Harris&Ewing Calvin Coolidge Inaugural Ball. March 4, Washington DC 1925

We’ve warned on just this for a long time. The US oil casino.

“Senior unsecured bondholders were hammered even more, averaging just 6 cents on the dollar.”

• Energy Exploration & Production Debt Recoveries Hit ‘Catastrophic’ Level (BBG)

Creditors of energy exploration and production companies that went bankrupt last year recouped less than half the usual amount for their claims, and 2016 is shaping up just as bad, according to Moody’s Investors Service. Recovery rates for 15 U.S. E&P bankruptcies averaged a “catastrophic” 21% last year, well below the historical average of 59%, Moody’s said in a report released Monday. Senior unsecured bondholders were hammered even more, averaging just 6 cents on the dollar. Collectively, the debacle could be worse than the telecom industry’s collapse in the early 2000s, measured by both the number of companies that go bust and the recoveries, Moody’s said.

Many of the E&P firms that went bankrupt in 2015 were smaller companies with less flexibility to maneuver as energy prices crumbled, while larger companies were able to stave off failure with debt exchanges and new second-lien issuance, analysts led by David Keisman wrote. But more than half of those swaps were followed by bankruptcy, according to the report. “I don’t expect the recoveries for the companies that went bankrupt in the first half of 2016 to be any better,” Moody’s analyst Amol Joshi said in an interview. “The worst may be behind them, but the sector still remains quite stressed.”

So who’s going to jump in to save the lenders in the “worst bust of any industry this century”?

• Oil Bankruptcies Leave Lenders With ‘Catastrophic’ Recovery Rate (BBG)

U.S. oil bankruptcies haven’t been this “catastrophic” for lenders in a long time, in what may be the worst bust of any industry this century, according to Moody’s Investors Service. Creditors are recovering an average 21% of what they lent, compared with about 59% in past decades, the credit-rating agency said Monday in a report that looks into lending to 15 exploration and production companies that filed for bankruptcy protection in 2015. That may be on par with, or worse than, the telecommunications industry collapse in 2001 and 2002, the study led by David Keisman said. High-yield bonds recovered a mere 6%, compared to 30% in previous years going back to 1987.

Defaults in the oil and natural gas industry have been rising through a market slump that has exceeded two years as companies lacked the cash to make interest payments on their debt. Bankruptcies among U.S. producers so far this year are about twice the number among companies rated by Moody’s in all of 2015, the report said. The oil and gas figures have helped propel U.S. corporate defaults to the highest since 2009. Less than half of the companies that negotiated distressed-debt exchanges in 2015 to try to stave off bankruptcy succeeded, the analysts wrote.

The opposite of what was a popular view until recently, and probably still is among many.

• Strategist: If Trump Wins, ‘The U.S. Economy Would Take Off in a Big Way’ (BBG)

Financial markets are starting to “wake up” to the possibility of a Donald Trump presidency in the wake of Hillary Clinton’s recent health concerns and tightening polls, according to Bank of America Merrill Lynch Head of Global Rates and Currencies Research David Woo. He says investors are still underestimating the real estate mogul’s chances of ascending to the highest office in the land, and what a seismic change this could be for markets and the world’s largest economy. While the outsider candidate poses a risk to one of 2016’s hot investment strategies, he could prove to be a massive boost for the greenback and U.S. economy.

“The U.S. economy would take off in a big way” if Trump were elected and Republicans control both legislative houses next year, said Woo, thanks to the fiscal stimulus that Trump would enact. Trump has pledged to spend at least twice as much as the Democratic nominee on infrastructure and also enact a massive tax cut, two measures that would entail a renewed issuance of Treasuries. Against this backdrop, the greenback would strengthen and U.S. Treasury yields would rise, a view shared by Woo and other fixed income veterans as well.

Spot on from Stockman.

• A Homerun For The Donald – Attack The Fed’s War On Americans (Stockman)

The central banks have gone so far off the deep-end with financial price manipulation that it is only a matter of time before some astute politician comes after them with all barrels blasting. As a matter of fact, that appears to be exactly what Donald Trump unloaded on bubble vision this morning: By keeping interest rates low, the Fed has created a “false stock market,” Donald Trump argued in a wide-ranging CNBC interview, exclaiming that Fed Chair Janet Yellen and central bank policymakers are very political, and should be “ashamed” of what they’re doing to the country… He’s completely correct.

After all, they are crushing real wages with their 2% inflation targeting; destroying savers with NIRP and sub-zero rates; and burying unborn taxpayers in monumental debts that today’s politicians are pleased to issue with reckless abandon because the short-run carry cost is nil. Interest on the Uncle Sam’s $19.4 trillion of debt, for example, is easily $500 billion lower than its true economic cost based on a normal yield after inflation and taxes and elimination of the phony $100 billion per year in so-called Fed “profits” that are booked by the treasury as negative interest expense. Alas, when interest rates eventually normalize, the Treasury’s debt service costs will soar by hundreds of billions.

At the same time, the entirety of the Fed’s “profits”, which are conjured from thin air because it buys interest-yielding government and GSE debt with printing press liabilities which cost virtually nothing, will disappear. That’s because it will be forced to take reserve charges for giant principal losses on the falling prices of its $4.5 billion portfolio of government and GSE bonds. At that moment, the long-abused citizens of Flyover America, who have already been clobbered as savers and wage earners, will get hit with the triple whammy of soaring Federal tax bills. And this is not a matter of if or even when; it’s really just a question of how soon. When it comes to the establishment’s monetary lunacy, of course, Mario Draghi’s is always leading the charge.

So just consider what has been happening after his inartful punt during last week’s ECB meeting. First, the casino cheerleaders have insisted that there is nothing to sweat about with respect to the incredible anomaly that now plagues the euro-bond markets. To wit, socialist Europe has apparently not issued enough qualifying debt (with a yield not below the negative 0.4% threshold) to fill the ECB’s $90 billion per month purchase target. The solution is real simple according to Draghi’s acolytes in the casino. In addition to lowering the bond yield threshold as deep into the subzero freezer as necessary, they have proffered an even better solution. Just buy up the stock market, too!

What, that was the highly anticipated speech?

• Fed Looks Unlikely To Hike Next Week After Brainard Warning (R.)

The Federal Reserve should avoid removing support for the U.S. economy too quickly, Fed Governor Lael Brainard said on Monday in comments that solidified the view the central bank would leave interest rates unchanged next week. Brainard said she wanted to see a stronger trend in U.S. consumer spending and evidence of rising inflation before the Fed raises rates, and that the United States still looked vulnerable to economic weakness abroad. “Today’s new normal counsels prudence in the removal of policy accommodation,” Brainard, one of six permanent voters on the Fed’s rate-setting committee, told the Chicago Council on Global Affairs. She said the U.S. labor market was not yet at full strength, which means “the case to tighten policy preemptively is less compelling.”

Brainard did not comment on the specific timing of future rate policy changes but she held firm in arguing for caution in what could be the last word from a Fed policymaker before the central bank’s Sept. 20-21 meeting. Policymakers will go into the meeting divided, with some concerned current low rates will fuel a surge in inflation while another camp, which includes Brainard, has argued that the Fed should not rush to raise rates. Many other policymakers think the U.S. job market is near full strength and Fed Chair Janet Yellen argued in July the case for rate increases has strengthened. “I think circumstances call for a lively discussion next week,” said Atlanta Fed President Dennis Lockhart, who will not be a voter at next week’s policy review but will participate in discussions.

How predictable would you like it?

• The Expansion in Developed Markets Might Be Over (BBG)

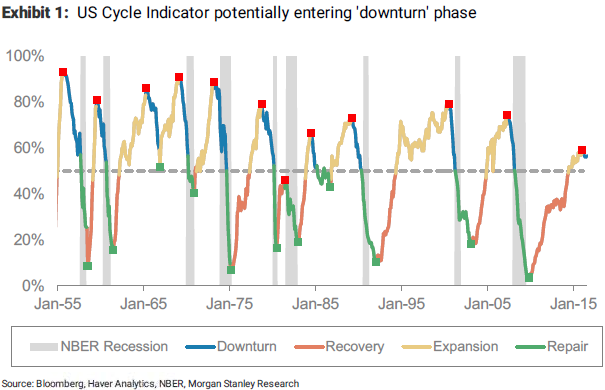

As traders are settling back into their routine after the slow summer months, things have started taking a turn for the worse in global markets. Now one indicator is even pointing to the end of the expansion in developed markets. According to new research from Morgan Stanley, so many developed countries are showing enough signs of slowing, that its cycle indicators — which take macro, credit and corporate factors into account — are leading analysts led by Chief Cross-Asset Strategist Andrew Sheets to conclude that a downturn could be coming sooner than some may think.

“The Morgan Stanley Cycle Indicators across the U.S., eurozone and Japan have stalled, highlighting the increasing risk that we have moved from ‘expansion’ to ‘downturn’ in [developed markets], even as our economics team flags upside risks to its macro outlook,” the team said in a note published on Sundayy. The team points out that if this is in fact the start of a cycle change, it would represent the shallowest recovery for the U.S. in more than 30 years. Here’s a look how these cycles have played out in the past, with recessions shaded.

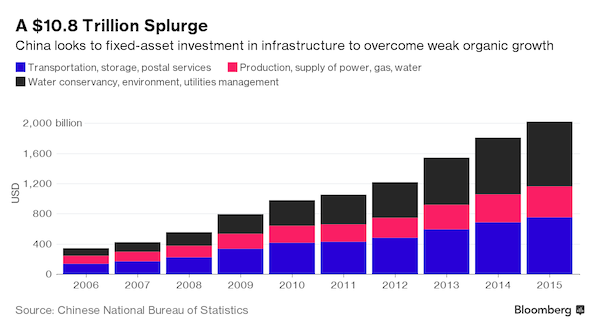

“..for over half of the infrastructure investments in China made in the last three decades the costs are larger than the benefits they generate..”

• China’s Infrastructure Planners are on a Road to Nowhere (BBG)

For all the roads, bridges and railways that China builds every year in an effort to keep the economy humming, the massive splurge may not be having the desired effect. That’s because more than half of China’s infrastructure investment has destroyed economic value instead of generating it, according to a study from the University of Oxford’s Saïd Business School. “The evidence suggests that for over half of the infrastructure investments in China made in the last three decades the costs are larger than the benefits they generate,” according to Atif Ansar, one of the study’s co-authors.

What’s more, unless China shifts its focus to fewer and higher quality types of public works that leave a positive legacy “the country is headed for an infrastructure-led national financial and economic crisis, which is likely also to be a crisis for the international economy,” according to the analysis that’s published in the Oxford Review of Economic Policy. China spent more than $10.8 trillion in infrastructure in the last decade alone, according to Bloomberg calculations based on official data of investment in categories such as transport, storage, power supply and water conservation. The Oxford study’s findings jar with views that China’s aggressive government-led infrastructure spending is vital to keep growth on track.

Researchers examined 21 large rail projects and 74 road projects whose starting dates ranged from 1984 to 2008. They then compared the economic value of those to 806 transport projects built in rich democracies. Instead of finding a long lasting, positive economic legacy, the Oxford study found that 75% of the transport projects in China exceeded budget. While one third of the roads built were congested, 41% of them have low usage. Both extremes are equally undesirable because “large unused capacity equals waste, as does too little capacity,” according to the paper. The buildup has also exacerbated China’s swelling debt as cost overruns equal about a third of the nation’s $28.2 trillion debt mountain, according to the paper.

Once more, why the euro will fail: All eurozone countries get punished for not being enough like Germany. But the only way Germany can be Germany is for the others not to be.

• Michael Pettis: Surplus Trade Statements by Schäuble “Utter Lunacy” (Mish)

A few days ago I pinged global trade expert Michael Pettis with my post Germany’s Finance Minister Blames ECB For German Trade Surplus; Why the Eurozone Will Destruct. His reply was interesting but not at all unexpected. Pettis labeled Wolfgang Schaeuble’s comments “utter lunacy”. Germany has no plans to reduce its export surplus, Finance Minister Wolfgang Schaeuble said on Friday, as the ECB has not changed its monetary policy which has led to a weaker euro which in turn boosts German exports. “Even before the European Central Bank decided its policies of unusual monetary policy, which also led to the euro exchange rate falling significantly, I said that we will increase German export surplus,” Schaueble told reporters. When asked whether he had any plans to decrease Germany’s export surplus, Schaeuble said: “I haven’t heard that the ECB is changing its monetary policy.”

Pettis Comments “What utter lunacy. It is one thing to defend the existing surplus by pretending to believe that it was not caused by income distortions at home but rather by foreign laziness, but to say that it is German policy to grow the surplus further is outrageous. Now that they have bankrupted Europe, and developing countries are in trouble, who but the US can possibly be forced into absorbing it? If the US were ever to decide that it cannot continuing absorbing everyone else’s deficient demand at the expense of becoming more like peripheral Europe, the consequences for Germany (and China and Japan) would be devastating.”

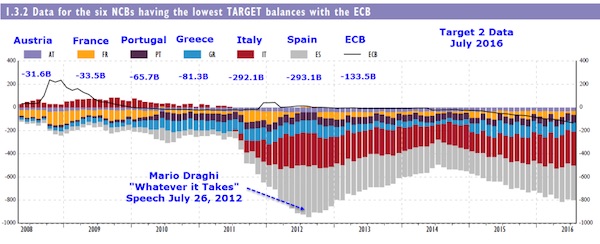

Target2 stands for Trans-European Automated Real-time Gross Settlement System. It is a reflection of capital flight from the “Club-Med” countries in Southern Europe (Greece, Spain, and Italy) to banks in Northern Europe. [..] Target2 is also a measure of capital flight. The Italian banking system is effectively bankrupt, and outflows from Italy have been picking up.

Six Largest Target2 Deficit Countries

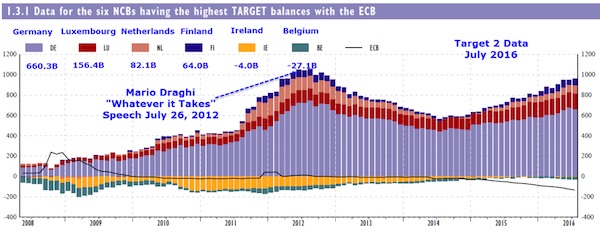

Six Largest Target2 Creditor Countries

Look closely at the six countries with the highest balances. Only four countries are positive: Germany, Luxembourg, the Netherlands, and Finland. The six largest deficit countries owe a collective 797.3 billion euros to the four creditor countries. The ECB itself is in hock for another 133.5 billion euros. Monetary policy can help external balances but it cannot fix internal target2 balances. Every county in the Eurozone is stuck with the Euro and the ECB’s interest rates whether it makes any sense or not (and it doesn’t). Rates suitable for Germany were not suitable for Spain, Ireland, Greece, and many other countries.

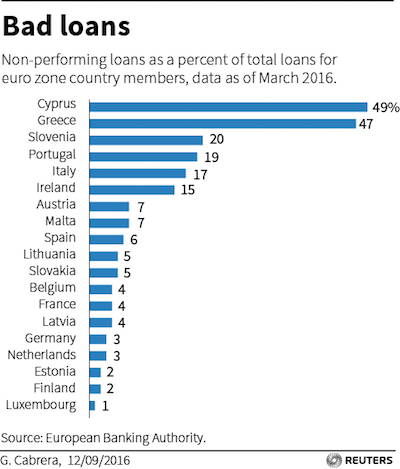

This sounds like the ECB is desperate (and fighting Germany). Unlike the US, European banks often still have 10+ year-old bad loans on their books, and now they get 3+ more years to get rid of them. Meanwhile the same ECB, through its NIRP and ZIRP policies, makes the banks bleed more cash. There’s no way this can end well.

• ECB Lets Banks Offload Bad Loans At Own Speed (R.)

Euro zone banks will get to set their own targets for cutting the €900 billion of bad loans left over from the financial crisis, facing sanctions only if they fall way short of the mark, new guidance by the ECB showed on Monday. Banks in weak economies such as Greece, Portugal and Italy are still struggling under the burden of unpaid loans extended before the crisis, which reduce their ability to lend and undermine investor confidence. The ECB, as the euro zone’s top bank supervisor, is trying to get banks to manage down that mountain of soured credit. But it cannot push them too hard if it doesn’t want them to incur hefty losses, which would also strangle lending. Under new guidance disclosed on Monday, banks will be asked to set numerical targets for the levels of non-performing loans they aim to reach in one and three years, and follow a number of other guidelines.

Failure to comply may lead to so-called ‘supervisory measures’ by the ECB, such as higher capital requirements. But the ECB said the new guidelines would be non-binding and only “significant” deviations from them may trigger action, while solving the problem would take longer than three years in many cases. [..] When the ECB disclosed plans to work on new guidelines for non-performing loans in January, some banks worried that it would force a fire sale of those assets. That would push down their selling price and hurt bank profits. However, the guidelines showed banks will be given three years or, in many cases, longer. “We chose a three-year target because most banks have a three-year projection in their business plans … for a number of banks, this will not be the end of the story, it will likely take longer,” Donnery said.

How the EU has designed the impossibility of a Greek recovery. If you kill consumption, you kill the economy and eventually the society. A whole range of food products went from 13% VAT to 24% since last summer. In the same time-frame pensions and wages were cut multiple times.

• Greek Prices Keep Rising as Household Incomes Keep Shrinking (Kath.)

While households’ disposable income keeps shrinking, consumers also face the constant increase of prices in dozens of commodities, particularly food products, making Greece one of the most expensive countries in the EU in this domain. Successive value-added tax hikes, and particularly one imposed last summer shifting a series of food commodities from the 13% to the 23% bracket and now to 24%, have led to a decline in consumption. This means that the industry and retail commerce, in turn, raise their prices in order to offset losses from the domestic market’s downturn. Although Greece has experienced deflation in the last three-and-a-half years, data published by Eurostat are revealing:

Food prices in Greece were up 2.3% compared with the same month in 2015, while the respective rise across the eurozone averaged at 0.9%. The hikes in fruit, vegetables and various vegetable oils are reminiscent of periods when the Greek economy suffered under the burden of inflationary pressures a few decades ago. Vegetable oils, including olive oil that is dominant in Greek households, were sold at a price 9.5% higher than a year earlier, while the rise in the eurozone amounted to 2.9%. Fruit prices grew 4.2% year-on-year, just below the eurozone average of 4.9%, while vegetable prices went up 7% against 5.6% in the eurozone. The prices of bread and cereals increased 2% on an annual basis, whereas in the eurozone the hike was no more than 0.2%.

“..barring any sudden change of tack the situation looks set to escalate.”

• US Funds And Iceland Square Up Over Bond Freeze (R.)

A group of U.S. funds battling with Iceland after it froze $1.4 billion of the government’s bonds they own are limbering up for a legal fight if Reykjavik continues to stonewall efforts at a deal. While the players and amounts of money involved mean the situation is unlikely to develop into an years-long Argentina-style standoff, it is overshadowing Iceland’s comeback from one of the world’s most extreme banking crises. A few weeks ago it took a big step in dismantling its 8-year old capital controls and the smooth progress so far has earned the country a double-notch credit rating upgrade and has been driving up its currency.

One headache, however, is that it remains deadlocked with funds Autonomy Capital, Eaton Vance, Loomis Sayles and Discovery Capital Management – whose frozen bonds are worth roughly 10% of Iceland’s annual economic output – after they spurned what they saw as low-ball government offer to unlock them back in June. Two of the funds, Autonomy and Eaton Vance, have filed a complaint to the European Free Trade Association (EFTA) in Brussels which is ongoing, saying that the quarantining of their bonds amounts to a discrimination against foreign investors. Autonomy has made a separate approach to a court in Iceland. Iceland rejects the claims saying that some domestic investors are also affected and that the moves are necessary to allow a smooth lifting of capital controls, so barring any sudden change of tack the situation looks set to escalate.

[..] One of the world’s top sovereign debt lawyers, Cleary Gottlieb’s Lee Buchheit, who represented Iceland’s government in cases over its failed banks but says he is not involved in the current squabble, is skeptical of the funds’ legal chances. “I don’t want to predict the outcome but it is going to be a challenge I think for these people to mount an effective legal complaint before EFTA here,” he said, adding that it would also be difficult to pursue the case in another country’s courts. “Anyone challenging what they have done is going to have to say that it was unnecessary or disproportionate.” “And if you have got the IMF saying: no, what they are doing is perfectly necessary and perfectly proportional to protect their balance of payments and exchange rate, it is going to be a tough argument to make.”

Let’s hope Australians take this to heart.

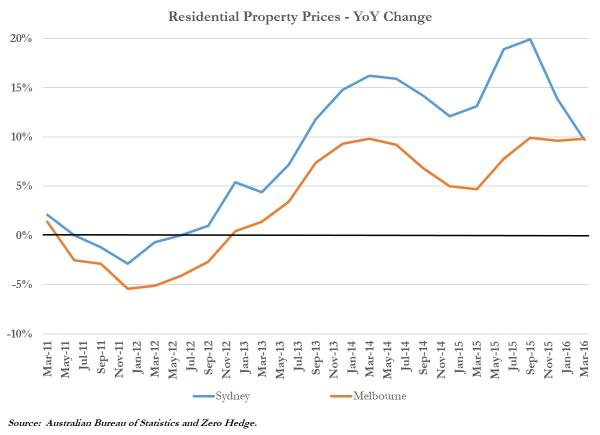

• Australia 6 Weeks From A Housing Collapse, US Report Warns (ZH)

U.S. based think tank International Strategic Studies Association (ISSA), is warning that similar efforts to restrict Chinese investment in Australian real estate could send prices tumbling there as well. In speaking with news.com.au, Greg Copley, President of ISSA, predicted that Australia has about 6 weeks before real estate prices start to collapse.

“We estimate that Australia has about six weeks or so to turn this situation around, otherwise there would be a massive hit on property valuations and the building trades.” The urgency is, I believe, based on the fact that this is about how long it will take for the banks’ policies to start switching off a lot of existing and planned contracts for Australian properties.” “The banks clearly believe Australian real estate values will decline, so they are attempting to avoid that risk. They’ve learned from the US collapse that seizing real estate collateral is a no-win scenario when the volume is great and the market slow.” “In so doing, they precipitate the market collapse but are less exposed to it.”

Real estate prices in Australia’s largest housing markets have soared over the past couple of years fueled, in no small part, by demand from Chinese buyers looking for offshore locations to park cash. The Sydney and Melbourne markets have been the largest beneficiaries of foreign capital with real estate prices up 53% and 51%, respectively, since 2012. That said, based on data from the Australian Bureau of Statistics it looks like home prices in Australia have already started their descent.

Key knows a lot of real estate is bought with ‘dirty money’. And chooses not to act. Time to get rid of him.

• NZ PM Wary Of Policies That Could Cause Catastrophic Housing Slump (Hickey)

Prime Minister John Key has warned against any strong Government policy moves to restrict or tax foreign buyers, saying he did not want to cause a catastrophic slump in the market. Referring to moves in Australia that some say have pushed the apartment market there to the brink of collapse, Key said Government’s role was to protect the value of equity in home owners’ homes. He also talked down the prospect of urgent action to roll out a second round of Anti-Money-Laundering (AML) requirements to real estate agents, solicitors and accountants, saying it could significantly increase compliance costs and therefore increase costs for first home buyers.

[..] “Like any public policy in the area of housing, it’s always a delicate balance between being effective in trying to slow prices going up, and making sure you don’t have some catastrophic reaction you’re not expecting,” Key said. “Years ago Australia bought in a vendor’s tax in Australia and it had such a significant impact they actually cancelled it. There’s always a happy medium,” he said. “Anyone in Government has to be a bit careful, because for most people their primary asset is their house and for most people, a significant amount of the home is borrowed from the bank, so you do have to protect their equity.”

[..] in response to a NZ Herald article on Saturday detailing police concerns about money laundering in real estate and delays in a long-mooted second round of anti-money laundering (AML) reforms to include real estate agents and solicitors, Key defended the pace of reforms, which Labour Leader Andrew Little has described as “chain dragging.” The report detailed how Justice Minister Amy Adams went against a recommendation last year from her officials for an immediate start to policy work on the reforms after a warning from police that up to NZ$1.6 billion a year of dirty money was being pumped into housing markets.

“Eliminating currency as a medium of exchange can only lead to the repudiation of “money” — which will beat a quick path to the repudiation of all authority.”

• Signs of Desperation (Jim Kunstler)

Does the public understand the rationale behind zero interest rate policy (ZIRP)? Not any more than they understand the interaction of gluons and quarks or the doctrine of the Holy Trinity. It is one of the abiding mysteries of our time, for instance, that a group like AARP, purporting to represent the interests of retired persons, has offered not a peep of pushback to ZIRP, which has pounded retired people dependent on savings into penury. Of course, this might be explained by the pervasive racketeering feature of our current national life: AARP is an insurance racket masquerading as a citizen interest group. Or, stretching credulity to suppose that AARP is honest, perhaps the org’s executives don’t understand that zero interest on savings equals zero income to savers.

Kenneth Rogoff tries to justify his war on cash by invoking two of the era’s favorite bogymen: terrorists and drug dealers. Cash, he says, allows this axis of evil to do its thing(s). This is a ruse, of course. If currency is eliminated, these outfits will turn to gold and silver, it’s that simple. And so will everybody else, by the way. The real reason to abolish cash and herd all money into central banks is to permit the authorities to confiscate it one way or another, either by unavoidable taxation or by “bail-ins” – declaring deposits to be “unsecured loans” that can be repudiated in the event of a financial “accident.” The results are already in for this experiment: “money” becomes more and more dishonest, that is, it cannot be trusted to represent what it pretends to stand for: an index of account and a store of value.

Its role as the basis of capital formation is so impaired that real capital (i.e. wealth) cannot be generated, meaning that none of the credit issued as “money” will ever be paid back. Zero interest rate policy eventually equals zero interest paid. “Money” based on loans that won’t be paid back loses its legitimacy. Herding all the “money” onto central bank computers only allows for more three-card-monte maneuvers to conceal the bezzle. It would be much harder to hide the destruction of value in circulating paper currency. Eliminating currency as a medium of exchange can only lead to the repudiation of “money” — which will beat a quick path to the repudiation of all authority. And there is your recipe for really suicidal political disorder.

As long as there are things left to destroy, we’ll destroy them.

• The Tropical Paradise The US Wants To Turn Into A War Zone (G.)

Even here, in a region bursting with natural beauty, it is hard to imagine a more idyllic scene than Green Beach on Pagan island. Azure waters roll ashore before disappearing into the volcanic sand on a perfectly shaped horseshoe beach; on the horizon, cliffs plunge into darker open water that stretches, unhindered, more than 1,600 miles to the north-east coast of the Philippines. But in just a few years, Pagan’s tranquility could be shattered by the sound of heavy artillery, ending any hopes the displaced people of this 10-mile-long speck in the western Pacific have of returning to their ancestral home, more than three decades after a volcanic eruption forced all 300 residents to flee.

According to plans outlined by the US Department of Defence, as many as 5,000 marines will descend on the island to conduct war games as part of the Obama administration’s pivot towards the Asia-Pacific. The exercises will not only make human settlement impossible; campaigners say it will lead to the destruction of ancient cultural relics and threaten wildlife, including indigenous endangered animals such as fruit bats and tree snails. The marines will be among more than 8,000 who are due to be relocated to Guam and Hawaii from Okinawa as part of a controversial agreement between Washington and Tokyo to reduce the US military footprint on the southern Japanese island.

Faced with the near-certain destruction of their homeland – part of the US Commonwealth of the Northern Marianas – dozens of former residents have joined forces with environmental campaigners to launch a lawsuit they hope will expose the folly of the Pentagon’s plans to transform Pagan and Tinian, an inhabited island 200 miles to the south, into simulated theatres of war. The whole of Pagan would be turned into a simulated war zone to enable troops from the US, and regional allies Japan, South Korea and Australia, to prepare for possible confrontations sparked by China’s military buildup in the South China Sea and its claims to Japanese-administered islands in the East China Sea.