John Vachon Beer signs on truck, Little Falls, Minnesota Oct 1940

As expected. 9 banks in Italy alone is a big number.

• 25 European Banks Fail Stress Test (NY Times)

Banks in Europe are €25 billion, or about $31.7 billion, short of the money they would need to survive a financial or economic crisis, the European Central Bank said on Sunday. That conclusion was a result of a yearlong audit of eurozone lenders that is potentially a turning point for the region’s battered economy. The E.C.B. said that 25 banks in the eurozone showed shortfalls in their own money, or capital, after a review devised to uncover hidden problems and to test their ability to withstand a sharp recession or other crisis. The review looked at banks’ books through the end of 2013. Of the 25 banks, 13 have still not raised enough capital to make up the shortfall, the central bank said. The highly anticipated assessment of European banks was intended to remove a cloud of mistrust that has impeded lending in countries like Italy and Greece and left the eurozone struggling to avoid lapsing back into recession. By exposing a relatively small number of sick banks — of the 130 under review — the central bank aims to make it easier for the healthier ones to raise money that they can lend to customers.

Italy had by far the largest number of banks that failed the review, with nine, of which four must raise more capital. Monte dei Paschi di Siena, whose troubles were well known, must raise €2.1 billion, the central bank said, the largest of any individual bank covered by the review. Greece’s banking system was also hard hit, with three banks found short of capital. One, Piraeus Bank, has since raised enough capital to satisfy regulators. The other two are Eurobank, which must raise €1.76 billion, and National Bank of Greece, which must raise €930 million. The overall capital shortfall for the banks under review was in the middle of analyst estimates. However, the review also uncovered €136 billion in troubled loans that banks had not previously reported. In addition, banks had overvalued their other holdings by €48 billion, the E.C.B. said.

Stress tests may have failed 25 banks, but they’re not nearly strict enough.

• Testing Europe’s Stress Tests (Bloomberg)

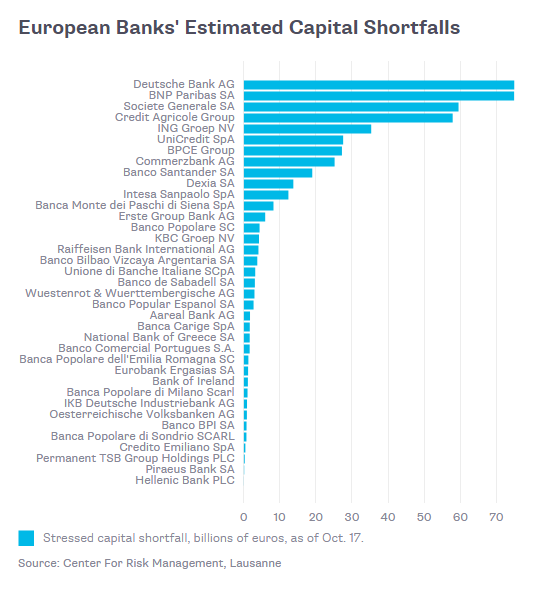

On Sunday, the European Central Bank will publish the results of stress tests designed to restore much-needed confidence in the euro area’s financial system. To succeed, the ECB must convince investors that it has truly forced banks to recognize their losses and raise enough capital to be healthy. What would a really tough stress test look like? Research by economists at Switzerland’s Center for Risk Management at Lausanne offers an indication. By simulating the way the market value of banks’ equity tends to behave in times of stress, they estimate how much capital banks would need to raise in a severe crisis. The answer, as of Oct. 17, for just 37 of the roughly 130 banks included in the ECB’s exercise: €487 billion ($616 billion). Deutsche Bank, three big French banks and ING Groep NV of the Netherlands are among those with the largest estimated shortfalls. Here’s a breakdown by bank:

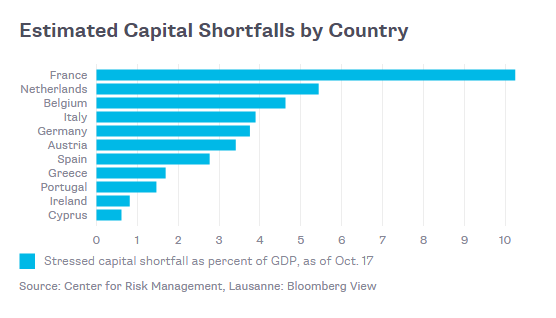

And here’s a breakdown by country, as a percentage of gross domestic product:

The economists’ approach, based on a model developed at New York University, isn’t perfect. It could, for example, overestimate capital needs if the quality of banks’ management and assets has improved in ways that the market has yet to recognize. And, because crises are rare, the modelers had scant historical data with which to build estimates of how banks might fare in future disasters. That said, this relatively simple model has some important advantages over the ECB’s much more labor-intensive stress tests. The Swiss group’s approach is free of the political considerations that constrain the ECB, which can’t be too harsh for fear of reigniting the European financial crisis. In addition, the model implicitly includes crucial contagion effects, such as forced asset sales and credit freezes, that the ECB’s exercise ignores.

A bit of back-testing suggests that the economists’ approach works relatively well. The NYU model’s projection for the largest U.S. banks’ stressed capital needs before the 2008 crisis, for example, comes pretty close to the roughly $400 billion that the banks actually had to raise. If the ECB’s number is a lot smaller than the figure the model comes up with — as early indications suggest it will be — that won’t be a good sign.

If only these tests were credible.

• Europe Stess Tests Tests Could Trigger A Near-Term Crisis (MarketWatch)

The European Central Bank is preparing a diagnosis of the eurozone’s banking. woes. Unfortunately, it has no power to write a prescription. In fact, the Sunday release of the results of new stress tests and the ECB’s Asset Quality Review could do more near-term harm than good, says Carl Weinberg, chief economist at High Frequency Economics. ECB President Mario Draghi’s 2012 pledge to do “whatever it takes” to preserve the euro and the ECB’s subsequent creation of a never-yet-utilized emergency bond-buying program put the debt crisis on the back burner. European stocks outperformed in the second half of last year as investors and commentators cheered a temporary pickup in growth. But the crucial area of lending across the eurozone remains lackluster. Many banks are nursing bruised balance sheets, and the degree to which lenders are hurting is likely to become more evident with this latest batch of tests.

Overall industrial and economic output remain below pre-crisis levels and unemployment across much of southern Europe remains at levels, unfathomable in the U.S., even during the worst of the Great Recession. The region is stumbling back toward recession, led by a German slowdown. Now, discussions of Europe’s long-running economic woes regularly use the term “depression,” Weinberg has been using the dreaded D-word for years. There isn’t a single accepted definition of a depression, but economists have usually described the phenomenon as one in that lasts several years and is characterized by a large rise in unemployment, falling credit and a big drop in economic output. The eurozone’s current woes appear to tick all those boxes. When it comes to the stress tests, the hope is that a more rigorous review led by the ECB will reassure investors that the region’s banking sector is in relatively solid shape. Of course, to be credible, some banks will have to fail, which will require them to scramble to shore up capital.

Bloomberg, citing a draft communique on Friday, reported that the ECB was set to fail 25 lenders. Weinberg worries that the tests could trigger a near-term crisis. The problem isn’t that the banks are being scrutinized, it’s that there’s no credible plan to fill in capital shortfalls and allow the banks to repair themselves via retained earnings. There is, for example, no equivalent to the controversial but successful Troubled Asset Relief Program, or TARP, that saw U.S. taxpayers effectively take temporary stakes in crippled banks that were eventually bought back from the Treasury. “If the AQR would get banks recapitalized and make them better able to lend, I would be delighted and that would be the end of this six-year-going-on-seven-year depression,” Weinberg said in an interview. Instead, the exercise is “nothing more than an evaluation.”

Emerging markets set to stop emerging.

• America Stems Flow Of Funds As China Stalls And Eurozone Retreats (Observer)

There is growing unease as the US central bank prepares to turn off its printing presses. Over five years the Federal Reserve has pumped almost $4.5 trillion into the US economy, in a desperate effort to counter the effects of recession and the collapse of hundreds of banks following the financial crash. Next week the Federal Reserve chief Janet Yellen will allocate the last tranche of new money, having wound down from a regular $85bn of quantitative easing (QE) a month to a final $15bn. Some analysts believe the decision to stop the extra spending is a reflection of the US economy’s robust recovery. Falling unemployment, a return to health across the banking sector and consistently strong manufacturing growth all conjure thoughts of a return to pre-recession normality. Given the huge amounts of money that poured into the US stock market last year, triggering a rise in the S&P 500 of almost 30%, most investors thought the same. But they have proved more cautious in 2014, restricting the S&P 500 to a 6% increase so far.

Disturbed by the lack of similar action in Brussels and in Frankfurt – home of the European Central Bank – investors fear that the eurozone is sliding ever closer to recession. They are also worried about a sharp slowdown in China, following moves by the ruling People’s party to tackle escalating state sector debts. Wild price swings in global stock markets earlier this month were a signal that investors remain ready to pull their funds at a moment’s notice. In this febrile atmosphere, the Fed’s next move could be crucial. Yellen appears ready to maintain the $4.5tn cache of bonds and mortgage-backed securities that make up the bulk of the Fed’s balance sheet. As the bonds mature, she will buy new ones to keep the balance steady. But she may be edging away from raising interest rates from 0.25%, a move pencilled in by many economists for February.

Best advice there is.

• Don’t Buy A Home (MarketWatch)

After an extended drought of credit available to consumers, it’s going to get easier to buy a home. The Federal Housing Finance Agency this week polished off a new set of guidelines that will allow government backing of loans that it had shunned since the mortgage crisis. And in a surprise move, the guidelines include a provision to consider some mortgages without down payments. And Mel Watt, the FHFA director, said earlier this week that Fannie Mae and Freddie Mac are planning to guarantee some loans with down payments of as little as 3%. That should help underwater homeowners. Let’s begin by saying that’s not necessarily a bad thing. There are instances where loans should be available to borrowers without the means to place a down payment. It’s just that I can’t think of any.

The FHFA and the Obama administration are both worried about the amount of credit available to the average American. It’s an epidemic problem. About a third of housing sales were to cash buyers in the first quarter, according to the National Association of Realtors. As I’ve written before, this is extraordinarily high, indicative of a housing market that favors the wealthy. So by lowering the standards of what types of loans are acceptable to the big mortgage giants, it’s obvious that the FHFA’s effort is about encouraging banks to provide more loans. The government is essentially saying: “Go ahead and lend; we’ll hold the paper.” But in trying to ease credit and turn a mythic housing recovery into a real one, the FHFA may be overreaching. That’s because you know exactly who’s going to be taking out those loans: people who can’t afford them. And because there will always be some people who believe that because they can borrow, they can afford these loans, you know how this new policy is going to play out.

Dark economic days ahead in Brazil no matter who wins. A stronger dollar and higher rates will hit it like a sledgehammer.

• Brazilians Vote for Leader as Polls Show Nation Divided (Bloomberg)

Brazilians vote today in a national election that pits President Dilma Rousseff, who says she wants to protect social gains achieved during 12 years of her Workers’ Party rule, against challenger Aecio Neves, who says the incumbent has driven the economy into recession. Voting stations open at 8 a.m. today and close at 5 p.m. in each of Brazil’s three time zones. Some opinion polls published yesterday showed Rousseff statically tied with Neves of the Brazilian Social Democracy Party, while others indicated either the incumbent or challenger with the lead.

Neves proposes to cut spending, slow inflation to target and attract more private investment, while keeping social welfare programs such as cash transfers to the poor and low-cost housing. While the economy in 2014 slipped into recession for the first time since 2009, Rousseff has gone on the attack, saying Neves’s policies jeopardize record-low unemployment and programs that lifted 35 million people out of poverty. “Brazil’s consumer-led consumption model has run its course and needs to be replaced with one based on investment and quality public services,” said Paulo Sotero, director of the Brazil Institute at the Washington-based Woodrow Wilson International Center for Scholars. “Those who benefited from that model, and they weren’t few, feel that change could put at risk those advances.”

If Ukraine if serious about not letting Luhansk and Donetsk secede, how can it hold elections that do not include the regions, and still pretend to derive legitimacy from them?

• Ukraine Votes in Wartime Ballot Set to Back Pro-EU Forces (Bloomberg)

Ukrainians voted today in an election that’s being shaped by their nation’s conflict with pro-Russian insurgents and Vladimir Putin’s land grab in Crimea. Polling stations opened at 8 a.m. and will close at 8 p.m., after which exit polls are due. Backing for billionaire President Petro Poroshenko’s party and the Popular Front of his Prime Minister Arseniy Yatsenyuk tops 40%, while the Regions Party of deposed leader Viktor Yanukovych isn’t running. Poroshenko wants to build a coalition with other pro-European parties. “We’re likely to see a fairly stable majority” in an alliance led by Poroshenko’s bloc, Yuriy Yakymenko, an analyst at the Kiev-based Razumkov Center for Economic and Political Studies, which has tracked Ukrainian elections for two decades, said last week by phone. “

Lawmakers will unite behind plans for Ukraine’s future accession to the European Union.” The snap vote will vanquish the legislature elected under Russian-backed Yanukovych as Poroshenko seeks support to end the war, tackle the deepest recession in five years and revive the world’s worst-performing currency. Ukraine’s crisis has fixed the nation on a pro-EU trajectory and driven a wedge between Russia and its former Cold War foes.

It’s not as if they have any real alternatives to vote for. Both parties will squeeze them dry.

• Stagnant Paychecks for US Workers Underlies Voter Discontent (Bloomberg)

Eleven days before midterm elections comes fresh evidence of why voters are unhappy: even those with a full-time job are probably making less than they did before the recession. The typical American worker’s weekly earnings, adjusted for inflation, were lower during the July through September quarter than in the third quarter of 2007, the last such measurement before the recession started, Labor Department data released yesterday showed. Even as the unemployment rate dropped to 5.9% in September from a peak of 10% and a soaring stock market brought financial gains for the wealthy, there has been only sluggish improvement in the living standards of middle-class Americans during President Barack Obama’s administration.

The Labor Department said median usual pay for Americans employed full-time was $790 per week in the third quarter. That’s about a dollar less per week than in the third quarter of 2007, using the department’s adjustment for inflation. There’s been no net gain for those workers since 1999. The Labor Department pay data captures the experience of ordinary American full-time workers. Unlike some other income data reported by the government, it excludes the impact of joblessness, public assistance, investment income and workers forced to take part-time jobs because they cannot find full-time employment. In September, 7.1 million Americans worked part-time for economic reasons, down from a peak of 9.2 million in March 2010, though still higher than the 4.5 million who did so in November 2007, on the eve of the recession.

Combine this with the next article.

• Record Number Of Britons In Low-Paid Jobs (Guardian)

A record 5 million workers are now in low-paid jobs, according to a new report, sparking calls for government action to help tackle the problem. The Resolution Foundation said the numbers earning less than two thirds of median hourly pay – equivalent to £7.69 an hour – increased by 250,000 last year to reach 5.2 million. The increase partly reflected growth in employment, but there was also a reverse in the previous year’s slight fall in low-paid work, said the thinktank. The report said there was a serious problem of people being stuck in low-paid jobs, with almost one in four minimum wage employees still on that rate for the last five years. Workers in Britain are more likely to be low paid than those in comparable economies such as Germany and Australia, said the Resolution Foundation.

The thinktank’s chief economist, Matthew Whittaker, said: “While recent months have brought much welcome news on the number of people moving into employment, the squeeze on real earnings continues. While low pay is likely to be better than no pay at all, it’s troubling that the number of low-paid workers across Britain reached a record high last year. “Being low paid – and getting stuck there for years on end – creates not only immediate financial pressures, but can permanently affect people’s career prospects. A growing rump of low-paid jobs also presents a financial headache for the government because it fails to boost the tax take and raises the benefits bill for working people.

“All political parties have expressed an ambition to tackle low pay. Yet the proportion of low-paid workers has barely moved in the last 20 years. A focus on raising the minimum wage can certainly help the very lowest paid workers in Britain, but we need a broader low-pay strategy in order to lift larger numbers out of working poverty. “Economic growth alone won’t solve our low-pay problem. We need to look more closely at the kind of jobs being created, the industries that are growing and the ability of people to move from one job or sector to the other, if we’re really going to get to grips with low pay in Britain today.”

Combine his with the preceeding article.

• Nearly A Third Of British Voters Prepared To Support Ukip (Observer)

The phenomenal rise in support for Ukip is underlined by a new Opinium/Observer poll which shows almost one-third of voters would be prepared to back Nigel Farage’s party if they believed it could win in their own constituency. While the survey, which puts the Conservatives and Labour neck-and-neck on 33%, shows a substantial boost for the Tories (up five points on a fortnight ago), the rise of Ukip will be deeply alarming to the main parties. With just over three weeks to go before a crucial byelection in the normally safe Tory seat of Rochester and Strood, which Ukip threatens to seize, the poll puts Ukip on 18% of the national vote, with the Lib Dems on 6% and the Greens on 4%.

If the Ukip candidate Mark Reckless, who defected from the Tories last month, wins the byelection, the Conservatives fear there could be a rush of defections as MPs conclude that their chances of re-election are higher under Ukip colours. When asked to respond to the statement “I would vote for Ukip if I thought they could win in the constituency I live in”, 31% of voters said they agreed. This includes 33% of Tory voters, 25% of Liberal Democrats and 18% of Labour supporters. Voters were equally divided on whether a vote for Ukip was a wasted one, with 40% saying it was, and 37% saying it was not.

Renzi wants IMF-style reforms.

• 1 Million Italians Rally in Rome to Protest Labor Rules Change (Bloomberg)

Italians staged a massive rally in Rome to protest Prime Minister Matteo Renzi’s proposed overhaul of labor market rules. Italian television RAI said several hundred thousand people took part in the demonstration, while news agency Ansa cited CGIL union organizers as saying the number was closer to 1 million. Many of the protesters carried red balloons and waved red union banners under bright sunny skies. CGIL chief Susanna Camusso told the demonstrators the union is ready to continue its protest “with all necessary means” including a general strike. She shouted to the cheering crowd at the end of her speech in Piazza San Giovanni “onward to work, to the struggle!”

CGIL called the rally to protest Renzi’s Jobs Act, which includes measures to ease firing rules and make the labor market more flexible. Renzi has said that the plan is a way to attract investments at a time when youth unemployment was at a record high 44.2% in August. His proposals, which were approved by the Senate in a confidence vote this month, will have to be passed by the Chamber of Deputies. The Rome demonstration follows a separate 24-hour strike that disrupted air and ground transport in the country’s biggest cities yesterday. More disruptions are expected Nov. 14, when Alitalia’s staff and Easyjet’s flight attendants will go on strike, according to a statement posted on the Italian Transport Ministry’s website.

Special Drawing Rights should be abolished. So should the IMF itself.

• IMF Sets 0.05% Floor on Interest Rate on Special Drawing Right (Bloomberg)

The International Monetary Fund is setting a 0.05% floor on the interest rate used to determine borrowing costs for some of its loans. The executive board modified rules today to make the change, according to a statement today in Washington. The IMF’s Special Drawing Right, based on a basket of the dollar, yen, euro and pound, is the fund’s unit of account that serves as a supplemental reserve asset and was designed to improve global liquidity. The SDR interest rate was quoted on the IMF website at 0.03% today compared with 0.13% in April and more than 3% in August 2008, before central banks slashed borrowing costs to zero to boost growth in the aftermath of the financial crisis. The rate will be 0.05% on Oct. 27, the IMF said.

The board also approved changing the rounding convention for calculating the SDR rate to three decimal points from two, the statement said. The SDR interest rate is used to calculate interest charged to member nations for non-concessional loans and SDR allocations, and the rate paid to members for SDR holdings. It is calculated from a weighted average of the short-term money market rates of the SDR basket currencies. A floor will prevent the SDR rate from going negative, in the event that money market interest rates on some of the currencies in the underlying basket themselves go negative, an IMF official told reporters on condition of anonymity. The fund has no legal basis for charging a negative rate on SDRs.

China is not growing anywhere near 7% anymore, but it may take years before that is admitted.

• China State Economist Sees 2015 Growth Slowest in Over 2 Decades (Bloomberg)

China’s economic growth is expected to be at 7% in 2015 unless the central government imposes stronger-than-expected stimulus measures, according to Fan Jianping, chief economist at a state research institute. A decrease in exports and property development, two “engines” fueling China to be the world’s second-largest economy, will be the main cause of a slowing of growth, Fan, who works at the State Information Center under the National Development and Reform Commission, told an industry conference today. Fan’s forecast is in line with a median estimate of 51 analysts in a Bloomberg News survey as Chinese leaders have signaled they will tolerate a weaker expansion, leaving the economy heading for the slowest full-year growth since 1990. Chinese leaders will set a gross domestic product growth target of about 7% for 2015, according to 13 of 22 analysts polled by Bloomberg.

“I don’t rule out that we will see on-year expansion lower than 7% in some single quarters next year,” Fan said. He said his forecast was based on his agency’s research, which uses China’s industrial production as a key indicator to the economic growth. Fan’s remarks may cool down an improved sentiment in Chinese economy as GDP expanded by a better-than-forecast 7.3% in the third quarter from a year earlier. While the government has relaxed home-purchase controls and pumped liquidity to lenders, the economy also got support from a pickup in exports in September. “In at least six months, economic growth is unlikely to pick up remarkably,” Fan said in Shanghai. GDP expansion in three months from October is seen at 7.2 to 7.3%, which will lead the full-year growth to about 7.3% as reading in the fourth quarter has bigger weighting, he said. China set 2014 GDP growth target at 7.5%.

RT video seeking to make the case for a second plane – a Ukraine figher jet – near MH17.

• MH-17: The Untold Story (RT)

Three months after Malaysia Airlines Flight MH17 was violently brought down from the skies over Ukraine, there are still no definitive answers to what caused the tragedy. Civil conflict in the area prevented international experts from conducting a full and thorough investigation. The wreckage should have been collected and scrupulously re-assembled to identify all the damage, but this standard investigative procedure was never carried out. Until that’s done, evidence can only be gleaned from pictures of the debris, the flight recorders or black boxes and eye-witnesses’ testimonies. This may be enough to help build a picture of what really happened to the aircraft, whether a rocket fired from the ground or gunfire from a military jet.

As we’ve known for 100 years.

• You’re Powered By Quantum Mechanics. No, Really… (Observer)

Every year, around about this time, thousands of European robins escape the oncoming harsh Scandinavian winter and head south to the warmer Mediterranean coasts. How they find their way unerringly on this 2,000-mile journey is one of the true wonders of the natural world. For unlike many other species of migratory birds, marine animals and even insects, they do not rely on landmarks, ocean currents, the position of the sun or a built-in star map. Instead, they are among a select group of animals that use a remarkable navigation sense – remarkable for two reasons. The first is that they are able to detect tiny variations in the direction of the Earth’s magnetic field – astonishing in itself, given that this magnetic field is 100 times weaker than even that of a measly fridge magnet. The second is that robins seem to be able to “see” the Earth’s magnetic field via a process that even Albert Einstein referred to as “spooky”. The birds’ in-built compass appears to make use of one of the strangest features of quantum mechanics.

Over the past few years, the European robin, and its quantum “sixth sense”, has emerged as the pin-up for a new field of research, one that brings together the wonderfully complex and messy living world and the counterintuitive, ethereal but strangely orderly world of atoms and elementary particles in a collision of disciplines that is as astonishing and unexpected as it is exciting. Welcome to the new science of quantum biology. Most people have probably heard of quantum mechanics, even if they don’t really know what it is about. Certainly, the idea that it is a baffling and difficult scientific theory understood by just a tiny minority of smart physicists and chemists has become part of popular culture. Quantum mechanics describes a reality on the tiniest scales that is, famously, very weird indeed; a world in which particles can exist in two or more places at once, spread themselves out like ghostly waves, tunnel through impenetrable barriers and even possess instantaneous connections that stretch across vast distances.

But despite this bizarre description of the basic building blocks of the universe, quantum mechanics has been part of all our lives for a century. Its mathematical formulation was completed in the mid-1920s and has given us a remarkably complete account of the world of atoms and their even smaller constituents, the fundamental particles that make up our physical reality. For example, the ability of quantum mechanics to describe the way that electrons arrange themselves within atoms underpins the whole of chemistry, material science and electronics; and is at the very heart of most of the technological advances of the past half-century. Without the success of the equations of quantum mechanics in describing how electrons move through materials such as semiconductors we would not have developed the silicon transistor and, later, the microchip and the modern computer.

Every single step takes in the US with regards to ebola seems ‘confused’. Or should that read ‘complacent’?

• Nurse Held at N.J. Airport Calls US Reaction to Ebola ‘Disorganized’ (Bloomberg)

A nurse who tested negative for Ebola said officials at Newark Airport in New Jersey appeared confused and disorganized, and gave her only a granola bar to eat while she was detained for more than six hours after arriving from Sierra Leone. In a first-person account in the Dallas Morning News, Kaci Hickox criticized the treatment she received after returning from a monthlong assignment with Doctors Without Borders in the country, one of three West African nations at the center of the current outbreak. “No one seemed to be in charge,” Hickox wrote in the account yesterday. “No one would tell me what was going on or what would happen to me.” Hickox said she was detained at the airport upon her arrival at 1 p.m. on Oct 24. At the time, her temperature was recorded at 98 degrees. Three hours later, after a confusing series of interactions with officials, her temperature was recorded at 101 degrees using a forehead scanner.

Hickox said she told officials that her skin temperature could have been elevated because her face was flushed with anxiety and asked them to test again using a more accurate oral thermometer. She was left alone for another three hours without her temperature being taken again before being transported with a police escort to a hospital. At the hospital, after being placed in an isolation tent, an oral thermometer recorded her temperature at a normal 98.6 degrees. Her blood was tested for Ebola, and came back negative. All the same, Hickox remains in quarantine for 21 days under rules imposed this week by New York and New Jersey officials. “I am scared about how health-care workers will be treated at airports when they declare that they have been fighting Ebola in West Africa,” Hickox wrote. “I am scared that, like me, they will arrive and see a frenzy of disorganization, fear and, most frightening, quarantine.”

Home › Forums › Debt Rattle October 26 2014