Berenice Abbott Columbus Circle, Manhattan 1936

COVID, Hong Kong, Russiagate, they’re all familiar subjects. Now come ICU shortages and what can only be called a collapse in US -and international- retail, hospitality and travel industries.

We’re just getting started but everyone wants to think we’re almost done.

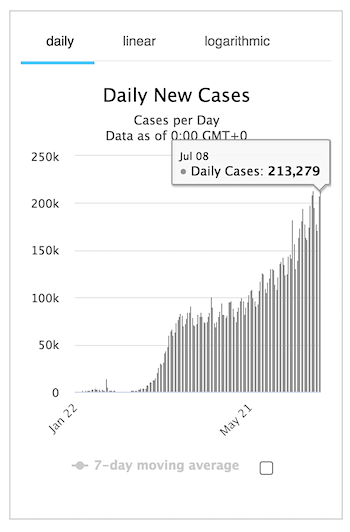

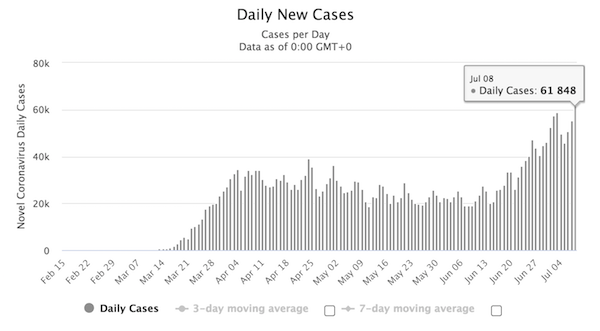

The US set a record for new cases, and the world missed it by a hair.

BREAKING: Coronavirus Outbreak

According to JHU data, US yesterday new high of 60,021. The sudden jump is partly due to an increase of tests turnaround time. CA reported new high of 9,897, TX reported new high of 9,845. MO, OK, MT, HI also reported new highs. pic.twitter.com/RoBy789qVC

— Yaneer Bar-Yam (@yaneerbaryam) July 8, 2020

Can someone translate what Biden is saying? pic.twitter.com/3drSILZSsU

— Ian Miles Cheong (@stillgray) July 9, 2020

Tennessee, West Virginia and Utah?!

• US COVID19 Cases Rise By Over 60,000, Setting Single-Day Record (R.)

The United States reported more than 60,000 new COVID-19 cases on Wednesday, the biggest increase ever reported by a country in a single day, according to a Reuters tally. The United States faces a bleak summer with record-breaking infections and many states forced to close parts of the economy again, leaving some workers without a paycheck. In addition to nearly 10,000 new cases in Florida, Texas reported over 9,500 cases and California reported more than 8,500 new infections. California and Texas also each reported a record one-day increase in deaths. It was the second day in a row that U.S. deaths climbed by more than 900 in a day, the highest levels seen since early June, according to the tally.

Tennessee, West Virginia and Utah all had record daily increases in new cases, and infections are rising in 42 out of 50 states, according to a Reuters analysis of cases for the past two weeks compared with the prior two weeks. The U.S. tally stood at 60,020 late on Wednesday, with a few local governments not yet reporting. The previous U.S. record for new cases in a day was 56,818 last Friday. The United States has reported over 3 million cases and 132,000 deaths from the virus, putting President Donald Trump’s pandemic strategy under scrutiny.

ICU shortages coming up in multiple locations.

• The US Surrendered To The Pandemic. Protect Yourself (MoA)

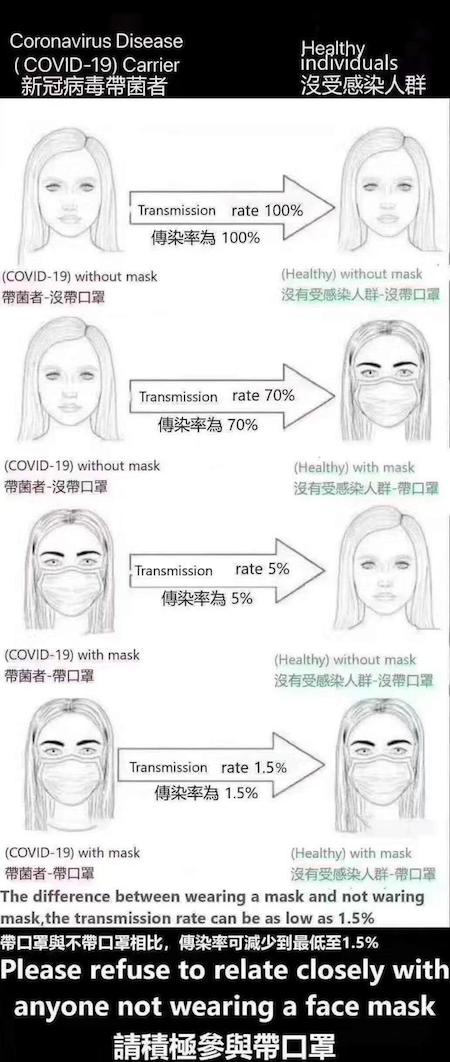

Yesterday the United States registered more than 60,000 new Covid-19 cases. As the number of new cases continues to increase unabated about two weeks from now it is likely to reach hundred thousand new cases per day. The increase of testing is not the cause of higher new case numbers. The rate of people among those who were tested and were found positive has also increased. In Florida, which yesterday had nearly 10,000 new cases, the positive test rate has reached nearly 20%. That means that the epidemic is still accelerating. This did not need to happen. Yesterday Germany, at a quarter the size of the U.S., had 279 new cases. It does 1 million tests per week and the positive rate is decreasing.

China has defeated a new local outbreak in Beijing by testing more than 10 million people. The last two days it reported zero new cases. Many of those who test positive, especially the younger ones, will not fall ill with severe symptoms. But some 10-15% are estimated to need medical support. How many of them will die depends on the quality of care that can be given to them. Some thirty hospitals in Florida have already run out of space in their intensive care units. That is the point where the real emergency begins. Six months after the disease was discovered more is known of how to care for Covid-19 cases. The death rate per cases has therefore decreased. But this only holds when there are sufficient beds, doctors and staff available.

At the current U.S. rate that will soon no longer be the case. We do know that the hospitalization curve follows the testing/symptoms curve by some 10-14 days while ICU admittance follows the above curve with some 15 to 20 days delay. The eventual recovery in an ICU bed takes up to four weeks. A bed once occupied will not be available for quite some time.

The changes will be gigantic. So will the misery. We just don’t want to know.

• 53% Of Restaurants Closed Amid Coronavirus Have Shuttered Permanently (RD)

New research from Yelp shows that as of June 15, there were nearly 140,000 total business closures on the website since March 1. When compared to similar research released in April, which showed more than 175,000 business closures, these latest numbers indicate that more than 20% of businesses closed in April have reopened. In March, restaurants had the highest numbers of business closures listed on the app compared to other industries, and the rate of closure has remained high. Of the businesses that closed, 17% are restaurants, and 53% of those restaurant closures are indicated as permanent on Yelp. Retail, however, is the hardest hit overall.

During the peak of the pandemic, the number of diners seated across Yelp Reservations and Waitlist dropped essentially to zero. In early June, numbers of diners seated are down 57% of pre-pandemic levels. Predictions about the restaurant industry’s fate in a post-pandemic world have been abundant throughout the crisis. The National Restaurant Association estimated that 15% of restaurants could close, while Barclay’s estimate is more optimistic, predicting approximately 10% of restaurants will shutter permanently. Though it’s hard to find a silver lining in Yelp’s data, some predictions have been more dire still.

In May, OpenTable said one in four restaurants were at risk for closure, for example, though those numbers focus on restaurants that use the reservations platform. Casual or fine dining sit-down restaurants and mom-and-pop concepts that are not well capitalized are expected to experience the brunt of this crisis. The Independent Restaurant Coalition, for example, forecast that as many as 85% of independent restaurants could permanently close by the end of the year. Yelp’s data does illustrate how some restaurants have been able to weather the storm, however, reporting a 10-fold increase in searches for takeout since March 10, for example. Takeout and delivery searches are up 148%, with Yelp predicting this off-premise trend could be here to stay.

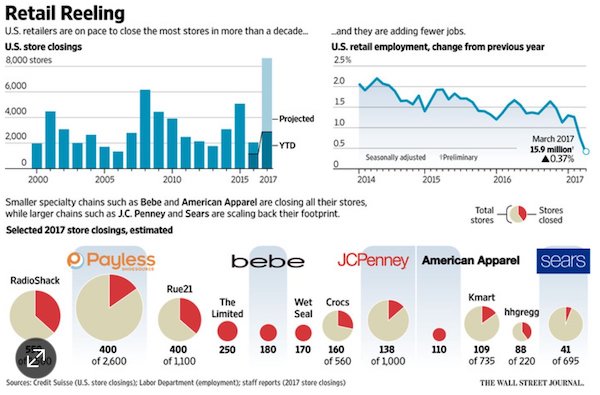

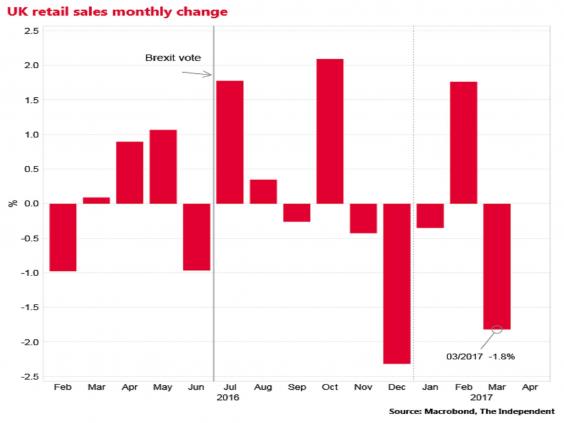

Retail, travel, hospitality. Much of it will never be back.

• United Airlines Sends Furlough Warnings To 36,000 Workers (R.)

United Airlines said on Wednesday it was preparing to send notices of potential furloughs to 36,000 U.S.-based frontline employees, or about 45% of staff, as travel demand hit by the coronavirus pandemic struggles to recover. United shares lost 3.3% in midday trading. Not everyone who receives a notification will be furloughed, United said, with the final number depending on how demand evolves and how many employees accept early exit packages and temporary leaves. The furloughs would begin on Oct. 1, when a government-imposed ban on forced job cuts by airlines that accepted billions of dollars in federal payroll aid expires.

“The United Airlines projected furlough numbers are a gut punch, but they are also the most honest assessment we’ve seen on the state of the industry,” Association of Flight Attendants-CWA (AFA) President Sara Nelson said in a statement. The Chicago-based airline continues to burn through about $40 million of cash every day, with a number of efforts to cut costs and raise liquidity failing to compensate for the drastic drop-off in travel demand as COVID-19 cases continue to rise in the United States. The furlough warnings vary by work group. Flight attendants are among the hardest hit, with about 15,000 of roughly 25,000 set to receive notifications. United is working with the different unions on options to mitigate the final furlough number.

Said it a few days ago: A state holding company modeled after Roosevelt’s Reconstruction Finance Corporation.

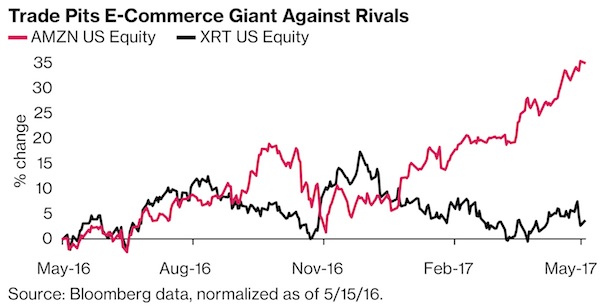

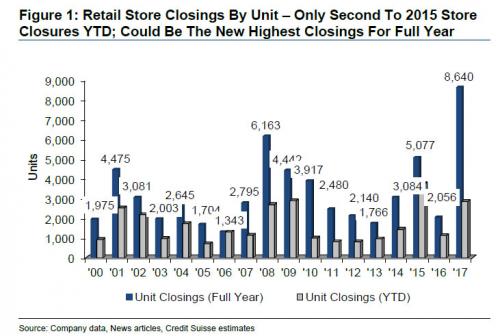

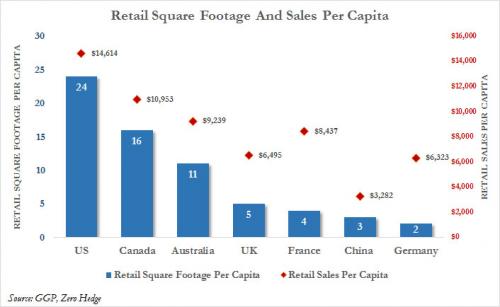

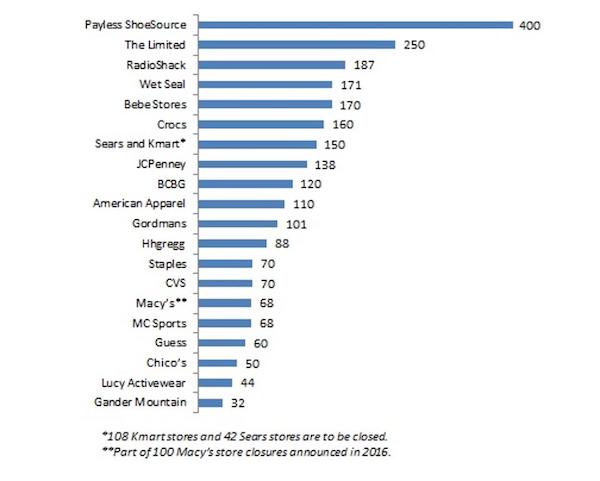

• US Retail Apocalypse: Over 25,000 Stores Could Close By Year End (ZH)

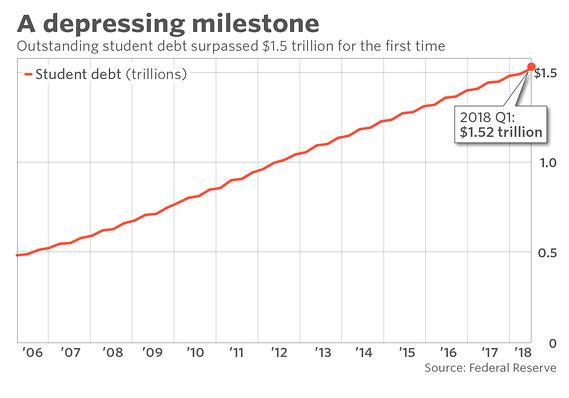

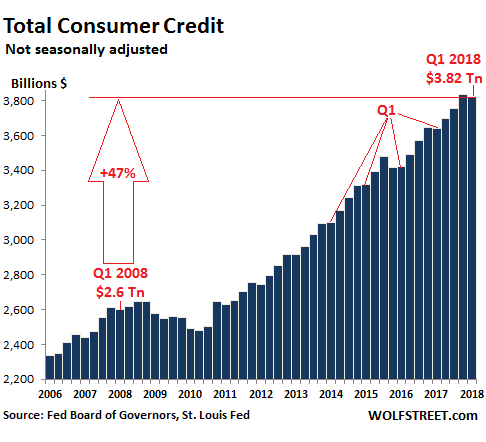

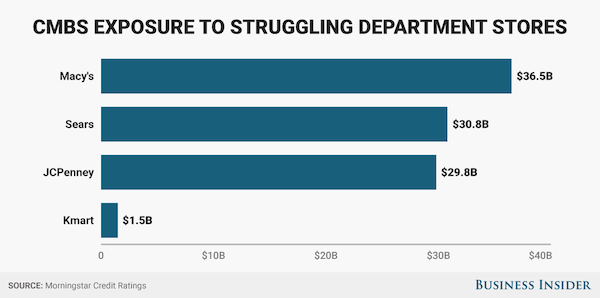

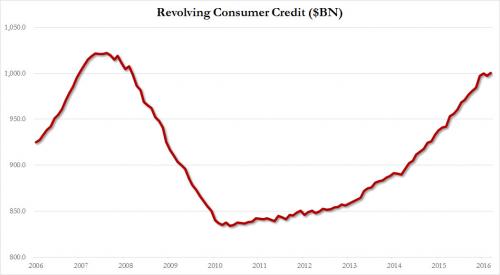

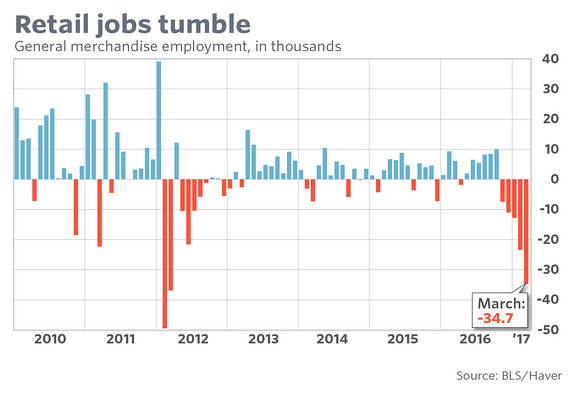

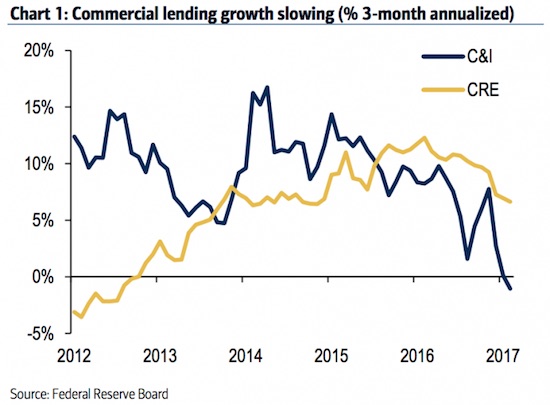

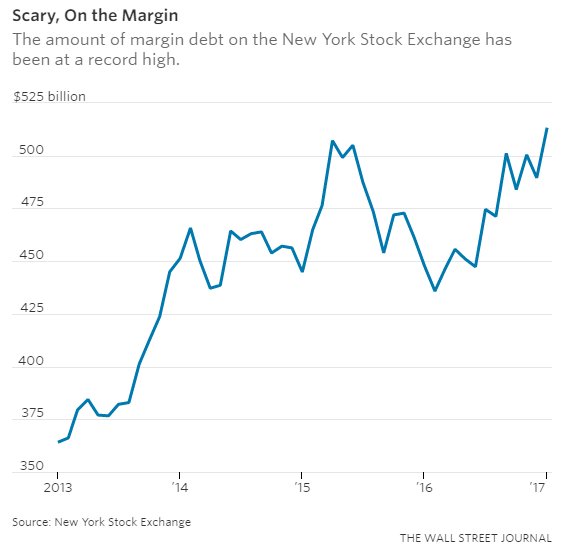

The unprecedented implosion of U.S. commercial real estate during the coronavirus pandemic is likely to get worse as newly delinquent CMBS loans are surging as the list of retail store closures continues to rise. Trepp’s June CMBS remittance report showed CMBS delinquencies hit a high of 10.32%, not seen since 2012. It was noted that that retail CRE loans were in rough shape. Many retail shops are heavily indebted, some have already declared bankruptcy, while others are quickly shrinking their operating size, by reducing store footprint to rein in cost as the virus-induced recession, blended with a plunge in consumption, along with a shift to online, is resulting in a rapid acceleration of the retail apocalypse. Coresight Research’s latest forecast has upwards of 25,000 retail stores could close by year end.

Forbes has released an updated list of confirmed store closures. So far, it looks like 8,708 store units have or will shutter operations this year, and could quickly surpass 2019 totals of 9,302, in a matter of months. With thousands of retail stores closing and the economy contracting, the next conversation Wall Street will have is about deep economic scarring and permanent job loss. Already, 3 million jobs have been eliminated from the economy, some of which have come from the closure of retail stores. The bad news about permanent job loss is that it’s a consumption killer, resulting in less spending at retailers, suggesting an even greater amount of store closures beyond anyone’s wild guess could be seen over the next 12-24 months.

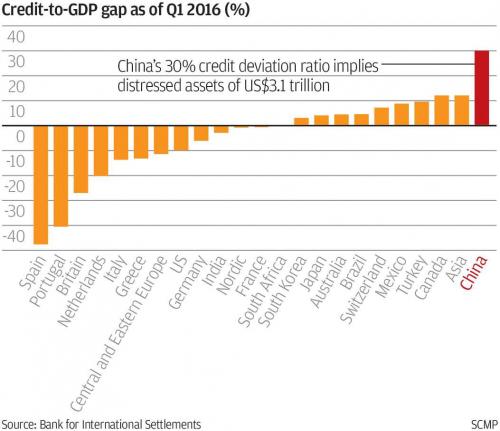

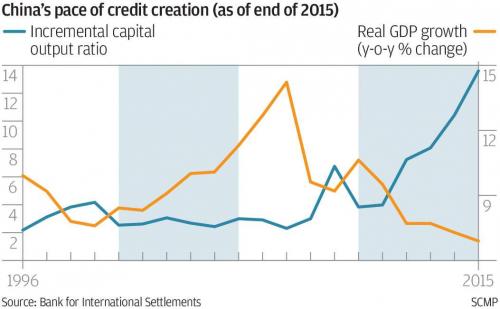

They can’t do a thing. They don’t even have the guts to let the yuan float.

• US Coronavirus Stimulus Reignites China’s Criticism Of Dollar Hegemony (SCMP)

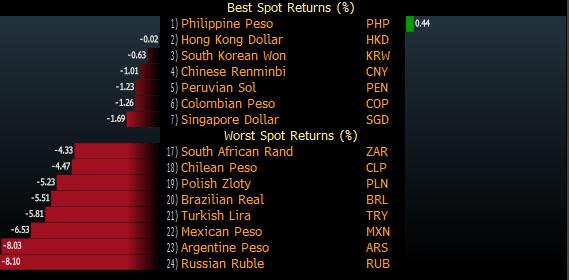

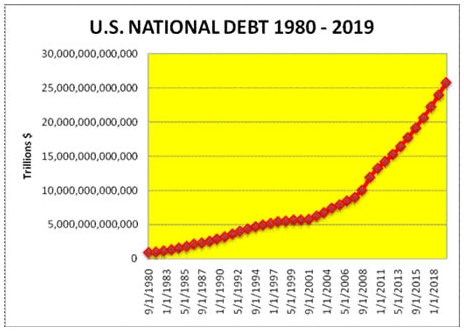

The US economic policy response to the coronavirus crisis and the threat of financial sanctions on China have reinvigorated criticism in Beijing over the US dollar hegemony, but few analysts see a viable alternative currency emerging any time soon. Chinese officials have recently taken aim at the unprecedented coronavirus stimulus in the United States, which has seen American debt levels balloon and stoked concern in Beijing about the devaluation of the US dollar assets held by Chinese financial institutions. Threats by the US to sanction China over its imposition of a national security law on Hong Kong have also ratcheted up anxiety about being cut off from the US dollar-dominated SWIFT international payments system.

[..] Though the attitude in Beijing may be increasingly wary, few Western economists believe Washington is abusing the power of the US dollar with its coronavirus response. Others point out the impact on exchange rates has so far been relatively mild. “The Federal Reserve, like every other central bank, makes its monetary policy decisions mostly on the basis of domestic considerations,” said Eswar Prasad, the former head of the International Monetary Fund’s China division and now a trade professor at Cornell University. The fact its actions “reverberate around the world” are simply a consequence of its policy mandates, which are purely domestic in nature, Prasad added. Continued expansion of US monetary policy amid a protracted global recession is also likely to be positive for the real world economy, and particularly for economies with current account deficits and significant amounts of US dollar-denominated debt, according to analysts.

“Given the US dollar shortage that emerged with Covid, a weaker dollar is still good for the world, relieving funding pressures in both developed markets and emerging markets,” said Steve Englander, global head of North America macro strategy at Standard Chartered Bank. Reform of international monetary policy is likely to take a back seat to efforts to stabilise the global economy from the coronavirus pandemic. But even in the long-term, it is not clear what shape that would take. “In fact, the Fed’s apparent magnanimity in allowing other countries to have access to dollar financing collateralised by their holdings of US Treasuries will pull countries even deeper into the clutches of the dollar,” Prasad said.

A major obstacle is still the absence of an alternative reserve currency, Prasad said. China’s own push to internationalise the yuan has faltered over the past decade, despite its growing economic clout. The most recent figures from the SWIFT system showed that the Chinese currency accounted for just 1.66 per cent of international payment transactions in April versus 43 per cent for the US dollar. Fang Xinghai, vice-chairman of the China Securities Regulatory Commission, said last month that China’s ability to reduce its reliance on the US dollar would be greatly enhanced if it can boost the international usage of the yuan. A debate about the merits of the US dollar as the major reserve currency is likely to re-emerge after the coronavirus, according to Englander, especially when the liquidity was no longer needed. “[But] the question is which currency do you trust to replace it and what improvement would that make.”

PBOC is still buying. A lot. Question: with what? Their dollar reserves? They don’t have a lot of those that they can use freely

• China’s Market Euphoria Trumps Political Risk In Hong Kong (R.)

The country’s blue-chip CSI300 index hit five-year-highs in recent sessions on a state-endorsed rally and a retail trading frenzy. But Chinese investors and brokerages say they are increasingly drawn by Hong Kong shares, whose gains have been more modest. “Elephants are dancing (in mainland China), but in Hong Kong, many stocks are lying on the floor,” Shen Weizheng, senior advisor at brokerage Direct Access, said during an online pitch to mainland investors on Wednesday. “Buy more Hong Kong stocks. You don’t lose money buying bargains.” Mainland-listed A-shares are on average 35% more expensive than their Hong Kong-listed peers, also called “H-shares” widening from 23% just a month ago.

Share prices of the same company often differ vastly in the two markets. A growing number of U.S-listed Chinese internet companies, including NetEase and JD.com, have chosen to float in Hong Kong through secondary listings amid heightened Sino-U.S. tensions. New York-listed Alibaba, which completed its Hong Kong listing last year, could get the greenlight to enter the benchmark Hang Seng Index .HSI next month. “Capital is flowing into the city. The more intense the rivalry between the U.S. and China, the more unique Hong Kong will be as a centre to welcome back leading Chinese companies listed in the U.S.,” said Hao Hong, managing director at BOCOM International.

With China seemingly hell-bent on conquering Hong Kong, why would they not?

• Some US Government Officials Want To Depeg Hong Kong Dollar (IBT)

Some aides to U.S. Secretary of State Michael Pompeo have suggested that Washington could punish China by compromising the Hong Kong dollar’s peg to the U.S. dollar. Tensions between the U.S. and China have been escalating for months, worsened by Beijing’s imposition of new security laws in Hong Kong that some think will eliminate the city-state’s autonomy. Bloomberg reported that one way to undermine the Hong Kong dollar peg would be by restricting the ability of Hong Kong banks to purchase U.S. dollars. The matter has been discussed with Pompeo but not yet with senior members of President Donald Trump’s White House staff.

Hong Kong has linked its currency to the U.S. dollar since 1983 and has generally performed well trading within a narrow band. The proposal would also face obstacles among other U.S. government officials who fear it would just hurt Hong Kong banks and not mainland China itself. Last month, Hong Kong’s financial secretary, Paul Chan said that if the US slapped sanctions on the city-state, then China’s central bank could supply it with American dollars. Eddie Yue, chief executive of the Hong Kong Monetary Authority, Hong Kong’s de facto central bank, said that the 36-year old dollar peg predates the 1992 U.S-China Policy Act which features a provision permitting the U.S. dollar “to be freely exchanged” with the Hong Kong dollar.

Yue suggested that the unlikely event of Trump blocking Hong Kong’s access to U.S. dollars would amount to an “apocalyptic” scenario that could backfire on Washington. “With Hong Kong’s financial system closely integrated with the global economic and financial systems, any move that hits our financial system would also send shockwaves across the global financial markets, including the U.S.,” he said. “Confidence of international investors in using the [U.S. dollar] and holding U.S. financial assets could also be undermined.”

Again, the PBOC is buying.

• Surging Demand for Hong Kong Dollars Underscores Beijing Support (BBG)

Demand for Hong Kong dollars is intensifying in the face of an increasingly politicized environment, with mainland buying helping to buoy both the pegged currency and local stock market. The city’s de facto central bank sold a combined HK$15.8 billion ($2 billion) to purchase the greenback on Wednesday, the biggest intervention since it started defending the peg on the strong end of the trading band in late April. The Hong Kong Monetary Authority has now spent almost $12 billion this year to keep the currency from strengthening further. Wednesday’s intervention came shortly after news that some Trump aides are considering plans to undermine the peg mechanism in retribution for Beijing’s crackdown on civil liberties in the former British colony.

Mainland-based investors showed their support for the city through buying more than $1 billion worth of Hong Kong shares on the day. The events show how the city’s financial system is increasingly being caught up in the rivalry between Washington and Beijing. For now, Hong Kong’s markets seem immune to the tensions. Red-hot Chinese equities, a stronger yuan and low valuations have helped push Hong Kong stocks into a bull market. Mainland purchases of local equities since Beijing first announced plans for Hong Kong’s controversial security law are now nearing $9 billion. “Bullish sentiment is pushing short-term funds and liquidity into Hong Kong,” said Banny Lam, managing director at CEB International Capital Corp. “China’s stock market is very hot and you see a lot of people using the stock connect to buy these shares. All these factors are attracting liquidity.”

Shouldn’t this be big on CNN?

• UK Judge Orders Christopher Steele To Pay Damages To Russian Bankers (RT)

A London judge has ordered former British spy Christopher Steele to pay thousands of pounds in damages for not verifying the claims he included in his scandalous Russian dossier, which alleged Donald Trump’s ties with Moscow. Steele was taken to court by Mikhail Fridman and Petr Aven, Russian bankers from Alfa Group, who contested one of the key allegations in the paper – that they were responsible for delivering “large amounts of illicit cash” to President Vladimir Putin in the 1990s. Justice Mark Warby of the High Court of England and Wales ruled on Wednesday that Steele’s claim against Fridman and Aven was “inaccurate and misleading.”

Steele’s firm, Orbis Business Intelligence, violated British data privacy law as it “failed to take reasonable steps to verify the allegation,” and will now pay £18,000 pounds (around $22,600) in damages to each of the bankers, Warby said. Fridman said in a statement that he was “delighted” with the outcome of the trial. He has insisted that the dossier’s claims that Alfa Group was somehow a link between the Russian government and the Trump campaign during the 2016 election were absolutely groundless. “Ever since these odious allegations were first made public in January 2017, my partners and I have been resolute and unwavering in our determination to prove that they are untrue, and through this case, we have finally succeeded in doing so,” Fridman said.

The MSM will present it as a poltical ploy. All they think they need to do is lift it over the election, and then throw it out.

• John Solomon: Indictments Coming In Russia Investigation (WND)

Investigative reporter John Solomon says there’s a “lot of activity” in U.S. Attorney John Durham’s criminal investigation of the Obama administration’s probe of now-debunked claims of Trump-Russia collusion during the 2016 election. “My sources tell me there’s a lot of activity. I’m seeing, personally, activity behind the scenes [showing] the Department of Justice is trying to bring those first indictments,” Solomon said [..] “And I would look for a time around Labor Day to see the first sort of action by the Justice Department.” Solomon said he’s seeing “action consistent with building prosecutions and preparing for criminal plea bargains.”

“Until they bring it before the grand jury you never know if it’s going to happen. I’m seeing activity consistent with that.” Top former officials, including former CIA Director John Brennan, are said to be targets of the Durham investigation. But Attorney General William Barr has said he doesn’t expect Obama and former Vice President Joe Biden, the presumptive Democratic presidential nominee, to be subjects of a criminal investigation. “There is overwhelming evidence in the public record now that crimes were committed,” Solomon said. He cited “falsification of documents, false testimony, false representations before the FISA court.”

Solomon said he is hearing from defense lawyers and people “on the prosecution side” that complications with the coronavirus pandemic are “slowing down” the grand jury process. WND reported this week Sen. Charles Grassley, R-Iowa, the chairman of the Senate Finance Committee, said Durham should launch any prosecutions before the November election. [..] A report from DOJ Inspector General Michael Horowitz found at least 17 “significant” errors or omissions related to the Obama administration’s efforts to use the Foreign Intelligence Surveillance Act provisions against Trump.

How is this still a topic?

• Top US Commander Unconvinced By ‘Russian Bounty To Taliban’ Intel (RT)

Intelligence claiming Russia paid Taliban fighters to target US troops in Afghanistan lacked evidence, the top US general in the region has said. His account crushes yet another sensational media report based on anonymous sources. General Kenneth McKenzie, who oversees military operations in the Middle East and Central Asia as the head of US Central Command, told reporters on Tuesday that unverified reports about Russia having placed “bounties” on American soldiers in Afghanistan have yet to be substantiated. “The intel case wasn’t proved to me – it wasn’t proved enough that I’d take it to a court of law – and you know, that’s often true in battlefield intelligence,” the senior commander said. According to McKenzie, “there wasn’t enough there” to consider the intelligence credible.

He described the reports as “worrisome,” but stressed that there was no “causative link” to support the notion that an alleged bounty program had led to US deaths in Afghanistan. McKenzie’s remarks come a week after an assessment by the National Intelligence Council (NIC) concluded that the intelligence community has reservations about the allegations leveled against Russia. The memo said that the CIA and the National Counterterrorism Center had “medium confidence” in the reports, while the National Security Agency (NSA) and other spy agencies expressed “lower confidence.” [..] Responding to the allegations, Kremlin spokesman Dmitry Peskov didn’t mince his words, blasting the unverified US media reports as “100 percent bulls**t.”

It doesn’t matter what the top commander thinks, or even what US intelligence admits. The public has been indoctrinated. And that is the goal.

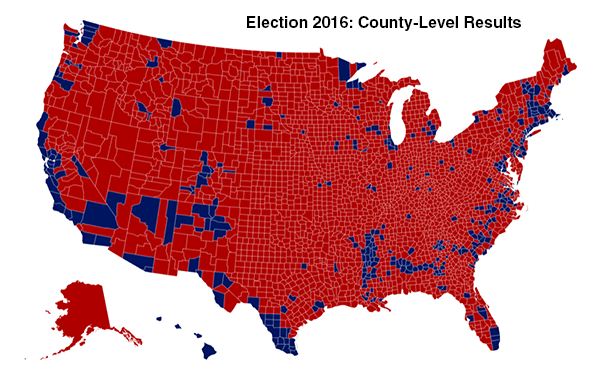

• Most Americans Believe Russia Targeted US Soldiers (R.)

A majority of Americans believe that Russia paid the Taliban to kill U.S. soldiers in Afghanistan last year amid negotiations to end the war, and more than half want to respond with new economic sanctions against Moscow, according to a Reuters/Ipsos poll released on Wednesday. The national opinion poll conducted on Monday and Tuesday shows that the American public remains deeply suspicious of Russia four years after it tried to tip the U.S. presidential election in Donald Trump’s favor, and most Americans are unhappy with how the president has handled relations with the country.

The Reuters/Ipsos poll follows a series of reports, including several by Reuters, that Russia had been rewarding Taliban-affiliated militants, possibly by offering them bounties, to attack and kill U.S. troops in the region. Moscow denies the allegations. The New York Times and Washington Post both reported that several American soldiers were believed to have died as a result of the bounties. Trump said last week he was not told about the reported Russian effort, because intelligence officials were uncertain about its veracity. The New York Times reported that the president received written briefings about the program earlier this year, and it was also included in a widely read CIA report in May.

Overall, 60% of Americans said they found reports of Russian bounties on American soldiers to be “very” or “somewhat” believable, while 21% said they were not credible and the rest were unsure. Thirty-nine percent said they thought Trump “did know” about Russia’s targeting of the U.S. military before reports surfaced in the news media last month, while 26% said the president “did not know.” Eighty-one percent of Americans said they viewed Russian President Vladimir Putin as a threat to the United States, including 24% who saw him as an “imminent threat.” Only 35% said they approved of Trump’s handling of Russia, compared with 52% who disapproved.

We try to run the Automatic Earth on donations. Since their revenue has collapsed, ads no longer pay for all you read, and your support is now an integral part of the interaction.

Thank you.

“Nearly every war that has started in the past 50 years has been a result of media lies.”

Julian Assange spent his 49th birthday behind bars alone, separated from his family, all because he dared expose US war crimes to the world.pic.twitter.com/v11ltYTaJv

— Sarah Abdallah (@sahouraxo) July 7, 2020

Support the Automatic Earth in virustime.