NPC Shoomaker’s saloon at 1311 E Street N.W. Washington DC 1917

All growth is being exposed as debt. Don’t know that it’s wise to claim that it’s oil whodunnit.

• Oil Market Spiral Threatens To Prick Global Debt Bubble, Warns BIS (AEP)

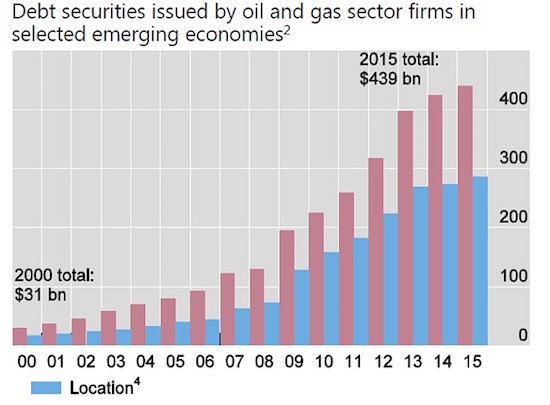

The global oil industry is caught in a self-feeding downward spiral as falling prices cause producers to boost output even further in a scramble to service $3 trillion of dollar debt, the world’s top watchdog has warned. The Bank for International Settlements fears that a perverse dynamic is at work where energy companies in Brazil, Russia, China and parts of the US shale belt are increasing production in defiance of normal market logic, leading to a bad “feedback-loop” that is sucking the whole sector into a destructive vortex. “Lower prices have not removed excess capacity from the market, but instead may have exacerbated it. Production has been ramped up, rather than curtailed,” said Jaime Caruana, the general manager of the Swiss-based club for central bankers.

The findings raise serious questions about the strategy of Saudi Arabia and the core Opec states as they flood the global crude market to knock out rivals in a cut-throat battle for export share. The process of attrition may take far longer and do more damage than originally supposed. Oil exporters are embracing austerity and slashing government spending, leading to a form of fiscal tightening that is slowing the global economy. Speaking at the London School of Economics, Mr Caruana said the sheer scale of leverage in the oil and gas industry is amplifying the downturn since companies are attempting to eke out extra production to stay afloat. The risk spreads on high-yield energy bonds have jumped from 330 basis points to 1,600 over the past 18 months, amplifying the effects of the oil price crash itself.

The industry has issued $1.4 trillion of bonds and taken out a further $1.6 trillion in syndicated loans, driving up the combined energy debt threefold to $3 trillion in less than a decade. While US shale frackers hog the limelight in the Anglo-Saxon press, many of these energy groups are giant “parastatals”, such as Rosneft, Petrobras or CNOOC. The BIS said state-owned oil companies increased debt at annual rate of 13pc in Russia, 25pc in Brazil and 31pc in China between 2006 and 2014, much it in the form of dollar debt through offshore subsidiaries. These oil companies do not respond to pure market pressures since they are cash cows for government budgets. The nexus of oil and gas debt is just one part of an over-stretched financial system, increasingly exposed to the dangers of a “maturing financial cycle” and to punishing moves in the global currency markets.

Mr Caruana said an “illusion of sustainability” has blinded borrowers and debtors, lulling them into a false of security when credit was easy and asset prices were rising. This illusion can die in the blink of an eye. “The turning of the financial cycle can be quite abrupt,” he said. The BIS calculates that debt in US dollars outside the United States has surged to $9.8 trillion, a fivefold rise since 2000 and an unprecedented level for the global monetary system as a whole. While some of this dollar debt is matched by dollar assets and dollar earnings, a big chunk has been used to play the local property markets of east Asia, Latin America or eastern Europe, and another chunk has been gobbled up by “non-tradable” sectors that have no natural currency hedge if it all goes wrong. [..] The BIS seems to be telling us that reckoning can still be orderly if we face up to reality, or end in a chaotic wave of defaults if we do not. Either way, the debt must clear.

All banks.

• Gundlach Says Financials Below Crisis Prices ‘Frightening’ (BBG)

DoubleLine Capital’s Jeffrey Gundlach said it’s “frightening” to see major financial stocks trading at prices below their financial crisis levels. He cited Deutsche Bank and Credit Suisse as examples in a talk outlining bearish views at a conference in Beverly Hills, California, on Friday. Both banks fell this week to their lowest levels since the early 1990s in European trading. “We see the price of major financial stocks, particularly in Europe, which are truly frightening,” Gundlach said. “Do you know that Credit Suisse, which is a powerhouse bank, their stock price is lower than it was in the depths of the financial crisis in 2009? Do you know that Deutsche Bank is at a lower price today than it was in 2009 when we were talking about the potential implosion of the entire global banking system?”

The manager of the $54.7 billion DoubleLine Total Return Bond Fund said the dollar is headed lower in 2016 and that he’s buying non-U.S. currencies for the first time in five years. The euro is likely to strengthen against the greenback as the probability that the Federal Reserve will increase borrowing costs at its March meeting is virtually zero, and only 50% for the rest of the year, he told the Tiger 21 conference for high-net-worth investors. Gundlach, 56, said he’s considering buying corporate bonds later this year as prices continue to fall, including investing his personal money. “The whole question for me is when am I going to buy enormous amounts of corporate credit, because it’s crystal clear that that’s the next opportunity that’s out there,” Gundlach said. “There’s plenty of things out there that will have 100% returns. It’s a whole question of: Don’t tell me what to buy, tell me when to buy it.”

Debt related to energy and mining is still very risky, because of weakness in China’s economy and a worldwide oil glut, he said. “There’s simply no bullish case for oil right now,” Gundlach said. While he’s considering buying corporate debt, Gundlach said he’s moving away from municipal bonds, which have become overpriced. Puerto Rican general obligation bonds, which are priced for a haircut, are an exception, he said. The possibility for a workout is high because of the large number of Puerto Ricans in Florida, which is a key battleground state in this year’s presidential election, Gundlach said. “My guess is if you get defaulted on, you’re probably going to get something like 70 cents anyway,” he said.

So are losses.

• Global Financial System Risk Is Soaring Worldwide (ZH)

We warned earlier in the week that the credit risk of the world's financial institutions were on the rise and that trend has worsened as the week ends.

Global Bank Risk is spiking…

European Bank Risk is blowing out in Core and Peripheral nations…

And China Bank credit risk has broken to new cycle highs..

Some idiocysncratic names to keep an eye on…

Deutsche Bank – Europe's largest derivatives exposure (and thus epicenter of collapse should things turn out as bad as the bank's CoCos suggest) – is suffering seriously… It is becoming very clear that banks are buying protection on DB to hedge their counterparty exposure…

ICBC Bank is among China's largest banks (depending on the volatility of the day) and as China bank risk soars so China's sovereign risk is soaring too with devaluation and systemic crisis co-priced into these contracts…

National Commercial Bank – the largest Saudi bank and proxy for The Kingdom's wealth – is seeing its credit risk explode. As one analyst noted, if NCB has a crisis then Saudi military adventurism is in grave jeopardy…

And finally – yes it is spilling over to American banks and their "fortress" balance sheets…

But apart from that "storm in a teacup" – Buy The F**king Dip, right?

Just one example.

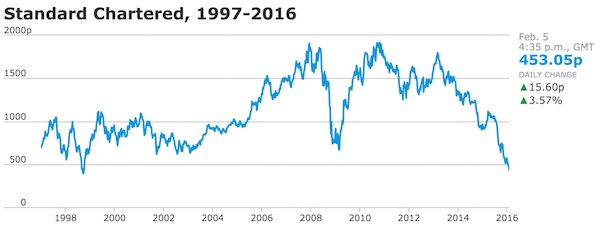

• Standard Chartered Down 57%, Returns to 1998 (WSJ)

Standard Chartered’s share price has fallen over 20% this year, reaching depths last seen in 1998, in the midst of the Asian economic crisis. The problems the bank faced back then are much the same as they are now. Back in 1997, StanChart’s share price was soaring. But following a crisis of confidence in Asia’s economy, the bank’s stock had collapsed 60% a year later. It was also still suffering from a tarnished reputation, after it was banned for a year from the Hong Kong IPO market in 1994 for creating a false market for shares. The board turned to a former senior banker from a Wall Street giant to solve its problems. Rana Talwar, a senior banker at Citigroup, was appointed head of StanChart in June 1998, a year after joining from the US bank. Talwar quickly set about re-organising the bank’s focus – binning unwanted regions (such as its British consumer finance arm) and concentrating on Asia via a series of acquisitions.

He also looked to refocus the investment bank, focusing in currency dealing, corporate banking and cash management, and eventually making some strategic deals in Asia. Fast forward almost 20 years, and new chief executive Bill Winters – an ex-JP Morgan banker – is also trying extract StanChart from a period of underperformance driven by a sputtering Asian economy, and ongoing run-ins with regulators. A new strategy is also underway, with a move toward retail, private banking and wealth management, cutting back on higher-risk corporate business and some investment banking units, such as equity capital markets. But investors have continued to sell the stock.Under Talwar, StanChart’s share price rebounded, as China’s economy kicked into overdrive. Today, while Standard Chartered’s share price continues to drop, Winters will be keen that China’s economy finds a second wind.

56.97%

The amount Standard Chartered share price has dropped since Winters joined in May 2015

Omen.

• US Exports Fell In 2015 For First Time Since Recession (AP)

The U.S. trade deficit rose in December as American exports fell for a third straight month, reflecting the pressures of a stronger dollar and spreading global weakness. Those factors contributed to the first annual drop in U.S. export sales since the Great Recession shrank global trade six years ago. The December deficit increased 2.7% to $43.4 billion, the Commerce Department reported Friday. Exports fell by 0.3%, driven by sales declines of civilian aircraft, autos and farm products. Imports increased 0.3% as Americans bought more foreign-made cars and petroleum. For all of 2015, the deficit rose 4.6% to $531.5 billion. Exports fell 4.8%, the first setback since 2009 when the world was in the grips of recession. Imports also retreated 3.1%.

American exporters have been hurt by global economic weakness and a stronger dollar, which makes their products more expensive on overseas markets. A wider trade deficit is a drag on economic growth because it means fewer overseas sales by American producers and larger imports of foreign goods. The deficit subtracted about one-half percentage point from growth in 2015, a year when the economy, as measured by the gross domestic product, grew by a modest 2.4%. Analysts say trade will also subtract from growth this year as well given that the dollar has continued to rise and China, the world’s second largest economy, is still struggling to cope with slowing growth. The U.S. deficit with China set a record in 2015, rising 6.6% to $365.7 billion. The deficit with the EU also set a record, rising 7.9% to $153.3 billion.

The real impact of low oil prices starts to shine through even for the dimmest amongst us.

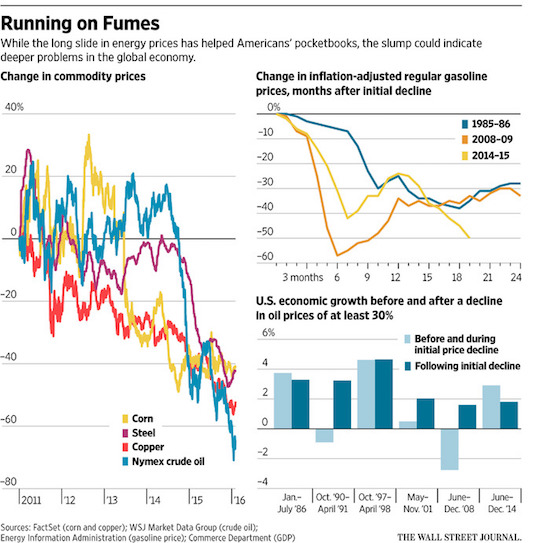

• Oil Rout Threatens Vicious Cycle for US Economy (WSJ)

With oil hovering at $30 a barrel and gasoline below $2 a gallon, the pleasure of lower fuel prices is turning painful for more of the U.S. economy. The problem isn’t just the layoffs and investment cutbacks in the oil patch, two effects that have been expected since crude oil began sliding in 2014. Worries about energy-related bankruptcies and loan defaults also are helping to tighten financial conditions, weighing on a broader swath of the economy. Can the U.S. have too much of a good thing? Few economists expect the crude slump will tip the economy into recession. But the fallout could grow harder to contain if the oil-price declines are instead a symptom of broader weaknesses in the global economy, including soft demand and an oversupply of raw material, productive capacity and labor.

Cheap oil reflects a strengthening dollar, which has already crimped U.S. exports. And consumer sentiment could take a hit if the early-year stock-market declines are sustained. The bottom line: Even if cheap gas is still good for consumers, the forces behind it could be more corrosive than initially imagined. This past month’s declines in oil “are less a sign that things are about to get a lot better, and more a sign that things are in danger of getting a lot worse,” said HSBC senior economist Stephen King. Typically, markets treat higher energy prices as tax increases and lower prices as tax cuts. Indeed, cheap gasoline has been a boon to American households, which saved around $140 billion last year as a result, roughly double the savings in 2014. Gas prices averaged $1.82 a gallon last week, down from $3.68 in June 2014.

And last year’s fuel-price drop contributed around 0.5 percentage point in consumption growth, according to Jason Thomas at private-equity firm Carlyle Group. But the overall boost was weaker than expected, suggesting high household debt levels along with rising housing, health-care and college-education costs have American consumers refraining from bigger purchases. Cutbacks in the oil patch have so far “swamped whatever benefits you had on the consumer side,” said Lewis Alexander, chief U.S. economist at Nomura Securities.

NOTE: private debt is also what causes these crises. So adding more won’t solve the issue.

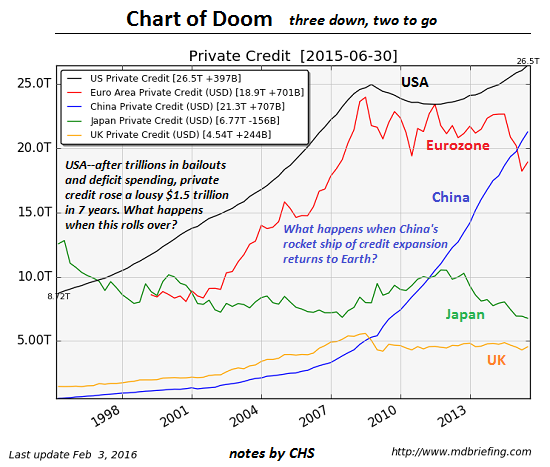

• The Chart of Doom: When Private Debt Stops Expanding… (CHS)

Once private credit rolls over in China and the U.S., the global recession will start its rapid slide down the Seneca Cliff. Few question the importance of private credit in the global economy. When households and businesses are borrowing to expand production and buy homes, vehicles, etc., the economy expands smartly. When private credit shrinks-that is, as businesses and households stop borrowing more and start paying down existing debt-the result is at best stagnation and at worst recession or depression. Courtesy of Market Daily Briefing, here is The Chart of Doom, a chart of private credit in the five primary economies:

Why is this The Chart of Doom? It’s fairly obvious that private credit is contracting in Japan and the Eurozone and stagnant in the U.K. As for the U.S.: after trillions of dollars in bank bailouts and additional liquidity, and $8 trillion in deficit spending, private credit in the U.S. managed a paltry $1.5 trillion increase in the seven years since the 2008 financial meltdown. Compare this to the strong growth from the mid-1990s up to 2008. This chart makes it clear that the sole prop under the global “recovery” since 2008-09 has been private credit growth in China. From $4 trillion to over $21 trillion in seven years–no wonder bubbles have been inflated globally.

Combine this expansion of private credit in China with the expansion of local government and other state-sector debt (state-owned enterprises, SOEs, etc.) and you have the makings of a global bubble machine. In other words, the faltering global “recovery” and all the tenuous asset bubbles around the world both depend on a continued hyper-velocity rocket rise in China’s private credit. What are the odds of this happening? Aren’t the signs that this rocket ship has burned its available fuel abundant? Three out of the five major economies are already experiencing stagnant or negative private credit growth. Three down, two to go. Helicopter money-government issued “free money” to households-is no replacement for private credit expansion.

Martin Wolf stating the obvious.

• Why It Would Be Wise To Prepare For The Next Recession (Wolf)

What might central banks do if the next recession hit while interest rates were still far below pre-2008 levels? As a paper from the London-based Resolution Foundation argues, this is highly likely. Central banks need to be prepared for this eventuality. The most important part of such preparation is to convince the public that they know what to do. Today, eight-and-a-half years after the first signs of the financial crisis, the highest short-term intervention rate applied by the Fed, the ECB, the Bank of Japan or the Bank of England is the latter’s 0.5%, which has been in effect since March 2009 and with no rise in sight. The ECB and the BoJ are even using negative rates, the latter after more than 20 years of short-term rates of 0.5%, or less.

The plight of the UK might not be that dire. Nevertheless, the latest market expectations imply a base rate of roughly 1.6% in 2021 and around 2.5% in 2025 — less than half as high as in 2007. What are the chances of a significant recession in the UK before 2025? Very high indeed. The same surely applies to the US, eurozone and Japan. Indeed, the imbalances within the Chinese economy, plus difficulties in many emerging economies, make this a risk now. The high-income economies are likely to hit a recession with much less room for conventional monetary loosening than before previous recessions. What would then be the options? One would be to do nothing. Many would call for the cleansing depression they believe the world needs. Personally, I find this idea crazy, given the damage it would do to the social fabric.

A second possibility would be to change targets, possibly to ones for growth or level of nominal gross domestic product or to a higher inflation rate. It would probably have been wise to have had a higher inflation target. But changing it when central banks are unable to deliver today’s lower target might destabilise expectations without improving outcomes. Moreover, without effective instruments a more ambitious target might just seem empty bombast. So the third possibility is either to change instruments or to use the existing ones more powerfully. One instrument, not much discussed, would be to organise the deleveraging of economies. This might need forced conversion of debt into equity. But, while desirable in extreme circumstances, this would be practically difficult.

Light at the end of the death spiral?! “Rational behavior, most likely, will prevail,..”

• Citi: World Economy Trapped In ‘Death Spiral’ (CNBC)

The global economy seems trapped in a “death spiral” that could lead to further weakness in oil prices, recession and a serious equity bear market, Citi strategists have warned. Some analysts -including those at Citi- have turned bearish on the world economy this year, following an equity rout in January and weaker economic data out of China and the U.S. “The world appears to be trapped in a circular reference death spiral,” Citi strategists led by Jonathan Stubbs said in a report on Thursday. “Stronger U.S. dollar, weaker oil/commodity prices, weaker world trade/petrodollar liquidity, weaker EM (and global growth)… and repeat. Ad infinitum, this would lead to Oilmageddon, a ‘significant and synchronized’ global recession and a proper modern-day equity bear market.”

Stubbs said that macro strategists at Citi forecast that the dollar would weaken in 2016 and that oil prices were likely bottoming, potentially providing some light at the end of the tunnel. “The death spiral is in nobody’s interest. Rational behavior, most likely, will prevail,” he said in the report. Crude oil prices have tumbled by around 70% since the middle of 2014, during which time the U.S. dollar has risen by around 20% against a basket of currencies. The world economy grew by 3.1% in 2015 and is projected to accelerate to expand by 3.4% in 2016 and 3.6% in 2017, according to the IMF. The forecast reflects expectations of gradual improvement in countries currently in economic distress, notably Brazil, Russia and some in the Middle East.

By contrast, Citi forecasts the world economy will grow by only 2.7% in 2016 having cut its outlook last month. Overall, advanced economies are mostly making a modest recovery, while many emerging market and developing economies are under strain from the rebalancing of the Chinese economy, lower commodity prices and capital outflows.

As I remarked the other day, the accelerating speed with which ‘policies’ lose steam looks very much like the Bernanke days.

• Negative-Interest-Rate Effect Already Dead, Central Banks Lost Control (WS)

The Bank of Japan’s surprise Negative-Interest-Rate party for stocks set a new record: it lasted only two days. Today a week ago, the Bank of Japan shocked markets into action. As the economy has deteriorated despite years of zero-interest-rate policy and Quantitative and Qualitative Easing (QQE) – a souped-up version of QE – the BOJ announced that it would cut one of its deposit rates from positive 0.1% to negative 0.1%. Headlines screamed Japan had gone “negative,” that it had joined the NIRPs of Europe – the Eurozone countries, Switzerland, Sweden, and Denmark. It was another desperate move, a head fake, and once the dust would settle, the hot air would go out. Now the dust has settled and the hot air has gone out.

On Thursday, January 28, the Nikkei closed at 17,041 down 19% from its Abenomics peak of 20,953 in June 2015. This situation is a bit of an embarrassment for the BOJ which has pushed Japanese asset managers of all kinds, including pension funds, particularly the Government Pension Investment Fund (GPIF), the largest such pension fund in the word, to get off their conservative stance, sell their Japanese Government Bonds which made up the bulk or entirety of their portfolios, and buy risk assets with the proceeds. This they did, near the peak of the Abenomics bubble. While the BOJ was eagerly mopping up JGBs, the asset managers bought mostly Japanese equities, but they also bought global equities and corporate bonds. And the mere prospect of all this buying, the front-running by hedge funds, and then the actual buying drove up Japanese stock prices in 2014 and early 2015.

The bet seemed to work out. Wealth had been created out of nothing. A few more years of this, and it might actually resolve the Japanese underfunded pension crisis. Then the party stopped, and Japanese stocks swooned. In the second quarter of fiscal 2015 (June through August), the most recent report available, the GPIF lost ¥7.9 trillion, or 5.6%! It was its first quarterly loss since 2008 during the Financial Crisis. Its decision to yield to the pressures of the government and the BOJ to plow into Japanese stocks, global equities, and corporate bonds, when they were at the peak, has turned into a fiasco. So now the BOJ is trying to re-inflate these assets. For over two years, BOJ Governor Haruhiko Kuroda has been giving whatever-it-takes and no-limits speeches that were once lapped up by hedge funds and that fueled the big Abenomics rally, but that have since become ineffectual, and perhaps the butt of many jokes, as Japanese stocks continued to swoon.

Hence, on Friday last week, the bazooka: negative rates. After some volatility, the Nikkei soared 2.8% for the day. On Monday, it gained another 2%. But then the hot NIRP air came out of the market, and the Nikkei has dropped every single day since. Today, it closed at 16,819, having given up all of the two-day NIRP party gains, plus some. It’s now down 19.7% from its Abenomics high. Pension fund beneficiaries in Japan will be ecstatic when they learn what this strategy is doing to their future. [..] The bitter irony for Japanese pension funds? The very JGBs that they sold to the BOJ upon the BOJ’s urging have since soared in price, while the prices of the risk asset they bought upon the BOJ’s urging have plunged.

Happy Lunar New Year. First, on Sunday China reserves numbers. ‘Eagerly anticipated’ though everyone knows they’re made up.

• China’s Reserves Pose The Next Hurdle For Yuan (CNBC)

China has recently struggled to shore up the yuan amid hefty capital outflows. Reserves data over the weekend may offer a glimpse of the severity of the challenge. Analysts are generally calling for a drawdown of around $100 billion, following a decline of $107.9 billion in December. Reserves plunged by $512.66 billion in 2015, a record drop for the country, to $3.33 trillion, a move attributed in part to Beijing’s moves to prop up the yuan. In addition, China suffered almost $700 billion of capital flight in 2015, according to the Institute of International Finance. Local companies rushed to repay overseas loans as the yuan depreciated, while global investors grew increasingly wary of the country’s economic slowdown and Chinese authorities’ interventions in the financial markets.

The reserve data due Sunday will be closely watched, even though China’s financial markets will be closed for the Lunar New Year holiday for the next week. “Global markets aren’t closed. I think we’ll see some contagion effect there if we see a very significant drainage coming through,” Steve Brice at Standard Chartered Wealth Management told CNBC’s Street Signs. “If there were a trend acceleration we’ve seen in December and extended to January that would lead to people putting more pressure on the Chinese authorities to be more clear on their communications.” China’s policymakers have struggled recently to implement changes to the currency, attempting to move from a dollar-peg to a trade-weighted basket.

The move was targeted at shifting the currency towards an exchange rate that better reflects China’s trade links as well as divert attention away from the dollar/yuan exchange rate, which has risen sharply amid the divergence in monetary policy between the U.S. and China. The PBOC has also let market forces play a greater role in setting the value of the yuan although its recent actions have increased rather than curb confusion. In January, the central bank, the People’s Bank of China (PBOC), guided the currency sharply lower without providing much indication to the market about its endgame – one factor in the China market selloff that triggered a global stock rout amid expectations the yuan would fall further. That spurred policymakers to intervene in the market by keeping the currency from falling further, but propping up the yuan also likely required selling dollars.

That’s opened up concerns about whether China’s reserves, the world’s largest, could become too depleted. Using IMF methodology, Khoon Goh, senior foreign-exchange strategist at ANZ, estimates that China will need a minimum of around $2.7 trillion in reserves if it keeps a fixed exchange-rate regime without capital controls. That leaves China only around a half a year of continuing to stabilize the yuan at the current drawdown rate, Goh said in a note Friday. Others have expressed concern about how the currency policy is affecting the reserves — and expectations of when the yuan will be allowed a freer float.

Lipstick’s washing off the pig.

• Europe’s Economic Outlook Darkens, Sends Shudder Through Markets (BBG)

Hints of investor optimism in Europe were snuffed out this week, as the darkening economic outlook registered across the continent and sent stocks and credit markets sliding. While market turmoil at the start of this year was sparked by a selloff in commodities and Chinese stocks, the reality of Europe’s own woes hit home as companies reported dismal earnings, and policy makers and institutions lined up to cut economic forecasts and warn of further risks. The European Commission cut its prediction for 2016 growth in the 19-nation bloc to 1.7% from 1.8% and said the largest economies of Germany, France and Italy will all perform worse than predicted just three months ago. While the ECB may spur into action again, moves in the euro and stocks suggest President Mario Draghi may be losing his ability to convince investors he can anesthetize the region from risks.

“Markets had a very rough start,” said Andreas Nigg at Vontobel Asset Management in Zurich. “There’s only so much central bankers, even Draghi, can do. Each incremental dose probably has a lower impact than the previous one. The weaker-than-expected economic growth and the associated increased likelihood of a recession led to selling of risky assets.” The blunt truth is that the euro area is still struggling to recover nearly six years after it first bailed out Greece, while European leaders are trying to tackle their latest crisis and stem the inflow of refugees. The doom and gloom nixed a nascent stock-market recovery in Europe, with a drop of 3.6% in the region’s shares this week almost completely erasing the rebound from the previous two. The losses have left the Stoxx Europe 600 Index down 9.9% this year, its worst start since 2008. It’s trading near its lowest valuation since July relative to a gauge of global equities.

New tech, too, is just a bubble.

• LinkedIn Sheds $11 Billion In Value On Stock’s Worst Day Since Debut (Reuters)

LinkedIn shares closed down 43.6% on Friday, wiping out nearly $11 billion of market value, after the social network for professionals shocked Wall Street with a revenue forecast that fell far short of expectations. The stock plunged as much as 46.5% to a more than three-year low of $102.89, registering its sharpest decline since the company’s high-profile public listing in 2011. The rout in the stock cost LinkedIn chairman Reid Hoffman about $1.2 billion based on his 11.1% stake in the company he co-founded, according to Reuters calculations. At least nine brokerages downgraded the stock to “hold” from “buy”, saying the company’s lofty valuation was no longer justified.

“With a lower growth profile, we believe that LinkedIn should not enjoy the premium multiple it has grown accustomed to,” Mizuho analysts wrote in a note. At least 36 brokerages cut their price targets, with Pacific Crest halving its target to $190. Their median target dropped 34% to $188, according to Reuters data. LinkedIn forecast full-year revenue of $3.60-$3.65 billion, missing the average analyst estimate of $3.91 billion, according to Thomson Reuters I/B/E/S. “This would imply that LinkedIn will grow around 15% in 2017 and 10% in 2018,” Mizuho analysts said. Underscoring the slowdown in growth, LinkedIn said online ad revenue growth slowed to 20% in the latest quarter from 56% a year earlier.

Told you -along with Ron Paul-, we should have dismantled it. Now NATO is a real and clear danger to all of us.

• Armed With New US Money, NATO To Strengthen Russia Deterrence (Reuters)

Backed by an increase in U.S. military spending, NATO is planning its biggest build-up in eastern Europe since the Cold War to deter Russia but will reject Polish demands for permanent bases. Worried since Russia’s seizure of Crimea that Moscow could rapidly invade Poland or the Baltic states, the Western military alliance wants to bolster defenses on its eastern flank without provoking the Kremlin by stationing large forces permanently. NATO defense ministers will next week begin outlining plans for a complex web of small eastern outposts, forces on rotation, regular war games and warehoused equipment ready for a rapid response force. That force includes air, maritime and special operations units of up to 40,000 personnel.

The allies are also expected to offer Moscow a renewed dialogue in the NATO-Russia Council, which has not met since 2014, about improved military transparency to avoid surprise events and misunderstandings, a senior NATO diplomat said. U.S. plans for a four-fold increase in military spending in Europe to $3.4 billion in 2017 are central to the strategy, which has been shaped in response to Russia’s annexation of Crimea from Ukraine in 2014. The plans are welcomed by NATO whose chief, Secretary General Jens Stoltenberg, says it will mean “more troops in the eastern part of the alliance … the pre-positioning of equipment, tanks, armored vehicles … more exercises and more investment in infrastructure.”

The only way I see to make any pensions sytem “remain viable” is to introduce basic income instead.

• Why Pensions Are The New Flashpoint In Greece’s Crisis (AP)

Combine a rapidly aging population, a depleted work force and leaky finances and any country’s pension system would be in trouble. For debt-hobbled, unemployment-plagued Greece, it’s a nightmare. Hemmed in by a grim economic reality and tough-talking bailout creditors, the leftwing-led government in Athens is now attempting the seemingly impossible: to reform the pension system without cutting pensions, largely through a steep increase in social security contributions. The overhaul, which creditors are demanding in return for rescue loans, means Greeks who have a job — and who are outnumbered by the unemployed and retired — have to pay for the rest Unions are up in arms about the move, which has become the main hurdle in Greece’s negotiations with its European creditors and the IMF.

Critics say the reform will heap the most pain on self-employed professionals and farmers, forcing them to pay up to three quarters of their income in pension contributions and taxes. They warn the majority will be forced to change jobs or emigrate — accelerating the brain drain the country has suffered since the crisis started in 2010. “We are fighting for our very survival,” said Georgios Stassinos, head of the country’s biggest engineers’ union. If the reforms are adopted, he said, “the country will be left without engineers, doctors, lawyers, pharmacists and economists.” The head of Greece’s bar associations, Vassilios Alexandris, said the new system would reduce some lawyers’ net incomes to as little as 31% of their gross intakes, from the current 46%. “Professionals will not pay their (pension) contributions, not out of choice but because they will be unable to,” he said.

In Greek cities, a wave of protests has become known as the necktie revolution, from a series of demonstrations by formally-dressed professionals. The discontent is even more obvious in the countryside, where farmers have manned highway blockades for over two weeks. Costas Alexandris, a farmers’ union leader in the northeastern area of Thrace, said he stands to pay 75% of his income in taxes and contributions next year under the government’s proposals, which include taxation on subsidies and a leap in farmers’ pension contributions from 7 to 28%. But if Greece wants to make its pensions system viable, it has few options. Current retirees have already seen their pensions cut repeatedly under austerity programs since 2009 and the retirement age has been raised from about 62 to 67.

Home › Forums › Debt Rattle February 6 2016