Paul Klee Girl in Mourning 1939

Note: tomorrow’s a travel day for me. Not sure about a Debt Rattle.

Plus tax relief. Plus support for young families to build new housing. Now compare that to Greece, where over half of young people are unemployed, and where taxes are being raised all the time and pensions cut. That, too, is a German decision. But Greeks don’t get to vote for or against Merkel.

• Merkel Promises Full Employment In Party Platform (R.)

Chancellor Angela Merkel’s conservatives will promise to all but eliminate unemployment in Germany by the year 2025 when they announce their 2017 election campaign platform on Monday. Merkel’s Christian Democrats (CDU) and their Bavarian sister party, the Christian Social Union (CSU), will present their platform for the Sept. 24 election on Monday with other already known policies such as income tax cuts worth 15 billion euros per year and promises to build flats. “A major point is that we’d like to achieve full employment,” Horst Seehofer, CSU chairman and state premier in Bavaria, said on Sunday on his way into a meeting of the conservative leadership. The CDU/CSU consider full employment to be a jobless rate of less than 3% – compared to 5.5% now.

Those “Economic Miracle” levels of unemployment have not been seen in the country since the mid-1970s. The two parties also want to add 15,000 police officers in the 16 federal states. The sister parties, however, will not agree on a joint position on refugees. The CSU wants an upper limit of 200,000 per year, which Merkel and the CDU rejects. “We agree to disagree on that,” Interior Minister Thomas de Maiziere (CDU) said in a Bild am Sonntag newspaper interview, referring to the issue that split the two parties badly since some 1 million refugees arrived in late 2015. The CDU/CSU hold a 16%age point lead over the center-left Social Democrats in opinion polls with a 40-24 lead, but would still need a coalition partner. They rule with the SPD and in the past they have ruled with the Free Democrats (FDP).

[..] Earlier on Sunday, CDU Finance Minister Wolfgang Schaeuble said in a radio interview there could be room to cut taxes by more than the €15 billion already announced. Germany has had balanced budgets since 2014 and the government plans to have no new borrowing in its planning through 2021. Schaeuble told Deutschlandfunk radio he hoped there could be tax relief beyond that already promised €15 billion income tax cut. “We’re planning, all in all, to do more than just correcting the income taxes by €15 billion,” he said, referring to plans to reduce the country’s “cold progression” tax increases – or clandestine tax increases. [..] Schaeuble said aside from fighting “cold progression”, the Christian Democrats want to support young families to build new housing while also supporting research and development for small- to medium-sized companies.

Messing it up as they go along.

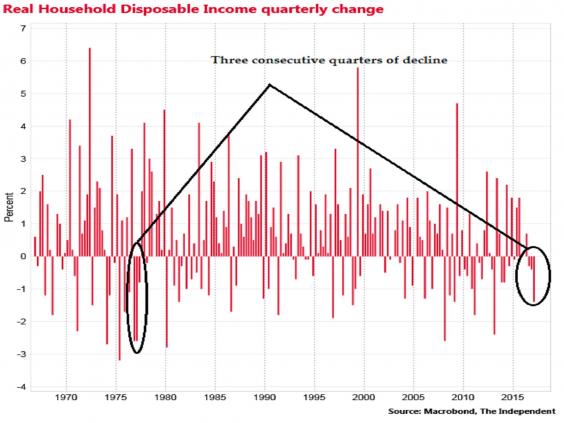

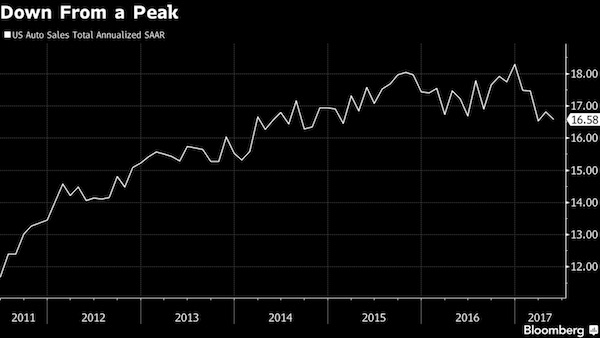

• Theresa May Steps Back From Public Sector Pay Cap Amid Austerity Backlash (Ind.)

Tory austerity appeared to be crumbling at the edges today, as Theresa May further distanced herself from a hated public sector pay freeze. Downing Street said the Government would consider potential wage increases for nurses, police officers and firefighters on a “case by case” basis after a string of top cabinet ministers signalled backing for an end to the blanket 1 per cent cap on all public servants. Environment Secretary Michael Gove said the Government should now listen to the recommendations of salary review bodies ignored by ministers for almost ten years. Education Secretary Justine Greening and Health Secretary Jeremy Hunt are also both reported to be pushing for new deals for teachers and nurses. The Independent reported last week how the Government faced a first ever strike from the Royal College of Nursing over a crisis in the profession.

There has also been mounting pressure from Jeremy Corbyn’s Labour – whose party fought a successful election campaign on an anti-austerity message. A Downing Street spokesman defended the Government’s record, but pointed to potential changes ahead. He said: “Dealing with the economic mess we inherited from Labour has meant hard work and sacrifice, including for public sector workers. That hard work and those tough decisions have helped get our deficit down by three quarters, and public sector pay restraint has helped us protect jobs. “Independent public sector pay review bodies are currently reporting to Government and we are responding to them on a case-by-case basis. While we understand the sacrifice that has been made, we must also ensure we continue to protect jobs and deal with our debts.”

What is the Queen would be received like this?:

“MPs and trade unions vowed to hold the largest demonstrations in UK history if Donald Trump made a state visit to the UK..”

• Donald Trump May Make ‘Sneak’ Visit To UK Within Fortnight (G.)

Anti-Donald Trump protesters are preparing to spring into action at short notice, after it emerged that Downing Street is braced for a snap visit from the US president in the next two weeks. A formal state visit, which was expected to take place over the summer, was postponed last month, amid fears that it could be disrupted by mass protests, despite Theresa May extending the invitation personally when she visited the White House late last year. But Whitehall sources confirmed the government has now been warned that the president could visit Turnberry, his golf resort in Scotland, during his trip to Europe, between attending the G20 summit in Hamburg next weekend and joining celebrations for Bastille Day in France on 14 July.

Trump would be expected to come to Downing Street to meet the prime minister for informal talks as part of any such visit – though final confirmation would be likely to be given with just 24 hours’ notice, to minimise the risk of disruption. May invited Trump to Britain seven days after his inauguration when she became the first foreign leader to visit him in the White House. In February activists, MPs and trade unions vowed to hold the largest demonstrations in UK history if Donald Trump made a state visit to the UK, forming The Stop Trump coalition, even hiring a permanent staff member. In early June, just after the UK general election, it emerged that the US president had told May that he did not want to go ahead with the state visit to Britain until the British public supports his coming, fearing large-scale demonstrations.

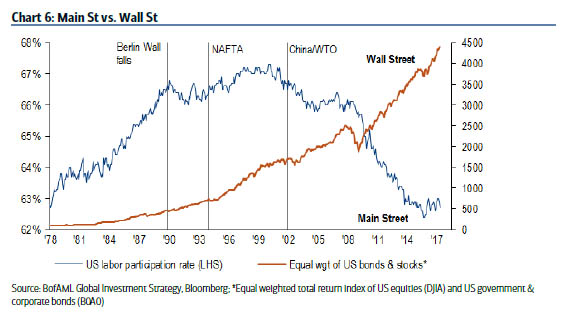

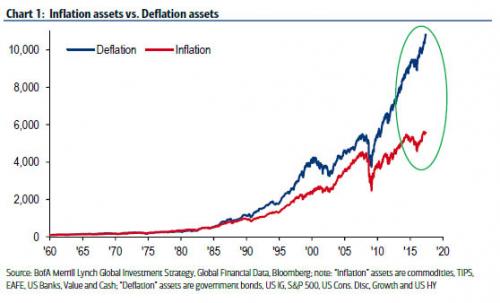

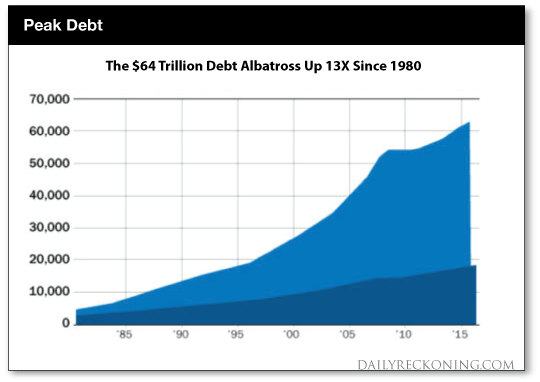

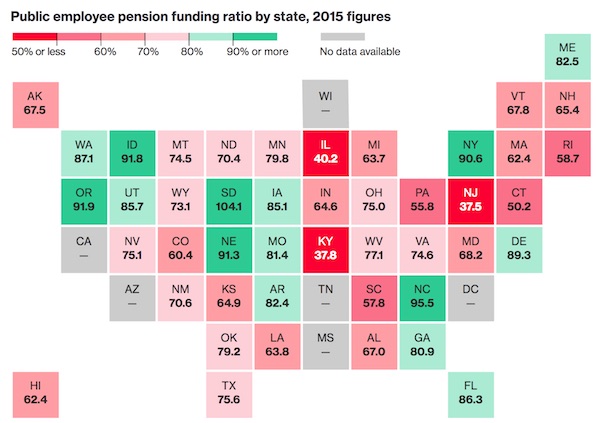

How about you borrow some more, guys? Or, you know, come clean and tell people their pensions are shot.

• Maine, New Jersey Lawmakers Scramble To End Partial Government Shutdowns (R.)

Partial government shutdowns in Maine and New Jersey entered a second day on Sunday as lawmakers returned to their respective state capitals in a bid to break budget impasses that have led to the suspension of many nonessential services. In Maine, a bipartisan legislative committee met in Augusta in hopes of breaking a stalemate between Republican Governor Paul LePage and Democratic lawmakers. The shutdown came after LePage threatened to veto a compromise reached by lawmakers in the state’s $7.055 billion, two-year budget. In New Jersey, the legislature was due to reconvene to resolve a political fight over a controversial bill that Governor Chris Christie said must be passed alongside the state’s budget.

After House Republicans in Maine voted to reject a compromise deal on Saturday, the Bangor Daily News reported that Republican Minority Leader Ken Fredette presented a $7.1 billion plan he said could get the governor’s approval, but some Democrats noted that was costlier than the rejected compromise. “The Speaker thinks it is unconscionable that Maine doesn’t have a budget, especially leading into the holiday weekend,” Mary-Erin Casale, a spokeswoman for Democratic House Speaker Sara Gideon, said Sunday morning. If the budget committee meeting on Sunday in Augusta agrees on a deal, the measure would go to the full legislature. LePage has insisted on a budget with deeper spending cuts than those contemplated by lawmakers and has promised to veto any spending plan that raises taxes.

Sign of things to come.

• Illinois House Approves Major Income Tax Hike (CTrib)

The Illinois House on Sunday approved a major income tax increase as more than a dozen Republicans broke ranks with Gov. Bruce Rauner amid the intense pressure of a budget impasse that’s entered its third year. The Republican governor immediately vowed to veto the measure, saying Democratic House Speaker Michael Madigan was “protecting the special interests and refusing to reform the status quo.” The measure, which needed 71 votes to pass and got 72, is designed to start digging the state out of a morass left by the lengthy stalemate. Madigan, in a statement, praised the action as “a crucial step toward reaching a compromise that ends the budget crisis by passing a fully funded state budget in a bipartisan way.”

The tax hike now heads to the Senate, but whether there will be enough votes to send it to Rauner’s desk is in question. When the Senate approved its own tax hike in late May, no Republicans voted for it and several Democrats voted against it. Senators return to the Capitol on Monday. The crucial vote in the House was the big story Sunday, though. Ultimately, pressure that had built up in districts across the state moved enough Republicans to defy the governor. With state government operating without a budget for two full years, public universities risk losing their accreditation, social service providers are closing their doors and layoffs of road construction workers are imminent.

Adding to lawmakers’ anxiety was a promised downgrade of the state’s credit rating to junk status, which could spike the cost of borrowing at a time when the state has $15 billion in unpaid bills. Left out of the House budget package was a plan for dealing with the unpaid bills, though both sides generally agree that some amount of borrowing will be needed. Rauner, a former private equity specialist from Winnetka, had spent tens of millions of dollars on legislative campaigns and TV ads to prop up the Illinois Republican Party as a counterweight to Madigan and his labor union allies. And Republican lawmakers largely had stuck by their governor — until Sunday. [..] The proposal mirrors a plan the Senate passed earlier this year and calls for raising the personal income tax rate from the current 3.75% to 4.95%, which would generate roughly $4.3 billion. An increase in the corporate income tax rate from 5.25% to 7% would bring in another $460 million.

Bearish on the dollar? You sure?

• China Inc’s $7.8 Billion of Dividend Payments Will Stress the Yuan (BBG)

The yuan’s rebound may be undermined by a seasonal hunt for dollars as Chinese companies prepare to pay dividends to shareholders overseas. Demand for the greenback and other currencies will peak at $7.8 billion in July, a substantial sum considering that local lenders settled an average of $11.8 billion in foreign-exchange for clients in the first five months of 2017. China’s currency reserves have shrunk every July in the last three years, with former regulator Guan Tao saying last week that demand for foreign-exchange surges in this period. China’s exchange rate has turned more volatile in the past two months, climbing the most in more than a year in May and then declining in June before suspected central bank intervention spurred a rally.

Goldman Sachs warned capital outflows have picked up, while recent data suggest the economy is showing signs of slowing as an official deleveraging drive crimps spending. “The need for dividend payouts will pressure the yuan and may pressure a recent increase in China’s foreign reserves,” said Xia Le at BBVA. “The yuan’s advance in the past few days is not sustainable – short-term factors such as dividend payments and long-term ones like capital outflows will work together to push the currency weaker in the coming months.” Offshore-listed Chinese firms need to pay a combined $16 billion of dividends in foreign exchange in the three months through August. That includes $2.4 billion in June and $5.9 billion for August.

Abe will shuffle his cabinet to deflect attention from himself. But he’s in trouble.

• Japan PM Abe’s Party Suffers Historic Defeat In Tokyo Election (R.)

Prime Minister Shinzo Abe’s Liberal Democratic Party suffered an historic defeat in an election in the Japanese capital on Sunday, signaling trouble ahead for the premier, who has suffered from slumping support because of a favoritism scandal. On the surface, the Tokyo Metropolitan assembly election was a referendum on Governor Yuriko Koike’s year in office, but the dismal showing for Abe’s party is also a stinging rebuke of his 4-1/2-year-old administration. Koike’s Tokyo Citizens First party and its allies took 79 seats in the 127-seat assembly. The LDP won a mere 23, its worst-ever results, compared with 57 before the election. “We must recognize this as an historic defeat,” former defense minister Shigeru Ishiba was quoted as saying by NHK.

“Rather than a victory for Tokyo Citizens First, this is a defeat for the LDP,” said Ishiba, who is widely seen as an Abe rival within the ruling party. Past Tokyo elections have been bellwethers for national trends. A 2009 Tokyo poll in which the LDP won just 38 seats was followed by its defeat in a general election that year, although this time no lower house poll need be held until late 2018. [..] “We must accept the results humbly,” said Hakubun Shimomura, a close Abe ally and head of the LDP’s Tokyo chapter. “The voters have handed down an extremely severe verdict.” Abe is expected to reshuffle his cabinet in coming months in an effort to repair his damaged ratings, a step often taken by beleaguered leaders but one that can backfire if novice ministers become embroiled in scandals or commit gaffes.

If Kuroda’s out of ideas, that means Abenomics has failed. And that in turn means Abe should go too.

• Abe’s Mentor Says BOJ Needs Fresh Face as Kuroda Is Out of Ideas (BBG)

Haruhiko Kuroda shouldn’t serve another term as governor of the Bank of Japan because the central bank will need fresh ideas as it moves toward exiting years of unprecedented monetary easing, according to an adviser to the prime minister. “An exit will surely come up within the next five years and we need someone who can prepare for it,” said Nobuyuki Nakahara, a former BOJ board member. “He will fall into inertia and struggle to come up with bold new ideas. It’s the same in the private sector when a corporate president stays too long,” he said. Nakahara’s comments come amid growing speculation among private economists that Prime Minister Shinzo Abe will reappoint Kuroda, 72, after his five-year term ends in April.

Nakahara, who was close to Abe’s father, Shintaro, has known the prime minister since he was young and has advised him for years. In an interview on June 29, Nakahara, one of the architects of Abenomics, said he didn’t have any replacements for Kuroda in mind. But he said change at the top of the BOJ would be good because the government and central bank should strike a new accord and form a new strategy for the next five years. The current accord, issued in January 2013, says the central bank should aim for price stability at an annual inflation rate of 2%, while the government is responsible for strengthening competitiveness and the nation’s growth potential. More than four years later, the inflation target remains far off.

[..] Kuroda’s propensity to surprise markets with innovative ideas has been waning, according to Nakahara. And the strains of his record easing are particularly evident in the bank’s purchases of exchange-traded funds, which are distorting the market, he said. “They can’t keep holding ETFs forever,” he said. Nakahara offered a possible solution. How about getting companies to buy back their own shares from the BOJ? Or the BOJ could tell companies it plans to sell the shares on the market. If the companies need funding for share buybacks, the central bank could help with a loan-support program. “That’s my secret strategy,” he said.

Really, close Al Jazeera? What an awful signal that would be. Why not close CNN then?!

• Saudi Arabia, Allies Give Qatar Two More Days To Accept Demands (R.)

Four Arab states that accuse Qatar of supporting terrorism agreed to extend until Tuesday a deadline for Doha to comply with a list of demands, as U.S. President Donald Trump voiced concerns about the dispute to both sides. Qatar has called the charges baseless and says the stiff demands – including closing Qatar-based al Jazeera TV and ejecting Turkish troops based there – are so draconian that they appear designed to be rejected. Saudi Arabia, Bahrain, Egypt and the United Arab Emirates (UAE) have raised the possibility of further sanctions against Qatar if it does not comply with the 13 demands presented to Doha through mediator Kuwait. They have not specified what further sanctions they could impose on Doha, but commercial bankers in the region believe that Saudi, Emirati and Bahraini banks might receive official guidance to pull deposits and interbank loans from Qatar.

According to a joint statement on Saudi state news agency SPA, the four countries agreed to a request by Kuwait to extend by 48 hours Sunday’s deadline for compliance. Foreign ministers from the four countries will meet in Cairo on Wednesday to discuss Qatar, Egypt said on Sunday. Kuwait state media said its Emir Sheikh Sabah Al-Ahmad Al-Jaber Al-Sabah had received a response by Qatar to the demands. It did not elaborate. The four states cut diplomatic and commercial ties with Qatar on June 5, accusing it of supporting terrorism, meddling in their internal affairs and cosying up to regional adversary Iran, all of which Qatar denies. Mediation efforts, including by the United States, have been fruitless. Trump spoke separately to the leaders of Saudi Arabia, Qatar and the Crown Prince of Abu Dhabi in the UAE to discuss his “concerns about the ongoing dispute”, the White House said.

For history buffs.

• The Crash of 1929 (Jesse’s Café/PBS)

“…people believed that everything was going to be great always, always. There was a feeling of optimism in the air that you cannot even describe today.” “There was great hope. America came out of World War I with the economy intact. We were the only strong country in the world. The dollar was king. We had a very popular president in the middle of the decade, Calvin Coolidge, and an even more popular one elected in 1928, Herbert Hoover. So things looked pretty good.” “The economy was changing in this new America. It was the dawn of the consumer revolution. New inventions, mass marketing, factories turning out amazing products like radios, rayon, air conditioners, underarm deodorant…One of the most wondrous inventions of the age was consumer credit. Before 1920, the average worker couldn’t borrow money. By 1929, “buy now, pay later” had become a way of life.”

“Wall Street got the credit for this prosperity and Wall Street was dominated by just a small group of wealthy men. Rarely in the history of this nation had so much raw power been concentrated in the hands of a few businessmen…” “One of the most common tactics was to manipulate the price of a particular stock, a stock like Radio Corporation of America…Wealthy investors would pool their money in a secret agreement to buy a stock, inflate its price and then sell it to an unsuspecting public. Most stocks in the 1920s were regularly manipulated by insiders ” “I would say that practically all the financial journals were on the take. This includes reporters for The Wall Street Journal, The New York Times, The Herald-Tribune, you name it. So if you were a pool operator, you’d call your friend at The Times and say, “Look, Charlie, there’s an envelope waiting for you here and we think that perhaps you should write something nice about RCA.”

And Charlie would write something nice about RCA. A publicity man called A. Newton Plummer had canceled checks from practically every major journalist in New York City… Then, they would begin to — what was called “painting the tape” and they would make the stock look exciting. They would trade among themselves and you’d see these big prints on RCA and people will say, “Oh, it looks as though that stock is being accumulated. Now, if they are behind it, you want to join them, so you go out and you buy stock also. Now, what’s happening is the stock goes from 10 to 15 to 20 and now, it’s at 20 and you start buying, other people start buying at 30, 40. The original group, the pool, they’ve stopped buying. They’re selling you the stock. It’s now 50 and they’re out of it. And what happens, of course, is the stock collapses.”

Prediction: the EU will offer more money. They simply don’t understand that some things are not about money.

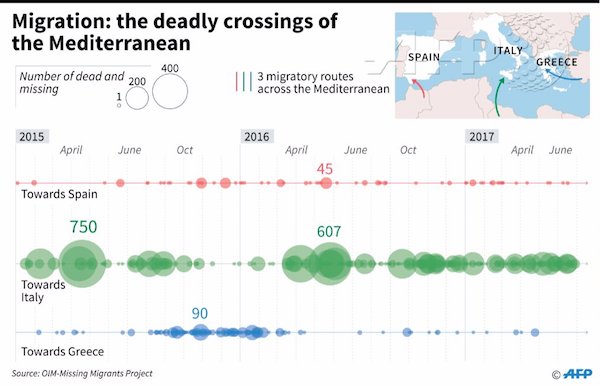

• Italy Urges EU Ports To Take Migrants As Pressure Builds (AFP)

The French and German interior ministers met with their Italian counterpart Marco Minniti in Paris on Sunday to discuss a “coordinated response” to Italy’s migrant crisis, hours after Minniti had called on other European countries to open their ports to rescue ships. The working dinner at the French interior ministry – also attended by EU Commissioner for Refugees Dimitris Avramopoulos – was aimed at finding “a coordinated and concerted response to the migrant flux in the central Mediterranean (route) and see how to better help the Italians,” a source close the talks said. The four-way talks between Minniti, Thomas de Maiziere of Germany, Gerard Collomb of France and Avramopoulos will also prepare them for EU talks in Tallinn this week. “The talks went off very well,” a member of the Italian delegation told AFP after the Paris meeting, with the “Italian proposals being discussed”.

“We are under enormous pressure,” Minniti had said earlier Sunday in an interview with Il Messaggero. With arrivals in Italy up nearly 19% over the same period last year, Rome has threatened to close its ports to privately-funded aid boats or insist that funding be cut to EU countries which fail to help. “There are NGO ships, Sophia and Frontex boats, Italian coast guard vessels” saving migrants i the Mediterranean, Minniti said, referring to the aid boats as well as vessels deployed under EU border security missions. “They are sailing under the flags of various European countries. If the only ports where refugees are taken to are Italian, something is not working. This is the heart of the question,” he said. “I am a europhile and I would be proud if even one vessel, instead of arriving in Italy, went to another European port. It would not resolve Italy’s problem, but it would be an extraordinary signal” of support, he said.

I’ve often said that the Congo is perhaps richer in resources than any other country. It should be prosperous, but instead it ranks 227th out of 230 countries for GDP per capita. That’s our doing.

From July 5, see documentary at https://rtd.rt.com/films/congo-my-precious/

• ‘Our Future Is Slavery, The West Gets Everything’ – Congo (RT)

RT Documentary travels to the vast, landlocked Democratic Republic of Congo, prized for its mineral resources, but plagued by centuries of colonial rule, dictatorship, civil wars and lawlessness, and meets people trying to make a living in one of the most desperate places on Earth. The documentary crew’s key to understanding the country, seven times the size of Germany, was Bernard Kalume Buleri, born in 1960, the same year DRC was granted its independence from Belgium. Buleri served as an interpreter, guide, and finally the hero and symbol of the country, having been a direct participant in some of its bloodiest chapters. “I can’t say that the Congolese, we are in control of our destiny. No, because the ones who benefit from our minerals are not the local population, but Western countries are the ones who are taking everything.

They make themselves rich, while we are getting poorer and poorer,” says Buleri. The country of almost 80 million is one of the world’s largest exporters of diamonds, coltan – essential for electronics – and has massive deposits of copper, tin and cobalt. “I’m afraid even for my children. Because they will continue in this system to be slaves forever. We’ll never be powerful enough to challenge the Western countries. So, the future will be the future of slaves,” Buleri continues. There is plenty of blame to go around for the predicament of what is also a fertile and scenic land. With almost no educated elite, DRC was poorly-prepared for its separation from Belgian rule, now best remembered for the atrocity-filled reign of King Leopold II, which may have killed as many as half of the country’s population.

The vacuum was filled by the archetype-setting African kleptocrat Mobutu Sese Seko, who ruled the country for more than three decades, until he was deposed in 1997, plunging Africa into a series of continent-wide conflicts that may have resulted in as many as 5 million deaths through violence, starvation and disease. The country’s below-ground wealth means that it was never left alone for long enough to reform and wean itself off its reliance on metals and gems – the widely-mentioned “mineral curse.” The mines the RT crew passes are now owned by local warlords, chiefs and officials, with exports mostly going to China. [..] Millions of locals – perhaps as many as one-fifth of the adult population – are employed in what is known as artisanal mining, inefficient small-scale prospecting with simple handheld tools, with no safety measures or guaranteed wages. But for a country that ranks 227th out of 230 for GDP per capita, according to World Bank data, any job at all is a matter of survival.