Walker Evans Shoeshine stand, Southeastern US 1936

A tas less Brexit than the past few days. Since most of the ‘journalism’ is so ‘end of the world’ one-sided, let’s start with some different views.

‘Doug Bandow is a former Special Assistant to President Ronald Reagan and author of Foreign Follies: America’s New Global Empire. He is a Senior Fellow at the Cato Institute.’

• 16 Reasons To Celebrate Brexit’s Win (Bandow)

1. Average folks took on the commanding heights of politics, business, journalism and academia and triumphed. Obviously, the “little guy” isn’t always right, but the fact he can win demonstrates that a system whose pathways remain open to those the Bible refer to as “the least of these.” The wealthiest, best-organized and most publicized factions don’t always win.

2. Told to choose between economic bounty and self-governance, a majority of Britons chose the latter. It’s a false choice in this case, but people recognized that the sum of human existence is not material. The problem is not just the decisions previously taken away from those elected to govern the UK; it’s also the decisions that would have been taken away in the future had “Remain” won.

3. Those governed decided that they should make fundamental decisions about who would rule over them. The Eurocrats, a gaggle of politicians, bureaucrats, journalists, academics, lobbyists and businessmen were determined to achieve their ends no matter what the European people thought. A constitution rejected? Use a treaty. A treaty rejected? Vote again. A busted monetary union? Force a political union. And never, ever consult the public. No longer, said the British.

13. Schadenfreude is a terrible thing, but almost all of us glory in the misfortune of at least some others. The recriminations among the Remain camp in Britain are terrible to behold. Labour Party tribunes blame their leader Jeremy Corbyn, whose Euroskeptic past created suspicions inflamed by his criticisms of the EU while nominally praising it. His supporters blame the Scottish nationalists for not turning out their voters. Former Liberal-Democrat Party leader and deputy Prime Minister Nick Clegg trashed Cameron and Chancellor of the Exchequer George Osborne for seeking political advantage by holding the referendum. The Scots are mad at the English. Irish “republicans” in Northern Ireland also are denouncing the English, while their longtime unionist rivals are trashing the republicans. The young are blaming the old for ruining their futures. Apparently, America isn’t the only home for myopic bickering.

14. Sometimes the advocate of a lost cause triumphs. Nigel Farage has been campaigning against the EU forever, it seems. Yet every advance appeared to trigger a retreat. His United Kingdom Independence Party picked up support, but then had to shed some of those whose views really were beyond the pale. UKIP was able to break into the European Parliament, which it hated, but won only one seat at Westminster, despite receiving 3.9 million votes, or 12.6% of the total, in last year’s election. One reason was that Cameron and the Tories stole his issue, promising a referendum on the EU—in which they then opposed separation. Election night he admitted that it looked like the UK would choose to remain. Except the British people ended up taking his advice.

From Charles’ “correspondent” Ron. Brexit as a natural phenomenon. “I believe we have entered a critical but wonderful age, the age of reemergence of decentralization and decentralized governance; may we preserve this opportunity for the gift that it is to life, liberty and property.”

• Brexit, a Step in the Right Direction (OTM)

“Mankind’s fundamental quest is to survive and prosper by solving scarcity. BREXIT is simply a modern example of an old pattern of behavior that seeks to resolve scarcity, (the shrinking pie of economic opportunity and ownership), through reconfiguration of relationships to reallocate resources to enable more equitable equilibrium in supply and demand. As a prelude to BREXIT, housing in Britain, in particular, had become out of reach for those that have labored under the assumption that hard work, education, and a good job would lead to an ability to own a home, which many young Britons now find economically out of their reach; many Britons blame the government’s monetary policy of 0% interest rates for inflation and unaffordable housing.

In another sign of frustration, a few years ago a graffiti sign expressed a sentiment of the youth in Britain, one of them posted at Bell Lane near Liverpool St. Station, it read: ‘Sorry, the lifestyle you ordered is out of stock.’ The Bank of England has continued policies that have contributed to the exasperation expressed through the referendum, this along with the burdens of having an open country and economy that increased labor supply which in turn increased demand for housing and available credit to driving the asset bubble. This type of scarcity, being seen in Britain, is very common throughout history and is generally driven by the confluence of interests that connects and drives centralized, unified policies between bankers, merchants (in today’s world global corporations) and governments.

Turning back the clock a bit, I would like to include a couple of quotes by an amazingly brilliant and eloquent commentator in economics, Fredic Bastiat in his writings from 1850: 1) “I do not dispute their right to invent social combinations, to advertise them, to advocate them, and to try them upon themselves, at their own expense and risk. But I do dispute their right to impose these plans upon us by law – by force – and to compel us to pay for them with our taxes.” 2) “Self-preservation and self-development are common aspirations among all people. And if everyone enjoyed the unrestricted use of his faculties and the free disposition of the fruits of his labor, social progress would be ceaseless, uninterrupted, and unfailing. But there is also another tendency that is common among people. When they can, they wish to live and prosper at the expense of others.”

Currency wars with an twist.

• Brexit Pulls Central Bankers In Conflicting Directions (WSJ)

ECB President Mario Draghi urged central banks to better coordinate policies to confront the problem of ultralow inflation in an era of slow global growth, underscoring the conundrum he and his associates face in the wake of Britain’s vote to leave the European Union. The guardians of the global monetary system face conflicting pressures as they seek to support their economies amid new turbulence. They also run the risk that their efforts will work at odds with each other and destabilize the financial system. Central banks should examine whether their policies are “properly aligned,” Mr. Draghi said at an ECB conference in Portugal. He further warned that currency devaluations aimed at boosting national competitiveness are a “lose-lose” for the global economy.

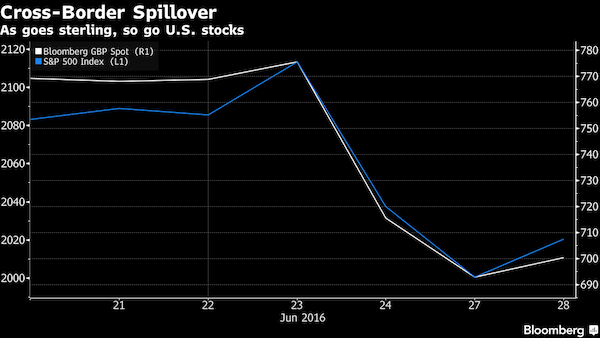

“In a globalized world, the global policy mix matters—and will likely matter more as our economies become more integrated,” Mr. Draghi said. “The speed with which monetary policy can achieve domestic goals inevitably becomes more dependent on others.” His warning resonated as central banks try to respond to the looming Brexit. Last week’s vote sent currencies spinning, pushing up the dollar and Japanese yen and driving down the euro and the British pound. It also sent investors away from stocks and risky bond investments. Markets settled on Tuesday after two days of sharp selling of risky assets. The Bank of England faces the risk of recession paired with the threat of inflation. If it lowers interest rates to boost growth, it could put additional downward pressure on its currency which stirs inflation. If it stands still, economic growth could suffer.

Diminishing returns on the biggest debt drive in history will diminish with a vengeance.

• When Central Planning Fails (ZH)

Things have not been going according to plan for Kuroda-san and his policy-making ‘Peter-Pan’s in Japan. Since The Bank of Japan unleashed NIRP on its ‘saving’ community – which, according to the textbooks would force money to reach for riskier investments, pumping stocks up, or flush cash into inflationary consumption – stock prices have collapsed and bond prices have exploded… In fact, in six months, bonds are outperforming stocks by a central-bank-credibility-crushing 70%!!! Rate cuts…not working.

And it’s not just The BoJ that is struggling – since The Fed hiked rates, The S&P is down 3.5% and Treasuries are up 16%!!

Behind the rhetoric, the EU is powerless to demand on the timeline. Moreover, guys like Juncker and Tusk are starting to fear for their cushy jobs.

• Cameron Wins Brexit Breathing Space At Gloomy EU Summit (AFP)

EU leaders gave Britain breathing space Tuesday by accepting it needed time to absorb a shock Brexit vote before triggering a divorce but insisted the crunch move could not wait months. A humiliated Prime Minister David Cameron came face-to-face with European colleagues for the first time since last week’s vote at a Brussels summit which leaders said was “sad” but pragmatic. Trillions of dollars have been wiped off world markets since Thursday’s vote to leave the EU, while the United Kingdom’s future has been thrown into doubt after Scotland said it would push for a new independence referendum. Further shockwaves juddered through British politics as Jeremy Corbyn, leader of the main opposition Labour party, vowed to fight on despite losing a crushing no-confidence vote among his party’s lawmakers.

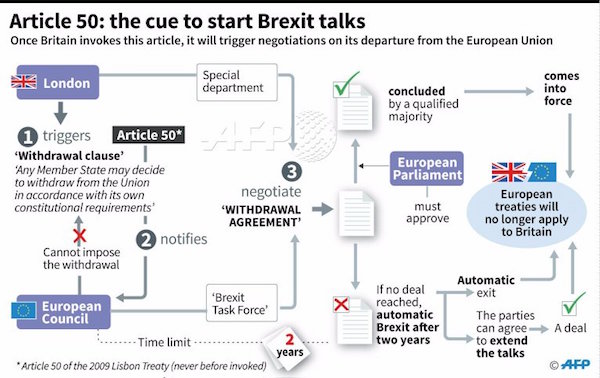

Thousands of people took to the streets of London, which voted overwhelmingly to stay in the EU, to protest against the referendum result, waving EU flags and placards saying: “Stop Brexit”. After hours of talks in Brussels, EU President Donald Tusk said that he understood that time was needed “for the dust to settle” in Britain before the next steps can be taken. But reflecting wider concerns of a domino effect of other states wanting to leave, EC president Jean-Claude Juncker said Britain did not have “months to meditate”. He set a clear timetable for triggering Article 50, the EU treaty clause that begins the two-year withdrawal process, after Cameron’s successor takes office in early September. Juncker said that if the new prime minister was a pro-remain figure, Article 50 should be activated “in two weeks after his appointment” – but if it was a supporter of the leave campaign, “it should be done the day after his appointment,” he added.

Note how the term ‘populist’ is regurgitated by media like Bloomberg, and then applied to anyone ‘we’ are supposed to eye with suspicion. Beppe Grillo, Nigel Farage, Hugo Chavez, Podemos, there’s a long list by now, and all they have in common is resistance to ‘The Model’. Problem of course is, when used this way, a term loses its meaning. But for now, everyone takes for granted that anyone who’s a Euroskeptic is also per definition a populist.

• Draghi Wishes for a World Order Populists Will Love to Hate (BBG)

Mario Draghi has just pushed the boundaries of central banking further into the realm of globalization, at a time when globalization is on the run. Following the work of Reserve Bank of India Raghuram Rajan and others, the ECB president on Tuesday became the most senior global central banker so far to call for more explicit policy cooperation between jurisdictions. Draghi’s aim is to mitigate the damaging cross-border side-effects brought on by the combination of monetary activism and tighter global financial links. “We have to think not just about whether our domestic monetary policies are appropriate, but whether they are properly aligned across jurisdictions,” Draghi said at the ECB’s annual policy forum in Sintra, Portugal. “In a globalized world, the global policy mix matters.”

While Draghi made no explicit reference in the speech to the U.K.’s June 23 decision to quit the EU, a powerful rejection by voters of globalization, he told European leaders just hours later that he leans toward the more pessimistic forecasts of the impact of Britain’s vote on growth in the rest of the region, according to a document obtained by Bloomberg News. [..] Policy coordination is a laudable thought as long as it’s not taken too far, said Omair Sharif at Societe Generale in New York. “What he’s getting at is simply the idea that we don’t have a great understanding of all the financial linkages and capital flows,” Sharif said. “That certainly does call for better understanding among central banks, not necessarily coordinated policies.”

It was all borrowed growth anyway. And you can’t borrow growth.

• Exposure Of Asian Economies To UK Banks Will Cause Sharp Slowdown (SCMP)

Asian economies may slow down sharply and currencies may be pushed broadly lower as the Brexit contagion hits Asia, with Hong Kong likely to fall into a recession and the Chinese yuan to decline further, according to analysts. Britain’s dramatic decision to break from the European Union has roiled financial markets and sent shockwaves across the globe. Asian economies could soon feel deeper pains through several channels, including the financial sector, trade, investor confidence, and investor psychology, according to analysts from Nomura on Tuesday. “It’s not a temporary contagion. There are going to be several waves [on Asia],” said Rob Subbaraman at Nomura in a conference call.

Subbaraman said his team had slashed GDP growth forecasts for all major economies in the region and put Asia’s aggregate growth at 5.6% in 2016, down from a previous projection of 5.9%. In the region, Hong Kong may be hit the most, with its 2016 GDP likely to shrink by 0.2%, compared with a previous estimate of 0.8% growth. In 2015, Hong Kong’s economy grew by 2.4%. Singapore’s projected growth rate for 2016 was also cut sharply to 1.1%, versus an estimate of 1.8% previously. “Hong Kong and Singapore are both financial hubs and very exposed to UK banks,” said Subbaraman. “They also have managed exchange rates, which give central banks less leeway in rate policy. There is also a risk that the HIBOR (Hong Kong Interbank Offered Rate) rates could start rising.”

In particular, the reasons that they forecast an “outright recession” for the Hong Kong economy are mainly related to a stronger Hong Kong dollar, which is rising with the US dollar amid global risk aversion. Hong Kong’s reliance on exports also leaves it exposed to Brexit risks, as the city’s merchant exports to the UK and the rest of the EU accounted for 14% of GDP in 2015, the highest in Asia, Nomura analysts said.

More currency wars with more twist.

• Japan Inc.’s Yen Nightmare Looms at Large Exporters (BBG)

For a sense of how much the surging yen will hurt Japanese earnings, look at the gap between where companies expected the currency to trade and where it actually is. On average, large manufacturers calculated their earnings forecasts assuming the yen would be about 114 per dollar, based on data from the Bank of Japan. With the yen’s latest rally, the gap with that forecast is the widest since the global financial crisis in 2008.

Cities won’t be happy with this. Parking tickets are a large source of income.

• Robot Lawyer Overturns 160,000 Parking Tickets In London And New York (G.)

An artificial-intelligence lawyer chatbot has successfully contested 160,000 parking tickets across London and New York for free, showing that chatbots can actually be useful. Dubbed as “the world’s first robot lawyer” by its 19-year-old creator, London-born second-year Stanford University student Joshua Browder, DoNotPay helps users contest parking tickets in an easy to use chat-like interface. The program first works out whether an appeal is possible through a series of simple questions, such as were there clearly visible parking signs, and then guides users through the appeals process.

The results speak for themselves. In the 21 months since the free service was launched in London and now New York, DoNotPay has taken on 250,000 cases and won 160,000, giving it a success rate of 64% appealing over $4m of parking tickets. “I think the people getting parking tickets are the most vulnerable in society. These people aren’t looking to break the law. I think they’re being exploited as a revenue source by the local government,” Browder told Venture Beat. The bot was created by the self-taught coder after receiving 30 parking tickets at the age of 18 in and around London. The process for appealing the fines is relatively formulaic and perfectly suits AI, which is able to quickly drill down and give the appropriate advice without charging lawyers fees.

Shilling’s not had his strongest year so far, but duly noted.

• Oil Is Still Heading to $10 a Barrel (A. Gary Shilling)

Back in February 2015, the price of West Texas Intermediate stood at about $52 per barrel, half of its 2014 peak. I argued then that a renewed decline was coming that could drive it below $20, a scenario regarded by oil bulls as unthinkable. But prices did fall further, dropping all the way to a low of $26 in February. Since then, crude rallied to spend several weeks flirting with $50 per barrel, a level not seen since last year. But it won’t last; I’m sticking to my call for prices to decline anew to $10 to $20 per barrel. Recent gains have little to do with the fundamentals that led to the collapse in the first place.

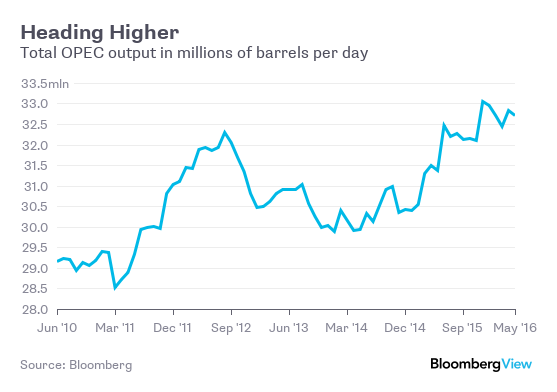

Wildfires in the oil-sands region in Canada, output cuts in Nigeria and Venezuela due to political unrest, and hopes that American hfracking would run out of steam are the primary causes of the recent spurt. But the world continues to be awash in crude, and American frackers have replaced the OPEC as the world’s swing producers. The once-feared oil cartel is, to my mind, pretty much finished as an effective price enforcer. Even OPEC’s leader, Saudi Arabia, is acknowledging the new reality by quashing recent attempts to freeze output, borrowing from banks and preparing to sell a stake in its Aramco oil company as it tries to find new sources of non-oil revenue.

The Saudis and their Persian Gulf allies continue to play a desperate game of chicken with other major oil producers. Cartels exist to keep prices above equilibrium, which encourages cheating as cartel members exceed their allotted output and other producers take advantage of inflated prices. So the role of the cartel leader, in this case Saudi Arabia, is to cut its own output, neutralizing the cheaters to keep prices up. But the Saudis suffered market-share losses from their previous production cuts. OPEC has effectively abandoned restraints, with total output soaring to as high as 33 million barrels per day at the end of last year:

“..a zombie holding a bag of dog-shit is like unto the end of the world..”

• A Zombie Is A Terrible Thing To Behold (Jim Kunstler)

The politics of Great Britain are now falling apart landslide-style. Since just about everybody in or near power can be blamed for the national predicament, there’s nobody to turn to, at least not yet. The Labour party just acted out The Caine Mutiny, starring Jeremy Corbyn as Captain Queeg. The Tory Cameron gave three months notice without any plausible replacement in view. Now Cameron’s people are hinting in the media that they can just drag their feet on Brexit, that is, not do anything to enable it from actually happening for a while. Of course, that’s what the monkeyshines of banking and finance have done: postponed the inevitable reckoning with the realities of our time: growing resource scarcity, population overshoot, climate change, ecological holocaust, and the diminishing returns of technology.

Britain illustrates the problem nicely: how to produce “wealth” without producing wealth. It’s called “the City,” their name for the little district of London that is their Wall Street. In the absence of producing real things, the City became the driver of the UK’s economy, a ghastly parasitical organism that functioned as the central transfer station for the world’s swindles and frauds, churning the West’s dwindling residual capital into a slurry of fees, commissions, arbitrages, rigged casino bets, and rip-offs. In the process, it enabled the ECB to run the con-job that the EU became, with the fatal distortions of credit that have put its members into a ditch and sent the private European banks off a cliff, Thelma and Louise style.

The next stage of this protean global melodrama is what happens when currencies and interest rates become completely unglued from their assigned roles as patsies in financial racketeering. Sooner or later we’ll know what’s going on in the vast shadowy gloaming of “derivatives,” especially the “innovative” arrangements that affect to be “insurance” against losses in currency and interest rate “positions” — bets made on the movements of these things. When currencies rise or fall quickly, these so-called “swaps” are “triggered,” and then some hapless institution is left holding a big bag of dog-shit. A zombie is a terrible thing to behold, but a zombie holding a bag of dog-shit is like unto the end of the world.

Dmitry uses the same definition of fascism I did the other day. More people should, because it tells you who the real fascists are.

• Elites, ‘You’re Fired!’ (Dmitry Orlov)

• Patriotism is one’s love of one’s native land and people. It is a natural, organic result of growing up in a certain place among a certain people, who have also grown up there, and who pass along a cultural and linguistic legacy that they all love and cherish. This does not imply that those not of one’s family, neighborhood or region are in any way inferior, but they are not one’s own, and one loves them less.

• Nationalism is a synthetic product generated using public education and is centered around certain hollow symbols: a flag, an anthem, some yellowed pieces of paper, a few creation myths and so on. It is supported by certain rituals (parades, speeches, handing out of medals) that comprise a civic cult. The purpose of nationalism is to support the nation-state. Where nationalism serves the needs of one’s native land and people, nationalism and patriotism become aligned; when it destroys them, nationalism becomes the enemy and patriots form partisan movements, rise up and destroy the nation-state.

• Fascism is the perfect melding of the nation-state and corporations, in the course of which the distinction between public and private interests becomes erased and corporations come to dictate public policy. An almost perfect expression of fascism is the recent transatlantic and transpacific trade agreements negotiated in secret by the Obama administration, which at the moment, to everyone’s great relief, seem to be dead in the water.

It should be obvious that fascism has to be defeated, and if we were to pick just one perfectly good reason to fire the transatlantic elites then it is to thwart this corporate power grab. But it does not stop there, because nationalism and patriotism are also in play. Patriotism is a natural, core human value without which all you have is a rootless population shifting about opportunistically. Nationalism is a relatively recent innovation (nation-states are a 17th century invention) and as such a dangerous one, but in the case of some of the older and more successful nation-states it does provide significant benefits: a cherished cultural tradition anchored to a national language and literature, the ability to keep the peace and to repel outside aggression. And then there is the EU, with its flag depicting a constellation of stars that are obviously orbiting something—something that could only be a black hole, since it is invisible.

Bit by bit, Brexit gets defined in its real perspective. Bernie Sanders needs numbers too much to make his case, but the case is obvious.

• The World Is Rejecting Globalization (Bernie Sanders)

Surprise, surprise. Workers in Britain, many of whom have seen a decline in their standard of living while the very rich in their country have become much richer, have turned their backs on the EU and a globalized economy that is failing them and their children. And it’s not just the British who are suffering. That increasingly globalized economy, established and maintained by the world’s economic elite, is failing people everywhere. Incredibly, the wealthiest 62 people on this planet own as much wealth as the bottom half of the world’s population — around 3.6 billion people. The top 1% now owns more wealth than the whole of the bottom 99%. The very, very rich enjoy unimaginable luxury while billions of people endure abject poverty, unemployment, and inadequate health care, education, housing and drinking water.

Could this rejection of the current form of the global economy happen in the United States? You bet it could. During my campaign for the Democratic presidential nomination, I’ve visited 46 states. What I saw and heard on too many occasions were painful realities that the political and media establishment fail even to recognize. In the last 15 years, nearly 60,000 factories in this country have closed, and more than 4.8 million well-paid manufacturing jobs have disappeared. Much of this is related to disastrous trade agreements that encourage corporations to move to low-wage countries. Despite major increases in productivity, the median male worker in America today is making $726 dollars less than he did in 1973, while the median female worker is making $1,154 less than she did in 2007, after adjusting for inflation.

Nearly 47 million Americans live in poverty. An estimated 28 million have no health insurance, while many others are underinsured. Millions of people are struggling with outrageous levels of student debt. For perhaps the first time in modern history, our younger generation will probably have a lower standard of living than their parents. Frighteningly, millions of poorly educated Americans will have a shorter life span than the previous generation as they succumb to despair, drugs and alcohol. Meanwhile, in our country the top one-tenth of 1% now owns almost as much wealth as the bottom 90%. 58% of all new income is going to the top 1%. Wall Street and billionaires, through their “super PACs,” are able to buy elections.

This makes it look like Rutte plays hardball, or almost. In reality, he’s looking for ways to disregard the outcome of the Dutch referendum. Already, while the applicable law says that the outcome should be implemented by the government as soon as possible, Rutte just keeps pushing it forward. After July 1, when Holland is no longer chair of the EU, pressure will rise on both sides. But if Rutte tries to sign the Ukraine deal despite the referendum, ‘binding assurances’ or not, he should be voted out of office ASAP. The Dutch people said NO, and Rutte can‘t turn that into a YES.

• Dutch PM Rutte Wants ‘Binding’ Assurances Over EU’s Ukraine Deal (R.)

Dutch Prime Minister Mark Rutte asked European Union leaders on Tuesday for “legally binding” assurances to address his country’s concerns over a trade and association deal with Ukraine and said The Hague would block it otherwise. The Netherlands is the only EU state not to have ratified the bloc’s agreement on closer political, security and trade ties with Kiev following a referendum in April in which the Dutch voted overwhelmingly to reject it. The agreement with Kiev, reached after Russia annexed Crimea from Ukraine in March 2014 and then backed rebels fighting government troops in the east of the country, is being provisionally implemented now, but its future hinges on the Netherlands.

“What we need is a legally binding solution, which will address the many worries and elements of the discussion in the Netherlands leading up to the referendum,” Rutte said after an EU leaders’ summit in Brussels to discuss the aftermath of Britain’s vote last week to leave the bloc. The debate around the referendum in the Netherlands, which showed dissatisfaction with Rutte’s government and policy-making in Brussels, zeroed in on whether the agreement with Kiev would herald EU membership for Ukraine and its 45 million people. “The exact form – I don’t know yet,” Rutte said. “It could be that we have to change the text, it could be that we can find a solution which will not involve changing the text of the association agreement. I don’t know yet.

“If I am not able to achieve that … we will not sign,” he said. “We will try to find a solution, it will be difficult, the chances are small that we will get there but I think we should try.” The whole deal could be derailed should The Hague refuse to ratify it, but a senior EU official said he hoped this could be solved by the end of the year.

Home › Forums › Debt Rattle June 29 2016