Harris&Ewing Camp Meade, Maryland 1917

“It’s not good for equipment to park anything, whether it’s an airplane, a frack pump or a car.”

• Half of US Fracking Companies Will Be Dead or Sold This Year (Bloomberg)

Half of the 41 fracking companies operating in the U.S. will be dead or sold by year-end because of slashed spending by oil companies, an executive with Weatherford said. There could be about 20 companies left that provide hydraulic fracturing services, Rob Fulks, pressure pumping marketing director at Weatherford, said in an interview Wednesday at the IHS CERAWeek conference in Houston. Demand for fracking, a production method that along with horizontal drilling spurred a boom in U.S. oil and natural gas output, has declined as customers leave wells uncompleted because of low prices.

There were 61 fracking service providers in the U.S., the world’s largest market, at the start of last year. Consolidation among bigger players began with Halliburton announcing plans to buy Baker Hughes in November for $34.6 billion and C&J Energy buying the pressure-pumping business of Nabors Industries Ltd. Weatherford, which operates the fifth-largest fracking operation in the U.S., has been forced to cut costs “dramatically” in response to customer demand, Fulks said. The company has been able to negotiate price cuts from the mines that supply sand, which is used to prop open cracks in the rocks that allow hydrocarbons to flow.

Oil companies are cutting more than $100 billion in spending globally after prices fell. Frack pricing is expected to fall as much as 35% this year, according to PacWest, a unit of IHS. While many large private-equity firms are looking at fracking companies to buy, the spread between buyer and seller pricing is still too wide for now, Alex Robart, a principal at PacWest, said in an interview at CERAWeek. Fulks declined to say whether Weatherford is seeking to acquire other fracking companies or their unused equipment. “We go by and we see yards are locked up and the doors are closed,” he said. “It’s not good for equipment to park anything, whether it’s an airplane, a frack pump or a car.”

Read more …

Not a big Stratfor fan, but smart analysis by Friedman: “The main assumption behind European integration was that a free trade zone would benefit all economies. If that assumption is not true, then the entire foundation of the EU is cast into doubt..”

• The ‘Grexit’ Issue And The Problem Of Free Trade (Stratfor)

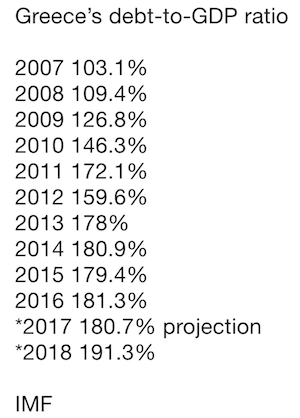

The Greek crisis is moving toward a climax. The issue is actually quite simple. The Greek government owes a great deal of money to European institutions and the International Monetary Fund. It has accumulated this debt over time, but it has become increasingly difficult for Greece to meet its payments. If Greece doesn’t meet these payments, the IMF and European institutions have said they will not extend any more loans to Greece. Greece must make a calculation. If it pays the loans on time and receives additional funding, will it be better off than not paying the loans and being cut off from more? Obviously, the question is more complex. It is not clear that if the Greeks refuse to pay, they will be cut off from further loans.

First, the other side might be bluffing, as it has in the past. Second, if they do pay the next round, and they do get the next tranche of funding, is this simply kicking the can down the road? Does it solve Greece’s underlying problem, which is that its debt structure is unsustainable? In a world that contains Argentina and American Airlines, we have learned that bankruptcy and lack of access to credit markets do not necessarily go hand in hand. To understand what might happen, we need to look at Hungary. Hungary did not join the euro, and its currency, the forint, had declined in value. Mortgages taken out by Hungarians denominated in euros, Swiss francs and yen spiraled in terms of forints, and large numbers of Hungarians faced foreclosure from European banks.

In a complex move, the Hungarian government declared that these debts would be repaid in forints. The banks by and large accepted Prime Minister Viktor Orban’s terms, and the European Union grumbled but went along. Hungary was not the only country to experience this problem, but its response was the most assertive. A strategy inspired by Budapest would have the Greeks print drachmas and announce (not offer) that the debt would be repaid in that currency. The euro could still circulate in Greece and be legal tender, but the government would pay its debts in drachmas. In considering this and other scenarios, the pervading question is whether Greece leaves or stays in the eurozone. But before that, there are still two fundamental questions.

First, in or out of the euro, how does Greece pay its debts currently without engendering social chaos? The second and far more important question is how does Greece revive its economy? Lurching from debt payment to debt payment, from German and IMF threats to German and IMF threats is amusing from a distance. It does not, however, address the real issue: Greece, and other countries, cannot exist as normal, coherent states under these circumstances, and in European history, long-term economic dysfunction tends to lead to political extremism and instability. The euro question may be interesting, but the deeper economic question is of profound importance to both the debtor and creditors.

Read more …

Won’t the Troika even give it that one year?

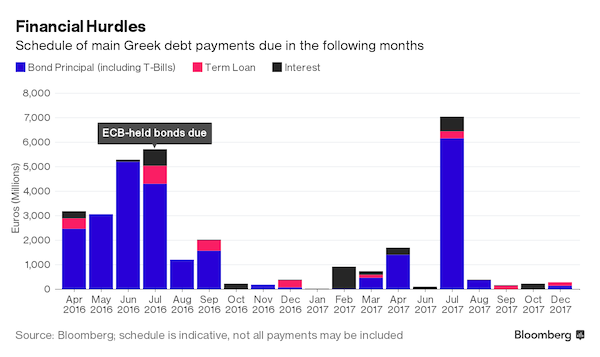

• If Greece Can Survive 2015, It’s Home Free (MarketWatch)

For the third time in five years, Greece’s parlous financial state is shaking up global markets. In 2010 and 2012, the country was saved from default by two massive rescue packages organized by the EU, the ECB and the IMF. This time, the question is whether Greece, which owes about €320 billion to its creditors, really wants to save itself. Its government, run by radical left-wing group Syriza, says it doesn’t want to default, but it also won’t make the economic reforms creditors demand. In fact, Syriza has vowed to protect pensioners and public employees’ salaries even as debt payments come due. With nearly 20 billion euros owed to creditors over the next six months, the two sides are far apart, and the risks of a default or “Grexit” — Greece’s exit from the euro — are rising.

Still, all may not be lost. If Greece can get through 2015, it won’t have to pay creditors very much until the next decade. “People are saying this is the crunch year,” said Franklin Allen, an expert on financial crises who is executive director of the Brevan Howard Centre and professor at Imperial College London. In fact, we’re in the crunch months. Athens owes around €2.5 billion to the IMF by mid-June. It made a payment to the IMF in early April. Greece and its creditors meet again on Friday in Riga, Latvia, although few expect a deal. Both Prime Minister Alexis Tsipras and Finance Minister Yanis Varoufakis have said Greece will meet its obligations, but on Monday Tsipras ordered local governments to transfer funds to the Greek central bank.

That amounts to confiscating €2 billion in reserves local governments hold in commercial banks. The money could be used to pay salaries and part of the debt to the IMF. The yield on Greece’s two-year bonds soared to near 30% on Tuesday. Yikes! The Greek government wants €7.2 billion in emergency bailout funds to get it over the hump. So far, creditors aren’t budging. IMF Managing Director Christine Lagarde last week warned against any payment delays and told Varoufakis to accelerate reforms, such as privatizations and labor-market changes. It’s a recipe for a stalemate. That’s why Allen, who also has taught finance at The Wharton School of the University of Pennsylvania, thinks “there’s about a 40% chance they’ll default on something.”

Read more …

What’s a few billion among friends?

• Greek Banks Win More Emergency Cash as Talks Loom (Bloomberg)

The ECB almost doubled an increase in emergency funding to Greek banks from last week before political talks shift to Brussels and Latvia over the country’s bailout review. The European Central Bank’s Governing Council raised the cap on Emergency Liquidity Assistance by about €1.5 billion to €75.5 billion on Wednesday, people familiar with the decision said. ELA is funding provided by national central banks at their own risk and is extended against lower-quality collateral than the ECB accepts. “The ceiling increase shows that deposit outflows from Greek lenders continue,” said Andreas Koutras at In Touch Capital Markets Ltd. in London. “The question now is when will the collateral against ELA be exhausted — in other words how much time is left?”

Euro-area finance ministers will meet in Riga, Latvia, on Friday in their latest attempt to persuade Greece to commit to economic reforms so that aid payments can be released before the country runs out of money. Greek Prime Minister Alexis Tsipras and German Chancellor Angela Merkel are due to meet on the sidelines of a European Union immigration summit in Brussels on Thursday, according to a Greek government official. Greek stocks and bonds rose Wednesday after Finance Minister Yanis Varoufakis saw a “convergence” of views and ECB Executive Board member Benoit Coeure said progress was being made.

“In recent days, there has been tangible progress in the quality of the discussions,” Coeure said in an interview with the Athens-based newspaper Kathimerini. “Significant differences on substance remain.” There are signs Greece’s creditors are curbing demands for far-reaching reforms as part of current talks, focusing on a number of key actions instead, Medley Global Advisors said in a client report on Wednesday. The softening stance comes on condition Greece stays co-operative on fiscal targets, according to Medley.

Read more …

“..from the perspective of the Eurozone and IMF, this is all extremely small beer. You would think the key players on that side had more important things to do with their time.”

• Greece: Of Parents And Children, Economists And Politicians (Wren-Lewis)

Chris Giles has a recent FT article where he describes how non-Greek policymakers (lets still call them the Troika) see themselves like parents trying to deal with the “antics” of the problem child, Syriza in Greece. He splits these parents into different types: those that want to act as if the child is grown up (though they believe they are not), those who want to be disciplinarians etc. As a description of how the Troika view themselves, and present themselves to the public, the analogy rings true. It certainly accords with the constant stream of articles in the press predicting an impending crisis because the Greeks ‘refuse to be reasonable’.

[..] We know that if Greece was not part of the Euro, but just another of a long line of countries that have borrowed too much and had to partially default, its remaining creditors would be in a weak position now that Greece has achieved primary surpluses (taxes>government spending). The reason why the Troika is not so weak is that they have additional threats that come from being the issuer of the Greek currency.

It is important to understand what the current negotiations are about. Running a primary surplus means that Greece no longer needs additional borrowing – it just needs to be able to roll over its existing debts. Part of the argument is about how large a primary surplus Greece should run. Common sense would say that further austerity should be avoided so that the economy can fully recover, when it will have much greater resources to be able to pay back loans. Instead the creditors want more austerity to achieve large primary surpluses. Of course the former course of action is better for Greece: which would be better for the creditors is unclear! The negotiations are also about imposing additional structural reforms. Greece has already undertaken many, and is prepared to go further, but the Troika wants yet more.

As Andrew Watt points out, from the perspective of the Eurozone and IMF, this is all extremely small beer. You would think the key players on that side had more important things to do with their time. The material advantages to be gained by the Troika playing tough are minimal from their perspective, but the threats hanging over the Greek economy are damaging – not just to investment, but also to the very primary surpluses that the Troika needs. So why do the Troika insist on continuing with brinkmanship? Can it be that this is really about ensuring that an elected government that challenges the dominant Eurozone political and economic ideology must be forced to fail?

Read more …

This has always been obvious no matter what Draghi or Schäuble say. They have no way of knowing, they can just wish.

• Greek Contagion Risks May Be Higher Than You Think (CNBC)

A perception in financial markets that Greece exiting the euro zone would have limited knock-on effects is misguided, some analysts say. Euro zone officials meet in Latvia this week to discuss a rescue deal between Greece and its creditors amid growing talk that time is running out for Athens to avoid defaulting on its debt and being ejected from the 19-member euro zone. “UBS does not believe, as its base case that Greece, will leave the euro,” Paul Donovan, UBS global economist, said in a video published by the bank’s research team. “However, there seems to be a belief in financial markets that if Greece were to be forced from the euro area it should be regarded as an isolated incident,” he said. “This belief, seems to us, to be dangerous.”

Donovan said that the view that Greek problems were distinct from the rest of the euro zone was reflected in recent online search patterns: Searches on Google for the term “Grexit” had soared, while those for “euro crisis” or “euro collapse” had not, even though they did during the 2012 euro zone debt crisis. In the latest crisis, government bond yields in peripheral euro zone countries—in the past viewed as most vulnerable to any Greek contagion—have not followed Greek bond yields higher. Greek bond yields have risen sharply this week, reflecting the greater risk attached to holding them. Greece’s benchmark 10-year bond yielded over 13% on Tuesday, well above Spain’s 10-year yield at 1.48% and Portuguese yields at 2.12%.

Although this can partly be explained by the ECB’s massive monetary stimulus program, which is putting downward pressure on yields, it also reflects diminished contagion fears. “I don’t get the sense that there is a widespread view that if a deal is not made and Greece exits the euro zone, you would have this massive contagion effect,” Ben White, Politico’s chief economic correspondent, told CNBC on Monday. UBS’ Donovan said any contagion from a Grexit would come from the banking system. He said that if Greece did leave the euro area, any money in Greek banks would be redenominated into a new currency, which would probably plunge in value, distressing depositors.

Depositors in other countries may think their holdings are safe, since their country is not going to leave the euro zone–or they may decide to avoid any risk and withdraw their savings, Donovan said. “Why take the risk that your country probably won’t leave the euro, if it’s a relatively simple operation to withdraw your savings and hold them in cash?” Donovan asked. “A euro held as cash today is a euro tomorrow,” he said. “A euro held in a bank account today may be an entirely different currency tomorrow, if the irrevocable monetary union has been revoked. Investors are thus likely to choose cash over deposits.”

Read more …

We haven’t a clue yet.

• We’re Just Learning the True Cost of China’s Debt (Bloomberg)

The true cost of the debt that China’s real estate developers peddled to eager international investors during a five-year property boom is now becoming clear. Having found themselves shut out of local bond and loan markets seven years ago, a band of developers began looking elsewhere for funds. First an initial public offering, and then a dollar bond sale. It became a well-trodden path. By 2010, a core group of four – Kaisa, Fantasia, Renhe, Glorious Property – raised a total of $5.6 billion. On Monday, Kaisa buckled under $10.5 billion of debt and defaulted. China’s home builders became the single biggest source of dollar junk debt in Asia amid government measures to prevent a property bubble.

Developers already funneled $78.8 billion from international equity and bond markets into an industry that’s grown to account for one third of the world’s second-biggest economy. Most of the first rush of dollar offerings, in 2010, falls due in the next two years. “It was an unintended consequence of the Chinese government that property developers are selling equity and debt to offshore investors,” said Ben Sy, a Hong Kong-based managing director in JPMorgan’s private banking division. “There happened to be huge demand from international investors in the past few years driven by the intense search for yield.” Kaisa was the first to debut in the dollar note market in 2010, selling $650 million of five-year bonds that April.

The securities paid a 13.5% coupon, more than twice the 6.3% average yield for Bank of America Merrill Lynch’s U.S. Real Estate index at the time. The Shenzhen-based developer was among nine real estate companies that raised $4 billion selling offshore bonds that year, a record at the time and fourfold the previous high. Six of the nine had listed their shares on the Hong Kong stock exchange in the previous 24 months. Chinese developers’ move into the international capital markets started in earnest in 2007. From January to December, as the rest of the world slid deeper into recession, homebuilders raised $7.2 billion. Since 2008, another $11.5 billion has been raised via IPOs in Hong Kong.

Read more …

The Dracula Squid.

• ‘Goldman Advising On The Economy Like Dracula On Running A Blood Bank’ (RT)

Goldman Sachs’ claim that a Labour victory in the general election would impact negatively on Britain’s economy has been dismissed by leading British economists, who say the Wall Street giant’s outlook is laughable and colored by self-interest. In a research document sent to clients earlier this week, Goldman claimed a Labour-led government could spark an exodus of investors from the City of London to more business-friendly pastures. The bank’s warning adds to a growing chorus of concern emanating from the City that Ed Miliband’s party would formulate fiscal and economic policy in the interest of people rather than profit. Speaking to RT on Wednesday, British economist James Meadway insisted Goldman Sachs is not a credible voice on economic policy.

“Listening to Goldman Sachs for advice on how to run the economy is like listening to Dracula on how to run a blood bank,” he said. UK economist and anti-austerity campaigner Michael Burke added Goldman Sachs’ general election analysis amounts to “laughably bad economics.” Burke told RT Goldman’s assessment of Labour’s prospective role in government appears to “confuse the economy with the well-being of its own bankers.” He added the Wall Street banking giant’s prognosis is “blatantly political” and born of self-interest. Goldman Sachs is a powerful player in the City of London and across the European Union.

However, the investment bank has been the focus of a firestorm of criticism in recent years over allegations of insider trading, corruption, aggressive investment vehicles with profound social impacts, and its role in compounding Europe’s sovereign debt crisis. Despite the bank’s less-than-gleaming reputation, its condemnation of Labour will likely be welcomed by City financiers and Conservatives. Speaking to its clients earlier this week, the investment bank said a victory for Labour would be understood as “more problematic by the business community” than victory for the Tories. Goldman billed a coalition between Labour and the Scottish National Party (SNP) as the most toxic combination of parties that could enter government next month.

Read more …

I’m not sure I find the celebrity contest that seems to go along with this thing all that appealing. Nothing against Russell, or Max.

• Russell Brand Eyes Cryptocurrency As Integral Part Of Global Revolution (RT)

In his quest for a global revolution, political activist Russell Brand is eyeing crypto currency and crowd funding as a way of negating and avoiding the capitalist system. Such combination can set the stage for a new era, believes RT’s Max Keiser. Russel Brand has long been promoting organized civil disobedience to bring about a political revolution and fair distribution of wealth unfeasible under capitalism. With his calls sometimes bordering on anarchy, Brand has emerged as a leftist political figure seeking social justice and decentralization of state control over the individual.

“I think what is important is to organize and to disobey. To be really, really disobedient. Revolution is required. It is not a revolution of radical ideas, but simply the implementation of the ideas that they say we already have,” Brand was telling his supporters as he campaigned for resistance. Now Brand has taken one of these revolutionary ideas, the cryptocurrency, and teamed up with StartJoin crowdfunding platform to help people break away from conventional monetary and financial systems. “Essentially what we need is alternative systems and models, and alternative currency is an integral part of that,” Brand told Max Kaiser, the co-guru behind the financial side of the StartCOIN project and the host of RT’s Kaiser Report.

“I’m very interested in setting up social enterprises, such as our cafe that we’ve started, replicating that model more and more,” Brand explained. “Small businesses, practical, functional things where people can come together in an entrepreneurial spirit, creatively, and work together – hopefully ultimately using an alternative currency and completely negating and avoiding the system.” “The more I deal with bureaucracy, the more I deal with consumerism, the more I think that there is really very little it can offer us,” he added. Brand’s latest project is aimed at promoting digital literacy, to further boost online activism. By raising £150,000 for at least 1,000 laptops he is planning to give away for free, Brand wants to make the voices of even the most marginalized individuals in the community heard.

Read more …

Land of shame.

• More Than A Million Brits Have Used Food Banks In The Past Year (Guardian)

More than 1 million people, including rising numbers of low-paid workers, were forced to use food banks in the last 12 months, challenging claims that the dividends of Britain’s economic recovery are being equally shared. The latest figures from the Trussell Trust, which coordinates a network of food banks in the UK, show a 19% year-on-year increase in food bank users, demonstrating that hunger, debt and poverty are continuing to affect large numbers of low-income families and individuals. Nearly 1.1 million people received at least three days of emergency food from the trust’s 445 food banks in 2014-15 – up from 913,000 the previous year. Back in 2009-10, before the Liberal Democrat-Conservative coalition took power, the then little-known charity fed 41,000 people from its 56 food banks.

Chris Mould, the Trussell Trust chairman, said the figures showed many people were experiencing “catastrophic” problems as a result of low incomes, despite signs of a wider economic recovery. He said: “These needs have not diminished in the last 12 months.” Experts warned that the figures were the “tip of the iceberg” of food poverty in the UK, while doctors said the inability of families to buy enough food had become a public health issue. The Trussell Trust figures show the biggest proportion, 44%, of food bank referrals last year – marginally lower than the previous year – were triggered by people pitched into crisis because their benefit payments had been delayed, or stopped altogether as a result of the strict jobcentre sanctions regime. More than a fifth, 22%, of food bank users were referred because of low income – meaning they were unable to afford food due to a relatively small financial crisis such as a boiler breaking down or having to buy a school uniform.

Read more …

This should have been one of the richest entities in the world. And look at it! What came out, see below, is they say they lose $2 billion to ‘graft’. $2 billion? Try $200 billion. These guys spend $2 billion on champagne alone.

• Petrobras, World’s Most Indebted Company, Gets Audited (CNBC)

Petrobras, the Brazilian oil giant, is hoping to finally release audited financial results for the fourth quarter after U.S. markets close on Wednesday, including an estimate of how much has been stripped out of the company by years of alleged fraud. The state-controlled oil company is engulfed in what’s probably the largest financial scandal in Brazil’s history—a high bar, given the country’s record of corruption. And Wednesday’s earnings report has big implications for investors and maybe even the future course of the world’s seventh-biggest economy. Markets are closely examining the results for the level of write-offs and impairments on Petrobras assets, whose values may have been inflated by the fraud. Estimates on how big those numbers may be are staggering: anywhere from $6 billion to $30 billion.

Andre Gordon of AMEC, a Brazilian shareholders’ rights group, said he’s “waiting to see the balance sheet” and expects impairments and writeoffs of between $10 billion to $15 billion. AMEC is active in lobbying for better corporate governance at Petrobras and within Brazil in general. Gordon said he hopes for a turning point for the company that will lead to less government entanglement with Petrobras, “but I am skeptical.” “Not even the opposition party talks about privatization of Petrobras—only small insignificant parties with small market share,” he said. The scandal started with the arrest early last year of a company director, who subsequently struck a deal with prosecutors in September. Since then, details have emerged almost daily of a decade-long, alleged bribery scheme involving company officials.

The executive alleged to investigators that for nearly 10 years, Petrobras contracts were routinely padded by 3%, with the extra money used for bribes and kickbacks. Much of that money was supposedly funneled to the country’s ruling political parties. Other executives have since come forward, and nearly 50 people have been arrested or charged, ranging from more than a dozen CEOs to politicians to party officials, including the treasurer of Brazilian President Dilma Rousseff’s Workers Party.

Read more …

Rousseff must step down and open the prosecutorial floodgates here, or there’ll be severe damage for decades.

• Petrobras To Book Nearly $17 Billion In Charges (MarketWatch)

Brazilian state-run oil company Petróleo Brasileiro SA on Wednesday finally put a price tag on the impact of a corruption scandal that has battered the company’s shares, writing off 6.2 billion reais ($2.1 billion) of alleged bribe payments

In addition, the company booked an impairment charge of 44.6 billion reais ($14.8 billion) for 2014 after determining that assets were overvalued on its balance sheet. As a result, the company reported a net loss of 26.6 billion reais for the fourth quarter on revenue of 85.04 billion reais. Earnings before interest, taxes, depreciation and amortization stood at 20.06 billion reais, up from 15.55 billion reais a year earlier.

The disclosures were part of the first audited financial statements released by Petrobras in more than eight months. Brazilian federal prosecutors since last year have been investigating allegations that the company’s suppliers conspired to overcharge Petrobras for major projects, funneling some of the illicit profit to former Petrobras executives and politicians in the form of bribes and illegal political donations. Petrobras has portrayed itself as a victim of the graft and says it has cooperated with authorities. Still, the company struggled to calculate the scheme’s impact on its balance sheet, leading auditor PricewaterhouseCoopers to refuse to sign off on its statements since the third quarter of 2014.

“With the publication of audited 2014 results, Petrobras has cleared a significant obstacle, after a collective effort, that shows our ability to overcome challenges in an adverse environment,” Chief Executive Aldemir Bendine said in a statement. The financials come just days before an April 30 deadline in Petrobras’s bond covenants that could have allowed the holders of billions of dollars of Petrobras debt to demand early repayment.

Read more …

“Only 5,000 resettlement places across Europe are to be offered to refugees..”

• Most Migrants Crossing Mediterranean Will Be Sent Back (Guardian)

Only 5,000 resettlement places across Europe are to be offered to refugees who survive the dangerous Mediterranean sea crossing under the emergency summit crisis package to be agreed by EU leaders in Brussels on Thursday. A confidential draft summit statement seen by the Guardian indicates that the vast majority of those who survive the journey and make it to Italy – 150,000 did so last year – will be sent back as irregular migrants under a new rapid-return programme co-ordinated by the EU’s border agency, Frontex. More than 36,000 boat survivors have reached Italy, Malta and Greece so far this year. The draft summit conclusions also reveal that hopes of a major expansion of search-and-rescue operations across the Mediterranean in response to the humanitarian crisis are likely to be dashed, despite widespread and growing pressure.

The summit statement merely confirms the decision by EU foreign and interior ministers on Monday to double funding in 2015 and 2016 and “reinforce the assets” of the existing Operation Triton and Operation Poseidon border-surveillance operations, which only patrol within 30 miles of the Italian coast. The European council’s conclusions said this move “should increase the search-and-rescue possibilities within the mandate of Frontex”. The head of Frontex said on Wednesday that Triton could not be a search-and-rescue operation. Instead, the EU leaders are likely to agree that immediate preparations should begin to “undertake systematic efforts to identify, capture and destroy vessels before they are used by traffickers”. The joint EU military operation is to be undertaken within international law.

The statement describes the crisis as a tragedy and says the EU will mobilise all efforts at its disposal to prevent further loss of life at sea and to tackle the root causes of the human emergency, including co-operating with the countries of origin and transit. “Our immediate priority is to prevent more people dying at sea. We have therefore decided to strengthen our presence at sea, to fight the traffickers, to prevent illegal migration flows and to reinforce internal solidarity,” it says, before adding that the EU leaders intend to support all efforts to re-establish government authority in Libya and address key “push” factors such as the situation in Syria. But the detail of the communique makes it clear that the measures to be agreed fall far short of this ambition.

In particular in terms of sharing responsibility across the EU for those who survive the journey, the draft statement suggests only “setting up a first voluntary pilot project on resettlement, offering at least 5,000 places to persons qualifying for protection”, it says. The EU leaders also make a commitment to “increasing emergency aid to frontline member states” – taken to mean Italy, Malta and Greece – “and consider options for organising emergency relocation between member states”.

Read more …

“Leggeri ruled out putting his ships anywhere near the Libyan coast, saying stepping up search-and-rescue operations would only encourage desperate migrants to risk the passage.”

• EU Borders Chief Says Saving Migrants’ Lives ‘No Priority’ (Guardian)

The head of the EU border agency has said that saving migrants’ lives in the Mediterranean should not be the priority for the maritime patrols he is in charge of, despite the clamour for a more humane response from Europe following the deaths of an estimated 800 people at sea at the weekend. On the eve of an emergency EU summit on the immigration crisis, Fabrice Leggeri, the head of Frontex, flatly dismissed turning the Triton border patrol mission off the coast of Italy into a search and rescue operation. He also voiced strong doubts about new EU pledges to tackle human traffickers and their vessels in Libya.

“Triton cannot be a search-and-rescue operation. I mean, in our operational plan, we cannot have provisions for proactive search-and-rescue action. This is not in Frontex’s mandate, and this is in my understanding not in the mandate of the European Union,” Leggeri told the Guardian. The capsizing of a trawler off Libya late on Saturday sparked a public outcry. EU foreign and interior ministers held an emergency meeting on Monday and a special summit on the issue has been called for Thursday in Brussels. The ministers and the European commission agreed to bolster the current Triton mission, to increase its funding and assets, and to expand its area of operation while also calling for new military measures to “systematically capture and destroy” traffickers’ vessels.

Thursday’s summit is to finalise the EU response. Donald Tusk, the president of the European council, who called and will chair the emergency summit, said the leaders had to agree on quick and effective action. “Our overriding priority is to prevent more people from dying at sea … to agree on very practical measures, in particular by strengthening search and rescue possibilities,” he said. But Leggeri ruled out putting his ships anywhere near the Libyan coast, saying stepping up search-and-rescue operations would only encourage desperate migrants to risk the passage. He signalled that Frontex was not asking for more boats, and voiced scepticism about the new talk of military action.

Read more …

More great stuff from ‘our’ side.

• ‘Maidan Snipers Trained In Poland’: Polish MP (RT)

Snipers who are thought to have operated in Kiev’s Independence Square amidst events that led to a coup in February 2014 were trained in Poland and sent to Ukraine to “do a favor” for the US, a Polish Euro-MP claimed in an interview. On February 20, 2014, riot police trying to restrain anti-government demonstrators on Maidan Nezalezhnosti in Kiev suddenly retreated up the street from whence they had come. As the protesters rushed forward, gunfire suddenly broke out, with many witnesses saying it was a sniper attack. In some two hours, 46 people were killed.

A year after the tragedy that provoked a huge backlash from the Ukrainians, ultimately leading to the rapid toppling of then-President Viktor Yanukovich, the events on the square are still pending investigation. Several Berkut riot police officers have been detained, but not much progress has been made, while murky details and speculation have been emerging in the press. In a new development, Polish former presidential candidate Janusz Korwin-Mikke told Wiadomosci media outlet that the snipers had actually been trained in Poland. Korwin-Mikke, 72, a European lawmaker and leader of Poland’s conservative KORWiN party, claimed this was a CIA operation. This came as a “Yes” reply to the question whether he believed the CIA was involved.

“Yes – but it was also our operation. The snipers were trained in Poland,” Korwin-Mikke said adding this was done “to provoke riots.” Poland trained those “terrorists” to please the US, which invested heavily into Ukrainian coup, the politician alleged. “Let me say this again: we are doing a favor to Washington,” Korwin-Mikke said. Challenged about his sources, the politician said he overheard this in the European Parliament as Estonia’s Foreign Affairs Minister Urmas Paet “admitted” to the then-EU foreign affairs chief Catherine Ashton that it was “our people who opened fire on Maidan, not those of Yanukovich or Putin.” It is not clear when the conversation took place, but in March previous year a tape with a telephone conversation between the two politicians was leaked which went among the same lines.

Read more …

And we don’t need to provide no steenking proof.

• US Accuses Russia Of ‘Ramping Up’ Ukraine Presence (BBC)

The US has accused Russia of deploying more air defence systems in eastern Ukraine in breach of a ceasefire deal. The state department also said Russia was involved in training separatist forces in the area and building up its forces along the border. The Kremlin has not yet responded to the claims. A truce between Ukrainian forces and pro-Russian rebels in east Ukraine was brokered by the West in Minsk in February. State department spokeswoman Marie Harf said in a statement that “combined Russian-separatist forces” were violating the terms of the Minsk deal, keeping artillery and multiple rocket launchers in prohibited areas.

“The Russian military has deployed additional air defence systems into eastern Ukraine and moved several of these nearer the front lines,” she said. ‘Complex training’ “This is the highest amount of Russian air defence equipment in eastern Ukraine since August.” Ms Harf said the “increasingly complex nature” of training of pro-Russian forces in east Ukraine “leaves no doubt that Russia is involved”. “Russia is also building up its forces along its border with Ukraine,” she said. “After maintaining a relatively steady presence along the border, Russia is sending additional units there. These forces will give Russia its largest presence on the border since October 2014.” Earlier this month, about 300 US paratroopers arrived in western Ukraine to train with Ukrainian national guard units. At the time, Kremlin spokesman Dmitry Peskov warned the move “could seriously destabilise” the situation in Ukraine.

Read more …

It’s should be mandatory. Get us royal family of lying chimps.

• If A Clinton Were To Marry A Bush, The US Could Cancel Elections (RT)

With apologies to their respective spouses, if Jeb Bush’s son, George P. Bush, had married Chelsea Clinton, Americans could have spared themselves the spectacle of Election 2016 and saved billions of dollars. All that the USA needs now is for a young Clinton to pair up with a junior Bush. Should the union produce an heir, a single line of monarchy would be established. This is the reality of the USA’s broken politics in 2015. A country pretty much established in opposition to hereditary elites now has the most closed political system in the Western world. In the past, America’s strange obsession with the British Royal Family was usually explained by fact that the US has no monarchy of its own. The bad news for Queen Elizabeth’s bunch is that this is increasingly the case in name only.

Right now, Hillary Clinton is close to an even money favorite to become the next American President. The only other short-odds candidate appears to be Jeb Bush. After the former Florida governor there’s a clutch of outsiders like Rand Paul, Scott Walker and Marco Rubio filling out the field. It’s depressing on so many levels. Should Hillary, as expected, secure the White House and serve two terms it’ll mean that America will have been ruled by either a Bush or Clinton for 28 out of 36 years. The only break coming during the 8-year Obama Presidency. Of course, the former first lady served as Secretary of State for half of Obama’s reign. Despite a common misconception that the Roosevelts, Teddy and Franklin D, were close relatives, (they weren’t) keeping things in the family has not been the American way.

In fact, George Bush Senior was the first President since FDR to have been born into the politically-connected WASP elite. Instead, post-war American Presidents have tended to be outsiders, coming from left field. Think Reagan, Nixon and Carter, for instance. Even the ultimate ‘silver-spoon’ Commander-in-Chief, John F. Kennedy, was far from an insider by dint of his Catholic religion. Indeed, despite their great wealth and celebrity, the Kennedy clan never came close to establishing the kind of dynasty that the Bush family has managed. However, the Boston brood remains powerful in the world of baby kissers and it’s commonly accepted that the late Edward was pivotal in securing Obama’s nomination for the 2008 contest.

Read more …

Audit it.

• Fed Refuses to Comply With Lawmakers’ Request For Names in Probe (WSJ)

The Federal Reserve has not replied to a lawmakers’ request that it identify the individuals who had contact with a private consulting firm that published a report on the central bank’s market-sensitive internal policy deliberations. In October 2012, the day before the Fed released its minutes of its September 2012 policy meeting, Medley Global Advisors, sent a report to its clients with several sensitive details that subsequently appeared in the minutes. A central bank probe found a “few” Fed staffers had contact with Medley before the report, but did not identify them. Rep. Jeb Hensarling (R., Texas), Chairman of the House Financial Services Committee, sent a letter to Fed Chairwoman Janet Yellen on April 15 asking the Fed to name them by 5 p.m. EDT April 22.

The deadline passed without any response by the Fed, a committee spokesman said Wednesday. The Fed declined to comment. Medley did not respond to a request for comment. The central bank’s policy-making Federal Open Market Committee makes decisions on interest rates that can cause huge swings in global financial markets. Confidential information about its internal deliberations or advance information about the minutes of its meetings or possible future actions can be worth huge sums of money to traders around the world.

Read more …

We won’t rest till all wildlife is gone.

• Wolves Shot From Choppers Shows Oil Harm Beyond Pollution (Bloomberg)

Here’s one aspect of Canada’s energy boom that isn’t being thwarted by the oil market crash: the wolf cull. The expansion of oil-sands mines and drilling pads has brought the caribou pictured on Canada’s 25-cent coin to the brink of extinction in Alberta and British Columbia. To arrest the population decline, the two provinces are intensifying a hunt of the caribou’s main predator, the gray wolf. Conservation groups accuse the provinces of making wolves into scapegoats for man-made damage to caribou habitats. The cull carried out in winter when the dark fur of the wolves is easier to spot against the snow has claimed more than 1,000 animals since 2005. Hunters shoot them with high-powered rifles from nimble two-seat helicopters that can hover close to a pack or lone wolf.

In Alberta, some are poisoned with big chunks of bait laced with strychnine, leading to slow and painful deaths that may be preceded by seizures and hypothermia. “It’s an unhappy necessity,” Stan Boutin, a University of Alberta biologist, said of the government-sponsored hunt. “We’ve let the development proceed so far already that now, trying to get industry out of an area, is just not going to happen.” The energy industry has delivered a death blow to caribou by turning prime habitat into production sites and by introducing linear features on the landscape that give wolves easy paths to hunt caribou, such as roads, pipelines and lines of downed trees created by oil and gas exploration.

A drop in drilling after oil prices plunged can’t reverse the damage. More than C$350 billion ($285 billion) spent by Alberta’s oil-sands producers to build an industrial complex that’s visible from space have made the province’s boreal herds of woodland caribou the most endangered in the country. Their population is falling by about half every eight years, according to a 2013 study in the Canadian Journal of Zoology. Since 2005, Alberta has auctioned the rights to develop more than 25,000 square kilometers (9,652 square miles) of land in caribou ranges to energy companies, according to the Canadian Parks and Wilderness Society, an Ottawa-based charity. That’s equivalent to about three times New York’s metropolitan area.

“When the oil industry goes in there and cuts those lines and drills and puts in pipelines, it helps the wolves,” said Chad Lenz, a hunting guide with two decades of experience based in Red Deer, Alberta. Lenz has watched caribou herds shrink as the number of wolves soar. “There’s not a place in Alberta that hasn’t been affected by industry, especially the oil industry.” Home to the world’s third-largest proven crude reserves, Alberta depends on levies from the energy industry to build new roads, schools and hospitals.

Read more …

It’s no use staying. Your kids deserve better. California is yesterday.

• What California Can Learn About Drought From ‘Chinatown’ (MarketWatch)

In the 1974 film “Chinatown,” a fictional Los Angeles politician issues a warning as he lays out his case for creating an aqueduct to bring water to the city from the inland valley more than 200 miles north: “Beneath every street there is a desert, and without water the dust will rise up and cover us as if this place never existed.” For California, these words still resonate as a severe drought drags into its fourth year, prompting the first-ever mandatory restrictions on water usage and stirring questions about how the drought will be handled as the climate becomes warmer and drier. With the mood of the present-day state becoming more unsettled, “Chinatown” is perhaps more timely than ever, offering a cautionary tale and a possible roadmap for our thinking about water.

“I can’t tell you how many times people have said, ‘Forget it, Jake. It’s Chinatown,’” said Jon Christensen at UCLA, speaking of the iconic movie’s staying power. Although the film itself is a fictional work, “like all great art,” Christensen said, “it captures a great truth about water in California and in the American West.” The film, starring Jack Nicholson, Faye Dunaway and John Huston, dramatizes the California water wars of the early 1900s, accenting corruption, deception and secret dealings within Los Angeles, a city whose character would be shaped by its growing thirst for water. The film is set in the 1930s but is loosely based on the events of 1913, when Los Angeles began siphoning off water from the Owens Valley, on the eastern side of the Sierra Nevada, through an aqueduct.

As the L.A. region flourished, businessmen involved in the deal to bring water to the city profited wildly, while farmers in the Owens Valley were left to watch their land go dry and their regional economy suffer. The tension between agricultural and residential interests has been a defining conflict in California’s history, according to many experts. In March, the Golden State’s cities and towns were ordered to reduce their water usage by 25%. Farmers were exempted from these restrictions, even though agriculture amounts to 80% of water use in the state. Gov. Jerry Brown defended agriculture’s water consumption but has said water rights may need to be re-examined.

Read more …