Camille Pissarro The Boulevard Montmartre at Night 1897

Yesterday’s refusal to extradite Julian Assange is great news, but no-one really knows what it means. Craig Murray was one of the few allowed inside the courtroom, and he’s optimistic Assange will be out on bail by tomorrow. Let’s cling to that for now.

“I should be very surprised if Julian is not released on Wednesday pending the appeal.”

• Julian Assange: Imminent Freedom (Craig Murray)

It has been a long and tiring day, with the startlingly unexpected decision to block Julian’s extradition. The judgement is in fact very concerning, in that it accepted all of the prosecution’s case on the right of the US Government to prosecute publishers worldwide of US official secrets under the Espionage Act. The judge also stated specifically that the UK Extradition Act of 2003 deliberately permits extradition for political offences. These points need to be addressed. But for now we are all delighted at the ultimate decision that extradition should be blocked. The decision was based equally on two points; the appalling conditions in US supermax prisons, and the effect of those conditions on Julian specifically given his history of depression.

The media has concentrated on the mental health aspect, and given insufficient attention to the explicit condemnation of the inhumanity of the US prison system. I was the only person physically present in the public gallery inside the court, having been nominated by John Shiption to represent the family, aside from two court officials. I am quite sure that I again noted magistrate Baraitser have a catch in her throat when discussing the inhumane conditions in US supermax prisons, the lack of human contact, and specifically the fact that inmates are kept in total isolation in a small cage, and are permitted one hour exercise a day in total isolation in another small cage. I noted her show emotion the same way when discussing the al-Masri torture evidence during the trial, and she seemed similarly affected here.

Julian looked well and alert; he showed no emotion at the judgement, but entered into earnest discussion with his lawyers. The US government indicated they will probably appeal the verdict, and a bail hearing has been deferred until Wednesday to decide whether he will be released from Belmarsh pending the appeal – which court sources tell me is likely to be held in April in the High Court. I should be very surprised if Julian is not released on Wednesday pending the appeal. I shall now be staying here for that bail hearing.

Could be for only 3 years.

• Mexican President Promises Asylum For Julian Assange (RT)

Mexico’s president has offered asylum to WikiLeaks founder Julian Assange, hours after a British judge refused to extradite Assange to the US to face espionage charges. “Assange is a journalist and deserves a chance, I am in favor of pardoning him,” President Andres Manuel Lopez Obrador told reporters on Monday, saying “we’ll give him protection.” “Our tradition is protection,” Obrador added. [..] Were Assange to take Lopez Obrador up on his offer, he would likely have to weigh the president’s promise of protection against the fact that Obrador could be voted out of office in 2024, when his six-year term concludes.

Since taking office, Lopez Obrador has pursued an idiosyncratic foreign policy. On one hand, the left-wing president sheltered Bolivian President Evo Morales following a right-wing coup in 2019 and refused to follow the lead of the US and its allies in Latin America and recognize opposition leader Juan Guaido as Venezuela’s interim president last year. On the other hand, Lopez Obrador has been largely supportive of US President Donald Trump’s administration. The Mexican leader tightened up security at his southern border when Trump railed against Central American migrant “caravans” entering the US via Mexico, and was repaid by Trump during negotiations with OPEC last year, when the US President intervened to help Mexico avoid cuts to oil production.

One single death doesn’t have much meaning.

• Nurse Dies Following Vaccination With Pfizer’s COVID19 Shot In Portugal (RT)

Health authorities in Portugal are investigating the sudden death of a pediatric surgery assistant in Porto, who was reportedly in “perfect health” when she received the Pfizer vaccine against the coronavirus. Identified on Monday as Sonia Azevedo, 41, the mother of two worked as a surgical assistant at the Instituto Portugues de Oncologia (IPO), an oncology hospital in Porto. She was among the 538 healthcare workers at IPO who received their first dose of the Pfizer-BioNTech vaccine last Wednesday. Azevedo had dinner with her family on New Year’s Eve, and was found dead in bed the following morning.

“I want to know what caused my daughter’s death” her father Abilio told the Portuguese tabloid Orreio da Manha. He described her as a “well and happy” person who “never drank alcohol, didn’t eat anything special or out of the ordinary.” Azevedo was so proud to be among the first to receive the vaccine, she changed her Facebook profile picture to reflect that. “Covid-19 vaccinated,” she wrote under a selfie with her face mask on. “We don’t know what happened. It all happened quickly and with no explanation,” Azevedo’s daughter Vania Figueiredo told the paper. “I didn’t notice anything different in my mother. She was fine. She just said that the area where she had been vaccinated hurt, but that’s normal…”

Ivermectin goes mainstream. “But we have to do more testing”.

• Cheap Hair Lice Drug May Cut Risk Of COVID19 Death By 80 Percent (NYP)

A simple treatment for COVID-19 could be cheaper than 20 bucks — and familiar to most grade school nurses. Head lice drug ivermectin is being explored as a potential treatment for the coronavirus following a promising new study that showed an 80% reduction in hospitalized COVID-19 patient deaths. Just 8 out of 573 patients who received ivermectin passed away, compared to the 44 individuals out of 510 who died after being given a placebo. An earlier study of the antiparasitic prescription drug, which costs between $17 and $43 for a course of treatment, according to GoodRx, revealed promising results in April — by removing all viral RNA within 48 hours of a single dose.

Liverpool University virologist Andrew Hill has called the new study “transformational” in the search for a coronavirus therapy. His findings, based on data from over 1,400 patients, were made public in a video posted to YouTube in which Hill discusses his results in a previously aired livestream. The research currently awaits peer review prior to publishing. “If we see these same trends observed consistently across more studies, then this really is going to be a transformational treatment,” said Hill. However, critics have called Hill’s study conclusion premature, urging further research before declaring ivermectin an effective treatment — citing other buzzed-about methods that ultimately failed to deliver, such as hydroxychloroquine and tocilizumab.

“All we have are observational studies and clinicians’ opinions,” said University of Sydney professor Andrew McLachlan, the Daily Mail reported. “Many of the current studies have low numbers of participants, weak study designs, and inconsistent (and relatively low) ivermectin dosing regimes, with ivermectin frequently given in combination with other drugs.”

Long piece on all options.

• The Lab-Leak Hypothesis (Baker)

What happened was fairly simple, I’ve come to believe. It was an accident. A virus spent some time in a laboratory, and eventually it got out. SARS-CoV-2, the virus that causes COVID-19, began its existence inside a bat, then it learned how to infect people in a claustrophobic mine shaft, and then it was made more infectious in one or more laboratories, perhaps as part of a scientist’s well-intentioned but risky effort to create a broad-spectrum vaccine. SARS-2 was not designed as a biological weapon. But it was, I think, designed. Many thoughtful people dismiss this notion, and they may be right. They sincerely believe that the coronavirus arose naturally, “zoonotically,” from animals, without having been previously studied, or hybridized, or sluiced through cell cultures, or otherwise worked on by trained professionals.

They hold that a bat, carrying a coronavirus, infected some other creature, perhaps a pangolin, and that the pangolin may have already been sick with a different coronavirus disease, and out of the conjunction and commingling of those two diseases within the pangolin, a new disease, highly infectious to humans, evolved. Or they hypothesize that two coronaviruses recombined in a bat, and this new virus spread to other bats, and then the bats infected a person directly — in a rural setting, perhaps — and that this person caused a simmering undetected outbreak of respiratory disease, which over a period of months or years evolved to become virulent and highly transmissible but was not noticed until it appeared in Wuhan.

There is no direct evidence for these zoonotic possibilities, just as there is no direct evidence for an experimental mishap — no written confession, no incriminating notebook, no official accident report. Certainty craves detail, and detail requires an investigation. It has been a full year, 80 million people have been infected, and, surprisingly, no public investigation has taken place. We still know very little about the origins of this disease. Nevertheless, I think it’s worth offering some historical context for our yearlong medical nightmare. We need to hear from the people who for years have contended that certain types of virus experimentation might lead to a disastrous pandemic like this one. And we need to stop hunting for new exotic diseases in the wild, shipping them back to laboratories, and hot-wiring their genomes to prove how dangerous to human life they might become.

The drug itself is not experimental enough?!

• US May Cut Some Moderna Vaccine Doses In Half To Speed Rollout (R.)

The U.S. government is considering giving some people half the dose of Moderna’s COVID-19 vaccine in order to speed vaccinations, a federal official said on Sunday. Moncef Slaoui, head of Operation Warp Speed, the federal vaccine program, said on CBS’ “Face the Nation” that officials were in talks with Moderna and the Food and Drug Administration about the idea. Moderna’s vaccine requires two injections. “We know that for the Moderna vaccine, giving half of the dose to people between the ages of 18 and 55, two doses, half the dose, which means exactly achieving the objective of immunizing double the number of people with the doses we have,” Slaoui said. “We know it induces identical immune response” to the full dose, he added.

The U.S. Centers for Disease Control and Prevention said it had administered 4,225,756 first doses of COVID-19 vaccines in the country as of Saturday morning and distributed 13,071,925 doses. The U.S. has also approved a vaccine from Pfizer, which like Moderna’s requires two shots. Vaccinations have fallen far short of early targets, as officials had hoped to have 20 million people vaccinated by the end of the 2020. Slaoui said he was optimistic vaccinations would continue to accelerate. He rejected the suggestion that officials should prioritize giving more people a single shot, rather than holding back doses for the second shot, saying that cutting Moderna vaccine doses in half was “a more responsible approach that would be based on facts and data.” Slaoui said it would likely not be known until late spring whether vaccinated people can still spread the disease to others.

Vaccination iron curtain?!

• Putin Pushes Plan To Roll Out COVID “Immunity Passports” In Russia (ZH)

As Russian President Vladimir Putin ramps up his aggressive campaign to stamp out COVID-19 once and for all (as Russia races to vaccinate its most vulnerable citizens while striking deals to supply “Sputnik V” to developing markets the world), the embattled president has just raised the possibility of distributing ‘immunity passports’, an idea that has gained traction around the world since the dawn of the pandemic. According to an RT report, the Russian government is considering the development and distribution of documents verifying whether individuals have been vaccinated. China has already road-tested technology transmitting people’s COVID status via smartphone apps, and it’s widely suspected that Beijing will impose some version of immunity passports, if they haven’t already.

In a series of instructions to officials, published at the end of 2020, President Vladimir Putin ordered policymakers “to consider issuing certificates to people who have been vaccinated against Covid-19 infections using Russian vaccines…or the purpose of enabling citizens to travel across the borders of the Russian Federation and those of other countries.” Russia’s Prime Minister, Mikhail Mishustin, has been charged with implementing the recommendations, and is set to report back on January 20. For once, Putin and American billionaire Bill Gates will be seeing eye to eye, as support for “immunity passports” grows not just among governments (even in “liberal democracies” like Canada), but the private sector as well. As RT reminds us, the IATA has voiced support for “immunity passports” as a strategy for hastening the revival of air travel.

The International Air Transport Association, which represents 290 airlines across the world, has supported the idea of vaccine passports, and is developing its own digital system to track who has been immunized against the virus. Passengers may be expected to present equivalent documents before being allowed to board planes in the future. Immunizations with the Russian-made Sputnik V vaccine, the first to be registered for the prevention of Covid-19 anywhere in the world, have been taking place in growing numbers in the capital and across the country. More than 70 centers in Moscow are now offering jabs, and at least 800,000 people have received their first dose.

Remember, once they arrived, people might soon find “Immunity Passports” will become a permanent facet of their lives: even after the COVID-19 pandemic ends, they could be used to offer evidence that a traveler has been vaccinated – not just for COVID-19, but for any other diseases, or even perhaps mutated forms of COVID-19. Critically, as we noted previously, if we are going to live in a world where vaccines are mandatory for travel, who is to say that every nation on Earth is going to acknowledge the validity of every other vaccine. The Mainstream Media makes it seem as though just getting any vaccine with some sort of paperwork to back it up should be good enough, but this is unlikely to be true.

The church is powerful in Greece.

• Greek Orthodox Church To Defy Lockdown By Opening For Epiphany (G.)

The Greek Orthodox church has announced it will defy government lockdown orders aimed at curbing the spread of coronavirus and open places of worship to mark Epiphany this Wednesday. After an emergency session of the holy synod, its governing body, senior clerics said they would press ahead as planned and celebrate the baptism of Christ on 6 January. “The synod does not agree with the new government measures regarding the operation of places of worship and insists on what was originally agreed with the state,” the ecclesiastical body said in a statement. “It asks that the aforementioned decision be absolutely respected by the state without further ado taking into consideration … that all the foreseen hygiene measures were upheld by clerics in thousands of churches across Greece.”

The announcement, which flies in the face of new week-long restrictions on movement, is the most open act of defiance yet by the powerful institution. Before the holiday season Athens’ centre-right government had said it would relax curbs and permit all places of worship to conduct services, albeit with limited congregations, on Christmas Day, New Year’s Day and the Epiphany. But with the country’s health system under pressure after a surge in coronavirus cases, the administration rescinded the decision at the weekend saying restrictions eased over the festive period would be reimposed to facilitate the reopening of schools on 11 January. Greece has been in lockdown since 7 November.

How the prime minister, Kyriakos Mitsotakis, who kicked off the new year with a cabinet reshuffle earlier on Monday, will react to the decision remains to be seen. The sight of worshippers breaching restrictions that have caused consternation, not least in the retail sector, would fuel further controversy. Epidemiologists have called for even tougher curbs if a second wave of the pandemic is to be brought under control in a country that, while faring better than most, has recorded 140,099 coronavirus cases and 4,957 Covid-19 deaths to date.

This bloated industry can do with some less.

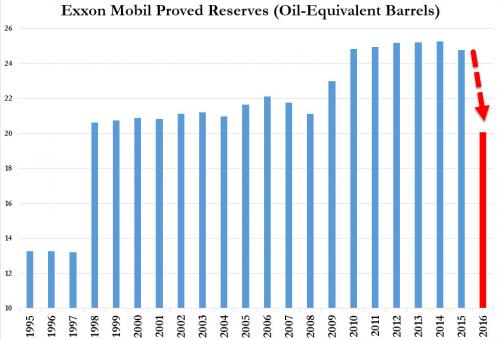

• Tourism Tumbles To 1990 Levels As Pandemic Halts Travel (ZH)

While few industries have been spared by the impact of the COVID-19 pandemic, even fewer have been hit as hard as the tourism sector. As 2020 drew to a close with severe limitations to travel still in place, the World Tourism Organization (UNWTO) expects international arrivals to have declined by 70 to 75 percent compared to the previous year. As Statista’s Felix Richter writes, that equates to a decline of around 1 billion international arrivals, bringing the industry back to 1990 levels.

Prior to the coronavirus outbreak, the global tourism sector had seen almost uninterrupted growth for decades. Since 1980, the number of international arrivals skyrocketed from 277 million to nearly 1.5 billion in 2019. As Statista’s chart above shows, the two largest crises of the past decades, the SARS epidemic of 2003 and the global financial crisis of 2009, were minor bumps in the road compared to the COVID-19 pandemic. Looking ahead, most experts don’t expect a full recovery in 2021, which started off with many countries still battling the second wave of the pandemic. According to the UNWTO’s estimates, it will take the industry between 2.5 and 4 years to return to pre-pandemic levels of international tourist arrivals.

“Persistent rumor has the president laying out a royal flush of deadly information about his antagonists, enough to make heads explode among the formerly cocksure and vaporize the narrative they’ve been running for four years.”

• Giving Up the Ghost (Kunstler)

Things are shaking loose. Secrets are flying out of black boxes. Shots have been fired. The center is not holding because the center is no longer there, only a black hole where the center used to be, and, within it, the shriekings of lost souls. Will the United States go missing this week, or fight its way out of the chaos and darkness? Whatever occurs in this strange week of confrontation, Joe Biden will not be leading any part of it. Where has he been since Christmas? Back to hiding in the basement? Did the American people elect a ghost? Even if this storm blows over, could Joe Biden possibly claim any legitimacy in the Oval Office? And then what happens with the rest of the story — which is an epic economic convulsion sharper than the Great Depression — as time is unsuspended and the year 2021 actually unspools?

Only the bare outlines of this week’s fateful game are visible. Mr. Trump has not conceded the election. An action will play out in congress under rarely-used constitutional rules as to how the electoral college votes are awarded to whom. The rancor around this action is already epic. Few of the political players are beyond suspicion of dark deals and shifty allegiances. Persistent rumor has the president laying out a royal flush of deadly information about his antagonists, enough to make heads explode among the formerly cocksure and vaporize the narrative they’ve been running for four years. A whole lot of people are converging in the nation’s capital at midweek, maybe even the touted million. It is a moment, possibly, not unlike the Bastille in Paris, 1789. They will be clamoring right outside Congress as the electoral vote ceremony proceeds. If the battle is not joined in the chamber, it’s a little hard to believe the crowd will just heave a million sighs, trudge back to their cars, and drive quietly home.

Senator Ted Cruz has come up with a pretty sound plan: a ten-day emergency audit of the balloting with an electoral commission consisting of five Senators, five House Members, and five Supreme Court Justices — to consider and resolve the disputed returns. The proposal is based on the 1877 procedure for resolving the contested Hayes-Tilden election. “Once completed, individual states would evaluate the Commission’s findings and could convene a special legislative session to certify a change in their vote, if needed,” the proposal stated. Naturally, the Democratic Party’s news media handmaidens denounced it as “embarrassing” — which raises the question: who exactly will be embarrassed if the plan goes ahead?

We try to run the Automatic Earth on donations. Since ad revenue has collapsed, you are now not just a reader, but an integral part of the process that builds this site.

Click at the top of the sidebars for Paypal and Patreon donations. Thank you for your support.

Support the Automatic Earth in virustime, election time, all the time. Click at the top of the sidebars to donate with Paypal and Patreon.