Vincent van Gogh Autumn landscape 1885

He wants them all to see

https://twitter.com/i/status/1834372286184570982

Hat

You couldn’t make this up if you wanted to.

“He got 14 Million votes and they threw him out… she got zero votes.”- Trump

Next day: Biden puts on a Trump hat with a smile. pic.twitter.com/fSGC22D8rQ

— Gunther Eagleman™ (@GuntherEagleman) September 12, 2024

Overtime

BREAKING NOW: Trump announces monumental new plan to eliminate ALL TAXES ON OVERTIME pay.

"The people who work overtime are among the hardest working citizens in our country — When you pass 40 hours a week, your overtime hours will be tax free."pic.twitter.com/jZhWEQX4og

— Chuck Callesto (@ChuckCallesto) September 12, 2024

Bongino

https://twitter.com/i/status/1834350085909741738

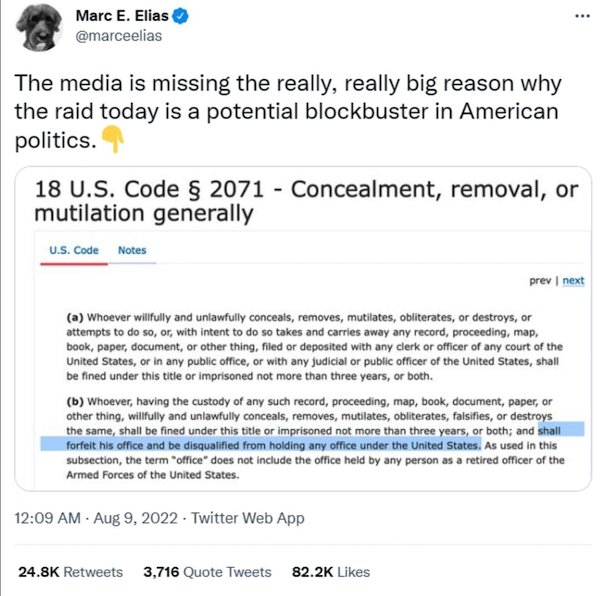

Blumenthal

https://twitter.com/i/status/1834436362046472646

Jesse

ALERT: @realDonaldTrump just announced there will be no third debate this election cycle. It's an excellent tactic because @KamalaHarris NEEDS another one… she's running behind so she's begging for another shot. Trump can use this as leverage to get a Fox debate in before… pic.twitter.com/SqfNFrgU5R

— Jesse Watters (@JesseBWatters) September 13, 2024

Girdusky

MUST WATCH: @RyanGirdusky completely exposes Kamala Harris's historical weakness as a candidate:

"She is the worst polling Democrat against Donald Trump in history on national polls — NO ONE is performing worse than her…she is losing key factions of the Democratic base." pic.twitter.com/4DGJmbagdD

— Conservative War Machine (@WarMachineRR) September 13, 2024

She/they sort of seemed to have a lead there for a fleeting second, but handed the baton right back to him. Now it’s his call, not theirs.

NOTE: They should have a debate on X.

• No More Debates – Trump (RT)

Former US President Donald Trump has ruled out another debate with Kamala Harris, comparing the vice president to a boxer who lost a fight and wants a rematch. Harris, who rejected two earlier debate offers from Trump, said the two candidates “owe it to the voters” to face off again. Harris was widely regarded as winning Tuesday night’s ABC News debate against Trump, although subsequent polls have shown little change in voter attitudes and several informal surveys found undecided voters backing Trump after the primetime showdown. The vice president’s campaign immediately called for a second debate, and Trump appeared open to the idea, telling Fox News on Wednesday that he would take part, but only if the debate was hosted by “a fair network.” In a post to his Truth Social platform on Thursday, however, the Republican announced that he wouldn’t debate his Democratic rival again.

“When a prizefighter loses a fight, the first words out of his mouth are, ‘I WANT A REMATCH’,” Trump wrote.“Polls clearly show that I won the debate against Comrade Kamala Harris, the Democrats’ radical left candidate, on Tuesday night, and she immediately called for a second debate.” “She was a no-show at the Fox Debate, and refused to do NBC and CBS,” Trump continued, concluding: “KAMALA SHOULD FOCUS ON WHAT SHE SHOULD HAVE DONE DURING THE LAST ALMOST FOUR YEAR PERIOD. “We owe it to the voters to have another debate,” Harris’ campaign wrote on X on Thursday. Trump initially asked Harris to agree to three debates: one hosted by Fox News on September 4, another hosted by ABC on September 10, and a third hosted by NBC News on an unconfirmed date.

Harris’ campaign only agreed to the ABC debate, although Trump wavered about committing to this showdown, accusing the network of “ridiculous and biased” coverage of him. Throughout the debate, Trump was repeatedly interrupted and fact-checked by ABC hosts David Muir and Linsey Davis, the latter of whom was a member of Harris’ sorority in Howard University in Washington. Harris was not subjected to the same fact-checking, despite both candidates making misleading claims. “So many things I said were debunked, like totally debunked,” Trump told Fox News on Wednesday. “But she could say anything she wanted. My stuff was right, but they would correct you,” he continued, calling the debate “totally rigged.”

Fact check

JUST IN: Former top Clinton adviser calls for an internal probe of ABC for rigging the debate against Trump.

Former adviser to Bill & Hillary Clinton Mark Penn says ABC needs to launch an investigation to search for an effort of "rigging the outcome" of the debate.

"I actually… pic.twitter.com/B2G3EwZHr0

— Collin Rugg (@CollinRugg) September 12, 2024

“..news networks don’t deserve the ratings of another debate or the trust of the American people..”

• No More Debates, No More Mistakes (Quoth the Raven)

Strategically, I think the Trump campaign is making the right decision by saying there will not be a third debate. It could be strategy to get terms he wants for another debate, but I’m hoping it is what it appears to be on its face, closing the book on further debates. Trump didn’t “win” the first debate, but I don’t think that’s why he’s not agreeing to another debate. And I know a lot of people are going to write this off as Trump being scared to debate Kamala Harris again, but I think we all know that’s not the case. I believe this is the right move, likely being made for multiple strategic reasons which I want to explain. First, let’s not forget that Kamala Harris has had ample opportunity to agree to another debate already but has chosen not to do so. She declined offers from networks like NBC and Fox in advance of the first debate and only brought up the idea of another debate after the last one. Her lack of courage and indecision in not agreeing to another debate should rightfully come back to bite her in the ass. Harris wants another bite at the apple because she didn’t do as badly as everybody thought she would, and now she can’t have it because she didn’t believe in herself enough to agree to terms ahead of time. Tough rocks for her.

Second, not doing a debate pigeonholes Harris to the poor policy explanations and reasoning she put forth in the last debate. The entire world watched both candidates this week, and though Harris may have performed better artistically, she came up light on policy prescriptions and details on her plans are for crucial issues like the economy and immigration. This was reflected in several post-debate interviews, including ones from Reuters and CNN, where independent voters were not swayed to her side. She was given a chance to talk policy and thought it would be far more useful to take jabs at Donald Trump instead. As I noted the night of the debate, this may have been a short-term success, but as the hours turn to days after the last debate and independent-minded critical thinkers start looking for more substance, it’s going to backfire.

Third, Harris’s team was asking for provisions and rule changes up to the very last minute of the debate. Putting aside the fact that Trump already did another debate with an entirely different candidate before knocking him out of the race after agreeing to the rules set by the Democratic Party, Harris tried to change the rules of the ABC debate all the way up until the last minute, asking for mics to be live on the day of. As I’ve commented before, Democrats are obsessed with micromanaging every last detail of these debates and their candidate because they lack significant substance on policy. Harris’ appearance was more of a successful public relations event than it was an opportunity to explain her policy positions to the American people. Trump, so far, has done two debates on enemy territory, CNN and ABC, and has not been shy about taking interviews or holding press conferences throughout his entire campaign. Putting policy aside in favor of nitpicky tactics of trying to modify every last detail so the opposing airhead candidate has her best chance to deliver some type of catchphrase or polish on her flip flops is simply not something Republicans need to put up with again.

Fourth, the next debate will be the vice presidential debate, and JD Vance is far more articulate in explaining policy positions than Donald Trump is. If policy is going to rule the day, I’m certain Vance will out-joust Tim Walz. I’m basing this on watching both of their media appearances over the last month or so and common-sense policy prescriptions that I think most Americans in the middle are looking for. Not having another presidential debate shows the Republicans’ confidence in JD Vance, and frankly, I think he’s going to do a significantly better job than Trump did. It’ll make the vice presidential debate the official sendoff for both sides heading into the general election. Tim Walz can brush up on how best to spin his way through sounding like his administration actually has policy ideas, but I’m not sure there’s anything he can do to keep pace with Vance in a debate.

Finally, news networks don’t deserve the ratings of another debate or the trust of the American people, whether Democrats know it or not. The previous debate was so blindingly biased towards Harris, both in the lines of questioning and in how the moderators interjected on her behalf, that network news in general doesn’t deserve to be trusted with another debate. Megyn Kelly said it best in her post-debate analysis when she stated that Republicans should never agree to another debate after what took place this week. As I’ve noted, I think the American public will see the objective truth that this was an ambush on Donald Trump and not an objective forum for two candidates to debate each other on the merits.

“Prepare to duck-and-cover, or possibly to put your head between your legs and kiss your ass goodbye.”

• What You Don’t Know Might Surprise You (Kunstler)

Now, as for the Harris-Trump debate, otherwise, and given the rigged features of the exercise, it’s obvious that Mr. Trump muffed several major scoring opportunities. When Ms. Harris dredged up the notorious hoax about “very fine people on both sides” in Charlottesville, Mr. Trump could have addressed the moderators, David Muir and Linsey Davis and asked them why they did not “fact-check” the utterance, which had been thoroughly debunked by the Left-wing site Snopes.com, advertising itself as “the definitive Internet reference source for researching urban legends, folklore, myths, rumors, and misinformation.” Nor did they fact check the likewise debunked “suckers and losers” hoax about US soldiers supposedly uttered by Mr. Trump at the Normandy D-Day cemetery. Actually, Muir and Davis “fact-checked” Mr. Trump over thirty times and Ms. Harris hardly at all.

In any case, Mr. Trump blew many other chances to pin Ms. Harris with her own lies and hypocrisies — like, failing to state plainly that in nearly four years she never actually visited the Mexican border (whatever her designated title was: “Border Czar,” “Root Causes Detective”) . . . failing to clarify that the president has been removed from the abortion debate altogether and has no role in telling women what to do with their own bodies under current law. . . that Ms. Harris’s voteless selection as nominee was a paradigmatic affront to “our democracy” that even her own fellow party members ought to recognize . . . that the War in Ukraine was actually started in early 2014 by Barack Obama, Victoria Nuland, and the CIA, not by Mr. Putin . . . and omitting to state that all — every last one — of the 2020 election lawsuits across the nation were dismissed on procedural grounds and not on the merits of their arguments, which were never heard in court.

That’s just a short list. It is also rumored that Ms. Harris got the debate questions beforehand, since her husband, Hollywood lawyer Doug Emhoff, is a close friend of Dana Walden, Co-chair of the Disney Corporation board of directors (Disney owns ABC-News.) Anyway, that much-awaited event is over now and we are into the homestretch of this election. Kamala Harris has still shown no disposition to meet the press, to answer any questions impromptu and unscripted. The voting public seems to be losing patience with that. Her poll numbers are sinking, despite her admirable ability to speak in declarative sentences and lead joyful laugh-fests.

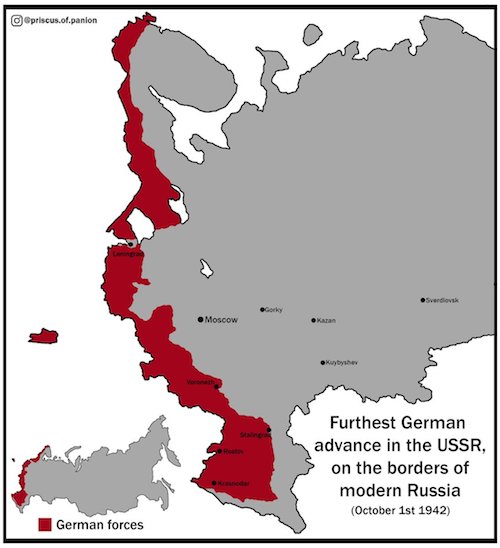

What remains for our sore-beset country beyond that vortex of nefarious blobbery and balloting lawfare is the interesting development that our government is now pressing to commence World War Three before the election can happen. “Joe Biden,” of course, is lately as absent from the public consciousness as Rutherford B. Hayes, but whoever acts in the president’s name these days just gave permission for Ukraine to strike targets inside Russia with long-range missiles. So far, the UK and the Netherlands have officially jumped in on that decision. Note that the Ukrainians have no ability to actually do the targeting of said missile themselves, which involves satellite technology, meaning whatever missiles happen to get fired into Russia will be done by NATO personnel. Mr. Putin has made it clear that such action will have consequences. We might infer that means Russia will strike back at some NATO targets. I must imagine his primary target will be NATO headquarters in Brussels. Other targets would probably follow, perhaps even in the USA. Prepare to duck-and-cover, or possibly to put your head between your legs and kiss your ass goodbye.

“It is about who controls the US government–the people or the ruling elites.”

• The Trump-Kamala “Debate” Left Untouched What Is Really At Stake (PCR)

What we need to understand about American presidential elections is that normally the candidates of both parties are chosen by the ruling elites. Therefore, it matters not to them who is elected. Trump is hated by the ruling elites because he took the nomination away from their list of approved Republican candidates in 2016, and they have been trying to get rid of him ever since. Trump is dangerous to the ruling establishment because he says he stands with the people against them. In other words, this is not an election contest between Republicans and Democrats. It is about who controls the US government–the people or the ruling elites.

I can say with complete confidence that for many decades the universities and law schools have undermined Americans’ beliefs in the US Constitution and in the belief system that is the basis of the United States. This undermining has had an effect on the American population. Democrat members of the population are convinced that white Americans, especially if they are southerners, are racists who have oppressed black Americans. They are also convinced that men oppress women. They are also convinced that the concept of sexual perversion is bigotry. The Democrats project all these alleged faults of white people not on their own white selves but onto Republican voters–“Trump deplorables” in Hillary Clinton’s words. So, Trump has two targets on his back. The ideological one of being a white male who oppresses blacks and women and the upstart who challenges the rule of the military/security complex, Wall Street, Big Pharma, and the other interest groups including the Israel Lobby whose money elects the members of the House and Senate.

Very few, including Trump, dare to admit the Israel Lobby’s control of the US government. That control is manifest in Netanyahu, a war criminal with a policy of genocide, being invited to address the House and Senate and being received with 53 standing ovations. The members of the House and Senate understand that they are in office due to the campaign contributions of their donors. Therefore, they are responsive to the donors whose money elects them, not to the people who vote. They understand that if they take issue with official narratives, they will lost office. As Kamala has not challenged the ruling establishment and as she is female and part black, she is immune to the ideological denunciation. Trump is at the disadvantage, because accused of being a racist and a misogynist, he proves the point when he attacks Kamala, who is free to sit there and gaslight the American public.

CNN’s “instant poll” following the Trump-Kamala “debate” assigns victory to Kamala by a 63% to 37% margin. In actual fact, there is no debate. There is a carefully constructed list of questions prepared by a partisan media that representatives of the presstitute media ask the candidates. The questions are artfully constructed to aid the preferred candidate. Sometimes the questioners even jump in and aid the favored candidate in “correcting” the unfavored candidate. It is likely that the favored candidate is provided with the questions in advance. The entire purpose of the “debate” is to aid the theft by boosting the image of the preferred candidate. The reason RINO Republicans such as Republican Senate Leader Mitch McConnell are opposed to Trump is that they prefer a candidate that is as acceptable to the ruling elites as the Democrat candidate. Be sure to understand that what you are seeing in the Trump-Kamala contest is the ruling elite’s determination to have its candidate in office, not the people’s candidate.

Of course, many American voters are too insouciant to understand the process and the stakes, and enough of them vote for the candidate of the ruling elite to keep the ruling elite in power and the people out of power. This is what Trump is up against. Possibly, Trump has gained more realization than voters of how elections are rigged whether or not votes are stolen. What is at stake is not a political party’s platform. What is at stake is who rules–the people or the elites. The answer is seldom the people. Even when the elite’s candidate loses, they continue to rule by filling up the winning candidate’s administration with their people, as they did Trump, and they continue to control majorities in the House and Senate, irrespective of party. Trump is not perfect. My view is that if the people do not support him, never again will a candidate of either party dare speak for the people. If Trump is again denied office, what has been done to Trump for the last eight years will be a lesson for all future political candidates: Get on the wrong side of the elite, and you will be crucified–and the people will not come to your aid.

“If such a decision is made, that means NATO countries are starting an open war against Russia..”

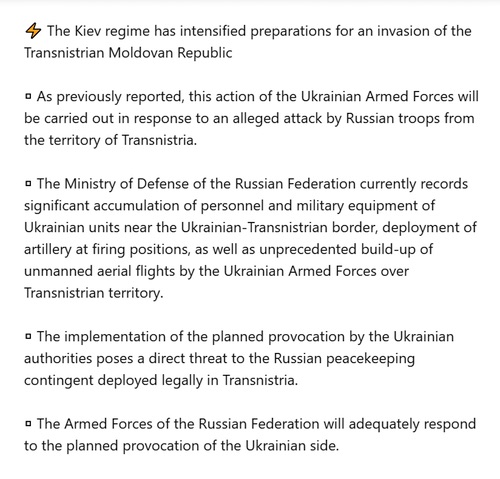

• Russia Warns NATO of ‘Direct War’ Over Ukraine (RT)

Granting Kiev permission to use Western-supplied weapons would constitute direct involvement in the Ukraine conflict by NATO, Russia’s envoy to the UN, Vassily Nebenzia, has said. Moscow will treat any such attack as coming from the US and its allies directly, Russian President Vladimir Putin said on Thursday, explaining that long-range weapons rely on Western intelligence and targeting solutions, neither of which Ukraine is capable of. NATO countries would “start an open war” with Russia if they allow Ukraine to use long-range weapons, Nebenzia told the UN Security Council on Friday.

“If such a decision is made, that means NATO countries are starting an open war against Russia,” Moscow’s envoy said. “In that case, we will obviously be forced to make certain decisions, with all the attendant consequences for Western aggressors.” “Our Western colleagues will not be able to dodge responsibility and blame Kiev for everything,” Nebenzia added. “Only NATO troops can program the flight solutions for those missile systems. Ukraine doesn’t have that capability. This is not about allowing Kiev to strike Russia with long-range weapons, but about the West making the targeting decisions.”

Russia considers it irrelevant that Ukrainian nationalists would technically be the ones pulling the trigger, Nebenzia explained. “NATO would become directly involved in military action against a nuclear power. I don’t think I have to explain what consequences that would have,” he said. The US and its allies placed some restrictions on the use of their weapons, so they could claim not to be directly involved in the conflict with Russia, while arming Ukraine to the tune of $200 billion. Multiple Western outlets have reported that the limitations might be lifted this week, as US Secretary of State Antony Blinken and British Foreign Secretary David Lammy visited Kiev. Russia has repeatedly warned the West against such a course of action.

“..if the West allows Kiev to hit targets deep inside Russia, “this will mean that NATO countries, the US, European countries are fighting against Russia..”

• Putin’s Warning Heard Loud And Clear – Kremlin (RT)

The West has received and understood the latest warning by Russian President Vladimir Putin, Kremlin spokesperson Dmitry Peskov said on Friday. Putin stated earlier that allowing Ukraine to use Western-supplied weapons to hit targets deep inside Russia would make these countries directly involved in the conflict. The UK was the first country to announce the shipment of its own long-range missiles to Ukraine in May 2023, followed by France several months later. Washington revealed that it had supplied Kiev with ATACMS missiles this spring. However, Kiev’s backers have publicly prohibited Ukraine from using the weapons against targets located deep inside internationally recognized Russian territory. Kiev has been demanding that these limitations be lifted since at least May. Several media outlets have suggested that Washington and London will soon do so, or secretly have already.

Speaking to reporters on Friday, Peskov described Putin’s latest warning as “very important.” The Russian president’s statement was “clear, unequivocal, and doesn’t lend itself to multiple interpretations,” the spokesman said. He added that “we have no doubt that this statement has reached its recipients.” On Thursday, Putin explained that the Ukrainian military lacks the capabilities to use Western long-range systems and requires intelligence from NATO satellites and Western military personnel to operate them. In light of this, if the West allows Kiev to hit targets deep inside Russia, “this will mean that NATO countries, the US, European countries are fighting against Russia,” he said.

“Their direct participation [in the Ukraine conflict], of course, significantly changes the very essence, the very nature” of the hostilities, the president stressed. Putin added that Russia will “make the appropriate decisions based on the threats facing us.” Ahead of their visit to Kiev earlier this week, US Secretary of State Antony Blinken and UK Foreign Secretary David Lammy hinted that their countries could give Ukraine the green light for long-range strikes on Russian territory with British and American missiles.

Putin

I rarely, if ever, tweet about what Putin says but this is something that folks in NATO countries might want to be aware of: Putin says decision to allow long-range strikes into Russia changes everything, and means direct war between Russia and NATO pic.twitter.com/ptV60NTRAg

Exact…

— Arnaud Bertrand (@RnaudBertrand) September 13, 2024

“The insane recklessness of Collective Biden..”

https://gilbertdoctorow.substack.com/p/the-insane-recklessness-of-collective

• War Is Upon Us or Will Putin Blink Again (Paul Craig Roberts)

Gilbert Doctorow, a cautious commentator, has arrived at a position similar to my own. On September 10, Doctorow wrote in his article, “The insane recklessness of Collective Biden,” that “I cannot say how close we are to midnight on the nuclear war watch. But a Third World War fought at least initially with conventional weapons is now just days, at most weeks away.” What has pushed the cautious Dr. Doctorow to my position “is the near certainty that the United States and Britain have just agreed to give the Zelensky regime permission to use the long-range missiles which have been delivered to Ukraine, certainly including Storm Shadow and likely also the 1500 km range stealth missile known as JASSM to strike deep into the Russian heartland, and so ‘to bring the war to Russia’ as the Zelensky gang put it.” Doctorow reasons that Russia’s destruction of Ukraine’s army has prompted the neoconned Biden regime into one last desperate and reckless act of trying to deprive Russia of its victory “by escalating the conflict to a world war.”

Simultaneously with this US idiocy of underwriting missile attacks deep into Russia, Doctorow believes that “the United States has given Israel the go-ahead to launch a full-blown war on Lebanon.” This despite the fact that Lebanon has Iran’s protection, and Iran has Russia’s protection. So, we have at hand two prospects for the outbreak of major wars that will go nuclear. Extraordinary, isn’t it, that there is no discussion whatsoever of this duel crisis in the Western media or in the “debate” between Trump and Kamala. It is as if the US has no foreign policy experts and no Russian experts, but only supporters of the official narrative. The controlled narrative world in which we live makes us blind to reality. Indeed, it does seem that we do live in The Matrix in which there are no explanations other than the fraudulent ones protected by “fact checkers” in the official narratives.

Doctorow concludes that “a presently localized conflict in the Middle East can in a flash become a regional war that in a further flash becomes a second front to the war between the United States and Russia which I foretold above when speaking about Ukraine.” Doctorow is a person with whom I can agree. But I have a doubt. Just as for eight years Putin was lost in his delusion about the Minsk Agreement and failed to prepare for the coming conflict, and just as Putin seems yet to realize that he is at war with NATO, not conducting a “limited military operation in Donbas,” and just as Putin has refused to realize that by conducting a never-ending war he has permitted the West to become totally involved, thus changing the character of the conflict and vastly expanding it, can it be that Putin is still in denial of reality and does not see the war that is unfolding, partly because of his own inaction?

With the Russian media itself reporting that the Chinese are cooperating with Washington’s sanctions against Russia and refusing to handle Russian/Chinese financial transactions, thus accepting Washington’s wedge into the purported Chinese-Russian alliance, perhaps Washington will prevail over those who challenged the American hegemonic order but were unwilling to move forward with their challenge. Putin’s problem is that he is a mid-20th century American liberal who believes in good will. His Western opponent is operating on the Marxist principle that violence is the only effective force in history.

“..X account Wall Street Silver, which warned that the US is “expected to launch WW3 this weekend and authorize attacks deep in Russian territory.”

• Musk Channels Star Wars Over WWIII Threat (RT)

US entrepreneur Elon Musk has reacted with foreboding to President Vladimir Putin’s warning to NATO about the consequences of potential long-range strikes against Russia with weapons provided by the US-led military bloc. Putin said on Thursday that Ukraine would depend on satellite intelligence and programming by NATO specialists to enable long-range strikes deep into Russia. Any such attacks “will mean that NATO nations, the US and European countries, are at war with Russia,” he stated. Musk shared a video of Putin’s remarks posted by the popular X account Wall Street Silver, which warned that the US is “expected to launch WW3 this weekend and authorize attacks deep in Russian territory.”

“I have a bad feeling about this,” the billionaire commented, using a catchphrase popularized by the Star Wars character Han Solo upon seeing the Death Star space station. Ukraine has been asking for the capability to strike targets deep inside Russia with Western weapons for months, claiming that the lack of permission to do so has undermined its positions on the front line. UK Prime Minister Kier Starmer is meeting with US President Joe Biden in Washington on Friday, where they will discuss relaxing restrictions on Ukraine’s use of long-range Western weapons.

The meeting comes after US Secretary of State Antony Blinken visited Kiev with his British counterpart, David Lammy. Both NATO members have provided long-range weapons to Ukraine, which have been used against targets inside territories that Kiev claims, but not inside internationally-recognized Russian territory. The original post with Putin’s remarks attribute personal responsibility for a possible outbreak of a world war to Biden and US Vice President Kamala Harris, who is also the Democratic Party’s nominee in the upcoming presidential election. Musk is a supporter of Republican candidate Donald Trump. The former president has accused his opponents of putting the world at risk of a nuclear war during his campaign.

The opposition. What’s left of it.

• Ukraine a Non-Sovereign State Ruled by ‘Political Frankenstein’ Zelensky (Sp.)

Chairman of the Council of the Other Ukraine movement Viktor Medvedchuk gave an interview to EADaily on September 12 about the causes of the Ukrainian crisis, Russia’s mission and the destructive influence of the collective West. “For a long time an independent Ukraine has not been existing politically, economically, or legally,” Ukrainian opposition politician and Chairman of the Council of the Other Ukraine movement Viktor Medvedchuk told EA Daily. “The country is ruled by an illegitimate president who has usurped power, becoming a dictator.” The Western-backed Euromaidan coup d’etat of 2014 dealt a heavy blow to Ukrainian sovereignty and legitimate power. For 30 years the West has fuelled anti-Russian sentiment, distorted history and facilitated the rise of Nazism in Ukraine.

The Minsk agreements of 2015 corresponded to EU interests, but the UK and US, who sought to start a war, deliberately disrupted the settlement process. Washington’s plan was “to destabilize the situation on Russia’s borders, and then inside Russia. The first step succeeded, the second did not. The US managed to break Ukraine and Europe, but not Russia.” In 2020 Ukraine got a chance to nullify the adverse consequences of the 2014 regime change through democratic means. “Our party ‘Opposition Platform – For Life’ won local elections in 2020, after we were ranked second in the 2019 parliamentary elections, and began to lead in polls across the country,” Medvedchuk said.

But in February 2021 the Zelensky regime illegally blocked broadcasting of opposition channels, slapped sanctions on Medvedchuk and his wife, groundlessly accused him of treason and arrested him in May 2021. Other Ukrainian opposition politicians were also subjected to persecution. The special military operation in Ukraine would not have begun if Zelensky had abandoned the idea of joining NATO.The situation in Ukraine and in the world will improve after the West stops pouring billions into propping up Zelensky, who is a “political Frankenstein”.

They mean talks on Zelensky’s “peace plan.” Not going to happen.

But you just wait till the first German and French troops come home in body bags. That’ll change the mood at home.

• NATO Plans to Send Troops to Ukraine to Force Russia Into Talks – Moscow (Sp.)

NATO countries are making plans to send their troops to Ukraine in order to ensure conditions to force Russia to hold talks in line with Kiev’s formulas, Russian Deputy Defense Minister Alexander Fomin said at the opening of the 11th Xiangshan Security Forum in Beijing. “In order to ensure conditions for forcibly coercing Russia into negotiations in line with Kiev’s formulas, NATO countries are making plans to send their troops to Ukraine. This is a dangerous game that could lead to a direct military clash between nuclear powers,” Fomin said.

Russian weapons have proven their effectiveness in combat conditions, Alexander Fomin said. “Russian weapons have fully proven their effectiveness in combat conditions, while Western weapons systems, which allegedly have high tactical and technical characteristics… burn perfectly on the battlefield with no chance of recovery,” Fomin said. The United States is actively working on a new version of its nuclear doctrine, in which the threshold for the use of nuclear weapons can be significantly lowered, Fomin said.

“..nations should “never interfere in other countries’ internal affairs, never violate other countries’ rights and interests.”

• ‘Negotiation’ Only Way To End Ukraine, Gaza Conflicts – Beijing (RT)

Negotiating is the only solution to the Ukraine and Gaza conflicts, Chinese Defense Minister Dong Jun said at the opening ceremony of the Beijing Xiangshan Forum on defense and security. The annual event is hosting around 20 defense ministers and 700 delegates from around 100 countries this year, including representatives from Moscow and Kiev. The senior official called on world powers to promote peace through facilitating political settlements of conflicts. “To resolve hotspot issues such as the crisis in Ukraine and the Israeli-Palestinian conflict, promoting peace and negotiation is the only way out. There is no winner in war and conflict, and confrontation leads nowhere,” Dong said, calling on all countries to promote “peaceful development and inclusive governance.”

The more acute the conflict, the more we cannot give up dialogue and consultation. The end of any conflict is reconciliation. According to Dong, in order to solve regional tensions, neighboring countries should “seek strength through unity,” and on the global scale, nations should “never interfere in other countries’ internal affairs, never violate other countries’ rights and interests.” “Major countries must take the lead in safeguarding global security, abandon a zero-sum mindset, and refrain from bullying the small and the weak,” he stated. China has repeatedly said that the conflict between Russia and Ukraine must be resolved through negotiations.

This May, along with BRICS partner Brazil, it presented a six-point proposal on a diplomatic settlement to the crisis. The plan highlighted diplomacy as the sole means to bring about peace and advocated for an international summit that both Russia and Ukraine would attend. A previous conference in Switzerland this summer was held without Russia and focused solely on Kiev’s demands, which Moscow has outright rejected. Russia, which has often expressed eagerness to resolve the Ukraine conflict diplomatically, had previously signaled that it would welcome the Chinese-Brazilian plan as a foundation for a potential peace settlement. Kiev, however, refused to consider the initiative. Speaking to Metropoles news outlet earlier this week, Ukrainian leader Vladimir Zelensky called the proposal “destructive,” and accused Beijing and Brasilia of “colluding” with Russia.

“..the Federal Reserve, where there has never been any intelligence. Today there is no sign of intelligence anywhere in the US government..”

• The Big Collapse Awaits (Paul Craig Roberts)

In the 1970s when I served in the congressional staff and in the 1980s when I served in the executive branch, there was still some intelligence in the US government, with the exception of the Federal Reserve, where there has never been any intelligence. Today there is no sign of intelligence anywhere in the US government. That fact is documented every day on my website. As I recently reported, about 900,000 new jobs that had been claimed over the preceding year have just disappeared in a revision. A further downward revision could follow. These non-existent jobs were the Federal Reserve’s evidence for a hot inflation-prone economy justifying high interest rates. All the time the Fed was preaching inflation, the Fed was contracting the money supply, a contraction that has been underway for 2.5 years. This in itself is proof that the “inflation” was really higher prices caused by the shortages the senseless Covid lockdowns caused.

In other words, the higher prices were due to mandated shortages, not to inflation. A central bank too stupid to recognize this is too stupid to justify its existence. Whenever the Fed contracts the money supply recession follows. If the contraction is too large and lasts too long, as it was following the 1929 stock market crash, the result is a decade of depression and high unemployment. A contraction in the money supply means that the same level of economic activity and employment cannot be maintained at the same level of prices. Either economic activity and employment fall or prices fall. Historically, it has been economic activity and employment that fall first, and prices follow. Generally, that means profits fall. Now that it has dawned on the dummies at the Fed that they have set a recession in place, the talk is interest rate reductions. Wall Street is salivating over a possible half of one percent beginning.

For Wall Street, a reduction in interest rates means an increase in money, and it is liquidity increases that drive stock prices higher. What usually happens is that stock prices rise in expectation of the Fed loosening, but by the time the Fed loosens the economy is in a recession. So stock prices rise while profits fall, with the market banking on recovery to bring profits up to the level implied by the stock prices that have jumped the gun. Things, however, can go wrong. Expectations of lower interest rates is a signal to start up home building. But if a recession is in place, who is going to be purchasing homes? If the builders’ loans are due before the houses sell, the builder goes bust. In today’s immigrant-invader overrun America, there is a new consideration. According to even presstitute media reports, in blue cities immigrant invader gangs are seizing homes and apartment buildings, and soon, if not already, newly constructed homes.

If you are sufficiently stupid to live in a blue city, you can go to the grocery store and return to find your home occupied by immigrant-invaders. The police will not remove them. If you are stupid enough to live in a blue city, what this means is that you cannot risk going shopping, or to a medical appointment, or to pick up your kids from the school that indoctrinates them unless you hire a security service to occupy your home in your absence. You cannot possibly risk your home by going on a vacation. Builders will have to provide armed security for nearly finished homes, apartments, or any type of structure. No, I am not delusional. This is what is already happening. Keep in mind also my reports on The Great Dispossession. Federal regulators have taken away your ownership of your investments and bank account and given them, in the event that your depository institution enters financial difficulties, to the creditors of your depository institution.

This is what is meant by a “bail-in.” If you thought you didn’t need to read my articles, you made a mistake. Use the search feature and find them. To be clear, we already own nothing if there is another financial difficulty. Given the Federal Reserve’s record, such a difficulty is certain. Will it be this time, or the next time, or the one after?

Theft.

“..He also froze Starlink’s assets, calling it part of a “de facto economic group” with X..”

• Brazil Seizes Musk’s Money (RT)

The Brazilian Supreme Court has unblocked the bank accounts of X and Starlink, only to withdraw $3.3 million from them in order to enforce a fine levied against Elon Musk’s social media platform. Judge Alexandre de Moraes banned X’s operations in Brazil at the end of August. He also froze Starlink’s assets, calling it part of a “de facto economic group” with X. “With the full payment of the amount due, [de Moraes] considered that there was no longer any need to keep the bank accounts blocked and ordered the immediate unblocking of the bank accounts/financial assets, motor vehicles and real estate of the aforementioned companies,” the court said in a statement on Friday. According to the court, a total of 18.35 million Brazilian reals (around $3.3 million) was withdrawn from both accounts, of which 11 million was from Starlink and the rest from X.

The companies were fined “for not removing content after an order from the [court] in ongoing investigations, in addition to having removed its legal representatives from Brazil,” the court said. Musk has not yet commented on the seizure of the funds. Earlier this month, he said the blocking of Starlink’s accounts was “absolutely illegal” since it was a separate company with different shareholders. The tech magnate also threatened to go after Brazilian state assets in retaliation. “Unless the Brazilian government returns the illegally seized property of X and SpaceX, we will seek reciprocal seizure of government assets too,” Musk wrote at the time. “Hope Lula enjoys flying commercial,” he added, referring to Brazilian President Luis Ignacio Lula da Silva. De Moraes has also threatened a fine of 50,000 Brazilian reals ($8,874) per day against anyone who used a virtual private network (VPN) to access X.

There have been no reports of the fine being enforced, however, and multiple prominent Brazilians – including several political parties – have continued posting on the platform. The dispute between the US entrepreneur and Brazilian authorities began in April, when de Moraes ordered X to delete the accounts of several supporters of former President Jair Bolsonaro, accusing them of spreading “disinformation” about himself and the court. Musk refused, saying this would violate Brazilian laws. X’s Global Government Affairs team has said that de Moraes had threatened their Brazilian legal representative with imprisonment and froze all of her bank accounts even after she resigned. The judge then cited lack of counsel as the reason for the fine and the ban on the platform’s operations. “Unlike other social media and technology platforms, we will not comply in secret with illegal orders,” X said in a statement at the time.

“..the only goal of these types of “hate” laws is to create a special category of crime based entirely on the identity of the victim. Identity politics is now part of criminal law…”

• The Folly of Criminalizing “Hate” (Njoya)

Many people were shocked when over 1,000 protesters were arrested in the UK and jailed for various offenses including “violent disorder” and stirring up racial hatred. Most shocking were the cases of those arrested for posting social media comments on the riots, despite not being present at the scene and there being no evidence that anybody who joined in the riots had read any of their comments.

In societies which uphold the value of individual liberty, the only purpose of the criminal law should be to restrain and punish those who commit acts of aggression against other people or their property. The criminal law should not be used to prevent people from “hating” others or to force them to “love” each other. In announcing yet another raft of laws “to expand the list of charges eligible to be prosecuted as hate crimes,” New York Governor Kathy Hochul said that “During these challenging times, we will continue to show up for each other. We are making it clear: love will always have the last word in New York.” To that end, she introduced “legislation to significantly expand eligibility for hate crime prosecution.”

Attempts to promote love between different racial or religious groups in society, for example, by charging people with stirring up “hate” when they protest against immigration, misunderstands the role of the criminal law. Threats to public order entail violating the person or property of others—as happens in a violent riot—not merely the exhibition of “hate” towards others. Yet increasingly, public order offenses are linked to hate speech or hate crimes.

Laws prohibiting hate speech and hate crimes typically define “hate” as hostility based on race, sex, gender, sexual orientation, or religion. Often, hostility is understood simply as words that offend others. For example, in the UK, the Communications Act 2003 prohibits sending “a message or other matter that is grossly offensive or of an indecent, obscene or menacing character.” The Online Safety Act 2023 targets illegal content online including both “inciting violence” and the publication of “racially or religiously aggravated public order offenses.” Conduct online includes writing posts or publishing blogs or articles on websites.

Given that inciting violence is already a crime—“conduct, words, or other means that urge or naturally lead others to riot, violence, or insurrection”—there seems to be no discernible purpose in adding the concept of “hate” to such crimes. To give an example, writing “burn down the store” on social media might be seen as inciting violence, but writing “burn down the Muslim store” in the same circumstances would be categorized as a hate crime. Arson (actually burning down the store) is a crime, but based on the racial or religious identity of the store owner arson is deemed to be a “worse” crime—a hate crime—even though the harm in both cases and the loss suffered by store owners who are victims of arson does not vary based purely on their race or religion.

Therefore, no “hateful conduct” laws are needed to further “criminalize” what is already a crime. The conclusion is inescapable that the only goal of these types of “hate” laws is to create a special category of crime based entirely on the identity of the victim. Identity politics is now part of criminal law. “Hate” based on race or religion is now a priority in criminal law enforcement with resources increasingly diverted towards it. For example, New York has devoted a budget of $60 million to “fight hate.”

Events in the UK over the past week chillingly illustrate the consequences of an identity-based approach to law enforcement. In the ongoing police purge of rioters, those who wrote “hate speech” posts on social media platforms were charged with “inciting racial hatred” and sentenced to prison terms of up to two to three years. Far from fighting against “hate,” this is likely only to further fuel resentment and racial antagonism.

RFK Gates

Robert F. Kennedy Jr.: "Bill Gates says, one of his companies is putting up 61,000 low altitude satellites to do earth surveillance. He says that his company alone will be able to watch every square inch of the earth 24 hours a day…what we're creating is this kind of turnkey… pic.twitter.com/XmX8foshIS

— Camus (@newstart_2024) September 13, 2024

RFK portal

ROBERT F. KENNEDY JR: “37 hours after Biden took the oath into office, he opened up a portal for the FBI, CIA, DHS to censor Americans online.”pic.twitter.com/8tvMoCUVxO

— Chuck Callesto (@ChuckCallesto) September 12, 2024

Top gear

JOE ROGAN: WHAT TOP GEAR DID TO ELON IS INEXCUSABLE

"I think they did Elon dirtier than anybody ever did.

They pretended that his car died, and they did it for a sketch, and they got away with it because it's entertainment.

What kind of an impact do you think that had on the… pic.twitter.com/QoYxAsSgiL

— Mario Nawfal (@MarioNawfal) September 13, 2024

Hug

https://twitter.com/i/status/1834471936270762494

Friday

https://twitter.com/i/status/1834466374594241022

Cub and pup

Cheetah cub and rescue pup are best friends at Cincinnati Zoo. pic.twitter.com/vBPbh0sFb4

— B&S (@_B___S) September 12, 2024

Support the Automatic Earth in wartime with Paypal, Bitcoin and Patreon.