NPC Berberich shoe store window, Seventh Street, Washington, DC June 1920

“Overnight the mindlessly bullish JBTD (Just Buy the Dip) crowd felt the cold steel of Edward Scissorhands.”

• Buckle-Up: Global Stocks In For Long Roller Coaster Ride (CNBC)

Whipsawing global markets scream fears about global growth conditions and unless data from the world’s major economies improve, a deeper correction is on the cards, say strategists. Asian markets tumbled on Friday, extending the sharp selloff in U.S. and European equities overnight as intensifying concerns over the health of the euro zone economy hit risk appetite. Australia’s benchmark S&P/ASX 200 index led losses, falling 1.8% in the morning session, while Japan’s Nikkei 225 and South Korea’s KOSPI were both off 1.2%. “There are a lot of questions at the moment and not a lot of answers in regards to Europe’s economy, the stability of China’s housing market and the timing of the Fed’s first rate hike,” Chris Weston, chief market strategist at IG told CNBC.

“The hallmarks are in place for a stock market correction – Brent crude prices are falling, long-end U.S. bonds are telling the story that markets are starting to look at low growth and low inflation for a long period of time,” he said. In order to arrest the volatile downtrend in stocks, there needs to be a good run of economic data out the world’s leading economies, Weston said. Nicholas Ferres, investment director, global asset allocation, Eastspring Investments say the bearish price action suggests a market correction is already underway. “Overnight the mindlessly bullish JBTD (Just Buy the Dip) crowd felt the cold steel of Edward Scissorhands. Failure of the market to extend the rebound from the prior day probably suggests that a deeper correction is likely underway,” he said. “From my perch, this reflects a genuine growth scare, evident in the macro news flow from Europe, China and Japan, rather than a direct fear of U.S. policy normalization,” he said.

People are not spending. They’re broke. How can you raise inflation in those conditions?

• Fed Aim Off Target as Inflation Descends Near Danger Zone (Bloomberg)

Federal Reserve officials are hunting for new tactics to raise price increases to their target as slowing global growth, cheaper commodities and flat wages sound warnings that inflation is descending toward the danger zone. The Fed needs a clear strategy for getting the inflation rate higher after falling short of its 2% target for 28 consecutive months. Now, as longer-run inflation expectations erode in financial markets, the Federal Open Market Committee is shifting its focus toward prices after putting its main emphasis on jobs for months. Several officials worried that “inflation might persist below” the committee’s target for “quite some time,” minutes from the Sept. 16-17 meeting said. Too-low inflation “is getting to be a real issue again,” said former Fed Governor Laurence Meyer. With inflation at 1.5% according to the Fed’s preferred index, Meyer said FOMC policy makers aren’t likely to raise interest rates, even if the economy approaches full employment, defined as a jobless rate of 5.2% to 5.5%.

Unemployment was 5.9% last month. “The timing of the first rate hike is all about inflation,” said Meyer, now a senior managing director at Macroeconomic Advisers LLC in Washington. Policy makers including regional Fed Presidents William Dudley of New York, Charles Evans of Chicago and Narayana Kocherlakota of Minneapolis have in recent days all mentioned below-target inflation as a risk that weighs against raising interest rates too soon. An inflation rate approaching zero is bad for the economy because of its impact on behavior by businesses and consumers. Companies’ inability to raise prices hurts profits, and they rarely compensate by cutting wages, so they fire workers instead. Consumers anticipating falling prices may postpone discretionary purchases. This can combine to create a vicious circle of less spending and further downward pressure on prices.

Not just junk bonds.

• Why The Strong Dollar May Sink Junk Bonds (CNBC)

A simmering mix of a strong U.S. dollar and weak commodity prices may be brewing up trouble for junk bond exchange-traded funds (ETFs) with a hefty weighting in materials companies. “If the U.S. dollar stays strong, that will exacerbate the impact of the weaker commodity prices” on miners’ cash flow and the ability to meet debt payments, said May Zhong, a credit analyst at Standard & Poor’s. Coal companies, especially U.S.-based ones competing in the export market, are a particular concern, she said. Faced with oversupply, thermal coal prices have fallen to near five-year lows, while the U.S. dollar index has risen as much as 8.3% so far this year. But Australian miners may also take a hit, she said. “The Australian dollar hasn’t fallen to the same extent as major commodity prices. It’s still relatively strong compared to the U.S. dollar,” she said.

“You do need a weak local currency to help those [B-rated] miners or shield them from weaker commodity prices,” Zhong said. That may have a knock-on effect on the high-yield bond ETFs, which in turn may weigh the entire junk-bond segment. Around 14.7% of the holdings of the iShares iBoxx high-yield ETF, which tracks the Markit iBoxx index, are in the oil and gas industries, while another 6.5% are in basic materials. The ETF has around $13.3 billion in net assets. While that’s a drop in the bucket compared with a total bond market estimated at around $38 trillion, some analysts consider bond ETFs a market risk as they are more susceptible to hot money flows, potentially affecting the trading liquidity of underlying bonds. Around 37% of U.S. corporate credit is held by households and funds, according to RBS data from August.

Everything must go.

• Iran Matches Saudi Oil Discounts in Bear Market for Crude (Bloomberg)

Iran will sell its oil to Asia in November at the biggest discount in almost six years, matching cuts by Saudi Arabia as global crude benchmarks slide deeper into a bear market. State-run National Iranian Oil Co. cut official selling prices of its crude to buyers in Asia for November, two people with knowledge of the pricing decision said yesterday. The decrease came a week after Saudi Arabia, the world’s largest oil exporter, reduced the price of Arab Light crude for Asia to the lowest since December 2008. Brent crude, the international benchmark, fell to the lowest in almost four years today. “The timing of Iran’s price cuts makes the price war more and more probable,” Eugen Weinberg, head of commodities research at Commerzbank AG in Frankfurt, said by phone yesterday. “Iran is fully aware of the direction of and the mood in the market. Given that we’ve seen consecutive cuts, this would seem to be some kind of action and reaction.”

Middle Eastern oil producers are facing greater competition in Asia, their largest market. Cargoes from the U.S., Russia and Latin America are finding buyers there amid a surplus on international markets. The pace of demand growth is lower in the region as the economy slows in China, the world’s second-largest oil consumer. Futures for Brent and West Texas Intermediate, the U.S. benchmark, have both fallen more than 20% from their June peaks, meeting the common definition of a bear market. Front-month Brent traded as low as $88.11 a barrel today on the ICE Futures Europe exchange in London, the lowest since December 1, 2010. WTI dropped as low as $83.33 a barrel on the New York Mercantile Exchange, the lowest since July 3, 2012.

WTI is looking at $80 today. $84 now.

• OPEC: Milder Winter To Pressure Oil Price Further (CNBC)

The oil price could face further downward pressure as a warmer winter is expected to hit demand further, the supplier of about 40% of the world’s oil warned. Official forecasts expect heating degree days in the U.S. to be 12% lower than last winter, implying lower demand, the Organization of Petroleum Exporting Countries (OPEC) said in its monthly oil market report as Brent traded close to a four-year low. At the same time, OPEC said the weather has been less of a factor determining U.S. fuel consumption, as heating oil now contributes below 20% of the demand for “middle distillates” or medium weight refined oil products in the country.

Brent crude fell below $90 on Friday, as supply rises and markets digested more grim economic news, with analysts now slashing their oil price forecasts. The free fall in the oil price has increased pressure on OPEC members to take action to cut supply, which analysts said is unlikely before its meeting at the end of November. But Saudi Arabia has shown reluctance to cut production at the risk of losing market share to other countries.

This is just too crazy. This is what business in America has come to.

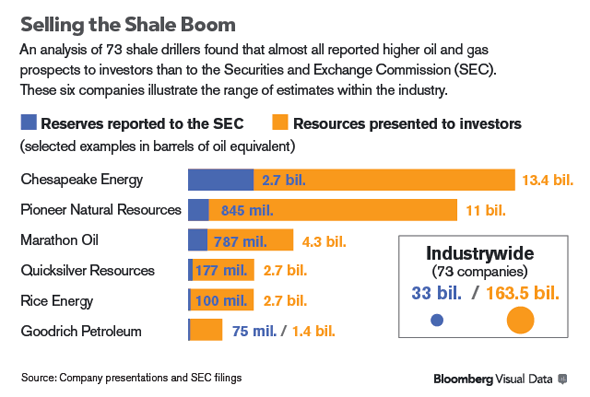

• US Shale Drillers Hugely Overestimate Reserves Before Investors (Bloomberg)

Lee Tillman, chief executive officer of Marathon Oil Corp., told investors last month that the company was potentially sitting on the equivalent of 4.3 billion barrels in its U.S. shale acreage. That number was 5.5 times higher than the proved reserves Marathon reported to federal regulators. Such discrepancies are rife in the U.S. shale industry. Drillers use bigger forecasts to sell the hydraulic fracturing boom to investors and to persuade lawmakers to lift the 39-year-old ban on crude exports. Sixty-two of 73 U.S. shale drillers reported one estimate in mandatory filings with the Securities and Exchange Commission while citing higher potential figures to the public, according to data compiled by Bloomberg. Pioneer’s estimate was 13 times higher. Goodrich’s was 19 times. For Rice Energy, it was almost 27-fold. “They’re running a great risk of litigation when they don’t end up producing anything like that,” said John Lee, a University of Houston petroleum engineering professor who helped write the SEC rules and has taught reserves evaluation to a generation of engineers.

“If I were an ambulance-chasing lawyer, I’d get into this.” Experienced investors know the difference between the two numbers, Scott Sheffield, chairman and CEO of Irving, Texas-based Pioneer, said in an interview. “Shareholders understand,” Sheffield said. “We’re owned 95% by institutions. Now the American public is going into the mutual funds, so they’re trusting what those institutions are doing in their homework.” Investors poured $16.3 billion in the first seven months of the year into mutual funds and exchange-traded funds focused on energy companies, including drillers that create fractures in rocks by injecting fluid into cracks to enable more oil and gas to flow out of the formation. That’s almost twice as much as in the same period last year, bringing total assets to $128.2 billion, according to New York-based Strategic Insight.

The TTIP is a malignant tumor growing secretly underneath our skins.

• US Firms Could Make Billions From UK Via Secret TTIP Tribunals (Independent)

Britain faces a real risk of being ordered to pay vast sums to US multinationals under the controversial TTIP trade deal being negotiated between Washington and the EU, an analysis of similar agreements has revealed. The Government has repeatedly played down concerns that secret tribunals established by TTIP will lead to large numbers of American corporations suing the UK in trade disputes. But United Nations figures uncovered by The Independent show that US companies have made billions of dollars by suing other governments nearly 130 times in the past 15 years under similar free-trade agreements. In one case alone the US oil company Occidental Petroleum successfully sued the government of Ecuador for $1.8bn. A separate case claiming $6bn has also be filed. The tribunals are used to rule on disputes between nation states and aggrieved companies.

Details of these cases are often kept secret, but notorious precedents include the tobacco giant Philip Morris suing Australia and Uruguay for restricting advertising and putting health warnings on packets. TTIP has provoked storms of protest from European campaign groups and largely left-leaning politicians. On Saturday, protesters will stage a “day of action” against the proposed deal in hundreds of cities across the UK and Europe. Critics say the tribunals, held under the so-called Investor-State Dispute Settlement (ISDS) system, subvert democratic justice, giving power over foreign citizens to big companies. Hearings are held in private, in international courts at the World Bank in Washington DC, bypassing the legal system of the country being sued, meaning details are often impossible to uncover. In some cases the very existence of the case is not made public.

Draghi, Larry Summers, everyone has a go at Germany. Which is really bad timing gicen recent economic data coming from Berlin.

• Draghi Clashes With Germany’s Schaeuble Over Steps for Europe (Bloomberg)

European Central Bank President Mario Draghi and German Finance Minister Wolfgang Schaeuble differed over what further steps to take if the euro-area economy keeps weakening as the region came under renewed foreign pressure to revive growth. As the International Monetary Fund’s annual meeting in Washington began, Draghi pledged anew to loosen monetary policy more if needed and called on those governments with the room to ease fiscal policy to do so. By contrast, Schaeuble warned against U.S.-style quantitative easing and urged continued budgetary discipline. The differences demonstrate the lack of a common front in euro-area policy making as its economy continues to deteriorate and the IMF estimates there is as much as a 40% risk of a third recession since 2008. Finance ministers and central bankers from the Group of 20 economies meet today, and Europe’s economic performance will be among the issues discussed, officials said.

“There is a concern about a deflationary spiral, we aren’t predicting it, but we want to preclude it,” Canadian Finance Minister Joe Oliver told reporters. “No one is saying it’s a piece of cake, far from it.” The euro-area has re-emerged as the main concern of officials worldwide after its economy stalled in the second quarter and inflation slowed to the weakest in almost five years. The IMF this week cut its euro-area growth forecasts to 0.8% for 2014 and 1.3% next year and said the ECB should consider buying government debt. “More, we hope, will be done,” IMF Managing Director Christine Lagarde told reporters. Speaking in Washington yesterday, Draghi reiterated his call on governments to overhaul their economies now and repeated the ECB is “ready to alter the size and/or the composition of our unconventional interventions, and therefore of our balance sheet, as required.”

China is a danger first and foremost to itself, internal strife will rule the day. Its impact on the world will come after.

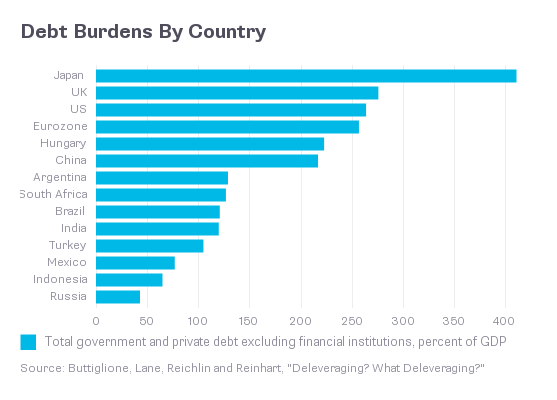

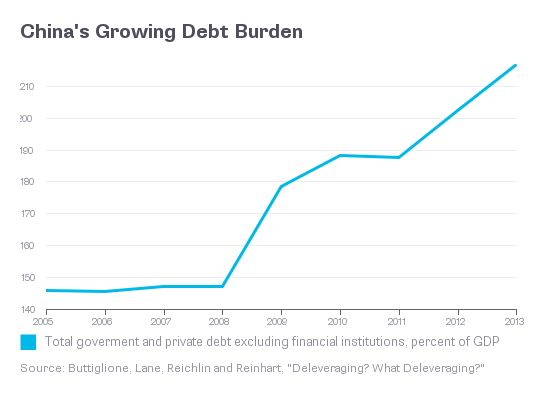

• Is China’s Bubble the Next Financial Crisis? (Bloomberg)

Will China be the source of the next global financial disaster? The evidence increasingly offers reason for concern, though the nature of any calamity could be very different from what the world endured in 2008. At a time when consumers and governments in the U.S. and Europe have been trying – with limited success – to pare down or at least stabilize their debt burdens, China has been doing the opposite. Over the past five years, it has pumped more than $13 trillion of credit into its economy, in an effort to keep its growth rate up amid a weak global recovery. The Chinese credit boom has rapidly turned the country into one of the developing world’s most indebted, according to a new report from London’s Centre for Economic Policy Research. As of 2013, total private and government debt, excluding that of financial institutions, stood at 217% of gross domestic product, up from only 147% in 2008.

That’s more than in any major developing nation other than Hungary, though still significantly less than in advanced nations such as the U.S. or Japan. Such credit-fueled growth can’t be sustained for long without causing major distortions and setting the country up for a fall. The stimulus is already running into diminishing returns. Over the five years through 2013, government and private debt grew by about 3 yuan for each added yuan of economic activity, a level of credit intensity that the U.S. exceeded only in the years leading up to the 2008 crisis. As in the U.S., much of the money is going to borrowers with questionable ability to pay, fueling overbuilding and excess capacity.

Nobel=clueless.

• Health Of Global Economy Is Worrying: Stiglitz (CNBC)

The euro zone is “very much” at risk of a recession and U.S. continues to struggle with a mediocre recovery, said Nobel Prize-winning economist Joseph Stiglitz, sounding the alarm on the deteriorating global economy. If Europe were to enter a recession it would likely be “relatively minor,” but persistent stagnation puts the single-currency bloc “on target for a lost decade,” he said. “To me, the problem is not whether [euro zone countries] are growing a little positive or negative, the real point is they are not back to where they should be,” Stiglitz, a professor of economics at Columbia University, told CNBC on Friday. Austerity is the wrong prescription for repairing the euro zone economy and underlies economic stagnation, he said.

“European leaders have consistently overestimated where the economy was going. Unfortunately, the leaders of Europe, in particular Germany, don’t seem to recognize that austerity is one of the reasons Europe is doing so poorly,” Stiglitz said. There is a lot of slack in the U.S. economy, Stiglitz said. “The U.S. has been moving along in this very mediocre way. What’s remarkable is how low the growth is in spite of the fact that… we have some very strong positives,” he said, referring to the country’s huge discoveries of natural gas and thriving high-tech sector. Furthermore, a stronger U.S. dollar may prove to be a bane for the economy, putting the country’s exporters at a competitive disadvantage, he said. Asked whether the world’s largest economy will be strong enough to justify an interest rate hike by mid-2015, he said “almost surely no.”

Get out of the EU, amici.

• Bad Loans At Italy Banks Up 20% In August To Record High (Reuters)

The Bank of Italy said on Thursday bad loans in the country rose 20% year-on-year in August reaching a new record high as the third-largest economy in the euro zone struggles to recover from recession. The loans that are least likely to be repaid were worth €173.9 billion ($222 billion) in August, the highest level since the start of the current statistical series in 1998, central bank data showed. In July, non-performing loans rose 20.5% to €172.4 billion. At the same time, lending to companies and families continued to contract, with loans to households down 0.8% in August after falling 0.7% a month earlier. Credit to non-financial companies fell 3.8% after a contraction of 3.9% in July.

There’d better be no blood flowing in Catalunya, or the world’s Hemingways may once again descend on Spain.

• Barcelona Stirs as Spain Warns of Separatist Tinderbox (Bloomberg)

Tensions are rising in Barcelona. As Catalan President Artur Mas goads the Spanish courts, threatening to defy their suspension of a Nov. 9 vote on independence, Prime Minister Mariano Rajoy is preparing measures to ensure he can retain control of the police in Catalonia. Politicians and civic leaders in the region who want to remain part of Spain say they have been threatened by separatists. “There’s been a cat let out of the bag,” said James Amelang, a professor of Spanish history at the Autonomous University of Madrid. “I really think the politicians might have lost their capacity to put it back.” Mas’s independence drive has been propelled by a surge of support on the streets, with hundreds of thousands attending peaceful rallies in Barcelona last month. As the date of the proposed vote approaches, officials in Madrid are preparing for when the force of Catalan separatism crashes into the immovable object of the Spanish constitution.

Spanish Foreign Minister Jose Manuel Garcia-Margallo warned last week that events in Catalonia could be moving too fast for the regional leader to control. Mas “may see the political process shift away from the institutions, and particularly the regional government, and move onto the streets, which is extremely dangerous,’ Garcia-Margallo told state radio broadcaster RTVE. ‘‘When institutions lose control, we head down an unknown path.’’ Spain’s national police force put more officers on the streets of the Catalan capital this month to beef up security at government buildings, a government press officer said on Oct. 1. Europa Press reported reinforcements total about 300 policemen. The central government has also drafted a law that would give officers from the regional police, the Mossos d’Esquadra controlled by Mas’s government, the chance to transfer to the national police force commanded by Madrid.

Ho much longer will Britain stay in the EU?

• UKIP: From ‘Clowns’ To Contenders (CNBC)

Just last year, Conservative Party grandee Kenneth Clarke described them as a “collection of clowns” – yet now they represent the greatest electoral challenge to the three main U.K. political parties for decades. The U.K. Independence Party (UKIP) – the closest the U.K. has to the U.S. tea party – has emerged from the fringes to the limelight, winning its first seat in the U.K. parliament in a by-election on Thursday. UKIP candidate Douglas Carswell won a by-election in Clacton, south east England by a majority of 12,404 to become the party’s first member of parliament. The election was triggered by incumbent member of Parliament (MP) Douglas Carswell’s defection from the Conservative Party to UKIP. The party briefly had one MP in 2008, when then-Conservative MP Bob Spink defected. Clacton – with its working class, elderly, white and economically left-behind population – was already identified as one of the constituencies most likely to vote UKIP in May’s general election by Matthew Goodwin and Rob Ford, authors of “Revolt on the Right” and experts on the party.

A by-election further north may actually be more concerning for the main political parties. In Heywood and Middleton, a safe Labour seat to date, the death of the local MP has triggered a vote. Labour candidate Liz McInnes won the vote by a margin of 617 — a far cry from a 5,971 majority at the 2010 general election. The results suggest that UKIP has made significant inroads there and gone beyond attracting only right-wing Conservatives, but also left-wing voters, who feel threatened by cheap labor from immigrants. “UKIP supporters are very pessimistic on the economy,” John Curtice, professor of politics at the University of Strathclyde, told CNBC. “The improvement in the economy hasn’t trickled down to the older working-class, and that’s UKIP’s constituency.”

The new way to spell democracy.

• Dark Money Groups Set Record in 2014 US Midterm Elections (Bloomberg)

The Internal Revenue Service calls them “social welfare” groups – they don’t disclose their donors and so far this cycle they’ve spent $100 million trying to influence elections. Never before have these types of organizations spent so much, so soon in Congressional races, according to a new analysis by the Center for Responsive Politics. If the past is precedent, that means roughly $200 million in dark money will go toward influencing the 2014 elections, CRP estimates. The trend means it’s harder than ever to know who the big spenders are or which interest is taking which side in an election. The social welfare groups, organized under section 501(c)(4) of the tax code, raise and spend unlimited amounts of money. Their cousins, super PACs, also raise and spend unlimited cash, but must disclose contributors. Some of the election cycle’s mega-groups toggle between using dark money groups and super-PACs depending on need and donor preference.

The David and Charles Koch-backed political network stopped using their dark money group for TV ads in the final 60 days of the cycle, and are now funding election spots with their new super PAC. Generally, the nonprofits spend in multiple races — but there are a few examples this year of 501(c)(4)s dedicated to one candidate. The highest profile is the Kentucky Opportunity Coalition, a nonprofit that started running commercials this summer to support Senate Minority Leader Mitch McConnell. One hint as to who’s behind the group: The treasurer is listed as Caleb Crosby. He’s also the treasurer for Karl Rove’s American Crossroads – which just started running ads in Kentucky against McConnell’s Democratic opponent, Alison Lundergan Grimes. Democrats don’t tend to use dark money groups as much. They favor super PACs, and so far this year their super PACs are better funded than the Republicans’.

It’s being reported as an unfortunate incident, but it says much more. The report by the Russian Union of Engineers has been totally silenced in the west.

• MH-17 Report False Flag Exposed (Zero Hedge)

When exactly a month ago the supposedly objective, impartial Netherlands released its official, 34-page preliminary report of the MH-17 crash over Ukraine, presumably based on black box data, air traffic control records, and other “authentic, verified” information, there were precisely zero mentions of “oxygen”, “mask” or “oxygen mask.” Which is odd, because in what should become the biggest Freudian slip scandal in false-flag history, certainly since the Gulf of Tonkin, yesterday Dutch Foreign Minister Frans Timmermans accidentally revealed for the very first time ever, that one of the Australian passengers aboard the doomed airplane “appears to have donned an oxygen mask before the fatal crash, suggesting some on board might have been aware of their impending deaths, a Dutch official disclosed.”

Clearly a crucial aspect of the crash, as it points at the severity of the alleged explosion, yet one which was not noted until yesterday and which completely skipped the purvey of the official crash report for reasons unknown. Needless to say, this makes a complete mockery of the story that the plane had exploded upon impact with the “Russian” missile, and is why there was supposedly no trace of any impact on the flight’s black box recorder. Whether or not it also means that the alternative theory that a Ukraine jet had purposefully downed the Malaysian aircraft to serve as a pretext to implicate Russia, is unclear. But it also means that yet another conspiracy theory becomes fact: namely that whoever were the western powers who doctored and manipulated the “official” crash report of MH-17 to implicate Putin, not only lied but fabricated evidence.

What happens when you don’t throw out in 1 generation the knowledge acquired in 1000.

• The Amish Farmers Reinventing Organic Agriculture (Atlantic)

“In the Second World War,” Samuel Zook began, “my ancestors were conscientious objectors because we don’t believe in combat.” The Amish farmer paused a moment to inspect a mottled leaf on one of his tomato plants before continuing. “If you really stop and think about it, though, when we go out spraying our crops with pesticides, that’s really what we’re doing. It’s chemical warfare, bottom line.” Eight years ago, it was a war that Zook appeared to be losing. The crops on his 66-acre farm were riddled with funguses and pests that chemical treatments did little to reduce. The now-39-year-old talked haltingly about the despair he felt at the prospect of losing a homestead passed down through five generations of his family. Disillusioned by standard agriculture methods, Zook searched fervently for an alternative. He found what he was looking for in the writings of an 18-year-old Amish farmer from Ohio, a man named John Kempf. Kempf is the unlikely founder of Advancing Eco Agriculture, a consulting firm established in 2006 to promote science-intensive organic agriculture.

The entrepreneur’s story is almost identical to Zook’s. A series of crop failures on his own farm drove the 8th grade-educated Kempf to school himself in the sciences. For two years, he pored over research in biology, chemistry, and agronomy in pursuit of a way to save his fields. The breakthrough came from the study of plant immune systems which, in healthy plants, produce an array of compounds that are toxic to intruders. “The immune response in plants is dependent on well-balanced nutrition,” Kempf concluded, “in much the same way as our own immune system.” Modern agriculture uses fertilizer specifically to increase yields, he added, with little awareness of the nutritional needs of other organic functions. Through plant sap analysis, Kempf has been able to discover deficiencies in important trace minerals which he can then introduce into the soil. With plants able to defend themselves, pesticides can be avoided, allowing the natural predators of pests to flourish.

Yes, the numbers keep getting worse.

• The Ominous Math Of The Ebola Epidemic (WaPo)

When the experts describe the Ebola disaster, they do so with numbers. The statistics include not just the obvious ones, such as caseloads, deaths and the rate of infection, but also the ones that describe the speed of the global response. Right now, the math still favors the virus. Global health officials are looking closely at the “reproduction number,” which estimates how many people, on average, will catch the virus from each person stricken with Ebola. The epidemic will begin to decline when that number falls below one. A recent analysis estimated the number at 1.5 to 2. The number of Ebola cases in West Africa has been doubling about every three weeks. There is little evidence so far that the epidemic is losing momentum. “The speed at which things are moving on the ground, it’s hard for people to get their minds around. People don’t understand the concept of exponential growth,” said Tom Frieden, director of the U.S. Centers for Disease Control and Prevention.

“Exponential growth in the context of three weeks means: ‘If I know that X needs to be done, and I work my butt off and get it done in three weeks, it’s now half as good as it needs to be?’ Frieden warned Thursday that without immediate, concerted, bold action, the Ebola virus could become a global calamity on the scale of HIV. He spoke at a gathering of global health officials and government leaders at the World Bank headquarters in Washington. The president of Guinea was at the table, and the presidents of Liberia and Sierra Leone joined by video link. Amid much bureaucratic talk and table-thumping was an emerging theme: The virus is still outpacing the efforts to contain it. “The situation is worse than it was 12 days ago. It’s entrenched in the capitals. Seventy% of the people [who become infected] are definitely dying from this disease, and it is accelerating in almost all settings,” Bruce Aylward, assistant director general of the World Health Organization, told the group.

Aylward had come from West Africa only hours earlier. He offered three numbers: 70, 70 and 60. To bring the epidemic under control, officials should ensure that at least 70% of Ebola-victim burials are conducted safely, and that at least 70 percent of infected people are in treatment, within 60 days, he said. More numbers came from Ernest Bai Koroma, president of Sierra Leone: The country desperately needs 750 doctors, 3,000 nurses, 1,500 hygienists, counselors and nutritionists. The numbers in this crisis are notoriously squishy, however. Epidemiological data is sketchy at best. No one really knows exactly how big the epidemic is, in part because there are areas in Liberia, Sierra Leone and Guinea where disease detectives cannot venture because of safety concerns. The current assumption is that for every four known Ebola cases, about six more go unreported.

There is very little out there that doesn’t signal a gross incompetence, lack of urgency and lack of understanding.

• Ebola Is ‘Entrenched And Accelerating’ In West Africa (BBC)

The World Health Organization (WHO) has warned that Ebola is now entrenched in the capital cities of all three worst-affected countries and is accelerating in almost all settings. WHO deputy head Bruce Aylward warned that the world’s response was not keeping up with the disease in Guinea, Liberia and Sierra Leone. The three countries have appealed for more aid to help fight the disease. The outbreak has killed more than 3,860 people, mainly in West Africa. More than 200 health workers are among the victims. Speaking on Thursday, Mr Aylward said the situation was worse than it was 12 days ago. “The disease is entrenched in the capitals, 70% of the people affected are definitely dying from this disease, and it is accelerating in almost all of the settings,” he said. Meanwhile in Spain, seven more people are being monitored in hospital for Ebola. They include two hairdressers who came into contact with Teresa Romero, a Madrid nurse looked after an Ebola patient who had been repatriated from West Africa. She is now very ill and reported to be at serious risk of dying.

Elsewhere: The UK is investigating reports a Briton suspected of having the disease has died in Macedonia, though Macedonia’s health ministry says there are “high chances” this is not a case of the disease Britain is to begin enhanced screening for Ebola in people travelling from affected countries, the government announces. The US is introducing new security measures to screen passengers arriving from Ebola-affected countries in West Africa at five major US airports. In Texas, a county sheriff deputy was quarantined after visiting the home of the first person diagnosed with Ebola on US soil, who later died from the virus. The medical charity Medecins Sans Frontieres reported a sharp increase of Ebola cases in the Guinean capital, Conakry, dashing hopes that the disease was being stabilised there.

Home › Forums › Debt Rattle October 10 2014