Dorothea Lange Homeless mother and child walking from Phoenix to Imperial County CA Feb 1939

“A massive, unprecedented intervention in the markets by the Federal Reserve stopped the default cycle in its tracks. As a result, trillions of dollars in risky debt did not enter default and were not written off…”

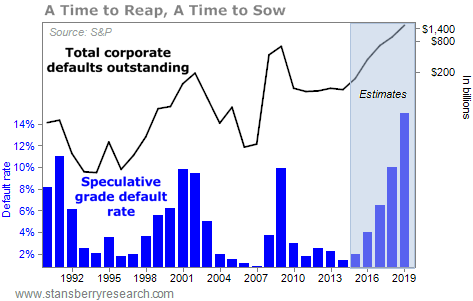

• We’re in the Early Stages of Largest Debt Default in US History (Stansberry)

We are in the early stages of a great debt default – the largest in U.S. history. We know roughly the size and scope of the coming default wave because we know the history of the U.S. corporate debt market. As the sizes of corporate bond deals have grown over time, each wave of defaults has led to bigger and bigger defaults. Here’s the pattern. Default rates on “speculative” bonds are normally less than 5%. That means less than 5% of noninvestment-grade, U.S. corporate debt defaults in a year. But when the rate breaks above that threshold, it goes through a three- to four-year period of rising, peaking, and then normalizing defaults. This is the normal credit cycle. It’s part of a healthy capitalistic economy, where entrepreneurs have access to capital and frequently go bankrupt. If you’ll look back through recent years, you can see this cycle clearly…

In 1990, default rates jumped from around 4% to more than 8%. The next year (1991), default rates peaked at more than 11%. Then default rates began to decline, reaching 6% in 1992. By 1993, the crisis was over and default rates normalized at 2.5%. Around $50 billion in corporate debt went into default during this cycle of distress. Six years later, in 1999, the distress cycle began to crank up again. Default rates hit 5.5% that year and jumped again in 2000 and 2001 – hitting almost 8.7%. They began to fall in late 2002, reaching normal levels by 2003. Interestingly, the amount of capital involved in this cycle was much, much larger: Almost $500 billion became embroiled in default. The growth in risky lending was powered by the innovation of the credit default swap (CDS) market. It allowed far riskier loans to be financed. As a result, the size of the bad corporate debts had grown by 10 times in only one credit cycle.

The most recent cycle is the one you’re most familiar with – the mortgage crisis. Six years after default rates normalized in 2003, they suddenly spiked up to almost 10% in 2009. But thanks to a massive and unprecedented government intervention, featuring trillions of dollars in credit protection, default rates immediately returned to normal in 2010. As a result, only about $1 trillion of corporate debt went into default during this cycle. You should know, however, that the regular market-clearing process of rising, peaking, and normalizing default rates did not occur in the last cycle. A massive, unprecedented intervention in the markets by the Federal Reserve stopped the default cycle in its tracks. As a result, trillions of dollars in risky debt did not enter default and were not written off.

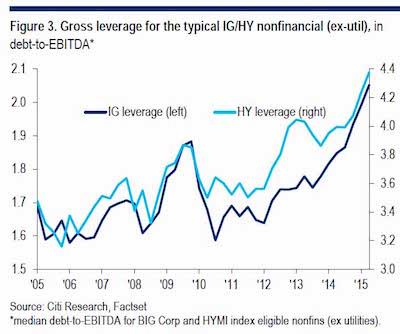

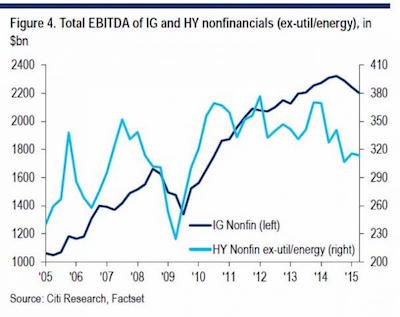

EBITDA= earnings before interest, tax, depreciation and amortization

• It’s Not The Record High US Corporate Debt That Is The Biggest Risk (ZH)

[..] even Goldman has admitted that rising leverage and the soaring buybacks are, “like a bad dream”, the major problem for corporate imbalances, the truth is that surging debt is not the full story, nor is it the scariest aspect of this story. The real risk is that while debt is rising on both a relative and an absolute basis, EBITDA, or cash flow, of both junk companies as well as Investment Grades, has been declining for at least one year. Or rather, while junk-rated companies have seen their EBITDA decline consistently over the past 5 years, the big inflection point came in early 2014 when IG EBITDA also plateaued, and has been declining since.

It is this ongoing decline in actual cash flows, which tracks the third consecutive quarter of declining Y/Y revenues (the decline in EPS is far slower as hundreds of billions in shares have been removed from the market, keeping the EPS ratio higher than where it would be) that is the biggest risk to both the S&P500 and the market, if such a thing still existed. Even Goldman is unable to provide a counterfactual case:

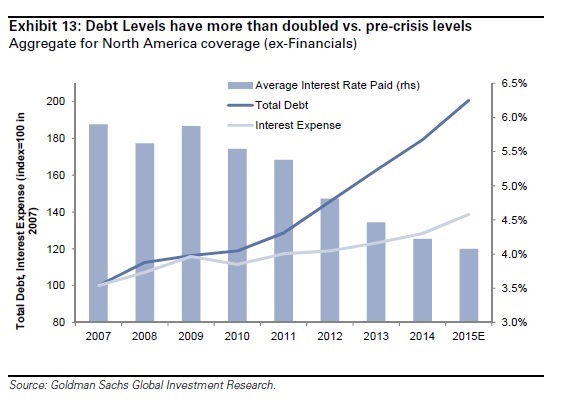

Now, the counter-argument one hears is that the cost of this debt has never been this cheap with the average interest rate paid dropping from close to 6% to 4% in 2015. Put another way, as debt has more than doubled, the amount of interest expense has only gone up by 40%. This is all good until you normalize EBITDA. Indeed, if EBITDA was at “normalized levels” (which we define as median NTM EBITDA from 1Q07-2Q15), leverage would move to 1.75X, over 30% higher than the average over the last 10 years.

But here is the real kicker: with even Goldman admitting that buybacks as a shortcut to creating “engineered” earnings will no longer work and instead may be punished by investors, companies refuse to accept this. Certainly don’t tell that to McDonalds, which earlier today defied S&P to announce a major debt increase to boost shareholder returns, even if it meant its A rating would be lost as it was downgraded to BBB+. Contrary to Goldman’s take, it was rewarded by shareholders. So even as cash flows continue to decline, companies will engage in this one and only line of defense against sellers and shorters as in a world where 2% growth is the new norm (and that with the benefit of $13 trillion in central bank liquidity). And instead of investing in the future, replenishing their asset base, this asset stripping of corporations to reward shareholders will continue.

“..4.4% of all outstanding derivatives contracts at those institutions..”

• US Banks Said To Hold $10 Trillion Of Risky Trades (FT)

The repeal of part of the Dodd-Frank financial reforms has left big US banks holding $10tn of risky derivatives trades on their books, according to an investigation by Democrats. Senator Elizabeth Warren, a liberal Wall Street foe, said the repeal -which sparked a firestorm when it was slipped into a budget bill in December 2014- had left federally insured banks exposed to dangerous swaps trades. The rollback of the relevant rule, which followed almost no congressional debate, sparked stinging criticism of Wall Street and cemented perceptions of the pernicious influence of bank lobbyists on Capitol Hill. The rule would have required banks to push out swaps trades to entities that are not insured with taxpayer funds.

But on Tuesday Ms Warren cited figures from bank regulators indicating that about $10tn of those contracts remained on banks books, the first such estimates. The furore over the repeal helped set the stage for Wall Street regulation to feature in the 2016 presidential race with Hillary Clinton and Bernie Sanders, the Democratic contenders, jousting over how to rein in banks risk taking. Sheila Bair, former chair of the Federal Deposit Insurance Corporation and now president of Washington College in Maryland, told the FT earlier this year before she joined the school that the swaps repeal was a ‘classic backroom deal’. “There’s no way this would have passed muster if people had openly debated it, so [the banks] had to sneak it on to a must-pass funding bill. For an industry that purports to want to regain public trust, it was an extraordinary thing to do”.

Swaps trades enable institutions to exchange streams of payments, typically to reduce their interest rate or currency risks. Banks want to keep the trades on their books simply because their margins are higher that way, Ms Bair said, noting that counterparties would demand more collateral from a non-insured affiliate. Ms Warren and Elijah Cummings, a senior Democrat in the House of Representatives, cited an estimate from the FDIC that 15 banks registered as swap dealers currently hold up to $9.7tn of the affected swaps. It said they represented 4.4% of all outstanding derivatives contracts at those institutions. The total comprises $6.1tn in credit derivatives, $1tn in commodity derivatives and $2.6tn in equities derivatives. In letters published on Tuesday the two lawmakers also took aim at bank regulators, saying they had compounded the risks to taxpayers by failing to introduce new capital margin requirements on swap trades.

“..if even a small number of customers suddenly wanted their money back, and especially if they wanted physical cash, banks would completely seize up.”

• US Banks Are Not “Sound”, Fed Report Finds (Simon Black)

Late last week, a consortium of financial regulators in the United States, including the Federal Reserve and the FDIC, issued an astonishing condemnation of the US banking system. Most notably, they highlighted “continuing gaps between industry practices and the expectations for safe and sound banking.” This is part of an annual report they publish called the Shared National Credit (SNC) Review. And in this year’s report, they identified a huge jump in risky loans due to overexposure to weakening oil and gas industries. Make no mistake; this is not chump change. The total exceeds $3.9 trillion worth of risky loans that US banks made with your money. Given that even the Fed is concerned about this, alarm bells should be ringing. Bear in mind that, in banking, there are three primary types of risk, at least from the consumer’s perspective.

The first is fraud risk. This ultimately comes down to whether you can trust your bank. Are they stealing from you? MF Global was once among the largest brokers in the United States. But in 2011 it was found that the firm had stolen funds from customer accounts to cover its own trading losses, before ultimately declaring bankruptcy. It’s unfortunate to even have to point this out, but risk of fraud in the Western banking system is clearly not zero.

The second key risk is solvency. In other words, does your bank have a positive net worth? Like any business or individual, banks have assets and liabilities. For banks, their liabilities are customers’ deposits, which the bank is required to repay to customers. Meanwhile, a bank’s assets are the investments they make with our savings. If these investments go bad, it reduces or even eliminates the bank’s ability to pay us back. This is precisely what happened in 2008; hundreds of banks became insolvent in the financial crisis as a result of the idiotic bets they’d made with our money.

The third major risk is liquidity risk. In other words, does your bank have sufficient funds on hand when you want to make a withdrawal or transfer? Most banks only hold a very small portion of their portfolios in cash or cash equivalents. I’m not just talking about physical cash, I’m talking about high-quality liquid assets and securities that banks can sell in a heartbeat in order to raise cash and meet their customer needs to transfer and withdraw funds. For most banks in the West, their amount of cash equivalents as a%age of customer deposits is extremely low, often in the neighborhood of 1-3%. This means that if even a small number of customers suddenly wanted their money back, and especially if they wanted physical cash, banks would completely seize up.

Each of these three risks exists in the banking system today and they are in no way trivial. Very few people ever give thought to the soundness of their bank, ignoring the blaring warning signs that are right there in front of them. Every quarter the banks themselves send us detailed financial statements reporting both their low levels of liquidity and the accounting tricks they use to disguise their losses. Now we have a report from Fed and the FDIC, showing their own concern for the industry and foreshadowing the solvency risk I discussed above.

Overleveraged malinvestment defines the Chinese economy.

• Chinese Defaults Spread as Cement Maker to Miss Bond Payment (Bloomberg)

China is headed for its latest corporate default amid slowing economic growth, as a cement maker said it will fail to pay bond investors and will file for liquidation. China Shanshui Cement “will be unable to obtain sufficient financing on or before” a Thursday maturity date on its 2 billion yuan ($314 million) of 5.3% securities, it said in a statement Wednesday. The company, which is incorporated in the Cayman Islands, has decided to file a winding up petition and application for appointment of provisional liquidators with the courts there, it said. That “will also constitute an event of default” on its $500 million 7.5% dollar bonds due 2020, according to the filing.

Investors have been scarred by defaults from Chinese firms this year in industries including property and commodities, as President Xi Jinping shifts toward greater reliance on services to drive growth amid the weakest economic expansion in a quarter century. Shanshui would be at least the sixth company to renege on obligations in the nation’s onshore bond market this year, after Shanghai Chaori Solar Energy became the first in 2014. “For offshore creditors, recovering value from Shanshui’s dollar bonds will be a long process given that onshore creditors will be all over the company first in the case of liquidation,’’ said Zhi Wei Feng at Standard Chartered in Singapore.

Nonsense: “Fixed-asset investment increased 10.2% in the first 10 months, while retail sales climbed 11% in October..”

• China Factory Output, Investment Sluggish As Old Economy Slows (Bloomberg)

China’s industrial production and investment slowed further in October, showing the government’s pro-growth measures are yet to revive the nation’s old economic engines. Retail sales defied the weakness, rising more than economists forecast. Industrial output rose 5.6% in October from a year earlier, the National Statistics Bureau said on Wednesday (Nov 11), below the 5.8% median estimate of economists surveyed by Bloomberg and compared with September’s 5.7%. Fixed-asset investment increased 10.2% in the first 10 months, while retail sales climbed 11% in October. China’s leaders are seeking to transition from an investment-driven, manufacturing-dominated economy to a more consumption and services-led one in the next five years while maintaining growth of at least 6.5% a year.

With the real estate sector stalling, manufacturing deteriorating, and inflation muted, policy makers are under pressure to step up stimulus as new growth drivers aren’t picking up the slack quickly enough. The better-than-expected economic growth figure last quarter “did not alleviate downside risks facing the economy,” Liu Li-Gang at Australia & New Zealand Banking wrote in a note ahead of the data. Mr Liu wrote that the central bank “will remain accommodative and keep market interest rates steadily low.” The retail sales result compared with a median economist projection of 10.9%. Wednesday is an annual e-commerce shopping bonanza known as Singles’ Day in China.

Transactions on this year’s event passed 57.1 billion yuan (S$12.8 billion) before midday, eclipsing the 2014 mark with another 12 hours still to go. China’s consumer inflation waned in October while factory- gate deflation extended a record streak of negative readings, data Tuesday showed. That followed a tepid trade report suggesting the world’s second-biggest economy isn’t likely to get a near-term boost from global demand as overseas shipments dropped 6.9% in October in dollar terms from a year earlier.

Quietly?!

• Goldman Sachs Says Corporate America Has Quietly Re-Levered (Tracy Alloway)

You might choose to whisper it softly, but the balance sheets of U.S. companies are yelling it loudly, while wielding a baseball bat: Corporate leverage is now at its highest level in a decade, according to a new analysis from Goldman Sachs. Years of low interest rates and eager investors have encouraged Corporate America to go on a shopping spree. On its list are share buybacks and dividend hikes to reward equity investors, as well as a series of merger and acquisition deals, all funded through a generous bond market. Since cash flow has not kept up with the boom in bond sales, the splurge has left Corporate America with its highest debt load in about 10 years, according to the bank.

“Companies in the United States have taken advantage of low interest rates to issue record levels of debt over the past few years to fund buybacks and M&A,” Goldman analysts led by Robert Boroujerdi wrote in the note. “This has driven the total amount of debt on balance sheets to more than double pre-crisis levels.” While much of that could be attributed to the energy sector, in which exploratory oil and gas firms have relied on friendly capital markets to fund growth, the trend appears widespread. Goldman points out that even after stripping out the besieged energy sector, net debt to earnings is at its highest point since the crisis.

Traumatic events will happen regardless.

• Credit Suisse CEO Sees ‘Traumatic’ Event If Rates Increase (Bloomberg)

Credit Suisse CEO Tidjane Thiam said he sees the risk of a “traumatic event” in global markets once the current period of low interest rates comes to an end. “Frankly, it’s quite likely that there will be at the end of all this period a relatively traumatic event,” Thiam, 53, said in an interview with Bloomberg Television on Tuesday in New York. “It’s quite likely that interest rates will rise and there will be impacts in the real economy, the real world, so as a financial-services company, we have to position ourselves quite defensively.” Speculation about the Federal Reserve’s rate outlook has prompted swings in securities markets as investors assess whether the global economy is strong enough to withstand a U.S. rate increase.

Futures markets show that there’s a 66% chance the Fed will raise borrowing costs for the first time in nine years on Dec. 16, while ECB President Mario Draghi has all but pledged to boost stimulus to bolster growth across the euro area. Earlier expectations for a delay until March had to be trimmed after Fed Chair Janet Yellen told U.S. lawmakers that action next month remains a “live possibility,” a case later bolstered by American job gains. “Every time you see in markets, when you go from a high-rate environment to a low-rate environment or from a low to a high-rate environment, experience shows that a number of people are caught unprepared,” Thiam said. “That is likely to happen again.”

The comments were part of an interview in which Thiam discussed the opportunity for the bank to expand in managing money for wealthy clients across Asia and the strengths of the firm’s securities unit. The CEO last month announced a plan to reorganize Credit Suisse along geographical lines, cut as many as 5,600 jobs and focus more on wealth management while shrinking and splitting up the investment bank. “Why do we want to be in wealth management? Because the world is getting wealthier,” said Thiam, who replaced Brady Dougan in July. “That’s a huge opportunity.” The second-largest Swiss bank after UBS remains “very focused” on emerging markets including China, where “we have been underweight,” Thiam said. Credit Suisse needs the investment bank to help Asian billionaires with illiquid assets who need access to financing, he said.

No kidding: “The weakness of global manufacturing activity is … putting pressure on energy demand..”

• Oil Prices Drop On Rising Stockpiles, Slowing Asian Economies (Reuters)

Crude oil prices fell on Wednesday after industry data showed an increase in U.S. stockpiles, while China’s factory output slowed and fears emerged that Japan’s economy may have fallen into recession added to demand woes. Benchmark U.S. crude futures slipped to a two-week low at $43.55 a barrel in early trading before edging back up to $43.72 a barrel by 0652 GMT, still down almost half a dollar from their last close. The price drops came on the back of rising stockpiles in North America and slowing economies in Asia. U.S. crude stocks jumped by 6.3 million barrels in the week to Nov. 6 to 486.1 million barrels, data from industry group the American Petroleum Institute showed late on Tuesday, compared with analyst expectations for an increase of 1 million barrels.

On the demand side, confidence among Japanese manufacturers fell in November for a third straight month to levels unseen in more than two years, a Reuters poll showed on Wednesday, reflecting fears that a China-led slowdown in overseas demand may have pushed Asia’s second-biggest economy into recession. “The weakness of global manufacturing activity is … putting pressure on energy demand,” JBC Energy said, adding that it expected a significant drop in oil demand growth in 2016. In China, factory output grew slower than expected at an annual 5.6% in October, data showed on Wednesday, slightly below analyst forecasts of 5.8% and down from 5.7% in September. China’s oil demand rose 0.9% in October from a year earlier to 10.14 million barrels per day (bpd), with many analysts expecting a further slowdown.

“This program is economic policy and first and foremost serves private banks from which the ECB purchases problematic loans. It is turning itself into the bad bank of Europe.”

• ECB Faces Three Suits Over Quantitative Easing in Germany (Bloomberg)

German politicians who failed in previous attempts to have courts derail EU policy filed lawsuits at the country’s top court challenging the ECB’s €1.1 trillion asset-purchase program. Three suits were filed over the last six months, according to Michael Allmendinger, a spokesman for the Federal Constitutional Court in Karlsruhe. Bernd Lucke, the head of political party ALFA, brought a case in September. Ex-lawmaker Peter Gauweiler said in an e-mailed statement that he also filed a complaint last month. “With its euphemistically so-called Quantitative Easing policy, the ECB is seeking to inflame inflation by printing huge amounts of money,” said Gauweiler, who was behind a case that resulted in a ruling from the EU’s top court earlier this year.

“This program is economic policy and first and foremost serves private banks from which the ECB purchases problematic loans. It is turning itself into the bad bank of Europe.” Nine months into the bond-buying program, the main goal of spurring inflation toward the ECB’s goal of close to but below 2% remains elusive with price increases still largely absent from the 19-nation euro region. With the economy at risk of cooling amid weaker growth in China and a slowdown in global trade, ECB President Mario Draghi has held out the prospect of more stimulus next month, when new consumer-price and growth forecasts will be published.

The cases are separate from a complaint attacking the ECB’s 2012 Outright Monetary Transactions program. That action was dealt a setback when the EU’s highest tribunal in June largely approved the OMT. The German judges still have to make a final ruling in that litigation. In his new suit, Gauweiler argues that Draghi may have been biased and shouldn’t have participated in decisions potentially affecting the refinancing efforts by Italy or Greece. Draghi used to work for the Italian finance ministry, so there are “serious indications” he may have have been in part responsible for the countries’ high level of debt and “financial manipulations” allowing Italy to enter the euro zone, said Gauweiler.

All the others managed to do what VW couldn’t, build engines that conform to the standards? That’s hard to swallow. It makes VW look too stupid to believe.

• VW Only Carmaker Found Cheating By US Regulator (Reuters)

Volkswagen is the only carmaker whose diesel engines have been found so far by a U.S. regulator to be using illicit emissions-control software, German magazine Wirtschaftswoche reported. “Up until now we have found no fraudulent defeat device in vehicles of other brands,” the magazine quoted Mary Nichols, chair of the California Air Resources Board (CARB), as saying in an interview published on Tuesday. The CARB has been testing diesel models of brands other than VW since the U.S. Environmental Protection Agency said in September that the German group used software for diesel VW and Audi cars that deceived regulators measuring toxic emissions. “Our tests of diesel vehicles will continue,” Nichols said. Separately, Nichols said the CARB would also look into VW’s Nov. 3 admission of manipulating carbon dioxide emissions, though added the carmaker’s latest malfeasance would probably not spark a new testing cycle.

Lesson no. 6.

• Minsky, Financial Instability, Great Depression & GFC (Steve Keen)

I explain Minsky’s Financial Instability Hypothesis-why he developed it, what were his inspirations, how well it fits the empirical record, and how it can be modeled easily using system dynamics methods. For some reason my webcam froze for the 1st half of the lecture; I start moving in the second half…

Contentious. Discuss.

• Bitcoin’s Place In The Long History Of Pyramid Schemes (FT)

The cryptocurrency was invented by an anonymous mathematician in 2008, and championed in the years that followed for its technology. At a time when many were unsettled by the actions of central banks after the financial crisis, bitcoin offered an alternative way to manage a currency, through mathematical rules rather than a metaphorical printing press. It also fit the vogue for technological innovation. Bitcoins are created by computers solving mathematical problems, with the total number that can be calculated into existence over time limited. An open ledger allows the community to track the distribution of coins. At a time when small start-ups were earning multibillion-dollar valuations for their power to disrupt industries, anyone with a good idea and a neat bit of software could make a fortune.

As bitcoin attracted more attention, its price rose, attracting more money and attention. Early adopters got rich quick, or bemoaned how they would have done had their bitcoin hoard not gone in the bin aboard a discarded hard drive. Bitcoins could be used to buy goods and services in the real world, although not usually without a third party intermediating. The attention and limited supply meant that by December 2013 bitcoins traded for more than $1,200 each. However, in 2014 the cryptocurrency lost three quarters of its value after running into an old world problem, the failure of an overextended broker. Mt Gox, a prominent bitcoin exchange, collapsed. Then the seizure of the Silk Road, a popular website for trading bitcoins for drugs and other frowned on goods and services, prompted a crash in the price to almost $100.

Such big swings in price undermine the case for bitcoin’s use as a currency. “It’s value is so volatile it’s not likely to serve as a medium of exchange”, says Eugene Fama, the Nobel Prize winning economist. He pointed to examples such as Zimbabwe. “When a currency has a variable value, the people just switch to a different currency, or to barter.” Bitcoin also lacks another feature of currencies: the balance sheet of a central bank standing behind it. They might be intangible, but a balance sheet has two sides to it, lists of assets and liabilities. The bitcoin ledger, by comparison, is just a glorified list of liabilities, keeping track of where the bitcoins are located. Furthermore, while the number of bitcoins is limited, the number of times the cryptocurrency can be replicated is not. There are a host of imitators, including Doge coin, started as a joke in 2013 at the height of alt-coin fever.

The inherent flaw of pyramid schemes is that they must always suck in new converts to avoid collapse, and the exponential growth in users is impossible to sustain. Bitcoin shares some of these features. It requires constant evangelism because its value derives from its use. The limited supply of bitcoins then becomes a fatal constraint. The more people use it, the greater the price must rise, dissuading its use as a currency. Bobby Lee, head of BTCC, the largest bitcoin exchange in China, argues its use for everyday transactions makes it a currency, and is frank about its price, saying: “The reason bitcoin has value today is scarcity, that is all.” He also agrees bitcoin has the character of a pyramid scheme, but compares it with bubbles in housing markets, which might also appear pyramidical. He adds: “It all comes down to what we think of a pyramid scheme. Is that a good thing, or a bad thing?”

Thanks, Schäuble.

• Abortions Up 50% In Greece Since Start Of The Crisis (Kath.)

The number of abortions carried out in Greece has risen 50% since the start of the crisis and miscarriages have doubled. Births at public hospitals, meanwhile, have dropped 30% in the same period and assisted pregnancies by 20%. These are but some of the findings that were presented on October 17-18 in Athens at the 7th Panhellenic Conference of Family Planning organized by the Greek Society for Family Planning, Birth Control and Reproductive Health. According to the experts, the crisis has affected women across all age groups and socioeconomic strata, as well as the behavior of young people and teenagers in particular.

Greece has become an abortion leader. Ten years ago, there were 200,000 abortions a year among a population of 11 million, while today this figure has risen to 300,000, according to the figures presented at the conference. It is estimated that 140 in 1,000 pregnancies end in abortion. This usually concerns women who already have one or two children. At the Alexandra Maternity Hospital, the biggest public institution of its kind in Greece and the benchmark for the study, births have dropped 30% since the start of the crisis. “A prenatal care package for an uninsured woman at a public hospital costs just under €500, while a caesarian section costs €1,000. The cost is higher for migrant women, who may pay as much as €1,500 for a C-section,” says Constantinos Papadopoulos, an obstetrician/gynecologist (OB/GYN). “And if you add the cost of raising a child, then you understand why women take such decisions.”

Things are already very bad in Greece, but apparently not enough yet.

• More Misery Ahead For Greeks As Economy Set To Shrink Again (Reuters)

Any Greeks hoping their days of economic pain are over following the latest bailout agreement with international lenders should look to the dire projections from Europe’s three main institutional forecasters for a reality check. The European Commission, the OECD and the EBRD all say Greece is heading into recession again this year and next, sinking back into the mire after last year’s positive reading ended a six-year depression. The light at the end of the tunnel, all three say, may be some growth returning during next year – but it is highly dependent on economic and banking reform. There will be arguments about why Greece remains in such a state – from accusations in Athens that lender-imposed austerity has crushed the life out of the economy to gripes from Brussels that Alexis Tsipras’s leftists wasted what improvements had been achieved.

The two sides are again at loggerheads – albeit possibly temporarily – over reforms and bailout cash, with the added complexity that Tsipras does not want to see indebted Greeks lose their homes while the country is providing food and housing for thousands of asylum-seekers. But there is no disagreement among the forecasters about the direction the Greek economic is heading. Both the Commission and the OECD see a 1.4% contraction this year, while the EBRD (the European Bank for Reconstruction and Development) sees 1.5%. This is particularly severe given the first half of the year saw growth of 1%, put down to Greeks running out to buy durable goods ahead of a threatened “Grexit” from the eurozone.

There is more divergence among the forecasters about next year. The Commission and OECD see a contraction of 1.3% and 1.2%, respectively. The Commission reckons much of this will be carry-over effects from this year’s political and economic turmoil, which included a failure to complete the previous bailout program, a referendum on austerity, a bitter fight with lenders, and the introduction of capital controls, many of which remain. The EBRD, however, expects a decline of 2.4%. Its mere involvement is significant, given that it only added Greece to its bailiwick of mainly poor, emerging economies this year.

And then there’s this.

• EU Fears Greek Debt Deal Would Unleash Mass Write-Off Calls In Spain (Telegraph)

Greece’s creditor powers have delayed talks over reducing the country’s debt mountain for fear of emboldening anti-austerity forces in the southern Mediterranean, the country’s finance minister has claimed. Euclid Tsakalotos said EU lenders would not discuss the question of Greece’s debt burden, which stands at 200pc of GDP, until after the Spanish elections are held in the new year. “The promise was that we would have a discussion on debt immediately after the first [bail-out] review and have deal before Christmas,” he told an audience at the London School of Economics on Tuesday night. “But we won’t have a deal because Spain has an election and [creditors] don’t want … to encourage the wrong people.”

Spain is due to hold its first post-crisis elections on December 20. The current conservative government of prime minister Mariano Rajoy has been fighting off anti-austerity forces in the opposition Socialist party and the grassroots Podemos movement, in a bid to become the first bail-out government to ever be re-elected in the eurozone. Wiping out some portion of Greece’s debt mountain has been a key demand of the Syriza government. Athens had been told talks could begin when the government had successfully passed its first round of laws in return for a release of bail-out cash. This review is due to be complete in the coming weeks but has hit stumbling blocks. And Mr Tsakalotos, an Oxford-educated economist, hinted at the continuing tensions between the newly elected government and its lenders.

He said many of Syriza’s negotiators “had wanted the Left to fail” in order to make an example of the country, and dissuade radical forces from similar demands to tear up austerity deals in Portugal and Spain. The IMF has called for a bold programme of debt write-offs and moratoriums on repayments for up to 40 years. The Fund has refused to take part in a new €86bn bail-out until a debt write-off has been agreed. EU creditors, however have resisted opening up the question of haircuts or repayment extensions until Athens has managed to “front-load” most of its austerity reforms. Mr Tsakalotos’s comments suggest creditors fear they will unleash a new wave of debt relief calls in former bail-out countries.

Wait till the 3 million refugees expected next year in Europe are added in.

• Germany May Need €21 Billion To House And Educate Refugees (Reuters)

Germany faces costs of more than €21bn this year to house, feed and educate hundreds of thousands of refugees, the Munich-based Ifo institute said on Tuesday. The new estimate, which assumes 1.1 million people will seek asylum in Germany in 2015, represents a sharp increase on a previous projection from late September which put the cost at €10bn. That estimate had assumed 800,000 arrivals and did not include costs related to education and training, which the Ifo said were necessary to ensure refugees, many of them fleeing war in the Middle East, were successfully integrated. “Training and access to the labour market are key in terms of both costs and integration,” Gabriel Felbermayr of the Ifo institute said.

The German government has not published an official estimate for how much the influx of refugees would cost it this year, but it has boosted funding to the country’s 16 regional states by €4bn. For next year, German states and towns have said they could face costs of up €16bn. The finance minister, Wolfgang Schäuble, has said the federal government would invest roughly €8bn in 2016 to shelter and integrate asylum seekers. Ifo also reiterated its call for a flexible interpretation of Germany’s minimum wage, saying a majority of businesses saw the €8.50 floor as a hindrance to employing refugees. Some members of chancellor Angela Merkel’s conservative camp have also called for flexibility on the minimum wage, but her coalition partner, the Social Democrats, have ruled out changes to one of its flagship reforms.

The UNHCR leaves all the hard work to volunteers, has just 20 people on Lesbos where at least 125,000 refugees landed in October alone, and then blames the resulting chaos on the Greek government.

• No One Is Really In Charge Of The Refugee Crisis (Reuters)

What sets this humanitarian crisis apart is the centrality of volunteers. On Lesbos alone, they number well into the hundreds. They are lifeguards from Spain, doctors from Holland, trauma counselors from the West Bank, nurses from Australia, a cook from Malaysia, and all manner of ordinary people pitching in however they can. Many come on their own dime, taking time off from work or pausing their lives indefinitely. They fill in critical gaps created by a perfect storm of political weakness and limits to aid: a Greek government in severe economic distress and without capacity to take control; a European Union strangled by politics as it struggles to define a uniform migration policy; and international aid groups that have been slow to move in because they do not normally operate in industrialized nations — and have to start their operations from scratch in a place like Lesbos.

Meanwhile, the boats keep coming, and grassroots volunteer efforts have grown increasingly sophisticated. A group called O Allos Anthropos, Greek for “The Other Person,” cooks and hands out free meals for thousands of refugees daily. A Drop in the Ocean runs its own camp for just-arrived refugees, particularly families with small children, where it provides food, tents and donated clothing. Yet another group, the Starfish Foundation, set up a central bus station for refugees in the parking lot of Oxy, a cliffside nightclub with stunning sea views. Volunteers there give out handmade bus tickets to the two official camps in the island’s south. But as winter sets in and the sea crossing grows more dangerous, the lack of an officially coordinated emergency response could lead to higher death tolls.

Though volunteers have tried organizing themselves in recent months — they now hold weekly meetings with aid workers from international organizations such as the IRC, United Nations High Commissioner for Refugees (UNHCR), and Doctors Without Borders (MSF) — most are not trained in crisis management. They vastly outnumber aid workers on the island, but for many, it’s their first experience with a humanitarian disaster. And because they’re in Greece temporarily, on hiatus from paid jobs back home, the high turnover means many must leave the island just as they are beginning to understand their roles.

On/off.

• Germany Sends Syrians Back To EU Borders (Local.de)

Germany is once again sending Syrian refugees back to the EU country where they first arrived, in line with the so-called Dublin regulations, the government confirmed on Tuesday. In August it emerged that for Syrian refugees, Germany had stopped following the Dublin rules, which stipulate that refugees must apply for asylum in the EU state where they first enter the 28-member union. The move was in part to alleviate the burden on countries like Italy and Greece where hundreds of thousands of migrants have been arriving by boat. But a spokesman for the Interior Ministry confirmed on Tuesday that Germany is now applying the Dublin procedure for all countries of origin and all member states at which migrants arrive – except Greece. This has been the case “for Syrian nationals, since October 21st”, he confirmed.

At the beginning of October, Chancellor Angela Merkel called the Dublin rules “obsolete” as they put the burden on EU states where migrants first arrive to process claims for refugee status. Still, of the refugees currently arriving in the country, few have actually been registered in another EU country before arriving in Germany. The Federal Office for Migration and Refugees (BAMF) reported that in October 1,777 people were sent back to other EU countries due to the Dublin rules – 5.6% of all decisions on refugee status made that month. Out of all asylum decisions made so far this year, just 8.5% – 17,410 – have been to send people back under the Dublin rules. In October, 181,166 refugees arrived in Germany, of which 88,640 were Syrian.

Interior Minister Thomas de Maizière and his office have been pushing for tighter controls on refugees recently, causing serious fractures within Germany’s coalition government. De Maizière unexpectedly announced on Saturday that Syrians would no longer be awarded three years’ residency in Germany and that they could no longer bring their families with them at a later point. But it quickly became clear that his comments did not have the backing of more senior figures in the government, who said the asylum process for Syrian refugees would not be changed. However the interior minister received backing from powerful figures in the conservative Christian Democratic Union (CDU), putting pressure on Merkel to revise her policy towards Syrian refugees.

This is getting so out of hand fighting becomes inevitable.

• Austria Calls For Greece, Italy Border Controls (AP)

Austria’s chancellor said establishing controls on the borders of Italy and Greece must be a priority to stem the influx of migrants into the EU. Werner Faymann said border controls inside the EU are less effective because refugee flows can “only be shifted” once the refugees have traveled thousands of kilometers (miles) in hopes of a safe haven. Faymann on Tuesday also urged quick completion of an agreement with Turkey offering Ankara billions of euros in aid for incentives to migrants to remain in Turkey instead of leaving for the EU. He said making sure that people fleeing war and hardship from regions in Asia and the Mideast can survive in Turkey is the “only sensible way.”

Meanwhile, Greek authorities said more than 10,000 refugees and economic migrants have crossed from Greece into Former Yugoslav Republic of Macedonia (FYROM) since Monday morning, on their long trek toward wealthier western and northern European countries. FYROM border police were letting groups of 50 across at regular intervals Tuesday. But large bottlenecks formed due to increased flows toward the border crossing at Idomeni after migrants were stranded on the Greek islands for days by a ferry strike.

While this continues.

• Refugee Boat Sinks Off Western Turkey, 14 Dead, 7 Children (AA)

Fourteen people drowned off Turkey’s western coast when a boat packed with refugees sank in the early hours of Wednesday, the Turkish Coast Guard said. The incident is the latest tragedy to affect refugees trying to reach Greek islands from Turkey in often unseaworthy vessels. A Coast Guard patrol found the sinking boat off the coast of Ayvacik district in Canakkale province – around 10 kilometers (4 miles) from Lesbos – at around 2 a.m. local time (0000GMT). Among the dead were seven children. The Coast Guard was able to rescue 27 people from the stricken vessel. It is not known why the boat sank. The casualties’ nationalities are yet to be released. Coast Guard divers are searching the area around the site of the disaster.

Home › Forums › Debt Rattle November 11 2015