Odilon Redon Sunset n.d.

He might as well stay home. Can’t talk about Concord, can’t talk about anything not in the report.

• US Justice Department Tells Mueller To Limit Congressional Testimony (R.)

The U.S. Justice Department told former Special Counsel Robert Mueller on Monday he should limit his testimony before Congress this week to discussing his public report on the Russia probe. In a letter to Mueller, Associate Deputy Attorney General Bradley Weinsheimer said his testimony set for Wednesday “must remain within the boundaries of your public report because matters within the scope of your investigation were covered by executive privilege.” The letter said “these privileges would include discussion about investigative steps or decisions made during your investigation not otherwise described in the public version of your report.”

Mueller completed in March his nearly two-year-long probe into Russian meddling in the 2016 election and possible obstruction of justice by President Donald Trump. The Justice Department released a redacted copy of his 448-page report in April. A spokesman for Mueller, Jim Popkin, said no one at the Justice Department, Congress or the White House would review Mueller’s statement before he delivers it on Wednesday. In back-to-back hearings before the House of Representatives Judiciary and Intelligence committees, Democrats are expected to try to get Mueller to focus his testimony on specific examples of Trump’s misconduct.

[..] Mueller has been using offices at his former law firm WilmerHale and working with a small team from the special counsel’s office to prepare for Wednesday’s hearings, Popkin said. “He will come well prepared,” Popkin said. “His team has been working on this for a while and they will be ready for whatever comes their way.”

“is it possible that he’s just not very bright?”

The entrapment operation that was the Special Counsel’s covert mission has turned out to be Mr. Mueller own personal booby-trap, prompting the question: is it possible that he’s just not very bright? Though Mr. Mueller’s final report asserted that the Russian government interfered in “a sweeping and systemic fashion” to influence the 2016 election, the 450-page great tome contains zero evidence to support that claim, and the discrepancy was actually noticed by federal judge Dabney Friedrich who is presiding over the case against the alleged Russian Facebook trolls that was one of the two tent-poles in the RussiaGate fantasy. The case is now blowing up in Robert Mueller’s face.

In early 2018, Mr. Mueller sold a DC grand jury on producing indictments against a Russian outfit called the Internet Research Agency and its parent company Concord Management, owned by Russian oligarch Yevgeny Prigozhin for the so-called election meddling. The indictment was celebrated as a huge coup at the time by the likes of CNN and The New York Times, styled as a silver bullet in the heart of the Trump presidency. But the indicted parties were all in Russia, and could not be extradited, and there was zero expectation that any actual trial would ever take place — leaving Mueller & Co. off-the-hook for proving their allegations.

To the great surprise of Mr. Mueller and his “team,” Mr. Prigozhin hired some American lawyers to defend his company in court. Smooth move. It automatically triggered the discovery process, by which the accused is entitled to see the evidence that prosecutors hold. It turned out that Mr. Mueller’s team had no evidence that the Russian government was involved with the Facebook pranks. This annoyed Judge Friedrich, who ordered Mr. Mueller and his lawyers to desist making public statements about Concord and IRA’s alleged “sweeping and systemic” collusion with Russia, and threatened legal sanctions if they did.

Three years ago. That went by fast.

• A Non-Hack That Raised Hillary’s Hackles (Ray McGovern)/span>

Three years ago Monday WikiLeaks published a trove of highly embarrassing emails that had been leaked from inside the Democratic National Committee. As has been the case with every leak revealed by WikiLeaks, the emails were authentic. These particular ones, however, could not have come at a worse time for top Democratic Party officials. The emails made it unmistakably clear that the DNC had tipped the scales sharply against Democratic insurgent Bernie Sanders, giving him a snowball’s chance in hell for the nomination. [..] A mere four days after the WikiLeaks release, a well orchestrated Democratic Convention nominated Clinton, while many Sanders supporters loudly objected.

Thus, she began her campaign under a cloud, and as more and more Americans learned of the fraud that oozed through the DNC email correspondence — including the rigging of the Democratic primaries — the cloud grew larger and darker. On June 12, 2016, six weeks before the convention, WikiLeaks publisher Julian Assange had announced in an interview on British TV, “We have upcoming leaks in relation to Hillary Clinton … We have emails pending publication.” Independent forensic investigations demonstrated two years ago that the DNC emails were not hacked over the Internet, but had been copied onto an external storage device — probably a thumb drive. Additional work over recent months has yielded more evidence that the intrusion into the DNC computers was a copy, not a hack, and that it took place on May 23 and 25, 2016.

No one knew how soon WikiLeaks would publish the emails, but the DNC offense/defense would surely have to be put in place before the convention scheduled to begin on July 25. That meant there were, at most, six weeks to react. But it only took two days. As early as July 24, about 48 hours after the leaks were published, and a day before the convention, the DNC first blamed Russia for hacking their emails and giving them to WikiLeaks to sabotage Clinton. Granted, it was a stretch — and the DNC would have to hire a pliable cybersecurity firm to back up their claim. But they had good reason to believe that CrowdStrike would perform that service. It was the best Clinton campaign manager Robbie Mook and associates could apparently come up with.

If they hurried, there would be just enough time to prepare a PR campaign before the convention and, best of all, there was little doubt that the media could be counted on to support the effort full bore. [..] It pretty much worked like a charm. The late Senator John McCain and others were quick to call the Russian “hack” an “an act of war.” Evidence? None. For icing on the cake, then-FBI Director James Comey decided not to seize and inspect the DNC computers. Nor, as we now know, did Comey even require a final report from CrowdStrike.

Not sure having it discussed by well-paid economists is all that useful.

• Inequality is Destroying Democratic Capitalism (Deaton)

At the risk of grandiosity, I think that today’s inequalities are signs that democratic capitalism is under threat, not only in the US, where the storm clouds are darkest, but in much of the rich world, where one or more of politics, economics, and health are changing in worrisome ways. I do not believe that democratic capitalism is beyond repair nor that it should be replaced; I am a great believer in what capitalism has done, not only to the oft-cited billions who have been pulled out of poverty in the last half-century, but to all the rest of us who have also escaped poverty and deprivation over the last two and a half centuries. It also provides our jobs and the cornucopia of goods and services that we take for granted.

And Milton Friedman, whose starry-eyed view of capitalism has much to answer for, was not entirely wrong when he extolled the freedom that free markets can bring. Though history has not been kind to his view that equality would be guaranteed by using markets to pursue freedom. But we need to think about repairs for democratic capitalism, either by fixing what is broken, or by making changes to head off the threats; indeed, I believe that those of us who believe in social democratic capitalism should be leading the charge to make repairs.

As it is, capitalism is not delivering to large fractions of the population; in the US, where the inequalities are clearest, real wages for men without a four-year college degree have fallen for half a century, even at a time when per capita GDP has robustly risen. Mortality rates are rising for the less-educated group at ages 25 through 64, and by enough that life expectancy for the entire population has fallen for three years in a row, the first time such a reversal has happened since the end of the first world war and the great influenza epidemic. Less educated Americans are dying by their own hands, from suicide, from alcoholic liver disease, and from overdoses of drugs. Morbidity is rising too, and they are also suffering from an epidemic of chronic pain that, for many, makes a misery of daily life.

“If you watch Fox News, you will believe Bill Clinton was Epstein’s No. 1 pal and enabler. If you watch MSNBC, this scandal is usually all about Donald Trump. ”

• Who Was Jeffrey Epstein Calling? (NYMag)

Perhaps, at long last, a serial rapist and pedophile may be brought to justice, more than a dozen years after he was first charged with crimes that have brutalized countless girls and women. But what won’t change is this: the cesspool of elites, many of them in New York, who allowed Jeffrey Epstein to flourish with impunity. For decades, important, influential, “serious” people attended Epstein’s dinner parties, rode his private jet, and furthered the fiction that he was some kind of genius hedge-fund billionaire. How do we explain why they looked the other way, or flattered Epstein, even as they must have noticed he was often in the company of a young harem?

Easy: They got something in exchange from him, whether it was a free ride on that airborne “Lolita Express,” some other form of monetary largesse, entrée into the extravagant celebrity soirées he hosted at his townhouse, or, possibly and harrowingly, a pound or two of female flesh. If you watch Fox News, you will believe Bill Clinton was Epstein’s No. 1 pal and enabler. If you watch MSNBC, this scandal is usually all about Donald Trump. In fact, both presidents are guilty (at the very least) of giving Epstein cover and credibility.

There are so many unanswered questions about Epstein, but one that looms over all of them is whether the bipartisan crowd who cleared a path for him will cover its tracks before we can get answers — not just Clinton and Trump and all those who drank at Epstein’s trough but also (among others) institutions like Harvard, Dalton, and the Council on Foreign Relations, or lawyers like the New York prosecutor Cy Vance Jr., whose office tried to downgrade Epstein’s sex-offender status; Kenneth Starr, who tried to pressure Republican Justice Department officials to keep the Epstein case from ever being prosecuted; and Alan Dershowitz, who tried to pressure the Pulitzer Prizes to shut out the Miami Herald for its epic investigative reporting that cracked open the case anew.

People are going to start talking soon, if only to protect themselves. But why hasn’t Maxwell been arrested yet?

• Chelsea Clinton Denies Ties To Jeffrey Epstein’s Alleged ‘Madam’ (MN)

Since Jeffrey Epstein’s latest arrest on sex trafficking charges, a who’s who of the rich and powerful — notably Donald Trump, Prince Andrew and Bill Clinton — have rushed to downplay their associations with the financier who is accused of abusing underaged girls. Now Chelsea Clinton has joined her ex-president father on this who’s who list. Her representative issued a statement to Politico over the weekend denying reports that the former First Daughter was close friends with Ghislaine Maxwell, Epstein’s ex-girlfriend and the alleged “madam” who has been accused of helping him procure underaged girls for sex.

Politico’s report on Maxwell, 57, focuses on how the daughter of the late British publishing mogul Robert Maxwell helped Epstein, the Brooklyn-born son of a New York City parks groundskeeper, gain access to social circles that allowed him to become friendly with two U.S. presidents, billionaire business moguls, America’s media elite and at least one member of the British royal family. Maxwell has not been criminally charged, but has settled two lawsuits filed by women who say she participated in Epstein’s alleged sex trafficking, the New York Times reported last week. She has denied any wrongdoing. Politico said Maxwell first grew close to the Clinton family after former president Bill Clinton left office, and eventually became friends with Chelsea Clinton, vice chair of the Clinton Foundation.

According to the news outlet, the two women vacationed together on a yacht in 2009, and Maxwell attended Chelsea’s wedding to Marc Mezvinsky in 2010, Politico reported. A photo of Maxwell at the wedding has circulated online. Maxwell also participated in the Clinton Foundation’s Clinton Global Initiative as recently as 2013, through The TerraMar Project, an oceanic non-profit she founded, according to the Initiative’s website. The contacts between Chelsea Clinton and Maxwell appear to have occurred after Maxwell’s name first emerged in accounts of Epstein’s alleged sexual abuse. “Ghislaine was the contact between Epstein and Clinton,” a person familiar with the relationship told Politico. “She ended up being close to the family because she and Chelsea ended up becoming close.”

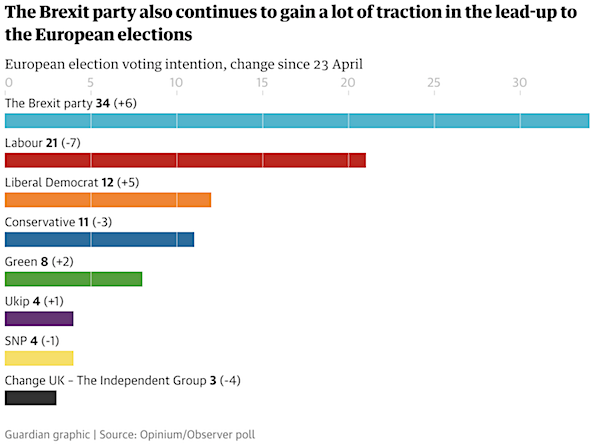

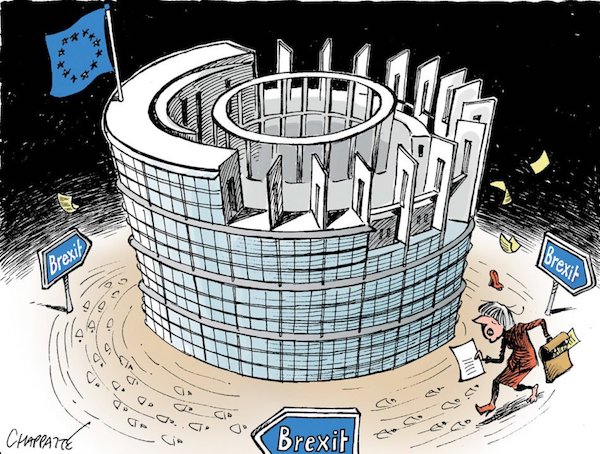

May goes away in July. Bye.

• UK’s May Takes Parting Shot at Putin in Desperate Diversion From Failure (SCF)

In what was billed as her last major speech before quitting Downing Street, Britain’s outgoing Prime Minister Theresa May focused her concerns on Russian President Vladimir Putin, lashing out at his “cynical falsehoods” and admonishing her successor “to stand up to” the Russian leader. Given her ignominious failure as premier over the Brexit fiasco, it seemed a strange choice of topic as she addressed the Chatham House think tank in London this past week. Her speech dealt with the wider theme of rising “populist politics” in the US and Europe. And she sought to portray Putin as an archetypal sinister figure fomenting populist threat to the “liberal” democratic order.

At one point, May claimed: “No one comparing the quality of life or economic success of liberal democracies like the UK, France and Germany to the Russian Federation would conclude that our system is obsolete.” This was supposed to be a riposte to an interview given by Putin to the Financial Times last month ahead of the G20 summit in Japan. During a lengthy interview on a wide range of issues, the Russian president was quoted as saying: “The liberal idea has become obsolete. It has come into conflict with the interests of the overwhelming majority of the population.”

Putin was apparently explaining a fairly straightforward and, to many observers, valid assessment of international politics. Namely, that Western establishments and institutions, including the mainstream media, are experiencing a crisis in authority. That crisis has arisen over several years due to popular perception that the governance of the political class is not delivering on democratic demands of accountability and economic progress. That in turn has led people to seek alternatives from the established parties, a movement in the US and Europe which is denigrated by the establishment as “populist” or rabble rousing.

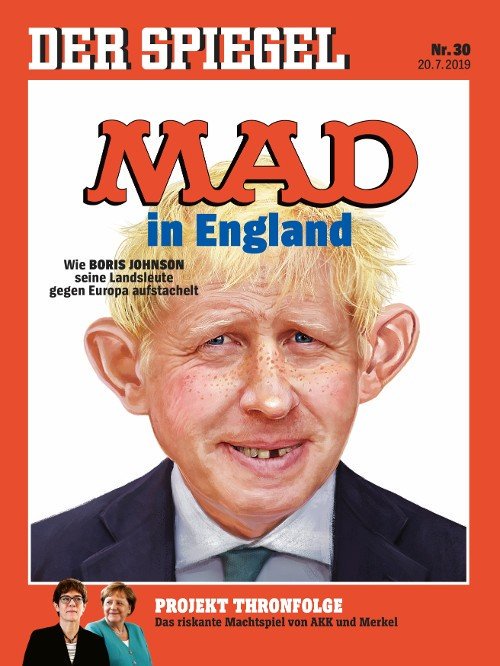

Boris is capable of doing very stupid things.

• Iran Warns West Against Starting Conflict (R.)

Iran’s foreign minister warned the West on Monday against “starting a conflict,” saying it was not seeking confrontation after its military seized the British-flagged tanker Stena Impero in the Strait of Hormuz last week. London described the seizure of the Stena Impero as “state piracy” and on Monday called for a European-led naval mission to ensure safe shipping through the Strait of Hormuz. Speaking in Nicaragua, Foreign Minister Mohammad Zarif said Iran had taken measures against the ship to implement international law, not in retaliation for the British capture of an Iranian tanker two weeks earlier in Gibraltar.

“Starting a conflict is easy, ending it would be impossible,” Zarif told reporters after meeting his Nicaraguan counterpart. “It’s important for everybody to realize, it’s important for Boris Johnson to understand, that Iran does not seek confrontation,” he said, referring to the front-runner to become Britain’s new prime minister. “Iran wants to have normal relations based on mutual respect,” he added. Zarif said Iran acted when it observed that the UK ship did not follow regulations. “The UK ship had turned down its signal for more time than it was allowed to (and) was passing through the wrong channel, endangering the safety and security of shipping and navigation in the Strait of Hormuz, for which we are responsible,” Zarif said.

France imports UK wind energy.

• France To Shut Down Nuclear Plants Due To Heatwave (Montel)

French weather service Meteo France issued a 40C heatwave warning on Monday for 21 regions across France, while utility EDF will shut down nearly 3 GW of nuclear capacity this week amid cooling water issues. Golfech 2 (1.3 GW) on the Garonne river would be stopped from Tuesday at 23:00 until 29 July at 23:59, while Golfech 1 (1.3 GW) would be halted from Wednesday at 02:00 until 29 July at 23:59. Low river flows and high water temperatures can force operators to cut output if it breaches environmental limits. Flows on key French rivers had “significantly” weakened over the last two weeks amid persistent hot and dry weather, the ministry of energy told Montel recently.

The St Alban 1 and 2 (2.6 GW) reactors, meanwhile, saw their output cut over the weekend, and though both reactors are now back online, EDF warned last week it could curb output at its nuclear plants located along the river Rhone – which also included Bugey (3.7 GW) – due to declining flows amid the hot weather. The temperature of the Rhone around St Alban and Tricast in was currently 26C, while it was 23.4C at Bugey, estimates from Montel’s Energy Quantified showed, with 28C deemed unsafe. French TSO RTE expected power demand to peak at 59.4 GW on Thursday and 58.6 GW on Friday, with a surge expected due to an increase in need for cooling.

Ugly. Peat fires are impossible to control.

• Huge Swathes Of The Arctic On Fire, Satellite Images Show (Ind.)

Vast swathes of the Arctic are suffering from “unprecedented” wildfires, new satellite images have revealed. North of the Arctic circle, the high temperatures are facilitating enormous wildfires which are wreaking ecological destruction on a colossal scale. It comes after the world’s hottest June on record which has been followed by a devastating heatwave in the US, with Europe forecast for the same treatment later this week. Satellite images reveal fires across Greenland, Siberia and Alaska, with warm dry conditions following ice melt on the enormous Greenland icesheet commencing a month earlier than average.

Pierre Markuse, a satellite photography expert, posted images showing smoke billowing across massive areas of uninhabited and wild land. The pictures show forest fires and burning peat. They also reveal the extent of the damage the fires leave behind. In Alaska wildfires have already burned more than 1.6 million acres of land. Mark Parrington, a senior scientist at the European Centre for Medium-Range Weather Forecast, said the amount of CO2 emitted by Arctic wildfires between 1 June and 21 July 2019 is around 100 megatonnes and is approaching the entire 2017 fossil fuel CO2 emissions of Belgium.

Satellite image processed by Pierre Markuse showing numerous wildfires burning in Russia just south of the Arctic Circle (Pierre Markuse/Creative Commons)