Vincent van Gogh Outskirts of Paris: Road with Peasant Shouldering a Spade 1887

The Great Dying of the Indigenous Peoples of the Americas. 95% of them, 56 million, had died by 1600. But who knows this? The history we’ve been told about is white man’s history, almost exclusively. In his lovely books 1491 and 1493, Charles Mann describes this from a different view. First, he says as many people lived in North America as in Europe when Columbus came 500 years ago. Second, the image of roaming herds of buffalo was not accurate then: there was no place for them, the land was farmed. Only after the people had died did the buffalo take over and multiply.

• Death Of 95% Of Indigenous People In Colonization Of America Cooled Earth (RT)

European colonization of the Americas contributed to the advent of the 17th century ‘Little Ice Age,’ a new study says. As some 55 million indigenous people were wiped out, their farmland turned into forest and sucked out CO2. Much of the continental US may feel like it is living through a ‘mini ice age’ due to the polar vortex weather pattern. But while this will come and go, there was a proper global drop in temperatures about four centuries ago, which is commonly called the ‘Little Ice Age.’ A team of scientists from University College London says that humans were partially to blame for it – particularly Europeans traveling to the New World for treasure and new life. While there were some natural reasons behind the oddball phenomenon, much of it remains veiled in mystery.

The British researchers argue that they have found a missing link – the “Great Dying” of indigenous people as result of the European conquest. The scientists found that some 56 million hectares of land were abandoned by the native population of the Americas as they fled or died due to epidemics, war, slavery and subsequent famine. Those lands were reclaimed by forests that, in turn, absorbed so much carbon dioxide that the process cooled Earth. “The resulting terrestrial carbon uptake had a detectable impact on both atmospheric CO2 and global surface air temperatures in the two centuries prior to the Industrial Revolution,” according to the study, published in the Quaternary Science Reviews.

Using a combination of counting methods, the researchers found that prior to the arrival of Europeans in 1492, the Americans were inhabited by some 60.5 million people. About 95 percent of them, or 56 million, had died by 1600. Some 55.8 million hectares (138.3 million acres) of what was previously farmland was reclaimed by the forests and led to a 7.4 pentagram carbon uptake, according to the paper. One pentagram (Pg) of carbon is equivalent to a billion metric tons. “These changes show that the Great Dying of the Indigenous Peoples of the Americas is necessary for a parsimonious explanation of the anomalous decrease in atmospheric CO2,” the paper notes.

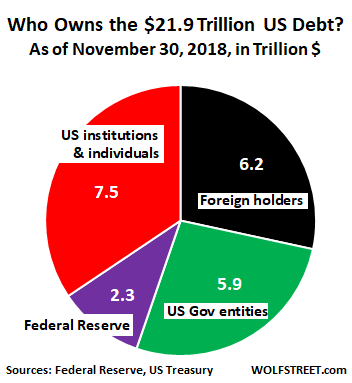

Treasuries stay at home. Foreigners no longer want them. Japan, China, Russia are all selling.

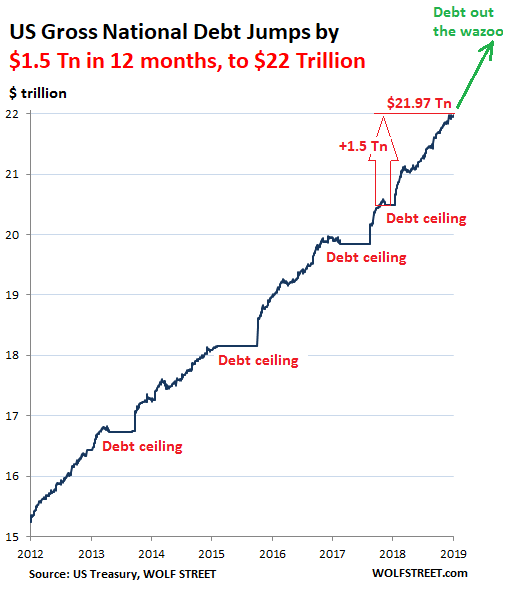

• Who Bought the Gigantic $1.5 Trillion of New 2018 US Government Debt? (WS)

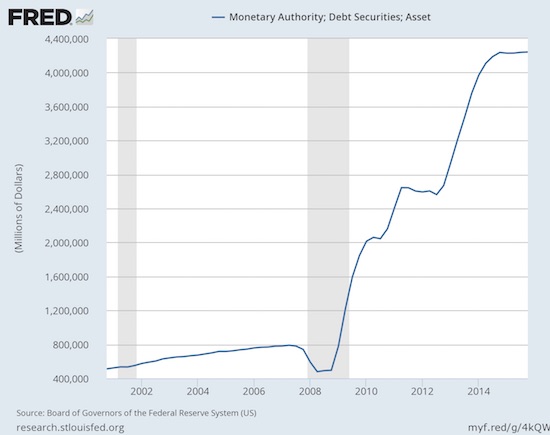

Under the impact of a stupendous spending binge peppered with juicy tax cuts, the Treasury Department has had to issue a flood of Treasury securities to fund the cash outflow. So, over the past 12 months, the US gross national debt has ballooned by $1.5 trillion to $22 trillion as of January 30, according to Treasury Department data. And these are the good times when the economy is hopping. At the next recession, this is going to get cute. But who the heck is buying all this debt? That question will grow increasingly important and worrisome as we move forward with this gigantic ballooning debt, fueled by deficits that Fed chairman Jerome Powell calls “unsustainable” at every chance he gets:

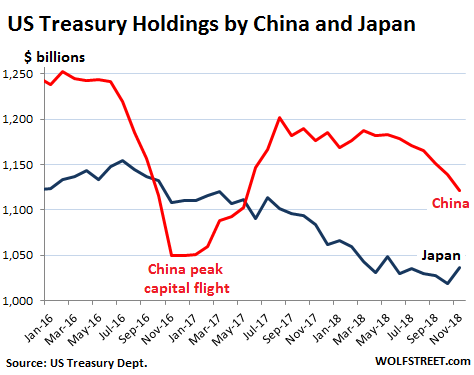

So, who bought all this debt? US government debt, as expensive as it is in terms of interest payments for US taxpayers, is a mildly income-producing asset for the creditors of the US. Somebody has to buy it, every last dollar of it. The US relies on it. So, who bought this pile of debt that got issued in 12 months? China, Japan, other foreign investors? Nope. They’re gradually unloading this debt. All foreign investors combined slashed their holdings of marketable Treasury securities in November by $105 billion from November a year earlier, to $6.2 trillion, according to the Treasury Department’s TIC data released today.

The Treasury Department divides these foreign investors into two categories: “Foreign official” holders (foreign central banks and government entities) cut their holdings by $144 billion over the 12 months, to $3.9 trillion at the end of November. But private-sector investors (foreign hedge funds, banks, individuals, etc.) increased their holdings by $52 billion, to $2.3 trillion. The two largest foreign creditors of the US — China and Japan — have both been unloading their Treasury securities: • China’s holdings fell by $55 billion from a year earlier to $1.12 trillion. • Japan’s holdings fell by $47 billion from a year earlier to $1.04 trillion, having now reduced its stash by 16% since the peak at the end of 2014 ($1.24 trillion).

[..] American banks (very large holders), hedge funds, pension funds, mutual funds, and other institutions along with individual investors in their brokerage accounts or at their accounts with the US Treasury were huge net buyers, while nearly everyone else was selling, increasing their holdings by $1.36 trillion over the 12-month period. These American entities combined owned the remainder of the US gross national debt, $7.5 trillion, or 34.4% of the total!

It’s mostly Russia really: The Russian central bank sold almost all of its U.S. Treasury stock to buy 274.3 tons of gold in 2018.

• Central Bank Gold Buying Hits Highest Level In Half A Century (CNBC)

The amount of gold bought by central banks in 2018 reached the second highest annual total on record, according to the World Gold Council (WGC). Central banks bought the most gold by volume since 1967, according to the industry research firm, which also highlighted it was the largest amount since former U.S. President Nixon Richard’s decision to end the dollar’s peg to bullion in 1971. Central bank net purchases reached 651.5 metric tons in 2018, 74 percent higher than in the previous year when 375 tons were bought. The WGC has estimated that central banks now hold nearly 34,000 tons of gold. The Federal Reserve is reported to hold the most, amounting for almost three quarters of the nation’s foreign-exchange reserve pot.

Taking the current spot price of $1,321.15 per troy ounce, gold purchases by central banks in 2018 amounted to a $27.7 billion spending splurge on the precious metal. “Heightened geopolitical and economic uncertainty throughout the year increasingly drove central banks to diversify their reserves and re-focus their attention on the principal objective of investing in safe and liquid assets,” said the report released on Thursday. The WGC said the bulk of the buying was carried out by a handful of central banks with Russia leading the way as it looks to swap out dollars from its portfolio. The Russian central bank sold almost all of its U.S. Treasury stock to buy 274.3 tons of gold in 2018.

Every country should hold its own gold. What’s the problem with that?

• Refusal To Return Venezuelan Gold Means End Of Britain As Financial Center (RT)

The freezing of Venezuelan gold by the Bank of England is a signal to all countries out of step with US interests to withdraw their money, according to economist and co-founder of Democracy at Work, Professor Richard Wolff.

He told RT America that Britain and its central bank have shown themselves to be “under the thumb of the United States.” “That is a signal to every country that has or may have difficulties with the US, [that they had] better get their money out of England and out of London because it’s not the safe place as it once was,” he said. The Bank of England is currently withholding $1.2 billion in gold from Venezuelan President Nicolas Maduro’s government, but is being urged by Washington to release it to the chairman of the National Assembly, Juan Guaido.Last week, the US backed Guaido as the legitimate president of Venezuela, after he declared himself interim president. According to Professor Wolff, control of Venezuela’s oil has always been an urgent issue for Washington. He also said that the collapse of Britain as a global power, which was accelerated by Brexit, is now about to take another step. “One of the few things left for Britain is to be the financial center that London has been for so long. And one of the ways you stay a financial center is if you don’t play games with other people’s money,” he said.

Pretty much a given now.

• Brexit Could Be Delayed Because Government Is Not Ready (Ind.)

Jeremy Hunt has said Brexit could be delayed as the government may need “extra time” to pass key legislation if Theresa May can agree a deal at the eleventh hour. The foreign secretary admitted that a technical delay to the Article 50 process could be necessary to prepare for Britain’s exit from the EU, which is legally due to take place on 29 March. MPs ordered the prime minister to go back to Brussels to renegotiate a key part of her Brexit deal after her plan was resoundingly defeated in the Commons earlier this month. But despite the Tory truce, Ms May faces an uphill battle to convince the EU to reopen talks on the withdrawal agreement, with European leaders lining up to rebuff her efforts.

Asked about Britain’s exit date, Mr Hunt told the Today programme: “I think that depends on how long this process takes. “I think it is true that if we ended up approving a deal in the days before 29 March then we might need some extra time to pass critical legislation. But if we are able to make progress sooner, then that might not be necessary. “We can’t know at this stage exactly which of those scenarios would happen.” There is growing concern among ministers that there is not enough time to pass the necessary legislation before exit day, amid reports that the February recess could be cancelled to give Ms May more time to win over the EU.

Ironically, Varoufakis points out exactly why Corbyn is too late (all he’s done is wait):

“Irresolute princes, to avoid present dangers, generally follow the neutral path, and are generally ruined” – Niccolò Machiavelli, The Prince

• What Corbyn Must Do To Rescue Britain From Its Brexit Torture (Varoufakis)

Britain’s prime minister has been remarkable in resolutely following a ruinous path that she keeps insisting remains the least perilous road to Brexit. Theresa May’s first crime against logic was to trigger Article 50 without a plan of what to do on 29 March 2019 if no deal had been struck with Brussels. Her second was to forfeit any bargaining power she had by accepting Michel Barnier’s two-phase negotiation (first London delivers all that Brussels demands, then Brussels considers what London wants). May’s two colossal errors combined to allow a gloating European Commission to dictate to her a withdrawal agreement that, independently of whether one is pro-Leave or pro-Remain, resembles the kind of treaty imposed upon a nation defeated at war.

Unsurprisingly, Brexit has turned into a process tearing Britain apart while revealing its constitutional inadequacies. The next few weeks are depressingly predictable. The prime minister will continue to run down the clock putting all the pressure on Remainers, both Tory and Labour, to avert a no-deal Brexit by accepting hers. That was the point of backing the Brady amendment on Tuesday: to take Brexit revocation off the table, gain two weeks during which to pretend to negotiate with a European Commission that does not have the mandate to negotiate and then take a version of the same withdrawal agreement, possibly with some pointless addenda, to parliament. If her blackmail fails again, she will apply for an extension of Article 50 until 1 July to start the same war of attrition anew.

It is imperative that May is prevented from following this path. Those who can stop her and fail to do so will not be forgiven by at least one generation of Britons. Which brings me to my friend and comrade Jeremy Corbyn and his team. Labour’s leadership understands that, with weeks to go before the cliff’s edge, Niccolò Machiavelli’s counsel applies just as much to them too. “Irresolute princes, to avoid present dangers, generally follow the neutral path, and are generally ruined” – Niccolò Machiavelli, The Prince

Until now it was right and proper for Labour to avoid distracting a Tory government while it was making a mess of things. Jeremy Corbyn’s critics were wrong to chastise him for delaying to call a vote of no confidence or for not backing a second referendum. Labour just did not have the numbers to win such votes. However, the time has come for Jeremy Corbyn to give a speech of hope for Britain, one that contains a clear vision of a country that heals itself after two years of wanton destruction by a short-sighted, clueless prime minister thinking solely of the unity of her divided government and party.

Why Brexit?!

• UK Homeless Crisis Is Worse Than Ever (Ind.)

Housing charities have criticised government claims of falling numbers of rough sleepers as homeless shelters across Britain report unprecedented demand. Communities secretary James Brokenshire said his department’s strategy was “starting to have an effect” as official figures showed that, on a “snapshot night in autumn”, the number of people sleeping on the street had dropped to 4,677 from 4,751 the year before. But Jon Sparkes, the chief executive of charity Crisis, said the count was widely believed to be an “unreliable” source which “significantly underestimated” the number of people experiencing the devastation of sleeping rough.

Shelters in England, Wales and Scotland contacted by The Independent all reported record levels of demand as temperatures in parts of the country dropped as low as -14C. On the snapshot count, Mr Sparkes said: “The problem is, these counts and estimates inevitably miss a significant number of people, including those not rough sleeping on that particular night, those hidden from view and who aren’t bedded down for the night.” Figures published by his organisation in December revealed levels of rough sleeping in the UK – including sleeping on public transport and in tents – had doubled in five years, rising by 20 per cent to 24,000 in just 12 months.

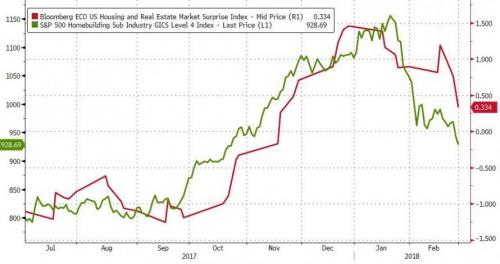

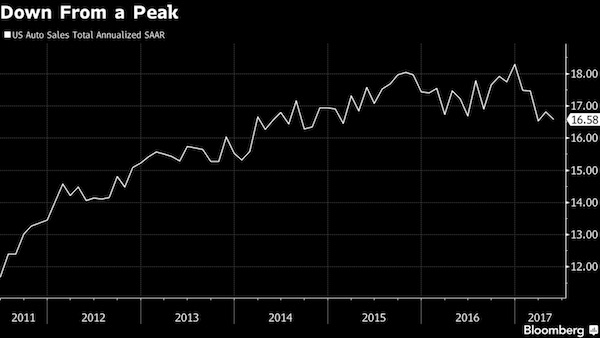

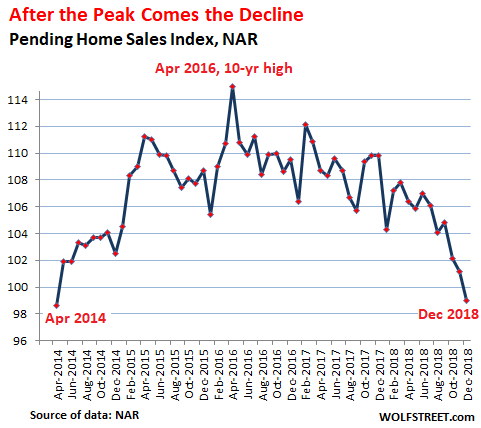

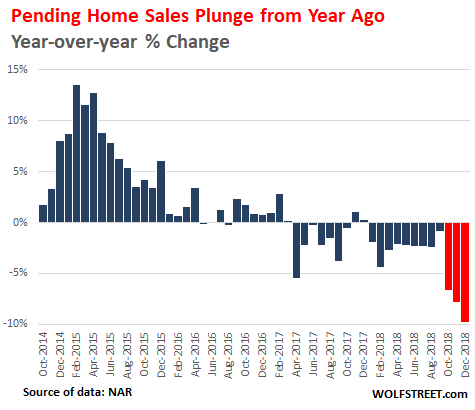

Lawrence Yun still has a job. Amazing.

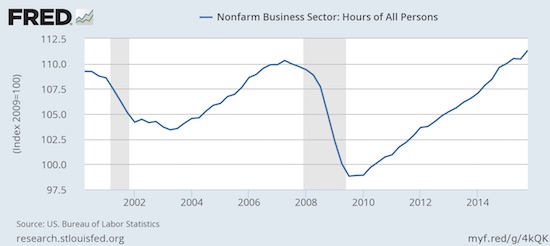

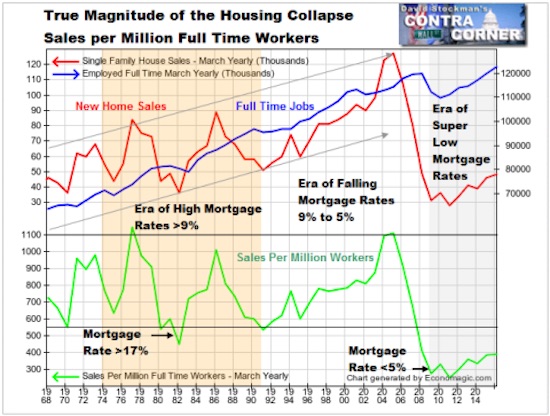

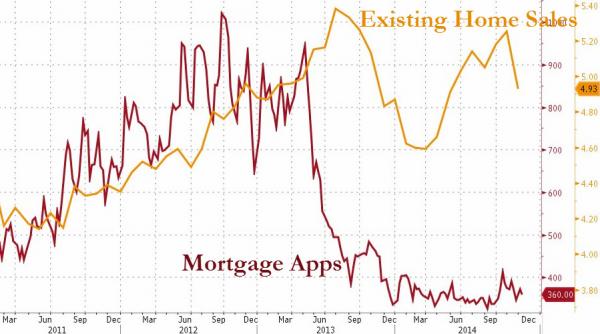

• US Home Sales to Get Even Uglier in Near Future (WS)

What will home sales look like in January and February? Very, very lousy, according to pending home sales, a measure that counts how many contracts were signed. Contract signings run roughly one or two months ahead of when the sales close and are reported as sales. The measure of pending home sales for December projects actual home sales in January and February. To that tune, the National Association of Realtors (NAR) said that its Pending Home Sales Index for December fell to the lowest level since April 2014. “It’s been dripping down, down, down,” NAR chief economist Lawrence Yun said in the interview.

“Frustrating that the housing market is not recovering.” Compared to December a year earlier, contract signings dropped 9.8%, the 12th month in a row of year-over-year declines, and the worst year-over-year decline since the days of housing and mortgage crisis. To show the acceleration of the declines of contract signings toward the end of the year, I marked October, November, and December in red. The NAR’s report blamed the stock market swoon that had sapped consumer confidence, unaffordable home prices – that, after years of price gains had far outgrown wage gains – and mortgage rates. The latter is an interesting theory because mortgage rates, after a peak in early November, were falling starting in mid-November and fell throughout December.

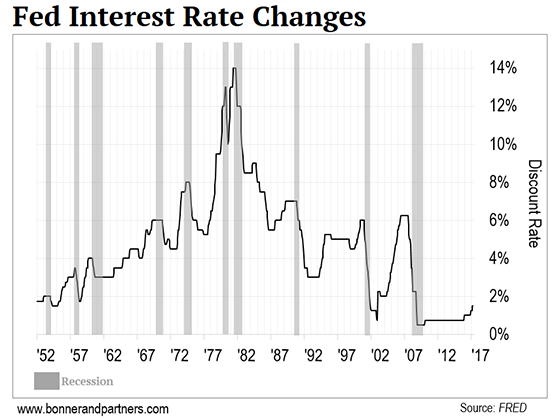

Let’s see the Fed tackle this one.

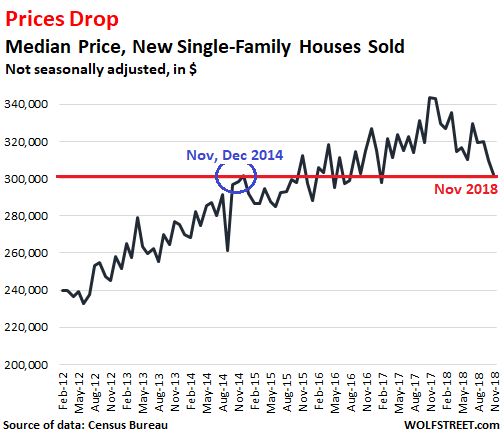

• US New Home Prices Drop 12% as Supply Surges (WS)

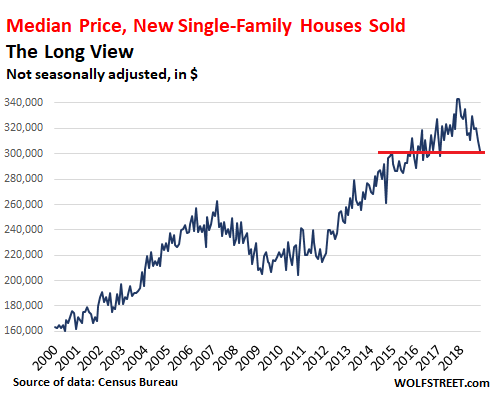

The Commerce Department has reopened for business, and the good folks there are now in hyperdrive to put together and release the data that was blocked during the partial government shutdown that had also shut down the Commerce Department. This morning, it released the sales data for new homes whose sales closed in November. This report had originally been scheduled for the end of December. In the near future, the Commerce Department will further catch up and release the new-home sales data for December, which had been scheduled for last week. So, time to catch up, and here we go. The median prices of new single-family houses that sold across the US in November 2018 fell 11.9% from November 2017 to $302,400, the lowest median price since October 2016, and in the same range as the median price in November and December 2014:

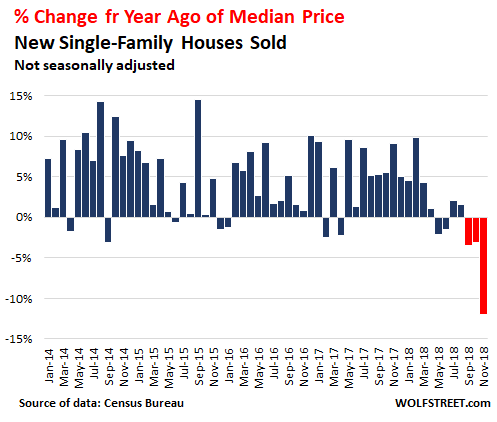

This new-home sales data – produced jointly by the Census Bureau and the Department of Housing and Urban Development – is very volatile, and subject to revisions in the following months. But after a while, and despite the jumpiness of the data, as the above chart shows, the trend becomes clear. The year-over-year decline of 11.9% was the third months in a row of year-over-year declines, and the largest year-over-year decline since Housing Bust 1. Note the many double-digit year-over-year price increases in prior years, which attest to the boom in prices that has now outrun what the market can bear:

Just how far prices have ballooned before they began to deflate becomes apparent in this long-term chart of the median price of new houses. At the price peak in December 2017 ($343,300), the median price was 31% above the crazy bubble peak in March 2007, before it all blew apart:

Pelosi will have to come with something. Does she understand this?

• Trump Says Border-Wall Talks ‘A Waste Of Money And Time’ (MW)

Negotiations with Congress are a waste of time if Democrats won’t discuss border-wall funding, President Donald Trump said Thursday, vowing to build a wall with or without congressional approval. In a wide-ranging Oval Office interview published Thursday night by the New York Times, Trump also said he’s done playing nice with House Speaker Nancy Pelosi, expressed optimism over reaching a trade deal with China and issued numerous denials related to special counsel Robert Mueller’s investigation. Pelosi has adamantly opposed any funding to build a wall along America’s southern border, and the specter of another government shutdown looms in two weeks, when a temporary funding deal expires.

“If she doesn’t approve the wall, the rest of it’s just a waste of money and time and energy.” A 17-member panel of lawmakers has been tasked with reaching a border-funding compromise. Trump suggested in the interview that an emergency order could be issued if Congress won’t allocate the $5.7 billion that he’s demanded for the wall. “I’ll continue to build the wall, and we’ll get the wall finished,” he told the Times. “Now whether or not I declare a national emergency — that you’ll see.” About Pelosi, Trump said: “I’ve actually always gotten along with her, but now I don’t think I will any more. . . . I think she’s doing a tremendous disservice to the country.”

When asked about a number of other subjects, Trump said he ”never did” speak to Roger Stone about WikiLeaks during his campaign; denied he was tampering with witnesses through his tweets; and said testimony by his intelligence chiefs earlier this week was mischaracterized by the media, despite the fact that video of the hearing was shown, along with a 42-page written transcript. He also called being president a “loser” job, financially. “I lost massive amounts of money doing this job,” he said. “This is not the money. This is one of the great losers of all time. You know, fortunately, I don’t need money.”

Varoufakis and David Adler. Personally, when someone says we need $8 trillion a year for a Green New Deal, I think: forget it. People think in terms of keeping present energy use levels alive, just switching to different sources. But the No. 1 issue should be to use less energy.

• With World Bank and IMF In Crisis, Time To Push Radical New Vision (DiEM25)

“Prosperity, like peace, is indivisible,” said the US treasury secretary, Henry Morgenthau, in his inaugural speech to the Bretton Woods conference, which gave birth to the World Bank (then the International Bank for Reconstruction and Development) and to the IMF. “We cannot afford to have it scattered here or there among the fortunate or enjoy it at the expense of others.” The original Bretton Woods plan was for exchange rates to be fixed, with the IMF helping heavily indebted countries restructure their debt and a stabilization fund curbing capital flight. Meanwhile, the World Bank would offer development finance and an international commodity stabilization corporation would “bring about the orderly marketing of staple commodities at prices fair to the producer and consumer alike”.

Finally, the whole system would be dollar-denominated, with the greenback being the only currency exchangeable for gold at a fixed rate. John Maynard Keynes, the chief British negotiator at Bretton Woods, was worried that the new system could only rely on the dollar as long as America had a trade surplus. The moment the United States became a deficit country, the system would collapse. So, Keynes suggested that instead of building the new world order on the dollar, all major economies would subscribe to a multilateral International Clearing Union (ICU). While keeping their own currencies, and central banks, countries would agree to denominate all international payments in a common accounting unit, which Keynes named the bancor, and to clear all international payments through the ICU.

Once set up, the ICU would tax persistent surpluses and deficits symmetrically so as to balance out capital flows, volatility, global aggregate demand and productivity. Had it been instituted, the ICU would have worked alongside the World Bank to keep the global economy in balance and build shared prosperity worldwide. But Keynes’s ICU was rejected. The United States was unwilling to replace the dollar as the anchor of the new monetary system. And so the IMF was downgraded to a bailout fund, the World Bank was limited to lending from its own reserves (contributed by stressed member states) and, crucially, any possibility of the IMF leveraging the World Bank’s investments (like a central bank might have done) was jettisoned.

They got young people ‘volunteering’ to be spied upon to an even higher degree than they already were.

• Apple Punishes Facebook, Google Over App Rules (BBC)

Apple revoked Google’s ability to offer its employees internal-only iPhone apps, likely causing significant disruption to the search giant. Apple was punishing its rival for breaking its developers’ policy, a day after it took the same action against Facebook. The move came after both firms used special access for market research. Apple restored Google’s access to the software by the end of the working day on Thursday. After more than 24 hours of disruption, Facebook had its access restored earlier on Thursday. “We are in the process of getting our internal apps up and running” a spokeswoman told the BBC. “To be clear, this didn’t have an impact on our consumer-facing services.”

Apple allows companies the ability to exert special control over employee devices in order to add additional security and control. Many firms use this to distribute apps that might contain private information to employees but not the wider public. Some firms also distribute test or beta versions of apps the firm is working on such as, in Google’s case, Maps, Hangouts and Gmail. Both firms use internal iOS apps to help employees access services such as travel. However, Apple explicitly prohibits firms from using this access on regular consumers. On Monday it was revealed that Facebook had used its enterprise access to distribute a market research app to the public, including teenagers. On Tuesday it became known that Google was doing something similar with its own app, Screenwise.

The Troika is not happy.

• Greece Raises Minimum Wage By 11% (K.)

An 11 percent increase in Greece’s minimum wage and the abolition of the so-called subminimum wage paid to young employees which were announced by Prime Minister Alexis Tsipras during a cabinet meeting early this week came into effect on Friday. “Today, a new era begins for the country’s young employees. An era with more rights, more dignity,” Labor Minister Effie Achtsioglou told state-run news agency ANA-MPA. “With the increase in the minimum wage and the abolition of the sub-minimum wage, we restore part of what austerity policies deprived employees of. And this is an act of justice.” The hike, the first such wage change in the country in almost a decade, raises the minimum wage from €586 to €650. The measure, however, has generated concern on the part of Greece’s creditors during their recent visit to the country to assess its post-bailout compliance.

Why those minimum wage were raised. Imagine if Greece were further north.

• 25% of Greeks Cannot Afford To Heat Their Homes (K.)

Almost one in four Greeks cannot afford to heat their home sufficiently, according to Eurostat data collected as part of the annual EU survey on income and living conditions in the bloc. Based on the report, 25.7 percent of Greeks said they were not able to keep their home adequately warm due to their economic condition. Greeks buy heating oil at an average price of 1,025 euros per liter when the average price for the whole of the European Union is 0.794 euros per litre and 0.781 euros in the eurozone. The largest share of people who shared the same view was recorded in Bulgaria (37 pct), followed by Lithuania (29 pct), Greece, Cyprus (23 pct) and Portugal (20 pct).

In contrast, the lowest shares – close to 2 percent – were recorded in Luxembourg, Finland, Sweden, the Netherlands and Austria. In 2017, eight percent of the EU population said in an EU-wide survey that they could not afford to heat their home sufficiently. This share peaked in 2012 with 11 percent, and has fallen continuously in subsequent years.