Jack Delano Atchison, Topeka, and Santa Fe Railroad locomotive shops San Bernardino, CA 1943

China Lunar New Year is from Jan 24-30. Hundreds of millions of Chinese traveling.

• China Quarantines 11 Million In Wuhan As Virus Kills 17, With 95 Critical (RT)

The World Health Organization (WHO) has commended China’s swift response to a rapidly moving virus gripping the country, but despite a quick-climbing infection tally, the agency is reluctant to classify it a global health threat. “What they are doing is a very, very strong measure and with full commitment,” WHO director-general Tedros Ahanom Ghebreyesus said on Wednesday, referring to Beijing’s shutdown of all public transportation in and out of the city of Wuhan, the viral epicenter. As of 10am local time, all trains, buses, railways and ferries traveling to and from Wuhan have halted operations until further notice in an effort to slow the spread of the virus, with the government calling on the city’s 11 million residents to refrain from leaving without “special reasons.”

Medical personnel were also posted at toll gates and checkpoints along major roadways to screen commuters for the illness. The comments followed an emergency WHO meeting in Geneva on Wednesday, where the health agency mulled whether to declare the novel coronavirus – now dubbed “2019-nCoV” – a worldwide emergency. Still unsure after a day of deliberation, however, WHO will meet again Thursday, with Tedros saying he took the decision “extremely seriously.” China’s National Health Commission (NHC), meanwhile, has provided the latest figures tracking the impact of the dangerous pathogen, with 131 newly confirmed infections bringing the total to 571 across some 25 Chinese provinces.

Seventeen people have died from the illness thus far, all in central China’s Hubei province, with another 95 in critical condition with severe pneumonia-like symptoms. There are also now 393 suspected infections in China – 257 of them registered on Wednesday alone – with 5,897 additional cases of “close contact,” the NHC said.

Couldn’t find any relevant write-ups of Schiff’s marathon, so here’s the text -not sure it covers all 3.28 minutes of it. But who cares? He had nothing new and what he had, he repeated 20+ times. Including the very dead: “The United States aids Ukraine and her people so that they can fight Russia over there, and we don’t have to fight Russia here.”

The Hunter Biden/Burisma story has not been debunked as Schiff repeats ad nauseum, what has been debunked -by Mueller- is Russiagate. But who cares?

Michael Tracey: “Counted at least 57 references to Russia or Putin in today’s impeachment trial which is why it’s a total fallacy to separate this episode from the Russiagate narrative which has dominated US politics for 3+ years. What’s happening now is just its inevitable culmination..”

• Adam Schiff’s Opening Argument At Senate Impeachment Trial (Pol.)

Mr. Chief Justice, Senators, counsel for the President, and my fellow House managers: “When a man unprincipled in private life desperate in his fortune, bold in his temper, possessed of considerable talents, having the advantage of military habits—despotic in his ordinary demeanour—known to have scoffed in private at the principles of liberty—when such a man is seen to mount the hobby horse of popularity—to join in the cry of danger to liberty—to take every opportunity of embarrassing the General Government & bringing it under suspicion—to flatter and fall in with all the non sense of the zealots of the day—It may justly be suspected that his object is to throw things into confusion that he may ‘ride the storm and direct the whirlwind.’”

Those words were written by Alexander Hamilton in a letter to President George Washington, at the height of the Panic of 1792, a financial credit crisis that shook our young nation. Hamilton was responding to sentiments relayed to Washington as he traveled the country, that America, in the face of that crisis, might descend from “a republican form of Government,” plunging instead into “that of a monarchy.” The Framers of our Constitution worried then—as we worry today—that a leader could come to power not to carry out the will of the people that he was elected to represent, but to pursue his own interests. They feared that a president could subvert our democracy by abusing the awesome power of his office for his own personal or political gain. And so they devised a remedy as powerful as the evil it was meant to combat: Impeachment.

Go Tulsi. Someone has to break the DNC, or the Democrats are finished as a party..

• Gabbard Suing Clinton For Defamation Over ‘Russian Asset’ Comments (Hill)

Rep. Tulsi Gabbard (D-Hawaii) is suing Hillary Clinton for defamation over the former secretary of State’s remarks on a podcast characterizing the Democratic presidential candidate as a Russian asset. Gabbard filed the defamation lawsuit Wednesday in the U.S. District Court for the Southern District of New York. Gabbard’s lawyers allege that Clinton’s comments have “smeared” Gabbard’s “political and personal reputation.” “Tulsi Gabbard is a loyal American civil servant who has also dedicated her life to protecting the safety of all Americans,” Gabbard’s lawyer Brian Dunne said in a statement. “Rep. Gabbard’s presidential campaign continues to gain momentum, but she has seen her political and personal reputation smeared and her candidacy intentionally damaged by Clinton’s malicious and demonstrably false remarks.”

Gabbard’s campaign referred all questions on the lawsuit to Dunne. In response to the lawsuit, Clinton spokesman Nick Merrill said “that’s ridiculous.” [..] The lawsuit claims that Clinton is a “cutthroat politician” and “sought retribution” for Gabbard endorsing Clinton’s 2016 Democratic primary opponent, Sen. Bernie Sanders (I-Vt.). Gabbard is now facing Sanders in the crowded 2020 Democratic primary. “Clinton’s false assertions were made in a deliberate attempt to derail Tulsi’s presidential campaign,” it says. Gabbard’s lawyers claim Clinton’s “peddling of this theory” has harmed Gabbard, voters and “American democracy.” “Tulsi brings this lawsuit to ensure that the truth prevails and to ensure this country’s political elites are held accountable for intentionally trying to distort the truth in the midst of a critical Presidential election,” the lawsuit says.

Congresswoman & Presidential candidate @TulsiGabbard on why she’s suing Clinton pic.twitter.com/nm8PWGm0jm

— The Convo Couch (@theconvocouch) January 23, 2020

No. 1 for DNC: dump Biden. He’s roadkill.

• Black South Carolina Elected Official Now Backing Sanders Over Biden (AP)

A South Carolina elected official who endorsed Joe Biden last month is switching her allegiance to Bernie Sanders in the state’s first-in-the-South presidential primary, saying she had viewed the former vice president — whose support in the state is considered deep — as “a compromise choice.” Dalhi Myers told AP on Wednesday that she was making the change in part because she values what she sees as Sanders’ strength in being able to go toe-to-toe with President Donald Trump in the general election. “I looked at that, and I thought, ‘He’s right,’” said Myers, a black woman first elected to the Richland County Council in 2016. “He’s unafraid and he’s unapologetic. … I like the fact that he is willing to fight for a better America — for the least, the fallen, the left behind.”

Sanders, a Vermont senator, frequently calls out what he sees as Trump’s dishonesty, referring on the campaign trail to the president as a “pathological liar.” Biden, whose relationships in South Carolina go back decades, has led polling in the state, particularly among the black voters who make up most of the state’s Democratic primary electorate. Sanders, whose 47-point loss to Hillary Clinton in 2016 in South Carolina blunted the momentum generated in opening primary contests and exposed his weakness with black voters, has focused on strengthening his ties in the state’s black community. In December, Myers, a corporate lawyer in Columbia, was among more than a dozen South Carolina elected officials to endorse Biden, saying at the time in a release from the Biden campaign that he was “the only candidate with the broad and diverse coalition of support we need to win” against Trump in the general election.

No, really. Dump Biden.

• Hunter Biden Ordered To Appear In Court Next Week For Contempt Hearing (ZH)

Hunter Biden has been ordered to stand in front of an Arkansas judge next Tuedsay to explain why he shouldn’t be held in contempt of court for failing to produce a laundry list of financial and personal information in his ongoing child support dispute with stripper Lunden Alexis Roberts. Roberts asked the court on Tuesday to hold Biden in contempt for failing to disclose financial information, contact information, and “a list of all companies he currently owns or in which he has an ownership interest,” as well as “all companies in which he has had an ownership interest in the past five years.” Also sought are a copy of Biden’s 2017 and 2018 tax returns, deeds to properties he owns, and an executed copy of a financial records release Biden has been avoiding filing unless the court allows him to do so under seal.

“The defendant continues to act as though he has no respect for this Court, its orders, the legal process in this state, or the needs of his child for support,” reads the filing, which adds “This is but another example of the defendant’s unnecessary actions to frustrate prompt adjudication of this matter and increase the plaintiff’s litigation costs.” Circuit Court Judge Holly Meyer agreed, ordering Biden to appear in person to explain his failure to produce the requested information which was due in August, 2019. In November, a DNA test revealed Hunter to be the father of the unnamed child with Roberts. In order to determine what Biden can cough up, Roberts has sought extensive financial records for periods which include his time on the board of a Ukrainian energy company while his father was the Obama administration’s point-man on Ukraine.

Still don’t quite get this. Did MbS pose as a Nigerian prince? Will the UN get involved if your phone is hacked? Are the UN and Bezos trying to seek vengeance for Khashoggi in a roundabout way?

• UN Demands US Probe Of Alleged Saudi Hack of Bezos’ Phone (ZH)

Despite the Saudi Embassy’s denial of the “absurd” claims that MbS hacked Jeff Bezos’ phone, United Nations experts have called for an “immediate investigation” by the United States. Independent experts Agnes Callamard, UN Special Rapporteur on summary executions and extrajudicial killings, and David Kaye, UN Special Rapporteur on freedom of expression, said in a statement Wednesday: “The information we have received suggests the possible involvement of the Crown Prince in surveillance of Mr. Bezos, in an effort to influence, if not silence, The Washington Post’s reporting on Saudi Arabia.” “The circumstances and timing of the hacking and surveillance of Bezos also strengthen support for further investigation by U.S. and other relevant authorities of the allegations that the Crown Prince ordered, incited, or, at a minimum, was aware of planning for but failed to stop the mission that fatally targeted Mr. Khashoggi in Istanbul.”

“The alleged hacking of Mr. Bezos’s phone, and those of others, demands immediate investigation by U.S. and other relevant authorities, including investigation of the continuous, multi-year, direct and personal involvement of the Crown Prince in efforts to target perceived opponents.” The U.N. experts reviewed a 2019 digital forensic analysis of Bezos’ iPhone, which they said was made available to them as U.N. Special Rapporteurs. The experts said that records showed that within hours of receipt of a video from the crown Pprince’s WhatsApp account, there was “an anomalous and extreme change in phone behavior” with enormous amounts of data from the phone being transmitted over the following months.

Oh cut it out.

• Boeing CEO Expects To Resume 737 MAX Production Before Mid-Year (R.)

Boeing Chief Executive Dave Calhoun told reporters on Wednesday the U.S. planemaker expects to resume 737 MAX production months before its forecasted mid-year return to service and said it did not plan to suspend or cut its dividend. The company announced a production halt in December, when the global grounding of the fast-selling 737 MAX following two deadly crashes in five months looked set to last into mid-2020 — a timeline pushed back after Boeing endorsed new simulator training for pilots. Calhoun said the company is not considering scrapping the MAX and expects it will continue to fly for a generation.

“I am all in on it and the company is all in on it,” Calhoun said, adding Boeing will not launch a marketing campaign to get customers to get back on 737 MAX planes. The company said on Tuesday it now expects regulators to approve the plane’s return to service in the middle of the year. Calhoun said he did not see recent issues raised about wiring or software as “serious problems.” The production delay threatens to cut U.S. GDP by as much as 0.5 percentage points. President Donald Trump on Wednesday told CNBC Boeing is a “very disappointing company.” United Airlines said Wednesday it does not expect to fly the Boeing 737 MAX this summer.

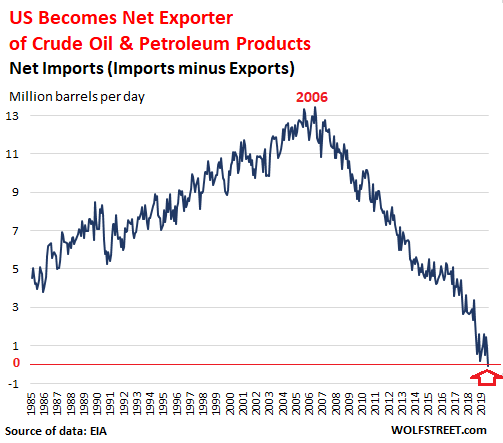

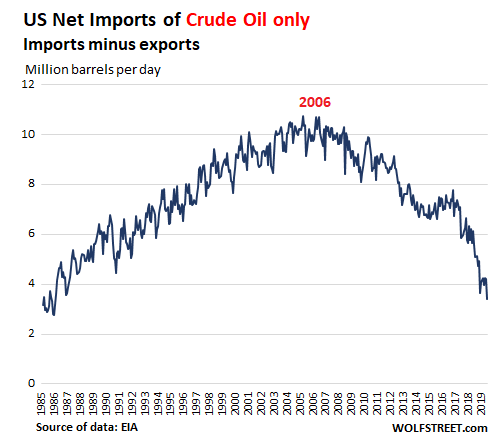

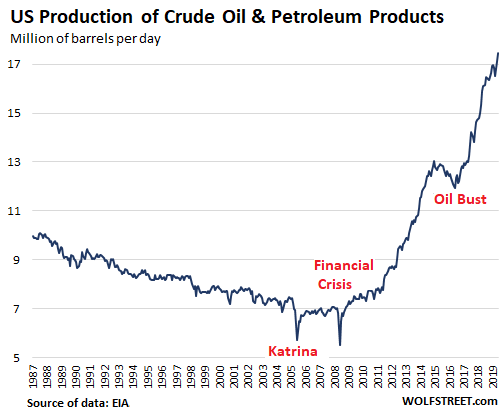

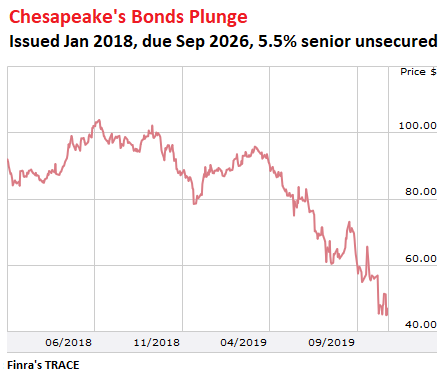

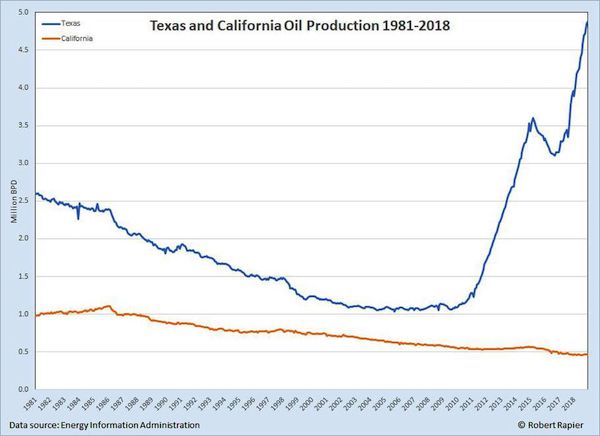

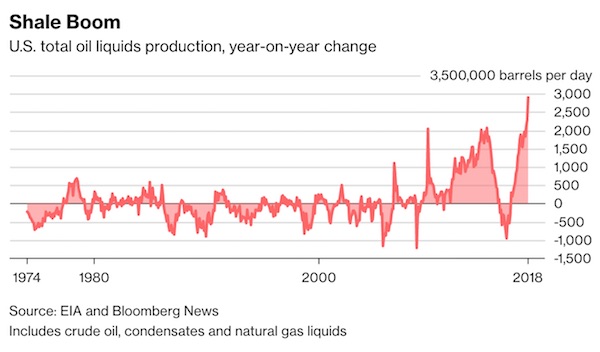

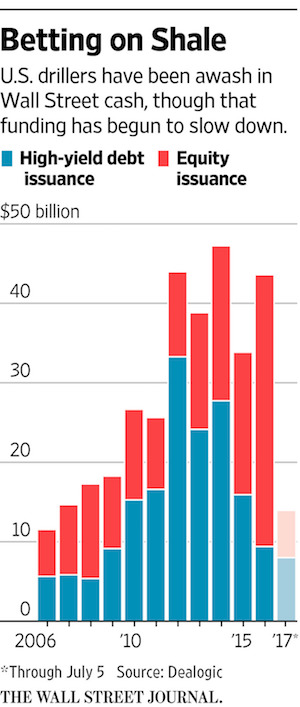

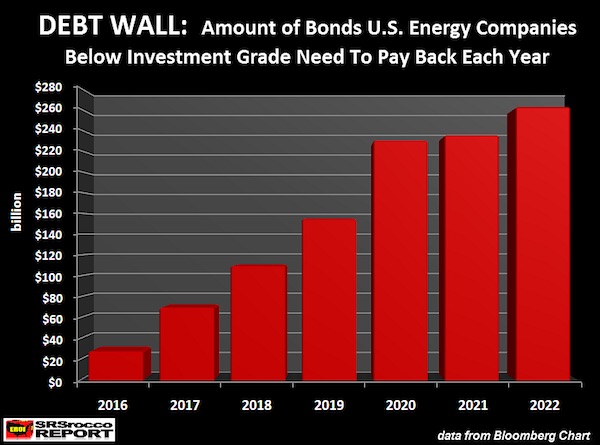

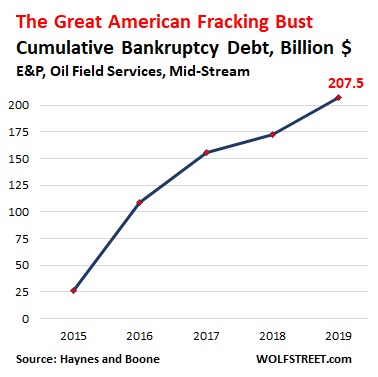

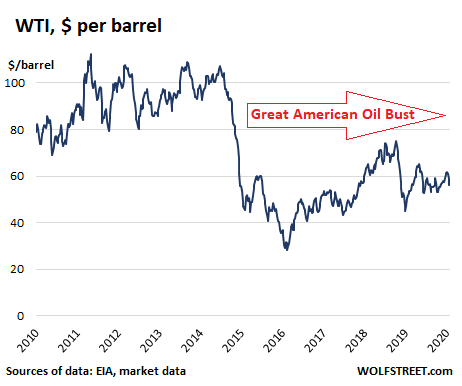

Subtitle: US Fracking Gushes Bankruptcies, Defaulted Debt, and Worthless Shares

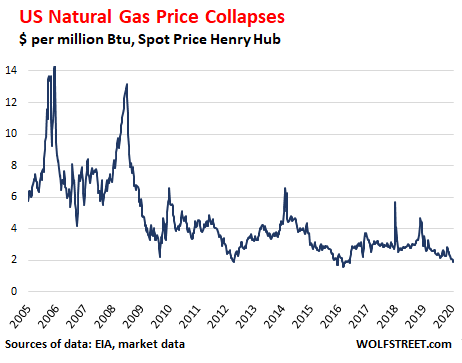

• The Great American Shale Oil & Gas Bust (WS)

Following the sharp re-drop in oil and natural gas prices in late 2018, bankruptcy filings in the US by already weakened exploration and production companies , oilfield services companies, and “midstream” companies (they gather, transport, process, or store oil and natural gas) jumped by 51% in 2019, to 65 filings, according to data compiled by law firm Haynes and Boone. This brought the total of the Great American Shale Oil & Gas Bust since 2015 in these three sectors to 402 bankruptcy filings. The debt involved in these bankruptcies in 2019 doubled from 2018 to $35 billion. This pushed the total debt listed in these bankruptcy filings since 2015 to $207 billion. The chart below shows the cumulative total debt involved in these bankruptcies since 2015.

But this does not include the much larger losses suffered by shareholders that get mostly wiped out in the years before the bankruptcy as the shares descend into worthlessness, and that then may get finished off in bankruptcy court. The banks, which generally had the best collateral, took the smallest losses; bondholders took bigger losses, with unsecured bondholders taking the biggest losses. Some of them lost most of their investment; others got high-and-tight haircuts; others held debt that was converted to equity in the restructured companies, some of which soon became worthless again when the company filed for bankruptcy a second time. The old shareholders took the biggest losses.

The Great American Fracking Bust started in mid-2014, when the price of WTI dropped from over $100 a barrel to below $30 a barrel by early 2016. Then the price began to recover, going over $70 a barrel in September and October 2018. But then it began to re-plunge. By the end of 2018, WTI had dropped to $47 a barrel. [..]

And 2020 is starting out terrible for natural gas producers. The price of natural gas has plunged to $1.90 per million Btu at the moment, a dreadfully low price where no one can make any money. Producers in shale fields that produce mostly gas, such as the Marcellus, are in deeper trouble still, because oil, even at these prices, would be a lot better than just natural gas. Producing areas with constrained takeaway capacity (it takes a lot longer to build pipelines than to ramp up production) are subject to local prices, which can be lower still. In some areas, such as the Permian in Texas and New Mexico, the most prolific oil field in the US, where natural gas is a byproduct of oil production, limited takeaway capacity has caused local prices to collapse, and flaring to surge.

Sent to WIkiLeaks yet?

• Ghislaine Maxwell’s Personal Emails Were Hacked (DM)

Ghislaine Maxwell’s personal emails have been hacked, and damaging information, including the names of individuals linked to Jeffrey Epstein’s sex trafficking case, are at risk of being publicly released. The revelation was made in a letter filed by the British socialite’s lawyers in the defamation case brought against her by Jeffrey Epstein accuser Virginia Guiffre, DailyMail.com has learned. The letter was sent by Maxwell’s attorney, Ty Gee, on December 5 to New York federal court Judge Loretta A. Preska but made public last week. The letter addresses the materials that should remain sealed or redacted in the case. It notes ‘the difficulty and complexity’ of the process as there are more than 8,600 pages, adding that it is ‘difficult-to-overstate importance to the lives of Ms. Maxwell and the non-parties’.

Gee’s letter says that the project ‘could not be accomplished by scanning or speed-reading’ as each page had to be carefully analysed to redact, for example, ‘a surname or an email address’. He refers to details that were released in error in the 2,000 pages that were made public in August by the U.S. Court of Appeals for the Second Circuit. Those filings revealed allegations that Maxwell procured underage girls for Epstein. She has denied those charges. ‘Despite the Second Circuit’s best efforts, it made serious mistakes. For example, it redacted a non-party’s name in one location but not another; so the media immediately gained access to that name,’ Gee wrote.

‘As another example, it redacted Ms. Maxwell’s email address (which linked to her own domain name) in one location but not another; shortly afterward hackers breached the host computer.’ The hack may have implications for Prince Andrew after it was revealed in December that the Duke of York exchanged emails with Maxwell in 2015 about Giuffre. In that email, revealed on Panorama, Maxwell and the British royal discussed Giuffre – despite denials from Prince Andrew that he had never met the then-teenager and that a photo of them together was a fake. ‘Let me know when we can talk. Got some specific questions to ask you about Virginia Roberts,’ Prince Andrew wrote in an email to Maxwell. She replied: ‘Have some info – call me when you have a moment.’

Make that 70.

• TEPCO Estimates It Will Take 44 Years To Decommission Fukushima No. 2 (JT)

Tokyo Electric Power Company Holdings Inc. has outlined plans for the decommissioning of its Fukushima No. 2 nuclear power station, estimating that the process will take 44 years. Tepco presented the outline of decommissioning plans to the town assembly of Tomioka, Fukushima Prefecture, one of the two host towns of the nuclear plant, on Wednesday. According to the outline, the decommissioning process will have four stages, taking 10 years for the first stage, 12 years for the second stage and 11 years each for the third and fourth stages.

Tepco will survey radioactive contamination at the nuclear plant in the first stage, clear equipment around nuclear reactors in the second, remove the reactors in the third and demolish the reactor buildings in the fourth. Meanwhile, the plant operator will transfer a total of 9,532 spent nuclear fuel units at the plant to a fuel reprocessing company by the end of the decommissioning process, and 544 unused fuel units to a processing firm by the start of the third stage.

Like it behooves a major charity. When interviewing such a CEO, always ask what their salaries are.

• Australia Red Cross: $11 Million ‘Administration Cost’ For Bushfire Help (7N)

The Australian Red Cross has admitted it may spend as much as $11 million processing the millions of dollars people from across the globe have donated to its bushfire appeal. However, in the face of public outcry, the charity has been forced to revise an earlier statement that suggested a large proportion of the $95 million raised could be quarantined for future natural disasters. The charity also pledged on Thursday to speed up the rate of its delivery of emergency funds to bushfire ravaged communities. “We’re now paying a million dollars a day and we’re keen to continue to speed that up, we know the assistance is needed now,” Red Cross’s director of emergencies, Noel Clement, told 7 NEWS.

Clement said the charity had already dispensed 700 grants of $10,000 each, totalling $7 million. He conceded however that of the revised total of $115 million donated so far – up from yesterday’s figure of $95 million – as much as $11 million could be spent on administration costs. Such a figure – roughly 10 per cent of total revenue raised – is generally considered to be the uppermost limit of acceptable administrative costs among large charitable organisations.

1980s: 4.5 million. 2019: 29,000.

• Monarch Butterfly Population Critically Low On California Coast – Again (G.)

The western monarch butterfly population wintering along California’s coast remains critically low for the second year in a row, a count by an environmental group released Thursday showed. The count of the orange-and-black insects by the Xerces Society, a not-for-profit environmental organization that focuses on the conservation of invertebrates, recorded about 29,000 butterflies in its annual survey. That’s not much different than last year’s tally, when an all-time low 27,000 monarchs were counted. “We had hoped that the western monarch population would have rebounded at least modestly, but unfortunately it has not,” said Emma Pelton, a monarch conservation expert with the Xerces Society.

By comparison, about 4.5 million monarch butterflies wintered in forested groves along the California coast in the 1980s. Scientists say the butterflies are at critically low levels in the Western US due to the destruction of their milkweed habitat along their migratory route as housing expands into their territory and use of pesticides and herbicides increases. Researchers also have noted the effect of climate change. Along with farming, climate change is one of the main drivers of the monarch’s threatened extinction, disrupting an annual 3,000-mile migration synced to springtime and the blossoming of wildflowers.

Photograph: Mike Blake/Reuters

Include the Automatic Earth in your 2020 charity list. Support us on Paypal and Patreon.