Cary Grant and Constance Bennett, stars of the film ‘Topper’, drive the Topper Buick 1937

This is the EU. This is what it stands for. There are no fiancial reasons for this to happen. It’s pure malice. And it’s why it’s way past time to close up shop in Brussels. The EU is the mob. Or as I’ve been saying for a long time: the EU eats people alive.

• ‘Patients Who Should Live Are Dying’: Greece’s Public Health Meltdown (G.)

Rising mortality rates, an increase in life-threatening infections and a shortage of staff and medical equipment are crippling Greece’s health system as the country’s dogged pursuit of austerity hammers the weakest in society. Data and anecdote, backed up by doctors and trade unions, suggest the EU’s most chaotic state is in the midst of a public health meltdown. “In the name of tough fiscal targets, people who might otherwise survive are dying,” said Michalis Giannakos who heads the Panhellenic Federation of Public Hospital Employees. “Our hospitals have become danger zones.” Figures released by the European Centre for Disease Prevention and Control recently revealed that about 10% of patients in Greece were at risk of developing potentially fatal hospital infections, with an estimated 3,000 deaths attributed to them.

The occurrence rate was dramatically higher in intensive care units and neonatal wards, the body said. Although the data referred to outbreaks between 2011 and 2012 – the last official figures available – Giannakos said the problem had only got worse. Like other medics who have worked in the Greek national health system since its establishment in 1983, the union chief blamed lack of personnel, inadequate sanitation and absence of cleaning products for the problems. Cutbacks had been exacerbated by overuse of antibiotics, he said. “For every 40 patients there is just one nurse,” he said, mentioning the case of an otherwise healthy woman who died last month after a routine leg operation in a public hospital on Zakynthos. “Cuts are such that even in intensive care units we have lost 150 beds.” “Frequently, patients are placed on beds that have not been disinfected.

Staff are so overworked they don’t have time to wash their hands and often there is no antiseptic soap anyway.” No other sector has been affected to the same extent by Greece’s economic crisis. Bloated, profligate and corrupt, for many healthcare was indicative of all that was wrong with the country and, as such, badly in need of reform. Acknowledging the shortfalls, the government announced last month that it planned to appoint more than 8,000 doctors and nurses in 2017. Since 2009, per capita spending on public health has been cut by nearly a third – more than €5bn – according to the OECD. By 2014, public expenditure had fallen to 4.7% of GDP, from a pre-crisis high of 9.9%. More than 25,000 staff have been laid off, with supplies so scarce that hospitals often run out of medicines, gloves, gauze and sheets.

Symbol of everything that’s wrong with Brussels. He was Luxembourg PM for 18 years.

• Jean-Claude Juncker Secretly Blocked EU Tax Reforms When Luxembourg PM (G.)

The president of the European commission, Jean-Claude Juncker, spent years in his previous role as Luxembourg’s prime minister secretly blocking EU efforts to tackle tax avoidance by multinational corporations, leaked documents reveal. Years’ worth of confidential German diplomatic cables provide a candid account of Luxembourg’s obstructive manoeuvres inside one of Brussels’ most secretive committees. The code of conduct group on business taxation was set up almost 19 years ago to prevent member states from being played off against one another by increasingly powerful multinational businesses, eager to shift profits across borders and avoid tax. Little has been known until now about the workings of the committee, which has been meeting since 1998, after member states agreed a code of conduct on tax policies and pledged not to engage in “harmful competition” with one another.

However, the leaked cables reveal how a small handful of countries have used their seats on the committee to frustrate concerted EU action and protect their own tax regimes. Efforts by a majority of member states to curb aggressive tax planning and to rein in predatory tax policies were regularly delayed, diluted or derailed by the actions of a few of the EU’s smallest members, frequently led by Luxembourg. The leaked papers, shared with the Guardian and the International Consortium of Investigative Journalists by the German radio group NDR, are highly embarrassing for Juncker, who served as Luxembourg’s prime minister from 1995 until the end of 2013. During that period he also acted as finance and treasury minister, taking a close interest in tax policy. Despite having a population of just 560,000, Luxembourg was able to resist widely supported EU tax reforms, its dissenting voice often backed only by that of the Netherlands.

“The standard of living in Italy is at the same level as in 2000..” Wait a minute, why is that such a bad thing? How awful were things in Italy 17 years ago?

• German Ifo Think Tank Chief Says Italy Risks Quitting Euro Zone (R.)

The head of Germany’s Ifo economic institute believes Italians will eventually want to quit the euro currency area if their standard of living does not improve, he told German daily Tagesspiegel. “The standard of living in Italy is at the same level as in 2000. If that does not change, the Italians will at some stage say: ‘We don’t want this euro zone any more’,” Ifo chief Clemens Fuest told the newspaper. He also said that if Germany’s parliament were to approve a European rescue program for Italy, it would impose on German taxpayers risks “the size of which it does not know and cannot control.” He said German lawmakers should not agree to do this. Italy is not seeking such a rescue program. The government in Rome is focusing on underwriting the stability of its banking sector, starting with a bailout of Monte dei Paschi di Siena.

Diplomatic language. Trump was partially briefed a few days ago. Oh, to be a fly on the wall for the full briefing today or tomorrow…

• Trump Aide Says US Sanctions On Russia May Be Disproportionate (R.)

A top aide to President-elect Donald Trump said in an interview aired on Sunday that the White House may have disproportionately punished Russia by ordering the expulsion of 35 suspected Russian spies. Incoming White House press secretary Sean Spicer said on ABC’s “This Week” that Trump will be asking questions of U.S. intelligence agencies after President Barack Obama imposed sanctions last week on two Russian intelligence agencies over what he said was their involvement in hacking political groups in the 2016 U.S. presidential election. Obama also ordered Russia to vacate two U.S. facilities as part of the tough sanctions on Russia.

“One of the questions that we have is why the magnitude of this? I mean you look at 35 people being expelled, two sites being closed down, the question is, is that response in proportion to the actions taken? Maybe it was; maybe it wasn’t but you have to think about that,” Spicer said. Trump is to have briefings with intelligence agencies this week after he returns to New York on Sunday. On Saturday, Trump expressed continued skepticism over whether Russia was responsible for computer hacks of Democratic Party officials. “I think it’s unfair if we don’t know. It could be somebody else. I also know things that other people don’t know so we cannot be sure,” Trump said.

He said he would disclose some information on the issue on Tuesday or Wednesday, without elaborating. It is unclear if, upon taking office on Jan. 20, he would seek to roll back Obama’s actions, which mark a post-Cold War low in U.S.-Russian ties. Spicer said that after China in 2015 seized records of U.S. government employees “no action publicly was taken. Nothing, nothing was taken when millions of people had their private information, including information on security clearances that was shared. Not one thing happened.” “So there is a question about whether there’s a political retribution here versus a diplomatic response,” he added.

By the end of November, Cuomo had already vetoed 70 other bills in 2016. ¿Qué pasa?

• Cuomo Vetoes Bill Requiring NY State To Fund Legal Services For Poor (NYDN)

Gov. Cuomo vetoed a bill late Saturday that would have required the state to fund legal services for the poor in each county. Cuomo’s office in a New Year’s Eve statement released just over an hour before the bill was required to be signed or vetoed said last-minute negotiations with the Legislature to address the governor’s concerns failed to yield a deal. “Until the last possible moment, we attempted to reach an agreement with the Legislature that would have achieved the stated goal of this legislation, been fiscally responsible, and had additional safeguards to ensure accountability and transparency,” Cuomo spokesman Richard Azzopardi said. “Unfortunately, an agreement was unable to be reached and the Legislature was committed to a flawed bill that placed an $800 million burden on taxpayers – $600 million of which was unnecessary – with no way to pay for it and no plan to make one.”

He said the issue will be revisited in the upcoming legislative session. The bill, which had support from progressive and conservative groups, would have given the state seven years to take over complete funding of indigent legal services from towns. Dozens of groups representing public defenders, municipalities and others expressed disappointment. Jonathan Gradess, executive director of the New York State Defenders Association, called Cuomo’s decision to veto the bill “stunning.” “We are all shocked that the Governor vetoed a bill that would have reduced racial disparities in the criminal justice system, helped ensure equal access to justice for all New Yorkers, provided improved public defense programs for those who cannot afford an attorney, and much-needed mandate relief for counties, Gradess said. “The governor refused to accept an independent oversight mechanism on state quality standards, and now, sadly tens of thousands of low-income defendants will pay the price.”

“As shopping patterns have changed..” means: as more credit cards have maxed out.

• A Giant Wave Of Store Closures Is About To Hit The US (BI)

Retailers are bracing for a fresh wave of store closures at the start of the new year. The industry is heading into 2017 with a glut of store space as shopping continues to shift online and foot traffic to malls declines, according to analysts. “If you are weaker player, it’s going to be a very tough 2017 for you, ” said RJ Hottovy, a consumer equity strategist for Morningstar. He said he’s expecting a number of retailers to file for bankruptcy next year, in addition to mass store closures. Nearly every major department store, including Macy’s, Kohl’s, Walmart, and Sears, have collectively closed hundreds of stores over the last couple years to try and stem losses from unprofitable stores and the rise of ecommerce. But the closures are far from over.

Macy’s has already said that it’s planning to close 100 stores, or about 15% of its fleet, in 2017. Sears is shuttering at least 30 Sears and Kmart stores by April, and additional closures are expected to be announced soon. CVS also said this month that it’s planning to shut down 70 locations. Mall stores like Aeropostale, which filed for bankruptcy in May, American Eagle, Chicos, Finish Line, Men’s Wearhouse, and The Children’s Place are also in the midst of multi-year plans to close stores. Many more announcements like these are expected in the coming months. The start of the year is a popular time to announce store closures. Nearly half of annual store closings announced since 2010 have occurred in the first quarter, CNBC reports.

In addition to closing stores, retailers are also looking to shrink their existing locations. “As leases come up, you’re going to see a gradual rotation into smaller-footprint stores,” Hottovy said. Despite recent closures, the US is still oversaturated with stores. The US has 23.5 square feet of retail space per person, compared with 16.4 square feet in Canada and 11.1 square feet in Australia — the next two countries with the highest retail space per capita, according to a Morningstar report from October. “Across retail overall the US has too much space and too many shops,” said Neil Saunders, CEO of the retail consulting firm Conlumino. “As shopping patterns have changed, some of those shops are also in the wrong place and are of the wrong size or configuration.”

1) Think it really matters what you call it? Or is it about how people perceive it?

2) It’s alright Ma, I’m only bleeding.

• PBOC’s Ma Says New Cash Transaction Rules Are Not Capital Controls (BBG)

China’s new regulations on cash transactions and overseas transfers are not capital controls, according to a central bank researcher cited by the official Xinhua News Agency. New requirements published by the People’s Bank of China Friday stoked concern that the government is imposing capital controls in a disguised form, Xinhua reported late Sunday. “It is not capital control at all,” Ma Jun, chief economist of the central bank’s research bureau, told the state-run news service. The $50,000 annual foreign exchange purchase quota for individuals is unchanged, and the rules won’t affect normal activities such as business investment and operations abroad or overseas travel and study, Ma said.

Ma’s comments follow the annual Jan. 1 reset of the $50,000 limit for individuals, which may potentially aggravate capital outflow pressures that have been intensifying after the yuan suffered its steepest annual slump in more than two decades. The PBOC said Friday it will tighten rules for banks to report cross-border customer transactions starting July 1 as part of stepped-up efforts to curb money laundering and prevent terrorism financing. Financial institutions will assume responsibility for reporting and there will be neither extra documentation nor official approval procedures for businesses and individuals, Ma said.

The Chinese come up with one creative way after another to tell us their growth is cratering, without actually saying it. But who’s listening?

• China Central Bank Adviser Calls For Flexible 2017 Growth Target (R.)

The Chinese government should set a more flexible target for economic growth this year to give more space for reform efforts, a central bank adviser told the official Xinhua news agency in comments published on Sunday. China’s economy grew 6.7% in the third quarter from a year earlier and looks set to achieve the government’s full-year forecast of 6.5-7%, buoyed by higher government spending, a housing boom and record bank lending. However, growing debt and concerns about property bubbles have touched off an internal debate about whether China should tolerate slower growth in 2017 to allow more room for painful reforms aimed at reducing industrial overcapacity and indebtedness.

Huang Yiping, a monetary policy committee member of the central People’s Bank of China and Peking University professor, told Xinhua that China’s GDP growth target range should be 6-7% for this year, compared with 6.5-7% in 2016. “The 6.5% target is just an average rate,” Huang said. “As long as employment is stable, a slightly wider growth target range in the short term will reduce the need for pro-growth efforts and give policy makers more room to focus on reforms.” This year’s growth target will determine the government’s monetary policy, Huang said. “Large-scale monetary loosening is unlikely, while the possibility of tightening can not be ruled out,” he added, citing inflation concerns, higher U.S. interest rates and a weakening yuan.

Don’t want to wait to see where it leads? Where would the movie end now?

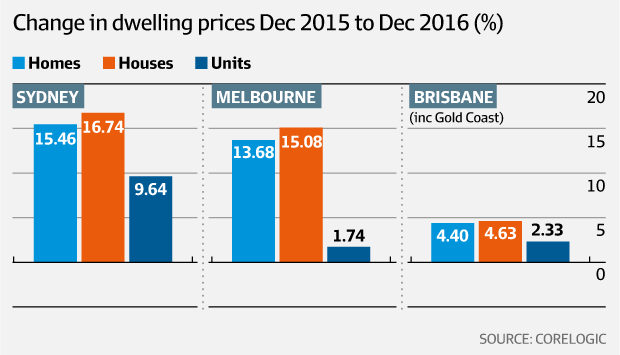

• Australia House Prices Defy 2016 Predictions, Rise More Than 15% (AFR)

Home prices defied forecasts they would stagnate in 2016 to grow more than they did during the “boom” year of 2015, according to year-end figures from property research firm CoreLogic. Dwelling prices rose 15.46% in Sydney while Melbourne had a rise of 13.68%. Even the much-maligned Hobart and Canberra housing markets posted strong gains, rising 11.24% and 9.29% respectively.

The data disappointed economists hoping for a more subdued housing market in 2016. At the end of 2015, Sydney and Melbourne closed with 11.5% and 11.2% growth respectively across houses and units, according to CoreLogic. ANZ had been expecting soft price growth and had forecast a 3% price rise for NSW, a 3.2% increase for Victoria, a 2% gain in Queensland and an overall 2.8% rise the country as a whole.

Long from Jim. And recommended.

• 2017: The Wheels Finally Come Off (Jim Kunstler)

Apart from all the ill-feeling about the election, one constant ‘out there’ since November 8 is the Ayn Randian rapture that infects the money scene. Wall Street and big business believe that the country has passed through a magic portal into a new age of heroic businessmen-warriors (Trump, Rex T, Mnuchin, Wilbur Ross, et. al.) who will go forth creating untold wealth from super-savvy deal-making that un-does all the self-defeating malarkey of the detested Deep State technocratic regulation regime of recent years. The main signs in the sky, they say, are the virile near-penetration of the Dow Jones 20,000-point maidenhead and the rocket ride of Ole King Dollar to supremacy of the global currency-space. I hate to pound sleet on this manic parade, but, to put it gently, mob psychology is outrunning both experience and reality. Let’s offer a few hypotheses regarding this supposed coming Trumptopian nirvana.

The current narrative weaves an expectation that manufacturing industry will return to the USA complete with all the 1962-vintage societal benefits of great-paying blue collar jobs, plus an orgy of infrastructure-building. I think both ideas are flawed, even allowing for good intentions. For one thing, most of the factories are either standing in ruin or scraped off the landscape. So, it’s not like we’re going to reactivate some mothballed sleeping giant of productive capacity. New state-of-the-art factories would require an Everest of private capital investment that is simply impossible to manifest in a system that is already leveraged up to its eyeballs. Even if we tried to accomplish it via some kind of main force government central planning and financing — going full-Soviet — there is no conceivable way to raise (borrow) the “money” without altogether destroying the value of our money (inflation), and the banking system with it.

If by some magic any new industrial capacity were built, much of the work in it would be performed by robotics, not brawny men in blue shirts, and certainly not at the equivalent of the old United Auto Workers $35-an-hour assembly line wage. We have not faced the fact that the manufacturing fiesta based on fossil fuels was a one-time thing due to special historical circumstances and will not be repeated. The future of manufacturing in America is frighteningly modest. We’ll actually be lucky if we can make a few vital necessities by means of hydro-electric or direct water power, and that will be about the extent of it. Some of you may recognize this as the World Made By Hand scenario. I’ll stick by that.

Not a new topic for many, but if it is for the New Yorker, there may be more people not aware of the Mosul Dam’s inherent problems: “a multilayer foundation of anhydrite, marl, and limestone, all interspersed with gypsum—which dissolves in contact with water. Dams built on this kind of rock are subject to a phenomenon called karstification..” Oh well, may be a good read up for all.

• The Mosul Dam: A Bigger Problem Than Isis? (New Yorker)

On the morning of August 7, 2014, a team of fighters from the Islamic State, riding in pickup trucks and purloined American Humvees, swept out of the Iraqi village of Wana and headed for the Mosul Dam. Two months earlier, isis had captured Mosul, a city of nearly two million people, as part of a ruthless campaign to build a new caliphate in the Middle East. For an occupying force, the dam, twenty-five miles north of Mosul, was an appealing target: it regulates the flow of water to the city, and to millions of Iraqis who live along the Tigris. As the isis invaders approached, they could make out the dam’s four towers, standing over a wide, squat structure that looks like a brutalist mausoleum. Getting closer, they saw a retaining wall that spans the Tigris, rising three hundred and seventy feet from the riverbed and extending nearly two miles from embankment to embankment. Behind it, a reservoir eight miles long holds eleven billion cubic metres of water.

A group of Kurdish soldiers was stationed at the dam, and the isis fighters bombarded them from a distance and then moved in. When the battle was over, the area was nearly empty; most of the Iraqis who worked at the dam, a crew of nearly fifteen hundred, had fled. The fighters began to loot and destroy equipment. An isis propaganda video posted online shows a fighter carrying a flag across, and a man’s voice says, “The banner of unification flutters above the dam.” The next day, Vice-President Joe Biden telephoned Masoud Barzani, the President of the Kurdish region, and urged him to retake the dam as quickly as possible. American officials feared that isis might try to blow it up, engulfing Mosul and a string of cities all the way to Baghdad in a colossal wave. Ten days later, after an intense struggle, Kurdish forces pushed out the isis fighters and took control of the dam.

But, in the months that followed, American officials inspected the dam and became concerned that it was on the brink of collapse. The problem wasn’t structural: the dam had been built to survive an aerial bombardment. (In fact, during the Gulf War, American jets bombed its generator, but the dam remained intact.) The problem, according to Azzam Alwash, an Iraqi-American civil engineer who has served as an adviser on the dam, is that “it’s just in the wrong place.” Completed in 1984, the dam sits on a foundation of soluble rock. To keep it stable, hundreds of employees have to work around the clock, pumping a cement mixture into the earth below. Without continuous maintenance, the rock beneath would wash away, causing the dam to sink and then break apart. But Iraq’s recent history has not been conducive to that kind of vigilance.

Don’t want to wait to see where it leads? Where would the movie end now?

• ‘Bad Boys of Brexit’ Headed For Screen (R.)

Three film production companies including Netflix are interested in making a warts-and-all screen dramatization of Nigel Farage’s insurgent Brexit campaign, according to an associate of Farage. This would be another extraordinary twist for Farage, who from the fringes of British politics achieved his life’s goal when Britons voted to leave the European Union last June, and has since befriended U.S. President-elect Donald Trump. The project would be based on “The Bad Boys of Brexit”, an account of Farage’s campaign by Arron Banks, a multi-millionaire British insurance tycoon who bankrolled the campaign, according to Andy Wigmore, a spokesman for Banks.

“We have three interested parties in the rights to the book and we will be meeting representatives from three studios including a Netflix representative on Jan. 19 in Washington DC,” Wigmore told Reuters in a text message. Farage, Banks, Wigmore and others in their circle will travel to Washington for Trump’s inauguration as president, which will take place on Jan. 20. “We have invited all of them (the studio representatives) to our pre-inaugural drinks party … We have also invited many of Trump’s team to the event,” said Wigmore.

The Sunday Telegraph newspaper earlier reported that Hollywood studio Warner Bros. was also interested, but it was unclear from Wigmore’s texts to Reuters whether those who have approached Banks included representatives of Warner Bros. The subtitle of Banks’ book is “Tales of Mischief, Mayhem and Guerrilla Warfare in the EU Referendum Campaign”. It is described on its publisher’s website as “an honest, uncensored and highly entertaining diary of the campaign that changed the course of history”. Asked whether Farage was likely to appear as himself in any screen adaptation of his campaign, Wigmore said: “Yes we all expect to make a Quentin Tarantino appearance”, a reference to the director’s cameo appearances in his own movies.

Home › Forums › Debt Rattle January 2 2017