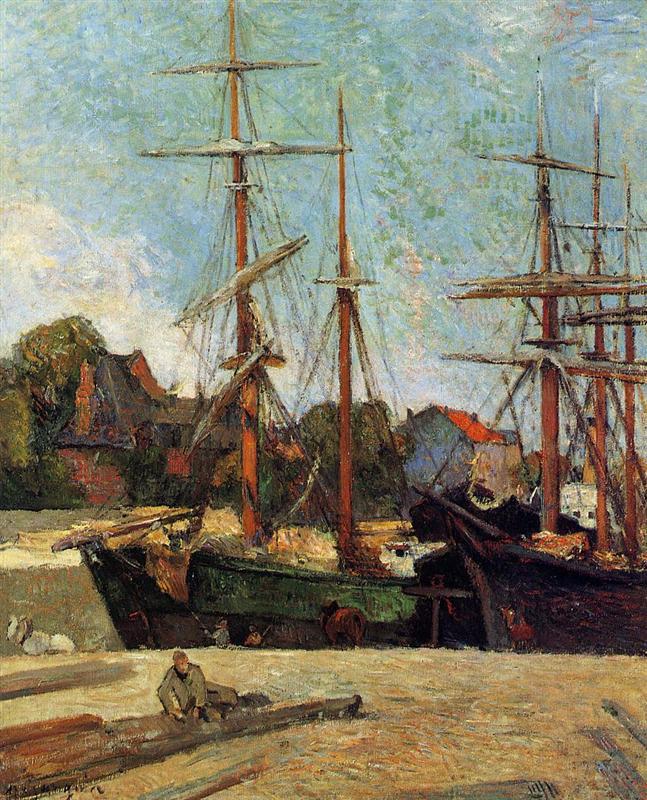

Paul Gauguin Schooner and three masters 1886

Under the seabed

BREAKING: Norwegian robotics company releases first footage of Nordstream pipelines after undersea attack

Over 165ft of the pipeline was destroyed or is now buried under the seabed pic.twitter.com/Nk3EUOlMo7

— ShapiroExposed.com (@JackPosobiec) October 18, 2022

Covid implants

Microchip Implants To Store COVID-19 Passport Data

Source: Forbes Middle East (Youtube) pic.twitter.com/N199vwqkIG— Wittgenstein (@backtolife_2023) October 18, 2022

Kari Lake

Omg pic.twitter.com/lHLWDbRuCI

— ShapiroExposed.com (@JackPosobiec) October 18, 2022

“Ukraine will refuse to negotiate with Russia and fight to return to its 1991 borders..”

Russia will refuse to go back even to 2014.

The US is aiming for forever war.

• American Advisor To Ukraine’s Military Reveals War Goals (RT)

Ukraine will refuse to negotiate with Russia and fight to return to its 1991 borders – established following an independence vote ahead of the collapse of the Soviet Union – according to Dan Rice, an American citizen advising the commander in chief of Kiev’s armed forces. Speaking to CNN’s Erin Burnett for an interview on Tuesday, Rice appealed to Western states for additional arms shipments to Ukraine, adding that while the country desperately needs air defense systems and aircraft, it has no interest in diplomacy with Moscow. “[Russia is] trying, in my opinion, to get to the negotiating table, to try to go back to the 2014 lines,” Rice claimed. “Ukraine won’t have it. Ukraine wants all of their land back, back to the ‘91 lines.”

Ukraine’s 1991 borders would include four formerly Ukrainian provinces – Donetsk, Lugansk, Kherson and Zaporozhye – as well as Crimea, all of which have voted to join the Russian Federation in a series of referendums. Crimea’s was held in 2014 soon after the ‘EuroMaidan’ revolution ousted Ukrainian President Victor Yanukovich, while the other provinces voted to leave Ukraine last month. Despite Rice’s assessment of Moscow’s position, the Kremlin has made clear that it has no intention of reversing the referendums, with Russian President Vladimir Putin recently stating that while he is prepared to negotiate with Kiev, “the choice of the people in Donetsk, Lugansk, Zaporizhzhia and Kherson will not be discussed.”

Russia’s most recent call for negotiations came last week, when Kremlin spokesman Dmitry Peskov suggested Moscow’s goals could be achieved diplomatically and that it remains “open” to talks. However, he added that “it takes two sides to have a dialogue,” saying negotiations are unlikely given the “very, very hostile stance” toward Russia by Ukraine’s Western backers. A US Marine combat veteran and West Point graduate who now runs the consulting firm Thayer Leadership, Rice went on to voice hopes that Poland would provide its “old Russian fighters”to Ukraine in exchange for American F-16 jets, claiming the aircraft are currently “mothballed” and would come at no cost to the US taxpayer.

“The biggest thing they need right now is air defense systems – both missiles and aircraft. We really need the Ukrainian Air Force to be restocked,” he continued. “We [the United States] are putting in a lot of air defenses, they are just getting there though.” Rice was tapped to serve as a special advisor to Valeriy Zaluzhnyi, the commander in chief of the Armed Forces of Ukraine, back in June, reportedly at the general’s “personal invitation.” His own LinkedIn page notes that he works in an “unpaid/voluntary role,” and says he will use his official access to “research the Ukrainian military leader development and learning, and how the culture changed between 2014-2022.”

”Russia formally included the plant in its civilian atomic energy infrastructure earlier this month.”

• Ukraine Tries To Capture Zaporozhye Nuclear Plant (RT)

Kiev launched an amphibious operation against the Russian city of Energodar in Zaporozhye Region, a senior local official has reported. Ukrainian commandos used around 30 speed boats overnight to cross the Dnepr River, targeting the city, Vladimir Rogov said, as cited on Wednesday morning by Russian media. “After artillery shelling of the city, they attempted to land, including to capture the Zaporozhye Nuclear Power Plant. The fighting continued for several hours, at least three or three and a half. The assault was fended off,” he said. Earlier in the day the city administration reported Ukrainian artillery attacks on several key facilities in Energodar, including the city administration building, an access road, and a transformer station crucial for its power supply. The latter was disabled, causing a blackout, the head of the city administration, Aleksandr Volga, said.

Energodar is located in Zaporozhye Region, one of four former Ukrainian regions that voted to become part of Russia last month. Energodar has been under Russian control since March. The Zaporozhye Nuclear Power Plant, the largest facility of its kind in Europe, is located on the shore of the Dnepr just outside the city. The site was the focus of a diplomatic spat between Russia and Ukraine, with both sides accusing each other of attacking it and risking a nuclear disaster. Kiev also claimed that Russia was stationing heavy weapons at the facility, which Moscow denies. Russia formally included the plant in its civilian atomic energy infrastructure earlier this month. The provincial capital, the city of Zaporozhye, remains under Ukrainian control and served as the staging ground for the amphibious operation, according to Rogov.

It takes the Jerusalem Post to report on this. Everyone else has re-defined neo nazis.

• US Lifts Ban On Funding ‘Neo-nazi’ Ukrainian Militia (JPost)

Congress is reported to have recently repealed its ban on a Ukrainian militia accused of being neo-Nazi, opening the way for American military assistance. Last June, Congress passed a resolution intended to block American military funding for Ukraine from being used to provide training or weaponry for the Azov Battalion, an independent unit that had been integrated into the former Soviet Republic’s national guard and was taking part in operations against Russian- backed rebels. Called a “neo-Nazi paramilitary militia” by Congressmen John Conyers Jr. and Ted Yoho, who cosponsored the bipartisan amendment, the battalion has been a source of controversy since its inception.

With the neo-Nazi Wolfsangel symbol on its unit flash – which resembles a black swastika on a yellow background – and founders drawn from the ranks of the paramilitary national socialist group called “Patriot of Ukraine,” the group would have been a fringe phenomenon in any Western nation, but with its army unequipped to face the separatist threat in the east, Kiev actually integrated Azov into its military forces. According to a report in The Nation, the Pentagon lobbied the House Defense Appropriations Committee to remove the Conyers-Yoho amendment from the 2016 defense budget, claiming it was unnecessary as such funding was already prohibited under another law. However, The Nation asserted that the law in question, known as the Leahy Law, only prohibits funding to groups that have “committed a gross violation of human rights,” which would not apply in this case.

The news that the Azov Battalion is now legally able to receive American aid has enraged the Simon Wiesenthal Center, which last week successfully blocked the battalion from holding a recruitment meeting in Nantes, France. “This step is hardly surprising to anyone who has been following the growing danger of Holocaust distortion in post-Communist Europe, and especially in the Baltics, Ukraine and Hungary,” said Wiesenthal Center Jerusalem office head Efraim Zuroff. “In recent years, the United States has purposely ignored the glorification of Nazi collaborators, the granting of financial benefits to those who fought alongside the Nazis, and the systematic promotion of the canard of equivalency between Communist and Nazi crimes by these countries because of various political interests.”

“By refusing to take a balanced approach, the EU is disqualifying itself to be an honest broker on peace negotiations that sooner rather than latter will need to start in the conflict.”

• Europe’s Ultimate Choices On Ukraine (OR)

EU’s decisions in support of Ukraine have purportedly been taken in the name of democracy, the rule of law and western values and against a military action by Russia considered unprovoked and illegal. The EU appears to have been also concerned about the unsettling of post-World War II borders – or rather the national frontiers that followed the end of the Cold War – and has expressed unfounded fears that Russia’s actions in Ukraine are the prelude for further aggression in Europe. Deep down, through its actions against Russia the European leadership psyche seems to have had a cathartic release, unleashing an old Russophobia manifested in Europe over decades if not centuries, melting together Czarist Russia, the Soviet Union and the Russian Federation in an effort to portray and convince the average European about an inherent Russian malignity that needs to be rooted out once and for all.

In its one-sided defence of Ukraine, the EU has been unwilling to recognize and accept the civil war character of the Ukraine conflict, Russia’s legitimate security concerns and its ongoing warnings about it over years, the historical background of a conflict rooted on the mistreatment of Ukraine’s Russian-speaking population that worsened since the US sponsored Ukraine coup in 2014 and its failure to support a diplomatic settlement in 2015 – i.e. the Minsk agreements -, in which they played a mayor facilitating role. The EU ignores the deep flaws of the current Ukraine government and the society it has tried to create, both defined now by blatant corruption, political persecution of opposition and an ultra-nationalist ideology, all this hardly reflecting so-called European values.

Sadly, the EU has been incapable to develop an autonomous and justly self-serving European alternative in the conflict and has become hostage of the US hegemonistic agenda. By refusing to take a balanced approach, the EU is disqualifying itself to be an honest broker on peace negotiations that sooner rather than latter will need to start in the conflict. Non-European countries like Turkey and Saudi Arabia are now taking the lead, reflected for instance in the recent Russo-Ukrainian prisoner exchange, a prominent role unthinkable only a few months ago which is embarrassing for Europe given its traditional place in diplomacy.

“It just saddens me to see death and destruction with no apparent end date or opportunity for resolution.”

• Bill Ackman Proposes Peace Plan For Ukraine And Russia (RT)

Ukraine should recognize Crimea as part of Russia and renounce its bid to join NATO for the sake of peace, US billionaire hedge fund manager Bill Ackman has said. Just like SpaceX and Tesla CEO Elon Musk before him, Ackman was immediately criticized online for suggesting that Kiev should be ready to make concessions in order to end the hostilities. “Crimea was part of Russia until 1954 and is largely comprised of ethnic Russians, which was apparently why the world did little when Russia annexed it back in 2014,” Ackman, the CEO of Pershing Square Capital Management, tweeted on Monday. He added that the borders should return to where they were prior to February 24, when Russia launched its military operation in the neighboring country and before four former Ukrainian regions voted to join Russia.

He added that the West should then help Kiev with its recovery, while the country should stay outside of NATO. “Thousands of lives will be saved and resources can be invested to rebuild [Ukraine] rather than in a war that will only lead to more destruction and death,” the billionaire wrote. “If there is a viable path to peace, we should pursue it. Each day the conflict continues, the risk to the world rises.” After receiving criticism online, Ackman clarified his stance on Tuesday. “Yesterday, I suggested that a reasonable peace settlement might be a return to the borders as of [February 24], a Marshall Plan to rebuild [Ukraine], and [Ukraine’s] decision to not join NATO. Then the knives came out. I was accused of being an appeaser and worse,” he wrote.

I ask: is [Ukraine] better off in a continued prolonged war that leads to 1,000s more [Ukrainian] deaths and the leveling of the country or does some kind of negotiated settlement make sense? … I am by no means an expert. It just saddens me to see death and destruction with no apparent end date or opportunity for resolution. “In a negotiated settlement, both parties must concede something or there is no opportunity for resolution. What is the least that both parties can concede that is acceptable for both? What am I missing in my analysis? What better ideas do you have?” Ackman argued.

Ackman’s comments came as more public figures in the West have been making suggestions for a possible peace deal between Russia and Ukraine. Venture capitalist and tech entrepreneur David Sacks tweeted on Sunday that the US should propose a ceasefire based on the February 23 lines and guarantee that Ukraine will not join NATO. Musk offered his own vision of a peace settlement this month, which includes Ukraine recognizing Crimea as Russian territory. Kiev and Western officials quickly blasted Musk for what they considered to be a plan that heavily favors Moscow.

“..while most of the US and NATO forces are a sad joke, the US nuclear triad and the USN’s submarine force are both still world class and extremely dangerous and capable..”

• A Few Updates About The NATO Crusade Against Russia (Saker)

What we are seeing is the creation of two parts of our planet: the AngloZionist Hegemony (in which only the USA and Israel have agency, the rest are colonies, occupied countries, volunteer slaves, etc.) and the Multipolar Free World. While the two blocks are not technically at war with each other, in reality they already very much are. Russia and Iran are bearing most of the military burden while other free countries quietly try to either stay out and keep a low profile or, even more quietly, assist China and rest of the Multipolar Free World to prevail economically. Of course, the AngloZionist Hegemony is using every means it has to subvert not only Russia, but also China, Iran and any other country daring to declare even a modicum of sovereignty.

The eventual and inevitable outcome of this confrontation is not in doubt, at least not to those who are aware of reality. It is not the outcome which I fear (in fact I await it with great anticipation!) but the potentially enormous costs of defeating the West’s last Crusade (last time Russia lost 27 million people, most of them innocent civilians, and that did not even do the full job – hence today’s war). I will never stop repeating that while most of the US and NATO forces are a sad joke, the US nuclear triad and the USN’s submarine force are both still world class and extremely dangerous and capable (and US SSNs come with not only anti-submarine and anti-surface capabilities, but also with land-attack missiles).

This is why it is absolutely crucial for Russia to turn up the pain dial steadily but SLOWLY. Those dimwits who constantly advocate for “firm Russian actions” and simply “hit them hard!” are clueless civilians from countries who never won a real war adn who have no idea whatsoever about modern warfare or about the immense risks their warmongering hysterics create for our entire planet. I can sincerely say that I thank God that Putin is a very careful type who fully understands that there are no “quickfix solutions” to denazifying and demilitarizing the AngloZionist Hegemony. And yes, Russia will continue to unilaterally and gradually rotating up the pain dial, and Russia will do so without feeling the need to seek approval from those who have never won a war but who believe that wars are won by “showing toughness”.

Ursula counts on your gullibility. Just look at this nonsense: “the market has really changed, from a pipeline gas market to a LNG market.”

The EU has cut itself off from pipeline gas. Now all it has is LNG. But that hasn’t changed “the market”, only the EU.

And now the US is talking about a export ban….

• Europe Compensated All Gas Volumes Cut By Russia – Ursula Von Der Leyen (Az.)

Compared to September 2021, in September 2022, Russia has cut 80 percent of its pipeline gas supplies, said President of the European Commission Ursula von der Leyen at the European Parliament Plenary on the preparation of the European Council meeting of 20-21 October 2022, according to the Commission. “But Europe has been able to compensate all that. We have diversified towards our trusted partners, like for example Norway and the United States. We have increased the savings. And it is good, we achieved in September a reduction of 15 percent. We have filled our storages up to 92 percent. We did not give in to this blackmail. We made it. And I think we can be proud of that. We resisted. That is important. But we also see that resisting Russian energy coercion comes at a price. European families have seen their gas bills skyrocketing. And our companies are struggling to keep up competitiveness. It is not only about the competitiveness in the Single Market – that is also important. But it is also about the global competitiveness that our companies are fighting for,” she said.

Ursula von der Leyen recalled that in March, the Commission proposed to the Council the option to cap gas prices. “At that time, this did not gain any traction. But today, we are coming back to this. So what is the model? The current benchmark determining gas prices is TTF. TTF is only focused on pipeline gas. What we see now is that the market has really changed, from a pipeline gas market to a LNG market. So we need a new, a specific price benchmark for LNG. The Commission will now develop this complementary benchmark together with the European regulator. But this takes time. So in the meantime, as a stop-gap measure, we will limit prices at TTF. We call this the market correction mechanism. Yesterday, we proposed guiding principles as a first step. On this basis, we will prepare the operational mechanism in a second step. This is concerning the price cap at wholesale level,” she said.

“According to von der Leyen, the EU has managed to reduce its “huge dependency on Russian gas” by two thirds in eight months..”

• EU Countries Urged To Share Gas (RT)

European Commission (EC) President Ursula von der Leyen has called on EU member states to jointly purchase gas in order to avoid competition that could push prices even higher. “Instead of outbidding each other, Europeans should buy gas together. For this, we will purchase together gas at {the} EU level… We do this because we have learnt the lesson. We literally saw in August, at the height of the filling season, how member states were outbidding each other and prices were spiking. We definitely can be smarter than this. So pooling our demand is a must,” Leyen said on Wednesday at the European Parliament session in Strasbourg. Her comments come a day after the EC announced a new emergency package of measures aimed at lowering gas prices and ensuring the EU’s winter energy supply.

Joint gas purchases are part of the plan, as is the introduction of binding “default rules” for member states to share gas in the case of an emergency. “We know that some member states are more directly exposed than others to Russian gas. The situation is especially challenging for landlocked countries in Central Europe. But in the end, in our single market with highly integrated supply chains, a disruption in one member state has a massive impact on all member states. So, sharing gas in a crisis is critical,” she stated. According to von der Leyen, the EU has managed to reduce its “huge dependency on Russian gas” by two thirds in eight months, and also to diversify supplies. However, she noted that this has come “at a high price” and urged the bloc to invest in “home-grown sources of energy” in order to maintain competitiveness.

“Hungary has a long-term contract for gas supplies with Russia’s Gazprom, and the country “is guaranteed to receive 4.5 billion cubic meters of natural gas a year from Russia.”

• Hungary Opposes ‘Dangerous’ EU Gas Plan (RT)

The European Commission’s proposal on joint gas purchases by EU member states is a risky move, Hungary’s Foreign Minister Peter Szijjarto warned on Wednesday. “The European Commission’s proposal is unsuitable and even dangerous… threatens to further cut gas supplies to Europe,” he stated in a video address posted to his Facebook page. The minister urged Hungary not to accept the “risky” proposal, which could only lead to a drop in supplies and an increase in energy prices. He stressed once more that Hungary opposes another “dangerous” notion – a price cap on Russian gas, which “would mean that the Russians would stop supplying natural gas to Europe.”

“According to simple economic principles, if we increase the quantity of a given product in a market, its price will decrease, but if we decrease the quantity of the product, the price will increase. Therefore, the amount of natural gas on the European market should be increased. It would be necessary for as much natural gas as possible to arrive in Europe from as many sources as possible,” he added. The minister said that Hungarian gas storages are currently 50% full, which means that the country has enough gas reserves for six months. He called this an “outstanding” result compared with other EU countries. Reuters, citing Aurora Energy Research analysts, recently reported that even a 100% gas storage level would only sustain the bloc for about three months.

Hungary has a long-term contract for gas supplies with Russia’s Gazprom, and the country “is guaranteed to receive 4.5 billion cubic meters of natural gas a year from Russia.” Also, at the end of August Hungary signed an additional two-month contract for the supply of up to 5.8 million cubic meters of Russian gas per day starting on September 1.

“You just don’t have enough volume to bring [in] to replace that gas for the long term, unless you’re saying ‘I’m going to be building huge nuclear [plants], I’m going to allow coal, I’m going to burn fuel oils’”

• Europe To Face Worse Gas Crisis In 2023 – Qatar (RT)

Europe is facing a shortage of natural gas over the next several years due to the break-up of trade with Russia, the energy minister of Qatar, a leading global exporter of liquefied natural gas (LNG), has said. Replacing all Russian gas with other sources doesn’t seem like a viable strategy, Saad al-Kaabi told the Financial Times in an interview published on Tuesday. If “zero Russian gas” flowed in to the EU, as Brussels intends, “I think the problem is going to be huge and for a very long time,” he said. “You just don’t have enough volume to bring [in] to replace that gas for the long term, unless you’re saying ‘I’m going to be building huge nuclear [plants], I’m going to allow coal, I’m going to burn fuel oils’,” the minister explained. The EU leadership prides itself on having reduced the share of Russian gas in the bloc’s mix from some 40% to just 7.5% in seven months.

Brussels hopes to massively ramp up supplies of LNG and increase piped imports from Norway and Algeria to fully eliminate reliance on Russian energy. The surge in demand from Europe is meeting some resistance from traditional markets for LNG in Asia. China has reportedly ordered its state importer not to re-export excess gas due to concerns over a possible deficit in the winter. Kaabi warned in the interview that while European nations had accumulated enough gas in storage facilities to make it through the upcoming winter relatively unscathed, there is no certainty that this will be the case in future seasons. The energy crisis may be “much worse next year,” unless Russian gas is imported, he said. “This coming winter, because of the storage capacity being full, it’s fine,” the Qatari official stated.

“It’s really replenishing the reserves, or the storage, for next year that’s going to be the issue.” Next year and the following year, even up to 2025, are going to be the issue. Commenting on the challenges that the Europeans are having in securing supplies from his nation, the minister said Doha was concerned about losing the EU market in the future because of its larger goal of moving away from fossil fuels. Europe needs to “get off the discussion that gas is not needed for a long time,” he suggested, “because everybody who’s going to invest in the gas sector, they’re looking at 25, 30, 40-year horizons to invest and to get reasonable returns on the investments.” QatarEnergy, the state-owned company that Kaabi also heads, prefers long-term contracts for 15-20 years in foreign trade.

Love good history lessons.

• Ukraine’s Most Nationalist Region Once A Pro-Russian Hotbed (Plotnikov)

“In the last decade of the 19th century, despite all its own difficulties in terms of national and economic life, Galicia became the center of the Ukrainian movement. In Russia’s Ukrainian lands, it played the role of a cultural arsenal with respect to Russia’s Ukrainian lands, where the means to bring about a cultural and socio-political revival of the Ukrainian people were created and improved,” Mikhail Grushevsky, a historian who was one of the first ideologists of Ukrainian nationalism, wrote in an article entitled Ukrainian Piedmont, back in 1906. Today, it is difficult to dispute his assertions. During the 20th century, western Ukraine, which Galicia is part of, was the main center of Ukrainian identity and the engine driving Ukrainization in the rest of the country’s regions.

But the history of the Galician lands does not begin at the end of the 19th century. It has roots in the deep past, tracing back to the very origins of Russia. After the first partition of the Polish-Lithuanian Commonwealth in 1772, Galicia came under the rule of Austria. Vienna needed to build an administrative system for the region, most of which was inhabited by Slavs. To do this, the Austrian authorities skillfully played on the incongruities between the Catholic Polish population (mainly townspeople and nobles) and the Orthodox peasantry. Seeing the latter as possible agents of Russian influence, a campaign was launched to Polonize them.

The effect, however, turned out to be exactly the opposite. Galician Russophilism was born amidst the Polonization drive in the first half to the middle of the 19th century, when Poles played the dominant role in the cultural and social life of the region. The local Rusyn population gave up hope of finding a way to integrate into the Austrian Empire without losing their traditions and culture, so they began to look for new meaning in the East. Moreover, in the period between the Congress of Vienna (1814-1815) and the Crimean War (1853-1856), Russia really was the hegemon of continental Europe. Austria itself called on Russian troops to help suppress a Hungarian uprising. For the Rusyns, the power of the neighboring empire was obvious, and they perceived Russia as a place where they could occupy a privileged position as part of the national majority, and not be second-class subjects.

Lending a whole new meaning to the term ‘conflict of interest’.

“..assisting them with potential business deals and investments while Joe Biden was Vice President; however, that work remained intentionally uncompensated while Joe Biden was Vice President..”

• Biden Family Got $5 Million Interest-free, Forgivable Loan From China (JTN)

President Joe Biden has made waves this fall with his plan to forgive hundreds of billions of dollars of student loans, shifting the burden to taxpayers. Five years earlier, his family cashed in on a zero-interest, forgivable loan of its own from an energy company in communist China, according to evidence in the possession of the FBI. The loan arrangement, confirmed in documents obtained by Just the News and also new information released by Sen. Charles Grassley (R-Iowa), shows the Chinese energy firm CEFC Beijing International Energy Company Limited understood the transaction would benefit Joe Biden’s family (referred to as “BD family” in the emails), but it also was creating heartburn with its own compliance/risk management officers.

The Chinese company’s leaders “fully support the framework of establishing the JV (joint venture), based on their trust on BD family,” stated a July 26, 2017 email from a CEFC official to Tony Bobulinski, a Hunter Biden business partner at the time. The email was written in part to explain why there had been a delay in getting the money to a firm called SinoHawk associated with the future president’s son and brother, Hunter Biden and James Biden, respectively. “The delay of wire is caused by the details on the JV building, as follows: 1) the positioning and strategy of the JV are not made fully clear to CEFC 2) 5 million is lent to BD family in the 10 million charter capital. How will this 5 million be used (or the 10 million as a whole)? This 5 million loan to BD family is interest-free,” the email stated.

“But if the 5 M is used up, should CEFC keep lending more to the family?” the email inquired. “If CEFC lends more, they need to know the interest rate for the subsequent loan(s).” The CEFC official went on to explain the nebulous transaction was raising worries with the company’s compliance officers. “Because of the reasons above, the risk management department of CEFC is showing concerns on the operation of SinoHawk, hence the delay of the wire,” CEFC’s Raymond Zhao wrote. At the time of the transaction, Joe Biden had already left the White House as vice president, was a private citizen and was planning for his eventual 2020 presidential run. Bobulinski has said in media interviews that Joe Biden was a silent partner in the Chinese transaction, identified in internal documents as “the big guy” who might get 10% of the deal.

Grassley on Monday released a letter he sent to the FBI that contained a summary of an October 2020 interview Bobulinski gave to the FBI concerning the Chinese loan transaction. According to Grassley, the $5 million Chinese transaction was paid to a Hunter Biden-connected firm in August 2017, one month after the email obtained by Just the News. Bobulinski told the FBI that some of the Chinese money paid in 2017 was actually deferred compensation for work Hunter and James Biden had done while Joe Biden was still vice president, Grassley wrote. Grassley and Sen. Ron Johnson previously have said some $6 million paid in spring 2017 was appeared to be for pre-2017 work.

“..gas power stations are doing the heavy lifting of grid balancing and wind backup. It wasn’t cheap before the war in Ukraine and it’s not cheap now.”

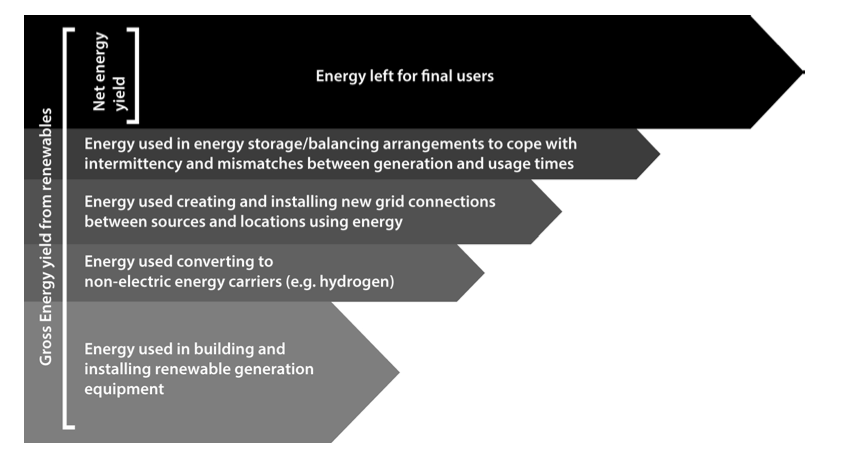

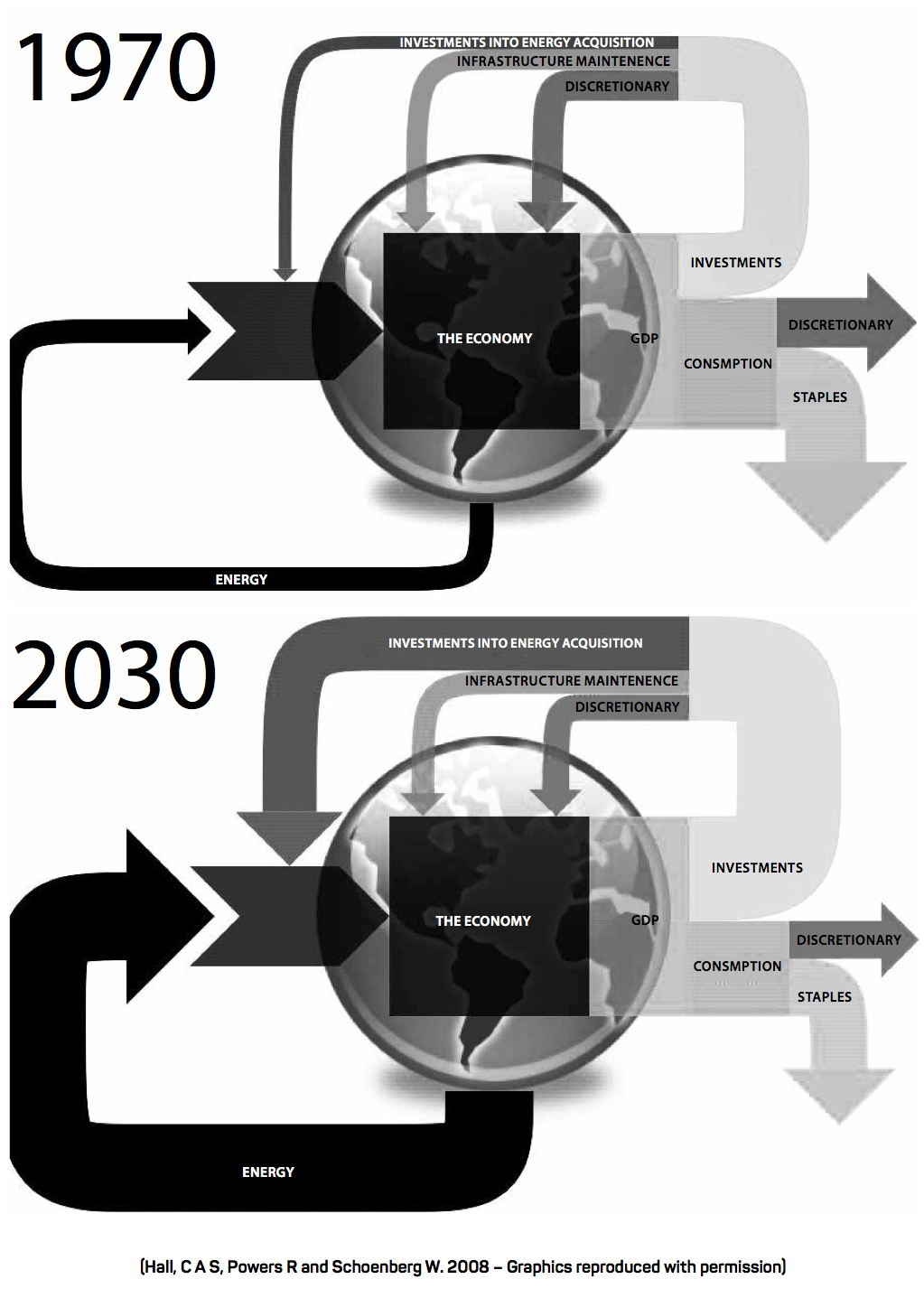

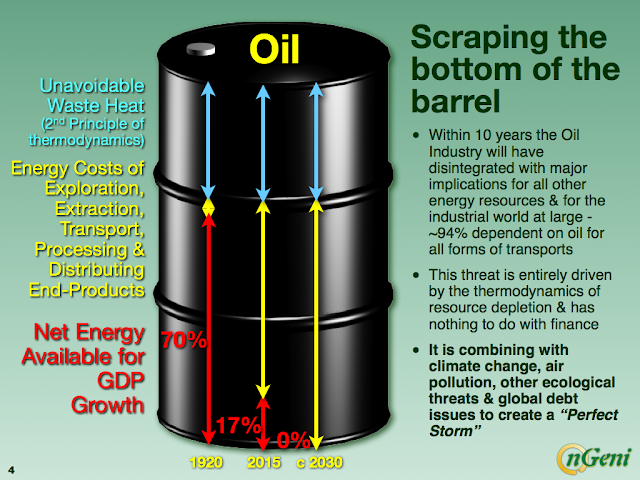

• Net Zero: Doubling Down On Stupid (TT)

Most of my thinking lately dwells on the impossibility of Net Zero. Green energy lobbyists have ramped up the propaganda in recent months, doing all they can to obscure the reality of Net Zero. There are now endless debates as to the true cost of wind energy. Carbon Brief is pushing the line that wind energy is “nine times cheaper”. Andrew Montford of Net Zero Watch has a crack at this dodgy number. Montford’s analysis is often quite good. Personally I think the argument needs to be reframed. Costing energy is an imprecise science because it’s fraught with complexity. The slam dunk argument against wind energy is when we frame it as intermittent versus dispatchable energy. I argue that the cost of building and operating windmills is not a standalone figure.

We must also consider the cost of grid balancing and the various energy storage technologies. Energy storage is in its infancy. It is not cheap. It is not going to get cheaper any time soon. In all probability it’s going to remain a pricey affair for decades to come. There will be shortages of lithium and battery grade nickel in the next five to ten years, leading to production and supply chain problems. In the interim gas power stations are doing the heavy lifting of grid balancing and wind backup. It wasn’t cheap before the war in Ukraine and it’s not cheap now. Moreover, as we’ve dismantled our conventional power generation, we’ve lost a great deal of spinning reserve for short term grid balancing so we’re now having to build standalone flywheels – simulating the spinning metal mass of a power station turbine.

The demonstrator is set to cost £25m. The more intermittent energy we add the more it destabilises the grid so we could end up needing dozens of these contraptions. Elsewhere the renewables sector is looking at conversion of surplus wind energy (at times of low demand) into hydrogen which would then be piped to gas stations and converted into methane. Again, this is not past the demonstrator phase, so we have no real world data on costs and conversion losses. One analysis has it that the technology to convert power to hydrogen and back to power has a round-trip efficiency of 18%-46%, In comparison, two mature long-duration technologies, pumped-storage hydropower and compressed air energy storage, boast round-trip efficiencies of 70%-85% and 42%-67%, respectively.

A more technical paper, assessing German research, concludes that the balancing of fluctuations of renewable energy though green hydrogen seems feasible only up to a level of several GWh per day. “However, the German government’s idea of replacing a significant share of conventionally produced electric energy in the order of TWh with hydrogen does not stand up to scientific analysis”. In short, there is no current cost effective technology capable of mitigating intermittency caused by wind and solar.

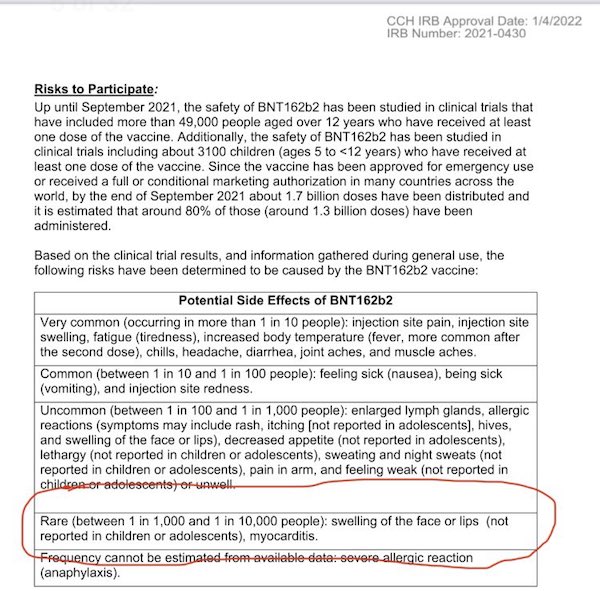

“The CDC panel voted 15-0 to add the Covid “vaccinations” to the Vaccines For Children program. Tomorrow they vote to move to the childhood schedule. ”

• Ladapo Dismisses CDC Adding COVID Vaccine to Childhood Schedule (FV)

Amidst the Center for Disease Control and Prevention’s (CDC) upcoming vote to add the COVID-19 vaccine to the Vaccine for Kids program along with being on the childhood vaccine schedule, Florida Surgeon General Joseph Ladapo declared any decision will have minimal, if any, impact on the Sunshine State. The CDC is set to meet with the Advisory Committee on Immunization Practices (ACIP) to vote. “Regardless of what [CDC] votes [Wednesday] on whether COVID-19 vax are added to routine child immunizations – nothing changes in FL,” Ladapo declared. “Thanks to [Gov. Ron DeSantis], COVID mandates are NOT allowed in FL, NOT pushed into schools, & I continue to recommend against them for healthy kids.

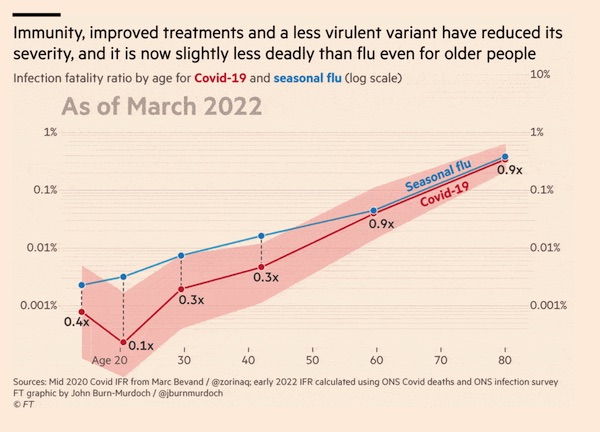

Ladapo recently recommended against men aged 18-39 receiving the mRNA COVID vaccines, citing a rise in cardiac risk to the tune of 84%. “Results from the stratified analysis for cardiac-related death following vaccination suggests mRNA vaccination may be driving the increased risk in males, especially among males aged 18 – 39,” the review from the Florida Department of Health says. “As such, the State Surgeon General recommends against males aged 18 to 39 from receiving mRNA COVID-19 vaccines. Those with preexisting cardiac conditions, such as myocarditis and pericarditis, should take particular caution when making this decision,” Ladapo’s office announced.

“Studying the safety and efficacy of any medications, including vaccines, is an important component of public health,” Ladapo said. “Far less attention has been paid to safety and the concerns of many individuals have been dismissed – these are important findings that should be communicated to Floridians.” Shortly after the surgeon general tweeted the announcement, Twitter blocked users from seeing it before restoring it. Ladapo took to social media Monday morning to combat critics and skeptics of the new release. “I love the discussion that we’ve stimulated. Isn’t it great when we discuss science transparently instead of trying to cancel one another?” he said. “I’m going to respond to the more substantive critiques.”

Tucker CDC

The CDC complained about our segment on the Covid vaccine being required for kids to attend school. We stand by what we said. Here's our response. https://t.co/R5DqVkzef4 pic.twitter.com/y2srvIgAHf

— Tucker Carlson (@TuckerCarlson) October 20, 2022

Only the state can mandate. But most will follow the CDC criminals.

• Ladapo: mRNA COVID-19 Vaccines Shouldn’t Be Given to Young Men (ET)

Studies and other data show that the Moderna and Pfizer COVID-19 vaccines should not be given to young men, Florida’s surgeon general says. Florida health officials recently analyzed data on vaccinated state residents and detected a sharp increase in heart-related deaths among males aged 18 to 39 after vaccination. The state is now recommending that population, with exceptions, should not get one of the messenger RNA (mRNA) vaccines. “In young men, from 18 to 39, it clearly was a signal for increased risk,” Florida Surgeon General Dr. Joseph Ladapo told EpochTV’s “American Thought Leaders” program. “That was the main finding.” [..]

Taken together with other research that has found young vaccinated males experiencing heart inflammation at higher rates than unvaccinated young males—including studies from Scandinavia, England, and the United States—Florida officials decided to issue the new recommendation, which contradicts guidance from the U.S. Centers for Disease Control and Prevention (CDC). “There are a number of studies that are indicating that these vaccines, mRNA COVID-19 vaccines, increase the risk of adverse cardiovascular and cardiac events. And we just added to that with another one,” Ladapo said.

“While our study is not definitive—and we never claimed it was—the fact that there is so much evidence that is consistent with our findings very obviously means that you need to consider whether doing … COVID-19, mRNA COVID-19 vaccinations, including them in a strategy, a public health strategy for young men at this point in the pandemic, makes sense. … It doesn’t make any sense. And obviously, should not be giving mRNA COVID-19 vaccines to young men at this point in the pandemic,” he added later. The official statement communicating the updated Florida guidance says that the benefit of vaccination for young males is likely outweighed by the “abnormally high risk of cardiac-related death.” It noted that the other available COVID-19 vaccines were not linked with the risk.

Baby Bear Tree

Saturn the Moon Jupiter and its moons

Reindeer cyclone

A hypnotic video from the Murmansk region in the village of Lovozero. By creating a cyclone, Reindeer make it impossible for predators to target individuals. Video by Lev Fedoseyev. pic.twitter.com/qDU3fed2Mv

— Fascinating (@fasc1nate) October 19, 2022

Fever

A group of rays is called a fever.

via alexkyddphoto/igpic.twitter.com/Uc2miuOLs9

— Wonder of Science (@wonderofscience) October 19, 2022

Support the Automatic Earth in virustime with Paypal, Bitcoin and Patreon.