Vilhelm Hammershoi Woman Seen from the Back 1888

“The less men think, the more they talk.”

~ Montesquieu

Nord Stream 2

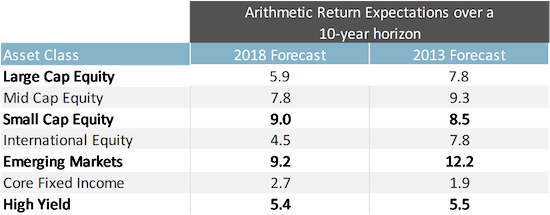

Ethical Skeptic 7:1

One can deny any single snapshot of data through casuistry, rhetoric, and deflection.

However, one cannot deny consistent momentum in data dynamics, compared consistently over time.

Now a 7:1 appetite in the virus for the recently vaccinated. pic.twitter.com/C6ac5xxURm

— Ethical Skeptic ☀ (@EthicalSkeptic) October 31, 2022

The Swiss National Bank just reported an enormous $142.6 BILLION dollar loss in the first 9 months of 2022, which is by far the largest loss in the bank’s 115 year history.

This is scary but not surprising. And it’s not about disinformation, but about anything that questions “official” info. “..the origins of the COVID-19 pandemic and the efficacy of COVID-19 vaccines, racial justice, U.S. withdrawal from Afghanistan, and the nature of U.S. support to Ukraine.”

It’s just partisan politics, flavored with a whiff of what both parties agree on, i.e. war. And it just so happens that the people who bring you this are the exact same lot that gave you Russia Russia, which was the biggest crop of disinformation ever.

• Leaked Documents Outline DHS’s Plans to Police Disinformation (IC)

Behind closed doors, and through pressure on private platforms, the U.S. government has used its power to try to shape online discourse. According to meeting minutes and other records appended to a lawsuit filed by Missouri Attorney General Eric Schmitt, a Republican who is also running for Senate, discussions have ranged from the scale and scope of government intervention in online discourse to the mechanics of streamlining takedown requests for false or intentionally misleading information. Though DHS shuttered its controversial Disinformation Governance Board, a strategic document reveals the underlying work is ongoing. DHS plans to target inaccurate information on “the origins of the COVID-19 pandemic and the efficacy of COVID-19 vaccines, racial justice, U.S. withdrawal from Afghanistan, and the nature of U.S. support to Ukraine.”

Facebook created a special portal for DHS and government partners to report disinformation directly. “Platforms have got to get comfortable with gov’t. It’s really interesting how hesitant they remain,” Microsoft executive Matt Masterson, a former DHS official, texted Jen Easterly, a DHS director, in February. In a March meeting, Laura Dehmlow, an FBI official, warned that the threat of subversive information on social media could undermine support for the U.S. government. Dehmlow, according to notes of the discussion attended by senior executives from Twitter and JPMorgan Chase, stressed that “we need a media infrastructure that is held accountable.” “We do not coordinate with other entities when making content moderation decisions, and we independently evaluate content in line with the Twitter Rules,” a spokesperson for Twitter wrote in a statement to The Intercept.

There is also a formalized process for government officials to directly flag content on Facebook or Instagram and request that it be throttled or suppressed through a special Facebook portal that requires a government or law enforcement email to use. At the time of writing, the “content request system” at facebook.com/xtakedowns/login is still live. [..] According to a draft copy of DHS’s Quadrennial Homeland Security Review, DHS’s capstone report outlining the department’s strategy and priorities in the coming years, the department plans to target “inaccurate information” on a wide range of topics, including “the origins of the COVID-19 pandemic and the efficacy of COVID-19 vaccines, racial justice, U.S. withdrawal from Afghanistan, and the nature of U.S. support to Ukraine.” [..] The inclusion of the 2021 U.S. withdrawal from Afghanistan is particularly noteworthy, given that House Republicans, should they take the majority in the midterms, have vowed to investigate. “This makes Benghazi look like a much smaller issue,” said Rep. Mike Johnson, R-La., a member of the Armed Services Committee, adding that finding answers “will be a top priority.”

And in view of DHS et al trying to control information flow, Ugo Bardi’s point is salient: Elon Musk understands that better than all the rest put together.

• “The Bird is Free.” Will Elon Musk Become Grand Duke of Mars? (Ugo Bardi)

Some people absolutely love censorship. But many (perhaps most) users of social media didn’t like to be watched from over their shoulders by those overzealous nannies who pretended to know better than them what is true and what is not. That generated criticism, and some attempts to rein in the censors. But, so far, we only saw censorship increasing its reach and becoming more pervasive.Except for the news of the day: the bird is free! Elon Musk bought Twitter and promises to eliminate censorship.

What’s happening? There are several possible interpretations, but at least something is clear: those who rule us are not a monolithic entity, as the Communist Party was in the Soviet Union. There are several would-be world rulers who are vying for power behind the scene. Musk may actually be smarter than most of them and able to understand that you gain nothing by silencing those who disagree with you. Suppose he wants to become the next US president, or maybe the Grand Duke of Mars, then he has to think like the Grand Duke of Tuscany did. He needs to know what people think because he can rule only if people agree that he is the ruler. Ruling by force and oppression is inefficient and, often, the ruler ends up hanged by the feet. So, Musk may well understand that he needs to leave some space for people to express themselves. The bird may not be completely free, but it has to be able to fly.

We seem to be in a transition moment (we always are). The Internet is under pressure by the attempt of controlling it by the powers that be, turning it into a tool for a totalitarian government (in China, the government may have succeeded at that). But, at the same time, some members of the elites are realizing that the Internet is a much better tool if used according to its characteristic of a two-way communication system. The Internet may allow us to generate a new governance system that might be more effective and just than the old totalitarian systems. It might be part of a “new Renaissance” that could take some aspects similar to the way Cosimo the 1st ruled in Tuscany during the 16th century. Maybe. But, as always, the future will surprise us.

But still, Musk would have to deflect the entire kitchen sink that will be thrown at him.

• How Elon Musk Should Shape Twitter — Sans the Sink (Turley)

News reports last week seemed to start out like a bar joke: The richest man in the world walks in carrying a sink . . . Of course, it was a joke — a colossal joke. The question is whom the joke is on. For Elon Musk, the punch line was appropriately delivered on Twitter, the company he’s taking over Friday at an inflated price. Calling himself “Chief Twit,” Musk posted the video with the caption “Entering Twitter HQ — let that sink in!” For the Musk-phobic, it was as funny as a drive-by shooting. CNN analyst Juliette Kayyem denounced Musk’s taunt as “fundamentally cruel.” After all, when Musk was first reported to be buying the company, employees were so traumatized that leadership had to offer emotional support just to “get through the week.”

The reason is less the fear of Musk bringing bathroom fixtures than free speech into San Francisco headquarters. Twitter has created one of the largest censorship systems in world history — a system widely condemned for a pattern of political bias and viewpoint intolerance. Outgoing CEO Parag Agrawal is unabashedly hostile to traditional views of free speech. Soon after he took over, he pledged to regulate content and said the company would “focus less on thinking about free speech” because “speech is easy on the Internet. Most people can speak. Where our role is particularly emphasized is who can be heard.” For employees who are true believers of this censorship scheme, the joke no doubt feels like it’s on them. The censorship skill set may not be quite as much in demand in a Musk-owned firm.

While Facebook, Google and other companies are still committed to corporate censorship, Musk has pledged to restore free speech principles to Twitter. But the joke may still be on Musk if he yields to Twitter’s corporate culture or the mainstream media’s unrelenting pressure. Democratic leaders like Hillary Clinton have turned from private censorship to good old-fashioned state censorship. Clinton has called on foreign governments to step in and pass laws that would force Twitter to continue to censor opposing views. New Zealand Prime Minister Jacinda Ardern recently repeated this call for global censorship at the United Nations to the applause of diplomats and media alike. Musk may have to yield to such domestic laws, but he can use his platform to inform citizens of those countries they are being censored and controlled in what they are allowed to read.

The most important thing in America is for Musk to hit the ground running at Twitter. First, he needs to order the preservation of all records. There are well-supported examples of biased censorship, including the burying of The Post’s Hunter Biden laptop story before the election. There are also allegations of back-channel communications from the government to manage a type of censorship-by-surrogate system to evade the First Amendment. Second, Musk should focus on the First Amendment as a model for Twitter’s content-management policy. It has become a mantra on the left that free-speech objections to social-media censorship are meritless because the First Amendment does not apply to private corporations.

Lagarde should be fired for 1) making this statement, and 2) meaning it.

• ‘Inflation Came From Nowhere’ – Lagarde (RT)

The European Central Bank (ECB) has doubled its key interest rate to the highest level in more than a decade in an attempt to combat soaring inflation, ECB President Christine Lagarde has explained. In an interview with Irish national broadcaster RTE on Friday, Lagarde said: “We do it because we are fighting inflation” that had “pretty much come about from nowhere.” She pointed to a speedier-than-expected economic rebound from the pandemic as a cause alongside “the energy crisis caused by Mr. Putin who has decided in an unjustifiable way to invade another country.” The ECB chief added: “That’s what he [Putin] is trying to do, cause chaos and destroy as much of Europe as he can. This energy crisis is causing massive inflation which we have to defeat.”

She went on to say that “Anybody who is behaving in that way has to be driven by evil forces,” and that the “sick”Russian president is a “terrifying person.” Discussing her previous meetings with the Russian leader, Lagarde described him as an “unbelievably super-briefed person” with “flashing, freezing eyes.” After expressing her view, Lagarde however stressed that she’s “just a central banker,” and “shouldn’t be saying all these things.” On Thursday, the ECB announced another interest rate hike, taking Eurozone rates to the highest level since 2009. According to Lagarde, they are aimed at bringing inflation back to “reasonable levels so the cost of living isn’t as high as it is for people.” In September, inflation across the euro area hit 10%.

The EU has blamed Russia for the spiraling energy crisis across the continent. However, many economists point to the bloc’s fiscal policy responses as a major reason behind the crisis. Moscow has also criticized the “illogical and often absurd” moves by Western nations, saying that the sanctions imposed by the US, EU, and other countries on Russia have backfired and resulted in a sweeping energy crisis as well as record inflation across the West.

This will cost Erdogan a lot of points. He negotiated the grain corridor, meant for Africa nations, but grabbed 34% for himself AND allowed Kiev to use the corridor to hide drones.

• Putin Clarifies Position On Grain Deal (RT)

The grain deal between Moscow and Kiev has not met its stated goals, Russian President Vladimir Putin said on Monday. Most of the Ukrainian agricultural products exported under the agreement have not reached the poorer nations they were supposedly intended for and have instead ended up in Europe and Türkiye, he argued. Putin said Moscow was suspending its participation in the deal, but not fully withdrawing from it. The deal was promoted to “secure the interests of the poorer nations,” he said, adding that, according to Russian intelligence, the real structure of Ukraine’s grain exports is vastly different. “We agreed to that [grain deal] precisely in the interests of the poorer nations,”the Russian president said.

“On the whole, it looks like 34% of [the Ukrainian] grain gets to Türkiye, 35% or even more is taken by the EU nations and only between three and four … or five percent, according to our Agriculture Ministry … goes to the poorer nations,” Putin said. His words came as the Russian military closed the Black Sea grain corridor used to export Ukrainian grain under the agreement reached in Istanbul in July. The agreement – mediated by the UN and Türkiye – was initially hailed as critical for easing the global food crisis and helping the world’s poorest nations avoid starvation. Russia has since repeatedly pointed out that the grain, in fact, goes to other destinations. Moscow decided to halt its participation in the deal following a massive drone attack on its naval base in the Crimean port city of Sevastopol last week.

According to the Russian Defense Ministry, the naval drones used in the attack navigated through the grain corridor’s security zone to reach their targets. One of them might have even been launched from a civilian vessel chartered to transport Ukrainian grain shipments, it added. Earlier on Monday, Kremlin spokesman Dmitry Peskov said that Russia was ready to compensate the missing Ukrainian grain export volumes from its own stocks. At the same time, he said that Moscow could not yet name the conditions that would make it resume its participation in the deal. In the wake of Moscow’s decision to suspend its participation in the deal, the UN has insisted that “food must flow”regardless of circumstances. Civilian vessels “can never be a military target or held hostage,” the UN coordinator for the Black Sea grain initiative, Amir Abdulla, said. Russia has previously said that it could not guarantee the security of the grain corridor if Kiev used it for military purposes.

Inevitable. If Turkey doesn’t do it, Russia must.

• Russia Tells UN It Will Inspect Black Sea Ships (RT)

Ukraine “grossly violated” the Istanbul agreement on grain exports via the Black Sea and forced Moscow to suspend it indefinitely, Russia’s envoy to the UN Vassily Nebenzia told the Security Council on Monday. The Russian Navy will inspect all cargo ships bound for Ukraine, even those unilaterally cleared by the Turkish-based coordination center, he added. “This subversive action of Kiev grossly violates the Istanbul agreements and, in fact, puts an end to their humanitarian dimension. It is now obvious to everyone that the Black Sea humanitarian corridor is being used by the Ukrainian side for military sabotage purposes,” Nebenzia said, referring to Saturday’s drone attack on Sevastopol. Russia “cannot guarantee the safety of civilian ships participating in the Black Sea initiative,” Nebenzia added, as “we do not know what other terrorist attacks Kiev is preparing with the support of its Western sponsors.”

On Sunday, after Moscow announced the suspension of the arrangement, the Joint Coordination Center (JCC) in Istanbul said it had greenlit 16 ships to navigate the corridor on Monday and “informed” Russia about the decision. According to maritime traffic data, at least two ships left the Black Sea port of Odessa in the morning, reporting Istanbul as their destination. “Decisions and measures taken without our participation are not binding on us,”Nebenzia told the UN. Moscow “cannot allow ships to pass without our inspection and will be forced to take independent measures” to inspect ships authorized by the JCC without Russian approval. Meanwhile, the UN coordinator for the Black Sea grain initiative, Amir Abdulla, insisted that “the food must flow.”

The UN and Türkiye mediated a deal in July under which Ukrainian grain could be exported via the Black Sea, while Western obstacles to the exportation of Russian grain and fertilizer would be removed. The US and its allies insist they had never sanctioned grain exports – but their sanctions on Russian ships and insurance made them impossible in practice. Moscow has criticized the West for not keeping its side of the deal and pointed out that the bulk of Ukrainian exports had gone to the EU and not the African nations most affected by food insecurity. Russia halted its compliance with the pact on Saturday, after Kiev launched a major drone attack on the Black Sea Fleet and civilian vessels involved in securing safe passage for agricultural cargo from Ukrainian ports. On Sunday, after studying the wreckage of the unmanned combat vehicles, the Russian Defense Ministry said that those behind the attack made active use of the UN-brokered grain corridor.

Just making friends.

• Israeli Finance Minister Added To Kiev’s ‘Kill List’ (RT)

Israeli finance minister, Avigdor Lieberman has been added to the database of the “enemies of Ukraine” on the controversial Mirotvorets website on Sunday. The authors of the site, which is believed to have links to the Ukrainian security services, described Lieberman as “Russia’s agent of influence,” who had been manipulating publicly significant information in favor of Moscow. They also blamed him for taking part in acts of “humanitarian aggression” against Ukraine. Among the actions that led to Lieberman being placed on the list, were his refusal to finance an Israeli field hospital in Ukraine in March and his neutral stance on who is to blame for the massacre in the Kiev suburb of Bucha in April. The website also shared a link to an article, claiming that he had ties with Russian gas giant Gazprom.

Ukrainian authorities have frequently expressed their disappointment with the level of support they’ve been getting from Israel during the conflict with Russia. The country has only provided Kiev with humanitarian aid and life-saving defense equipment, but not weapons and munitions. Israel also refrained from joining international sanctions on Moscow. Last week, Liberman said that Israeli assistance to Ukraine since the outbreak of the fighting between Russia and Ukraine in late February amounted to some $40 million. Liberman has been finance minister since 2021. He’s a veteran politician, who has occupied various high positions in the Israeli government over the years, including foreign minister, defense minister, and deputy PM. The 64-year-old is also the head of Yisrael Beiteinu (Israel Our Home), which holds seven seats in the country’s parliament, the Knesset.

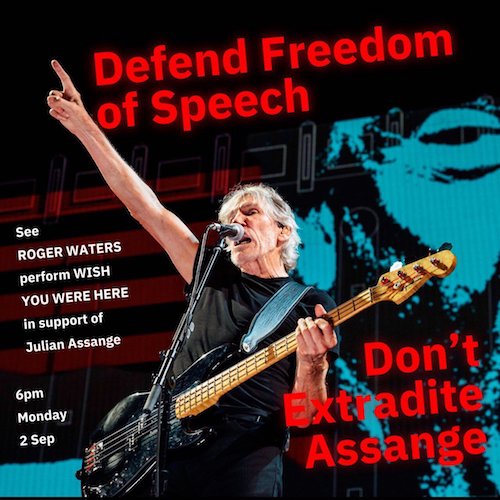

Liberman was born in Chisinau, Moldova when the republic was part of the Soviet Union and immigrated to Israel in 1978. The Mirotvorets website, translated as ‘peacemaker’, was launched in 2014, positioning itself as an independent database run by anonymous moderators to help Ukrainian authorities and “special services” apprehend pro-Russian terrorists, separatists, and war criminals, among others. However, some have branded the database a ‘kill list,’ which is backed by the government, after several individuals, including writer Oles Buzina, politician Oleg Kalashnikov, and Russian journalist Darya Dugina were assassinated shortly after their profiles appeared on the website. The most recent high-profile additions to Mirotvorets included Kazakhstan’s president, Kassym-Jomart Tokayev, Pink Floyd co-founder Roger Waters. There were claims that the world’s richest man, Elon Musk, was put on the database in mid-October, but swiftly removed from it. The alleged addition happened after Musk offered a peace plan, which envisaged Kiev giving up territories to Moscow.

Slow grind.

• Much Of Kiev Without Power & Water After New Russian Airstrikes (ZH)

Much of the Ukrainian capital of Kiev is without electricity or water, after the latest round of major Russian airstrikes on Monday. The Russian military announced ‘successful’ strikes on multiple of the country’s vital infrastructure facilities. “The Russian Armed Forces continued to launch strikes with high-precision long-range air and sea-based weapons against Ukrainian military and energy facilities,” the Defense Ministry said. “The goals of the strikes were successful. All assigned objects were hit.” Meanwhile, Ukrainian Prime Minister Denys Shmyhal confirmed direct hits on 18 sites – most of which were connected to the nation’s energy supply. These ramped up attacks have created a growing sense of panic with temperatures plunging and winter approaching.

“Missiles and drones hit 10 regions, where 18 sites were damaged, most of them energy-related,” Shmyhal stated on Telegram. “Hundreds of settlements in seven regions of Ukraine were cut off.” Facilities in Cherkasy and Kirovohrad also came under attack. Ukraine’s military said it intercepted projectiles over the Lviv region, which spared this western part of the country from damage. The Washington Post noted there are “power outages continuing in the Kyiv, Zaporizhzhia, Dnipropetrovsk and Kharkiv regions,” and others. The Post listed some of the below regions impacted by large-scale power outages and water supply disruptions:

• Kyiv region: Russian strikes damaged buildings, and rescuers are searching for victims, the regional police said. Attacks left 80 percent of the capital without water and are likely to cause sustained power outages, Mayor Vitali Klitschko said.

• Kharkiv: Two strikes hit critical infrastructure facilities in the eastern city, causing problems with the water supply and affecting the public transit network, the mayor said.

• Zaporizhzhia region: An infrastructure facility was struck by rockets, the local governor said, prompting warnings from officials in the southern region that energy supplies there could also be affected.

• Cherkasy region: Some of the region lost power after air attacks on infrastructure facilities, the military administrator said.Ukrainian Foreign Minister Dmytro Kuleba condemned the attacks as more war crimes: “Another batch of Russian missiles hits Ukraine’s critical infrastructure. Instead of fighting on the battlefield, Russia fights civilians,” he tweeted. Additionally Kyiv mayor Vitali Klitschko announced on Telegram that these fresh strikes left 80% of residents in the capital without water and some 350,000 homes with no electricity. “Just in case, we ask you to stock up on water from the nearest pumps and points of sale,” he advised. The mayor’s office vowed that water supply to the effected parts of the city would be restored in three to four hours, with emergency utility crews working urgently on it.

Rescue teams in the capital are reportedly searching for possible casualties under the rubble of buildings destroyed or damaged from the new salvo of Russian strikes; however, at this point casualty numbers are unclear. The US ambassador said she and her staff had to take shelter in this latest attack on the capital: Already before Monday’s attacks, Ukrainian officials estimated that 40% of the nation’s electrical power systems had been severely damaged, and urged households to limit their usage, especially with non-essential large appliances. Ukrainians are further being warned to prepare for long-term power outages as a frigid winter is just around the corner.

“The mirage is over. This Hell-begotten war must end.”

• From The Surreal To The Real To The Meta-Real (Batiushka)

[..] the surreal continued when, on 23 October, with the Russian Defence Minister’s phone calls to his US, UK, French and Turkish counterparts about the Russian discovery of a Kiev/MI6 plot to use a ‘dirty’ bomb and blame it on Russia. Having outed the plot, Sergei Shoigu had alerted the US Establishment to the extremism of the now desperate Kiev elite (and their British MI6 operatives). The US put the Kiev crazies in their place, since, after all, the US are the string-pullers and puppets are not allowed to do anything without their express permission. The US duly stated that it has seen no evidence that Russia intends to use nuclear weaponry and President Putin stated that Russia has no plans to use nuclear weapons. The panic and hysteria of the Western media and of others was unfounded; though the mass media did not report the US admission. Panic and hysteria sell.

[..] Let us now come back to reality. The 87,5% of the world which either supports the Russian campaign to liberate the Ukraine, or else remains neutral towards it, shows the increasing isolation of the Nazi West. And it is now also crystal clear that ‘the West’ is in fact only the USA, just as NATO is only the USA, the Wicked Witch of the West. The rest is just camouflage, a mirage. In Italy, Germany, France, Moldova, the Czech Lands, Romania (the former Defence Minister), Bulgaria, Serbia, even in the UK, dissident voices are protesting. For God’s sake, negotiate with Russia! The Ukraine is their business, not ours, they’re all basically Russkies anyhow. We want gas and food! Who cares about the Nazi puppets in Kiev?

More and more all European governments, apart only from the Hungarian, are being seen as what they are – simply US puppet elites, who do not represent their peoples. EU or Non-EU Europe, there is no difference, apart from Hungary, which alone has, in every sense, a popular government. If Nobel Prizes were given non-politically, surely Victor Orban should have won one of them by now. Here the hypochondriac French are going crazy because China is sanctioning them by depriving them of paracetamol. Perhaps as many as 20% of Western Europeans have now realised that the whole Ukraine affair is a put-up job, arranged by the US, with its British poodle yapping at its feet. Same as Iraq, same as Afghanistan. Same old, same old.

The poodle is more papist than the Pope. Over the last two months it is notable that most Ukrainian flags have been taken down in Europe. It is rare to see one now. The working class were never interested, they always knew it was just another operation by the arms industry, but now even the conformist middle-class is taking down its Ukrainian flags. The mirage is over. This Hell-begotten war must end.

UK was directly involved.

• Drone Attack On Sevastopol (MoA)

This morning at 4:20 local time the Russian fleet in the Crimean port of Sevastopol was attacked by nine unmanned aerial vehicles and seven autonomous maritime drones. Earlier a maritime drone that had run aground in Crimea and had been found and pictured. During today’s attack a large U.S. drone had flown circles south of Crimea. It likely relayed data from and to the drones. The maritime drones are British and Russia alleges that British specialists had trained the Ukrainian navy in using them. It also says that British soldiers were involved in the attack on the Nord Stream pipeline. The Ukrainians published two videos shot by the maritime drones while attacking. One of the video shows extensive gun fire impacts near the drone from a Russian helicopter that is attacking it.

The Russians say that all the aerial drones and 4 of 7 maritime drones were defeated before they could caused damage. They also say that one mine seeking ship was damaged in the harbor. It is possible that the damage is greater than Russia admits. As a consequence of the attack Russia declared that the deal which allowed for grain exports from Odessa has been suspended. That deal had already been in danger as the ‘west’ had not fulfilled its part of the deal which would have allowed for the export for Russian fertilizer to third parties. I find it likely that Russia will take additional measures to punish the Ukrainian navy for the brazen attack. Additional attacks on Ukrainian infrastructure is another possibility.

Meanwhile all recent attempts by the Ukrainian army to penetrate the Russian held lines have failed. It is notable that these are now much smaller in size with just a battalion or in some cases just two companies in the lead. It is now definitely mud season in Ukraine during which it is impossible to cross most farmland even on feet. This will hinder the attacking forces on both sides until winter sets in.

Lula has strong ties to China and has been a driving force behind BRICS.

“..the next BRICS summit in South Africa, which will consolidate BRICS+, as an array of nations are itching to join, from Argentina and Saudi Arabia to Iran and Turkey.”

• Comeback Kid Lula In The Eye Of A Volcano (Escobar)

Lula is one of the founders of the BRICS in 2006, which evolved out of the Russia-China dialogue. He’s immensely respected by the leaders of the Russia-China strategic partnership, Xi Jinping and Vladimir Putin. He has promised to serve only one term, or up to the end of 2026. But that’s exactly the key stretch in the eye of the volcano, straddling the decade Putin described in his Valdai speech as the most dangerous and important since World War II. The drive towards a multipolar world, institutionally represented by a congregation of bodies from BRICS+ to the Shanghai Cooperation Organization to the Eurasia Economic Union, will profit immensely to have Lula on board as arguably the natural leader of the Global South – with a track record to match.

Of course, his immediate foreign policy focus will be South America: he already announced that will be the destination of his first presidential visit, most probably Argentina, which is bound to join BRICS+. Then he will visit Washington. He has to. Keep your friends close and your enemies closer. Informed opinion across the Global South is very much aware that it’s under Obama-Biden that the whole, complex operation to topple Dilma and expel Lula from politics was orchestrated. Brazil will be a lame duck at the upcoming G20 in Bali in mid-November but in 2023 Lula will be back in business side-by-side with Putin and Xi. And that also applies to the next BRICS summit in South Africa, which will consolidate BRICS+, as an array of nations are itching to join, from Argentina and Saudi Arabia to Iran and Turkey.

And then there’s the Brazil-China nexus. Brasilia has been Beijing’s key trade partner in Latin America since 2009, absorbing roughly half of China’s investment in the region (and the most of any Latin American investment destination in 2021) and firmly placed as the fifth largest exporter of crude for the Chinese market, second for iron and first for soybeans. The precedents tell the story. Right from the start, in 2003, Lula bet on a strategic partnership with China. He considered his first trip to Beijing in 2004 as his top foreign policy priority. The goodwill in Beijing is unshakeable: Lula is considered an old friend by China – and that political capital will open virtually every red door.

In practice, that will mean Lula investing his considerable global clout in strengthening BRICS+ (he already stated BRICS will be at the center of his foreign policy) and the inner workings of South-South geopolitical and geo-economic cooperation. That may even include Lula formally signing up Brazil as a partner of the Belt and Road Initiative (BRI) in a way that won’t antagonize the US. Lula, after all, is a master of this craft.

Saudi Arabia cannot pick the US over OPEC+ and BRICS. It’s not in their interest.

• Why The US-Saudi Relationship Is Withering (RT)

As the Gulf States are ultimately concerned with preserving their own value systems and independence, they have increasingly diversified their relationships in recent years with tilts towards Russia and China. Beijing, with its enormous demand for energy, has also become a lucrative alternative to the West. Similarly, stable ties with Moscow also allow for cooperation in the common interests of oil-exporting countries, which has also had the effect of reducing Western influence and dominance over those countries. On recognizing this, why would Saudi Arabia and the states of OPEC voluntarily undermine their own oil revenue merely to suit the geopolitical interests of the United States?

The world is in the middle of an energy price crisis exacerbated by the conflict in Ukraine. Saudi Arabia sees that the US and some of its allies want to purposefully try to lower the price of oil in a bid to try and hurt Russia. However, that is not how the market works and, by extension, such a move is also an assault on Saudi and OPEC interests. While the kingdom is officially neutral in regards to Russia-Ukraine, it also recognizes that the success of an energy price cap would embolden the West to push harder against Russia, which also serves to undermine the kingdom’s geopolitical independence.

In other words, if the US succeeded in dividing OPEC by unilaterally demanding a price cap on oil products, it would defeat the very purpose of the organization itself to protect the respective economic interests of those countries. The United States has been a useful partner to Saudi Arabia, but it is not a friend. It is not part of a ‘bloc’ or ideological coalition, as let’s say the UK is, but merely has seen the West as the most useful and lucrative partner to fulfil its own political needs. As those needs change, Saudi Arabia’s preferences are also subject to change. Washington is therefore learning that the kingdom is not a client state to be called on when needed, and thus this very close and often contradictory partnership is starting to strain.

Nero comes to mind.

• They Rule Over Dysfunctional Ruin, but They Rule (Crooke)

Since 2008, we have lived in a western world shaped by the ‘permanent state’ or by our managerial technocrats – label to choice. This ‘creative class’ (as they like to see themselves) is particularly defined by its intermediary position in relation to the wealth-controlling oligarchic cabal as ultimate big money overlords on one hand, and the dullard ‘Middle Class’ below them – at whom they sneer and deride. This intermediary class didn’t set out to dominate politics (they say); It just happened. Initially, the aim was to foster progressive values. But instead, these professional technocrats, who both had accreted considerable wealth and were tightly congregated into cliques in America’s large metro areas, came to dominate left-wing parties around the world that formerly were vehicles for the working class.

Those who coveted membership in this new ‘aristocracy’ cultivated their image as one of cosmopolitan, fast-moving money, glamour, fashion, and popular culture – multiculturalism suited them to perfection. Painting themselves as the political conscience of the whole of society (if not the world), the reality was that their Zeitgeist reflected primarily the whims, prejudices and increasingly psychopathies of one segment of liberal society. Into this milieu arrived two defining events: In 2008, Ben Bernanke, Chair of the Federal Reserve, gathered together in the aftermath of the Global Financial Crisis, a room-full of the wealthiest oligarchs, ‘locking them in’ until they found the solution to the unfolding systemic bank failure.

The oligarchs did not find a solution but were released from their lock-up anyway. They opted instead, to throw money at structural problems, compounded by egregious errors of judgement about risk. And to finance the resulting massive losses – which were over $10 trillion in the U.S. alone – the world’s central banks began printing money – since when they have never stopped! Thus begun the era in the West where deep problems are not solved, but simply have freshly-printed money thrown at them. This methodology was whole-heartedly adopted by the EU also, where it was called Merkelism (after the former German Chancellor). Underlying structural contradictions were simply left to accumulate; kicked down the road.

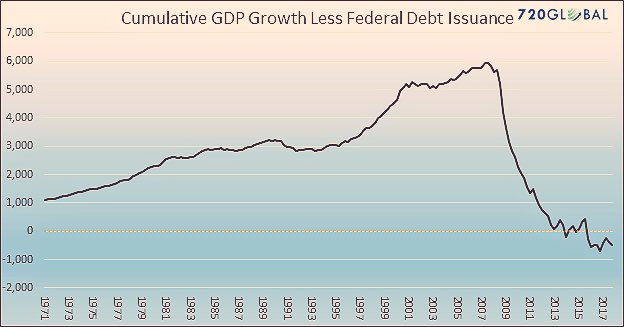

“To provide some perspective, from 2020- Q2 2022, US government debt increased over $7 trillion.”

• US Economic Decline And Global Instability Part 3 (Phillyguy)

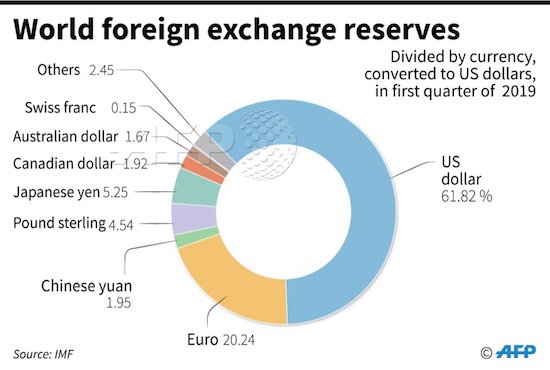

The US emerged from WWII as the world’s leading power. Since that time, US global supremacy has rested on unrivaled military and economic power, control of world’s energy reserves (primarily in the Middle East), and maintaining the dollar as the world’s reserve currency. This relationship began to transform in the mid-1970s, as US corporate profits began to stagnate/decline, the proximate cause being the 1973-1975 recession [3], a consequence of increased competition from rebuilt economies in Europe- primarily Germany (Marshall Plan) [4], Japan/South Korea (Korean war) and more recently China. The US ruling elite responded to this economic challenge by pursing neoliberal economic policies (reviewed in [1]).

This included: 1) multiple tax cuts for the wealthy, 2) financial deregulation- repeal of Glass–Steagall legislation (1933 Banking Act) by the Gramm–Leach–Bliley Act (GLBA) in 1999 and Commodity Futures Modernization Act (CFMA) of 2000, that exempted over-the-counter derivatives trades between financial firms from regulation. It should be noted that both of these bills were passed during the waning years of the Clinton Administration and may have been a quid pro quo to spare President Clinton an impeachment conviction over his affair with White House intern Monica Lewinsky [5]. 3) attacks on labor and the poor and job outsourcing to Mexico, China and other low-wage platforms, facilitated by passage of North American Free Trade Agreement (NAFTA) in 1994 [6].

The effect of these policies is vividly observed in the manufacturing sector. In 1960 the US produced 50% of global manufacturing output, accounting for 25% of GDP. Today, the US produces circa 17% of global manufacturing output, accounting for 11% of GDP [7]. 4) Spending vast amounts of taxpayer money (> $20 trillion) on post-911 militarization. The neoliberal economic policies outlined above precipitated the Global Financial Crisis 2007-2008 (GFC), the largest financial crash since the Great Depression [8] [9] [10]. None of the structural economic problems giving rise to the GFC (listed above) have been resolved; instead, the FED has used the US Treasury as a taxpayer-funded ‘piggy bank’ (the FED cannot print money) to pump over $40 trillion (this figure may be as high as $50 trillion) to support insolvent banks, inflate bond and equity markets and over-priced real estate, creating the ‘everything bubble’ [11].

Thus, since 2009, the US ‘economy’ has been sustained by continuous money printing to prop up financial markets and the Pentagon. Not surprisingly, this has been accompanied by an explosion of debt and rising inflation, further exacerbated by the Covid-19 pandemic, war in Ukraine and sanctions on Russian energy, which has led to demands for even more money to support financial markets and the Pentagon. To provide some perspective, from 2020- Q2 2022, US government debt increased over $7 trillion [12].

Must read history lesson.

• Russia’s New Regions On Collision Course With Ukraine 100 Years Ago (Nepogodin)

When four formerly Ukrainian regions joined Russia nearly a month ago, the collective West tried to present the occurrence as treacherous, unprecedented, and lacking local support. However, the reunification was preceded by a century-long struggle by a large amount of the regions’ inhabitants for the right to be considered Russians. In February 2015, the deputies of the parliament of the self-proclaimed Donetsk People’s Republic (DPR) signed a memorandum declaring the continuity of their statehood from the Donetsk-Krivoy Rog Republic, one of the numerous entities that emerged during the Russian Civil War. This quasi-state, which was created by the Bolsheviks in 1918 and aspired to become part of the Russian Soviet Federative Socialist Republic (RSFSR), included not only Donbass, but also the Zaporozhye and Kherson Regions.

History may zigzag, but time puts everything in its place. Today, Russian Donbass is restoring lost ties with Russia and establishing new ones,” wrote Denis Pushilin, the head of the DPR, shortly before the start of Russia’s military offensive. In this article, RT explores the brief history of the Donetsk-Krivoy Rog Republic and explains why the residents of Donbass wanted to live as part of Russia even 100 years ago. Back in 1999, the famous Russian political geographer and theorist Vladimir Kagansky wrote a large article entitled ‘Ukraine: Geography and Fate of the Country’, in which he made a forecast: Ukraine will inevitably transform, and this transformation mainly depends on Russia. He concluded that its self-determination would inevitably be anti-Russian, citing the country’s “stretchable borders” as one of the main reasons. At a minimum, this would encompass just the right bank of the Dnieper, or even Galicia alone.

At a maximum, the borders would stretch to the southern Russian cities of Voronezh and Stavropol. “The USSR and the CIS are a semi-empire of republics around Russia, and Ukraine is the main link in this necklace, a geopolitical pendant. Ukraine divides the space of the former USSR into separate, geographically separated blocks, and connects three blocks (Belarus and the Baltic States – Moldova – the Caucasus). Ukraine is the only alternative to Russia as the center of the current CIS and the entire post-Soviet space. It is the only way to potentially bypass Russia – the main anti-Russian bastion, and Russia’s main partner in the arrangement of this space,” wrote Kagansky.

Inflation As A Prelude To War

Rogan The Shining

https://twitter.com/i/status/1587125259492331520

Support the Automatic Earth in virustime with Paypal, Bitcoin and Patreon.