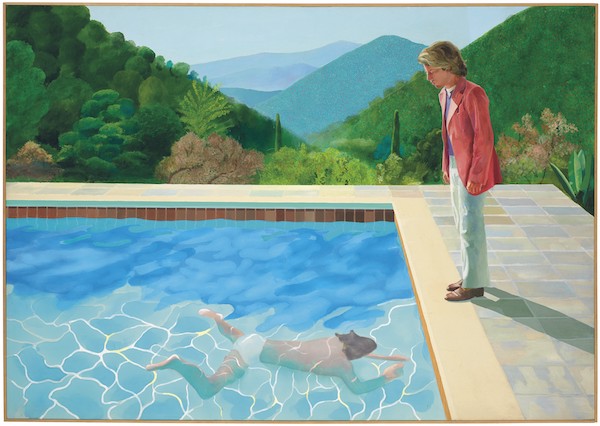

David Hockney Portrait of an Artist (Pool with Two Figures) 1972

Fauci Cruz

.@margbrennan: “Sen. Cruz told the Attorney General you should be prosecuted.”

Dr. Fauci: [Laughs] I should be prosecuted? What happened on January 6th, senator? … That’s okay, I’m just gonna do my job. I'm gonna be saving lives, and [Republican lawmakers] are gonna be lying." pic.twitter.com/8hbjgkhEeS

— The Recount (@therecount) November 28, 2021

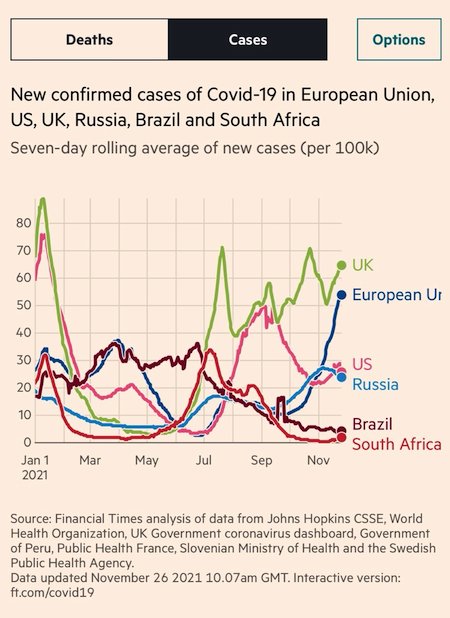

Alarm! Close down South Africa!

Declaring ‘I Represent Science’ disqualifies any scientist. Check what Einstein had to say.

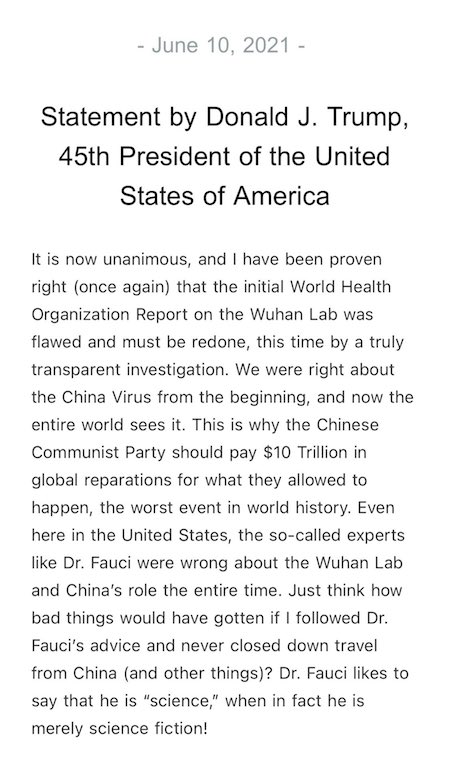

• Fauci Escalates Feud With GOP Senators, Declaring ‘I Represent Science’ (JTN)

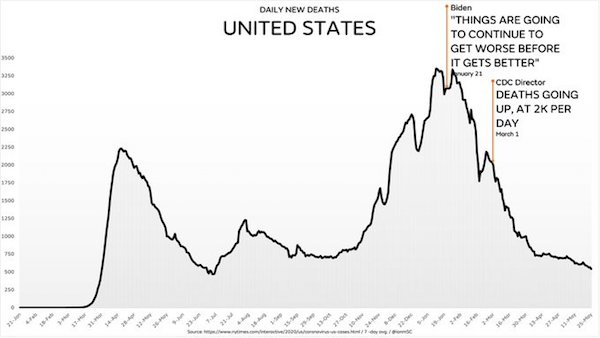

Dr. Anthony Fauci escalated his feud with Republicans on Sunday, declaring on national television that senators who are challenging his COVID policy decision are “anti-science.” ”They’re really criticizing science because I represent science. That’s dangerous,” Fauci told CBS Face the Nation. The top doctor’s comment drew immediate criticism, including from longtime critic Sen. Rand Paul, who called it “hubris.” “It’s astounding and alarming that a public health bureaucrat would even think to claim such a thing, especially one who has worked so hard to ignore the science of natural immunity,” Paul wrote. Wikipedia founder Larry Sanger added his own slam. “Fauci is a bureaucrat, not a scientist,” he tweeted.

Fauci and his boss, NIH Director Francis Collins, spent most of their time on television Sunday talking about the new coronavirus variant called Omicron. Fauci said the U.S. must do “anything and everything” to curb cases of the variant, although it’s “too early to say” whether a lockdown was needed. Collins said it will take weeks before scientists understand how effective current vaccines are at protecting against it. “We do know that this is a variant that has a lot of mutations—like 50 of them, and more than 30 of those in the spike protein, which is the part off the virus that attaches to your human cells if you get infected,” Collins told Fox News. Fauci added he believed Americans had to get ready to live with COVID.

“I don’t think we’re going to eradicate it,” he said. “We’ve only eradicated one infection of mankind, and that’s smallpox. I don’t think we’re even going to eliminate it.” But it was Fauci’s war of words with GOP senators that generated the most buzz.. “Anybody who’s looking at this carefully, realizes that there’s a distinct anti-science flavor to this, so if they get up and criticize science, nobody’s going to know what they’re talking about,” Fauci said. “But if they get up and really aim their bullets at Tony Fauci, well people can recognize that there’s a person there, so it’s easy to criticize, but they’re really criticizing science because I represent science.”

Fauci bringing up Jan 6 tells you his political leaning. And that is now the science.

• Cruz Responds To Fauci’s Attack On Him, Doubles Down On Call For Criminal Probe (DW)

Sen. Ted Cruz (R-TX) responded to an attack from Dr. Anthony Fauci, Director of the National Institute of Allergy and Infectious Diseases and the Chief Medical Advisor to the president, on Sunday by doubling down on his call for the Department of Justice to investigate Fauci for alleged false statements that he made while testifying to Congress. “Anybody who spins lies and threatens and all that theater that goes on with some of the investigations and the congressional committees and the Rand Pauls and all that other nonsense, that’s noise, Margaret, that’s noise,” Fauci said during an interview with CBS News’ Margaret Brennan. Later, when asked about Sen. Ted Cruz (R-TX) saying that Fauci should be prosecuted by the Department of Justice, Fauci responded: “Yeah. I have to laugh at that. I should be prosecuted? What happened on Jan. 6, senator?”

Fauci claimed that Republicans were trying to scapegoat him to protect former President Donald Trump and that Republicans who are attacking him are “lying.” Cruz responded to Fauci’s remarks in a series of tweets late on Sunday afternoon, calling Fauci “an unelected technocrat who has distorted science and facts in order to exercise authoritarian control over millions of Americans.” “He lives in a liberal world where his smug ‘I REPRESENT science’ attitude is praised,” Cruz said.

Cruz then laid out four “facts” related to his call for the DOJ to investigate Fauci:

1/ On May 11, Fauci testified before a Senate Committee that “the NIH has not ever and does not now fund gain-of-function research in the Wuhan Institute of Virology.”

2/ On October 20, NIH wrote they funded an experiment at the Wuhan lab testing if “spike proteins from naturally occurring bat coronaviruses circulating in China were capable of binding to the human ACE2 receptor in a mouse model.” That is gain of function research.

3/ Fauci’s statement and the NIH’s October 20 letter cannot both be true. The statements are directly contradictory.

4/ 18 USC 1001 makes it [a] felony, punishable by up to 5 years in prison, to lie to Congress.“No amount of ad hominem insults parroting Democrat talking points will get Fauci out of this contradiction,” Cruz concluded. “Fauci either needs to address the substance—in detail, with specific factual corroboration—or DOJ should consider prosecuting him for making false statements to Congress.”

They’re just guessing. They have no idea. Very mild, no cough, no loss of smell. But but…

• WHO: Omicron Poses ‘Very High’ Global Risk (R.)

The Omicron variant is likely to spread internationally, posing a “very high” global risk where Covid-19 surges could have “severe consequences” in some areas, the WHO said on Monday. The UN agency, in technical advice to its 194 member states, urged them to accelerate vaccination of high-priority groups and to “ensure mitigation plans are in place” to maintain essential health services. “Omicron has an unprecedented number of spike mutations, some of which are concerning for their potential impact on the trajectory of the pandemic,” the WHO said. “The overall global risk related to the new variant of concern Omicron is assessed as very high.” Further research is needed to better understand Omicron’s potential to escape protection against immunity induced by vaccines and previous infections, it said, adding that more data was expected in coming weeks. “Covid-19 cases and infections are expected in vaccinated persons, albeit in a small and predictable proportion”, it added.

“The preparation that we have ongoing … just needs to be revved up,” he continued, “by getting more people vaccinated and getting the fully vaccinated boosted.”

They have no clue if the vaccines will do anything vs Omicron.

• Fauci Reveals Plan To Prepare Americans For Omicron (RT)

White House coronavirus adviser Dr. Anthony Fauci has described the Omicron variant of Covid-19 as a “clarion call” to get people vaccinated. This is amid fears that the new variant may prove resistant to existing jabs. In the weeks since it was first discovered in Botswana, the Omicron variant of Covid-19 has rapidly become the dominant strain of the virus in South Africa, and cases have been discovered in Europe, Asia, and the Middle East. Although the US has shut down travel from a number of affected African countries, Fauci told ABC News on Sunday that “inevitably it will be here, and the question is, will we be prepared for it?” “The preparation that we have ongoing … just needs to be revved up,” he continued, “by getting more people vaccinated and getting the fully vaccinated boosted.”

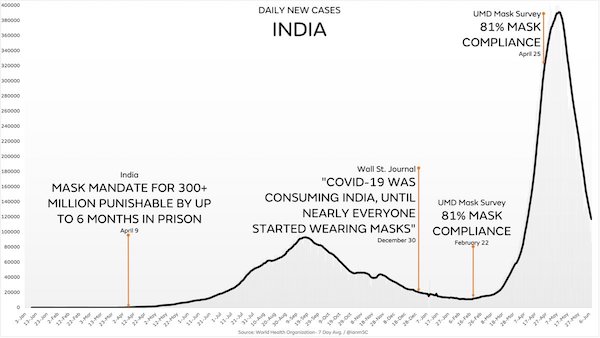

Fauci also touted the wearing of face masks as key to preparing for Omicron. In a separate appearance on NBC News, he described the rise of the Omicron variant as a “clarion call” to get more people vaccinated. Little is known about Omicron, save for its high number of spike protein mutations, which Fauci said gave the variant “an advantage in transmissibility.” Preliminary information suggests the variant may evade the protection offered by the current crop of vaccines. The first recorded Omicron cases in Botswana occurred in fully vaccinated people, and the European Centre for Disease Control stated on Friday that the new variant might be associated with “a significant reduction in vaccine effectiveness and increased risk for reinfections.”

Fauci also touched on these worries on NBC News, telling host Chuck Todd that Omicron “might evade immune protection … possibly even against some of the vaccine-induced antibodies.” South African governmental adviser Professor Barry Schoub has described the Omicron symptoms as “mild” for “the great majority of the patients” infected with the new Covid-19 strain. “Their symptoms were so different and so mild from those I had treated before,” South African Medical Association chair Dr. Angelique Coetzee told The Telegraph on Saturday. In his push to get more Americans vaccinated, Fauci has previously described the Alpha, Beta, and Delta variants as “clarion calls” to boost vaccination. Some 59% of the US population is now fully vaccinated, and 21% of these people have received booster doses.

“Why do people still take this man seriously?”

• Biden and Fauci’s Omicron Travel Ban ‘Worse Than Useless,’ Critics Say (NYP)

Critics took aim Saturday at White House chief medical adviser Dr. Anthony Fauci and President Biden for their “worse than useless” response to the highly contagious Omicron variant of COVID-19. “No worries, travel ban begins next week because you know, variants don’t spread on holiday weekends,” Republican Rep. Thomas Massie of Kentucky scoffed on Twitter. “Who really believes this variant isn’t already here?” The Fauci-approved weekend-long delay in launching the ban on travel from Omicron-infected African countries angered City Councilman Joe Borelli (R-SI). “Why do people still take this man seriously?” Borelli, the chamber’s new minority leader, asked. “Either this is a life or death emergency, or it doesn’t need to happen. It seems like this is a lockdown for the sake of lockdowns.”

Rep. Elise Stefanik (R-NY) decried “the stunning hypocrisy of Democrats” regarding COVID travel bans during the last 20 months. “When President Trump took bold and decisive action in February 2020 to impose travel restrictions into the United States from coronavirus hot spots, Joe Biden attacked him, calling this decision a disgrace and xenophobic,” said Stefanik — who has called for Fauci to be fired over the gain-of-function funding controversy. And Sen. Tom Cotton (R-Ark.) condemned the Biden administration’s too-little, too-late travel measure as “worse than useless.” “Joe Biden and Tony Fauci push crushing restrictions on Americans—like masking two-year-olds—that are pointless,” Cotton tweeted Saturday. “But when it comes to targeted travel bans to protect American citizens, it’s nothing but incompetence and half measures from this White House.”

Testing the variant? Not the vaccine?

• BioNTech Testing New Covid Variant To See If It Responds To Vaccine (JTN)

Medical company BioNTech said this week that it is testing its vaccine against the latest COVID-19 variant to determine whether or not the shot is effective against the latest mutation of the pandemic virus. World leaders and medical officials expressed alarm this week at a new “variant of concern” arising in Africa, one that is allegedly, like the Delta variant before it, highly transmissible. Officials from numerous countries including the U.S. put in place travel bans against countries reportedly experiencing spread of the variant. BioNTech said that it was exploring whether or not it would have to alter its vaccine in any way to account for the new strain.

“We expect more data from the laboratory tests in two weeks at the latest,” the company told told Reuters. “These data will provide more information about whether B.1.1.529 could be an escape variant that may require an adjustment of our vaccine if the variant spreads globally.” The company told media this week that earlier this year it had already planned for the potential need of a rapid alteration of the vaccine in case of the emergence of new variants.

Not the worst source for risk assessment.

• Goldman Slams Omicron Panic: “This Mutation Is Unlikely To Be More Malicious” (ZH)

One look at the ridiculous plunge across asset markets on Friday, which sent oil into one of its biggest tailspins in history (which as Goldman calculated would only make sense if the Omicron lockdowns are twice as bad as anything observed so far), and one would think that the Omicron variant – which as Edward Snowden so aptly put it “sounds like the name of an 80s movie’s evil Robot King” (of course, the WHO had no choice but to skip the Xi variant, located right before Omicron in the Greek alphabet for obvious propaganda reasons) – is several times more aggressive and far more deadly than the Delta or any other Covid variant to date. Neither is the case, and in fact, as even Tom Peacock, one of the original Imperial College narrative-setters admitted, “it may turn out to be an odd cluster that is not very transmissable.”

Alas, that would not help politicians who kill a lot of birds with just one brand new and “horrifying” variant, including getting a carte blanche for trillions in new vote-buying stimmies, enforcing even more ruthless and authoritarian government restrictions a dream come true for all liberal fans of big government, and most importantly forcing another round of mail-in ballot elections one year from today.

And yet, perhaps the pandemic apocalypse is not just around the corner. On one hand, Angelique Coetzee, the chairwoman of the South African Medical Association said today that “the new Omicron variant of the Coronavirus results in MILD disease, WITHOUT prominent symptoms.” On the other, none other than the most important bank on Wall Street – Goldman “Vampire Squid” Sachs – which sets the narrative that all other banks dutifully follow, has decided that it’s not worth starting a panic crash over this mutation and in a note published late on Friday writes that “this mutation is unlikely to be more malicious and that the existing vaccines will most likely continue to be effective in preventing hospitalizations and deaths” and as a result, while Goldman “would monitor the situation in Gauteng closely over the next month, we do not think that the new variant is sufficient reason to make major portfolio changes.”

[..] Conclusion: while we do not have sufficient information to forecast a global B.1.1.529 wave, a high rate of transmission almost inevitably leads to a variant dominance. Nevertheless, we can have reasonable degree of confidence that this mutation is unlikely to be more malicious and that the existing vaccines will most likely continue to be effective in preventing hospitalizations and deaths. As such, while we would monitor the situation in Gauteng closely over the next month, we do not think that the new variant is sufficient reason to make major portfolio changes.

“The deal was sweetened for voters by the promise of financial assistance.”

• Swiss Get To Choose Whether To Keep Vaccine Passports In Place (RT)

Despite months of protests, Swiss citizens have overwhelmingly voted to keep the country’s system of Covid vaccination certificates in place. The deal was sweetened for voters by the promise of financial assistance. Some 62% of voters chose on Sunday to maintain the country’s coronavirus measures. These measures include a controversial system of Covid vaccination certificates, required since September to enter bars, restaurants, theaters and other public spaces. Majorities in 24 of Switzerland’s 26 cantons backed the law, with only the tiny cantons of Schwyz and Appenzell Innerrhoden rejecting the measures. All of Switzerland’s political parties with the exception of the right-wing Swiss People’s Party supported the law, which was brought to a vote after anti-lockdown groups gathered nearly 200,000 signatures to challenge it earlier this year.

Under Switzerland’s system of direct democracy, any initiative can be brought to a vote with 100,000 signatures. Voters in June backed the introduction of the measures by 60%, but recent months have seen protests break out in Swiss cities over the introduction of vaccine certificates. Police in October used rubber bullets, tear gas and water cannon to disperse crowds of people who broke through barriers outside the parliament building in Bern. “The democratic process has been respected but the law is still unconstitutional,” Michelle Cailler of the ‘Friends of the Constitution’ group said after the vote on Sunday. Cailler’s group was one of several who campaigned against the law.

Céline Amaudruz of the Swiss People’s Party, which is currently topping opinion polls in Switzerland, called on the government to take “coherent and measured” action, rather than treating the result as a “blank cheque” to impose whatever coronavirus-related policies it wishes. The law voted on provides for more than just vaccine passports. It also expands financial support for citizens and businesses affected by the pandemic, a provision that may have won over some reluctant voters.

A little confusing.

• Appeals Court Blocks California Vaccine Mandate For Prison Workers (Hill)

A federal appeals court on Friday issued a temporary stay of a coronavirus vaccine mandate for prison workers. The 9th U.S. Circuit Court of Appeals issued the stay, postponing the Jan. 12 deadline to get thousands of prison workers vaccinated until at least March, The Associated Press reported. The move by the appeals court came after a request for a stay of a September ruling by a lower court pending an appeal. The appeals court also moved up opening briefs to Dec. 13, according to AP. California Department of Corrections and Rehabilitation statistics show that at least 240 prisoners have died from COVID-19 and more than half the state prison population has been infected, according to the AP.

The move from the appeals court blocked an earlier decision from U.S. District Judge Jon Tigar that required prison employees to get the vaccine. Tigar’s decision would also require prisoners to get either the vaccine or a medical or religious exemption in order to do work outside the prison or get in-prison visits from family. Both Gov. Gavin Newsom (D) and the California Correctional Peace Officers Association opposed the prison worker mandate, the AP noted. Don Specter, director of the nonprofit Prison Law Office, said the court’s decision “puts both the prison staff and the incarcerated population at greater risk of infection,” according to AP.

Simple. And this is in people who have already been infected.

• Rapid and Effective Vitamin D Supplementation in COVID-19 Patients (PubMed)

Background : We aimed to establish an acute treatment protocol to increase serum vitamin D, evaluate the effectiveness of vitamin D3 supplementation, and reveal the potential mechanisms in COVID-19.

Methods : We retrospectively analyzed the data of 867 COVID-19 cases. Then, a prospective study was conducted, including 23 healthy individuals and 210 cases. A total of 163 cases had vitamin D supplementation, and 95 were followed for 14 days. Clinical outcomes, routine blood biomarkers, serum levels of vitamin D metabolism, and action mechanism-related parameters were evaluated.

Results : Our treatment protocol increased the serum 25OHD levels significantly to above 30 ng/mL within two weeks. COVID-19 cases (no comorbidities, no vitamin D treatment, 25OHD <30 ng/mL) had 1.9-fold increased risk of having hospitalization longer than 8 days compared with the cases with comorbidities and vitamin D treatment. Having vitamin D treatment decreased the mortality rate by 2.14 times. The correlation analysis of specific serum biomarkers with 25OHD indicated that the vitamin D action in COVID-19 might involve regulation of INOS1, IL1B, IFNg, cathelicidin-LL37, and ICAM1.

Conclusions : Vitamin D treatment shortened hospital stay and decreased mortality in COVID-19 cases, even in the existence of comorbidities. Vitamin D supplementation is effective on various target parameters; therefore, it is essential for COVID-19 treatment.

The idea is better than the execution.

• White Smoke From Wuhan Lab Chimney Signals New Variant Has Been Named (BBee)

Thousands gathered outside the Wuhan Institute of Virology with faces of anxious anticipation over the weekend, as rumors had been circulating that a new COVID-19 variant would soon be named. The hopeful pilgrims’ hours of waiting were not in vain. Cheers erupted as white smoke began pouring out of the chimney early Sunday morning, signaling the creation and naming of a new COVID-19 variant. “It was a lively debate,” said one source from inside the Wuhan lab. “Yuhang suggested we just keep following the Greek alphabet and name it Xi. We haven’t heard from him in a few days, come to think of it.”

“Nu” was also floated as a possibility, but scientists wanted to avoid the stigma of being associated with nu-metal, generally acknowledged as the worst musical genre on the planet. One guy kept wanting to call it “The One-Der Variant” but this was confusing as everyone kept pronouncing it as Oh-NEE-der instead of Wonder. Finally, there was a last-ditch effort to name it the Trump variant, but this was finally defeated in favor of the safer “Omicron variant” according to sources within the lab. After the celebration died down, the pilgrims shuffled away, their faces full of cheer. But they’ll be back in a few weeks for the next one.

“Let your light shine so brightly that others can see their way out of the dark.”

~ Native American

France

Following Emanuel Macron’s announcement that a health pass would be required in all “bars, restaurants, amusement parks, shopping centers, trains, coaches and planes,” hundreds of thousands took to the streets across France for several months. 182/pic.twitter.com/SDXzIoWEMF

— Michael P Senger (@MichaelPSenger) November 24, 2021

Support the Automatic Earth in virustime; donate with Paypal, Bitcoin and Patreon.