bosses are protecting her career so adamantly. Both by refusing to fire her, and by steering the conversation into being about her controversial blog posts rather than the fact that she told a spectacular lie in an attempt to cover them up, Reid is being propped up despite this story constantly re-emerging and making new headlines with new embarrassing details, and despite her lack of any discernible talent or redeeming personal characteristics. This tells us something important about what is going on in the world.

It is not difficult to find someone to read from a teleprompter for large amounts of money. What absolutely is difficult is finding someone who is willing to deceive and manipulate to advance the agendas of the privileged few day after day. Who else would be willing to spend all day on Twitter smearing everyone to the left of Hillary Clinton while still claiming to stand on the political left? Who else would advance the point-blank lieabout “17 intelligence agencies” having declared Russia guilty in US election meddling months after that claim had been famously and virally debunked? Who else would publicly claim that Edward Snowden’s NSA leaks did not benefit anyone besides Russia? Who else could oligarchs like Comcast CEO Brian L Roberts, whose company controls MSNBC, count on to consistently advance his agendas?

While it’s easy to find someone you can count on to advance one particular lie at one particular time, it is difficult to find someone you can be absolutely certain will lie for you day after day, year after year, through election cycles and administration changes and new war agendas and changing political climates. A lot of the people who used to advance perspectives which ran against the grain of the political orthodoxy at MSNBC like Phil Donahue, Ed Schultz and Dylan Ratigan have vanished from the airwaves never to return, while reporters who consistently keep their heads down and toe the line for the Democratic establishment like Chris Hayes, Rachel Maddow and Joy Reid are richly rewarded and encouraged to remain.

It’s just that I’m asking myself if maybe the notion that ‘we can change and be better people’ is itself a narrative?!

• How Humanity Could Become Impossible To Propagandize (CJ)

Narrative rules our world today, from our most basic concepts about ourselves to the behavior of nations and governments. Right now your direct experience of life is little more than the air going in and out of your respiratory system, your gaze moving from left to right over this text, and perhaps the sensation of your bum in a chair or sofa; without any narrative overlay, those experiences are all you are in this moment. Add in mental narrative and all of a sudden you’re a particular individual with a particular name and a particular story, who has perhaps some concerns about the future and regrets about the past, with all sorts of desires and goals and fears and aversions. As far as your actual present experience is concerned, all that stuff is pure mental noise. Pure narrative.

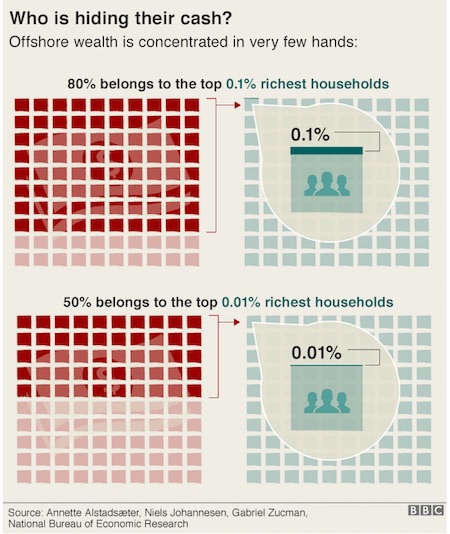

The same is true of things like power, money, and government. There is nothing grafted onto the electrons of the universe which says that the world needs to be mostly ruled by a few billionaires and their lackeys. Only the made-up rules about how power, money and government operate cause that to be the case, and those rules are only as true as we all collectively agree to pretend they are. They are all mental constructs that people made up, and we can therefore change them whenever we want to. Which is why so much plutocratic effort goes into making sure that we don’t.

Narrative dominates our society from top to bottom, which means that all someone has to do to control society is control its narratives. If people are sick, hungry, or poor, you don’t have to give them medicine, food or money to pacify them; you can just give them a narrative instead. If you can get them subscribed to the notion that attempts to rectify these problems with economic justice ought to be rejected and avoided by all hardworking Americans, you can have them defending the plutocracy and advocating their own poverty without giving them a thing. In a society where power is relative and money equals power, the rich are necessarily incentivized to keep everyone else poor in order to retain power, so using narrative control to pacify the masses is a common and useful tactic.

Wherever you look, life itself appears to be exiting the planet. Rapidly.

• Study Warns Of Alarming Decline In Australian Fish (AFP)

Conservation experts warned Wednesday of alarming falls in Australian fish populations and called for more marine reserves and better management to halt the decline. A 10-year study, looking at nearly 200 species at 544 sites, found the main cause was overfishing, with climate change also contributing, although the organisation that manages the nation’s fisheries disputed the findings. The research, in the decade to 2015 by the University of Tasmania and Sydney’s University of Technology, indicated that the numbers of large fish species – over 20 centimetres (eight inches) – had decreased by about 30 percent.

Claimed to be the first independent assessment of the size and abundance of coastal fish species off the Australian continent, it used frequent underwater surveys by divers along blocks of reef. Researchers compared areas where fishing was allowed with marine parks where it was limited or not permitted at all. “We found consistent population declines amongst many popular commercial and recreational fishes, including in marine parks that allowed limited fishing, while numbers increased within no-fishing reserves,” said lead author Graham Edgar. The study, published in the journal Aquatic Conservation, warned that the present situation globally — with more than 98 percent of seas open to some form of fishing — needed “immediate multinational attention”.