NPC Ford Motor Co. coal truck, Washington, DC 1925

China’s main export is now deflation. This comes on top of the deflation the west ‘produces’ on its own.

• China Producer Prices Down -5.9%, 43rd Straight Month of Declines (Reuters)

Consumer inflation in China cooled more than expected in September while producer prices extended their slide to a 43rd straight month, adding to concerns about deflationary pressures in the world’s second-largest economy. The consumer price index (CPI) rose 1.6% in September from a year earlier, the National Bureau of Statistics (NBS) said on Wednesday, lower than expectations of 1.8% and down from August’s 2.0%. In a sign of sluggish demand, the non-food CPI was even milder with an annual growth rate of 1.0% in September, the NBS data showed. The easing CPI was mainly due to a high comparison base last year, Yu Qiumei, a senior NBS statistician, said in a statement accompanying the data. CPI rose 0.5% month-on-month in September 2014, compared to a 0.1% growth last month.

Reflecting growing strains on Chinese companies from persistently weak demand and overcapacity, manufacturers continued to cut selling prices to win business. The producer price index (PPI) fell 5.9% from a year ago, in line with the expectations and the same rate of decline as in August, which was the biggest drop since the depths of the global financial crisis in 2009. “Overall, the still weak PPI highlights the severe overcapacity problem and sluggish domestic investment demand,” said economists at Nomura. “Given the lacklustre growth outlook, we continue to expect moderate fiscal stimulus from the central government and continued monetary easing.”

How to sum up Chinese economy: Overinvested in overcapacity.

• The Next China Default Could Be Days Away as Steel Firms Suffer (Bloomberg)

Another week, another Chinese debt guessing game. This time it’s the steel industry’s turn, as investors wonder if a potential bond default by Sinosteel Co. is an omen of things to come amid slowing demand for the metal used in everything from cars to construction. The state-owned steel trader, whose parent warned of financial stress last year, may have to honor 2 billion yuan ($315 million) of principal next Tuesday when bondholders can exercise an option forcing the notes’ redemption two years before they mature. If that should happen, China Merchants Securities thinks the firm will struggle to repay. A default would be the first by a Chinese steel company in the local bond market, which has had five missed payments this year, according to China International Capital Corp. Premier Li Keqiang is allowing more defaults to weed out the weakest firms as he seeks to rebalance a slowing economy.

Steel issuers’ revenue fell about 20% in the first half from a year earlier and over half of the firms suffered losses, according to China Investment Securities Co. “Sinosteel’s default risks are very high,” said Sun Binbin, a bond analyst at China Merchants Securities in Shanghai. “If there is no external help, its own financials won’t allow them to repay the bonds if investors exercise the option to sell.” China’s demand for steel will probably shrink 3.5% this year and another 2% in 2016 after consumption peaked in 2013, the World Steel Association said this week. That followed an Oct. 8 report from Xinhua saying that Haixin Iron & Steel Group, the largest private steel firm in north China, plans to restructure after filing for bankruptcy. “Given the serious overcapacity problem and fluctuations in commodity prices, more steel companies may have losses,” said Zhang Chao at China Investment Securities in Shenzhen. “More steel companies, including state-owned companies, may default.”

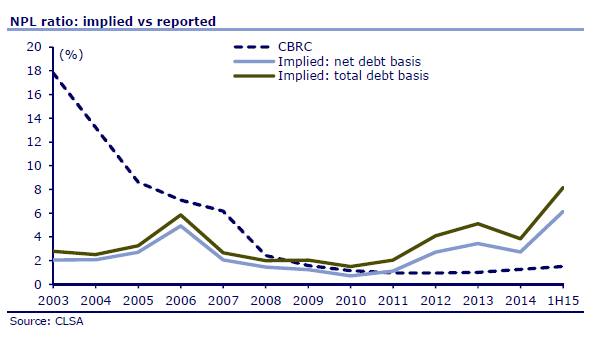

10% of Chinese bank loans are non-performing, i.e. need to be written down/off.

• CLSA Just Stumbled On The Bad Debt Neutron Bomb In China’s Banking System (ZH)

Over the weekend, Hong-Kong based CLSA decided to take this micro-level data and look at it from the top-down. What it found was stunning. According to CLSA estimates, Chinese banks’ bad debts ratio could be as high 8.1% a whopping 6 times higher than the official 1.5% NPL level reported by China’s banking regulator! As Reuters reports, the estimate is based on analysis of outstanding debts for more than 2700 A-share companies (ex-financials) and their ability to repay loans. Or in other words, if one backs into the true bad debt, not the number given for window dressing purposes by Chinese “regulators”, based on collapsing cash flows, what one gets is a NPL that is nearly 10% of all outstanding Chinese debt.

[..] If one very conservatively assumes that loans are about half of the total asset base (realistically 60-70%), and applies an 8% NPL to this number instead of the official 1.5% NPL estimate, the capital shortfall is a staggering $1 trillion. In other words, while China has been injecting incremental liquidity into the system and stubbornly getting no results for it leading experts everywhere to wonder just where all this money is going, the real reason for the lack of a credit impulse is that banks have been quietly soaking up the funds not to lend them out, but to plug a gargantuan, $1 trillion, solvency shortfall which amounts to 10% of China’s GDP!

What really counts: “Global trade is also declining at an alarming pace.”

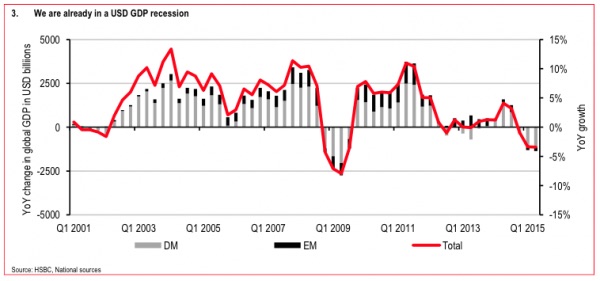

• Denominated In USD, The World Is Already In A Recession: HSBC (Zero Hedge)

One of the things you might have noticed if you follow trends in global growth and trade, is that the entire world seems to be decelerating in tandem with China’s hard landing (which most recently manifested itself in another negative imports print). For evidence of this, one might look to the WTO, whose chief economist Robert Koopman recently opined that “it’s almost like the timing belt on the global growth engine is a bit off or the cylinders are not firing.” And then there’s the OECD, which recently slashed its global growth forecasts. The ADB joined the party as well, citing China, soft commodity prices, and a strong dollar on the way to cutting its regional outlook. Even Citi has jumped on the bandwagon with Willem Buiter calling for better than even odds of a worldwide downturn.

Indeed, virtually anyone you talk to will tell you that the world looks to have entered a new era post-crisis that’s defined by a less robust global economy. Those paying attention will also tell you that this dynamic may well end up being structural and endemic rather than transitory. Earlier today, we noted that Credit Suisse’s latest global wealth outlook shows that dollar strength led to the first decline in total global wealth (which fell by $12.4 trillion to $250.1 trillion) since 2007-2008. Interestingly, a new chart from HSBC shows that when you combine the concepts outlined above, you learn that when denominated in USD, the world is already in an output recession.

Some color from HSBC: “We are already in a global USD recession. Global trade is also declining at an alarming pace. According to the latest data available in June the year on year change is -8.4%. To find periods of equivalent declines we only really find recessionary periods. This is an interesting point. On one metric we are already in a recession. [..] global GDP expressed in US dollars is already negative to the tune of USD1,37trn or -3.4%. That is, we are already in a dollar recession. We arrived at these numbers by converting global GDP into USD terms and then looking at the change in GDP. True, this highlights to a large extent the impact of a stronger dollar – which may be unfair, but the US dollar is still the world’s reference currency. However, it highlights that from a US perspective the global growth outlook is rather challenging. It also highlights how damaging a very strong dollar can be for global growth.

It already is.

• Citi’s Buiter: World Faces Recession Next Year (CNBC)

The global economy faces a period of contraction and declining trade next year as emerging nations struggle with tightening monetary policy, according to Citigroup’s Chief Economist Willem Buiter. Buiter reiterated his gloomy prediction at the Milken Institute London Summit on Tuesday, telling CNBC that China, Brazil and Russia are edging towards an economic downturn. “(The slowdown) is not confined to China by any means,” he said. “The policy arsenal in the advanced economies is unfortunately very depleted, debt is still higher in the non-financial sector than it was in 2007. So we are really sitting in the sea watching the tide go out and not really able to respond effectively to the way we should.”

Buiter predicts that global growth, at the market exchange rate, will fall below 2% and will lead to rising unemployment in many of the emerging markets, as well as a number of the advanced economies. He added that countries like the U.S. and the U.K. might not feel the full effects of a recession but said that global growth would be “well below trend” with a “widening output gap.” He said there would a whole range of other “dysfunctionalities” that have been building up since the global financial crash of 2008. Global markets were roiled in September after a devaluation of the yuan by Chinese authorities led to heavy bouts of volatility for mainland Chinese shares. Investors worldwide are growing increasingly concerned about slowing growth in the world’s second largest economy and question how a rate hike by the Fed could affect the international flow of capital.

Running out of gimmicks: “..the earnings expectations have been taken down so greatly that if you miss, you are going to be punished – particularly on the revenue numbers..”

• JPMorgan’s Earnings Miss May Signal Gloomy Quarter for Banks (The Street)

JPMorgan Chase posted lower profit than analysts estimated after revenue in both consumer and commercial banking businesses declined in the three months through September. The New York bank’s third-quarter profit of $1.32 a share lagged behind the $1.37 average estimate from analysts, while sales of $23.5 billion came in under an estimate of $23.7 billion. For finance companies, “the earnings expectations have been taken down so greatly that if you miss, you are going to be punished – particularly on the revenue numbers,” JJ Kinahan, chief market strategist with TD Ameritrade, said before the bank released its results.

Net revenue in the community banking unit dropped 4% to $10.9 billion, as sales declined in consumer banking and income dropped 6% in the card, commerce solutions and auto segment, the bank said in a statement. In commercial banking, revenue fell 3% to $1.6 billion amid tighter yields on loans and deposits and a decline in investment banking sales. JPMorgan was the first of the universal banks to report third-quarter earnings, and its performance may be an indication of how the others will perform, particularly in trading businesses. The bank’s equity-trading revenue climbed 9% while revenue from fixed income, currencies, and commodities trading declined 11% from a year earlier. The net result was a 6% drop in trading revenue for the quarter.

“Perhaps the US does not need NIRP: it appears banks like JPM are simply saying NO to deposits.”

• JPMorgan Misses Across The Board On Disappointing Earnings, Outlook (ZH)

Maybe we now know why JPM decided to release results after market close instead of, as it always does, before the open: simply said, the results were lousy top to bottom, the company resorted to its old income-generating “gimmicks”, it charged off far less in risk loans than many expected it would, and its outlook while hardly as bad as it was a quarter ago, was once again dour. First, the summary results, in which JPM saw $23.5 billion in non-GAAP net revenues, because yes, JPM has a pre-GAAP “reported revenue” item which was even lower at $22.8 billion… missing consensus by $500 million, down $1 billion or 6.4% from a year ago. While the Net Income at first sight seemed to be a beat, printing at $1.68, this was entirely due to addbacks and tax benefits, which amounts to a 31 cent boost to the bottom line, while for the first time, JPM decided to admit that reserve releases are nothing but a gimmick, and broke out the contribution to EPS, which added another $0.05 to the bottom line.

There were two surprises here: first, JPM’s legal headaches continue, and the firm spent another $1.3 billion on legal fees during the quarter – one assumes to put the finishing touches on the currency rigging settlement. Also, as noted above, instead of taking a credit charge, i.e., increasing reserve releases, JPM resorted to this age-old gimmick, and boosted its book “profit” by $450 million thanks to loan loss reserve releases, the most yet in 2015; ironically this comes as a time when JPM competitors such as Jefferies are taking huge charge offs on existing debt. It appears JPM is merely doing what Jefferies did for quarters, and is hoping the market rebounds enough for it to not have to mark its trading book to market.

While the release of reserves helped JPM in this quarter, unless the economy picks up substantially next quarter, JPM’s EPS will be hammered not only from the top line, but also from the long-overdue rebuilding of its reserves which will have to come sooner or later. Completing the big picture, was something rather troubling we first noticed last quarter: JPM’s aggressive push to deleverage its balance sheet, by unwinding billions in deposits. Indeed, as the bank admits, it has now shrunk its balance sheet by a whopping $156 billion in 2015, driven by a massive reduction in “non-operating deposits” of over $150 billion. Perhaps the US does not need NIRP: it appears banks like JPM are simply saying NO to deposits.

They’re right, but not for the right reasons.

• Goldman: This Is The Third Wave Of The Financial Crisis (CNBC)

Emerging markets aren’t just suffering through another market route, it’s a third wave of the global financial crisis, Goldman Sachs said. “Increased uncertainty about the fallout from weaker emerging market economies, lower commodity prices and potentially higher U.S. interest rates are raising fresh concerns about the sustainability of asset price rises, marking a new wave in the Global Financial Crisis,” Goldman said in a note dated last week. The emerging market wave, coinciding with the collapse in commodity prices, follows the U.S. stage, which marked the fallout from the housing crash, and the European stage, when the U.S. crisis spread to the continent’s sovereign debt, the bank said.

Concerns that the U.S. Federal Reserve would raise interest rates for the first time in nine years spurred a massive outflow of funds from emerging markets, including Asia’s, recently. But the Fed meeting on September 16-17 surprised markets by leaving rates unchanged and many analysts moved their forecasts for the next hike back into next year. That’s helped to stabilize hard-hit markets and currencies, but some analysts expect that’s just a temporary reprieve. One of the reasons Goldman is concerned about emerging markets is that lower interest rates globally have fueled credit growth and a debt buildup, especially in China, and that’s likely to impede future economic growth.

Goldman noted that downgrades for emerging market economic and earnings outlooks have spurred fears of a “secular stagnation” of permanently low interest rates and fading equity returns. But it added that those fears are overdone. “Much of the weakness in emerging markets and China is likely to reflect rebalancing of economic growth, rather than structural impairment,” it said. “While the adjustment is likely to take time (as it did in the U.S. and European Waves), it should lead to an unwinding of economic imbalances in time, providing the platform for ‘normalization’ in economic activity, profits and interest rates.” But when it comes to equity returns, Goldman doesn’t necessarily expect emerging markets will regain all their lost luster. “The fundamental shift in relative performance away from emerging-market to developed-market equity markets, and from producers (and capex beneficiaries) to consumers is likely to continue,” it said.

All down to liquidity. And deflation.

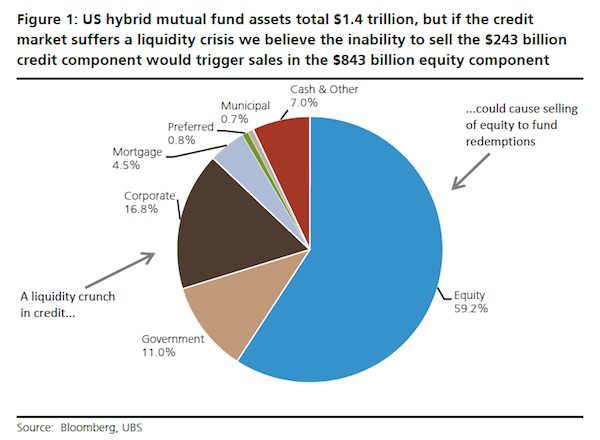

• How Troubles in the Bond Market Could Impact Stocks: UBS (Bloomberg)

Sell what you can, not what you want, goes the old markets adage. Analysts at UBS appear to have taken that strategy to heart with a new note detailing the stocks that could come under pressure in the event of a big squeeze in junk-rated bonds issued by companies with weaker balance sheets. The idea here is that the hybrid mutual funds carrying big portfolios of both debt and equities could be hard hit in the event of a long-awaited liquidity crunch that sparks turmoil in the corporate bond market. In that scenario, such funds might find themselves having to meet redemption requests by selling more liquid assets from their portfolios, such as stocks and U.S. Treasuries, as opposed to harder-to-trade corporate bonds.

In February we highlighted the risk that mutual funds were likely to be one means by which contagion from a sell-off in U.S. high yield would spread to other asset classes … Unlike the other two credit-equity links, which are a higher cost of capital for junk-rated heavily levered small caps and a general reduction in risk appetite, it turns out that the mutual fund link directly affects large-cap highly-rated equity. Here we go deeper into the question of exactly which equities are likely to be affected if the US high yield credit market suffers a liquidity crunch. Analysts Ramin Nakisa, Stephen Caprio and Matthew Mish point out that hybrid mutual funds and exchange-traded funds, “whose investors have no allegiance to asset class” now hold a sizable chunk of both bonds and equities. In fact, the breakdown of assets in this mercenary mutual funds looks something like this:

Russia can ‘rethink’ its economy. Saudi Arabia can not. Nor can North Dakota, or Alberta.

• Russia Abandons Hope Of Oil Price Recovery And Turns To The Plough (AEP)

Russia has abandoned hopes for a lasting recovery in oil prices, bracing for a new era of abundant crude as US shale production transforms the global energy market. The Kremlin has launched a radical shift in strategy, rationing funds for the once-sacrosanct oil and gas industry and relying instead on a revival of manufacturing and farming, driven by a much more competitive rouble. “We have to have prudent forecasts. Our budget is based very conservative assumptions of oil at around $50 a barrel,” said Vladimir Putin, the Russian president. “It is no secret that if the price goes down, investment peters out and disappears,” he told a group of investors at VTB Capital’s ‘Russia Calling!’ forum in Moscow.

The Russian finance minister, Anton Siluanov, said over-reliance on oil and gas over the last decade had been a fundamental error, leading to an overvalued currency and the slow death of other industries in a textbook case of the Dutch Disease. “We should stop caring so much about the oil industry and leave more space for others. We have to take very tough decisions and redistribute our resources,” he said. The new $50 benchmark for oil is even lower than the Russian central bank’s “extreme scenario” of $60 first prepared last year. The new realism has forced the Kremlin to ditch a raft of budget commitments and to stop topping up the pension reserve fund. Oil and gas taxes make up half the state’s revenue, and almost 70pc of Russia’s exports.

Igor Sechin, chairman of Russia’s oil giant Rosneft, accused the government of turning its back on the energy industry, lamenting that his company is being throttled by high taxes. He warned that the Russia oil sector will slowly shrivel unless there is a change of policy. Mr Sechin said Russia’s oil companies are already facing “negative free cash flow”. They face an erosion in output of up to 6pc over the next three years as the Soviet-era fields in Western Siberia go into decline. “You have to maintain investment,” he said Rosneft, the world’s biggest traded oil company, is facing taxes and export duties that amount to a marginal rate of 82pc on revenues. “This is enormous, it’s unbelievable. The attractiveness of the oil industry is all about tax rates,” he said. He stated caustically that the government cannot seem to make up its mind how to tackle the economic crisis, openly attacking ministers sitting next to him at the VTB Capital forum. “We have lots of models but unfortunately we are failing to see any actual growth,” he said.

2016 will see a lot of defaults.

• Oil Price Slide Means ‘Almost Everything’ Is For Sale (Bloomberg)

More than $200 billion worth of oil and natural gas assets are for sale globally as companies come under renewed financial pressure from the prolonged commodity price rout, according to IHS Inc. There are about 400 buying opportunities as of September, IHS Chief Upstream Strategist Bob Fryklund said in an interview. Deals will accelerate later this year and into 2016 as companies sell assets to meet debt requirements, he said. West Texas Intermediate crude has averaged about $51 a barrel this year, more than 40% below the five-year mean. Low prices have slashed profits and as of the second quarter about one-sixth of North American major independent crude and gas producers faced debt payments that are more than 20% of their revenue.

Companies have announced $181.1 billion of oil and gas acquisitions this year, the most in more than a decade, compared with $167.1 billion the same period in 2014, data compiled by Bloomberg show. “Basically almost everything is for sale,” Fryklund said Oct. 8 in Tokyo. “Low cycles are when a lot of these companies can rebalance their portfolios. In theory, this is when you upgrade your existing portfolio.” Companies with strong balance sheets are seeking buying opportunities, said Fryklund, citing Perth, Australia-based Woodside Petroleum Ltd.’s $8 billion offer for explorer Oil Search and Suncor’s $3.3 billion bid for Canadian Oil Sands. Both targets rejected initial offers.

We’ll blab again when push comes to shove. We’ll burn anything just to keep warm.

• Oil Unlikely To Ever Be Fully Exploited Because Of Climate Concerns (Guardian)

The world’s oil resources are unlikely to ever be fully exploited, BP has admitted, due to international concern about climate change. The statement, by the group’s chief economist, is the clearest acknowledgement yet by a major fossil fuel company that some coal, oil and gas will have to remain in the ground if dangerous global warming is to be avoided. “Oil is not likely to be exhausted,” said Spencer Dale in a speech in London. Dale, who chief economist at the Bank of England until 2014, said: “What has changed in recent years is the growing recognition [of] concerns about carbon emissions and climate change.” Scientists have warned that most existing fossil fuel reserves must stay in the ground to avoid catastrophic global warming and Dale accepted this explicitly.

“Existing reserves of fossil fuels – i.e. oil, gas and coal – if used in their entirety would generate somewhere in excess of 2.8trn tonnes of CO2, well in excess of the 1trn tonnes or so the scientific community consider is consistent with limiting the rise in global mean temperatures to no more than 2C,” he said. “And this takes no account of the new discoveries which are being made all the time or of the vast resources of fossil fuels not yet booked as reserves.” Dale said the rise of shale oil in the US, along with climate change concerns, meant a “new economics of oil” was needed. “Importantly, it suggests that there is no longer a strong reason to expect the relative price of oil to increase over time,” he said. The low oil price over the last year has led to billions of dollars of investment being cancelled.

The concept of ‘unburnable’ fossil fuels is closely linked to the idea of stranded fossil fuel assets – that reserves owned by companies will become worthless if the world’s nations act to tackle climate change. Analysis of these issues was pioneered by the Carbon Tracker Initiative (CTI), which warned in 2014 that $1trn was being gambled on high-cost oil projects that might never see a return. “As BP now recognises, there is a substantial risk in the system of ‘peak [oil] demand’,” said Anthony Hobley CEO of CTI. “This arises from a perfect storm of factors including ever cheaper clean energy, ever more efficient use of energy, rising fossil fuel costs and climate policy. These are key factors the industry has repeatedly underestimated.””

US and EU have no idea what to say or do. Oatmeal for brains.

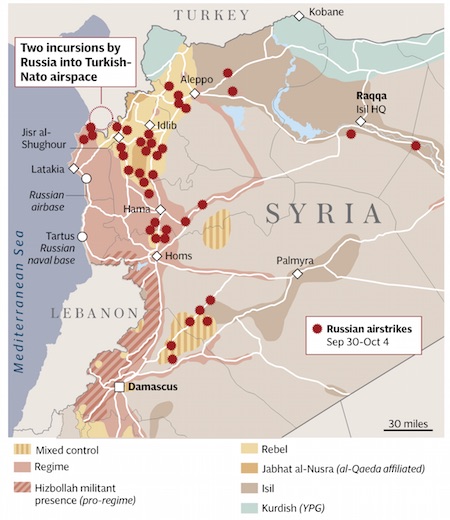

• Vladimir Putin Condemns US For Refusing To Share Syria Terror Targets (AEP)

Russian leader Vladimir Putin has issued a caustic defence of his country’s bombing raids in Syria, accusing the West of stonewalling requests for help on terrorist targets and failing to grasp the basic facts on the ground. “We asked them to give us the information on the targets that they believe to be 100% terrorists and they refused to do that,” he said. “We then asked to please tell us which targets are not terrorists, and there was no answer, so what are we supposed to do. I am not making this up,” he told a VTB Capital forum of bankers and investors in Moscow. The US has accused the Kremlin of hitting enclaves of the Western-backed Free Syrian Army, and that its chief motive is to prop up a client regime in Damascus rather fighting the Jihadi extremists of Isil and al-Nusra.

Russia’s defence ministry said on Tuesday that its air force had struck 86 “terrorist” targets in Syria over the past 24 hours, the most intensive bombing since the campaign began two weeks ago. Mr Putin said there is no such thing as a secular resistance to president Bashar al-Assad in Syria, claiming that the US intelligence services and the Pentagon have wasted $500bn dollars on a largely fictious force. “Where is the free Syrian army,” he asked mockingly, alleging that munitions drops from the sky were falling into the hands of Isil, whatever the original intentions. “I think some of our partners simply have mush for brains. They do not have a clear understanding of what is really happening in the country and what goals they are seeking to achieve,” he said.

Mr Putin claimed the legal high ground, insisting that Russia is acting on the invitation of the Syrian authorities. “All our actions fully comply with the UN charter, contrary to the actions of our colleagues from the so-called US-led international coalition,” he said. Despite his pugnacious tone, Mr Putin appeared keen to play up the idea of a grand coalition of Russia and the West to defeat Isil. “I believe we have a common interest but so far co-operation has been military only,” he said. Mr Putin said Russian and US pilots are exchanging “friend\foe” signals to avoid dangerous incidents in the combat theatre. “It is a sign of mutual trust, but it is not enough,” he said, adding that he has offered to send a high-level mission to Washington led by premier Dmitry Medvedev to deepen ties – again receiving no answer.

“I do not take my mandate from the European people.”

• I Didn’t Think TTIP Could Get Any Scarier, But Then.. (John Hilary)

I was recently granted a rare glimpse behind the official façade of the EU when I met with its Trade Commissioner in her Brussels office. I was there to discuss the Transatlantic Trade and Investment Partnership (TTIP), the controversial treaty currently under negotiation between the EU and the USA. As Trade Commissioner, Cecilia Malmström occupies a powerful position in the apparatus of the EU. She heads up the trade directorate of the European Commission, the post previously given to Peter Mandelson when he was forced to quit front line politics in the UK. This puts her in charge of trade and investment policy for all 28 EU member states, and it is her officials that are currently trying to finalise the TTIP deal with the USA.

In our meeting, I challenged Malmström over the huge opposition to TTIP across Europe. In the last year, a record three and a quarter million European citizens have signed the petition against it. Thousands of meetings and protests have been held across all 28 EU member states, including a spectacular 250,000-strong demonstration in Berlin this weekend. When put to her, Malmström acknowledged that a trade deal has never inspired such passionate and widespread opposition. Yet when I asked the trade commissioner how she could continue her persistent promotion of the deal in the face of such massive public opposition, her response came back icy cold: “I do not take my mandate from the European people.”

So who does Cecilia Malmström take her mandate from? Officially, EU commissioners are supposed to follow the elected governments of Europe. Yet the European Commission is carrying on the TTIP negotiations behind closed doors without the proper involvement European governments, let alone MPs or members of the public. British civil servants have admitted to us that they have been kept in the dark throughout the TTIP talks, and that this makes their job impossible. In reality, as a new report from War on Want has just revealed, Malmström receives her orders directly from the corporate lobbyists that swarm around Brussels. The European Commission makes no secret of the fact that it takes its steer from industry lobbies such as BusinessEurope and the European Services Forum, much as a secretary takes down dictation.

Imagine that in the US, Germany, Japan, China. EU scorched earth tactics.

• Greek Corporate Profits Fell 86% In Five Years (Kath.)

Greek companies’ pretax profits have posted a dramatic 86% decline over the last five years, according to a survey of 4,997 firms by Grant Thornton. The profit slide for those companies added up to €5.3 billion in the period from 2009 to 2014, while their work forces shrank by 19% and their taxpaying capacity declined by 60%. The results of the survey were presented on Tuesday at Grant Thornton’s annual international conference, which was hosted in Athens for the first time, in the presence of Grant Thornton International head Edward Nusbaum.

The analysis of the survey’s findings showed a major drop in the operating profits of the sampled companies by 32% or €4.8 billion, in their net assets by €2.6 billion, and in their net borrowing by €7.5 billion: Total borrowing declined from €44.7 billion in 2009 to €37.3 billion last year. This drop is due to pressure from the credit sector for the repayment of loan obligations, which has resulted in a fall in the realization of new investments. The sectors with the highest debt burden are tourism, entertainment and information, fish farming, vehicle imports, food service etc.

FBI or Goldman. Who’s stronger?

• Goldman Entangled in Scandal at Malaysia Fund 1MDB (WSJ)

Goldman Sachs’s role as adviser to a politically connected Malaysia development fund resulted in years of lucrative business. It also brought exposure to an expanding scandal. As part of a broad probe into allegations of money laundering and corruption, investigators at the Federal Bureau of Investigation and the Justice Department have begun examining Goldman Sachs’s role in a series of transactions at 1Malaysia Development Bhd., people familiar with the matter said. The inquiries are at the information-gathering stage, and there is no suggestion of wrongdoing by the bank, the people said. Investigators “have yet to determine if the matter will become a focus of any investigations into the 1MDB scandal,” a spokeswoman for the FBI said.

The widening scandal—investigators in five countries are now looking into 1MDB—highlights the sometimes risky path that Goldman has cut in emerging markets in search of faster growth. A few years before the Malaysia deals, Goldman did a series of controversial transactions with the Libyan Investment Authority that also brought unwelcome attention. The Libyan sovereign-wealth fund claimed in a lawsuit filed in 2014 in London that the bank took advantage of its unsophisticated executives to sell them complicated and ultimately money-losing investments. Goldman has said the claims are without merit. A trial in the suit is scheduled to begin next year.

The bank earned $350 million for executing nine trades for Libya, according to the investment authority. It earned far more from the Malaysian fund. The bank was consulted during 1MDB’s inception, advised it on three acquisitions and arranged the sale of $6.5 billion in bonds that alone brought in close to $600 million in fees, according to people close to the bank. 1MDB is now entangled in accusations of billions of dollars of missing money, putting it at the center of a political crisis for Malaysian Prime Minister Najib Razak, who oversees the fund. Malaysian government investigators earlier this year traced $700 million into Mr. Najib’s alleged bank accounts through agencies, banks and companies linked to 1MDB..

Remember, Beppe’s a trained accountant.

• #DeutscheBank Full Of Holes (Beppe Grillo)

“Two days ago, Deutsche Bank, a bank with assets worth more than Italy’s GDP, has declared the need to adjust the results for the third quarter of 2015 to reflect losses of almost €6 billion.

$70 thousand billion in derivatives Details of the reasons for these losses are not yet available but it is well known that the bank has an anomalous concentration of derivatives in its portfolio: $75 thousand billion (about €65 thousand billion!), equivalent to 20 times Germany’s GDP. It seems that Deutsche Bank has really not learned much from the 2008 crisis, even though America’s Securities Exchange Commission (SEC) in May of this year, penalised its structured finance dating back to the time of Lehman Brothers, with a fine of $55 million.

And yet Deutsche Bank passed the European Banking Authority’s stress tests without any particular censuring. However, the US stress tests carried out by the Federal Reserve before the summer, definitely found the German bank to have done badly and classed it among those that would not survive another financial crisis. So perhaps those that said the European stress tests put too much emphasis on the spread of the yield of government bonds among the various member countries, were not wrong. It’s a phenomenon that has become dangerously familiar to us, to such an extent that now, very few are aiming to tackle the root causes of the problems.

“High-income countries are already at or close to the zero lower bound on short-term interest rates. Their ability, or at least willingness, to act effectively in response to a large negative shock to demand is very much in question. ”

• Solid Growth Is Harder Than Blowing Bubbles (Martin Wolf)

It used to be said that when the US sneezed, the world economy caught a cold. This is still true. But now the world economy also catches a cold when China sneezes. It has lost its last significant credit-fuelled engine of demand. The result is almost certain to be a further boost to the global “savings glut” or, as Lawrence Summers calls it, “secular stagnation” – the tendency for demand to be weak relative to potential supply. This has big implications for global economic risks. In its latest World Economic Outlook , the IMFd strikes not so much a gloomy note as a cautious one. The world economy is forecast to grow by 3.1% this year (at purchasing power parity) and 3.6% in 2016. The high-income economies are forecast to grow by 2% this year, with growth at 1.5% even in the eurozone.

Emerging economies are forecast to grow 4% this year. This would be well below the 5% in 2013 or 4.6% in 2014. While China’s economy is forecast to grow by 6.8% and India’s by 7.3, Latin America’s is forecast to shrink by 0.3% and Brazil’s by 3%. So think of the world as a single economy. If it grows as forecast, it will probably be expanding at best in line with potential. But if a few of the things on the list were to go wrong, it would suffer rising excess capacity and disinflationary pressure. Even if nothing worse happened (and it easily could), it would still be a concern because room for policy manoeuvre is now quite limited.

Commodity-exporting and debt-burdened emerging countries will now have to retrench, just as crisis-hit eurozone countries had to a few years ago. Just as was the case in the eurozone, these economies look for external demand to pick them up. They may wait in vain. High-income countries are already at or close to the zero lower bound on short-term interest rates. Their ability, or at least willingness, to act effectively in response to a large negative shock to demand is very much in question. The same might even prove true of China.

Bit of humor.

• 15 Reminders That China Is Completely Unpredictable (Michael Johnston)

The Communist Party does not hesitate to implement bizarre rules and restrictions. Though opinions have become more divided in recent months, the general assumption among investors is that China maintains tremendous economic potential, and will become increasingly dominant in coming decades. There are plenty of good reasons for such an optimistic assumption, including numerous demographic tailwinds. But many investors fail to at least consider one obstacle facing the Chinese economy: the fact that it exists within a Communist State. Below are 15 reminders of just how unpredictable, illogical, and counterproductive a Communist government can be.

Reincarnation: In 2007, China banned Buddhist monks from reincarnating without government permission. According to State Religious Affairs Bureau Order N0. 5, applications must be filed by Buddhist temples before they can recognize individuals as reincarnated tulkus. This law deemed to be “an important move to institutionalize management of reincarnation.” In reality, it was widely seen as an attempt to limit the influence of the Dalai Lama, the exiled spiritual leader of Tibet. Buddhist monks living outside China are prohibited from seeking reincarnation, which effectively allows China to choose the next Dalai Lama. (The spiritual leader is believed to be able to control his own rebirth.)

Outside of China: About 44 million Americans believe that Bigfoot exists, and 16 million believe that Paul McCartney died in 1966 (and was secretly replaced by a lookalike). No permits or approvals are required for any of these beliefs.

Heathens!

• A German Manifesto Against Austerity (NewEurope)

The Foundation for European Progressive Studies has published the manifesto of fourteen high profile German economists, academics, policy advisors, leaders, and leaders signed a manifesto calling for a “European Europe” as opposed to a “German Europe.” Among them the Vice President of the World Health Organization, Detlev Ganten, Gustav Horn, of the German Institute of Economic Research (DIW), Heidemarie Wieczorek-Zeul, the former German minister for foreign aid, Dieter Spöri, the former Deputy Prime Minister and Minister of Economic Affairs of the State of Baden-Württemberg. Hailing from the social democratic family, they point to the Euro crisis and the danger of Brexit to call for the defense of the European Project. This is not the first critical voice in Germany against austerity politics.

However, this carries the weight of German economists that are very much part of the policy elite in Germany and the EU. What adds to their credibility is their attack on both Chancellor Angela Merkel, as well as the government’s junior partner, namely the SPD. They point towards a widening social cleavage, as the primary trigger of a rise in right Eurosceptic parties across Europe, including Germany. More profoundly, they point towards a German hegemonic project of austerity that is threatening to destroy Europe. In response to this challenge, they sign a 12 point manifesto. The manifesto is in many respects a personal attack on Chancellor Merkel, held responsible for the imposition of an austerity regime across Europe and accused of honing — along with Finance Minister Wolfgang Schäuble — a narrative of German domination reminiscent of the past century.

But, the manifesto is also an attack on the lack of a principled stand by the SPD. The economists accuse the Chancellor of a policy aimed at saving German and French banks, imposing the burden on the Greek population. The economists underscore that the austerity plan that has been imposed on Greece since 2010 is devoid of any theoretical or practical substance. They point towards a (German) policy impasse, calling for an investment-driven rather than austerity-driven strategy to avoid the final breakdown of the Greek economy. The SPD is being accused of tolerating if not conniving with “neoliberal” policies that they would have condemned had they been in opposition, including “pension cuts, unjust VAT increases, privatisation, the undermining of trade unions and free collective bargaining and an altogether reduction of the Greek demand, without which the country cannot get to its feet.”

“But in the end, Fox tells us, Obama will always be unable to control the envious, Christian-fearing, success-hating African Marxist Terrorist in control of his subconscious…”

• Rupert Murdoch Is Deviant Scum (Matt Taibbi)

It all comes back to Rupert Murdoch. As multiple recent news stories have proven, the 2016 presidential race is fast becoming a referendum on the News Corp CEO and reigning media gorgon. The two top candidates in the Republican field are a Fox News contributor (Ben Carson opened his Fox career two years ago comparing Obama to Lenin) and a onetime Fox favorite who is fast becoming the network’s archenemy: Donald Trump is the fallen angel in the Fox story, a traitor who’s trying to tempt away Murdoch’s lovingly nurtured stable of idiot viewers by denouncing their favorite “news” network as a false conservative God. The fact that Trump is succeeding with this message on some level has to be a source of terrible stress to Murdoch. He must be petrified at the prospect of losing his hard-won viewership at the end of his life.

This, in turn, might explain last week. Otherwise: what was Rupert Murdoch doing tweeting? Murdoch owns or controls print, cable and film outlets in so many places that his cultural and political views are fast becoming a feature of global geography. The sun never sets on his broadcast empire, a giant hovering Death Star that’s been firing laser cannons of “Rupert Murdoch’s Many Repellent Thoughts About Stuff” at planet Earth for decades now. Yet Murdoch apparently still doesn’t feel like he’s getting his point across. At 8:59 p.m. last Wednesday night, the 84 year-old scandal-sheet merchant had to turn to Twitter to offer his personal opinion on Ben Carson and the American presidential race. To recap: “Ben and Candy Carson terrific. What about a real black President who can properly address the racial divide?”

Forget for a minute what Murdoch said. Think about the why. Murdoch’s networks have already spent the last eight years hammering home this message to the whole world. Fox News has constantly presented Barack Obama as a mongrel, a kind of Manchurian President, raised in madrassas and weaned on socialism, who hates white people and yearns to euthanize them. The network spent years exhaustively building and tweaking Obama’s supervillain persona, almost always employing this Two-Face theme. The president in Fox lore is superficially a polite, intelligent, “articulate” American politician who sounds on the level. But in the end, Fox tells us, Obama will always be unable to control the envious, Christian-fearing, success-hating African Marxist Terrorist in control of his subconscious.

“..global wealth has fallen by $12.4tn in 2015 to $250tn..”

• Half Of World’s Wealth Now In Hands Of 1% Of Population (Guardian)

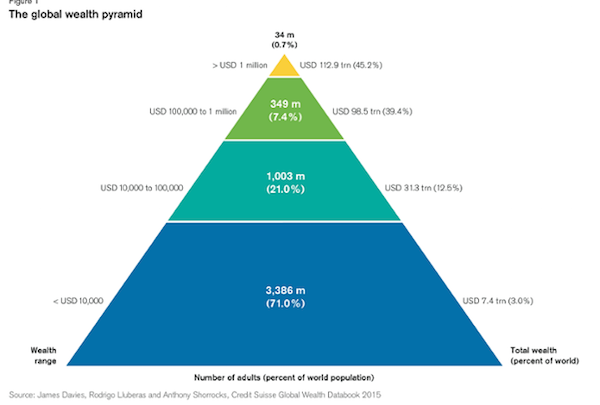

Global inequality is growing, with half the world’s wealth in the hands of just 1% of the world’s population, according to a new report which pointed to a rising discrepancy in prosperity in the UK. The report by Credit Suisse also found that there was a slowdown in the pace of growth of wealth of the middle classes compared with that of the very richest. “This has reversed the pre-crisis trend which saw the share of middle-class wealth remaining fairly stable over time,” said Tidjane Thiam, chief executive of the Swiss bank. A person needs only $3,210 (£2,100) to be in the wealthiest 50% of world citizens, $68,800 (£45,000) to be in the top 10% and $759,900 (£500,000) to earn a place in top 1%. Some 3.4 billion people – 71% of all adults in the world – have wealth below $10,000 in 2015.

A further 1 billion – 21% of the global population – fall in the $10,000-$100,000 (£6,560-£65,600) range. Each of the remaining 383 million adults – 8% of the population – has wealth of more than $100,000, including 34 million US dollar millionaires, who comprise less than 1% of the world’s adult population. Some 123,800 individuals within this group are worth more than $50m, and 44,900 have more than $100m. The UK has the third-highest number of these so-called ultra-high net worth individuals. The report concludes that global wealth has fallen by $12.4tn in 2015 to $250tn – the first fall since the 2008 banking crisis. This is largely a result of the impact of the strength of the dollar, the currency which is used as the basis for Credit Suisse’s calculations.

Home › Forums › Debt Rattle October 14 1015