Robert Capa Catholic church between bricks from the destroyed Jewish Ghetto Warsaw, Poland 1948

60 days to go till November 3 and hunting season is open. Smear’s the word. It’ll be so ugly many people will just turn away in disgust. Many others will keep staring at it the way people stare at traffic accidents.

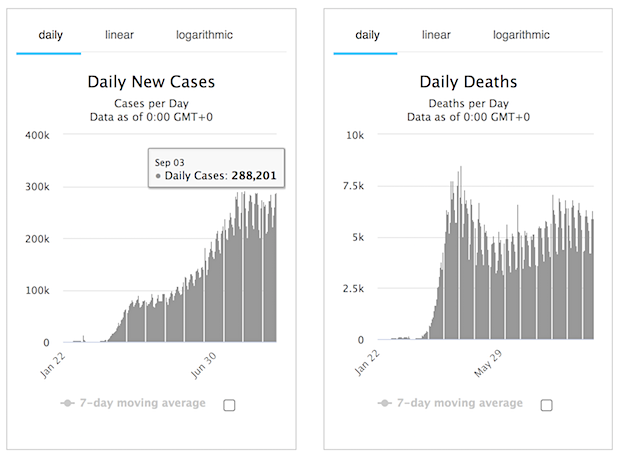

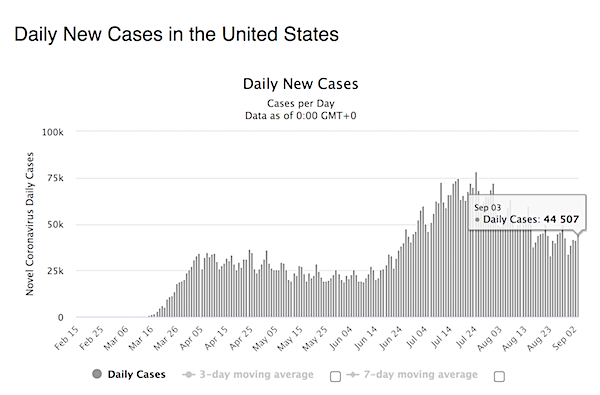

Bradykinin give us even more incentive to roll out rapid tests, HCQ, zinc, vitamin D in huge quantities. What are we waiting for?

Taleb and Bar-Yam

Whitney Webb is one of multiple voices discussing the Transition Integrity Project (TIP). Bipartisan in this case means: anti-Trump. Basically, all these war scenarios claim that if Biden doesn’t win big, there’ll be war in the streets. They sort of openly advocate for that.

• Bipartisan Washington Insiders Plan for Chaos if Trump Wins Election (Webb)

A group of Democratic Party insiders and former Obama and Clinton era officials as well as a cadre of “Never Trump” neoconservative Republicans have spent the past few months conducting simulations and “war games” regarding different 2020 election “doomsday” scenarios. Per several media reports on the group, called the Transition Integrity Project (TIP), they justify these exercises as specifically preparing for a scenario where President Trump loses the 2020 election and refuses to leave office, potentially resulting in a constitutional crisis. However, according to TIP’s own documents, even their simulations involving a “clear win” for Trump in the upcoming election resulted in a constitutional crisis, as they predicted that the Biden campaign would make bold moves aimed at securing the presidency, regardless of the election result.

This is particularly troubling given that TIP has considerable ties to the Obama administration, where Biden served as Vice President, as well as several groups that are adamantly pro-Biden in addition to the Biden campaign itself. Indeed, the fact that a group of openly pro-Biden Washington insiders and former government officials have gamed out scenarios for possible election outcomes and their aftermath, all of which either ended with Biden becoming president or a constitutional crisis, suggest that powerful forces influencing the Biden campaign are pushing the former Vice President to refuse to concede the election even if he loses. This, of course, gravely undercuts the TIP’s claim to be ensuring “integrity” in the presidential transition process and instead suggests that the group is openly planning on how to ensure that Trump leaves office regardless of the result or to manufacture the very constitutional crisis they claim to be preventing through their simulations.

Such concerns are only magnified by the recent claims made by the 2016 Democratic presidential candidate and former Secretary of State under Obama, Hillary Clinton, that Biden “should not concede under any circumstances.” “I think this is going to drag out, and eventually I do believe he will win if we don’t give an inch, and if we are as focused and relentless as the other side is,” Clinton continued during an interview with Showtime a little over a week ago. The results of the TIP’s simulations notably echo Clinton’s claims that Biden will “eventually” win if the process to determine the election outcome is “dragged out.”

The for now (but don’t hold your breath on that one) ultimate smear piece, based exclusively on anonymous sources. All it says has been denied by not anonymous sources, who were actually present, like Trump himself, and Sarah Sanders, but that’s not the point. The point is smear; that’s how this will be fought.

• Trump: Americans Who Died in War Are ‘Losers’ and ‘Suckers’ (Atl.)

Trump remained fixated on McCain, one of the few prominent Republicans to continue criticizing him after he won the nomination. When McCain died, in August 2018, Trump told his senior staff, according to three sources with direct knowledge of this event, “We’re not going to support that loser’s funeral,” and he became furious, according to witnesses, when he saw flags lowered to half-staff. “What the fuck are we doing that for? Guy was a fucking loser,” the president told aides. Trump was not invited to McCain’s funeral.

(These sources, and others quoted in this article, spoke on condition of anonymity. The White House did not return earlier calls for comment, but Alyssa Farah, a White House spokesperson, emailed me this statement shortly after this story was posted: “This report is false. President Trump holds the military in the highest regard. He’s demonstrated his commitment to them at every turn: delivering on his promise to give our troops a much needed pay raise, increasing military spending, signing critical veterans reforms, and supporting military spouses. This has no basis in fact.”)

[..] On Memorial Day 2017, Trump visited Arlington National Cemetery, a short drive from the White House. He was accompanied on this visit by John Kelly, who was then the secretary of homeland security, and who would, a short time later, be named the White House chief of staff. The two men were set to visit Section 60, the 14-acre area of the cemetery that is the burial ground for those killed in America’s most recent wars. Kelly’s son Robert is buried in Section 60. A first lieutenant in the Marine Corps, Robert Kelly was killed in 2010 in Afghanistan. He was 29. Trump was meant, on this visit, to join John Kelly in paying respects at his son’s grave, and to comfort the families of other fallen service members.

But according to sources with knowledge of this visit, Trump, while standing by Robert Kelly’s grave, turned directly to his father and said, “I don’t get it. What was in it for them?” Kelly (who declined to comment for this story) initially believed, people close to him said, that Trump was making a ham-handed reference to the selflessness of America’s all-volunteer force. But later he came to realize that Trump simply does not understand non-transactional life choices. “He can’t fathom the idea of doing something for someone other than himself,” one of Kelly’s friends, a retired four-star general, told me. “He just thinks that anyone who does anything when there’s no direct personal gain to be had is a sucker. There’s no money in serving the nation.”

Would things be better if Trump were gone? The only alternative is having Hillary and Pelosi and Schiff in charge. Is that an improvement?

• The Trump Era Sucks and Needs to Be Over (Matt Taibbi)

The question, “What is Trump thinking?” is the wrong one. He’s not thinking, he’s selling. What’s he selling? Whatever pops into his head. The beauty of politics from his point of view, compared to every other damn thing he’s sold in his life — steaks, ties, pillows, college degrees, chandeliers, hotels, condominiums, wine, eyeglasses, deodorant, perfume (SUCCESS by Trump!), mattresses, etc. — is that there’s no product. The pitch is the product, and you can give different pitches to different people and they all buy. In 2016 Trump reeled in the nativist loons and rage cases with his opening rants about walls and mass deportations, then slowly clawed his numbers up with the rest of the party with his “softening” routine.

Each demographic probably came away convinced he was lying to the other, while the truth was probably more that he was lying to all of them. Obviously there are real-world consequences to courting the lowest common denominator instincts in people, but to Trump speeches aren’t moral acts in themselves, they’re just “words that he is saying,” as long-ago spokesperson Katrina Pierson put it. In this sense the Republican Party’s 2020 platform is genius: there isn’t one, just a commitment to “enthusiastically support the President’s America-first agenda,” meaning whatever Trump says at any given moment. If one can pull back enough from the fact that this impacts our actual lives, it’s hard not to admire the breathtaking amorality of this, as one might admire a simple malevolent organism like a virus or liver fluke.

Trump blew through the Republican primaries in 2015-2016. His opponents, a slate of mannequins hired by energy companies and weapons contractors to be pretend-patriots and protectors of “family values,” had no answer for his insults and offer-everything-to-everyone tactics. Like most politicians, they’d been protected their whole lives by donors, party hacks, and pundits who’d turned campaigns into a club system designed to insulate paid lackeys from challenges to their phony gravitas. Trump had no institutional loyalty to the club, shat all over it in addition to its silly frontmen, and walked to the nomination.

[..] The paradox ensnaring America since November, 2016 is that Trump never intended to govern, while his opponents never intended to let him try. In an alternate universe where a post-election Donald had enough self-awareness to admit he was out of his depth, and the D.C. establishment agreed to recognize his administration as legitimate for appearances’ sake, Trump might have escaped four years with the profile of a conventionally crappy president, or perhaps a few notches below that — way below average, maybe, but survivable. Instead it was decided even before he was elected that admitting the president was the president was “normalizing” him. Normally no news is good news, and the anchorman is encouraged to smile on a day without war, earthquakes, terror attacks, or stock market crashes.

Under Trump it became taboo to have a slow news day. A lack of an emergency was a failure of reporting, since Trump’s very presence in office was crisis.

The ruling class.

• If Dems Win In 2020, It’s Virtually Impossible For GOP Ever To Win Again (PJW)

Professor Angelo M. Codevilla warns that if the Democrats win the 2020 elections, it would be “virtually impossible for conservatives ever to win again.” Codevilla, who is professor emeritus of International Relations at Boston University, made the prediction in a review published by the Claremont Review of Books for Michael Anton’s new book The Stakes: America at the Point of No Return. The book makes the argument that although some Americans may be disappointed in Trump’s performance, voting for him again is absolutely crucial for the republic’s survival because “this country’s ruling class would use control of the presidency to hurt us in our private and public lives for having dared to reject their mastery.” Importing non-citizens who are then given the vote, as well as institutionalizing elections by mail, which would give those who count the votes the power, would ‘guarantee disaster’ for the country, according to Codevilla.

He then issues a stark warning; It’s game over permanently for Republicans if Trump loses in 2020. “Should the Democrats win, the ruling Left – which includes just about everyone who controls American government and society’s commanding heights – is ready, willing, and eager to implement plans that would make it virtually impossible for conservatives ever to win national elections again,” writes Codevilla. The professor also cautions that Democrats’ stated refusal to concede to Donald Trump, which was recently amplified by Hillary Clinton, could manifest itself in “one or more blue state governors to refuse to certify that state’s electors to the Electoral College, so as to prevent the college from recording a majority of votes for the winner.” This threatens to set off a “systemic crisis” that could lead to a civil war “less like the American Civil War of the 19th century and more like the horror that bled Spain in the 20th.”

It’ll be ready on November 5th. No, the joke is not lost on us. That’s two whole months for what nursing homes are by law obliged to tally on a daily basis. It shouldn’t even take two hours.

• Cuomo Admin Accused Of Stonewalling Over COVID19 Nursing Home Deaths (NYP)

A government watchdog group is accusing Gov. Andrew Cuomo’s administration of sitting on data that would provide the full death tally of nursing home residents from the coronavirus. The Empire Center for Public Policy accuses the state Health Department of stalling on compliance with a Freedom of Information Law request seeking the information. Currently, New York’s tally of nursing home fatalities only counts those residents who died or are presumed to have died from COVID-19 inside those facilities. The figure excludes potentially thousands of nursing home residents who were transported to hospitals for treatment and died a few days later.

“The state Health Department is offering a new explanation for why it won’t provide the full death toll of coronavirus in nursing homes: it can’t find the records,” said Bill Hammond, a health analyst for the Empire Center who submitted the legal request for the data in early August. In a response letter sent to Hammond on Monday, the department said it could not yet fulfill the request “because a diligent search for relevant documents is still being conducted.” “We estimate that this Office will complete its process by November 5, 2020. The Department will notify you in writing when/if the responsive materials are available for release or if the time needed to complete your request extends beyond the above date,” said the department’s record access officer, Rosemary Hewig.

The delayed compliance in releasing information in response to legal requests has been a common practice of government agencies, with officials often saying they are still conducting a “diligent search” for records. “In this case, however, a search of any kind should not be necessary,” Hammond said in a blog post. He said the department’s Health Emergency Response Data System (or HERDS) has required nursing homes to file daily reports throughout the pandemic — including counts of all residents who die from coronavirus, both within the facilities or hospitals or elsewhere. “Those numbers are the basis for the partial count that the department does make public – which stood at 6,639 as of Aug. 29, but omits potentially thousands of residents who died in hospitals,” Hammond said.

Hammond said the “unusual methodology” is used by few if any other states and gives the public a “distorted picture of the pandemic.” “It makes it hard to compare New York to other states, or to gauge the merits of particular policies, such as the Health Department’s much-debated March 25 directive compelling nursing homes to accept coronavirus-positive patients being discharged from hospitals,” he said. The Justice Department is looking at whether the policies of New York and three other states contributed to COVID-19 nursing home deaths.

And you thought hanging chads were controversial…

• DOJ Conducting “Very Big” Voter Fraud Investigations – Barr (ET)

The Department of Justice is conducting several “very big” voter fraud investigations in multiple states, Attorney General William Barr told CNN in an interview aired on Sept. 2. “I know there are a number of investigations right now, some very big ones, in states,” Barr said in response to a question about how many voter fraud indictments the Department of Justice (DOJ) has brought on his watch. Barr said he did not know the exact number. At least 32 people have been criminally convicted of voter fraud in 2019, according to a database maintained by the conservative Heritage Foundation think tank. The attorney general made the remarks as part of a tense exchange with CNN anchor Wolf Blitzer about mail-in voting.

Barr has repeatedly said that mass mail-in voting is an invitation for voter fraud and coercion. Blitzer pressed the attorney general for evidence that this will be the case in 2020. Barr pointed to a recent conviction in Texas over 1,700 fraudulent ballots and noted that widespread evidence isn’t available because the United States has never attempted an election with the kind of massive access to mail-in voting available in 2020. At least 83 percent of American voters, or roughly 100 million people, will be able to vote by mail in the 2020 election, according to a tally by The Washington Post. “We haven’t had the kind of widespread use of mail-in ballots as being proposed,” Barr said.

“We’ve had absentee ballots from people who request them from a specific address. Now what we’re talking about is mailing them to everyone on the voter list, when everyone knows those voter lists are inaccurate.” Barr referenced the findings of a nonpartisan Commission on Federal Election Reform, co-chaired by former President Jimmy Carter and former Secretary of State James Baker, which determined in 2005 that mail-in voting creates the potential for voter fraud and opens the door to coercion if activists or party workers are allowed to handle ballots. Carter recently issued a statement to point out that the commission’s key finding was that states should invest in more research on mail-in voting. The former president encouraged states to invest resources to expand voting by mail.

More than 43 percent of likely American voters would not trust in the integrity of an election if all voters automatically received ballots or ballot request forms by mail, according to an Epoch Times National Poll conducted in late August. “This is playing with fire,” Barr said. “We’re a very closely divided country here and people have to have confidence in the results of the election and the legitimacy of the government. And people trying to change the rules to this methodology—which as a matter of logic is very open to fraud and coercion—is reckless and dangerous,” Barr said.

Bill Barr Busy.

• DOJ To File Antitrust Charges Against Google Within Weeks (ZH)

The Department of Justice will is preparing to slap Google with an antitrust case over the next several weeks, according to the New York Times – which insists, based on five sources, that Attorney General Bill Barr “overruled career lawyers who said they needed more time to build a strong case against one of the world’s wealthiest, most formidable technology companies.” The Times is suggesting, based on leaks, that Barr is rushing the case for political purposes and the charges are premature. “The Google case could also give Mr. Trump and Mr. Barr an election-season achievement on an issue that both Democrats and Republicans see as a major problem: the influence of the biggest tech companies over consumers and the possibility that their business practices have stifled new competitors and hobbled legacy industries like telecom and media.” -NYT

Some 40 lawyers working on a DOJ antitrust inquiry into Google parent Alphabet were reportedly told to wrap up their work by the end of this month, according to three of the five leakers, who we’re guessing are part of the 40-lawyer team – as “most of the 40-odd lawyers who had been working on the investigation opposed the deadline.” Others said they would not sign the complaint, while several left the case over the summer.

“Some argued this summer in a memo that ran hundreds of pages that they could bring a strong case but needed more time, according to people who described the document. Disagreement persisted among the team over how broad the complaint should be and what Google could do to resolve the problems the government uncovered. The lawyers viewed the deadline as arbitrary. While there were disagreements about tactics, career lawyers also expressed concerns that Mr. Barr wanted to announce the case in September to take credit for action against a powerful tech company under the Trump administration. But Mr. Barr felt that the department had moved too slowly and that the deadline was not unreasonable, according to a senior Justice Department official.” -NYT

Barr has shown a “deep interest” in the Google investigation, requesting regular briefings on the DOJ case, and “taking thick binders of information about it on trips and vacations and returning with ideas and notes.” The Times notes that antitrust action against Google has bipartisan support from a coalition of 50 states and territories, though Democrats and Republican state attorneys general conducting their own investigations are split on how to move forward. Republicans have accused Democrats of slow-walking the work in order to bring charges under a potential Biden administration, while Democrats have accused Republicans of wanting Trump to receive credit – a disagreement which could limit the number of states participating in prosecuting the Silicon Valley giant.

But but, I read Jeff Bezos lost $9 billion yesterday!

• In the Worst of Times, the Billionaire Elite Plunder Working Class America (CP)

In the midst of a global pandemic, unprecedented economic collapse, mass unemployment, hunger and desperation, the stock market is booming and the richest of the rich are richer than ever before. Since March, more than 58 million people in the U.S. have filed for unemployment. The Internal Revenue Service now predicts that the U.S. economy will have almost 40 million fewer jobs in 2021 than they predicted before the pandemic, as a result of the prolonged economic depression. As it becomes widely recognized that the economy is not going to “bounce right back” into full activity – even when coronavirus cases do eventually decline – and that the current depression will continue for a long time, companies are doing anything they can to drive their stock prices higher.

Desperate to maintain their profits, many large corporations are planning massive layoffs and acknowledging that currently furloughed workers are not going to have jobs to come back to. The Wall Street Journal reports that a recent study found, “nearly half of U.S. employers that furloughed or laid off staff because of COVID-19 are considering additional workplace cuts in the next 12 months.” The companies say low-paid workers will be the first to be cut. Twice as many workers had their pay cut by July 1 as during the Bush-Obama recession that began in 2009, according to the Washington Post. More than 10 million private sector workers have had their wages cut or been forced to work part-time. Car company Tesla forced all workers to take a 10 percent pay cut from mid-April until July. In the same period, Tesla stock skyrocketed, and CEO Elon Musk’s net worth has now quadrupled from $25 billion to over $100 billion.

Business software company Salesforce announced record sales levels one day and layoffs of 1,000 workers the next. The company’s stock rose 26 percent. Among small businesses, another study found that 50 percent of all small-business employees who were furloughed since March are still without work. Twenty-eight percent are still furloughed; 22 percent have been permanently laid off. Even in the government’s rigged and severely undercounted unemployment statistics, the number of people who have been unemployed 15-26 weeks is nearly double what it was at the height of the 2009 recession — and exponentially higher than at any other time since the Great Depression of the 1930s.

So the entire NSA brass must all move to Russia now? And Edward can come back home? Or is exposing an illegal program more illegal than said program itself?

• US Court: NSA Mass Surveillance Program Exposed By Snowden Was Illegal (DW)

A US federal appeals court on Wednesday ruled that the controversial National Security Agency (NSA) surveillance program exposed by whistleblower Edward Snowden was illegal. The ruling stopped short of calling the program unconstitutional. The US Court of Appeals for the Ninth Circuit said that the program, under which the NSA collected and analyzed bulk data provided by telecommunications companies, was in violation of the Foreign Intelligence Surveillance Act and could have been unconstitutional.= “Seven years ago, as the news declared I was being charged as a criminal for speaking the truth, I never imagined that I would live to see our courts condemn the NSA’s activities as unlawful and in the same ruling credit me for exposing them,” said Snowden, who fled to Russia after exposing the program, on Twitter.

“And yet that day has arrived.” He still faces charges of espionage in the US. After initially denying that the intelligence agency collected information on Americans, officials maintained that the spying helped the country combat domestic extremism. The most popular case cited was that of four California residents — Basaaly Saeed Moalin, Ahmed Nasir Taalil Mohamud, Mohamed Mohamud, and Issa Doreh — who have been convicted of funding the Al-Shabaab extremist group in Somalia. NSA’s domestic spying program helped get this conviction, which will not be impacted by the latest ruling. However, human rights organizations like the American Civil Liberties Union have hailed the ruling as “a victory for our privacy rights.”

“..the pandemic stripped away the veneer of politics to reveal the boorish reality underneath: that some people have the power to tell the rest what to do.”

• Capitalism Isn’t Working. Here’s An Alternative (Varoufakis)

Before 2020, politics seemed almost like a game, but with Covid came the realisation that governments everywhere possessed immense powers. The virus brought the 24-hour curfew, the closure of pubs, the ban on walking through parks, the suspension of sport, the emptying of theatres, the silencing of music venues. All notions of a minimal state mindful of its limits and eager to cede power to individuals went out of the window. Many salivated at this show of raw state power. Even free-marketeers, who had spent their lives shouting down any suggestion of even the most modest boost in public spending, demanded the sort of state control of the economy not seen since Leonid Brezhnev was running the Kremlin. Across the world, the state funded private firms’ wage bills, renationalised utilities and took shares in airlines, car makers, even banks. From the first week of lockdown, the pandemic stripped away the veneer of politics to reveal the boorish reality underneath: that some people have the power to tell the rest what to do.

[..] Suppose we had seized the 2008 moment to stage a peaceful hi-tech revolution that led to a postcapitalist economic democracy. What would it be like? To be desirable, it would feature markets for goods and services since the alternative – a Soviet-type rationing system that vests arbitrary power in the ugliest of bureaucrats – is too dreary for words. But to be crisis-proof, there is one market that market socialism cannot afford to feature: the labour market. Why? Because, once labour time has a rental price, the market mechanism inexorably pushes it down while commodifying every aspect of work (and, in the age of Facebook, our leisure too).

Can an advanced economy function without labour markets? Of course it can. Consider the principle of one-employee-one-share-one-vote underpinning a system that, in Another Now, I call corpo-syndicalism. Amending corporate law so as to turn every employee into an equal (though not equally remunerated) partner is as unimaginably radical today as universal suffrage was in the 19th century. In my blueprint, central banks provide every adult with a free bank account into which a fixed stipend (called universal basic dividend) is credited monthly. As everyone uses their central bank account to make domestic payments, most of the money minted by the central bank is transferred within its ledger. Additionally, the central bank grants all newborns a trust fund, to be used when they grow up.

People receive two types of income: the dividends credited into their central bank account and earnings from working in a corpo-syndicalist company. Neither are taxed, as there are no income or sales taxes. Instead, two types of taxes fund the government: a 5% tax on the raw revenues of the corpo-syndicalist firms; and proceeds from leasing land (which belongs in its entirety to the community) for private, time-limited, use.

RIP

• Eulogy to David Graeber (Steve Keen)

Oh David! @davidgraeber. . They say only the good die young, but why did you have to be one of them? There’s even more bullshit in the world now that you are no longer with us. It was a pleasure to know you, and it is a tragedy to say goodbye.

David was special for many, many reasons. The first I’ll mention is what I expect is the foundation of David’s appeal to Nika: his trusting innocence. There was a boyish openness and lack of ego in David that made you trust him, because you could. He was, at the same time, extremely intelligent and extremely funny. He had a nervy aspect, very befitting of someone raised in New York. But he was fundamentally funny, and looked on the world with a sense of bemusement, and all the while, incisive insight. He was intrinsically an anthropologist, in that he was capable of living amongst people and seeing their customs more clearly than they could themselves, while all the while celebrating those aspects, the good and the bad, because they were his people as well.

There was a selflessness to David too. There wasn’t an ounce of David’s body that was in it for David’s benefit alone. Well, he enjoyed his pleasures, but they could never be had at the expense of another person. That made him someone you could trust with your life. On top of that, he was an excellent if sometimes rambling speaker, whose charisma attracted support which was worth giving. David, I believe, came up with the slogan “We’re the 99%”. David, I believe, developed Occupy Wall Street’s voting system, which was a very powerful form of democracy that still respected the rights of the minority. He was a true leader in large part because he didn’t want to be.

He was also an excellent historian of money and debt. If you haven’t read Debt: the first 5000 Years, buy a copy and do so. It’s such a pity that David won’t be here to chronicle the start of its next 5000 Years. That’s the other thing: the suddenness. I knew David wasn’t feeling well—I’d exchanged a few messages with Nika where David’s health came up. Maybe it was Covid—I still don’t know. I won’t speculate. But it is so bloody awful to lose such a brilliant, lovely, funny, warm human being. It’s the unkindest cut of all that 2020 has managed to deliver.

Now we know why we speak of 20:20 vision, and 20:20 hindsight. We thought it was an ophthalmologist’s crazy numbering system. In fact, it was a warning from a time traveller.

Nassim Taleb – David Graeber

David Graeber

He was a real intellectual; very real: not one fake cell in his brain, not one fake bone in his body.

He thought independently.

He was monstrouly original.

He had intellectual courage.

The world seems much much smaller today than before Sep 2.

David, RIP

— Nassim Nicholas Taleb (@nntaleb) September 3, 2020

We try to run the Automatic Earth on donations. Since ad revenue has collapsed, your support is now an integral part of the process.

Thank you for your ongoing support.

“As humans we are fragile biological entities who will die unless we take care of each other”

– David Graeber

Support the Automatic Earth in virustime.