Saul Leiter Phone call c1957

FTX O’Leary This is good.

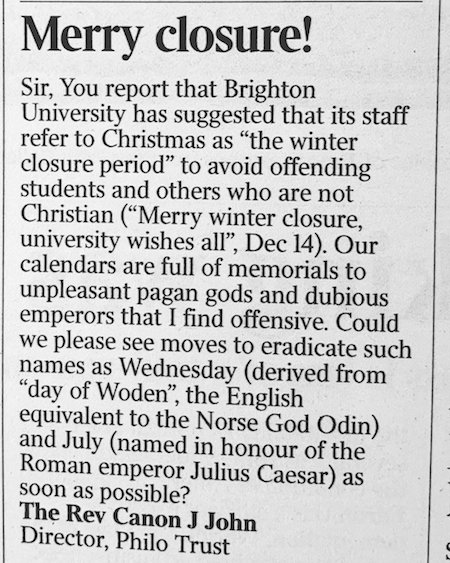

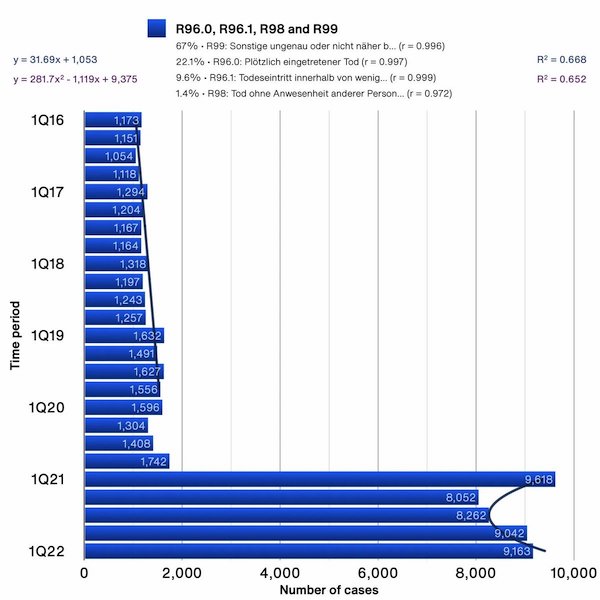

Germany died suddenly

Dutch farmers nitrogen

The Dutch government is expropriating 3000 farms on the basis of a falsehood. There is no nitrogen crisis and we should stop debating within the circle of the lies and false pretexts that they ‘allow’ us to debate within and expose their true intentions instead. @thecoastguy pic.twitter.com/QixWFkpVMv

— Eva Vlaardingerbroek (@EvaVlaar) December 16, 2022

Trump

President Trump is the ONLY person who can dismantle and DESTROY the censorship cartel. We need him BACK in the White House!!

— Ronny Jackson (@RonnyJacksonTX) December 15, 2022

Tucker vaccine risks

Research from the country that tells you unvaccinated truckers are domestic terrorists claims unvaxxed drivers get into more accidents. The data is… a joke. I broke it down on Tucker Carlson Tonight. pic.twitter.com/7wIEGNGL2m

— Jason Rantz on KTTH Radio (@jasonrantz) December 16, 2022

“..capable of evading any anti-ballistic missile system that could be fielded in the foreseeable future..”

• Moscow Reveals Capabilities Of Forthcoming ICBM Mobile Launcher (RT)

Russia will commence the development of a road-mobile intercontinental ballistic missile (ICBM) system next year, which will be a significant upgrade on the existing Yars system, Strategic Missile Forces (SMF) Commander Sergey Karakaev has said. The new platform will have increased mobility to facilitate “swift redeployment and launch from any region anywhere in the Russian Federation,” he told Krasnaya Zvezda (Red Star), the official newspaper of the country’s military. Karakaev offered no further details about the new project. The interview was published on Friday, ahead of SMF Day, which will be celebrated on Saturday. The SMF is the arm of the Russian military responsible for the country’s ground-based nuclear deterrence. It is currently “on the lookout for new technologies… which could be used to improve strategic weapon systems or create new ones,” Karakaev stated.

The silo-based Sarmat ICBM, as well as the Avangard and Yars systems, are examples of what is possible through such research, he added. The general praised the Sarmat missile in particular, which he said was capable of evading any anti-ballistic missile system that could be fielded in the foreseeable future. Russia approved production of the rocket following a successful test launch in April. Earlier this week, the Defense Ministry showcased the rearmament of an SMF site in central Russia by releasing footage, which showed two Yars missiles being loaded into silos. The ICBM has silo-launched and road-mobile variants.

“..an additional 300 tanks, up to 700 infantry fighting vehicles, and 500 Howitzers would be needed to repel the Russian forces..”

• US Considers Providing Ukraine With More Weapons – Politico (RT)

The US is planning to provide Ukraine with more weapons in the near future, extending the strike range of its military, Politico has reported. The media outlet, citing “six people with knowledge of the discussions,” claimed the move to provide additional supplies was prompted by concerns among top Ukrainian officials that Russia is amassing forces ahead of a major winter offensive. In its report on Thursday, Politico alleged that the Biden administration is currently entertaining the possibility of providing Kiev with, among other things, ground-launched small diameter bombs – high-precision munitions with a range of 150km (94 miles). Also under consideration, according to the article, is the delivery of joint direct attack munition kits, which are used to convert unguided aerial munitions into smart bombs.

These deliveries would be in addition to existing plans for the shipment of Patriot air-defense systems, Politico reported. Several US media outlets have indicated that those plans are in the final stages. Meanwhile, Kremlin spokesperson Dmitry Peskov said on Wednesday that Russia would certainly target these missile systems in Ukraine, should they be deployed there. On Thursday, Pentagon Press Secretary Brigadier General Patrick Ryder announced the expansion of a training program for Ukrainian military personnel at a US base on German soil. The number of troops attending there each month is reportedly expected to rise to around 500. In recent days, top Ukrainian officials – including the country’s top military commander, General Valery Zaluzhny, and Foreign Minister Dmitry Kuleba – have expressed concerns that Russia could launch a massive offensive as early as next month.

Zaluzhny did not rule out a new attempt by Moscow’s forces to take the Ukrainian capital Kiev. He also called on the West to provide Ukraine with more weaponry, saying that an additional 300 tanks, up to 700 infantry fighting vehicles, and 500 Howitzers would be needed to repel the Russian forces. While the US has already supplied Ukraine with short-range NASAMS air-defense systems, Kiev has been specifically requesting Patriot batteries since October, when Russia began massive missile and drone strikes on the country’s critical infrastructure. Moscow said the new strategy came in response to Ukraine’s attacks on Russian infrastructure, including the Crimean Bridge. Back in September, Russian Foreign Ministry spokeswoman Maria Zakharova warned Washington that “it would cross the red line and become an actual party to the conflict,” should it provide Ukraine with longer-range missiles.

“..the other territories Ukraine claims – Donetsk, Lugansk and Crimea – “could be the subject of a negotiation after a ceasefire.”

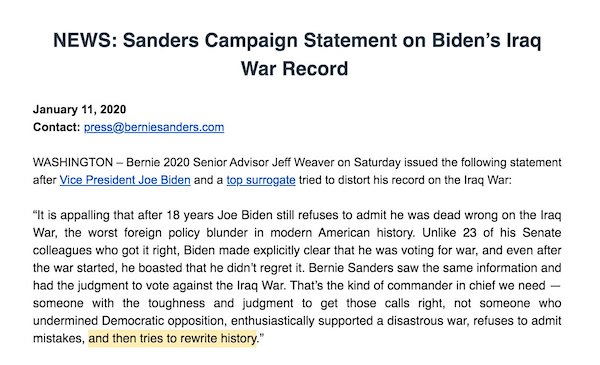

• Kissinger Outlines Ukraine Peace Proposal (RT)

Urgently negotiating an end to hostilities in Ukraine would prevent another world war, former US secretary of state Henry Kissinger argued in an essay published on Friday. The 99-year-old statesman noted that, in 1916, the US government had the chance to end the First World War through diplomacy, but missed it for reasons of domestic politics. Kissinger laid out his reasoning in the December 17 issue of The Spectator, describing the current conflict as a “war in which two nuclear powers contest a conventionally armed country,” a clear reference to Ukraine being a proxy war between the US and Russia. The “peace process” Kissinger proposes would “link Ukraine to NATO, however expressed,” as he believes neutrality for Kiev is no longer an option.

He also wants Russia to withdraw to the lines before February 24, while the other territories Ukraine claims – Donetsk, Lugansk and Crimea – “could be the subject of a negotiation after a ceasefire.” In addition to “confirming the freedom of Ukraine,” the arrangement would strive to “define a new international structure, especially for Central and Eastern Europe,” in which Russia should “eventually” find a place, he explained. While some would prefer “a Russia rendered impotent by the war,” Kissinger disagrees, arguing that Moscow’s “historical role should not be degraded.” Dismantling Russia could turn its vast territory into a “contested vacuum,” where “competing societies might decide to settle their disputes by violence” and neighbors could seek to claim territory by force, all in the presence of “thousands of nuclear weapons.”

In substance, this is the same proposal Kissinger had first floated in May, for which he was labeled an enemy of Ukraine and added to the notorious ‘Peacemaker’ kill list. In an interview earlier this month, Ukrainian President Vladimir Zelensky categorically rejected any sort of ceasefire that did not take Kiev’s claimed 1991 borders as the starting point. It was also unclear whether Moscow would accept any Western-mediated ceasefire at all, after former German Chancellor Angela Merkel’s admission that the 2014 Minsk armistice was intended to “give Ukraine time” to prepare for war. What’s fresh in Kissinger’s Spectator essay is his reasoning. He points to August 1916, at the height of the First World War, when the warring powers sought US mediation to end the unprecedented bloodshed.

Though “a peace based on the modified status quo ante was within reach,” President Woodrow Wilson delayed the talks until after he could get re-elected in November. By then it was too late, and the war would go on for two more years, “irretrievably damaging Europe’s established equilibrium.” Asked about Kissinger’s proposal, Kremlin spokesman Dmitry Peskov said Russian President Vladimir Putin was “eager to give the article a thorough reading,” but “hasn’t had a chance to do so yet, unfortunately.” Russia sent troops into Ukraine on February 24, citing Kiev’s failure to implement the Minsk agreements, designed to give the regions of Donetsk and Lugansk special status within the Ukrainian state. The Kremlin demanded that Ukraine officially declare itself a neutral country that would never join any Western military bloc. Kiev insists the Russian offensive was completely unprovoked.

“..if and when the diplomacy is ripe, they will be in the best possible position at the negotiating table.”

• Time For Ukraine Talks ‘Not Right Now’ – White House (RT)

It is not yet time for Ukraine to negotiate with Russia, US National Security Advisor Jake Sullivan argued in an interview on Friday. Meanwhile, Henry Kissinger – who held the same post in the early 1970s – has said talks should happen sooner rather than later. “We don’t know where this is going to end up,” Sullivan said of the conflict, speaking at the Carnegie Endowment think tank in Washington. “What we do know is that it’s our job to continue to sustain our military support to Ukraine, so they are in the best possible position on the battlefield, so that if and when the diplomacy is ripe, they will be in the best possible position at the negotiating table.” “That moment is not right now,” he added. According to Sullivan, Ukraine has won a series of battles, “repelled the Russian invaders from most of the country,” and is now “fighting to reclaim the remaining land.”

He called it “a remarkable thing” and said the Biden administration is asking Congress for “a substantial amount of further resources” to ensure “Ukraine has the means to fight this war.” Meanwhile, Americans training Ukrainian troops on the ground have spoken of mounting casualties and Ukraine’s chief of general staff, Valery Zaluzhny, is asking for more tanks, armored vehicles and artillery than most NATO members have in their arsenal, much less to spare. The US and its allies have supplied Ukraine with tube and rocket artillery, air defense systems, small arms, vehicles and ammunition, allowing Kiev to fight long after its domestic capabilities had been degraded. Russia has condemned the shipments as needlessly prolonging the conflict and increasing casualties, repeatedly warning the West that it risks becoming an open party to the conflict.

Earlier in the day, Sullivan applauded Japan’s new national security strategy, which will see Tokyo embark on massive military expansion citing the “strategic challenge posed by China.” The Japanese constitution – drafted mainly by the US occupation authorities after the Second World War – had renounced war and limited the country to a “self-defense” force. There was no indication that 46-year-old Sullivan was aware of his predecessor’s essay in The Spectator, in which the 99-year-old Kissinger called for an armistice in Ukraine before the conflict spins out of control. He pointed to the missed US opportunity to negotiate an end to the First World War in 1916, which led to millions more deaths and a far less stable post-war world that eventually collapsed into another global conflict.

“One might say that the West forgot the art of diplomacy..”

• Carthage Must Be Destroyed! (David Sant)

The dissolution of the Soviet Union in 1991 was not the result of losing a war. It was caused by the failed policies of a centralized economy, exacerbated by American manipulation of the oil markets, and a costly American-backed guerilla war in Afghanistan. The United States moved in with “shock therapy” economic advisors and took the opportunity to restructure a confused and gullible Russia, including writing a new constitution. For Russia the collapse of the Soviet Union had many similarities to the loss of Carthage in the Second Punic War. Despite making peace with their former adversary, and honoring their treaties, Russia found that she could never be accepted as a friend on equal terms by the Western world order. And this was for the very same reason that Carthage could never be tolerated by Rome.

Russia was and is in every way an equal to the Anglo-American Empire. Ever since Vladimir Putin became President of Russia, the chorus of the West has become louder and louder that Putin must go. While they cannot say it aloud yet, what they really mean is “Russia must be destroyed!” If Russia had continued the policy of submission to Western control that was begun by Boris Yeltsin, we can be assured that Moscow would have eventually met the same fate as Carthage from the Anglo-American Empire. However, the appointment of Vladimir Putin as President of Russia derailed their plans. Under his rule Russia has steadily reasserted her former leadership and strength against the machinations of the Anglo-American Empire.

While at first Mr. Putin made a genuine effort to be a “partner” with the West, by the year 2011 it was clear that the West would never accept Russia as a friend or an equal. The West had enjoyed two decades of bossing everyone else around and had learned to enjoy giving orders rather than negotiating. One might say that the West forgot the art of diplomacy. After watching in horror the NATO-led destructions of Serbia, Libya, and Syria, the Kremlin began asserting itself with foreign policy problems that directly affected Russian security interests starting in 2013.

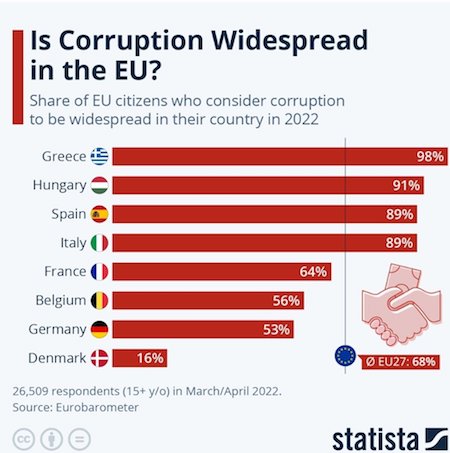

Harder to brainwash.

• Approval of EU Support For Ukraine Lags Among Greeks (K.)

Deviating from the general mood in Europe, a large number of Greeks hesitate to declare their approval of the European Union’s backing for Ukraine following the Russian invasion. In the relevant question of the Parliament’s Eurobarometer for autumn 2022, a majority of citizens in the 24 member-states approve of the position taken by the EU, with the exception of Slovakia, Bulgaria and Greece, which have the lowest percentages (49%, 48% and 48% respectively). The highest levels are recorded in Sweden (97%), Finland (95%), the Netherlands (93%), Portugal (92%) and Denmark (92%). The same survey showed that three quarters of European citizens (73%) agree with the specific measures taken by the EU, namely sanctions against the Russian government, as well as economic, military and humanitarian support to Ukraine. Again, Greece is at the bottom of the ranking, with only 46%.

Loffredo

I joined @TuckerCarlson to discuss the goal & impact of Western economic sanctions on the Russian people. Bottom line: The goal is regime change — grocery stores are full, gas is cheap and people can’t watch Netflix. pic.twitter.com/wMV9WGiJSA

— Jeremy Loffredo (@loffredojeremy) December 16, 2022

And the FBI works for the DNC, Pfizer and Raytheon..

• THE TWITTER FILES: Twitter… The FBI Subsidiary (ZH)

Twitter’s contact with the FBI was constant and pervasive, as if it were a subsidiary. Between January 2020 and November 2022, there were over 150 emails between the FBI and former Twitter Trust and Safety chief Yoel Roth. Some are mundane, like San Francisco agent Elvis Chan wishing Roth a Happy New Year along with a reminder to attend “our quarterly call next week.” Others are requests for information into Twitter users related to active investigations. But a surprisingly high number are requests by the FBI for Twitter to take action on election misinformation, even involving joke tweets from low-follower accounts.

The FBI’s social media-focused task force, known as FTIF, created in the wake of the 2016 election, swelled to 80 agents and corresponded with Twitter to identify alleged foreign influence and election tampering of all kinds. Federal intelligence and law enforcement reach into Twitter included the Department of Homeland Security, which partnered with security contractors and think tanks to pressure Twitter to moderate content. It’s no secret the government analyzes bulk data for all sorts of purposes, everything from tracking terror suspects to making economic forecasts. The #TwitterFiles show something new: agencies like the FBI and DHS regularly sending social media content to Twitter through multiple entry points, pre-flagged for moderation.

“..she asked whether there would be “impediments” to passing along classified information to industry partners. In response, the FBI was “adamant” that there were “no impediments to sharing.”

• Twitter Docs Reveal FBI Pressure To Control Speech (RT)

Twitter has maintained “constant and pervasive” contacts with the FBI and other US intelligence agencies for several years, according to internal company documents leaked to reporters. The files appear to show a concerted government campaign to blacklist content labeled as “misinformation.” Published by journalist Matt Taibbi on Friday, the sixth installment of the ‘Twitter Files’ revealed additional pressure placed on the website by the FBI and the Department of Homeland Security (DHS) between January 2020 and as recently as last month, largely focused on moderating particular posts and accounts discussing American elections. While earlier documents indicated high-level coordination between intelligence agencies and Twitter, the latest files suggest such collusion took place on a larger scale than was previously known.

In a period of less than three years, the site’s former Trust and Safety chief Yoel Roth alone exchanged more than 150 emails with the FBI. Prior to Friday, Roth was the only executive said to have had regular, direct contacts with the bureau, however the new files show that legal exec Stacia Cardille also held weekly meetings with not only the FBI, but the DHS, Department of Justice (DOJ) and the Office of the Director of National Intelligence (ODNI) beginning in September. In a letter addressed to Twitter’s former Deputy General Counsel Jim Baker – himself an ex-lawyer for the FBI – Cardille noted that she asked whether there would be “impediments” to passing along classified information to industry partners. In response, the FBI was “adamant” that there were “no impediments to sharing.”

“This passage underscores the unique one-big-happy-family vibe between Twitter and the FBI. With what other firm would the FBI blithely agree to ‘no impediments’ to classified information?” Taibbi asked. A number of messages sent to Twitter by the FBI contain explicit requests to take down certain posts, or even ban accounts altogether. In one case, the agency flagged so much “possible violative content” that Twitter staffers were later seen congratulating each other in an internal company chat for the “monumental undertaking” of reviewing it. Another missive sent on November 5, 2022 from the FBI’s ‘National Election Command Post’ provided a list of 25 accounts that “may warrant additional action.” Twitter was quick to permanently ban seven of those handles, while it temporarily suspended another and deleted eight tweets for alleged “civil misinformation policy violations.”

EU=hot air.

• EU Threatens Elon Musk With Sanctions (RT)

The EU has warned Elon Musk that Twitter could be targeted by sanctions after the platform owned by the entrepreneur suspended several journalists for allegedly sharing real-time location data about the billionaire and his family. “News about arbitrary suspension of journalists on Twitter is worrying,” wrote EU Commissioner for Values and Transparency Vera Jourova in a tweet on Friday. “EU’s Digital Services Act requires respect of media freedom and fundamental rights,” she said, adding that these rights are reinforced under the recently adopted European Media Freedom Act.= “[Elon Musk] should be aware of that. There are red lines.

And sanctions, soon,” Jourova warned, as the Digital Services Act is set to start coming into force next summer and will be fully implemented by 2024. Her threats come after Twitter suspended around half-a-dozen journalists on Thursday who reported and shared links to ElonJet, which provides real-time tracking of Musk’s personal flights. Musk has explained the decision by stating that the information being shared was “basically assassination coordinates” and pointed to Twitter’s terms of service, which prohibit doxxing – the illegal publishing of personal information – of anyone by anyone. “Same doxxing rules apply to ‘journalists’ as to everyone else,” the billionaire wrote on Thursday.

Twitter has previously suspended the original @elonjet account, as well as other similar flight-tracking channels owned by Florida student Jack Sweeney, who had been posting real-time data on private flights of the world’s wealthiest men, including Musk, Amazon CEO Jeff Bezos, Meta CEO Mark Zuckerberg and Microsoft founder Bill Gates. Musk – a self-proclaimed “free speech absolutist” – purchased Twitter for $44 billion in late October. Back then he initially promised not to suspend any accounts that were exercising free speech, noting that that extended “even to not banning the account following my plane, even though that is a direct personal safety risk.”

“Take a beat and lay off the proto-fascism. Maybe try putting down your phone,” the New York congresswoman suggested. Musk brushed off AOC’s criticism by simply replying: “You first.”

• AOC Accuses Musk Of ‘Proto-fascism’ (RT)

Democratic Representative Alexandria Ocasio-Cortez, commonly referred to as AOC, has joined the backlash against Elon Musk after Twitter suspended several journalists for allegedly violating the platform’s anti-doxxing policies while reporting on the ElonJet flight tracker. AOC accused Musk of abusing his power as the new owner of Twitter and told him to “lay off the proto-fascism.” That was after he temporarily suspended half-a-dozen journalists from CNN, the New York Times, and The Washington Post, among others, for reporting on and providing the links to ElonJet – a flight tracker that posted real-time flight data about Musk’s private jet.

Musk had accused the journalists of sharing information that was “basically assassination coordinates” and cited Twitter’s terms of service, which prohibit doxxing – publishing the personal information and real-time coordinates of other people. In a series of Twitter posts on Friday, Cortez insisted that Musk should not have suspended the reporters because he was “a public figure,” suggesting that being the victim of such location information-sharing comes with the territory. “You’re a public figure. An extremely controversial and powerful one,” AOC wrote. “I get feeling unsafe, but descending into abuse of power + erratically banning journalists only increases the intensity around you.”

“Take a beat and lay off the proto-fascism. Maybe try putting down your phone,” the New York congresswoman suggested. Musk brushed off AOC’s criticism by simply replying: “You first.” The billionaire had previously stated that he was fine with any criticism coming his way over his handling of Twitter, which he purchased in late October for $44 billion, but insisted that threatening the safety of his family was over the line. “Criticizing me all day long is totally fine, but doxxing my real-time location and endangering my family is not,” he wrote.

“I could have bought an island with the $44 billion, but this was a much better use of the money.”

• What I Discovered At Twitter HQ (Jay Bhattacharya)

You spoke with Elon for almost an hour. How was your conversation? The topic, of course, was censorship. My sense is that he bought Twitter in part because he is deeply offended by the idea that something like Twitter, which is so important for public communication… had put their thumb on the scale. It wasn’t specifically about Covid. Generally, his sense was that one side of the conversation wasn’t being heard on many, many issues… I think he views this as: he’s in a very privileged position that allows him to restore free speech, allow for free discussion of ideas. And he wants to use what gifts he’s had for that purpose. He even made a joke: I could have bought an island with the $44 billion, but this was a much better use of the money.

Was he a lockdown sceptic during the pandemic? I think he generally was a lockdown sceptic… He famously, early in the pandemic, protested against being locked down when the shutdown orders came, and then moved Tesla’s headquarters to Texas… He was very clear that he was aware of the harms of lockdowns. He mentioned the early days of the pandemic — that he had a number of plants in China, with tens of thousands of employees. He said: “Look, if somebody dies in amongst my employees, I find out immediately, because we stop paying them.” But he noticed that there were very, very few deaths on that metric early on. So his view was that it wasn’t clear that the case fatality rate numbers that were coming out matched reality in China itself, even from the earliest days of the pandemic… Certainly at this point, he was very sympathetic to my message about the harms to the poor of the world threatened by the economic dislocation caused by lockdowns, the closing of schools — all of that I think he opposed.

So then an engineer shows you your files. What did you find out? An engineer comes to me, we talk in this little cubicle. And so it turns out that there are two major sources of information for the journalists that are looking at this. First, there’s this tool, which Bari Weiss made famous: for each person, they’ll have the status of the person and history of the status of that person… That includes some personal identifying information, which is why you’re not seeing a dump of those files for everybody, because they’re not supposed to share that… I had got permission to look at myself of course. And I asked for permission to look at Martin Kulldorff.

“The Big News Media may not be able to avoid reporting on it, especially with Twitter loosened up, and their lying attempts to spin events is going to look pathetic..”

• Truth And Consequences (Jim Kunstler)

Even if NBC, CBS, CNN, The New York Times, The WashPo, and the rest of the Big News Media mafia ignore the Twitter Files story, the revolution at Twitter is going to shake their windows and rattle their walls. There will be free debate in 2023 on this social media platform. News and ideas will be set loose across the landscape, and, for the first time in years, reality will have a chance to compete with the bad faith narratives of a regime at war against its own people. We’ll have to see how long this lasts before the Intel Community tries to shut Twitter down, ramp up a campaign to defame it, or blow it up as a viable business. Or make a move to, shall we say, neutralize the person behind the revolution there.

The more that free speech is actually permitted on Twitter, the more every other platform will look like a lame organ of propaganda, especially when it comes to issues that really matter such as the deadly consequences of the mRNA “vaccines,” the shady doings around recent US elections, the actual condition of the US economy, the perilous folly of “Joe Biden’s” war in Ukraine (and the family grifting operation that prompted it), and the evil machinations of the Intel Community itself. In about three weeks, the Party of Chaos will be swept out of power in the US House of Representatives. Their opponents will take control of all the House committee chairs, with subpoena power to compel the testimony of public figures who have managed to avoid answering questions for years. The Big News Media may not be able to avoid reporting on it, especially with Twitter loosened up, and their lying attempts to spin events is going to look pathetic when it is instantly contrasted with free analysis and informed debate in the public arena.

You can’t overstate what an advantage the insidious takeover of social media gave to forces seeking to wreck the country, though the effects have not been adequately explored yet. The people remain bamboozled over the Covid-19 operation especially. It certainly wasn’t some random act by Mother Nature, not with US public health agencies supporting gain-of-function research on coronaviruses from Ukraine to North Carolina to Wuhan, China. And the subsequent damage caused by the government’s response to the outbreak was either an epic fiasco of inept officialdom, or something that smells like mass murder. Dr. Anthony Fauci’s little trick to so far avoid answering questions about these matters was simply to not use the term “gain-of-function” in his correspondence arranging grants for it — especially after President Barack Obama banned that type of research by its name in 2014. So when asked about gain-of-function, he could just lie with abandon. After that simple ruse is exposed, the patent and royalty benefits enjoyed by Dr. Fauci — who doubled his net worth after 2019 — will be dragged into the light of day.

“Current events in northern Kosovo resemble an attempt to bring about the “end of history” in the Balkan context..”

• Has ‘The End Of History’ Arrived In The Balkans? (Lukyanov)

Current events in northern Kosovo resemble an attempt to bring about the “end of history” in the Balkan context. Of course, the same one that was promised 30-odd years ago, on a global scale, hasn’t happened, but the idea behind it has remained in people’s minds. Francis Fukuyama, the author of the concept, later admitted that he had been hasty and had failed to take into account important circumstances in the development of societies. However, he hasn’tabandoned it, and continues to believe that the predicted triumph of Western liberal ideology, and the corresponding way of life, will still take place, just later than expected. What has Kosovo got to do with this? The disintegration of Yugoslavia has taken as long as the concept of “the end of history” has existed.

And it has been, perhaps, the clearest example of what it meant in practice. The nature of that state – a socialist federal republic – was diametrically opposed to what was thought to be right after the Cold War. Firstly, socialism as a socio-political construct was simply written off as having failed. Secondly, it was a complex federation dominated by the largest ethnic group. This, to be fair,could be described as being in the spirit of multiculturalism, which has become popular in developed countries over the past couple of decades. But no, because multicultural communities have only been welcomed if they were part of a process that develops from homogeneous to heterogeneous through immigration and the influx of new citizens of different origins.

Thus, multinational states like Yugoslavia or the USSR (or even Czechoslovakia) have instead been perceived through the prism of self-determination. In other words, national aspirations were worthy of support but the desire to maintain (con)federative unions was equated with imperial ambitions.

“..now that winter proper has begun and the cold is settling in, consumption will increase, whatever the price of gas.”

• Is Europe’s Energy Crisis Actually A Boon? (OP)

The energy crisis that began last year in Europe and dramatically escalated following the EU response to Russia’s invasion of Ukraine has seen many in government worry about the survival of the continent during the winter. Yet not all see such a bleak picture. In fact, some believe that not only is the worst over for Europe but that the crisis actually did the EU a favor. That favor took the form of accelerating the buildout in renewables and the restart of hydrocarbon-fueled power plants. This take, which is certainly not very common right now, came from one investment manager, Per Lekander, who is managing partner at a firm called Clean Energy Transition LLP. Speaking to CNBC this week, Lekander said that Russia had, in fact, very little to do with Europe’s crisis, and it could even be said Vladimir Putin did Europe a favor.

“This [the crisis] is the consequence of long term under-investments in conventional, long term red tape in renewables and then these political closures of nuclear, coal, lignite, etcetera,” Lekander told CNBC. He then went on to add that the measures that European countries took after Russia began responding to EU sanctions by reducing gas flows went a long way toward ensuring that the continent would survive this winter. Energy demand reduction was one of these measures, according to the financier, and returning to hydrocarbons for power generation was another. A third one was the planned reduction in red tape in wind and solar power system construction—obstacles that these two industries have been complaining about for years.

It could be argued that this energy demand reduction that has allowed Europe to save on gas was a result of exorbitant prices rather than any voluntary change in energy consumption behavior patterns. Indeed, millions of people across the continent are being hit with electricity bills that are substantially higher than last year’s bills because of the international gas price inflation caused by the tightening of supply following the EU sanctions on Russia and Russia’s easy to predict response. The sabotage of Nord Stream added to this tightening and pushed prices higher. Another reason for the lower demand was the warm European autumn, as many noted at the time. As the weather was warmer than usual, people’s heating needs were lower. Yet now that winter proper has begun and the cold is settling in, consumption will increase, whatever the price of gas.

Indeed, the worst might not be over. The Guardian reported this week that Germany was at risk of gas shortages because it had failed to hit its consumption reduction target. The reason it had missed it—the target is 20 percent of consumption—was the colder weather last week, the head of the country’s energy regulator said. The European Union last month approved a gas consumption reduction target of 15 percent, but Germany was more ambitious because of its high reliance on the commodity. Whether the rest of Europe would be able to hit the 15-percent target is yet to be seen because, as Klaus Mueller said, “With temperatures of -10C [14F], gas consumption shoots up dramatically.”

“..such policies are “leveled against” ordinary consumers across the bloc.”

• German MP Blasts ‘Absurd’ Price Cap On Russian Oil (RT)

Imposing an artificial ceiling on the price paid for Russian oil will provoke an increase in prices for the commodity, the chairman of the Bundestag committee on energy, Klaus Ernst, said in an interview with TASS, calling the measure “absurd.” Berlin is planning to entirely abandon energy imports from Russia, according to Ernst, who stressed that the operations at an oil refinery in the German city of Schwedt are critically dependent on Russian supplies. “It is absolutely clear that when a ceiling is introduced on energy prices, the object targeted by the measure will inevitably reduce the supply. It is clear that this will be counterproductive, because the price will rise,” Ernst argued. “In this regard, I think that such a restriction is absurd.”

The price limit on Russian seaborne oil, set at $60 per barrel, was introduced earlier this month by the EU, the G7 countries, Australia and Norway. The measure bans Western companies from providing insurance and other services to vessels loaded with Russian oil, unless the cargo is bought at or below the price indicated. The EU is currently debating a similar step targeting Russian gas supplies. According to Ernst, the policies pursued by Brussels are “self-destructive.” “The EU deliberately excluded pipeline oil supplies from sanctions. The government rejects them, although there is no need for this,” he said, adding that such policies are “leveled against” ordinary consumers across the bloc.

“..they will do so slowly, as they both remain exposed to the U.S. economy..”

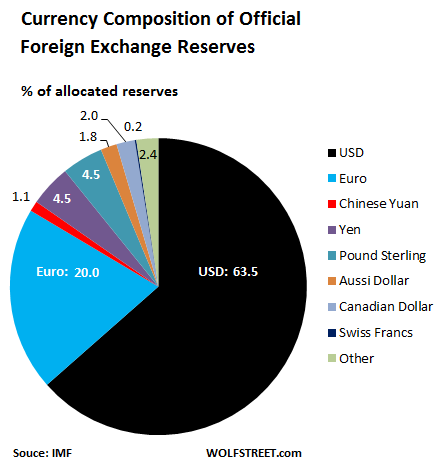

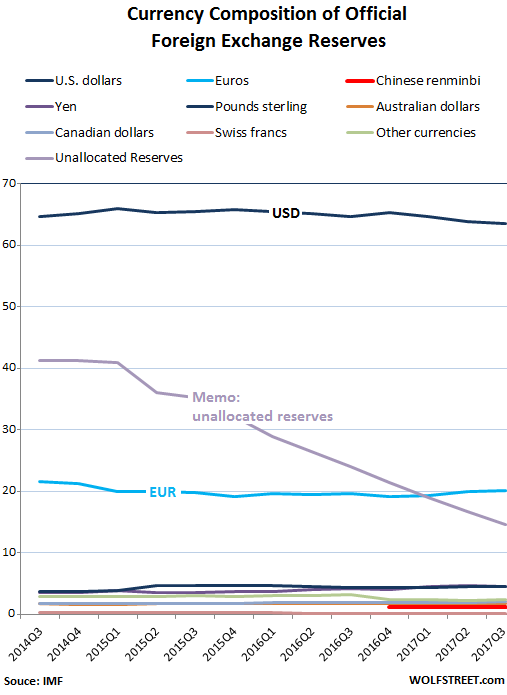

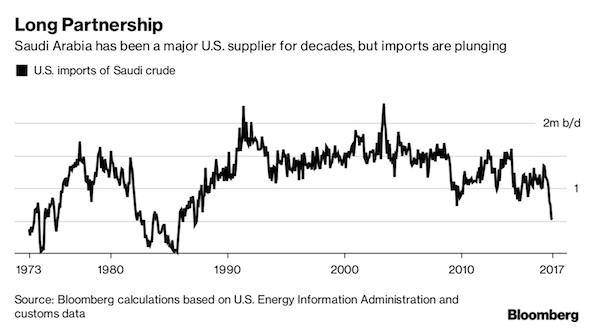

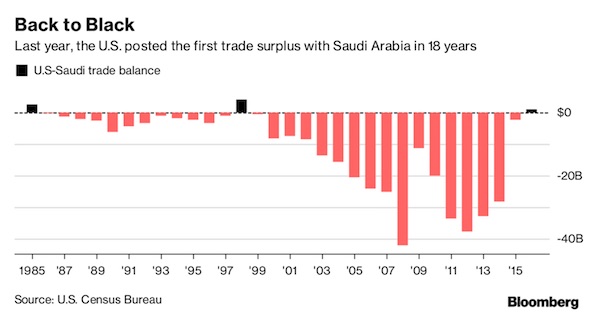

• The Petrodollar’s Long Goodbye (Prashad)

At this first China-GCC summit, Xi urged the Gulf monarchs to “make full use of the Shanghai Petrol and Gas Exchange as a platform to conduct oil and gas sales using Chinese currency.” Earlier this year, Saudi Arabia suggested that it might accept Chinese yuan rather than U.S. dollars for the oil it sells to China. While no formal announcement was made at the GCC summit nor in the joint statement issued by China and Saudi Arabia, indications abound that these two countries will move closer toward using the Chinese yuan to denominate their trade. However, they will do so slowly, as they both remain exposed to the U.S. economy. (China holds just under $1 trillion in U.S. Treasury bonds).

Talk of conducting China-Saudi trade in yuan has raised eyebrows in the United States, which for 50 years has relied on the Saudis to stabilise the dollar. In 1971, the U.S. government withdrew the dollar from the gold standard and began to rely on central banks around the world to hold monetary reserves in U.S. Treasury securities and other U.S. financial assets. When oil prices skyrocketed in 1973, the U.S. government decided to create a system of dollar seigniorage through Saudi oil profits. In 1974, U.S. Treasury Secretary William Simon — fresh off the trading desk at the investment bank Salomon Brothers — arrived in Riyadh with instructions from U.S. President Richard Nixon to have a serious conversation with the Saudi oil minister, Ahmed Zaki Yamani.

Simon proposed that the U.S. purchase large amounts of Saudi oil in dollars and that the Saudis use these dollars to buy U.S. Treasury bonds and weaponry and invest in U.S. banks as a way to recycle vast Saudi oil profits. And so, the petrodollar was born, which anchored the new dollar-denominated world trade and investment system. If the Saudis even hinted towards withdrawing this arrangement, which would take at least a decade to implement, it would seriously challenge the monetary privilege afforded to the U.S. As Gal Luft, co-director of the Institute for Analysis of Global Security, told The Wall Street Journal, “The oil market, and by extension the entire global commodities market, is the insurance policy of the status of the dollar as reserve currency. If that block is taken out of the wall, the wall will begin to collapse.”

Play

https://twitter.com/i/status/1603760623858376704

Wood art

https://twitter.com/i/status/1603925323166646272

Wat Samphran is a Buddhist temple in Amphoe Sam Phran, Nakhon Pathom province, around 40 km west of Bangkok. The temple is notable for its 17-story tall pink cylindrical building with a gigantic dragon sculpture curling around the entire height

Goose

https://twitter.com/i/status/1603508898421673985

Support the Automatic Earth in virustime with Paypal, Bitcoin and Patreon.