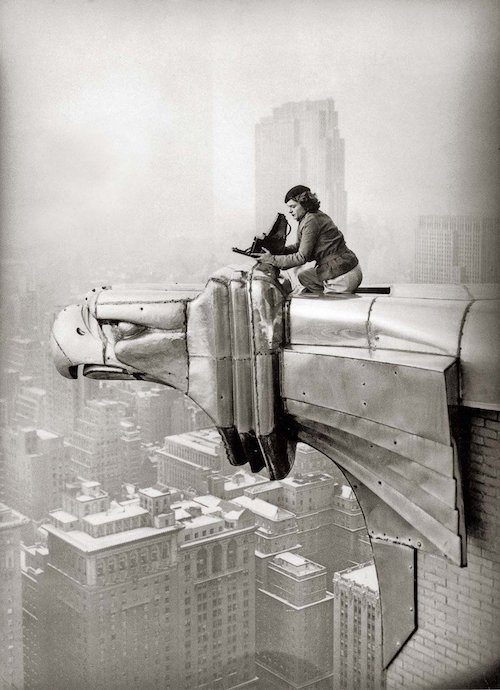

Ann Rosener Reconditioning used spark plugs for use in testing airplane motors, Melrose Park Buick plant, Chicago 1942

Even though he’s a rich celebrity Tom Hanks is probably lucky to fall ill at the time and place he did (now and in Australia). In Italy they might not treat his 63-year-old ass anymore. Many other countries, including Australia won’t either, in 1-2-3 weeks’ time. NBA suspended, Olympics, Eurocup and all other mass events should follow. They will anyway, so might as well do it nnow.

Other than that, as you’re tempted to criticize your government’s actions with regards to coronavirus, remember that everybody does it, every government is too late and too little, just like all the mainstream media and investors. This doesn’t mean your particular locality’s ‘leaders’ don’t deserve scrutiny, but it does provide perspective. They all dropped the ball and play catch-up, including the WHO. And they all have their eye on the economy, not the virus. Which is an issue for them only insofar as it affects the economy.

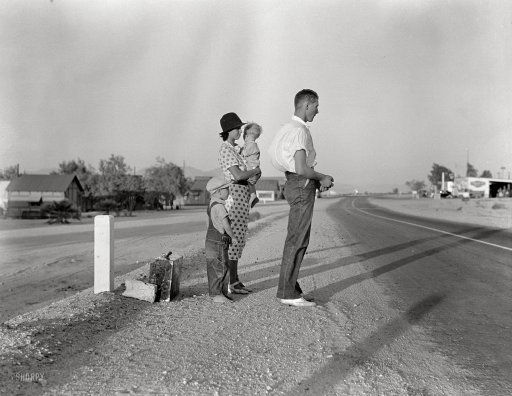

In the same vein, governments everywhere, central banks, IMF, World Bank, are all geared towards supporting companies, not people. But if 70% of Americans live paycheck to paycheck and self-isolation is inevitably the next thing coming to the US, how are people supposed to self-isolate when those paychecks stop coming?

Older people will not be treated, and poorer people will have no choice but to go out and find food and other items just to survive. Northern Italy is quite a rich part of the world, which is why they have such an excellent health care system. Many parts of the US are nowhere near that rich, and their health care matches that difference.

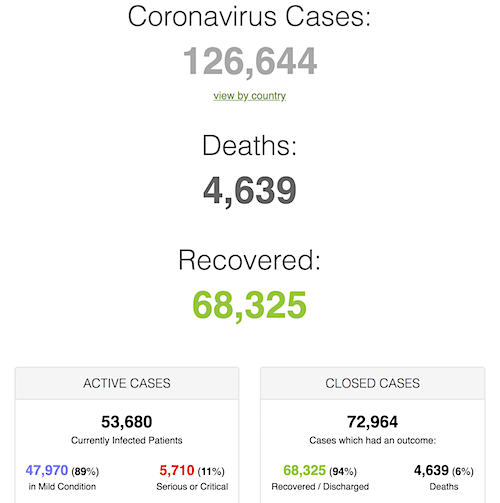

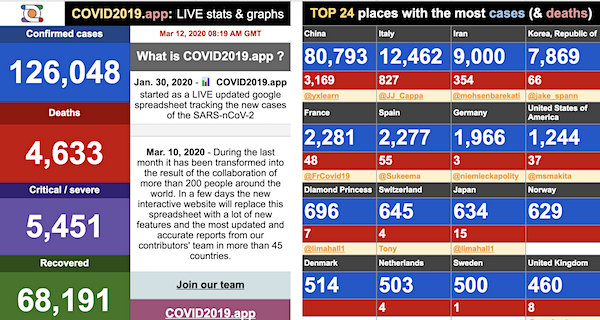

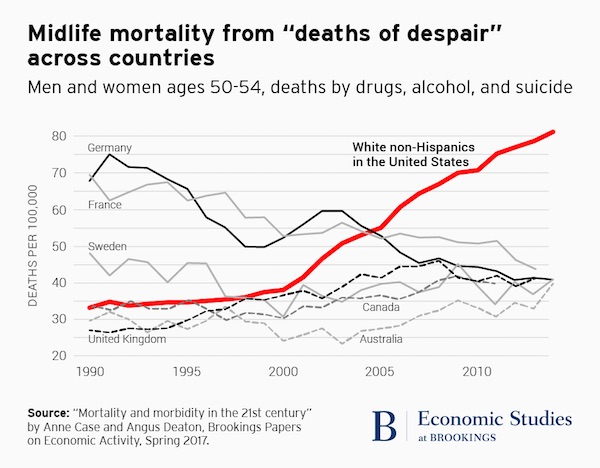

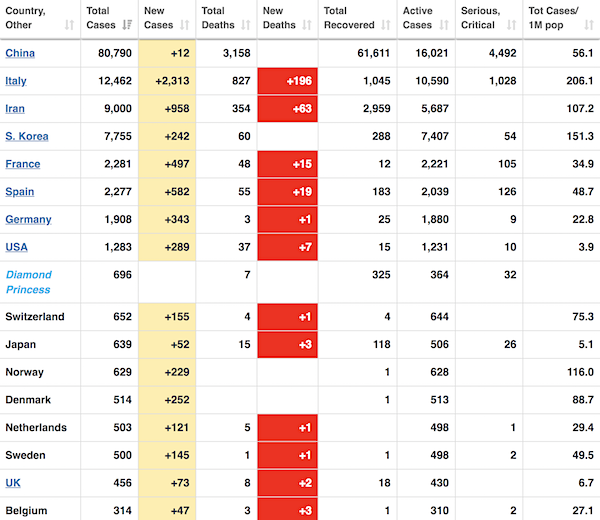

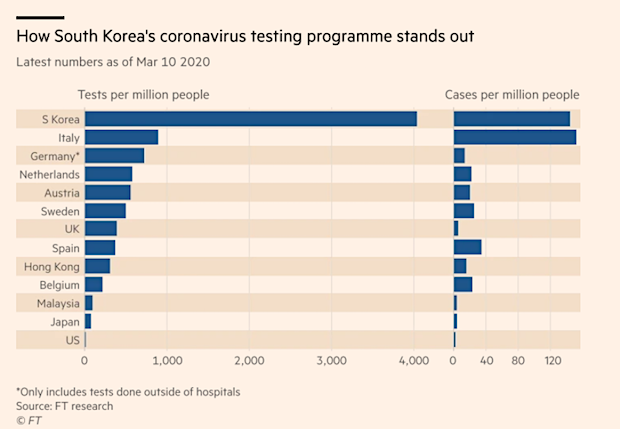

• Cases 126,644 (+ 7,255 from yesterday’s 119,389)

• Deaths 4,639 (+ 339 from yesterday’s 4,300)

As China states its peak is over, the rise in cases in European countries is relentless. As I was scribbling yesterday before the latest numbers came in:

“Denmark, Norway each have some 5 million inhabitants. Switzerland has 10 million. Holland has 17. Their cases to date are 340, 440, 652 and 503, respectively.

Germany has 82 million people and 1,622 cases. Ergo, per capita Denmark, Norway should have -to keep level with Germany- 16x more cases, Switzerland 8x, Holland 5x. That would mean 3,440, 7,040, 5,216 and 2,515 cases per capita (not the right term, but you get it).

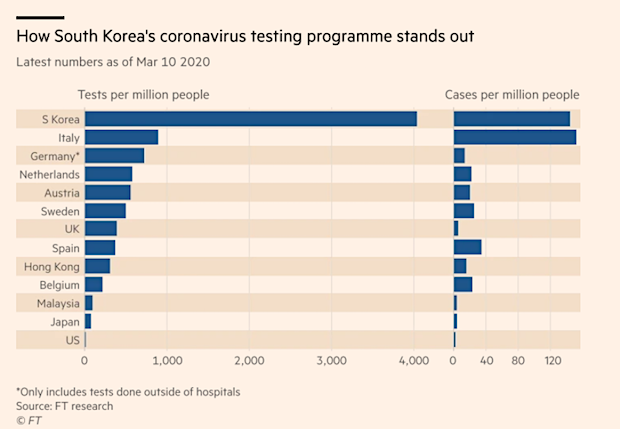

Norway is by far the worst. After Italy, Iran and South Korea, it’s the worst in infections per million people (if we forget Bahrain). It’s 27x worse than the US. So how many dire reports have you read from or about Norway?”

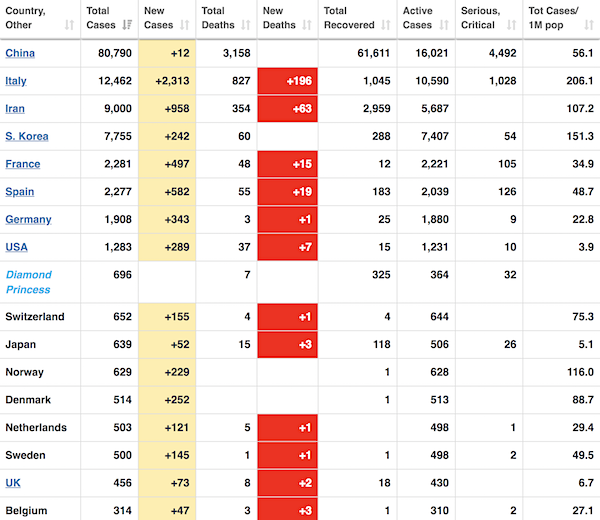

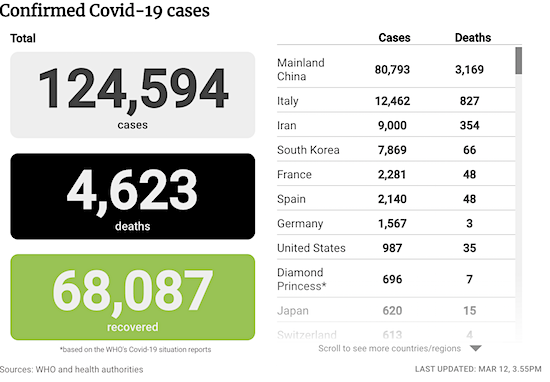

From Worldometer yesterday evening (before their day’s close)

This tells you a whole lot too.

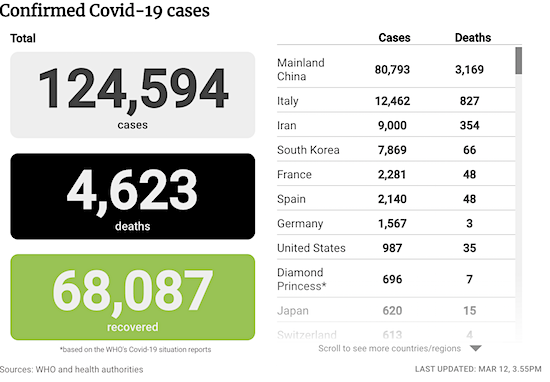

From SCMP: (Note: the SCMP graph was useful when China was the focal point; they are falling behind now)

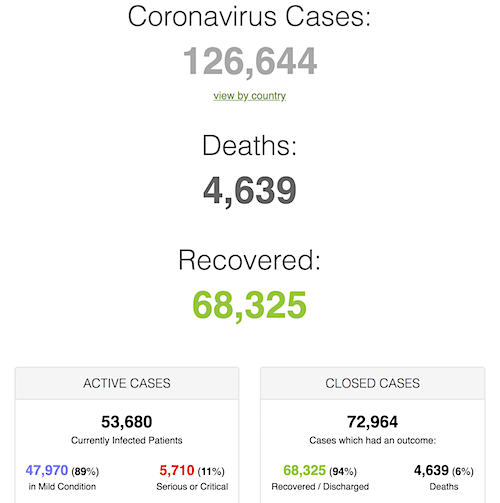

From Worldometer:

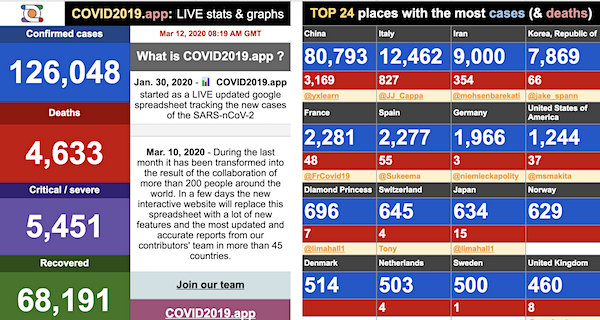

From COVID2019.app:

Another great read from Yascha Mounk at the Atlantic. Looks like I’ll have to pass for the next one, my freebies are up.

• The Extraordinary Decisions Facing Italian Doctors (Mounk)

Two weeks ago, Italy had 322 confirmed cases of the coronavirus. At that point, doctors in the country’s hospitals could lavish significant attention on each stricken patient. One week ago, Italy had 2,502 cases of the virus, which causes the disease known as COVID-19. At that point, doctors in the country’s hospitals could still perform the most lifesaving functions by artificially ventilating patients who experienced acute breathing difficulties. Today, Italy has 10,149 cases of the coronavirus. There are now simply too many patients for each one of them to receive adequate care. Doctors and nurses are unable to tend to everybody. They lack machines to ventilate all those gasping for air.

Now the Italian College of Anesthesia, Analgesia, Resuscitation and Intensive Care (SIAARTI) has published guidelines for the criteria that doctors and nurses should follow in these extraordinary circumstances. The document begins by likening the moral choices facing Italian doctors to the forms of wartime triage that are required in the field of “catastrophe medicine.” Instead of providing intensive care to all patients who need it, its authors suggest, it may become necessary to follow “the most widely shared criteria regarding distributive justice and the appropriate allocation of limited health resources. ”The principle they settle upon is utilitarian. “Informed by the principle of maximizing benefits for the largest number,”

[..] they suggest that “the allocation criteria need to guarantee that those patients with the highest chance of therapeutic success will retain access to intensive care.” The authors, who are medical doctors, then deduce a set of concrete recommendations for how to manage these impossible choices, including this: “It may become necessary to establish an age limit for access to intensive care.” Those who are too old to have a high likelihood of recovery, or who have too low a number of “life-years” left even if they should survive, will be left to die. This sounds cruel, but the alternative, the document argues, is no better. “In case of a total saturation of resources, maintaining the criterion of ‘first come, first served’ would amount to a decision to exclude late-arriving patients from access to intensive care.”

Read more …

Note: Italy is rated second in the world for healthcare provision by the WHO. The UK is 18th.

• ‘Healthcare On Brink Of Collapsing’: The Italy Coronavirus Quarantine (ITV)

I’m just back from Italy and “enjoying” my first day of self-isolation. Getting a real picture of how bad the situation is, especially in Lombardy and the north, has been really difficult for TV news because movement is so restricted, access to the overwhelmed hospitals impossible and the danger of infection so great. But it’s really important people understand just how bad things are, not least because it is where we may be headed. So I will continue to write here about conversations, emails or recordings with those who are still under quarantine in Italy. Some will be Britons who have stayed on, some Italians, some doctors. I start with a voice recording of two Milanese doctors speaking on WhatsApp about the situation at their hospitals.

The first identifies herself as Martina, but I believe she is Martina Crivellari, an intensive care cardiac anaesthesiologist at the San Raffaele Hospital in Milan. She said: “There are a lot of young people in our Intensive Care Units (ICUs) – our youngest is a 38-year-old who had had no comorbidities (underlying health problems). “A lot of patients need help with breathing but there are not enough ventilators. “They’ve told us that starting from now we’ll have to choose who to intubate – priority will go to the young or those without comorbidities. “At Niguarda, the other big hospital in Milan, they are not intubating anyone over 60, which is really, really young.” She added: “This virus is so infectious that the only way to avoid a ‘massacre’ is to have the least number possible getting infected over the longest possible timescale.

“Right now, if we get 10,000 people in Italy in need of ventilators – when we only have 3,000 in the country – 7,000 people will die. “Rome right now is like where Milan was 10 days ago. In 10 days there has been an incredible escalation. “Lombardy, which has the best healthcare in the country, is collapsing, so I don’t dare to think what would happen in less efficient regions. “We’ve had no critical cases among children but with children, viruses are much less aggressive – think chickenpox or measles. “But the very young are crazy carriers. “A child with no symptoms will go to visit its grandparents, and basically kill them. So it’s essential to avoid contact between them”.

Read more …

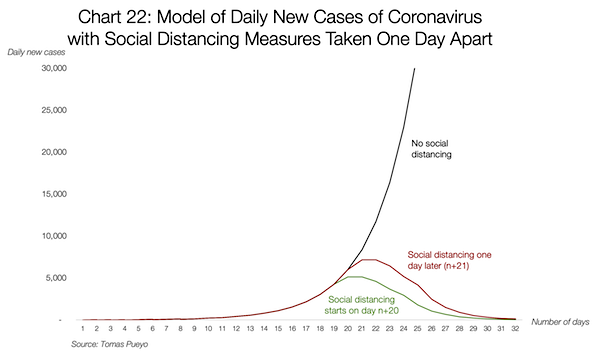

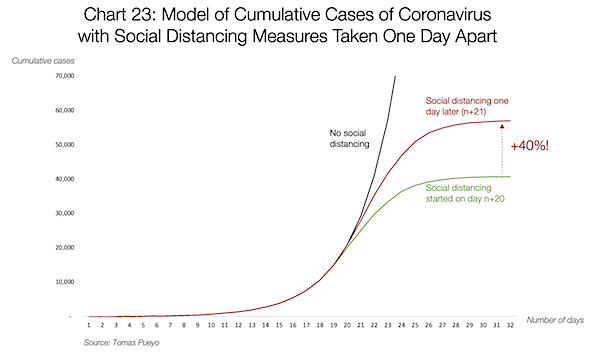

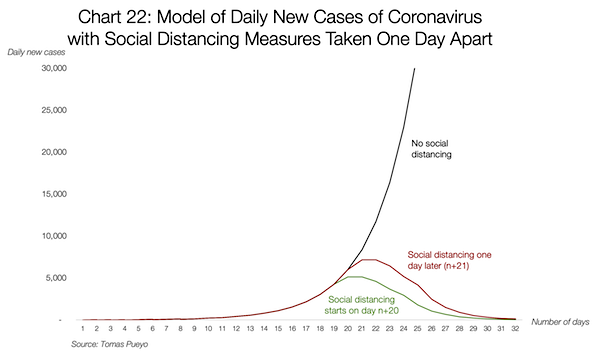

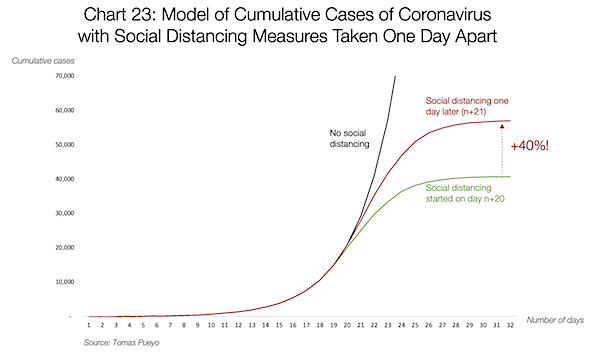

Comprehensize overview from Tomas Pueyo.

• Politicians, Community Leaders, Business Leaders: What To Do and When (M.)

When you’re done reading the article, this is what you’ll take away:

• The coronavirus is coming to you.

• It’s coming at an exponential speed: gradually, and then suddenly.

• It’s a matter of days. Maybe a week or two.

• When it does, your healthcare system will be overwhelmed.

• Your fellow citizens will be treated in the hallways.

• Exhausted healthcare workers will break down. Some will die.

• They will have to decide which patient gets the oxygen and which one dies.

• The only way to prevent this is social distancing today. Not tomorrow. Today.

• That means keeping as many people home as possible, starting now.

• As a politician, community leader or business leader, you have the power and the responsibility to prevent this.

You might have fears today: What if I overreact? Will people laugh at me? Will they be angry at me? Will I look stupid? Won’t it be better to wait for others to take steps first? Will I hurt the economy too much? But in 2–4 weeks, when the entire world is in lockdown, when the few precious days of social distancing you will have enabled will have saved lives, people won’t criticize you anymore: They will thank you for making the right decision. [..] Countries that are prepared will see a fatality rate of ~0.5% (South Korea) to 0.9% (rest of China). Countries that are overwhelmed will have a fatality rate between ~3%-5% Put in another way: Countries that act fast can reduce the number of deaths by ten. And that’s just counting the fatality rate. Acting fast also drastically reduces the cases, making this even more of a no-brainer.

Read more …

Also weeks too late.

• Trump Suspends Travel From Europe To US (BBC)

US President Donald Trump has announced sweeping new travel restrictions on Europe in a bid to combat the spread of the coronavirus. In a televised address, he said travel from 26 European countries would be suspended for the next 30 days. But he said the “strong but necessary” restrictions would not apply to the UK, where 460 cases of the virus have now been confirmed. There are 1,135 confirmed cases of the virus across the US, with 38 deaths. “To keep new cases from entering our shores, we will be suspending all travel from Europe,” Mr Trump said from the Oval Office on Wednesday evening. “The new rules will go into effect Friday at midnight,” he added. The travel order does not apply to US citizens. Mr Trump said the European Union had “failed to take the same precautions” as the US in fighting the virus.

A Presidential Proclamation, published shortly after Mr Trump’s speech, specified that the ban applies to anyone who has been in the EU’s Schengen border-free area within 14 days prior to their arrival in the US. This implies that Ireland is excluded from the ban as it is not one of the 26 Schengen countries. Bulgaria, Croatia and Romania are also EU members without being part of the Schengen area. Mr Trump spoke just hours after Italy – the worst affected country outside China – announced tough new restrictions on its citizens. It will close all shops except food stores and pharmacies as part of its nationwide lockdown. He said the travel suspension would also “apply to the tremendous amount of trade and cargo” coming from Europe into the US. But he later tweeted to say that “trade will in no way be affected” by the new measures.

Read more …

Clean up the planet one step at a time.

• Ban On European Travel To US Will Batter Airlines (R.)

The new U.S. ban on foreign citizens entering the country if they have traveled to Europe in recent weeks will heap more pressure on airlines already reeling from the coronavirus pandemic, hitting European carriers the hardest, analysts said. The 30-day restrictions from Friday, which exclude Britain, are similar to those that went into effect targeting China on Feb. 1, and come after the outbreak’s rapid spread across the European continent and in the United States. Industry watchers warned the move could also create chaos at dozens of airports across Europe as passengers attempt a last-minute rush to fly to the United States before the ban takes effect. Flights from Europe can still operate to a limited number of U.S. airports with enhanced screening under measures announced on Wednesday evening.

But only U.S. citizens, permanent residents and immediate family members will be allowed in, severely denting the passenger base and hurting the U.S. tourism industry. U.S. President Donald Trump said the ban was needed because the country was entering a “critical time” in the fight against the virus, which has spread across the United States and killed at least 37 people and infected 1,281. “We made a lifesaving move with early action on China. Now we must take the same action with Europe,” Trump said in an address to the nation. “We will not delay.” The ban stops movement of people, not goods, he later clarified on Twitter. U.S. airlines had already slashed flight schedules to Italy, facing the largest European outbreak, and will take another hit from lower demand for flights from major destinations like France and Germany.

Read more …

Not clear at all. Makes you wonder where a vaccine should come from, and tells you it’ll take long time yet.

• Why Does The Coronavirus Spread So Easily Between People? (Nature)

As the number of coronavirus infections approaches 100,000 people worldwide, researchers are racing to understand what makes it spread so easily. A handful of genetic and structural analyses have identified a key feature of the virus — a protein on its surface — that might explain why it infects human cells so readily. Other groups are investigating the doorway through which the new coronavirus enters human tissues — a receptor on cell membranes. Both the cell receptor and the virus protein offer potential targets for drugs to block the pathogen, but researchers say it is too early to be sure. “Understanding transmission of the virus is key to its containment and future prevention,” says David Veesler, a structural virologist at the University of Washington in Seattle, who posted his team’s findings about the virus protein on the biomedical preprint server bioRxiv on 20 February.

The new virus spreads much more readily than the one that caused severe acute respiratory syndrome, or SARS (also a coronavirus), and has infected more than ten times the number of people who contracted SARS. To infect a cell, coronaviruses use a ‘spike’ protein that binds to the cell membrane, a process that’s activated by specific cell enzymes. Genomic analyses of the new coronavirus have revealed that its spike protein differs from those of close relatives, and suggest that the protein has a site on it which is activated by a host-cell enzyme called furin. This is significant because furin is found in lots of human tissues, including the lungs, liver and small intestines, which means that the virus has the potential to attack multiple organs, says Li Hua, a structural biologist at Huazhong University of Science and Technology in Wuhan, China, where the outbreak began.

The finding could explain some of the symptoms observed in people with the coronavirus, such as liver failure, says Li, who co-authored a genetic analysis of the virus that was posted on the ChinaXiv preprint server on 23 February. SARS and other coronaviruses in the same genus as the new virus don’t have furin activation sites, he says. The furin activation site “sets the virus up very differently to SARS in terms of its entry into cells, and possibly affects virus stability and hence transmission”, says Gary Whittaker, a virologist at Cornell University in Ithaca, New York. His team published another structural analysis of the coronavirus’s spike protein on bioRxiv on 18 February.

Several other groups have also identified the activation site as possibly enabling the virus to spread efficiently between humans. They note that these sites are also found in other viruses that spread easily between people, including severe strains of the influenza virus. On these viruses, the activation site is found on a protein called haemagglutinin, not on the spike protein.

Read more …

Nice headline, but it’s only to boost the economy. It should be about the people.

• 6 Million Low-Income Australians To Get $750 Cash Coronavirus Stimulus (G.)

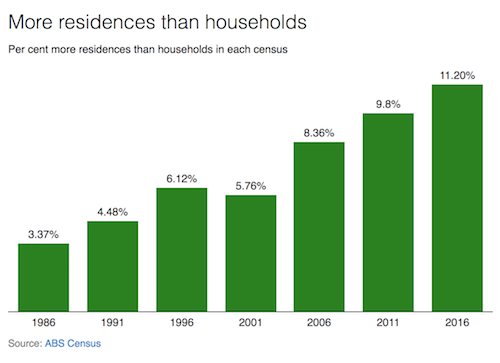

More than six million low-income earners will receive a $750 cash payment under a $17.6bn government stimulus package targeted at keeping Australians in work and avoiding the country’s first recession in almost 30 years. Announcing the package on Thursday, the prime minister, Scott Morrison, said he was confident the targeted measures would be enough to “do the job” of propping up the economy, as the Coalition abandons a much-touted surplus for the current financial year and shifts it focus to maintaining economic growth. The stimulus boost is equivalent to 0.9% of GDP in the March quarter, and follows initial estimates from Treasury that the effect of the coronavirus downturn in the March quarter would be 0.5%, on top of a 0.2% hit from the summer bushfire crisis.

Three-quarters of the $17.6bn package will be directed to businesses, with a $6.7bn cashflow payment pegged to employee wages, $4bn tied to new investment incentives, $1.2bn to support apprentices, and a $1bn fund for hard-hit sectors such as tourism. Businesses will also be allowed to defer tax obligations, with the Australian Taxation Office announcing that it will offer relief to those hit hard by the downturn on a case-by-case basis. The household stimulus will cost $4.76bn, with payments to begin flowing from 31 March. All welfare recipients and concession card holders will receive the $750 payment, including 2.4 million pensioners and those with a commonwealth seniors card. The government has targeted low-income earners as they are most likely to spend the stimulus payment, with Treasury understood to have estimated a 150% return to the economy for every dollar spent.

Read more …

How much longer can it last?

• Boeing Halts Hiring, Limits Overtime To Preserve Cash (CNBC)

Boeing is immediately suspending most hiring and implementing other measures to preserve cash as the rapid spread of the coronavirus roils the air travel industry, sending the manufacturer’s stock to the lowest level since mid-2017. Shares of the manufacturer plunged more than 18% — their biggest one-day percentage drop in more than four decades — to $189.08. Boeing’s plunge shaved more than 284 points off the Dow Jones Industrial Average, helping send the blue-chip index into a bear market. The company also is drawing down earlier than expected the entirety of a $13.8 billion loan it secured in January to give it a cushion to weather the turmoil.

Boeing is already reeling from the damage of two fatal crashes of its 737 Max and the worldwide grounding of the planes, which hits the one-year mark on Friday. “On top of the work of safely returning the 737 MAX to service and the financial impact of the pause in MAX production, we’re now facing a global economic disruption generated by the COVID-19 coronavirus,” Boeing’s CEO, Dave Calhoun, and CFO Greg Smith wrote in a note to employees Wednesday. The company is not laying off workers at this time, a Boeing official told CNBC. Boeing also doesn’t currently have plans to make any changes to its dividend, the official said. The company is also limiting travel and discretionary spending. It will also limit overtime to work necessary for its efforts to bring the 737 Max back in service and “other key efforts in support of our customers,” the executives wrote to employees.

Read more …

Nail. Coffin.

• Washington State House Passes Bill To Drop Boeing Tax Break (R.)

Washington state’s House of Representatives passed a measure on Wednesday night that removes a key tax break for Boeing and other aerospace firms, in a bid to head off possible European tariffs on U.S. goods and ease a transatlantic trade dispute over aircraft subsidies. “This measure is important to protect our state’s economy,” House Democratic Majority Leader Pat Sullivan said by phone. “We don’t want tariffs levied by the EU on the aerospace industry but also on other key industries in the state like wine and agricultural products.” The measure passed 73-24 after winning approval on Tuesday in the Senate, a spokeswoman for House Democrats said. However, late changes to the legislation means it must be put to another vote in the Senate before it can go to Washington state Governor Jay Inslee’s desk for signing.

The World Trade Organization has found that Boeing and Europe’s Airbus (AIR.PA), the world’s two largest planemakers, received billions of dollars of unfair subsidies in cases dating back to 2004. The global trade body has faulted both sides for failing to comply fully with previous rulings, opening the door to a tariff war. After years of debate, the focus of the European case against the United States involves a preferential state tax rate for aerospace introduced 16 years ago and renewed in 2013 to help attract production work for Boeing’s 777X. The planned law changes would remove the 40% saving on Business and Occupation tax, which saved Boeing some $118 million in 2018 based on published jetliner revenues.

Read more …

Isn’t he supposed to be on the corona team?

• Mnuchin: IMF, World Bank Funds Won’t Repay Belt and Road Debts To China (R.)

The U.S. Treasury is working with the International Monetary Fund and the World Bank to gain full transparency of countries’ debts from China’s Belt and Road infrastructure initiative and ensure that funds from the institutions are not used to repay China, Treasury Secretary Steven Mnuchin said on Wednesday. “We think this is critically important,” Mnuchin told a hearing of the U.S. House of Representatives Appropriations Committee. “We’re not ever going to be using money from these international organizations to pay back China.” Some countries saddled by debt from Belt and Road Projects, such as Pakistan, have turned to the IMF for assistance. Pakistan entered a $6 billion loan program with the Fund in July 2019.

Read more …

That queenie of yours is morally bankrupt as well.

• Ghislaine Maxwell ‘Persuaded’ Prince Andrew To Snub FBI’s Epstein Probe (NYP)

Prince Andrew has hired a crisis management specialist dubbed “the backroom fixer” — after snubbing the FBI on the advice of Jeffrey Epstein’s accused madam Ghislaine Maxwell, according to reports. The Duke of York was on Monday once again shamed by US authorities who say he “completely shut the door on voluntary cooperation” with the investigation into his late pedophile pal’s crimes. Now a family friend of Maxwell’s claims Andrew was “persuaded” to do so at her urging. “Ghislaine told me that yes, the lawyers and Ghislaine have finally convinced Andrew that it would do no good for him to talk to the FBI,” Maxwell friend Laura Goldman told the Sun.

“He wanted to talk to them because he has nothing to hide,” Goldman said of the “honorable” 60-year-old royal. “But it was Ghislaine who persuaded him that it didn’t matter. The FBI will never be satisfied.” Media heiress Maxwell — who has been in hiding since her ex Epstein was busted on serious sex charges before his suicide last summer — is “beside herself” over the damage the scandal has done to Andrew and the British royal family. “She said that the attempt to question Prince Andrew is a publicity ploy and reeks of desperation.”

Read more …

Calling those who suffered most from Nazis, Nazis, is a bad idea.

• Erdogan Slams Greece’s ‘Nazi’ Treatment Of Refugees (RT)

Athens’ treatment of thousands of refugees who have massed on the Turkey-Greece border is comparable to atrocities carried out by Nazi Germany, Turkey’s president has claimed amid the latest migrant row with the EU. Turkish President Recep Tayyip Erdogan lashed out at Greece in an address on Wednesday, claiming that Ankara’s Mediterranean neighbor has mistreated a flood of refugees that are trying to enter the EU through Turkey. “There’s no difference between those images from Greece’s border and what the Nazis did,” Erdogan said, apparently referring to photographs of clashes between migrants and Greek border police. He also announced that Turkey will keep its border open for migrants trying to gain entry to Europe, until Brussels agrees to meet commitments under a 2016 deal which Ankara claims have not been fulfilled.

The tactic has been described by some as tantamount to blackmail. Both sides are hoping to negotiate a new deal by the end of March. The Turkish president has a penchant for accusing other nations of Nazi-like behavior. In 2017, he accused Germany and the Netherlands of employing “Nazi practices” against Turkish citizens and his own government. When local German governments ran afoul of Erdogan that same year, the Turkish leader warned that European leaders “would revive gas chambers.” More recently, Erdogan has used the Nazi label to go after Tel Aviv. In 2018, he stated that “Hitler’s spirit re-emerges in some of Israel’s rulers,” adding that the Jewish state is “the most fascist and racist country in the world.”

Read more …

Oh, shut up and do something.

• Greece Warned By EU It Must Uphold The Right To Asylum (G.)

The Greek government has been warned by the EU executive that it must uphold the right to asylum, as leaders from Brussels travel to Athens for talks on the migrant crisis at the EU’s borders. Ylva Johansson, EU commissioner for home affairs, said she wanted to discuss a detention centre where asylum seekers were reported to have been captured and beaten, before being expelled from Greece without the chance to speak to a lawyer or claim asylum. The New York Times reported on Tuesday of “a black site” in north eastern Greece where migrants are held without legal recourse before being expelled to Turkey.

Johansson, a Swedish social democrat who took charge of EU migration policy a little more than 100 days ago, said she would raise the issue of the detention centre with Greek government ministers on Thursday. “These kind of temporary detentions that they have set up – is one of the things I would like to know more about … Of course you can have detention for some period of people that have come, but of course you can’t beat them,” she said. The commission has been accused of failing to uphold EU law since Greece announced earlier this month it was suspending asylum applications for one month, a move at odds with European law and the Geneva convention.

While the UN agency for refugees has said the Greek decision has no legal basis, the commission has said it needs time to assess the situation. Sidestepping whether Greece’s decision was illegal, Johansson said: “We are going to discuss actually what they are doing, but they have to let people apply for asylum.” She also said the commission did not plan to suspend the right to asylum by invoking a little-known clause of the EU treaty that allows Brussels to propose “provisional measures”, to help a member state facing an emergency because of large numbers of migrant arrivals.

Read more …

Oh well, we’ll all be dead…

• Greenland And Antarctica Ice Loss Accelerating (BBC)

Earth’s great ice sheets, Greenland and Antarctica, are now losing mass six times faster than they were in the 1990s thanks to warming conditions. A comprehensive review of satellite data acquired at both poles is unequivocal in its assessment of accelerating trends, say scientists. Between them, Greenland and Antarctica lost 6.4 trillion tonnes of ice in the period from 1992 to 2017. This was sufficient to push up global sea-levels up by 17.8mm. “That’s not a good news story,” said Prof Andrew Shepherd from the University of Leeds in the UK. “Today, the ice sheets contribute about a third of all sea-level rise, whereas in the 1990s, their contribution was actually pretty small at about 5%.

This has important implications for the future, for coastal flooding and erosion,” he told BBC News. The researcher co-leads a project called the Ice Sheet Mass Balance Intercomparison Exercise, or Imbie. It’s a team of experts who have reviewed polar measurements acquired by observational spacecraft over nearly three decades. These are satellites that have tracked the changing volume, flow and gravity of the ice sheets.

[..] Greenland and Antarctica are responding to climate change in slightly different ways. The southern polar ice sheet’s losses come from the melting effects of warmer ocean water attacking its edges. The northern polar ice sheet feels a similar sort of assault but is also experiencing surface melt from warmer air temperatures. Of that combined 17.8mm contribution to sea-level rise, 10.6mm (60 %) was due to Greenland ice losses and 7.2mm (40%) was due to Antarctica. The combined rate of ice loss for the pair was running at about 81 billion tonnes per year in the 1990s. By the 2010s, it had climbed to 475 billion tonnes per year.

Read more …

Oh, sure, the European Commission will save the world.

• New Rules Could Spell End Of ‘Throwaway Culture’ (BBC)

New rules could spell the death of a “throwaway” culture in which products are bought, used briefly, then binned. The regulations will apply to a range of everyday items such as mobile phones, textiles, electronics, batteries, construction and packaging. They will ensure products are designed and manufactured so they last – and so they’re repairable if they go wrong. It should mean that your phone lasts longer and proves easier to fix. That may be especially true if the display or the battery needs changing. It’s part of a worldwide movement called the Right to Repair, which has spawned citizens’ repair workshops in several UK cities. The plan is being presented by the European Commission. It’s likely to create standards for the UK, too – even after Brexit.

That’s because it probably won’t be worthwhile for manufacturers to make lower-grade models that can only be sold in Britain. It’s all part of what one green group is calling the most ambitious and comprehensive proposal ever put forward to reduce the environmental and climate impact of the things we use and wear. Proposals aim at making environmentally-friendly products the norm. It could mean manufacturers using screws to hold parts in place, rather than glue. The rules will also fight what is known as “premature obsolescence”, the syndrome in which manufacturers make goods with deliberately low lifespan to force consumers into buying a newer model.

Read more …

This hurts. Physically.

• Chelsea Manning Hospitalized After Suicide Attempt (G.)

Chelsea Manning’s legal team said that the former intelligence analyst had tried to take her own life on Wednesday but was transported to a hospital where she was recovering. The Alexandria sheriff, Dana Lawhorne, said: “There was an incident at approximately 12.11pm today at the Alexandria adult detention center involving inmate Chelsea Manning. It was handled appropriately by our professional staff and Ms Manning is safe.” Manning has been in jail since May 2019 for refusing to testify before a grand jury investigating WikiLeaks. She was scheduled to appear in federal court in Alexandria, Virginia, on Friday for a hearing on a motion to terminate the civil contempt sanctions stemming from that refusal.

Andy Stepanian, a spokesman for Manning’s legal team, said in a statement on Wednesday that Manning “remains unwavering” in her refusal to participate the hearing. “In spite of those sanctions – which have so far included over a year of so-called ‘coercive’ incarceration and nearly half a million dollars in threatened fines – she remains unwavering in her refusal to participate in a secret grand jury process that she sees as highly susceptible to abuse,” her attorneys said in a statement. “Ms Manning has previously indicated that she will not betray her principles, even at risk of grave harm to herself.” In the motion filed last month, Manning’s lawyers argued that Manning had shown during her incarceration that she could not be coerced into testifying before a grand jury. Manning served seven years in a military prison for leaking a trove of documents to WikiLeaks before Barack Obama commuted the remainder of her 35-year sentence in 2017.

Read more …

How many Nobel prizes has he received so far?

• Internet ‘Is Not Working For Women And Girls’ – Tim Berners-Lee (G.)

Women and girls face a “growing crisis” of online harms, with sexual harassment, threatening messages and discrimination making the web an unsafe place to be, Sir Tim Berners-Lee has warned. The inventor of the world wide web said the “dangerous trend” in online abuse was forcing women out of jobs, causing girls to skip school, damaging relationships and silencing female opinions, prompting him to conclude that “the web is not working for women and girls”. “The world has made important progress on gender equality thanks to the unceasing drive of committed champions everywhere,” Berners-Lee wrote in an open letter to mark the web’s 31st birthday on Thursday. “But I am seriously concerned that online harms facing women and girls – especially those of colour, from LGBTQ+ communities and other marginalised groups – threaten that progress.”

The warning comes a year after Berners-Lee launched the Contract for the Web, a global action plan to save the web from forces that threaten to drag the world into a “digital dystopia”. Without tackling misogynistic online abuse, the aims of the contract cannot be achieved, he said. “It’s up to all of us to make the web work for everyone,” the letter states. “That requires the attention of all those who shape technology, from CEOs and engineers to academics and public officials.” Berners-Lee highlights three areas that need “urgent” attention. First is the digital divide that keeps more than half of the world’s women offline, largely because it is too expensive, or they do not have access to the equipment or skills to use it.

Second is online safety: according to a survey by Berners-Lee’s Web Foundation, more than half of young women have experienced violence online, including sexual harassment, threatening messages and having private images shared without consent. The vast majority believe the problem is getting worse. The third threat comes from badly designed artificial intelligence systems that repeat and exacerbate discrimination. “Many companies are working hard to tackle this discrimination. But unless they dedicate resources and diversify teams to mitigate bias, they risk expanding discrimination at a speed and scale never seen before,” he writes.

[..] Berners-Lee said the coronavirus outbreak showed how urgent it was to take action. As workplaces and schools are forced to close, the web should be a “lifeline” that allows people to keep working and children to be educated. He called on companies and governments to tackle online abuse as a top priority this year. More data needs to be collected and published on women’s experiences online, while products, polices and services should all be designed based on data and feedback from women of all backgrounds, he said.

Read more …

If you read us, please support us. Help the Automatic Earth survive.