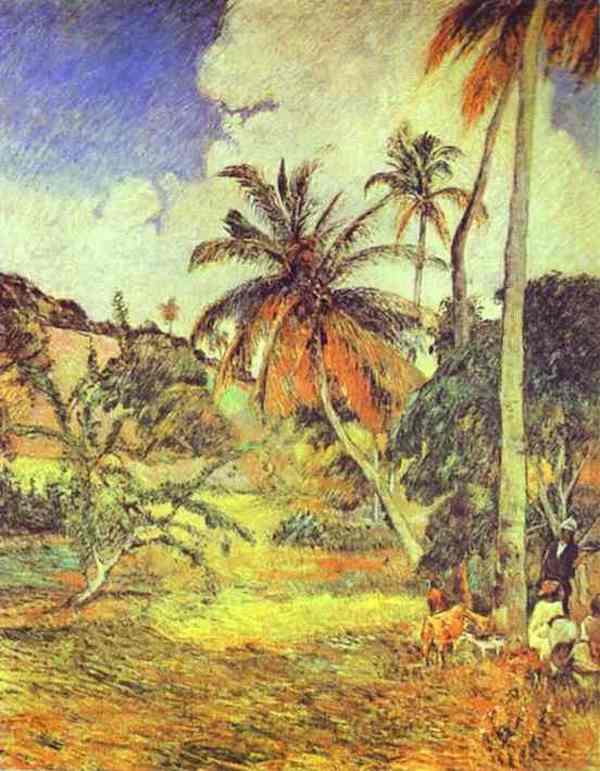

Paul Gauguin Palm trees on Martinique 1887

Dave

This is the greatest crypto video of all timepic.twitter.com/M34gqC4ch6

— yzy.eth (@LilMoonLambo) November 16, 2022

Devine

Miranda Devine about the G20 power grab pic.twitter.com/tpmwLZRZN0

— Wittgenstein (@backtolife_2023) November 17, 2022

Monty Python

https://twitter.com/i/status/1593092267619020801

Mr. Wonderful has most to fear.

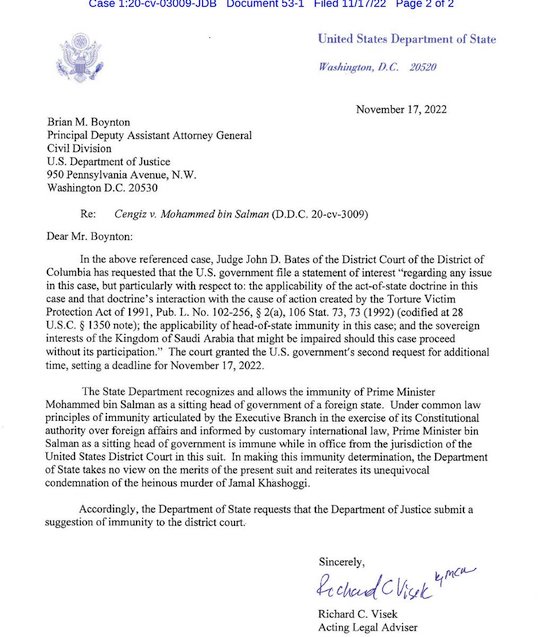

The U.S. says Saudi Prince Mohammed bin Salman’s official standing as the sitting head of a foreign government should give him immunity in the lawsuit filed by the fiancée of slain Washington Post columnist Jamal Khashoggi

Edward Dowd

Alarming… pic.twitter.com/mUWPecSmG8

— Wittgenstein (@backtolife_2023) November 17, 2022

“If there must be trouble, let it be in my day, that my child may have peace.”

– Thomas Paine

Ha ha, said the clown.

• Zelensky Declares Ukraine Corruption-Free (RT)

Corruption has been eradicated from Ukraine and all Russian influences have left or been chased out, Ukrainian President Vladimir Zelensky told a global audience at the Bloomberg New Economy Forum on Thursday. “No one will be able to forgive corruption in the future Ukraine,” he said, explaining that all the corrupt officials had fled the country in the months following the launch of Russia’s military operation. The remaining officials would not be tempted to “interfere in business operations” because all government services had gone electronic, he added. Zelensky promised there would be “no influence of Russian capital in Ukraine” going forward, explaining that any business interests not “united” behind his government had either “left our enterprises, or we pushed them out” – including the many political parties and media outlets his government has banned, such as the Party of Regions of predecessor Viktor Yanukovych.

The Ukrainian leader revealed he had just met with the vice president of the World Bank in order to “start a ‘pilot’ with them regarding investment insurance in Ukraine” and sought to allay potential concerns about corruption in his country. Investments – particularly by the mining and processing industries – would be safe, he insisted, praising the “independence of the economy, finances, and transparency of investments.” Western media outlets like The Guardian ranked Ukraine at or near the top on lists of the most corrupt nations in the world prior to the start of Russia’s military initiative in the country in February. Last year, Transparency International’s Corruption Perceptions Index ranked it the second-most corrupt in Europe.

Even Zelensky, in his inauguration speech, joked that 28 years of Ukrainian politicians had created a country of opportunities – “opportunities to steal, bribe and loot.” However, many of those voices have since gone quiet for fear of being seen as perpetuating a pro-Russian narrative. In June, the heads of the European Council and European Commission informed members of Zelensky’s government that they would have to “do their homework” to join the EU, tasking them with implementing judicial reforms, “de-oligarchizing” the economy, and fighting corruption successfully. The Council of Europe last month promised to help Kiev along by finding experts to advise it on constitutional reforms and electoral law to help the process along.

“..such statements could only be seen as an attempt to trigger a direct clash between Russia and NATO..”

• Ukraine Openly Lied To NATO Over Missile Strike, Diplomat Tells FT (RT)

Kiev has been accused of “openly lying” about the recent missile that hit Poland killing two civilians, the Financial Times reports citing an unnamed diplomat from a NATO country. Ukraine rushed to pin the blame on Moscow, while the Russian Ministry of Defense stated that footage from the site showed “elements of a missile from an S-300 air defense system used by the Air Force of Ukraine.” “This is getting ridiculous,” the official told the outlet on Wednesday. “The Ukrainians are destroying our confidence in them. Nobody is blaming Ukraine and they are openly lying. This is more destructive than the missile,” he said. The comments come in response to President Vladimir Zelensky claiming that Ukraine had nothing to do with the missile that struck Przewodow, Poland, on Tuesday, insisting that it was Russia that launched the weapon.

Zelensky has insisted that Ukrainian investigators be given access to the crash site, stating that if it turns out that it was indeed a Ukrainian rocket then Kiev would have to apologize. “But, sorry, first I want an investigation, access, the data you have – we want to have this,” Zelensky said, addressing his Western partners. NATO, the US and Poland have stated that there is no evidence to suggest Russia’s direct involvement in the incident. Polish President Andrzej Duda has indicated that the projectile was likely a Ukrainian air defense missile – an opinion that was seconded by NATO Secretary General Jens Stoltenberg and US Defense secretary Lloyd Austin.

Moscow, meanwhile, has condemned efforts to paint it as the perpetrator, saying such statements could only be seen as an attempt to trigger a direct clash between Russia and NATO. After several media outlets as well as Ukrainian and Polish officials initially blamed Russia for the attack, Moscow’s permanent representative to the United Nations, Vassily Nebenzia, stated that if it had not been for the evidence in the form of photos from the scene, “all facts would have been concealed from the public, and Russia would have been proclaimed the guilty side.” Kremlin Spokesman Dmitry Peskov has also stated that the initial claims made by Kiev and other Western officials were “yet another hysterical, rabidly Russophobic reaction that was not based on any real information.”

“Zelensky’s refusal to admit that a Ukrainian missile caused a fatal explosion in Poland makes him “not worth supporting..”

“It’s a lie that could get millions of Americans killed. So you have to ask yourself, is it time to stop backing this guy? Could the risk be too high? He’s lying on purpose to get us into a war?”

• Zelensky ‘Commanding The US To Lead WWIII’ – Tucker Carlson (RT)

Ukrainian President Vladimir Zelensky could be “lying on purpose to get us into a war,” Fox News host Tucker Carlson declared on Wednesday night. Zelensky’s refusal to admit that a Ukrainian missile caused a fatal explosion in Poland makes him “not worth supporting,” Carlson suggested. Zelensky “was commanding the US to lead the Third World War immediately” after the blast, Carlson told his viewers. “The only problem is that it was completely and utterly wrong.” The Ukrainian leader described the explosion, which killed two people, as a Russian attack on NATO territory and called on the West to put Russia “in its place” in response. Anonymous US intelligence officials seconded his claims in statements to the press.

Moscow argued that debris at the blast site showed that it was caused by a missile from the S-300 air defense system, a piece of Soviet-era kit fielded by Ukraine. Within hours, the leadership of the US, NATO, and Poland had all publicly stated that the explosion was caused by a Ukrainian anti-air missile. Zelensky doubled down. “I have no doubt that this is not our missile,” he said in a video address. “I believe that it was a Russian missile, based on our military reports.” “That’s not only untrue,” Carlson said. “It’s a lie that could get millions of Americans killed. So you have to ask yourself, is it time to stop backing this guy? Could the risk be too high? He’s lying on purpose to get us into a war?”

“Maybe he’s not worth supporting in the first place. Maybe he’s just another corrupt Eastern European strongman in a tracksuit, getting as rich as he can on American handouts.” Carlson has been a long-time critic of the US’ support for Zelensky, arguing that Ukraine is not democratic, and that intervening in its conflict with Russia is not in the US’ national security interest. Zelensky has since walked back his claims, saying on Thursday that Kiev doesn’t “know for 100%” what happened.

Tucker Zel

Remember all the global leaders who had Zelensky address their parliaments, giving him standing ovations, and chanting Slava Ukraini? This is the guy they were chanting for. A serial liar who keeps trying to start WW3 by pulling NATO into the US proxy war. pic.twitter.com/v60BY9yiLx

— Kim Dotcom (@KimDotcom) November 17, 2022

“It is “normal” for its president to stick to “hypotheses that seem obvious from the national defense point of view” under such circumstances..”

• Evidence Suggests Ukrainian Missile Struck Poland – Top Security Official (RT)

Evidence gathered by Poland, the US, and NATO suggests that it was a Ukrainian missile that killed two people on Polish territory not far from Ukraine’s border this week, the head of the country’s National Security Bureau (BBN), Jacek Siewiera, told the local RMF FM radio broadcaster on Thursday. Earlier, Polish President Andrzej Duda said that the missile was likely a Ukrainian one. Washington, meanwhile, admitted it had no evidence that would contradict Duda’s assessment, while Kiev rushed to blame the incident on Moscow. “All the evidence that has been collected on the NATO, American and our sides indicates that we are dealing with an S-300 missile launched by the Ukrainian anti-aircraft defense,” Siewiera said on Thursday, without offering details on the information gathered by investigators.

According to the BBN chief, the Polish Prosecutor’s Office is now leading the probe into the incident. Warsaw would not object to Ukrainian “observers” joining the investigation, Siewiera said, adding that the Polish president in particular “sees no obstacles” for this if all legal requirements are met. He also justified Ukrainian President Vladimir Zelensky’s stance on the issue by reasoning that Ukraine is now going through the “hardest period” of its conflict with Russia when it comes to air strikes. It is “normal” for its president to stick to “hypotheses that seem obvious from the national defense point of view” under such circumstances, the BBN head argued.

Zelensky insisted the missile was Russian and backtracked on this claim only after it was disputed by US President Joe Biden. Later, Zelensky maintained that no one can know for sure whose missile killed the two Poles. On Tuesday, Russia said it did not strike any targets closer than 35 kilometers (21.7 miles) from the border with Poland.

“The US government always has somebody to ‘hold responsible’ on political grounds.”

• Zelensky Backtracks On Missile Claims (RT)

President Vladimir Zelensky has toned down his claims that a Russian missile was responsible for the deaths of two people in a Polish village near the border with Ukraine. “I don’t know what happened this time. We do not know for a 100%,” Zelensky conceded on Thursday. He was responding to a question about the incident during a panel discussion at the Bloomberg New Economy forum in Singapore, which he attended via videolink. “But I am sure that there was a Russian missile and I am sure we were launching air defense missiles,” he added. The incident happened on Thursday evening, as Russia was hitting targets in Ukraine with a barrage of missiles. Zelensky declared that the projectile was Russian and that its landing on Polish territory was an attack on NATO’s collective security, urging retaliation.

Warsaw has since announced that the weapon was most likely a Ukrainian air defense missile that went astray, but Zelensky’s initial reaction was to point the finger at Moscow. The Russian military said it didn’t attack any site near the location of the village and that images of the crash site, which were published by Polish media, clearly identified the projectile as a Ukrainian air defense missile. Zelensky claimed during the Bloomberg panel that the Ukrainian military had told him that the images were not consistent with that kind of weapon. He claimed that nobody could say with full certainty what the origin of the missile was until a full investigation had been carried out.

He also thanked Ukraine’s foreign backers, who put the blame for the deaths in Poland on Russia, regardless of who fired the weapon. NATO and some of its members, including the US, stated that Moscow was responsible because it had launched missiles at Ukraine in the first place. Maria Zakharova, the spokeswoman for the Russian Foreign Ministry, said that Washington’s attitude may give a hint to US citizens about the veracity of American investigations in general. “The US government doesn’t care about getting the results in an investigation,” she said. “The US government always has somebody to ‘hold responsible’ on political grounds.”

“The statement follows talks between the head of Russia’s Foreign Intelligence Service (SVR), Sergey Naryshkin, and CIA Director William Burns, which took place in Türkiye earlier this week.”

• Zelensky Confirms Signals From West On Peace Talks (RT)

Ukrainian President Vladimir Zelensky has acknowledged that Kiev’s foreign backers have been speaking to him about the possibility of peace talks with Moscow. “I had received signals from state leaders, who said: ‘We think [Russian President Vladimir] Putin wants direct negotiations.’ And I said: ‘We will offer a public format [for the talks] because Russia is waging a public war against Ukraine,’” Zelensky told journalists on Wednesday. “I’m ready to recommend such a format. I’ll discuss with my colleagues how to do it,” he said, adding that he does not want to have any “backstage contact”with Russia. Recent reports indicate that Washington has been privately pushing Kiev to drop its uncompromising rejection of the peace process with Moscow.

Last week, the chairman of the US Joint Chiefs of Staff, General Mark Milley, suggested that a Ukrainian military victory might be unachievable and that winter could provide an opportunity to begin talks with Russia. Zelensky also said he does not believe that the US, which has been among Kiev’s main backers amid the conflict with Moscow, was discussing ways to end the fighting behind Ukraine’s back. “We have an agreement that they – the US – don’t discuss Ukraine without us… Is it really the case? We trust our partners,” he said. The statement follows talks between the head of Russia’s Foreign Intelligence Service (SVR), Sergey Naryshkin, and CIA Director William Burns, which took place in Türkiye earlier this week. Both the Kremlin and the White House confirmed the meeting, with the US side saying that it was aimed at keeping channels of communication open, and that a Ukrainian settlement was not on the agenda.

Zelensky has been sending mixed messages about the possibility of peace talks with Moscow throughout the conflict, even signing a decree in October that officially made it impossible for him to negotiate with his Russian counterpart Vladimir Putin. In a video address to the G20 on Tuesday, the Ukrainian leader said he was “convinced now is the time when the Russian destructive war must and can be stopped.” Conflict between Moscow and Kiev should conclude “fairly” and on the basis of the UN Charter, Zelensky insisted, stressing that Ukraine “shouldn’t be offered compromises with its sovereignty, territorial integrity and independence” in exchange for peace. He also claimed that Moscow should not be trusted, warning that Russia could use the cessation of hostilities “to grow its forces and launch a new series of terror and global destabilization.”

Russian Foreign Minister Sergey Lavrov reacted to the speech by saying that Russia is ready for talks, unlike Ukraine, which puts forward “invariably unrealistic and inadequate” terms for dialogue. According to Lavrov, Zelensky’s address was full of “militant, Russophobic and aggressive rhetoric.” Kremlin Press Secretary Dmitry Peskov also said that the speech by the Ukrainian leader “absolutely confirms”the unwillingness of Kiev to look for a settlement of the conflict through negotiations.

Banning all political parties and media that don’t toe the line. Let’s give him another $100 billion. Give him another 50 for banning CNN.

• Zelensky Cracks Down On Popular News Outlet, Bans CNN, Sky (RT)

Ukrainian President Vladimir Zelensky says he has granted a petition demanding that the government take action against popular opposition news website Starana.ua. The petition, which calls on the authorities to ensure the outlet is completely blocked, was submitted to the president’s website in late September, and has so far garnered more than 25,500 signatures. On Thursday, Zelensky announced that he had considered the petition and ordered the head of Ukraine’s National Security and Defense Council, Aleksey Danilov, to “address the issues raised in it, take necessary measures in response and inform the author of the results.”

Commenting on the petition, Zelensky accused Russia of using various forms of hybrid warfare against Ukraine, and said “the issues of protecting the domestic information space require constant attention and urgent response.” The author of the petition called Starana.ua “a pro-Russian” media outlet, which continues to “manipulate the opinions of Ukrainian viewers” despite being banned in the country. The website, which was among the most viewed online publications in Ukraine last year, was officially blocked by Zelensky’s government in August 2021, with more restrictions added this February, just over a week before the launch of Moscow’s military operation in the country. At that time, the journalists claimed that they had been persecuted due to their “alternative view” on the conflict in Donbass and Zelensky’s personal animosity towards them.

However, Starana.ua continued to remain accessible in Ukraine through several mirror sites. The outlet also began to actively develop its YouTube channel, which now has more than 600,000 subscribers. Foreign journalists have also faced obstacles working in Ukraine. On Monday, Kiev removed accreditation from a group of media workers, including those from CNN and Sky News, accusing them of reporting from the recently-retaken city of Kherson without the necessary authorization from the Ukrainian military.

Said it before: The Dutch are the last party that should have investigated. The main victim does not get to conduct this.

• Dutch Court Blames Russia for Missile That Struck MH17 (ET)

A court in the Netherlands determined what country manufactured the missile that struck down a Malaysia Airlines flight in 2014 over eastern Ukraine, killing 298 people. “The court is of the opinion that MH17 (Flight 17) was brought down by the firing of a BUK missile from a farm field near Pervomaisk, killing all 283 passengers and 15 crew members,” presiding judge Hendrik Steenhuis said, according to Reuters news agency. That flight is different than Malaysia Airlines Flight 370, which disappeared in 2014 while flying from Kuala Lumpur, Malaysia, to Beijing. The location of Flight 370, which disappeared about four months before Flight 17 was shot down, has still never been determined.

The statement was issued in the trial of several Russians and a separatist Ukrainian who were found guilty in absentia of the mass murder for their alleged involvement in shooting down Flight 17 over eastern Ukraine. Russians Igor Girkin, Sergey Dubinskiy, and Oleg Pulatov and Ukrainian separatist Leonid Kharchenko were on trial at the Schiphol Judicial Complex in Badhoevedorp, Netherlands, according to reports. Pulatov was acquitted while the three others were found guilty. None of the defendants appeared for the trial that began in March 2020, and if they’re convicted, it’s unlikely they’ll serve any sentence anytime soon. Prosecutors had sought life sentences for all four. Prosecutors and the suspects have two weeks to file an appeal.

Did they even have an accountant?

• Enron Liquidator Overseeing FTX Bankruptcy: Never Seen Anything Like This (ZH)

[..] FTX’s new CEO and liquidator, John Ray III, who also oversaw the unwinding and liquidation of Enron, admits that “Never in my career have I seen such a complete failure of corporate controls and such a complete absence of trustworthy financial information as occurred here.” And just in case his shock at FTX’s fraud of epic proportions was not quite clear enough, he adds that “from compromised systems integrity and faulty regulatory oversight abroad, to the concentration of control in the hands of a very small group of inexperienced, unsophisticated and potentially compromised individuals, this situation is unprecedented.”

According to Ray, he has located “only a fraction” of the digital assets of the FTX Group that they hope recover during the Chapter 11 bankruptcy. They’ve so far secured about $740 million of cryptocurrency in offline cold wallets, a storage method designed to prevent hacks. This is just a fraction of the $10-$50 billion in liabilities the company disclosed in its bankruptcy filing. How do we know it’s a fraud: as Ray writes on page 24, although the investigation has only begun and must run its course, it is my view based on the information obtained to date, “that many of the employees of the FTX Group, including some of its senior executives, were not aware of the shortfalls or potential commingling of digital assets.” Many maybe not, but some – and certainly SBF himself – did.

It gets better: Ray said that company’s audited financial statements should not be trusted, Ray said, adding that liquidators are working to rebuild balance sheets for FTX entities from the bottom up. FTX “did not maintain centralized control of its cash” and failed to keep an accurate list of bank accounts and account signatories, or pay sufficient attention to the creditworthiness of banking partners, according to Ray. Advisers don’t yet know how much cash FTX Group had when it filed for bankruptcy, but has found about $560 million attributable to various FTX entities so far.

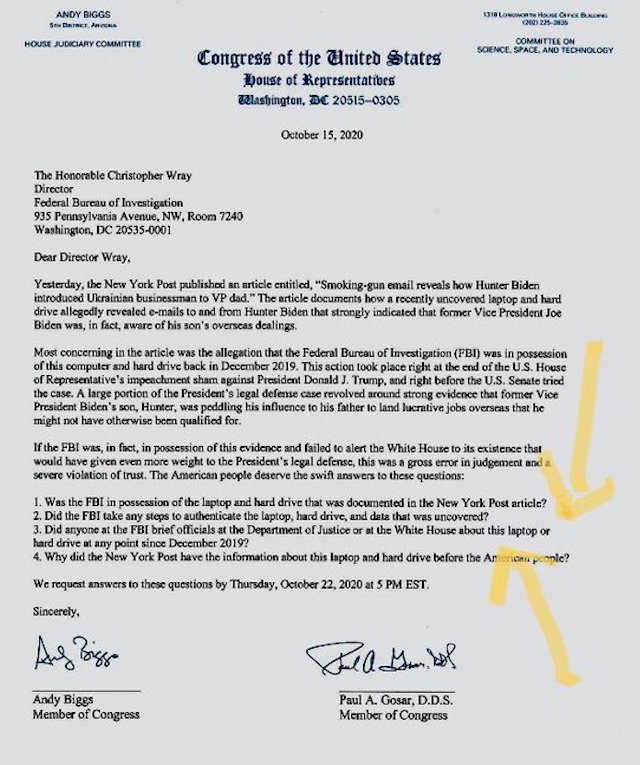

Not probing Huter has been politically motivated from the get go.

• White House Slams GOP For Probing Hunter Biden ‘Conspiracy Theories’ (RT)

The White House has dismissed Republican efforts to investigate President Joe Biden and his son’s overseas business ties, rejecting allegations that the commander in chief is under the sway of “foreign dollars” as a baseless conspiracy theory.In a statement to the New York Post on Thursday, a spokesman for the White House counsel’s office, Ian Sams, said House Republicans are “wasting time and resources on political revenge” after several lawmakers pledged to open a probe into the Biden family, namely the president’s son Hunter. “Instead of working with President Biden to address issues important to the American people, like lower costs, congressional Republicans’ top priority is to go after President Biden with politically motivated attacks chock full of long-debunked conspiracy theories,” the spokesman said.

Earlier on Thursday, GOP Reps. James Comer and Jim Jordan announced that an investigation into the president would be a priority during the next round of Congress, saying their probe would center whether Biden has been “directly involved with Hunter Biden’s business deals” and if he is in any way “compromised.” The pair of lawmakers alleged the Bidens “were involved in a scheme to try to get China to buy liquefied natural gas,” and said they would attempt to determine if the president was ever “swayed by foreign dollars or influence.” With Republicans taking back a majority in the House after last week’s midterm elections, Comer and Jordan are set to head up the House Judiciary and Oversight committees, respectively, putting them in better positions to spearhead congressional inquiries.

Hunter Biden’s foreign business ties have been questioned by Republicans since an October 2020 New York Post report which published the contents of one of his laptops. Emails and other communications found on the computer indicate the younger Biden used his father’s political influence for personal gain, and raised other questions about whether Joe Biden was involved in any of his son’s dealings. Until the midterms, however, Democrats held majorities in both houses of Congress in addition to the White House, leaving GOP critics unable to press forward with long-sought investigations.

This will topple governments.

• Italian Power Prices More Than Triple – Data (RT)

Electricity prices in Italy set an all-time record in October, the country’s oldest consumer association Unc reported on Thursday. Prices for electricity, which is being sold in the Apennines on the free market, have surged 329% since October last year, and topped the Unc rating of the most expensive goods and services. International flights followed power tariffs, with an annual increase in costs equaling 113%. Gas was next in the ranking, with prices surging more than 96% compared to last year. The Unc report comes on the heels of the latest data released by Italy’s official statistics agency ISTAT, which showed that the domestic price index soared 11.8% in October from a year earlier, the highest since March 1984. Annual consumer price growth led by soaring energy costs hit 12.6% in October, jumping from 9.4% in the previous month.

Basic food items have also seen dramatic inflation in Italy, with the prices of various vegetable oils, excluding olive oil, soaring by 55% year-on-year. Butter grew by 43%, followed by sugar, which picked up 17% from September and rose by 38.8% on an annual basis. The sharp increase is expected to make the average annual food bill rise by €761 ($787), at a time when cash-strapped families are already trying to cope with soaring energy bills. For families with one child, this figure will increase to €937 ($969), for those with two children – up to €1038 ($1073), with three – up to €1240 ($1282), Unc president Massimiliano Donna has said.

Looking for Twitter CEO. Jack is not available.

• Elon Musk Identifies Potential Tesla CEO Successor (Axios)

Elon Musk has recently identified someone as his potential successor to lead Tesla as CEO, according to James Murdoch, one of the company’s directors. Tesla investors have grown increasingly worried about Musk’s divided focus since he initiated steps to buy Twitter earlier this year. As the Twitter saga progressed, Tesla faced its own set of issues — including supply chain challenges in China and the erosion of profits from inflation. Murdoch made the comment while testifying in Musk’s pay package trial on Wednesday. In response to a question from a plaintiff’s lawyer suggesting Musk has never picked anyone as a potential successor, Murdoch responded that Musk “actually has” and has in the “last few months,” but didn’t get into specifics, Reuters reports.

Musk, who also testified Wednesday to defend himself against the lawsuit challenging his large compensation package, has often talked about how much he “hates doing management stuff” and how he doesn’t want to “be the boss of anything.” “I tried not to be CEO of Tesla, but I had to or it would die. I rather hate being a boss. I’m an engineer,” he said last year while testifying about Tesla’s SolarCity acquisition. On the stand this morning, Musk said the CEO title is not an apt description of what he does at his companies. In addition to Tesla, Musk currently leads in one way or another, four other businesses — The Boring Company, SpaceX, Twitter and Neuralink. Musk has served as Tesla’s CEO since October 2008. The pay package he accepted in 2018 stipulates that he stay on as CEO, or chief product officer and executive chairman with a CEO reporting to him, for at least a decade.

“The letter insists that free speech will only invite “disinformation, hate, and harassment“

• Clinton-Linked Dark Money Group Targets Twitter Advertisers (Turley)

In the shift of the left against free speech principles, there is no figure more actively or openly pushing for censorship than Hillary Clinton. Now, reports indicate that Clinton has unleashed her allies in the corporate world to coerce Musk to restore censorship policies or face bankruptcy. The effort of the Clinton-linked “Accountable Tech” reveals the level of panic in Democratic circles that free speech could be restored on one social media platform. The group was open about how losing control over Twitter could result in a loss of control over social media generally. For Clinton, it is an “all-hands on deck” call for censorship. She previously called upon foreign governments to crackdown on the free speech of Americans on Twitter.

We have been discussing how Clinton and others have called on foreign companies to pass censorship laws to prevent Elon Musk from restoring free speech protections on Twitter. It seems that, after years of using censorship-by-surrogates in social media companies, Democratic leaders seem to have rediscovered good old-fashioned state censorship. Accountable Tech led an effort to send a letter to top Twitter advertisers to force Musk to accept “non-negotiable” requirements for censorship. General Motors was one of the first to pull its advertising funds to stop free speech restoration on the site. Of course, the company had no problem with supporting Twitter when it was running one of the largest censorship systems in history — or supporting TikTok (which is Chinese owned and has been denounced for state control and access to data).

Twitter has been denounced for years for its bias against conservative and dissenting voices, including presumably many GM customers on the right. None of that was a concern for GM but the pledge to restore free speech to Twitter warrants a suspension. The letter is open about the potential cascading effect if free speech is restored on one platform: “While the company is hardly a poster-child for healthy social media, it has taken welcome steps in recent years to mitigate systemic risks, ratcheting up pressure on the likes of Facebook and YouTube to follow suit.” The letter insists that free speech will only invite “disinformation, hate, and harassment” and that “[u]nder the guise of ‘free speech,’ [Musk’s] vision will silence and endanger marginalized communities, and tear at the fraying fabric of democracy.”

Lockdown till Monday. Might make sense.

• Twitter On Lock Out After Mass Resignation Exodus; Operations At Risk (ZH)

Hundreds of Twitter’s remaining employees have reportedly resigned ahead of Elon Musk’s “extremely hardcore” cultural reset of the company. After Musk gave an ultimatum to his employees to either commit to the company’s new “hardcore” work environment or leave, many more workers declined to sign on than he expected, potentially putting Twitter’s operations at risk, according to Bloomberg sources, as well as internal Slack messages seen by The Verge and employee tweets. On Thursday afternoon, so many employees decided to take severance that it created a cloud of confusion over which people should still have access to company property.

According to a memo seen by Bloomberg and reports from Platformer’s Zoe Schiffer, Twitter closed its offices until Monday; urging employees to “please continue to comply with company policy by refraining from discussing confidential information on social media, with the press or elsewhere.” According to Bloomberg, in the final hours before his deadline, Musk tried to convince people to stay. Key staff were brought into meetings as the Thursday evening deadline neared to hear pitches on the social network’s future, according to people familiar with the matter. Musk, who had earlier said he was strictly against remote work, also sent a follow-up email Thursday softening his tone. “All that is required for approval is that your manager takes responsibility for ensuring that you are making an excellent contribution,” he wrote, adding that staffers should have in-person meetings with their colleagues not less than once per month.

Despite the ultimatum, no Twitter employees have been deactivated — even those who’ve publicly resigned, the Platformer also reported, adding that “Musk and his team only collected the list of “yes’s” — employees who said they want to be part of Twitter 2.0. They’re still trying to track who is out.” Elon’s attempt to ease the terms of the ultimatum wasn’t enough, and Twitter’s internal communications channels filled with employees offering a salute emoji, which has become a symbol for departing the company. Former staff tweeted the salute publicly, too, along with their internal Slack messages. Some employees who were departing speculated that so many were leaving, along with their knowledge of how the product works, that the social network may have trouble fixing problems or updating systems during its normal operations, according to people familiar with the matter.

Dog bear

https://twitter.com/i/status/1593051028165111809

Tiger babies

https://twitter.com/i/status/1593304803047837708

Illusion

https://twitter.com/i/status/1592933014790471680

Support the Automatic Earth in virustime with Paypal, Bitcoin and Patreon.