Marlon Brando screentest 1951

I was reading a piece by law professor John Eastman yesterday, before the entire left stumbled over each other to condemn it. I was thinking in my innocence that it’s interesting to know if questions over who’s a “natural born citizen” in America have ever truly been settled by politics or courts.

But I’m naive, and it’s attack time. They will defend Kamala Harris with all they got, with the entire MSM serving as their bullhorns. Which means Trump and his people have no choice but to go after her with all they got. Still, remembering the Obama birther fiasco, do they really want to die on this hill? Can’t we just leave it to the court system and legal experts? Or simply answer Eastman’s questions?

It’s all among signs of things to come between here and Nov. 3. Bill Barr yesterday promised that a first news flash from the Durham investigation into Russiagate origins will come out today, and that all of it will before Nov. 3. US elections are really just entertainment. Opium for the masses. Clickbaits, drama, anger, scandal. And I always thought it should be about people.

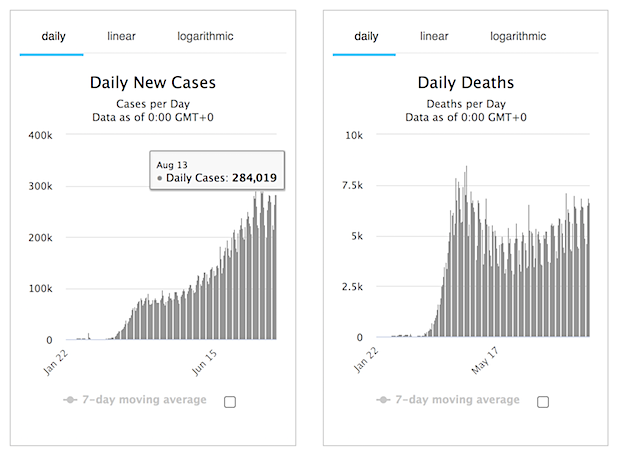

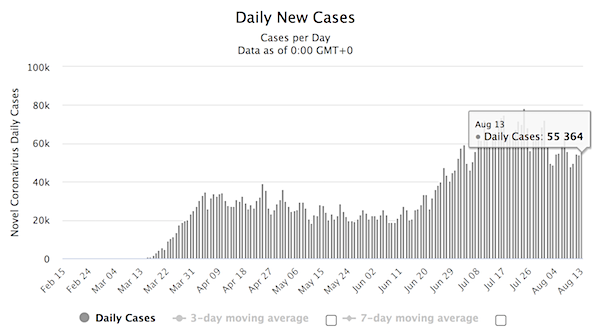

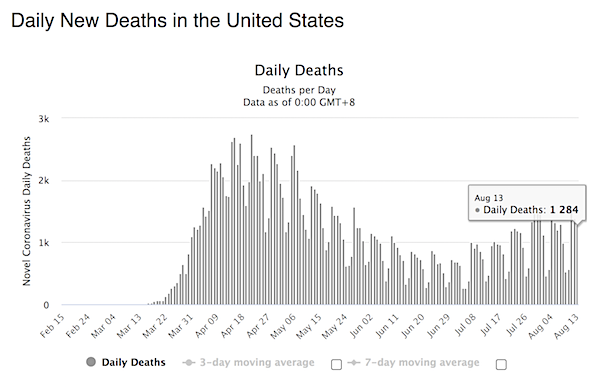

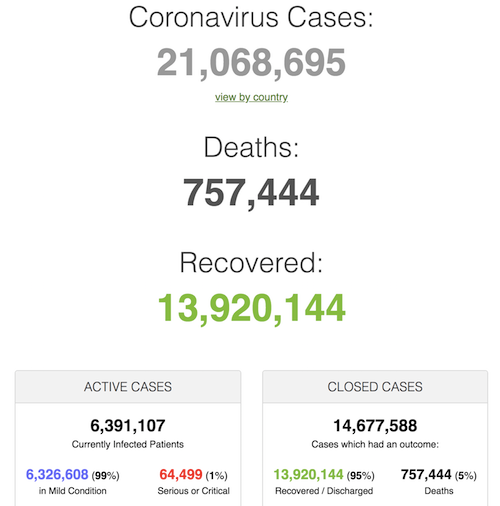

Not much movement in the numbers. We’re stuck in a broken record, with no progress anywhere. Not good.

There are 328 million Americans. 74 million of them are children. That leaves 254 million adults, of which 107 million are obese, or 42%. 42.4% have a BMI over 30. 9% are morbidly obese.

From this point of view, COVID is hardly the worst threat to either the people or the health care system. Or, to put it another way, it’s the people themselves that are the threat to the health care system.

Again, take high fructose corn syrup out of the diet, and you solve a huge chunk of that problem. Ban stuff that kills people, or make it much harder to get.

• US Obesity Epidemic Threatens Effectiveness of Any COVID Vaccine (KHN)

For a world crippled by the coronavirus, salvation hinges on a vaccine. But in the United States, where at least 4.6 million people have been infected and nearly 155,000 have died, the promise of that vaccine is hampered by a vexing epidemic that long preceded COVID-19: obesity. Scientists know that vaccines engineered to protect the public from influenza, hepatitis B, tetanus and rabies can be less effective in obese adults than in the general population, leaving them more vulnerable to infection and illness. There is little reason to believe, obesity researchers say, that COVID-19 vaccines will be any different. “Will we have a COVID vaccine next year tailored to the obese? No way,” said Raz Shaikh, an associate professor of nutrition at the University of North Carolina-Chapel Hill.

“Will it still work in the obese? Our prediction is no.” More than 107 million American adults are obese, and their ability to return safely to work, care for their families and resume daily life could be curtailed if the coronavirus vaccine delivers weak immunity for them. In March, still early in the global pandemic, a little-noticed study from China found that heavier Chinese patients afflicted with COVID-19 were more likely to die than leaner ones, suggesting a perilous future awaited the U.S., whose population is among the heaviest in the world. And then that future arrived.

As intensive care units in New York, New Jersey and elsewhere filled with patients, the federal Centers for Disease Control and Prevention warned that obese people with a body mass index of 40 or more — known as morbid obesity or about 100 pounds overweight — were among the groups at highest risk of becoming severely ill with COVID-19. About 9% of American adults are in that category. As weeks passed and a clearer picture of who was being hospitalized came into focus, federal health officials expanded their warning to include people with a body mass index of 30 or more. That vastly expanded the ranks of those considered vulnerable to the most severe cases of infection, to 42.4% of American adults.

More rapid testing. Good. Bring it. Test yourself everyday at breakfast.

• Israeli Hospital Trials Fast Saliva Test for COVID-19 (R.)

A newly developed saliva test aims to determine in less than a second whether or not you are infected with the novel coronavirus, Israel’s largest medical center said Thursday. Patients rinse their mouth with a saline wash and spit into a vial. This is then examined by a small spectral device that, in simple terms, shines light on the specimen and analyzes the reaction to see if it is consistent with COVID-19. With machine learning it gets more accurate over time. Eli Schwartz of the Center for Geographic Medicine and Tropical Diseases at Sheba Medical Center, who is leading the trial, said it was easier to use than PCR swabs commonly used to detect COVID-19.

“So far we have very promising results in this new method which will be much more convenient and much cheaper,” he said. The center said in an initial clinical trial involving hundreds of patients, the new artificial intelligence-based device identified evidence of the virus in the body at a 95% success rate. Amos Panet, an expert in molecular virology at Jerusalem’s Hebrew University, said he would like to see more data and comparisons with existing tests before making a final judgment. The amount of virus present in saliva increases as patients get sicker, he said, and a big challenge is to detect in “people who are borderline.” “It will be a game changer only if we see validation of this technology against the current technology,” he said.

Would M4A benefit the obese and hence diabetic? A long time ago, someone said: we’re raising a generation of blind amputees. How would a health care system deal with that?

• The Pandemic and Medicare for All (TMI)

When the novel coronavirus first arrived in the United States, it spurred on remarkable message discipline among America’s political class. The consensus that emerged on both sides of the aisle dictated that no matter what happened, Americans ought to be glad they do not live in a country with socialized medicine. At the final Democratic presidential debate on March 15, former Vice President Biden pointed to COVID numbers in Italy as evidence that not only was Medicare for all not a solution to the crisis, but it would put the country at greater risk. “With all due respect for Medicare for all, you have a single-payer system in Italy,” the former vice president said. “It doesn’t work there. It has nothing to do with Medicare for all. That would not solve the problem at all.”

Weeks later, in early April, Center for American Progress president Neera Tanden echoed the sentiment in a Twitter spat with a Medicare for All supporter. “You might want to check out the death rate in France before you think the form of health system is the answer here,” she tweeted. Not long after, the Washington Post ran an op-ed by former George W. Bush speechwriter Marc Thiessen declaring the COVID-19 pandemic was “an indictment of socialized medicine.” “If you think today’s pandemic bolsters the case for socialized medicine, then ask yourself a simple question: If you came down with a serious case of COVID-19, would you rather be in an Italian hospital or an American one?” the piece opens, before lauding Biden’s debate answer.

Such arguments were never fair — the pandemic was only just starting in the United States, while COVID-19 had indeed rampaged across Europe, there were contributing factors like years of austerity and a lack of supply chain redundancy in the modern globalized economy. But now, just a few months later, these arguments completely and utterly fail. New infections are still surging in the U.S. while countries with national health care programs have long since gotten a handle on the virus. On Tuesday, the U.S. reported more new COVID cases in a single day than Italy, France, and the U.K. reported last month combined, and roughly 45 percent of their total deaths.

Nice account from James Altucher. is he just getting old, or is New York really beyond salvation?

• NYC Is Dead Forever. Here’s Why (Altucher)

People say, “NYC has been through worse” or “NYC has always come back.” No and no. First, when has NYC been through worse? Even in the 1970s, and through the 80s, when NYC was going bankrupt, and even when it was the crime capital of the US or close to it, it was still the capital of the business world (meaning: it was the primary place young people would go to build wealth and find opportunity), it was culturally on top of its game – home to artists, theater, media, advertising, publishing, and it was probably the food capital of the US. NYC has never been locked down for five months. Not in any pandemic, war, financial crisis, never. In the middle of the polio epidemic, when little kids (including my mother) were going paralyzed or dying (my mother ended up with a bad leg), NYC didn’t go through this.

This is not to say what should have been done or should not have been done. That part is over. Now we have to deal with what IS. In early March, many people (not me), left NYC when they felt it would provide safety from the virus and they no longer needed to go to work and all the restaurants were closed. People figured, “I’ll get out for a month or two and then come back.” They are all still gone. And then in June, during rioting and looting a second wave of NYC-ers (this time me) left. I have kids. Nothing was wrong with the protests but I was a little nervous when I saw videos of rioters after curfew trying to break into my building. Many people left temporarily but there were also people leaving permanently. Friends of mine moved to Nashville, Miami, Austin, Denver, Salt Lake City, Austin, Dallas, etc.

Now a third wave of people are leaving. But they might be too late. Prices are down 30-50% on both rentals and sales no matter what real estate people tell you. And rentals soaring in the second and third-tier cities. I’m temporarily, although maybe permanently, in South Florida now. I also got my place sight unseen. Robyn was looking at listings around Miami and then she saw an area we had never been to before. We found three houses we liked. She called the real estate agent. Place #1. Just rented that morning 50% higher than the asking price. Place #2. Also rented (New Yorkers – “they came from New York for three hours, saw the place, got it, went back to pack.”). Place #3. “Available.” “We’ll take it!” The first time we physically saw it was when we flew down and moved in. “This is temporary, right?” I confirmed with Robyn. But…I don’t know. I’m starting to like the sun a little bit. I mean, when it’s behind the shades. And when I am in air conditioning.

All US politics is united against Julian Assange.

• What Kamala Harris Really Thinks of WikiLeaks (Lauria)

During a September 2017 U.S. Senate Intelligence Committee debate on an intelligence bill a line was inserted that said WikiLeaks “resembles a non-state hostile intelligence service” and that the U.S. “should treat it as such.” “This language would help investigators secure the authorization needed to surveil those U.S. citizens thought to be associated with WikiLeaks,” a McClatchy report quoted a government lawyer as saying. “You need to show that someone is an agent of a foreign power,” said the lawyer, Robert Deitz, who held senior legal positions at the Pentagon, the CIA and the National Security Agency. “It’s possible that Assange has colleagues in this country that they need to focus on,” McClatchy quoted Deitz as saying, “noting that such action can only be done under court order.”

The non-state hostile agency phrase was directly lifted from a scurrilous speech by Mike Pompeo in his first address as CIA director. The language survived the committee and made it into the bill voted on by the full Senate. But before it did two senators raised objections to it. One was Ron Wyden of Oregon. The other was Sen. Kamala Harris of California, the presumptive Democratic vice presidential candidate in November’s election. According to the McClatchy report, “Harris declared that she is ‘no supporter of WikiLeaks,’ which she said had done ‘considerable harm’ to the United States. But the clause on the group is ‘dangerous’ because it ‘fails to draw a bright line between WikiLeaks and legitimate news organizations that play a vital role in our democracy,’ according to her remarks for the record.”

Harris left no doubt that she is an enemy of WikiLeaks, as is her running mate, Joe Biden, who agreed it was more like a high-tech terrorist organization that Daniel Ellsberg’s release of the Pentagon Papers. Harris made clear she cared only about establishment media (which almost universally undergirds aggressive U.S. foreign policy) and was worried about it getting caught up in a WikiLeaks dragnet. She said she wants a “bright line” between publications such as The New York Times and WikiLeaks. Except, there can be no such legal line drawn as both establishment papers, like the Times, and WikiLeaks have done the exact same thing: possessed and published classified material.

Because there is no legal distinction, the Obama administration, which desperately wanted to indict WikiLeaks publisher Julian Assange, backed away citing its “New York Times problem.” The Trump administration had no such qualms and had Assange arrested in April 2019 and indicted on conspiracy to commit computer intrusion and 17 counts of the Espionage Act. The only bright line that can be drawn is political: a decision by the Department of Justice to not prosecute big media but to prosecute WikiLeaks for the same “crime”, which conflicts with First Amendment press freedoms. This is what Harris was calling for: Protect the state-managed corporate media but go after a serious publication that dares to reveal crimes of the U.S. government, which Harris wants to protect. In other words, for the same activity, the Times is afforded First Amendment protections, but WikiLeaks is not.

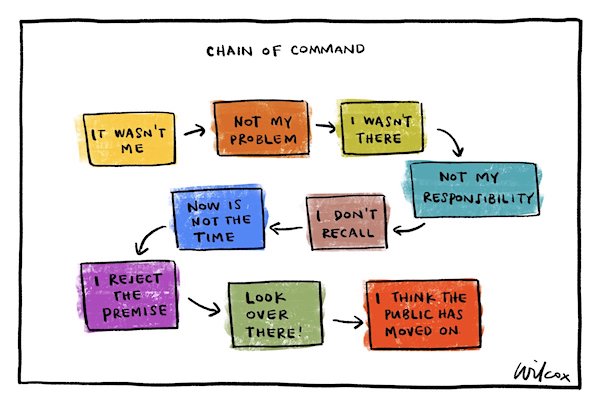

There are questions one can’t ask.

• Some Questions About Kamala Harris’ Eligibility (NW)

The fact that Senator Kamala Harris has just been named the vice presidential running mate for presumptive Democratic presidential nominee Joe Biden has some questioning her eligibility for the position. The 12th Amendment provides that “no person constitutionally ineligible to the office of President shall be eligible to that of Vice-President of the United States.” And Article II of the Constitution specifies that “[n]o person except a natural born citizen…shall be eligible to the office of President.” Her father was (and is) a Jamaican national, her mother was from India, and neither was a naturalized U.S. citizen at the time of Harris’ birth in 1964. That, according to these commentators, makes her not a “natural born citizen”—and therefore ineligible for the office of the president and, hence, ineligible for the office of the vice president.

“Nonsense,” runs the counter-commentary. Indeed, PolitiFact rated the claim of ineligibility as “Pants on Fire” false, Snopes rated it simply “False,” and from the other side of the political spectrum, Conservative Daily News likewise rated it “False.” All three (and numerous others) simply assert that Harris is eligible because she was born in Oakland—and is therefore a natural-born citizen from location of birth. The 14th Amendment says so, they all claim, and the Supreme Court so held in the 1898 case of U.S. v. Wong Kim Ark. But those claims are erroneous, at least as the Citizenship Clause of the 14th Amendment was originally understood—an error to which even my good friend, renowned UCLA School of Law professor Eugene Volokh, has fallen prey.

The language of Article II is that one must be a natural-born citizen. The original Constitution did not define citizenship, but the 14th Amendment does—and it provides that “all persons born…in the United States, and subject to the jurisdiction thereof, are citizens.” Those who claim that birth alone is sufficient overlook the second phrase. The person must also be “subject to the jurisdiction” of the United States, and that meant subject to the complete jurisdiction, not merely a partial jurisdiction such as that which applies to anyone temporarily sojourning in the United States (whether lawfully or unlawfully). Such was the view of those who authored the 14th Amendment’s Citizenship Clause; of the Supreme Court of the United States in the 1872 Slaughter-House Cases and the 1884 case of Elk v. Wilkins; of Thomas Cooley, the leading constitutional treatise writer of the day; and of the State Department, which, in the 1880s, issued directives to U.S. embassies to that effect.

The Supreme Court’s subsequent decision in Wong Kim Ark is not to the contrary. At issue there was a child born to Chinese immigrants who had become lawful, permanent residents in the United States—”domiciled” was the legally significant word used by the Court. But that was the extent of the Court’s holding (as opposed to broader language that was dicta, and therefore not binding). Indeed, the Supreme Court has never held that anyone born on U.S. soil, no matter the circumstances of the parents, is automatically a U.S. citizen.

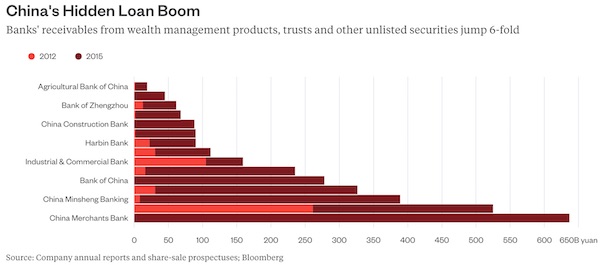

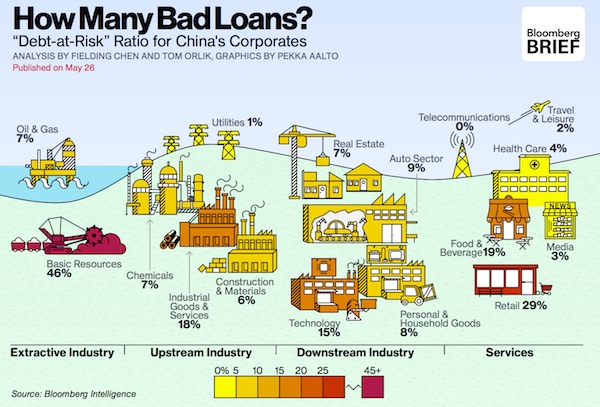

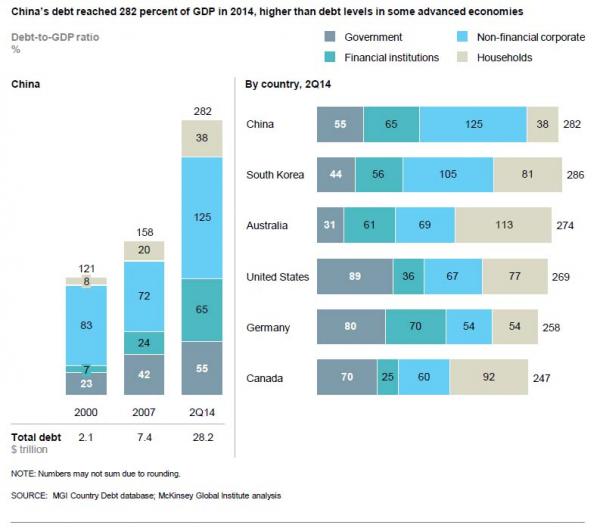

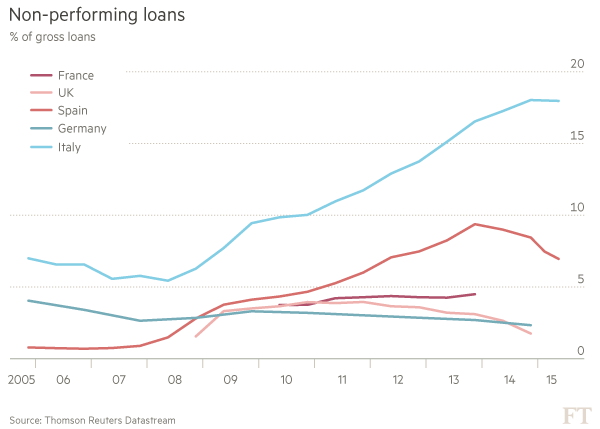

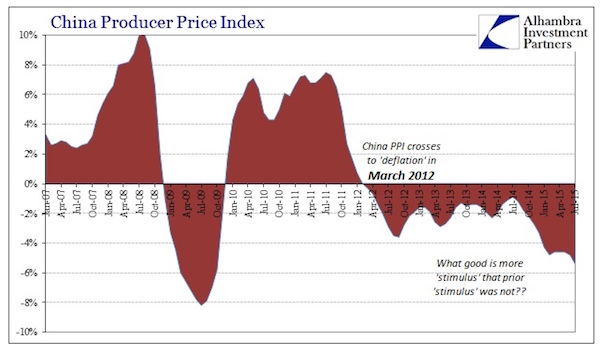

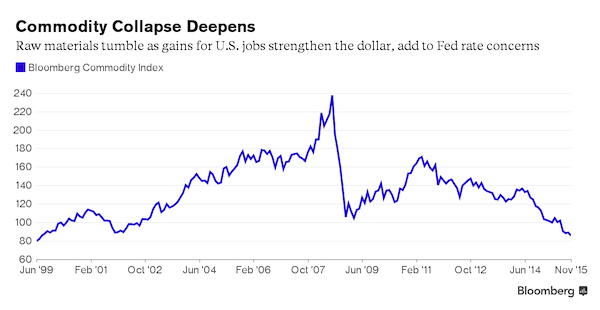

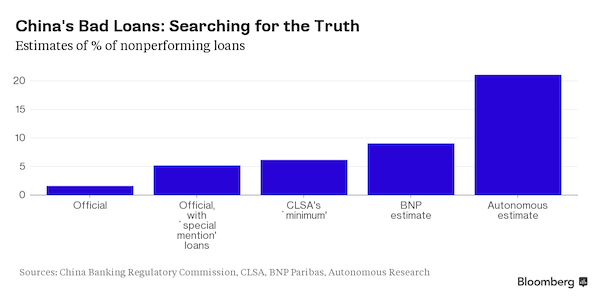

I’ve said it often before: none of this means much without also tallying shadow banks’ numbers.

• China’s Banks At Risk As $500 Billion In Non-Performing Loans Revealed (SCMP)

China’s top banking regulatory official said on Thursday that the country’s banks have to deal with 3.4 trillion yuan (US$489.5 billion) worth of non-performing loans in 2020 – flagging a big risk for the banking system in the world’s second-largest economy. The total marks a hefty increase from 2.3 trillion yuan in 2019, and the value of bad loans could be even higher in 2021. Guo Shuqing, chairman of the China Banking and Insurance Regulatory Commission, said in an interview with the official Xinhua News Agency that the increase in non-performing loans (NPLs) – loans in default or close to default – will put huge pressure on the country’s banks, especially small and regional ones.

“As many loans are rolled over [in 2020], some problems will only emerge next year,” Guo was quoted by Xinhua as saying, adding that a rebound in bad loans is “inevitable” since the coronavirus shock has adversely affected so many companies. The warning by Guo, who is also the Communist Party secretary at the People’s Bank of China, came at a time when many of the country’s small banks are facing a moment of reckoning after years of undisciplined balance sheet expansion, as well as instances of fraud and corruption. Meanwhile, Guo said, Chinese banks have improved their loan structure – with more lending going toward manufacturing, infrastructure, technology and small businesses.

Guo added that Chinese banks are now being told to enhance their support of small businesses. In addition, he said he will encourage banks to invest more in corporate bonds. According to official statistics from Guo’s agency, the NPL ratio in China was among the lowest in the world. The ratio for Chinese commercial banks rose 0.03 percentage points in the second quarter to 1.94 per cent at the end of June. But hidden bad loans, if exposed, could easily wipe out bank profits and erode capital bases. In the first half of this year, the combined profits of Chinese banks dropped for the first time in more than a decade – falling 9.4 per cent to 1 trillion yuan in the first half of the year, government data shows.

So, question is: who are the shadow banks’ debt collectors? Vinnie the Kneecapper and his friends?

• China’s Debt Collectors Flourish As Consumers Flounder (R.)

It’s not a good sign for any economy when debt collectors are booming and in China right now, the industry is on a hiring spree. Whole Scene Asset Management, a debt recovery firm based in the southern province of Hunan, plans to double staff numbers to 400 people this year as it expands into new cities. “Debt collection companies have been mushrooming,” said company founder Zhang Haiyan. “And with bad loans growing this year, everyone is adding new hands.” Rival Bricsman is also hiring – hoping to boost headcount of around 1,000 by 400-500 this year after landing a deal to collect delinquent consumer loans for China Minsheng Bank (600016.SS), people with knowledge of the matter said, declining to identified as they were not authorised to talk to media.

Bricsman, which is based in the eastern province of Jiangsu and counts other large banks amongst its clients, did not respond to a request for comment. As increasing numbers of consumers struggle with lost income in an economy battered by the coronavirus and U.S-China tensions, a burgeoning wave of non-performing loans is sparking concern among lenders – both at specialist consumer financing firms and traditional banks – and even among debt collectors. China is the midst of “an unfolding debt crisis”, says Joe Zhang, a business consultant and until last month vice chairman at the country’s largest debt collector YX Asset Recovery. The delinquency rate for consumer debt is climbing and collecting on those loans has become much harder, he added, estimating that at some weaker non-bank consumer lenders, soured loans may account for 30% to 50% of their portfolios.

[..] Chinese consumer debt has ballooned over the past five years, fuelled in part as banks scrambled to issue credit cards, with outstanding debt for bank-issued cards doubling to 17.6 trillion yuan ($2.5 trillion). Internet-based consumer financing, which is only lightly regulated, has also grown – by a dizzying 400 times to nearly 8 trillion yuan since 2014, according to the Guanghua School of Management. And Chinese household debt – including mortgages and unsecured consumer loans – has swollen to levels equivalent to nearly 60% of GDP, up from 18% in 2008, the peak of the global financial crisis.

300 anonymous accounts?!

• US Seizes $2 Million From 300 Terror-Linked Cryptocurrency Accounts (CNBC)

The Justice Department said it dismantled an elaborate cyber campaign used by overseas terror organizations to finance their operations and seized $2 million from more than 300 cryptocurrency accounts in what it described as the largest-ever seizure of its kind. The Justice Department said three overseas terrorist groups — al-Qassam Brigades, Hamas’ military wing; al-Qaeda and the Islamic State of Iraq and the Levant, also known as ISIS — used cryptocurrencies and social media to raise funds for their terror campaigns. “It should not surprise anyone that our enemies use modern technology, social media platforms and cryptocurrency to facilitate their evil and violent agendas,” Attorney General William Barr said in a release.

“As announced today, we will seize the funds and the instrumentalities that provide a lifeline for their operations whenever possible,” he added. “Terrorist networks have adapted to technology, conducting complex financial transactions in the digital world, including through cryptocurrencies. IRS-CI special agents in the DC cybercrimes unit work diligently to unravel these financial networks,” Secretary of the Treasury Steven Mnuchin said in a release. In one of the cases, the U.S. secretly took over websites that were operated by al-Qassam Brigades and monitored those who thought they had opened up their cyber wallets to the terror group but instead donated money to an account controlled by the U.S. government, according to court documents unsealed Thursday in the District of Columbia.

Successfully dividing the Arab world’s support for Palestinians.

• United Arab Emirates Sells Out Palestine For Israel (EI)

The United Arab Emirates and Israel have agreed to full normalization of relations, bringing their decades-long clandestine dealings proudly into the open. The so-called “Abraham Accords” sealing the deal were brokered by US officials. The deal is named for “the father of all three great faiths,” David Friedman, the US ambassador to Israel, told reporters at the Oval Office on Thursday. Religious and cultural tolerance is often used by Arab states and Israel to mask their efforts to normalize ties. Painting conflict in the region as stemming from a lack of understanding among religions is also a way to obscure its true origin: Israel’s violent dispossession of Palestinians and ongoing military occupation and steady ethnic cleansing of their land.

In exchange for normalization, Israel agreed to suspend plans to annex large swaths of the occupied West Bank “and focus its efforts now on expanding ties with other countries in the Arab and Muslim world,” according to the joint statement. However, this is spin. In reality, it was the United States that put Israel’s annexation plans on ice weeks ago. In fact, Prime Minister Benjamin Netanyahu reaffirmed his commitment to annexation shortly after the announcement of the agreement. The UAE is merely using the American-imposed freeze as an opportunity to bring its secret ties with Israel dating back to the 1990s into the open. These secret relations have included military and intelligence cooperation and even joint military exercises.

[..] Relations between Israel and Gulf States including Saudi Arabia and the UAE are founded on a mutual enmity towards Iran. Liquidating Palestinian rights and bypassing the Palestinian issue is seen as key to building up this anti-Iran alliance under American oversight. Annexation, moreover, would only be a formal rubber stamp for what Israel has been doing on the ground for decades: stealing land, forcibly displacing Palestinians and building colonies in flagrant breach of international law. This violent colonization has never ceased and will not stop as a result of this agreement.

India is Monsanto’s wet dream.

• Experts Debunk Claims of GMO Crops Success (OffG)

On 6 July 2020, an article extolling the benefits of genetically modified (GM) crops appeared on the BloombergQuint website based on an interview with Dr Ramesh Chand, a member of the key Indian Government think tank Niti Aayog (National Institution for Transforming India) . On 17 July, another piece that placed a positive spin on GM crops and gene-editing technology (Feeding 10 Billion People will Require Genetically Modified Food) appeared on the same site. According to Prof Andrew Paul Gutierrez, Dr Hans R Herren and Dr Peter E Kenmore, internationally renowned agricultural researchers, the pieces reported “sweeping unsupported claims” about the benefits of and need for genetically modified organisms (GMOs) and related technologies in agriculture in India.

The three academics felt that “a responsible and factual response” was required and have written a letter – containing what could be described as the definitive analysis of Bt cotton in India – to Dr Ramesh Chand, Dr Rajiv Kumar (Niti Aayog Vice Chancellor) and Dr Amitabh Kant (Niti Aayog CEO). Chand is reported as saying that there is no credible study to show any adverse impact of growing Bt cotton in the last 18 years in the country (India’s only officially approved GM crop). This is simply not the case. Moreover, Gutierrez et al argue that all of the credible evidence shows any meagre increases in cotton yield after the introduction of Bt cotton in 2002 were largely due to increases in fertiliser use. Before proceeding, it is pertinent to address the claim that ‘feeding 10 billion people will require genetically modified food’.

If we take the case of India and its 1.3 billion-plus population, it has achieved self-sufficiency in food grains and has ensured that, in theory at least, there is enough food available to feed its entire population. It is the world’s largest producer of milk, pulses and millets and the second-largest producer of rice, wheat, sugarcane, groundnuts, vegetables and fruit. However, food security for many Indians remains a distant dream. Hunger and malnutrition remain prevalent. But that is not because farmers don’t produce enough food. These problems result from other factors, including inadequate food distribution, social and economic policies, inequality and poverty. It is a case of ‘scarcity’ amid abundance (reflecting the situation globally). India even continues to export food while millions remain hungry. Productivity is not the issue.

And while proponents say GM will boost productivity and help secure cultivators a better income, this too ignores crucial political and economic contexts; with bumper harvests, Indian farmers still find themselves in financial distress. India’s farmers are not experiencing hardship due to low productivity. They are reeling from the effects of neoliberal policies and years of neglect. It’s for good reason that the calorie and essential nutrient intake of the rural poor has drastically fallen. Yet the pro-GMO lobby has wasted no time in wrenching these issues from their political contexts to use the notions of ‘helping farmers’ and ‘feeding the world’ as lynchpins of its promotional strategy.

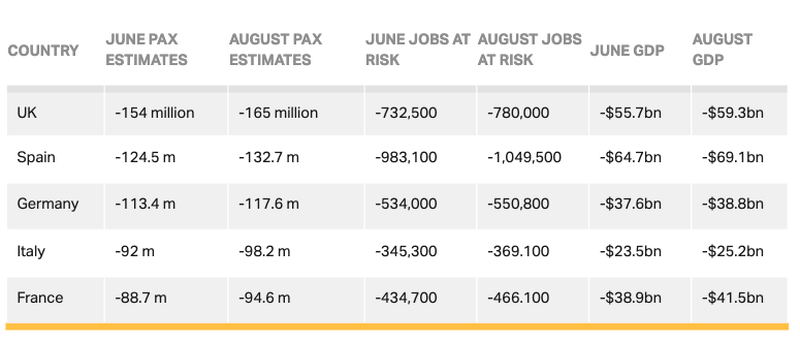

Everything travel related is getting hammered. There is no telling when it all will be back, or if it ever will. Bailing out the firms involved seems an awful waste of money. You do that for firms that have a future, not those that have a past.

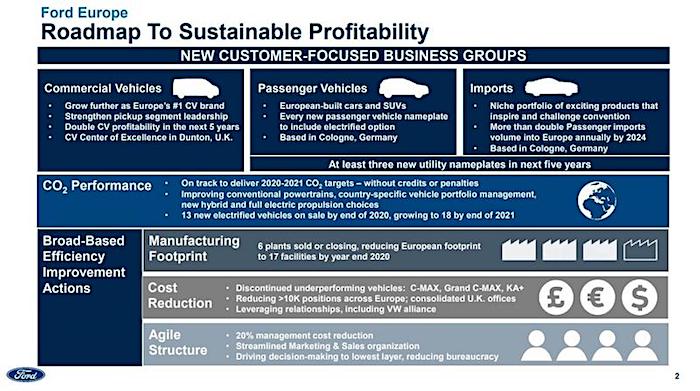

• Ford Is Slashing 10,000 Jobs, 6 Factories In Europe (ZH)

The auto industry continues to grapple with one of the worst recessions ever for the notoriously capital intensive sector. Ford, which feels like it has been in the midst of a yearslong “restructuring” that has never fully panned out or ended (and has involved numerous CEOs), continues to make major changes to its global personnel to try and find the right mix for its business going forward. This means that 10,000 positions are now being cut across Europe, the automaker disclosed yesterday. Ford is also going to be reducing the number of its plants in Europe to 17 from 23, the company revealed in a JP Morgan conference presentation on Wednesday.

In a slide called “Ford Euope: Road to Sustainable Profitability”, the company also disclosed it would be discontinuing underperforming vehicles, like its C-MAX and Grand C-Max. The company also plans on “leveraging” its relationship with VW. The company says it is on track to deliver on its 2020-2021 CO2 targets without credits or penalties and 13 new electic vehicles will be on sale by the end of 2020, up from just 5. This news comes days after it was announced that Ford would be replacing its CEO on relatively short notice. Ford said days ago it had tapped Jim Farley to replace a relatively still-newly appointed Jim Hackett as CEO. Hackett replaced former CEO Mark Fields and, for the most part, has failed to inspire confidence during his tenure at Ford.

Ford is currently in the middle of an $11 billion restructuring that is supposed to help to accelerate its development of new vehicles, including hybrids and EVs. Hackett had only just started with Ford back in 2017 and has said he will retire effective October. General Motors is following with a C-suite shakeup of its own, as its CFO leaves after just two years to work at a fintech startup. The company announced earlier this week that John Stapleton, GM North America chief financial officer, has been named its acting global chief financial officer, effective Aug. 15, after the resignation of the company’s current CFO, Dhivya Suryadevara.

Isn’t that what we wanted? Less flying, less pollution?

• 7 Million Jobs At Risk, European Airlines Could See “Further Declines” (ZH)

The International Air Transport Association (IATA) published a new report Thursday that warns the virus-induced downturn will continue to pressure air passenger numbers, employment and economies across Europe. IATA said passenger flights are expected to decline by 60% in 2020, resulting in millions of job losses in the aviation and tourism industries. IATA issued a similar warning of what has been announced by airlines, of which, complete recovery in passenger demand might not be seen until 2024. “The near-term outlook for recovery in Europe remains highly uncertain with respect to the second wave of the pandemic and the broader global economic impact it could have. Passenger demand in Europe is expected to recover gradually and will not reach 2019 levels until 2024. -IATA

IATA’s job loss estimate was increased by 17% from its June report, from 6 million to 7 million, mostly because the highly anticipated V-shaped recovery has failed to materialize. “It is desperately worrying to see a further decline in prospects for air travel this year, and the knock-on impact for employment and prosperity. said Rafael Schvartzman, IATA’s Regional Vice President for Europe. Schvartzman said, “It shows once again the terrible effect that is being felt by families across Europe as border restrictions and quarantine continue. It is vital that governments and industry work together to create a harmonized plan for reopening borders.”

If another wave of the virus were to hit Europe, justifying nationwide lockdowns, it could intensify the recession. Though the German tabloid newspaper Bild has said: “There will be no second hard lockdown in Europe because that would lead to a monster recession that would not be accepted by the population.”

20% of Greek GDP is tourism. So are at least 20% of jobs.

• Volume of Greek Air Traffic Plunged 74.3% in 2020 (GR)

A report came out on Thursday confirming the worst fears of Greek economic experts, stating that the country had seen a drop of 74.3% in the number of passengers who had traveled through their airports so far this year. This amounts to only 9 million air travelers who had used airports in the country so far in 2020, a staggering drop of almost three-quarters of its business. The number of international visitors coming into Greek airports this year so far amounts to 1,126,429, a stunning decrease from last year’s banner tourism season, which saw a total of 4,096,657 international arrivals. Although very disappointing, the numbers did not come as a shock to any in the sector, due to the punishing effects of travel bans imposed on many nations because of the coronavirus pandemic.

According to Greek media reports, the Civil Aviation Authority, or CAA, reported the precipitous drop in business in the first seven months of this year relative to the numbers seen in 2019. For the month of July 2020 alone, the high season for summertime travel to the country, passenger traffic at Greek airports had decreased 72.6%. During the month of July, a total of only 2,722,854 million passengers came through Greece’s airports; in that same period, there was a precipitous drop of 72.5% in the number of foreign arrivals. This means that there were fewer passengers overall in the first seven months of 2020 than there had been in the month of July only in 2019.

We try to run the Automatic Earth on donations. Since ad revenue has collapsed, your support is now an integral part of the process.

Thank you.

Support the Automatic Earth in virustime.