Arthur Rothstein Bank that failed. Kansas 1936

The essence behind the Leave surge. People dislike Cameron so much they’ll vote for anything he doesn’t want.

• Brexit Is The Only Way The Working Class Can Change Anything (G.)

In working-class communities, the EU referendum has become a referendum on almost everything. In the cafes, pubs, and nail bars in east London where I live and where I have been researching London working-class life for three years the talk is seldom about anything else (although football has made a recent appearance). In east London it is about housing, schools and low wages. The women worry for their children and their elderly parents – what happens to them if the rent goes up again? The lack of affordable housing is terrifying. In the mining towns of Nottinghamshire where I am from, the debate again is about Brexit, and even former striking miners are voting leave.

The mining communities are also worried about the lack of secure and paid employment, the loss of the pubs and the grinding poverty that has returned to the north. The talk about immigration is not as prevalent or as high on the list of fears as sections of the media would have us believe. The issues around immigration are always part of the debate, but rarely exclusively. From my research I would argue that the referendum debate within working-class communities is not about immigration, despite the rhetoric. It is about precarity and fear. As a group of east London women told me: “I’m sick of being called a racist because I worry about my own mum and my own child,” and “I don’t begrudge anyone a roof who needs it but we can’t manage either.”

Over the past 30 years there has been a sustained attack on working-class people, their identities, their work and their culture by Westminster politics and the media bubble around it. Consequently they have stopped listening to politicians and to Westminster and they are doing what every politician fears: they are using their own experiences in judging what is working for and against them.

Think I made it very and abundantly clear in the past that I fully agree with this. Tad surpised to see it come from Steve, given his link to Varoufakis.

• It’s Time To Call Time On The EU Experiment (Steve Keen)

The arguments for and against Brexit have focused on the economic costs and benefits for the UK in leaving or remaining within the EU. Though I am an economist, I am taking a more political perspective to this vote by focusing on the utterly undemocratic nature of the key institutions of the EU. The European Parliament is a weak, diversionary figurehead, while the real power resides within the unelected bureaucracy of the EU and the key political appointees of the Europe’s governments—and particularly its Finance Ministers. These effective cabals run roughshod over political democracies when they elect leaders that oppose core EU economic policies, while at the same time these policies are leading to the ruin of southern Europe, and the stagnation of France and Italy.

The EU has been a failed enterprise ever since 1992, when the Maastricht Treaty was approved. As the prescient non-mainstream English economist Wynne Godley realised at the time, the fetish in this Treaty for government surpluses would lead to the collapse of Europe. Godley wrote that “If a country or region has no power to devalue, and if it is not the beneficiary of a system of fiscal equalisation, then there is nothing to stop it suffering a process of cumulative and terminal decline leading, in the end, to emigration as the only alternative to poverty or starvation” (Godley, Maastricht and all that, London Review of Books, 1992). Godley’s words, which surely seemed rash and insanely pessimistic at the time, have proven true with time. I therefore think that it’s time to call time on the EU experiment. I’ll be voting for Brexit for this reason.

A bit surprisingly, Ambrose has turned hard against Brussels and Remain.

• Osborne’s ‘Punishment Budget’ Is Economic Vandalism (AEP)

George Osborne is disqualified from serving as Chancellor of the Exchequer for a single week longer. Whatever his past contributions, his threat to push through draconian fiscal tightening in an emergency Brexit budget is economic madness, if not criminal incompetence. Such action would leverage and compound the financial shock of Brexit, and would risk pushing the country into a depression. It violates the known tenets of macro-economics, whether you are Keynesian or not. Alistair Darling, the former Labour Chancellor, has connived in this Gothic drama. He professes to be “much more worried now” than he was even during the white heat of the Lehman crisis and the collapse of the Western banking system in 2008. So he should be. The emergency Budget that he endorses might well bring about disaster.

The policy response is the mirror image of what he himself did – wisely – during his own brief tenure through the Great Recession. We all understand why George Osborne is toying with such pro-cyclical vandalism – or pretending to – for he is acting purely as as partisan for the Remain campaign. He has fatally mixed his roles. No head of the Treasury can behave in this fashion. The emergency Budget would aim to cover a £30bn ‘black hole’ with a mix of tax rises and spending cuts. These “illustration” measures include 2p on income tax and a 5 percentage point rise on inheritance tax, and petrol and alcohol duties. Transport, the police, and local government would be axed by 5pc. There would be cuts in pensions and defence. Spending on the NHS would be “slashed’.

This is a fiscal contraction of 1.7pc of GDP. It would hammer the economy just as it was reeling from the immediate trauma of a Brexit vote and the probable contagion effects across eurozone periphery, already visible in widening bond spreads. It would come amid political chaos, before it was clear what the UK negotiating strategy is, or what the EU might do. It would be the worst possible moment to tighten. The Treasury has already warned that the short-term shock of Brexit would slash output by 3.6pc, or 6pc with 820,000 job losses in its ‘severe’ scenario. The Chancellor now states he will reinforce this with austerity a l’outrance. It is a formula for a self-feeding downward spiral, all too like the scorched-earth policies imposed on southern Europe during the debt crisis.

“.. the history of the last two centuries can be summed up in two words: democracy matters.”

• JPMorgan CIO: Brexit “Hardly The Stuff Of Economic Calamity” (ZH)

First The Telegraph, then The Sun, and today The Spectator all came out on the “Leave” side of the Brexit debate. However, perhaps even more shocking to the establishment is the CIO of a major bank’s asset management arm dismissing the apparent carnage that Cameron, Obama, and Osborne have declared imminent, warning that, “many articles on the Brexit vote overstate its risks and consequences.” As JPM’s Michael Cembalest adds, the reality is “hardly the stuff that economic calamity is made of.” As The Spectator concludes, “the history of the last two centuries can be summed up in two words: democracy matters.” As JPMorgan Asset Management CIO Michael Cembalest explains…

“My sense is that many articles on the Brexit vote overstate its risks and consequences for the UK, and/or overstate the vote’s impact on political movements and economic malaise in the Eurozone that predate it by months and years. Here are some thoughts on issues I have seen raised over the last few weeks. “UK growth will suffer a huge hit”. Of all the analyses I’ve read about a possible Brexit scenario, I found Open Europe’s report to be the most clear-headed and balanced. Their realistic case estimates the cumulative impact of Brexit on UK GDP at just -0.8% to 0.6% by the year 2030; hardly the stuff that economic calamity is made of.

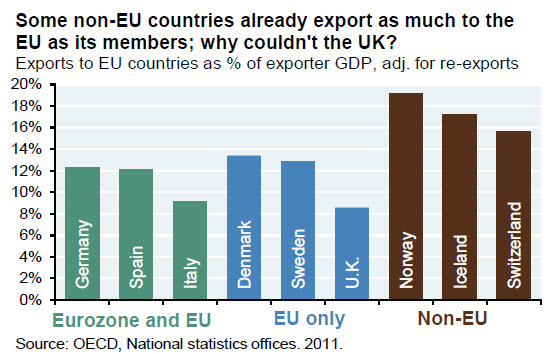

“UK-EU trade will collapse”. Not necessarily. Norway, Iceland and Switzerland have entered into agreements with the EU on trade and labor mobility (European Economic Area, European Free Trade Area). As shown below, these three non-EU countries export as much to the EU as its members do. Such agreements could serve as a template for post-Brexit trade between Britain and the EU, if both sides see it in their mutual self-interest.”

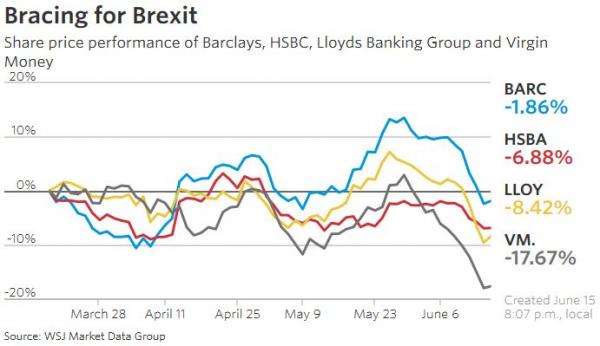

The City could take a big hit.

• Brexit: Which Banks Will Be Hit Hardest (WSJ)

Barclays and HSBC are the banks with the most business in Europe. Barclays got just under 9% of its profits from continental European businesses in 2015. At HSBC, roughly 5.5% of last year’s profits came from continental Europe, where it has a large French retail business. Local businesses could become much more difficult to run from the U.K. if a Brexit vote provokes a big change in the trade arrangements with the rest of Europe. Meanwhile, their large London-based investment banks—and those of other European and U.S. groups—would also face losing direct access to Europe without a new trade deal that preserved Britain’s “passport” for services. In this case, Deutsche Bank, BNP Paribas and Société Générale, for example, would suffer some of the same disruption and relocation costs as Barclays or HSBC.

The other vulnerable group would be U.K. mortgage lenders, such as Lloyds Banking Group, Virgin Money and OneSavings. If international investors react badly to Brexit, pulling capital out of the country, the pound will fall further and the Bank of England may feel compelled to lift interest rates to attract investors back into U.K. government bonds. Some believe benchmark interest rates might only have to go to, say, 2%, to make U.K. assets attractive, but that could upend the housing market, where prices have risen dramatically in the past couple of years, helped by substantial lending to small-time landlords. Ultra-low interest rates have kept debt-service costs minuscule, a situation that could be upended quickly.

Sounds like she’s giving up.

• Yellen Says Forces Holding Down Rates May Be Long Lasting, New Normal (BBG)

Federal Reserve Chair Janet Yellen seems to be coming around to what her one-time rival, Lawrence Summers, has been arguing for a while: Some of the forces holding down interest rates may be long-lasting and secular. That’s reflected in a marked downgrade in rate projections released by policy makers after their meeting on Wednesday. Six of 17 now only see one rise this year, after the central bank lifted rates effectively from zero in December. Officials also slowed the pace of expected moves in both 2017 and 2018: They now only foresee three increases in each of those years, down from the four they expected in March, according to their latest median forecast.

Yellen in the past has ascribed the low level of rates mainly to lingering headwinds from the financial crisis – tight mortgage credit, for instance – and suggested that they would dissipate over time. On Wednesday, though, she also pointed to more permanent forces that could depress rates for longer, namely, slow productivity growth and aging societies, in the U.S. and throughout much of the world. In a press conference after the Fed held policy steady, Yellen spoke of a sense that rates may be depressed by ”factors that are not going to be rapidly disappearing, but will be part of the new normal.”

She means the Leave vote did. When it looked like Remain would win easily, things were different.

• Yellen Says Brexit Vote Influenced Fed (BBG)

Federal Reserve chair Janet Yellen said next week’s referendum in the UK on whether to remain in the EU was a factor in the US central bank’s decision to hold interest rates steady at its meeting Wednesday in Washington. “It is a decision that could have consequences for economic and financial conditions in global financial markets,” Yellen said during a press conference following the meeting. A vote on June 23 by Britons to leave the EU “could have consequences in turn for the US economic outlook,” she said. Fewer Federal Reserve officials now expect the central bank to raise interest rates more than once this year, as policy makers gave a mixed picture of a US economy where growth is picking up and job gains are slowing.

While the median forecast of 17 policy makers remained at two quarter-point hikes this year, the number of officials who see just one move rose to six from one in the previous forecasting round in March, according to projections released by the Federal Open Market Committee on Wednesday following a two-day meeting in Washington. “The central bank reiterated that interest rates are likely to rise at a “gradual” pace, without referring in the statement to the next meeting in July or any other specific timing for another increase.

“The BOJ might also have found itself short of ammunition to respond to that turbulence.”

• Bank of Japan Stands Pat Ahead of Brexit Vote (WSJ)

The Bank of Japan stood pat Thursday despite a surging yen and faltering inflation, opting to wait until after the results of a British referendum next week that could roil global markets. The central bank’s decision comes amid growing skepticism about the effectiveness of Prime Minister Shinzo Abe’s economic program in ending Japan’s long cycle of lackluster growth and sporadic deflation. Abenomics, which has leaned most heavily on the central bank, hasn’t produced sustained, robust growth since it was launched more than three years ago. Japan’s economy has swung between modest expansions and contractions in recent quarters, while the BOJ’s hard-won gains in the battle against falling prices are starting to slip away.

Economists have expected the BOJ to take additional action in recent months, particularly given that BOJ Gov. Haruhiko Kuroda has repeatedly vowed to take action “without hesitation” if the central bank’s 2% inflation target is in danger. The central bank also stood pat in April, when expectations for action were high. Some BOJ policy board members, though, signaled ahead of this week’s meeting that they preferred to wait until after the U.K. votes next week on whether to leave the European Union, according to people familiar with the central bank’s thinking. They were concerned that even if the BOJ acted this week, the market impact of its move would fade if a “Brexit” vote rocked global financial markets, according to people close to the bank. The BOJ might also have found itself short of ammunition to respond to that turbulence.

Free trade, like all forms of centralization, depends on a growing economy. There is no such thing anymore.

• Is The World Turning Its Back On Free Trade? (BBC)

Which politician has captured the curve, summed up a growing mood, in a ferocious speech? “Your iron industry is dead, dead as mutton. Your coal industries, which depend greatly on the iron industries, are languishing. Your silk industry is dead, assassinated by the foreigner. Your woollen industry is in articulo mortis, gasping, struggling. Your cotton industry is seriously sick. Your shipbuilding industry, which held out longest, is come to a standstill.” The Latin, the silk and the mutton are a dead giveaway. Not Trump, but Lord Randolph Churchill in 1884 denouncing Free Trade. The system he preferred – “Fair Trade” – is coming back into fashion.

We have heard a lot about the revolt against the political elites, the backlash by those “left behind” by globalization; a lot about the movements and political personalities this has brought to the fore; a lot about the implications for immigration. But not so much about the economics of it all. It many signal a new rejection of one of the global elite’s most cherished policies – free trade. This is the notion that the fewer economic barriers around the world, and the less countries protect their own goods and trade with special policies, the richer we all end up. The opposite is protectionism – making foreign goods more expensive by putting taxes on their import , tariffs, in order to make home-grown products cheaper by comparison. While few embrace the word protectionism, growing numbers of politicians are openly embracing the principle behind it.

Donald Trump has said he would put a swingeing 45% tax on goods from China and 35% on many from Mexico. Many economists mock this as crazy stuff, but it is a sentiment that goes down well with many Americans. [..] Bernie Sanders has made it very clear he is opposed to NAFTA, the free trade bloc with Mexico and Canada, and the planned Asia Pacific agreement. He has been saying it for a while. This is him in 2011: “Let’s be clear: one of the major reasons that the middle class in America is disappearing, poverty is increasing and the gap between the rich and everyone else is growing wider and wider, is due to our disastrous unfettered free trade policy.”

“..only “a few lunatics” may want to join the EU now..”

• Switzerland Withdraws Longstanding Application To Join EU (RT)

The upper house of the Swiss parliament on Wednesday voted to invalidate its 1992 application to join the European Union, backing an earlier decision by the lower house. The vote comes just a week before Britain decides whether to leave the EU in a referendum Twenty-seven members of the upper house, the Council of States, voted to cancel Switzerland’s longstanding EU application, versus just 13 senators against. Two abstained. In the aftermath of the vote, Switzerland will give formal notice to the EU to consider its application withdrawn, the country’s foreign minister, Didier Burkhalter, was quoted as saying by Neue Zürcher Zeitung. The original motion was introduced by the conservative Swiss People’s Party MP, Lukas Reimann.

It had already received overwhelming support from legislators in the lower house of parliament in March, with 126 National Council deputies voting in favor, and 46 against. Thomas Minder, counsellor for the state of Schaffhausen and an active promoter of the concept of “Swissness,” said he was eager to “close the topic fast and painlessly” as only “a few lunatics” may want to join the EU now, he told the newspaper. Hannes Germann, also representing Schaffhausen, highlighted the symbolic importance of the vote, comparing it to Iceland’s decision to drop its membership bid in 2015. “Iceland had the courage and withdrew the application for membership, so no volcano erupted,” he said, jokingly.

Australia: “We have nothing else except real estate…”

• Highrise Harry Whispers The Terrible Truth (MB)

Highrise Harry’s media foghorns continue his campaign to abolish foreign buyer stamp duties today at the AFR: “Alluding to remarks by Meriton boss Harry Triguboff that he might have to reduce his apartment prices in the wake of the surcharges, Ms Berejiklian said that, given so many people were worried about housing affordability, the NSW government would be “happy to wear that consequence”. Mr Triguboff labelled the new taxes “very dangerous”, coming as they did on top of moves by the banks to tighten up lending to foreign buyers. He also urged caution in light of the decline of the mining sector. “We have nothing else except real estate. We have to be very careful,” Mr Triguboff told the AFR.” True indeed, Highrise. But that’s why policy must shift away from property and towards the repair of everything else.

Brussels trying to bend Greek sovereign law and legal system.

• EU Pushes Greece To Set Up New Asylum Committees (EUO)

The EU wants Greece to quickly set up new appeals committees to better cope with the large number of asylum requests. “New appeals committees under the new law will be set up in the next 10 days, I am confident that procedures will be accelerated soon,” EU migration commissioner Dimitris Avramopoulos [said]. The Greek commissioner said the government in Athens decided on Tuesday to “upgrade and enhance” the appeals committees. “We salute that the Greek government took that initiative,” he said. The aim was “to speed up judicial procedures to assess all the requests and give prompt answers”. The committees are an essential part of an agreement reached in March between Turkey and the EU for sending back migrants.

So far, dealing with appeals regarding asylum requests has been the job of the so-called backlog committees, created in 2010 to deal with the large number of pending asylum cases in Greece. But these committees were not designed to deal with massive influx, as more than 8,000 migrants are still stranded on the Greek islands. EU officials claim it was always the goal of Brussels and Athens to create new committees to take this burden off the backlog committees. A Greek source told EUobserver however that an amendment to the existing law on appeals committees is still being debated in the Greek parliament, and there is no guarantee that the new committees will be set up the next 10 days.

But the issue has become especially important for EU member states after it emerged that the committees had ruled in 55 cases involving Syrians that the claimant could not be returned back to Turkey. In effect ruling that Turkey is not a safe country. Only in two cases did they agree to send those Syrians back to Turkey. According to an EU source, the first decision by the backlog committees that said Turkey is not a safe country created a major upset in Brussels and in other EU capitals, prompting fears that the EU-Turkey deal could unravel. “They are seen as the enemy of the deal,” the source added.

E.O. Wilson makes a last desperate call.

• Could We Set Aside Half The Earth For Nature? (G.)

As of today, the only place in the universe where we are certain life exists is on our little home, the third planet from the sun. But also as of today, species on Earth are winking out at rates likely not seen since the demise of the dinosaurs. If we don’t change our ways, we will witness a mass extinction event that will not only leave our world a far more boring and lonely place, but will undercut the very survival of our species. So, what do we do? E.O. Wilson, one of the world’s most respected biologists, has proposed a radical, wild and challenging idea to our species: set aside half of the planet as nature preserves. “Even in the best scenarios of conventional conservation practice the losses [of biodiversity] should be considered unacceptable by civilised peoples,” Wilson writes in his new book, Half-Earth: Our Planet’s Fight for Life.

One of the world’s most respected biologists, Wilson is known as the father of sociobiology, a specialist in island biogeography, an expert on ant societies and a passionate conservationist. In the book, Wilson argues eloquently for setting aside half of the planet for nature, including both terrestrial and marine ecosystems. He writes that it’s time for the conservation community to set a big goal, instead of aiming for incremental progress. “People understand and prefer goals,” he writes. “They need a victory, not just news that progress is being made. It is human nature to yearn for finality, something achieved by which their anxieties and fears are put to rest…It is further our nature to choose large goals that while difficult are potentially game-changing and universal in benefit. To strive against odds on behalf of all life would be humanity at its most noble.”

The reason why half is the answer, according to Wilson, is located deep in the science of ecology. “The principal cause of extinction is habitat loss. With a decrease of habitat, the sustainable number of species in it drops by (roughly) the fourth root of the habitable area,” Wilson wrote via email, referencing the species-area curve equation that describes how many species are capable of surviving long-term in a particular area. By preserving half of the planet, we would theoretically protect 80% of the world’s species from extinction, according to the species-area curve. If protection efforts, however, focus on the most biodiverse areas (think tropical forests and coral reefs), we could potentially protect more than 80% of species without going beyond the half-Earth goal. In contrast, if we only protect 10% of the Earth, we are set to lose around half of the planet’s species over time. This is the track we are currently on.

Home › Forums › Debt Rattle June 16 2016