Jack Delano Conductor picks up message from operator on the Atchison, Topeka & Santa Fe 1943

The fear campaign still works like a charm.

• Britain’s Economy Shrinking At Fastest Rate Since 2009 (G.)

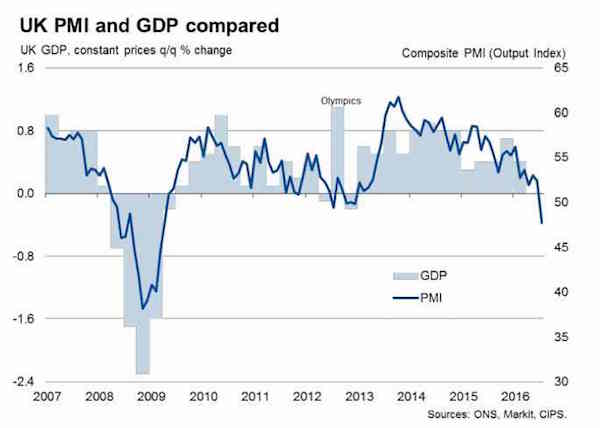

The Bank of England and the Treasury are under increasing pressure to prevent Britain from sliding into recession after a wide-ranging health check of the economy completed since the referendum showed the sharpest downturn in activity since the peak of the financial crisis seven years ago, Service industries ranging from banks to restaurants, hedge funds, bars, gyms and hairdressers were all affected by what was described as as a “dramatic deterioration” in business confidence that suggests the economy is on course to shrink by 0.4% in the third quarter unless conditions improve. The City now expects the Bank to deliver a package of immediate support – including a cut in interest rates and a resumption of its quantitative easing programme – when its monetary policy committee meets early next month.

Philip Hammond, the new chancellor, admitted that confidence had been dented by the surprise of Brexit vote and dropped a broad hint that he was contemplating spending increases and tax cuts for his autumn statement. In the first major survey of business activity and confidence since the referendum on 23 June, the services sector was particularly hard hit, showing its biggest drop on record. Manufacturing dropped to its lowest level since February 2013, according to Markit, which compiles the data in its purchasing managers’ index (PMI). The composite index, which measures both services and manufacturing, fell from 52.4 in June to 47.7 – an 87-month low. Anything below 50 signals a contraction in activity.

The services index dropped from 52.3 in June to 47.4, an 88-month low, while manufacturing fell from 52.1 in June to 49.1. Chris Williamson, the chief economist at Markit, said: “July saw a dramatic deterioration in the economy, with business activity slumping at the fastest rate since the height of the global financial crisis in early 2009.

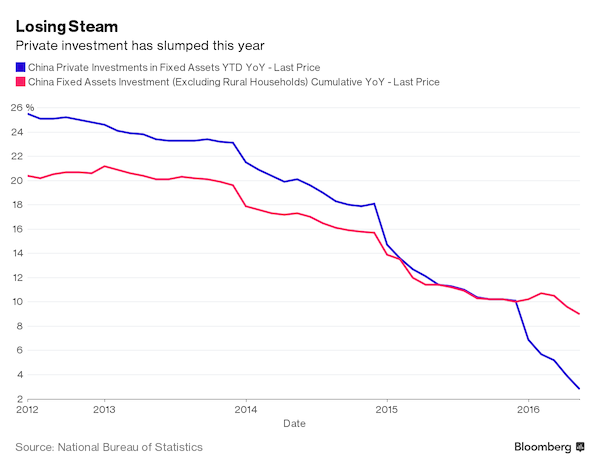

Private investment in fixed assets has collapsed. From 20% to 2%. Imagine what the government must do to fill the gap.

• Chinese Companies are Turning Japanese (BBG)

Chinese companies are swimming in cheap cash. Problem is, they’re not spending it. A reluctance to invest is frustrating policy makers after they unleashed a wave of cheap credit in an effort to stoke growth. Rather than build new plants or hire additional staff, corporates are opting to park money at the bank – or send it overseas through buying foreign assets. Known as the so called “liquidity trap,” it’s a problem not unlike the experience in Japan where weak business confidence and a reluctance to invest is also holding back the economy. “Cash-rich Chinese companies are searching for offshore investment, just as the Japanese did in the late 1980s due partly to the strength of the yen in the aftermath of the ‘Plaza Accord’,” ANZ bank economists led by Raymond Yeung wrote in a note.

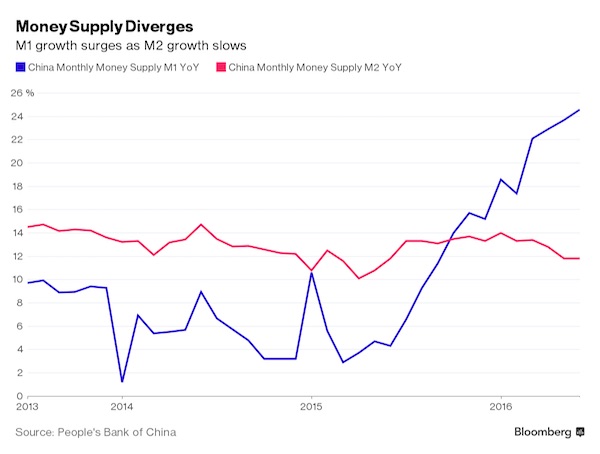

China’s two main money supply gauges continued to diverge in June. M1, which includes currency in circulation and bank deposits, surged 24.6 percent in June from a year earlier, the biggest increase in six years. The broader M2, which also includes savings deposits, increased 11.8 percent. That was flat from May and below the government’s 13 percent annual target. The divergence has raised eyebrows given the main driver behind M1 since mid-2015 has been a demand for deposits by corporates. While healthier balance sheets offer a buffer to debt-burdened companies, the bigger worry is that these companies are reluctant to spend on expanding new capacity.

In a note titled “The Caution of Chinese Corporations,” Thomas Gatley of consulting firm Gavekal Dragonomics highlighted that companies are raising new cash to either hoard it or make financial investments because they expect “a further slowdown in demand for their products, so there is little need to expand production capacity or other fixed assets.” Weak private investment data underscores the observation. Private investment slumped to 2.8 percent in the six months ended in June from a rate of more than 20 percent two years ago.

She handed $300 million in taxpayers’ funds to a buddy. That’s all. Slap that wrist!

• Lagarde Seen Likely to Avoid Jail Time, Keep IMF Job Amid Trial (BBG)

Christine Lagarde is likely to avoid jail time and keep her job as head of the IMF after she was ordered to stand trial in France on charges that carry a potential prison term. Lagarde, 60, on Friday lost a bid to challenge a December decision to be tried for alleged negligence during her time as French finance minister that paved the way for a massive government payout to tycoon Bernard Tapie. The specialized panel that will hear Lagarde’s case has previously found ministers guilty without having them actually serve time in prison. The panel’s record and Lagarde’s strong support from IMF member nations amid the long-running case mean there’s little chance that it will amount to more than a distraction from her role leading the world’s lender of last resort.

No date has been set yet for the trial, which is expected to last about a week. “I don’t think anybody really feels that this is a matter that undermines her effectiveness,” and if Lagarde received a suspended jail sentence, “she would just carry on,” said Edwin Truman, a former U.S. Treasury official who’s now a senior fellow at the Peterson Institute for International Economics in Washington. Lagarde is accused of failing to block an arbitration process in 2008 that brought to an end the longstanding dispute between former state-owned bank Credit Lyonnais and Tapie, a businessman and supporter of then-French President Nicolas Sarkozy. Tapie walked away with an initial award of about €285 million before it was cut to zero by an appeals court.

It’s simply the end of our economic system.

• The Great Period of Instability (G&M)

It was just before dawn on the morning of July 15, and I was trying to explain to my six-year-old daughter why – instead of a planned day at the park – I was suddenly heading to the airport to catch a flight to a city called Nice. “A bad man hurt a lot of people in France,” was the best explanation I could come up with. As I watched her turn the news over in her head, disappointment spreading on her face, I realized it was a sentence I’d uttered three times in 18 months. Barely 36 hours later, I called her from a sun-baked plaza in the historic old city of Nice. That day in the park would have to be postponed again. Some men with guns had tried to take over the government in Turkey. Instead of coming home, Daddy was flying somewhere else. More bad men, more people hurt.

After we hung up, I contemplated how little sense any of this must make to her. She’s not alone. All of us – including and especially the political and economic elites who have long stood atop this suddenly wobbly pyramid – have been left reeling by events. A “period of instability” is upon us, historian Margaret MacMillan told me this week, one that has parallels to the pre-war periods of the 20th century that she’s written acclaimed books about. Future historians are likely to judge today’s leaders on whether they seek to calm – or simply take advantage of – the choppy waters that we’re in. Rarely, it seems, has the world spun so rapidly, have events felt so out of control.

The headlines blur into one another, feeding the sense of a world in chaos. The war in Syria bleeds into the refugee crisis. The refugees’ march into Europe boosts politicians on the nationalist right. The truck attack in France is followed by the shooting of police in Louisiana. Then it’s a man with an axe on a train in Germany. On Friday, it was a shooting at a mall in Munich. “Brexit” in the United Kingdom is knocked from the top of the news by a putsch attempt in Turkey. They seem like disconnected events. But what links the British who voted to quit the EU with the Turks who gathered in a public square on Wednesday to cheer the imposition of a state of emergency is their anger at how the system has worked until now.

Brexit was won in the small cities and towns of England, places where globalization has meant de-industrialization, the closing of factories and the transfer of work to cheaper locales overseas. The phenomenon was exacerbated by an influx of job-seekers from Eastern Europe who made competition for remaining jobs even stiffer. Leave voters didn’t change their minds when the elites told them Brexit would batter housing prices, or the stock market. To many, the idea that the elites, people who owned property and shares, would take a turn suffering sounded just about right.

Wealth is debt.

• Inequality: The Nexus of Wealth and Debt (Coppola)

Debt. We love debt. Money is created by issuing debt. Our monetary system is debt-based. And because we measure economic growth in monetary terms, growth comes from debt. There is a direct relationship between rising debt, rising money supply and rising GDP. To reduce the burden of debt, and stop it building up again, would mean curing ourselves of our love of debt. And that has enormous social and political implications. It is by no means cost-free. Globally, debt has increased since the 2008 financial crisis. Much of this is in developing countries – in corporations and governments. China’s debt burden, both public and private, is already huge and still growing. Will its bubble burst? What would be the consequences? We don’t know.

But other developing countries also have large debt burdens, especially in corporations. The extent of developing-country debt, both government and corporate, is becoming a matter of considerable concern to economists and policymakers. In developed countries, household debt remains a huge problem. In some countries, households are still deleveraging, preferring to pay off debt rather than spend. This puts a dampener on economic growth. In other countries, households have repaired their balance sheets, but are now reluctant to borrow. Though the lack of lending is not entirely due to households: in some countries, lending standards are now so tight that many households and smaller businesses can’t borrow at all.

But there are some countries where households are borrowing wildly. In Sweden, debt secured on property is rising rapidly, fuelled by very low interest rates. Economic projections from the OBR forecast similar borrowing increases for UK households, though as yet there is little sign that UK households are willing or able to comply. But if they do not, the UK’s economic performance will disappoint. High and rising household debt backed by property creates financial instability. So does high and rising corporate and government debt, especially in foreign currencies. By encouraging borrowing against property and across borders, we may gain a little more economic growth – but at what price?

Increasing the global debt burden in pursuit of economic growth will inevitably lead to another financial crisis somewhere in the world. It is not sustainable. But despite the risk that rising debt poses, those who wield power in our current political and social systems have no real interest in reducing the global debt burden. This is because the other side of debt is wealth. And we love wealth.

I’m not a great fan of the ‘imminent collapse of the dollar’ meme. That will take a while longer.

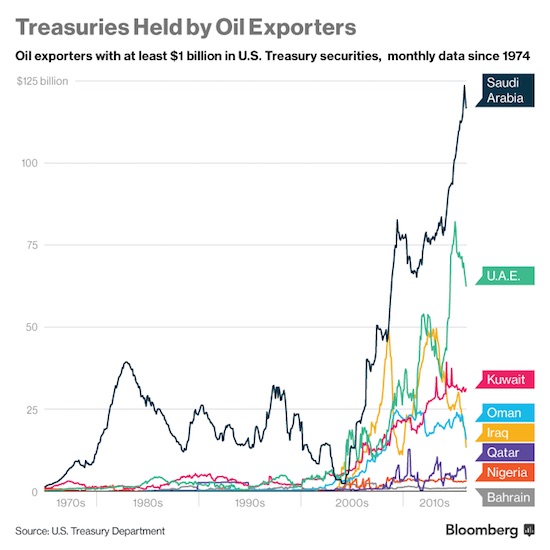

• The Rise and Fall of the Petrodollar System (Grass)

The intricate relationship between energy markets and our global financial system, can be traced back to the emergence of the petrodollar system in the 1970s, which was mainly driven by the rise of the United States as an economic and political superpower. For almost twenty years, the U.S. was the world’s only exporter of petroleum. Its relative energy independence helped support its economy and its currency. Until around 1970, the U.S. enjoyed a positive trade balance. Oil expert and author of the book “The Trace of Oil”, Bertram Brökelmann, explains a dramatic change took place in the U.S. economy, as it experienced several transitions: First, it transitioned from being an oil exporter to an oil importer, then a goods importer and finally a money importer. This disastrous downward spiral began gradually, but it ultimately affected the global economy.

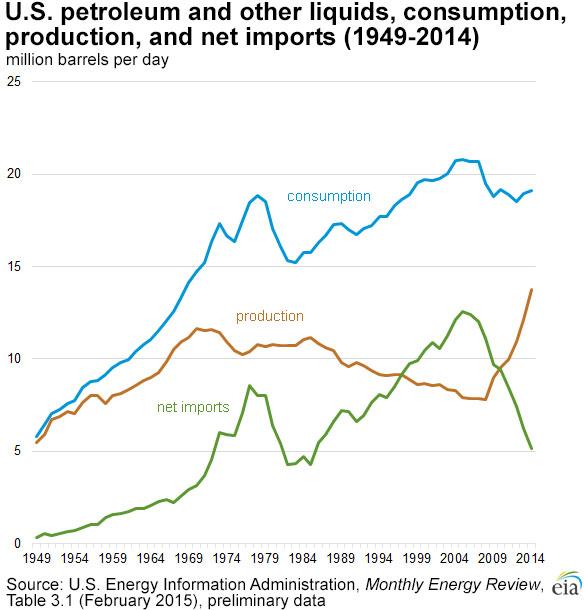

A petrodollar is defined as a US dollar that is received by an oil producing country in exchange for selling oil. As is shown in the chart below, the gap between US oil consumption and production began to expand in the late 1960s, making the U.S. dependent on oil imports. And while it led to the U.S. Dollar being established as the world’s premier reserve currency, it also contributed to the country’s increase in debt. The oil embargo of 1973-74 was a major hit that exposed the vulnerability of the U.S. economy. Nevertheless, under the banner of “national security” the future policy course was firmly set: in a 1973 National Security Council (NSC) paper, it was stated that “U.S. leverage in energy matters resulted from its economic and political influence with Saudi Arabia and Iran, the two leading oil exporters”.

From an upcoming book by Stockman.

• Trumped! A Nation On The Brink Of Ruin (David Stockman)

America’s faltering economy has been made in Washington DC, not at the illegal crossing routes on the Arizona border or the containership berths at Long Beach. For more than three decades the nation’s central banks have flooded the US and world economies with too much free money and Washington politicians have accommodated the beltway lobbyists and racketeers and the country’s huge entitlement constituencies with too much free boot. So the real disease is bad money and towering debts. The actual culprits are the Wall Street/Washington policy elites who have embraced statist solutions which aggrandize their own power and wealth.

That much, at least, Donald Trump has right. Throwing-out the careerists, pettifoggers, hypocrites, ideologues, racketeers, power-seekers and snobs who have brought about the current ruin is at least a start in the right direction. What made American great once upon a time, of course, was free markets, fiscal rectitude, sound money, constitutional liberty, non-intervention abroad, minimalist government at home and decentralized political rule. Whether Donald Trump gets that part of the equation remains to be seen.

Then again, the GOP establishment has failed, the Democrats are clueless and the mainstream media and punditry is overtly hostile. So if the ideals of world peace, capitalist prosperity and constitutional liberty are to survive at all, it’s up to the Donald. That might seem like cold comfort. But a nation that has been Trumped is a people coming back to life. Americans don’t want to take it anymore. They want their existing rulers to take a permanent hike. And that’s a start.

All entirely preventable. But that would require an actual cvilization.

• Nearly 3,000 Dead In Mediterranean Already This Year (R.)

Nearly 3,000 migrants and refugees have perished in the Mediterranean Sea already this year while almost 250,000 have reached Europe, the International Organization for Migration said on Friday. The estimated death toll could put 2016 on track to be the deadliest year of the migration crisis. Last year the same landmark was only reached in October, by which time nearly one million people had crossed into Europe. “This is the earliest that we have seen the 3,000 (deaths) mark, this occurred in September of 2014 and October of 2015,” IOM spokesman Joel Millman told a briefing. “So for this to be happening even before the end of July is quite alarming.”

Three out of four victims this year died while trying to reach Italy from North Africa, mostly Libya, a longer and more dangerous route. The others drowned between Turkey and Greece before that flow dried up with the March deal on migrants between Turkey and the European Union. Nearly 2,500 fatalities have occurred since late March, with about 20 migrants dying each day along the route from Libya to Italy, Millman said. Most are from West Africa and the Horn of Africa, although they may include people from Pakistan, Bangladesh and Morocco. “The (Libyan) coast guard has had some luck turning back voyages from Libya. We’ve heard in the last six weeks a number of cases where they have been able to turn boats back. “They (have also been) recovering bodies at an alarming rate,” Millman said.

Some 84,052 migrants and refugees have arrived in Italy so far this year, almost exactly the same number as in the same period a year before, he said. That indicated departures from Libya were at “maximum capacity” due to a limited number of boats deemed seaworthy. But there is “a very robust market of used fishing vessels and things coming from Tunisia and Egypt that are finding their way to brokers in Tripoli,” Millman said. “And you can actually go to shipyards where people are trying to repair boats as fast as they can to get more migrants on the sea.”

Home › Forums › Debt Rattle July 23 2016