Fred Lyon San Francisco Cable Car rounding the curve at Jones Street 1946

They are determined to get all the suckers they can get before the implosion. There’s a huge empty bag to be passed on.

• US New Home Sales Jump, Median Price Surges To Record High (R.)

New U.S. single-family home sales rose in May and the median sales price surged to an all-time high, suggesting the housing market had regained momentum. The Commerce Department said on Friday new home sales increased 2.9% to a seasonally adjusted rate of 610,000 units last month. April’s sales pace was also revised sharply higher to 593,000 units from 569,000 units. Economists polled by Reuters had forecast new home sales, which make up about 10% of all home sales, rising 5.4% to a pace of 597,000 units last month. Sales were up 8.9% on a year-on-year basis in May.

“While the data quality of the new home sales report is notoriously poor, the general picture from this report and the existing home sales report is one of solid housing demand in the important spring selling season,” said Michael Feroli, an economist with J.P. Morgan. The housing market has been bolstered by continued strong job growth. The unemployment rate fell to a 16-year low of 4.3% in May and mortgage rates are still favorable by historical standards. However, an increase in the cost of building materials and shortages of lots and labor have crimped homebuilding. With demand outstripping supply, house prices remain elevated. The median house price rose to a record high of $345,800 in May, from $310,200 in the prior month. The average sales price last month was $406,400, also a record high.

Ditto in Australia. This is from real estate broker Domain, responsible for ad campaigns like the one in the photo -which I took in Melbourne in 2011.

• Sydney Prices To Jump ‘Overnight’ As First-Home Incentives Kick In (D.)

Property prices in affordable areas are expected to jump “overnight” on the back of changes to first-home buyer stamp duty concessions starting in July, experts say. Strategic vendors in these locations are holding off accepting offers until next month to take advantage of the expected surge in demand. First-home buyers in NSW are set to save up to $24,740 with stamp duty concessions for homes up to $800,000 and a full exemption for homes under $650,000. Among those anticipating they will benefit from the changes is Quakers Hill home owner Bhugol Kansakar who bought his house for $611,000 in March 2015 – then a first-home buyer himself. Since May his three-bedroom home at 9 Nyngan Street has been on the market for $730,000 to $760,000. “We’ve had offers around $720,000 to $730,000 … we’re holding out until next month as stamp duty will be off for the first-home buyers,” Mr Kansakar said.

In this price bracket, first-home buyers would get a partial exemption from July. “It is a big block of land, three-bedrooms, perfect for a first home.” He anticipates he will be likely to get $760,000 or more for the home when the new rules come in. And he’s far from the only one anticipating he’ll get a premium, his sales agent Raine & Horne Blacktown business development manager Edwin Almeida said. About 40% of inquiries on homes he had listed across the Blacktown Council area priced under $750,000 were first-home buyers asking if they could formally exchange next month. He expects local prices would jump by $20,000 to $40,000. “Easy money does not make the market more accessible for first-home buyers. It just means vendors and developers will increase the price of property to meet demand,” Mr Almeida said.

Two pieces from a PDF by “The International Economy” site, entitled: “Has the World Been Fitted With a Debt Straightjacket? Nearly forty distinguished experts offer their wisdom”. Click the link to see all.

First, Steve Keen…

• The World Has Been Fitted With Two Debt Straightjackets (Steve Keen)

T he world has been fitted with not just one but two debt straightjackets: one made of public debt and the other of private debt. The situation in the United States is typical. The total U.S. debt level at the end of World War II was equivalent to 130% of GDP, with public debt being three-quarters of the total and private debt one-quarter. Today, it is 250% of GDP, with public debt being two-fifths of the total and private debt three-fifths. But there is a simple trick that could let the United States, like Harry Houdini, magically escape from one of these two straightjackets in a flash. Like any magic act, it’s ruined by the telling: despite all the political hand-wringing over the burden the public debt imposes on future generations, public debt could be eliminated by the stroke of a proverbial pen, for two simple reasons.

First, this debt is exclusively in U.S. dollars; second, the government is the only institution in the nation that “owns its own bank,” the Federal Reserve, which can create U.S. dollars at will. The Fed could buy up—and effectively cancel—this debt overnight. You might not like this trick, but it’s both possible and perfectly legal. That leaves the second straightjacket: private debt. Here Houdini’s escape is not possible, because if any individual tried to do what the U.S. government can do, that person would be gaoled for counterfeiting. All U.S. private debt is, like public debt, owed in U.S. dollars; but only the U.S. government has the privilege of owning its own bank. For the private sector, it’s effectively the banks that own the debtors. But paradoxically, most economists obsess about the public debt trap and ignore the private debt one.

Why? Because they believe that banks do not originate loans, but instead act as “intermediaries” between savers and borrowers. Therefore, they say, private debt doesn’t matter, because if the debtor can’t spend, the lender can, and vice versa. They therefore believe that the level of private debt, and its rate of growth or decline, are economically irrelevant. They can’t see a private straightjacket. Several central banks have recently loudly declared that this model is nonsense—including Germany’s ultraconservative Bundesbank. Banks are not “intermediaries of debt” but originators. They don’t lend pre-existing money, but create money when they make an entry in the borrower’s deposit account, which is matched precisely by an entry in the borrower’s debt account.

Since debtors borrow to spend, rising private debt boosts demand while falling debt reduces it. Demand in the United States was therefore boosted substantially as private debt rose almost fivefold from 1945 until 2008. Now demand from credit is stagnant and as likely to subtract from demand as add to it. So private debt is the real straightjacket constraining the economy. But with mainstream economists ignoring it and fretting about government debt, the U.S. economy is likely to remain in its debt straightjacket indefinitely. As the public has started to realize since the 2008 crisis took them by surprise, mainstream economists are inept magicians.

…second, Makoto Utsumi, Chairman of the International Advisory Board, Tokai Tokyo F.H., and former Vice Minister of Finance for International Affairs, Japan.

• The Future Prospects For Japanese Banks Look Like Hell (Makoto Utsumi)

Can Japan withstand the return to conventional monetary policy? The Bank of Japan has been conducting an unconventional monetary policy for almost two decades, drastically strengthening this policy since Governor Kuroda took office in 2013. As public debt accumulated to 250% of GDP and due to the massive holdings of Japanese Government bonds by the Japanese banking sector, some argue that Japan cannot withstand the return to conventional monetary policy. Here are my points of view: First, let us consider the impact of interest rates hikes on public finances. Many analysts argue that this move would be destructive to public finances due to increased interest payments. There is a point, however, almost all analysts neglect. When interest rates on the JGB rise, the rates on savings and deposits also rise.

As 20% of the interest income is withheld at source, the incremental tax revenue would offset to a great deal the increasing cost of the debt service to be paid by the government. Although the damage caused by the shift in monetary policy on the budget balance would be limited, the fiscal situation of Japan would become increasingly serious with a sustained lack of fiscal discipline. Japanese public finances seem to be on a path to breakdown and the Bank of Japan’s policy to purchase Japanese government bonds up to an amount equal to 80% of new issuances looks more and more like the monetization of the budget deficit. Next, let us see the impact on the banking sector. Two decades of unconventional monetary policy have been squeezing the banks’ profit margins through the extreme flattening of the yield curve.

From this view point, the return to conventional monetary policy is good news for the Japanese banking sector in the long run. On the other hand, in the short and medium terms, this would represent the harshest challenge for banks due to massive valuation losses on their bond holdings. According to the Bank of Japan’s survey, a 1 percentage point rise of interest rates on bonds would cause a loss of US$20 billion for mega-banks, US$25 billion for regional banks, and US$19 billion for credit unions. While the U.S. Federal Reserve is firmly committed toward exit and as the European Central Bank seems to be quietly probing a future exit strategy, where is the Bank of Japan going? If it continues to maintain zero or negative interest rates, current profits of the banking sector would be further squeezed.

If it starts to take steps toward conventional monetary policy, the banking sector would face serious valuation losses. Either way, the future prospects for Japanese banks look like hell. We will probably witness a clear distinction between two groups of banks: those who manage their business based on foresight and those who don’t. And we would see a deep reshuffle in the banking sector along with the exit process from the unconventional monetary policy of the Bank of Japan.

To paraphrase Juncker: “When things get serious in Europe, no rules or laws are immune to lies.”

• Europe’s Banking Union Is Dying in Italy (BBG)

The Italian government looks set to put Veneto Banca and Banca Popolare di Vicenza, two troubled regional lenders, into liquidation, selling off the good assets to a rival bank for a symbolic price. The toxic assets would be transferred to a bad bank, mostly funded by the government. Shareholders and junior bond-holders would contribute to the rescue, while senior creditors would be spared. The rival bank, Intesa Sanpaolo, would be getting a great deal for little risk. But for the Italian taxpayer, and the credibility of euro zone financial regulation, the plan is a loser and should be stopped. The Italian scheme is radically different from the one put in place two weeks ago, when the Spanish lender Banco Santander bought Banco Popular for one euro. In that case Santander also acquired Popular’s non-performing loans as well as all the future legal risks.

It also immediately went to the markets to raise capital to pay for it. Here, Intesa will only pick the assets it wants and insists that the operation not impact its capital ratio. This plan is a slap in the face of Italian taxpayers, who according to some estimates could end up paying around €10 billion ($11.1) for it. The government could have taken a less expensive route, involving the “bail in” of senior bondholders. It chose not to: Many of these instruments are in the hands of retail investors, who bought them without being fully aware of the risks involved. The government wants to avoid a political backlash and the risk of contagion spreading across the system. However, €10 billion is a whale of a premium to pay as an insurance against a contagion. And Rome may still face a backlash – from taxpayers who will feel defrauded.

Most importantly, this plan is a dagger in the heart of the euro zone banking union. This was one of Europe’s main responses to the sovereign debt crisis, designed to limit the contribution of taxpayers to bank rescues and to ensure all euro zone lenders faced a coherent set of rules. Italy is relying for its plan on its domestic liquidation regime. Rome will effectively by-pass the EU’s “single resolution board” which is supposed to handle bank failures in an orderly way and the “Banking Recovery and Resolution Directive,” which should act as the euro zone’s single rulebook. The advantage will be to spare senior bondholders but the cost will be huge: denting, perhaps irreversibly, the credibility of Europe’s newly formed institutions.

And there we go. After years of trying to save them. One day we’ll realize just how epic this failure is.

• Two Italian Zombie Banks Toppled Friday Night (WS)

When banks fail and regulators decide to liquidate them, it happens on Friday evening so that there is a weekend to clean up the mess. And this is what happened in Italy – with two banks! It’s over for the two banks that have been prominent zombies in the Italian banking crisis: Veneto Banca and Banca Popolare di Vicenza, in northeastern Italy. The banks have combined assets of €60 billion, a good part of which are toxic and no one wanted to touch them. They already received a bailout but more would have been required, and given the uncertainty and the messiness of their books, nothing was forthcoming, and the ECB which regulates them lost its patience. In a tersely worded statement, the ECB’s office of Banking Supervision ordered the banks to be wound up because they “were failing or likely to fail as the two banks repeatedly breached supervisory capital requirements.”

“Failing or likely to fail” is the key phrase that banking supervisors use for banks that “should be put in resolution or wound up under normal insolvency proceedings,” the statement said. This is the first Italian bank liquidation under Europe’s new Single Resolution Mechanism Regulation. The ECB explained: “The ECB had given the banks time to present capital plans, but the banks had been unable to offer credible solutions going forward. Consequently, the ECB deemed that both banks were failing or likely to fail and duly informed the Single Resolution Board (SRB), which concluded that the conditions for a resolution action in relation to the two banks had not been met. The banks will be wound up under Italian insolvency procedures.”

[..] nothing worked. Private sector money stayed away in droves. JP Morgan, which had been recruited to save the Italian banks, threw in the towel. These banks had been zombies for too long. Everybody knew it. But the government kept denying it. Just weeks ago, Italy’s Minister of Economy Pier Carlo Padoan insisted that the two banks would not be wound down. Last year, to dispel the mountain of evidence to the contrary, he insisted that that there would be no need of any future bail outs; and that, furthermore, Italy did not even have a banking problem. In early June, the two banks were instructed by the European Commission to raise an additional €1.25 billion in private capital. No one bit. Italy’s government then tried to persuade the European Commission and the ECB to water down the requirement to €600-800 million, and it urged Italian banks to chip in to the bank rescue fund. All that failed.

That leaves 25 sovereign countries with nothing to say on issues that are vitally important to them. Who are we kidding?

• ‘Emmangela’ Show Reasserts EU’s Franco-German Alliance (AFP)

Emmanuel Macron and Angela Merkel used the French president’s first Brussels summit Friday to deliver an unmistakeable message: their countries intend to lead the EU’s post-Brexit revival. The Franco-German power couple held an unusual joint press conference after meeting their 26 European Union counterparts, against a backdrop of their respective flags and the bloc’s blue banner with yellow stars. “When France and Germany speak with one voice, Europe can move forward,” newcomer Macron told a room almost filled to bursting point with reporters as he stood alongside the German chancellor. “There can be no pertinent solution if it is not a pertinent solution for France and Germany,” the 39-year-old centre-right leader.

Despite her more pragmatic tone, the message from 62-year-old Merkel was the same. “This press conference shows that we are resolved to jointly find solutions to problems,” she said. The joint press conference came exactly a year after Britain’s shock referendum vote to become the first country to leave the European Union, which prompted dire predictions of the break-up of the bloc. But Europe has jumped on the bandwagon of Macron’s stunning election victory over French far-right leader Marine Le Pen to trumpet a newfound optimism after years of austerity and crisis despite Brexit. At the heart of that is the idea that Macron may be able to repair the traditional “engine” behind European integration – the post-war alliance of Paris and Berlin after centuries of conflict.

Can the Greek finance minister please state that Schaeuble lies to Germans? Just to see the reaction?!

• Schaeuble Says British Were ‘Lied To’, ‘Deceived’ In Brexit Campaign (R.)

British people were “endlessly lied to and deceived” in last year’s Brexit referendum campaign, German Finance Minister Wolfgang Schaeuble said on Friday. Speaking in Berlin on the first anniversary of the Brexit vote, Schaeuble was scathing about the “leave” campaigners who persuaded a majority of voters to opt to quit the EU. “The Britons were endlessly lied to and deceived,” Schaeuble told a conference of family-run companies. When the Brexit campaigners “happened to be successful, the ones who did it ran away because they said they can’t take responsibility”. The two sides in Britain’s referendum campaign swapped bitter accusations they were making misleading or untrue statements, such as the claim that leaving the EU would free up large sums for public health spending.

In the days after the vote, Prime Minister David Cameron, who called the referendum, resigned, and several prominent leave campaigners dropped out of the race to succeed him. Schaeuble said the 70 years of growth and prosperity Europe had known since World War Two was not based on pure majoritarianism but on sustainable democratic models. “(We need) not just mechanisms that consist of my promising something to a majority,” he said. “Then you only have to look at the demographics to see that you’ll end up with endless debates about redistribution that lead to jealousy.”

May has become a very damaging force in Britain.

• UK MPs Plan Cross-Party Alliance To Defeat May, Hard Brexit (Ind.)

MPs from all parties are already planning an alliance to defeat Theresa May’s plans for a hard Brexit, just days into the new Parliament. Strategies to amend future legislation – including a key immigration bill – to force ministers to listen to business groups and to show the EU that Parliament wants a “softer” exit are being drawn up, The Independent has learned. One Conservative MP said the aim was to give confidence to “bullied” ministers who are reluctant to “speak out”, despite sharing the view that the Prime Minister’s plans put Britain on the road to disaster. Another MP outlined the importance of convincing Brussels that Parliament can “coordinate” to present a different, more EU-friendly policy to that of the Government. “It would really show how power has shifted if Parliament can coordinate itself – and that’s not impossible,” the MP said.

Pro-EU Tory Anna Soubry told The Independent: “We are talking to each other and will continue to talk to each other – this is something that transcends normal party political considerations. “It doesn’t have to be about forcing votes, but it may come to that. Certainly, the threat of losing a vote will weigh very heavily on the Government’s mind.” Another MP spoke of giving voice to changing public opinion, amid the first evidence that some people who voted Leave a year ago are changing their minds. Ms Soubry added: “I am up for working with everybody. Hopefully something concrete will come out of it, because this is the most important thing that’s been done in decades.” She said she was in contact with some of the 34 Labour MPs who, this week, challenged Jeremy Corbyn to change course by fighting to stay in the single market.

Noy much use, perhaps. Don’t say it out loud. Just wait for the Tories to blow up.

• Corbyn Vows To Force Early British Election (Ind.)

Jeremy Corbyn has said he will look to “force an early general election” after claiming it was “ludicrous” to suggest Theresa May could stay in power. The Labour leader made the claim before speaking at Unison’s annual conference in Brighton and also added he was pleased with the party’s recent surge in opinion polls. Mr Corbyn’s approval rating has been on the rise since the general election and it appears he will now attempt to pile pressure on the Prime Minister. “Mrs May called the election so not to have a coalition of chaos, but that is exactly what we have got, they don’t seem to have come to an agreement with the DUP two weeks after the election,” Mr Corbyn told the Daily Mirror. “We will challenge this Government at every step and try to force an early general election.”

George Osborne has some accounts to settle. And a very easy target to blame his own whoppers on.

• May Blocked Plan To Guarantee Rights Of EU Citizens In UK After Brexit (Ind.)

Theresa May single-handedly blocked a plan to immediately guarantee the future rights of the 3m EU citizens in the UK last summer, George Osborne has revealed. The then-Home Secretary was the only member of the Cabinet to oppose David Cameron, who “wanted to reassure EU citizens they would be allowed to stay”, after Brexit. “All his Cabinet agreed with that unilateral offer, except his Home Secretary, Mrs May, who insisted on blocking it,” revealed the Evening Standard, now edited by Mr Osborne. The proposal was discussed “in the days immediately after the referendum” exactly one year ago, said the newspaper. Ms May has denied the accusation and said that “was certainly not my recollection” of events. But Tom Brake, the Liberal Democrat Brexit spokesman, said: “It is a badge of shame that Theresa May blocked attempts to guarantee the rights of EU nationals after the referendum.

“It shows how cold and heartless she is. “Now that mean-spirited decision is coming back to haunt her as we see an exodus of skilled EU workers, from nurses to academics.” The revelation comes after EU citizens in the UK protested that Ms May’s “generous” offer – outlined last night – will leave them with less rights after Brexit than “British jam”. The Prime Minister’s proposals also ran into trouble from other EU leaders who warned of “open questions” and a “long, long way to go” before agreement. Ms May was forced to defend her position and said she wants to give EU citizens in the UK “certainty” but the details of the arrangement would be outlined during the negotiation process. Since reaching No 10, Ms May has faced down pleas to act unilaterally, insisting she would only offer guarantees to EU citizens if British ex-pats in the EU were given the same protection.

It’ll happen only after the round of rate hikes. There’s not enough room to go down right now.

• The Fed Needs to Acknowledge the Slowing Economy (DDMB)

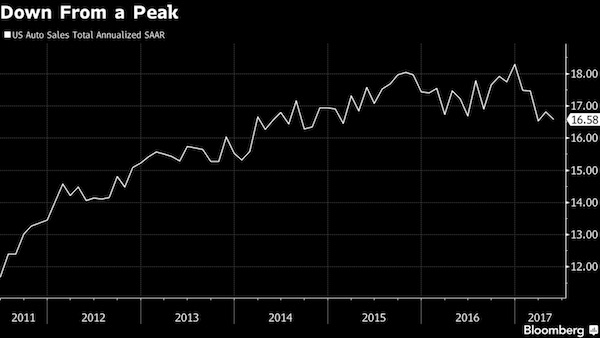

As any market veteran can tell you, those on the sell-side are the second-to-last to concede to a slowdown in economic activity. It’s unseemly to make negative calls when a firm’s main objective is keeping its clients fully invested in risky assets; the two aims naturally conflict. Hence the surprise when Bank of America Merrill Lynch said autos are headed for a “decisive downturn” that will trough in 2021 at around a 13-million-unit annualized rate, down from last year’s blistering record 17.6 million. A week earlier, Morgan Stanley, whose numbers are not quite as grim, also reduced its sales forecast, recognizing that the best days of the cycle have come and gone. The U.S. economy is consumption-centric. Growth in the current recovery has centered on three industries that have fed through to consumption in its various forms – autos, energy and financial services.

There’s something almost poetic in finance’s re-emergence, especially for those on Wall Street who’ve profited smartly from unprecedented levels of deal flow. Have a debt problem? Solve it with more debt. And why not? This system has worked for generations; insatiable demand for debt is why interest rates have staged their historic decline. Debt lit the fire that ignited the shale revolution. Debt put a floor under and then helped commercial real estate reach for the skies. Debt kept dying retailers alive. And debt made easier back-to-back years of record car sales. The question so many bullish economists must answer is what debt can do for the economy in the future. Much to the Saudis’ dismay, the energy industry is as lean and mean as it’s ever been; operating efficiency gains have been magnificent in a do-or-die environment. Energy is growth neutral going forward.

[..] It’s all good and well that strained industries want to extract what value remains from their CRE exposure as part of their exit strategies. But this only works in isolation. If motivated sellers move in tandem, you can bet teetering CRE valuations will be among the casualties, taking many over-exposed mid-size and small banks down with them. Call it a confluence of factors that bodes ill for the economic recovery, even as optimists hope the growth streak can stretch into a 10th year. By the way, leading the optimists’ charge is the Federal Reserve itself. Central bank policy makers’ expectations for future growth indicate the current economic recovery will unseat the record holder, the expansion that finally flamed out in 2001 after enjoying a life of exactly 10 years. But then it is the Fed that’s the very last to capitulate, to say nothing of forecast, a slowdown in economic activity.

“The best thing to do is to break Illinois into pieces right now. Just wipe us off the map.”; “Illinois is merely the canary in the coal mine.”

• Unfunded Liabilities Have Turned Illinois Into A Banana Republic (Lang)

Illinois is the perfect example of what happens when your state is run by fiscally irresponsible dunces for decades. The state is buried in debt, and hasn’t passed a budget in over 700 days. 100% of their monthly revenue is being consumed by court ordered payments, and the Illinois Department of Transportation has revealed that they may not be able to pay contractors (who are working on over 700 infrastructure projects) after July 1st if the state doesn’t pass a budget. To top it all off, the state’s credit rating is one step away from junk status, the lowest of any state. Because of these factors, Illinois may become the first state to declare bankruptcy since the Great Depression. Governor Bruce Rauner has gone so far as to call his state a “banana republic.” The state’s comptroller has admitted that “We are in massive crisis mode.”

And a reporter for the Chicago Tribune thinks Illinois has gone so far past the point of no return, that the state should be broken up. He recently wrote what basically sounds like a suicide note for Illinois. “Dissolve Illinois. Decommission the state, tear up the charter, whatever the legal mumbo-jumbo, just end the whole dang thing. We just disappear. With no pain. That’s right. You heard me. The best thing to do is to break Illinois into pieces right now. Just wipe us off the map. Cut us out of America’s heartland and let neighboring states carve us up and take the best chunks for themselves. The group that will scream the loudest is the state’s political class, who did this to us, and the big bond creditors, who are whispering talk of bankruptcy and asset forfeiture to save their own skins. But our beloved Illinois has proved that it just doesn’t deserve to survive.”

So how did it get to this point? The root of the problem is Illinois’ unfunded pension liabilities, which amount to $130 billion. The state’s leaders simply promised what could not be delivered. Most of their employees can retire in their 50’s, and many of them will receive 1-2 million dollars over the course of their retirements. As the debts associated with those pensions reached astronomical levels, the government increased taxes so much that many of the wealthiest and most productive citizens and businesses have moved away, leaving an even smaller tax base to draw from. In short, Illinois is in a death spiral, but it’s not alone. Illinois is merely the canary in the coal mine.

Hopeless.

• America’s Health-Care Rain Dance (Jim Kunstler)

The cost of everything medical is worked out in a private rain-dance between the aforementioned manifold concerned parties on the basis of what they think they can get away with in any particular case. In hospitals, this is enabled by the notorious ChargeMaster system which, to put it as simply as possible, allows hospitals to just make shit up. Any bill in congress that affects to reform the gross financial malfeasance in healthcare ought to start with the absolute requirement to publicly post the cost of everything that doctors and hospitals do, and enable the “service providers” to get paid only those publicly posted costs — obviating the lucrative rain-dance for dividing up the ransoms paid by hostage-patients who come to the “providers,” after all, in extremis. Notice that this crucial feature of the crisis is missing not only from the political debate but also from the supposedly public-interest-minded pages of The New York Times and other organs of the news media.

Perhaps this facet of the problem never entered the editors’ minds — in which case you really have to ask: how dumb are they? (The funniest claim about ObamaCare in today’s New York Times is the statement that 20 million citizens got access to health care under the so-called Affordable Care Act. Really? You mean they got health insurance policies with $8000-deductables, when they don’t even have $500 in savings to pay for car repairs? What planet do The New York Times editorial writers live on?) The corollary questions about deconstructing the insurance armature of the health care racket, and assigning its “duties” to a “single-payer” government agency is, of course, a higher level of debate. I’m not saying it would work, even if it was modeled on one of the systems currently working elsewhere, say in France.

But Americans have acquired an allergy to even thinking about that, or at least they’ve been conditioned to imagine they’re allergic by self-interested politicians. So, the current product of debate in the US Senate is just a scheme for pretending to reapportion the colossal flow of grift among the grifters. Spare yourself the angst of even worrying about the outcome of the current healthcare debate. It’s not going to get “fixed.” The medical system as we know it is going to blow up, and soon, just like the pension systems across the country, and the treasuries of the fifty states themselves, and the rest of the Potemkin US economy.

“The coalition says it takes as many precautions as possible within the laws of warfare..”

• US-Led Coalition Kills Almost 500 Syrian Civilians In One Month (NW)

The U.S.-led coalition’s strikes against the Islamic State militant group (ISIS) in two Syrian provinces killed 472 civilians in the last month, according to a monitor. The Syrian Observatory for Human Rights (SOHR), a U.K.-based monitoring group that has an extensive network of contacts on the ground in Syria, said the toll was more than double the month prior and the highest for a single month since raids began in September 2014. In Raqqa province, where the city of the same name is located, coalition strikes killed 250 civilians, including 53 children, SOHR said. In Deir ez-Zor, strikes killed 222 civilians, 84 of which were children. Rami Abdul Rahman, director of SOHR, told the AFP news agency that the total deaths caused by coalition strikes in Syria now amounted to 1,953. Of the deceased, 456 were children and 333 were women.

The coalition continues its bombing campaign in and around the eastern Syrian city of Raqqa, the largest under ISIS’s control in the country. It is supporting an Arab-Kurdish alliance waging a ground offensive against ISIS in the de facto capital of its self-declared caliphate that straddles the Iraqi-Syrian border. The coalition says it takes as many precautions as possible within the laws of warfare, but top coalition generals have admitted that civilian deaths are inevitable in the campaign to defeat ISIS. Some 100,000 civilians remain under ISIS control in the northern Iraqi city of Mosul, and thousands remain in Raqqa. Human rights groups have criticized the coalition for not exercising enough caution. One case in particular was a March 17 strike in Mosul that killed more than 100 civilians. The coalition investigated the incident and concluded that ISIS had placed booby traps in the building that maximized the damage on impact.

Greece must refuse.

• The Unfinished Negotiations For A Greek “Super-Memorandum” (Press Project)

They say that history repeats itself first as a tragedy then as a farce. It’s a commonplace expression that is nevertheless clearly true in crisis-ridden Greece. During the SYRIZA-AnEl coalition’s time in power(especially under the second mandate), even the seasons of the year have come to resemble each other. Winter is a time of tension, harsh disagreement and bluster. Spring is the season for gradual capitulation. May (2016 and 2017) is the month for government betrayal; June for further prerequisites and an “agreement.” The rest of the summer then marks a period of government euphoria, followed by an autumn of initial discussions with an eye to the next set of negotiations. By using what happened over the same span of time in 2016—along with the language of the Third (and “fourth”)Memorandum of Understanding—as a kind of textbook, it’s easy to tell where we are and where we’re headed.

The June 15 Eurogroup joint statement condenses all the results of the most recent set of negotiations. These are the most essential and specific points: “The reform measures cover areas such as pensions, income tax, the labour market as well as the financial and energy sectors. These should make Greece’s medium-term fiscal strategy more robust and support the growth-friendly rebalancing of the economy. The Eurogroup invited Greece together with the institutions and relevant third parties to develop and support a holistic, growth enhancing strategy.”

In this paragraph, the Eurozone Finance Ministers are essentially borrowing a page from 1984. In that legendary novel by George Orwell, war is peace; freedom is enslavement; ignorance is power. For the Eurogroup (as per usual), pension cuts, reductions in tax exemptions, an administration well-disposed to mass lay-offs, and the sale of Public Power Corporation shares all count as positive “reform measures.” Greece’s sentence to a “long-term memorandum,” requiring surpluses of 3.5% until 2022 and a little over 2% until 2060, constitutes “support [of] a holistic, growth enhancing strategy.” “The Eurogroup reconfirmed its approach to the sustainability of Greece’s public debt that was agreed in May 2016, while providing some further detail on the medium-term debt measures that could accrue to Greece. These measures would be implemented after successful completion of the programme, if a new debt sustainability analysis were to confirm that such measures are necessary.”

These two brief paragraphs finalize the results of the multi-month Greek debt negotiations. In short and as is plainly evident, the Greek government gained nothing in terms of its debt, while after months of Eurozone attempts to secure further relief the Eurogroup simply determined that everything decided back in May 2016 still holds. Even the government’s recent expectation that the (highly dangerous) phrase “if necessary” would be removed from the relief-program wording was ultimately frustrated. “The Eurogroup welcomed Greece’s commitment to maintain a primary surplus of 3.5% of GDP until 2022, and a fiscal path consistent with the European fiscal framework thereafter. According to analysis by the European Commission, such compliance would be achieved with a primary surplus of equal to or above but close to 2.0% of GDP in the period of 2023-2060.”