Unknown No Dog Biscuits Today

“The Bloomberg Commodity Index, a measure of returns for 22 raw materials, closed at the lowest in 16 years on Monday..”

• Stephen Roach: China Is The Biggest Commodities Story Since WWII (BBG)

Commodities are at risk of extending declines as China’s slowdown hurts demand and the world’s largest user shifts its economic model away from raw materials, according to Stephen Roach, who said some producers haven’t yet faced up to the change. “The China factor can’t be emphasized enough,” Roach, a senior fellow at Yale University, said in a Bloomberg Television interview in Hong Kong on Tuesday. China “has been the most commodities-intensive story that the world economy has seen in the post-WWII period. Now China is shifting the model to more of a commodity-light, services-led economy.”

Raw materials sank to the lowest level since 1999 this week as China’s slowest expansion in a quarter of a century cut demand in a reversal of the pattern seen a decade ago, when booming growth in Asia fueled a surge across commodity prices that was dubbed the super-cycle. Continued concern about China, coupled with a rising dollar as the Federal Reserve raises rates, will make it difficult for commodities to rebound, according to Roach, a former non-executive chairman for Morgan Stanley in Asia. “Commodities are, after a super-cycle, obviously going the other way, big time,” Roach said. Some companies “are in denial that China is changing its character, its structure. It’s going to take a while for that to sink in, and until it sinks in, there’s still downward pressure on commodity markets and prices.”

The Bloomberg Commodity Index, a measure of returns for 22 raw materials, closed at the lowest in 16 years on Monday as supplies of everything from oil to copper outstripped demand. Base metals and crude oil fell on Tuesday, with copper trading 0.6% lower at $4,645 a metric ton in London, down 26% this year. The best way to heal lower prices are lower prices, as that takes supply out of the system, according to Roach. Metals companies in China including producers of copper, aluminum, zinc and nickel have all announced cuts to supply or plans to rein in capacity growth to stem the price rout. Outside China, Glencore pared copper production from mines in Africa, while Alcoa has curbed aluminum output.

A test run that puts China GDP growth at 2.3%. A number picked by accident?

• Fitch Warns Of Effects Of Sharp China Slowdown (CNBC)

A sharp slowdown in the world’s second largest economy China would hit global growth hard, according to a report by Fitch ratings agency, which warned of “significant knock-on effects” for the rest of the world. In its report published Tuesday, Fitch warned that a sharp slowdown in China’s GDP growth rate to 2.3% during 2016-2018 “would disrupt global trade and hinder growth, with significant knock-on effects for emerging markets and global corporates. In turn, this would keep short-term interest rates and commodity prices lower for longer.” Global GDP growth is currently expected to be 3.1% in 2017, according to Oxford Economics’ global economic model which was used by Fitch to frame its “shock” China scenario. But if a slowdown of such a magnitude materialized in China, Fitch said global GDP growth would slow to 1.8% in 2017.

As a result, any rise in U.S. and euro zone short-term interest rates would be postponed, and oil prices would remain under pressure, Fitch said. ‘Lower-for-longer in terms of growth, interest rates and commodity prices, could be the defining mantra of this decade for the major advanced economies if a Chinese shock scenario materializes,’ Bill Warlick, senior director of Macro Credit Research at Fitch, noted in the study. While Fitch emphasized that this hypothetical scenario did not reflect its current expectations for China’s growth, it was “designed to test credit connections between China and the rest of the world.”

In terms of these “credit connections”, a China slowdown would “impair” the credit profiles of many companies globally, particularly commodity-dependent ones in oil and gas, steel, and mining, Fitch said. “Shipping companies would also suffer, as commodities account for a significant portion of freight volume. The global technology, heavy manufacturing and automotive sectors would also feel increased credit pressure due to a slowdown in Chinese demand,” the agency warned. [..] Within Fitch’s rated portfolio, 25 percent of oil and gas companies and 52 percent of other commodities companies are already sub-investment grade. If the slowdown scenario materialized, it could create ripple effects through the high-yield bond market, the agency said.

They should have checked his hands, too.

• Rio Tinto CEO Says Iron Ore Rivals ‘Hanging on by Their Fingernails’ (BBG)

The iron ore collapse has pushed producers to the brink of survival, according to the head of the world’s second-biggest mining company. “There are a lot of producers that we believed would leave the market that are hanging on by their fingernails,” Sam Walsh, chief executive officer of Rio Tinto Group, said in an interview with Bloomberg TV. “They are burning up cash reserves of their shareholders.” Iron ore’s 45% retreat this year has left the industry on the precipice of an unprecedented shake-out as higher-cost suppliers are slowly forced to exit the market. Prices are continuing to fall as the largest companies, including Vale, Rio Tinto and BHP Billiton, expand production and grab market share. Iron ore fell below $39 a metric ton last week, a record low in daily prices dating back to 2009. That’s down from near $190 in 2011, when Chinese demand was booming.

“I suspect that right now, even at a price of $39 a ton, there are people that are suffering pretty loudly,” Walsh said. “Sooner or later the adjustment will take place.” The slump has hurt miners’ shares. Rio stock has lost 28% in Sydney this year, dropping to A$40.39 on Dec. 9, the lowest price since 2009, while BHP has fallen 40%. In Brazil, Vale has dropped 49%. Rio and its rivals have been criticized by analysts, competitors and governments for pursuing a strategy of expanding lower-cost mines even as prices fell amid a global glut. Walsh said it would be abnormal for his company to consider withholding supply given that Rio is the lowest cost producer. Rio and BHP are in an “imaginary world” because their strategy hurts themselves as much as their competitors, Lourenco Goncalves, the CEO of Cliffs Natural Resources, the biggest U.S. iron ore producer, said last month. Prices below $50 are “not comfortable to anyone,” he said.

It’s same all over commodities: overproduce to stay alive. Run and still move backwards.

• Miners Shoveling Furiously Prop Up Aussie GDP as Iron Ore Melts (BBG)

The price of Australia’s top export has been almost slashed in half this year. That makes it all the more surprising economists increasingly see iron ore propping up growth as they assemble their 2016 forecasts. The reason: Australian producers are making up for the price destruction by doubling down on volume, in the process worsening a global supply glut. There’s even a new entrant to the market – Gina Rinehart, Australia’s richest person, last week oversaw her company’s first shipment of iron ore to South Korea. The surging exports are also papering over a massive drag on the economy from collapsing mining investment and could account for most of next year’s growth, according to Citigroup and Goldman Sachs.

Still, the fall in commodity prices will hurt fiscal revenue, making it more difficult for the government to pare back a deficit and reach its goal for a surplus by the end of the decade. “We’re running faster to stand still when it comes to national income,” said James McIntyre at Macquarie in Sydney. Australia is forecasting an 8% rise in the volume of iron ore exports next year to 824 million metric tons, which would be almost double the amount the country shipped five years earlier. Goldman Sachs estimates that the country’s net exports will contribute 2 percentage points to growth next year without which the economy would stall.

It’s everywhere. NatGas could bounce back a little if winter sets in.

• US Natural-Gas Prices Plunge Toward A 14-Year Low (MarketWatch)

The winter heating season has begun, but natural-gas prices have plunged toward levels they haven’t seen since January 2002. Natural gas for January delivery fell 10.9 cents, or 5.5%, to trade at $1.881 per million British thermal units Monday. It suffered a weekly loss of nearly 11% last week. Prices traded as low as $1.862 and based on the most active contracts, prices haven’t seen an intraday level this low since January 2002, according to FactSet data. A settlement around the current level would be the lowest since September 2001. The price drop comes amid a glut in supply. Domestic natural-gas supplies in storage topped out just above 4 trillion cubic feet the week of Nov. 20, the largest storage level on record, based on U.S. government data.

There is “too much natural gas, not enough demand—that is even with the shutdown of coal facilities,” said Richard Gechter, Jr., principal and president of Richard W. Gechter Natural Gas Consulting. “Supply has increased beyond anyone’s expectations.” The winter season historically runs from November to March of the following year. Supplies in storage stood at 3.88 trillion cubic feet as of Dec. 4, and the U.S. Energy Information Administration expects inventories will finish the end of the winter season at 1.862 trillion cubic feet. That would be a smaller drawdown than what’s typically seen in the winter. “Strong inventory builds, continuing production growth and expectations for warmer-than-normal winter temperatures have all contributed to low natural-gas prices,” the EIA said.

“It’s really a dramatic situation that really cannot continue for a very long time for many producers.”

• Never Mind $35, The World’s Cheapest Oil Is Already Close to $20 (BBG)

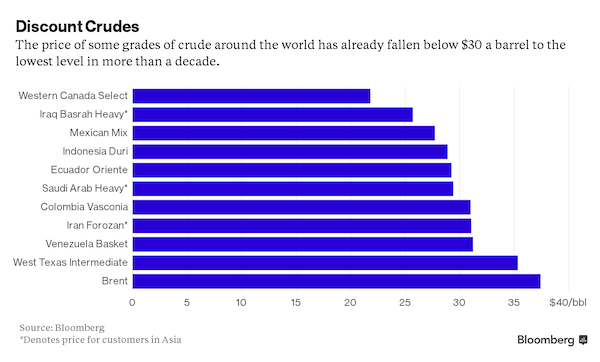

As oil crashes through $35 a barrel in New York, some producers are already living with the reality of much lower prices. A mix of Mexican crudes is already valued at less than $28, an 11-year low, according to data compiled by Bloomberg. Iraq is offering its heaviest variety of oil to buyers in Asia for about $25. In western Canada, some producers are selling for less than $22 a barrel. “More than one-third of the global oil production is not economical at these prices,” Ehsan Ul-Haq at KBC Advanced Technologies said. “Canadian oil producers could have difficulty in covering their operational costs.” Oil has slumped to levels last seen in the global financial crisis in 2009 amid a global supply glut.

While the prices of benchmarks West Texas Intermediate and Brent hover in the $30s, they represent a category of crude – light and low in sulfur – that is more highly valued because it’s easier to refine. Some producers of thicker, blacker and more sulfurous varieties have suffered heavier losses and are already living in the $20s. A blend of Mexican crude has plunged 73% in 18 months to $27.74 on Dec. 11, its lowest level since 2004, according to data compiled by Bloomberg. Venezuela is experiencing similar lows. Western Canada Select, which is heavy and sulfurous, has slumped 75% to $21.82, the least in seven years. Other varieties including Ecuador’s Oriente, Saudi Arabia’s Arab Heavy and Iraq’s Basrah Heavy were selling below $30, the data show.

Crudes of this type trade at a discount to lighter varieties because to process them “refiners have to invest in upgrading facilities such as coking plants, which are very expensive,” KBC’s Ul-Haq said. “Most places in the world, a lot of the producers they don’t really get the Brent price, and they don’t get the WTI price,” Torbjoern Kjus at DNB ASA in Oslo said. “It’s really a dramatic situation that really cannot continue for a very long time for many producers.”

Interconnected.

• Junk Rated Stocks Flashing Same Signal as High-Yield Bond Market (BBG)

Think equity investors have been blind to warning signs coming from junk bonds? Not quite. For most of the year pessimists have warned that equity markets were missing signals in high-yield credit, where losses snowballed even as gauges like the Standard & Poor’s 500 Index remained relatively stable. While true, most of that is an illusion of index composition – not evidence of complacency. As one of the broadest share gauges, the S&P 500 has companies that span the credit spectrum from junk to investment grade – or have no debt at all. From that perspective, it’s less surprising that the full index wouldn’t mimic the plunge in junk bonds themselves, where annual losses for related exchange-traded funds exceed 10%. And that’s what happened: until Friday, the equity gauge was virtually flat for the year.

What if you look at stocks that are representative of the high-yield universe? A basket compiled by Bloomberg of below investment-grade companies, including Chesapeake and Cliffs Natural Resources, has dropped a lot more – 51% in 2015. The slump in stocks with the lowest credit quality reflects the same concern gripping the debt market, that the commodity selloff and the Federal Reserve’s plan to start raising interest rates will jeopardize solvency. While near record cash and the resilience in large technology firms have sheltered the S&P 500 from deeper losses, junk-rated stocks are vulnerable to a credit contagion with a smaller size and a tilt toward commodities. “It’s really the same kind of signal,” Curtis Holden at Tanglewood Wealth Management, which oversees about $840 million, said. “The market is saying through how well the S&P 500 is holding up on a relative basis, ‘Look for quality. Don’t look for junk companies.”’

They would like you to believe this is due to “robots and regulation”.

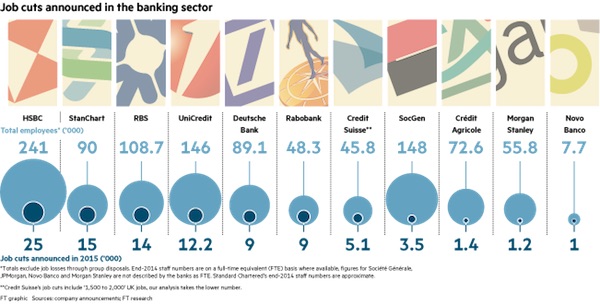

• Big Banks In Europe And US Announced 100,000 New Job Cuts This Year (FT)

Big banks in Europe and the US announced almost 100,000 new job cuts this year, and thousands more are expected from BNP Paribas and Barclays early next year, as the wave of lay-offs that began in 2007 shows no sign of abating. The 2015 cuts – which exclude the impact of major asset sales — amount to more than 10% of the total workforce across the 11 large European and US banks that announced fresh lay-offs, according to analysis by the Financial Times. The most recent came last week, as workers at Dutch lender Rabobank learnt of 9,000 cuts across their bank the day after Morgan Stanley announced 1,200 lay-offs, including at its ailing fixed income division.

Barclays and BNP Paribas, two of Europe’s biggest banks, will unveil job cuts when they announce strategies that are designed to strip out 10 to 20% of the costs at their investment banks, people familiar with the situations said. At Barclays, the axe will fall on March 1 when chief executive Jes Staley unveils a fresh strategy with the bank’s annual results. The announcement will include Barclays’ plans to move more quickly to shrink its investment bank, which employs about 20,000 people. BNP Paribas’s new corporate and institutional banking chief Yann Gérardin will announce a new cost cutting plan in February. The French bank has already said it is planning to cut more than 1,000 jobs in its Belgian retail network.

Banks have found that they have been carrying too many staff, as they suffer falls in revenues from a combination of tougher post-crisis regulation, ultra-low interest rates and sluggish activity among clients. Those under new leadership — such as Deutsche Bank, Credit Suisse and Barclays — have been under particular scrutiny, as incoming chief executives try to turn the ailing banks they inherited into the more profitable companies demanded by investors.

Good by and thanks for all the fish.

• Yahoo Told: Cut 9,000 Of Your 10,700 Staff (AP)

Yahoo is facing shareholder pressure to pursue other alternatives besides a complex spin-off of its internet operations while chief executive Marissa Mayer struggles to revive the company’s revenue growth. The demands from SpringOwl Asset Management and Canyon Capital Advisors reflect shareholders’ frustration with Ms Mayer’s inability to snap the company out of a financial downturn after three-and-half years in the top job. Ms Mayer hoped to placate investors with last week’s announcement of a revised spin-off, but the company’s shares have slid 6pc since then. The shares fell 32 cents to close at $32.59 on Monday. SpringOwl, a New York hedge fund, has sent a 99-page presentation to Yahoo’s board that calls for the company to lay off 9,000 of its 10,700 workers and eliminate free food for employees to help save $2bn annually.

Canyon Capital, a Los Angeles investment firm, wants Yahoo to sell its internet business instead of spinning it off. Yahoo has warned the spin-off could take more than a year to complete, a time frame that Canyon Capital called “simply unacceptable” after Yahoo spent most of 2015 preparing to hive off its $31bn stake in China’s Alibaba in an attempt to avoid paying taxes on the gains from its initial investment of $1bn. Yahoo scrapped the Alibaba spin-off after another shareholder, Starboard Value, threatened an attempt to overthrow the board if the company stuck to that plan. Starboard and other investors were worried the Alibaba stake would be taxed at a cost of more than $10bn after the Internal Revenue Service declined to guarantee it would qualify for an exemption.

Now that two more shareholders expressing their dismay with Yahoo’s direction, Ms Mayer’s fate could be tied to a cost-cutting reorganisation that she has been working on for the past two months. Ms Mayer, who is on a brief maternity leave after giving birth to twins last week, says the overhaul will jettison Yahoo’s least profitable products – a shake-up that could lay off a large number of workers.

The truth is slipping through the cracks of propaganda. American recovery my…

• Economic Pain In US Heartland As Likely Fed Hike Nears (Reuters)

America’s heartland, the vast area in the middle of the country that produces much of the nation’s food and energy and is home to many of its traditional manufacturers, is sending warning signals that all is not well with the economy. From agriculture to heavy equipment and small business lending, farmers, manufacturers and transport companies that serve them are taking hits from a stronger dollar or plunging prices for farm commodities and oil. Industry executives worry that the expected move by the U.S. Federal Reserve to raise interest rates on Wednesday – which would be the first hike in a decade – could put more jobs at risk.

“Many of the companies that we do business with are hurting and some have already gone away,” said Bill Hickey, president of Chicago-based steel company Lapham-Hickey Steel, which has seven mills across the country and supplies processed steel to car makers and construction firms. He worries banks could start cutting off credit to troubled industrial companies. The Thomson Reuters/PayNet Small Business Lending Index fell 5% in October from the previous month and was flat on the year, marking only the second time it had failed to rise since February 2010. Weakness in the manufacturing, farm and transport sectors likely will not deter a rate increase by the Fed, economists say. There is “no doubt that manufacturing weakness is costing growth,” said Harm Bandholz at UniCredit Research.

However, the sector only accounts for about 12% of the U.S. economy and some areas like automotive are performing well. “You can’t say that everything is perfect,” he said. “But the United States is not doing so bad anymore that we need 0% interest rates.” The downbeat indicators from heartland industries illustrate the economy’s lumpiness. Preliminary data show that November U.S. orders for heavy, over-the-road trucks fell 59% from a year earlier – the worst November since 2009, according to transportation analysis firm FTR. Freight at the U.S. major railroads was off 1.9% for the year through Dec. 5. Coal accounts for much of the decline. But shipments of consumer goods by container – or intermodal shipments – were only up 1.6%. “The numbers are as bad as I’ve seen them,” said Anthony Hatch, an independent railroad analyst.

Farmers are under pressure from declining crop prices and weak demand. U.S. farm incomes are expected to drop 38% for all of 2015, the steepest year-on-year drop since 1983. Nathan Kauffman, an economist with the Kansas City Fed, said higher rates would create “the potential for more financial stress.”

Set a target, make a prediction, see both fail miserably, rinse and repeat.

• The Mystery of Missing Inflation Weighs on Fed Rate Move (WSJ)

Federal Reserve officials this week are expected to raise interest rates for the first time in nine years on the expectation that employment and inflation will hit targets reflecting a healthy U.S. economy. But Fed officials face a troubling question: Jobs are on track, but inflation isn’t behaving as predicted and they don’t know why. Unemployment has fallen to 5%, a figure close to estimates of full employment, while inflation remains stuck at less than 1%, well below the Fed’s 2% target. Central bank officials predict inflation will approach their target in 2016. The trouble is they have made the same prediction for the past four years. If the Fed is again fooled, it may find it raised rates too soon, risking recession.

Low inflation—and low prices—sound beneficial but can stall growth in wages and profits. Debts are harder to pay off without inflation shrinking their burden. For central banks, when inflation is very low, so are interest rates, leaving little room to cut rates to spur the economy during downturns. The Fed’s poor record of predicting inflation has set off debate within the central bank over the economic models used by central bank officials. Fed Chairwoman Janet Yellen, in a 31-page September speech on the subject, acknowledged “significant uncertainty” about her prediction that inflation would rise. Conventional models, she said, have become “a subject of controversy.”

Ms. Yellen faces dissent from Fed officials who want to keep interest rates near zero until there is concrete evidence of inflation rising, voices likely to try to put a drag on future rate increases. While the job market is near normal, “I am far less confident about reaching our inflation goal within a reasonable time frame,” Charles Evans, president of the Chicago Fed, said in a speech this month. “Inflation has been too low for too long.” For a generation, economists believed central banks had control over the rate of inflation and could use it as a policy guide: If inflation was too low, then lower interest rates could boost the economy; high inflation could be checked by raising rates.

If the Fed would just listen to Martin Armstrong… (or the Automatic Earth, for that matter) “..lowering interest rates is DEFLATIONARY, not inflationary, for it reduces disposable income.”

• Are Negative Rates Fueling Deflation? (Martin Armstrong)

Those in power never understand markets. They are very myopic in their view of the world. The assumption that lowering interest rates will “stimulate” the economy has NEVER worked, not even once. Nevertheless, they assume they can manipulate society in the Marxist-Keynesian ideal world, but what if they are wrong? By lowering interest rates, they ASSUME they will encourage people to borrow and thus expand the economy. They fail to comprehend that people will borrow only when they BELIEVE there is an opportunity to make money. Additionally, they told people to save for their retirement. Now they want to punish them for doing so by imposing negative interest rates (tax on money) to savings. They do not understand that lowering interest rates, when there is no confidence in the future anyhow, will not encourage people to start businesses and expand the economy.

It wipes out the income of savers and then the only way to make and preserve money becomes ASSET investment, as in the stock market — not creating business startups. So lowering interest rates is DEFLATIONARY, not inflationary, for it reduces disposable income. This is particularly true for the elderly who are forced back to work to compete for jobs, which increases youth unemployment. Since the only way to make money has become ASSET INFLATION, they must withdraw money from banks and buy stocks. Now, they are in the hated class of the “rich” who are seen as the 1% because they are making money when the wage earner loses money as taxation rises and the economy declines. As taxes rise, machines are replacing workers and shrinking the job market, which only fuels more deflation.

Then you have people like Hillary who say they will DOUBLE the minimum wage, which will cause companies to replace even more jobs with machines. Democrats, in particular, are really Marxists. They ignore Keynes who also pointed out that lowering taxes would stimulate the economy. Keynes, in all fairness, did not advocate deficit spending year after year nor never paying off the national debt. Keynes wrote regarding taxes: “Nor should the argument seem strange that taxation may be so high as to defeat its object, and that, given sufficient time to gather the fruits, a reduction of taxation will run a better chance, than an increase, of balancing the budget.” Keynes obviously wanted to make it clear that the tax policy should be guided to the right level as to not discourage income.

Keynes believed that government should strive to maximize income and therefore revenues. Nevertheless, Democrats demonized that as “trickle-down economics.” Keynes explained further: “For to take the opposite view today is to resemble a manufacturer who, running at a loss, decides to raise his price, and when his declining sales increase the loss, wrapping himself in the rectitude of plain arithmetic, decides that prudence requires him to raise the price still more–and who, when at last his account is balanced with nought on both sides, is still found righteously declaring that it would have been the act of a gambler to reduce the price when you were already making a loss.

“There is something in the air like a gigantic static charge, longing for release.”

• Fedpocalypse Now? (Jim Kunstler)

If ever such a thing was, the stage is set this Monday and Tuesday for a rush to the exits in financial markets as the world prepares for the US central bank to take one baby step out of the corner it’s in. Everybody can see Janet Yellen standing naked in that corner — more like a box canyon — and it’s not a pretty sight. Despite her well-broadcasted insistence that the economic skies are blue, storm clouds scud through every realm and quarter. Equities barfed nearly four% just last week, credit is crumbling (nobody wants to lend), junk bonds are tanking (as defaults loom), currencies all around the world are crashing, hedge funds can’t give investors their money back, “liquidity” is AWOL (no buyers for janky securities), commodities are in freefall, oil is going so deep into the sub-basement of value that the industry may never recover, international trade is evaporating, the president is doing everything possible in Syria to start World War Three, and the monster called globalism is lying in its coffin with a stake pointed over its heart.

Folks who didn’t go to cash a month ago must be hyperventilating today. But the mundane truth probably is that events have finally caught up with the structural distortions of a financial world running on illusion. To everything there is a season, turn, turn, turn, and economic winter is finally upon us. All the world ‘round, people borrowed too much to buy stuff and now they’re all borrowed out and stuffed up. Welcome to the successor to the global economy: the yard sale economy, with all the previously-bought stuff going back into circulation on its way to the dump. A generous view of the American predicament might suppose that the unfortunate empire of lies constructed over the last several decades was no more than a desperate attempt to preserve our manifold mis-investments and bad choices.

The odious Trump has made such a splash by pointing to a few of them, for instance, gifting US industrial production to the slave-labor nations, at the expense of American workers not fortunate enough to work in Goldman Sachs’s CDO boiler rooms. Readers know I don’t relish the prospect of Trump in the White House. What I don’t hear anyone asking: is he the best we can come up with under the circumstances? Is there not one decent, capable, eligible adult out there in America who can string two coherent thoughts together that comport with reality? Apparently not.

The Ballad of Narayama. 1983 version is a great movie. Don’t think I ever saw the 1958 one.

• Throwing Out Granny: Abe Wants Elderly Japanese To Move To Countryside (BBG)

Mayor Yukio Takano has a problem. Since 1980, the number of children in his Tokyo ward has halved while the elderly population has doubled – and he’s running out of space to build more nursing homes in the Japanese capital’s most densely populated borough. A possible solution: Relocate his older constituents to the countryside. It’s an audacious idea, and it’s none other than Prime Minister Shinzo Abe who is pushing it. His government sees an exodus of elderly to rural precincts as the best way of coping with Tokyo’s rapidly aging population and shrinking numbers elsewhere. Then again, asking seniors to decamp to the countryside may also be unpopular.

“For sure, people are going to say this is like throwing out your granny, or pushing out people out who don’t want to go, but that’s not the case,” says Takano who is surveying residents of his Toshima ward on such a plan before moving ahead. “Japan is doomed if people in Tokyo can’t co-exist, and we can’t get the countryside reinvigorated.” For many in Japan, the idea of moving seniors to the countryside rekindles the legend of “ubasuteyama,” meaning granny-dumping mountain. Legend has it that old people in ancient times were carried off to the hills and left to die. There’s even a mountain named after the folk story in Nagano, central Japan. Abe put tackling Japan’s declining population at the top of his agenda in September in a revamp of his economic policies known as Abenomics. The government is trying to reverse two unwelcome trends.

A surge in Tokyo’s elderly population over the next 10 years may overwhelm urban healthcare systems; while depopulation and stagnant economies in rural Japan are set to leave nursing homes and hospitals half-empty. Eighty minutes by express train from Takano’s ward is the mountain town of Chichibu where the population has been decreasing since 1975. While the town’s center is lined with shuttered businesses and abandoned buildings, it does have plenty of empty nursing-home beds and underused medical facilities. [..] Japan’s population is set to drop by more than 700,000 a year on average between 2020 and 2030, when a almost third of the population will be 65 or older, according to the National Institute of Population and Social Security Research. At the same time, the government’s ability to extend financial incentives to spur population growth is limited, according to Ishiba, with central government debt at more than double that of GDP.

“It’s the old apocalyptic tale: God’s people versus Satan’s.”

• Absolute Good -Us- vs Absolute Evil -Them- (Crooke)

We all know the narrative in which we (the West) are seized. It is the narrative of the Cold War: America versus the “Evil Empire.” And, as Professor Ira Chernus has written, since we are “human” and somehow they (the USSR or, now, ISIS) plainly are not, we must be their polar opposite in every way. “If they are absolute evil, we must be the absolute opposite. It’s the old apocalyptic tale: God’s people versus Satan’s. It ensures that we never have to admit to any meaningful connection with the enemy.” It is the basis to America’s and Europe’s claim to exceptionalism and leadership. And “buried in the assumption that the enemy is not in any sense human like us, is [an] absolution for whatever hand we may have had in sparking or contributing to evil’s rise and spread.

How could we have fertilized the soil of absolute evil or bear any responsibility for its successes? It’s a basic postulate of wars against evil: God’s people must be innocent,” (and that the evil cannot be mediated, for how can one mediate with evil). Westerners may generally think ourselves to be rationalist and (mostly) secular, but Christian modes of conceptualizing the world still permeate contemporary foreign policy. It is this Cold War narrative of the Reagan era, with its correlates that America simply stared down the Soviet Empire through military and – as importantly – financial “pressures,” whilst making no concessions to the enemy. What is sometimes forgotten, is how the Bush neo-cons gave their “spin” to this narrative for the Middle East by casting Arab national secularists and Ba’athists as the offspring of “Satan”: David Wurmser was advocating in 1996, “expediting the chaotic collapse” of secular-Arab nationalism in general, and Baathism in particular.

He concurred with King Hussein of Jordan that “the phenomenon of Baathism” was, from the very beginning, “an agent of foreign, namely Soviet policy.” Moreover, apart from being agents of socialism, these states opposed Israel, too. So, on the principle that if these were the enemy, then my enemy’s enemy (the kings, Emirs and monarchs of the Middle East) became the Bush neo-cons friends. And they remain such today – however much their interests now diverge from those of the U.S. The problem, as Professor Steve Cohen, the foremost Russia scholar in the U.S., laments, is that it is this narrative which has precluded America from ever concluding any real ability to find a mutually acceptable modus vivendi with Russia – which it sorely needs, if it is ever seriously to tackle the phenomenon of Wahhabist jihadism (or resolve the Syrian conflict).

What is more, the “Cold War narrative” simply does not reflect history, but rather the narrative effaces history: It looses for us the ability to really understand the demonized “calous tyrant” – be it (Russian) President Vladimir Putin or (Ba’athist) President Bashar al-Assad – because we simply ignore the actual history of how that state came to be what it is, and, our part in it becoming what it is. Indeed the state, or its leaders, often are not what we think they are – at all. Cohen explains: “The chance for a durable Washington-Moscow strategic partnership was lost in the 1990 after the Soviet Union ended. Actually it began to be lost earlier, because it was [President Ronald] Reagan and [Soviet leader Mikhail] Gorbachev who gave us the opportunity for a strategic partnership between 1985-89.

Then Turkey will simply have to ask for more billions.

• EU To Offer Turkey No Guarantee On Taking In Refugees (Reuters)

The European Union will set no minimum on the number of Syrian refugees its member states are willing to take from Turkey in a resettlement scheme to be unveiled on Tuesday, a senior EU official said on Monday. The European Commission, the bloc’s executive, will present the proposal following an agreement with Ankara two weeks ago that European leaders hope can help stem the flow of refugees and economic migrants reaching the EU from Turkey via Greece. It will mention no number, the official said, in its plan for deserving cases to be flown directly from Turkey to the EU – an omission that could disappoint Turkish leaders. Nor will there be any system to send them to certain states – rather, EU countries can volunteer to take part in the scheme.

Germany under Chancellor Angela Merkel has led efforts for an EU agreement on taking in substantial numbers of the 2.3 million Syrians now sheltering in Turkey as a way of cutting back on people risking their lives in chaotic migration by sea. But few other states have been so enthusiastic, particularly following bitter rows inside the bloc in recent months caused by a German-backed push to impose mandatory quotas on governments to take in asylum seekers from frontier states Italy and Greece. An agreement among EU states in the summer to take in up to 22,000 refugees, mainly from the Middle East, has yet to become fully operational. The same is true for schemes to relocate up to 160,000 asylum seekers already inside the EU. Some countries argue against more schemes until capacity is reached in others.

They open the door and then close it. Just like that.

• Where The Dream Of Europe Ends (Gill)

Macedonia has shut its borders to all but three nationalities and the backlog has been returned to Athens where they wonder what to do next. Idomeni, the small Greek village that represents the final Greek frontier and the doorway to Europe for refugees fleeing war and poverty in their countries, was strangely empty on Wednesday night. After days of a stalemate when Macedonia closed its border to everyone except refugees from Syria, Afghanistan and Iraq, Greek authorities took measures to transport around 2,000 refugees back to Athens where they will be accommodated at Elaionas camp and, most recently, the Tae Kwon Do stadium, built for when Athens hosted the Olympic games in 2004 and converted into a temporary shelter.

Most refugees arriving in Greece want to move onward, heading through Macedonia mainly towards the promised lands of Germany, the Netherlands or Sweden. When the border shut, a backlog of desperate people became stranded at Idomeni in freezing conditions and with little food and water. These were people mainly from Iran, Pakistan, Eritrea, Sudan and other countries deemed non eligible by the Macedonian authorities. Back in Athens, their time is running out. At Victoria Square in central Athens, brothers Saif Ali, 18 and Ali 15 from Lahore in Pakistan were pondering their next move after reluctantly returning to Athens the previous day. Having wasted their money on an unsuccessful trip to Idomeni, they are currently staying at Elaionas camp, which is now full.

“We knew when we paid to take a bus to Idomeni that the border was closed, but we decided to take the risk. They didn’t let us pass, they beat us with sticks. They sent us back. Our money got wasted. “We were stuck there for five days, it was so cold.” said Saif Ali. “We tried to pass through with everyone else, they check your papers one by one. People had fake papers, and I saw some people borrow the papers of Afghanis, show them to the guards and then slip them back to the owners.”

Crazy.

• EU Backs Housing Scheme For Migrants And Refugees In Greece (AP)

The European Union has pledged to spend €80 million on a housing scheme for migrants and asylum speakers stranded in Greece. Kristalina Georgieva, the EU Commissioner for Budget and Human resources, signed an agreement Monday for a rent subsidy program due to launch next year. Thousands of stranded refugees are currently housed in old venues from the 2004 Olympics or are sleeping in tents pitched in city squares and parks in Athens. More than 750,000 migrants and refugees have crossed through Greece this year, hoping to travel to central and northern Europe, but Macedonia and other Balkan countries last month toughened border rules, restricting crossings to nationals from Syria, Iraq and Afghanistan. Under the scheme, migrants will receive hotel vouchers or checks to live in vacant apartments.

And why not drown some more people.

• Three Of Six Missing Migrants Confirmed Drowned (Kath.)

Greek coast guard officers recovered the bodies of three of the six people who were reported missing after their boat capsized off the coast of Kastelorizo as they tried to reach Greece from Turkey on Tuesday morning. The authorities said three of the passengers were confirmed drowned as the search continued for the other three. Greek coast guards were alerted by their Turkish counterparts after the latter rescued 12 migrants who had managed to swim to a small islet off Turkey’s coast and another five people from the sea. The nationality of the passengers was not clear.

Home › Forums › Debt Rattle December 15 2015