Andreas Feininger Production B-17 heavy bomber at Boeing plant, Seattle 1942

Absolutely brilliant interview with Michael Hudson. Read the whole thing. It’ll give you so much insight.

• How Bankers Became The Top Exploiters Of The Economy (Michael Hudson)

There are two ways of thinking about the economy. The school textbooks only talk about was producing goods and services for wages and profits. They don’t talk about rent or unearned income. That’s what I mean by “unreal” – not grounded in production. And they don’t talk about interest either, or the framework of debt and property rights. There’s a lot of talk about what seems to be the circular flow between producers and consumers. That circular flow is called Say’s law. For example, Henry Ford said he paid his workers $5 a day so that they could afford to buy the cars that they produced. Workers are depicted as paying their wages to buy what they make. All that seemed to make sense, but the economy of production is different from financial and property wealth. Who owns the assets, and who owes debts to whom?

If you look at the economic framework in terms of assets and debt, you find that the 1% makes its money by holding the 99% in debt. Or at least, you could say that the 5% make its money by holding the 95% in debt. The trick is to get other people in debt. How do you do that? You make them think that they can gain. They’re willing to borrow to buy a home, because they think that since 1945, the way that most American families have gotten rich – indeed, the way the middle class was created throughout most western countries – was by the increasing price of real estate they bought on credit. What they didn’t realize was that the price of real estate was being bid up in two ways. Number 1: By more bank lending, on easier terms. Number 2: By public infrastructure spending. Cities, states and federal governments built parks, museums, roads, railroads, water and sewer systems, and electric utilities. But this began to come to an end with Reagan and Thatcher in 1980.

You have had a privatization of public infrastructure – goods that the public sector provided for free, saving people from having to pay monopoly prices. Instead of financing public investment by progressive taxation, it was financed by borrowing. Banks got more and more aggressive and reckless in creating new credit, because they felt they were guaranteed against loss. That was the essence of financialization. Financial engineering replaced industrial engineering. What people thought was wealth turned out to be a rentier overhead. This confusion between real tangible wealth and financial overhead claims on the economy was recognized already over 100 years ago by somebody who won a Nobel Prize: Frederick Soddy. But he won the Nobel Prize in chemistry. He wrote many books saying what people think of wealth— stocks and bonds, bank loans and property rights —are virtual wealth. They are financial claims on real wealth.

A stock or bond is a claim on the income that real wealth can make. So it’s on the opposite side of the balance sheet from assets. It’s on the liabilities side. Economists used to talk about land as a factor of production. But land rights are really a property claim, like a monopoly claim. It’s as if you’d say Walt Disney’s patents on Mickey Mouse or movies that Walt Disney makes are a factor of production. They’re really a property right to charge a monopoly price. The right to charge a monopoly price for a cable service isn’t really a factor of production. It’s extractive. It’s what economists call a zero-sum activity. So classical economics has a different idea of what national income is from today’s idea. A monopoly right is not an addition to national wealth or income just because monopolists make more. It’s a subtraction from the economy’s circular flow.

Painful.

• World Out Of Whack: What’s Next For Global Real Estate? (CE)

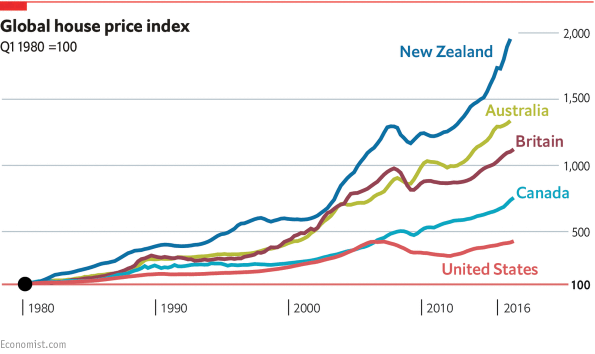

Ever since anyone can remember, global real estate prices have been going up. Pretty much doesn’t matter which country you’re from (unless, of course, it’s Syria, or Iraq… or Fuhggedistan): if you bought something in the last 2 to 3 decades, it’s like the ceilings were insulated with helium. Even when the 2008 crisis hit and we had Captain Clever ensuring the world that things were just peachy: “At this juncture, however, the impact on the broader economy and financial markets of the problems in the subprime market seems likely to be contained. In particular, mortgages to prime borrowers and fixed-rate mortgages to all classes of borrowers continue to perform well, with low rates of delinquency.” – Ben Bernanke, March 28, 2007 Even with that setback real estate has marched upward. The US, of course, took a decent breather and is only today back to where it was pre the GFC. But the US isn’t the world, so let’s look at what everyone else has been up to. Take a look at this:

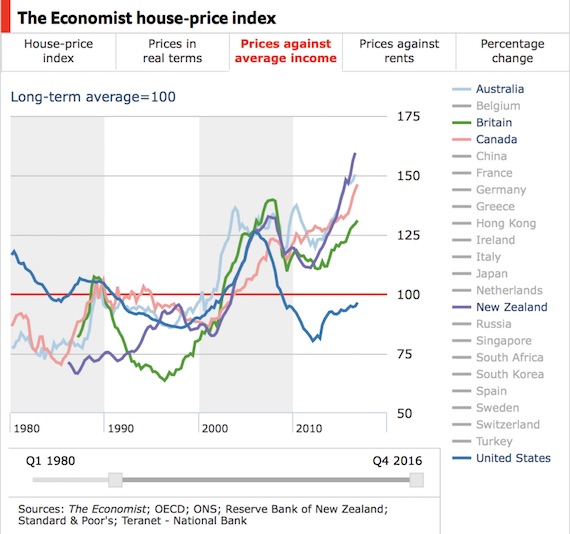

In truth, it hasn’t just been Mr. and Mrs. Smith in their tweed coats buying up UK properties, just as it hasn’t been Sheila and Bruce in Sydney, or even Maple and Hudson in Canada. A significant amount of buying power in these markets has come from offshore buyers, largely frightened Chinese money being parked. It’s pretty extraordinary, really.Prices alone don’t provide us with the entire picture or provide us with context. I mean, real estate prices in Harare went through the roof, too, in the 2008-09 period (in ZWD) but the currency went through the floor and real purchasing power collapsed. Context, therefore, is important.Also, clearly a swanky penthouse in Manhattan overlooking the Hudson river shouldn’t be priced the same as a swanky penthouse in Vientiane overlooking the Mekong. The main difference? Incomes. So let’s take a look at prices relative to incomes for a better understanding.

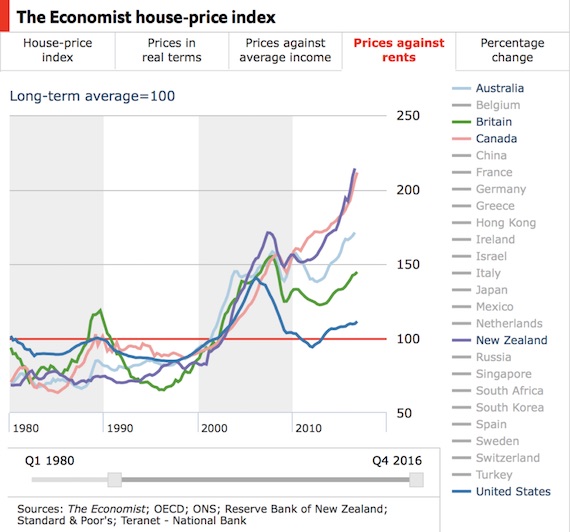

Buying a house in the US actually makes a lot more sense. Certainly relative to its international peers the US is cheap. In fact, if you factor in the ability to fix debt for a ridiculously long time in a currency that’s ultimately going to get hammered, and if you need to find somewhere to live then you’ve found a way to essentially be synthetically short the bond market (provided you fix your rates). I’m not advocating this as a strategy but merely pointing out the mechanics of the trade. As investors we’re interested in viewing real estate as we would any investment or asset, and as such understanding the cashflows is important. Naturally, incomes relative to asset prices tell us what the owner’s cashflows are relative to the asset they’ve buying… and the same analysis can be conducted against student loans, car loans – any credit instrument, really. Here’s rents (cashflows) relative to asset prices:

Kashkari makes sense. Lots of it. But will he push it through? Put his career on the line for it?

• Make Big Banks Put 20% Down—Just Like Home Buyers Do (Kashkari)

There’s a straightforward way to help prevent the next financial crisis, fix the too-big-to-fail problem, and still relax regulations on community lenders: increase capital requirements for the largest banks. In November, the Federal Reserve Bank of Minneapolis, which I lead, announced a draft proposal to do precisely that. Our plan would increase capital requirements on the biggest banks—those with assets over $250 billion—to at least 23.5%. It would reduce the risk of a taxpayer bailout to less than 10% over the next century. Alarmingly, there has been recent public discussion of moving in the opposite direction. Several large-bank CEOs have suggested that their capital requirements are already too high and are holding back lending.

[..] Bank of America CEO Brian Moynihan recently asked, “Do we have [to hold] an extra $20 billion in capital? Which doesn’t sound like a lot, but that’s $200 billion in loans we could make.” It is true that some regulations implemented after the 2008 financial crisis are imposing undue burdens, especially on small banks, without actually making the financial system safer. But the assertion that capital requirements are holding back lending is demonstrably false. How can I prove it? Simple: Borrowing costs for homeowners and businesses are near record lows. If loans were scarce, borrowers would be competing for them, driving up costs. That isn’t happening. Nor do other indicators suggest a lack of loans. Bank credit has grown 23% over the past three years, about twice as much as nominal GDP.

Only 4% of small businesses surveyed by the National Federation of Independent Business report not having their credit needs met. If capital standards are relaxed, banks will almost certainly use the newly freed money to buy back their stock and increase dividends. The goal for large banks won’t be to increase lending, but to boost their stock prices. Let’s not forget: That’s the job of a bank CEO. It isn’t to protect taxpayers. [..] There is a simple and fair solution to the too-big-to-fail problem. Banks ask us to put 20% down when buying our homes to protect them in case we run into trouble. Similarly, taxpayers should make large banks put 20% down in the form of equity to prevent bailouts in case the financial system runs into trouble. Higher capital for large banks and streamlined regulation for small banks would minimize frustration for borrowers. If 20% down is reasonable to ask of us, it is reasonable to ask of the banks.

This is why we get the calls for Eurobonds again, and the world’s biggest bad bank.

• Deepening EU Banking Crisis Meets Euro-TARP on Angel Dust (DQ)

The total stock of non-performing loans (NPL) in the EU is estimated at over €1 trillion, or 5.4% of total loans, a ratio three times higher than in other major regions of the world. On a country-by-country basis, things take look even scarier. Currently 10 (out of 28) EU countries have an NPL ratio above 10% (orders of magnitude higher than what is generally considered safe). And among Eurozone countries, where the ECB’s monetary policies have direct impact, there are these NPL stalwarts: Ireland: 15.8%; Italy: 16.6%; Portugal: 19.2%; Slovenia: 19.7%; Greece: 46.6%; Cyprus: 49%. That bears repeating: in Greece and Cyprus, two of the Eurozone’s most bailed out economies, virtually half of all the bank loans are toxic. Then there’s Italy, whose €350 billion of NPLs account for roughly a third of Europe’s entire bad debt stock.

Italy’s government and financial sector have spent the last year and a half failing spectacularly to come up with a solution to the problem. The two “bad bank” funds they created to help clean up the banks’ toxic balance sheets, Atlante I and Atlante II, are the financial equivalent of bringing a butter knife to a machete fight. So underfunded are they, they even strugggled to hold aloft smaller, regional Italian banks like Veneto Banca and Popolare di Vicenza, which are now pleading for a bailout from Rome, which in turn is pleading for clemency from Brussels. What little funds Atlante I and Atlante II have left are hemorrhaging value as the “assets” they’ve been used to buy up, invariably at prices that were way too high (often at over 40 cents on the euro), continue to deteriorate. The recent decision of Italy’s two biggest banks, Unicredit and Intesa Sao Paolo, to significantly write down their investment in Atlante is almost certain to discourage the private sector from pumping fresh funds into bailing out weaker banks.

Which means someone else must step in, and soon. And that someone is almost certain to be the European taxpayer. In February ECB Vice President Vitor Constancio called for the creation of a whole new class of government-backed “bad banks” to help buy some of the €1 trillion of bad loans putrefying on bank balance sheets. Constancio’s idea bore a striking resemblance to a formal proposal put forward by the European Banking Authority (EBA) for the creation of a massive EU-wide bad bank that, in the words of EBA president Andrea Enria, would “make it much easier to achieve critical mass and to create a well functioning market for (impaired) assets.” Here’s how it would work, according to Enria’s words:

“The banks would sell their non-performing loans to the asset management company at a price reflecting the real economic value of the loans, which is likely to be below the book value, but above the market price currently prevailing in illiquid markets. So the banks will likely have to take additional losses. The asset manager would then have three years to sell those assets to private investors. There would be a guarantee from the member state of each bank transferring assets to the asset management company, underpinned by warrants on each bank’s equity. This would protect the asset management company from future losses if the final sale price is below the initial transfer price.”

The Democrats are self-imploding over this. They need leadership, fast. And untainted.

• The Paranoid Attempts To Tie Trump To Russia (Qz)

In the months following Donald Trump’s surprise victory in the US presidential election, it has become increasingly clear that the Democratic party is unwilling—and perhaps unable—to come to terms with the country’s post-election reality. The party’s inability to accept defeat has since manifested itself through an increasingly hysterical campaign to blame Hillary Clinton’s defeat on alleged Russian interference. The charge that Russia, in the words of respected Russia expert and longtime Clinton associate Strobe Talbott, breached “the firewall of American democracy” has been repeated so often and by so many that it has taken on the patina of fact. It has become an article of faith, among disappointed Clinton partisans, mainstream political commentators, Democrats on Capitol Hill and Republicans like senator Lindsey Graham, that the election was tainted and that Trump’s legitimacy as president is questionable, at best.

The tendency to blame domestic disappointments on foreign bogeymen is not new and is perhaps better understood as a wave that periodically surfaces, then temporarily subsumes American politics. Indeed, this current reliance on conspiracy theories and accusations of unpatriotic disloyalty has been a feature, not a bug, of discourse regarding Russia since the onset of the crisis in Ukraine in early 2014. Yet this paranoia is, so far, little more than a distraction. By blaming Clinton’s loss on Russia, the political establishment is able to largely ignore the way economic, trade, and foreign policies failed large numbers of Americans. And, by elevating Vladimir Putin to supervillain status, this neo-McCarthyism is hindering debate and undermining legitimate attempts to deescalate tensions with our Russian colleagues.

MSNBC’s house intellectual Rachel Maddow has been among the most vociferous and, at times, most incisive critics of president Trump. Yet she also recently questioned whether Trump is actually under the control of the Kremlin. During her broadcast on March 9, Maddow told viewers that what she finds “particularly unsettling” is that “we are also starting to see what may be signs of continuing [Russian] influence in our country. Not just during the campaign but during the administration. Basically, signs of what could be a continuing operation.” That Maddow, a popular and respected liberal voice, would indulge in rhetoric of this sort is a worrying sign given the lack of hard evidence it is based on.

While many have convinced themselves that Russia tipped the scale of the election toward Trump, the more sinister allegations of Putin infiltrating the White House have not been born out. Even the former Director of National Intelligence James Clapper admitted in an interview with NBC’s Chuck Todd in early March that he has “no knowledge” and “no evidence” of “collusion” between Russia and the Trump campaign. Yet Maddow’s charge recalls some of the worst excesses of the early 1950’s, when our political life was marred by the Red Scare and a climate of paranoia prevailed. Unsubstantiated allegations, not dissimilar to the kind Maddow just levied, were characteristic of that era.

Steele was paying his ‘sources’ through third parties.

• Clinton Ally Says Smoke, But No Fire: No Russia-Trump Collusion (NBC)

Former Acting CIA Director Michael Morell, who endorsed Hillary Clinton and called Donald Trump a dupe of Russia, cast doubt Wednesday night on allegations that members of the Trump campaign colluded with Russia. Morell, who was in line to become CIA director if Clinton won, said he had seen no evidence that Trump associates cooperated with Russians. He also raised questions about the dossier written by a former British intelligence officer, which alleged a conspiracy between the Trump campaign and Russia. His comments were in sharp contrast to those of many Clinton partisans — such as former communications director Jennifer Palmieri — who have stated publicly they believe the Trump campaign cooperated with Russia’s efforts to interfere in the election against Clinton. Morell said he had learned that the former officer, Christopher Steele, paid his key Russian sources, and interviewed them through intermediaries.

“On the question of the Trump campaign conspiring with the Russians here, there is smoke, but there is no fire, at all,” Morell said at an event sponsored by the Cipher Brief, an intelligence web site. “There’s no little campfire, there’s no little candle, there’s no spark. And there’s a lot of people looking for it.” Morell pointed out that former Director of National Intelligence James Clapper said on Meet the Press on March 5 that he had seen no evidence of a conspiracy when he left office January 20. “That’s a pretty strong statement by General Clapper,” Morell said. About the dossier, Morell said, “Unless you know the sources, and unless you know how a particular source acquired a particular piece of information, you can’t judge the information — you just can’t.” The dossier “doesn’t take you anywhere, I don’t think,” he said.

No proof on this side of the fence either. Everybody’s just making stuff up.

• Justice Dept. Delivers Documents On Wiretap Claim To Congress (R.)

The U.S. Justice Department on Friday said it delivered documents to congressional committees responding to their request for information that could shed light on President Donald Trump’s claims that former President Barack Obama ordered U.S. agencies to spy on him. The information was sent to the House and Senate intelligence and judiciary committees, said Sarah Isgur Flores, a Justice Department spokeswoman. The chairman of the House Intelligence Committee, Republican Devin Nunes, said in a statement late on Friday that the Justice Department had “fully complied” with the panel’s request.

A government source, who requested anonymity when discussing sensitive information, said an initial examination of the material turned over by the Justice Department indicates that it contains no evidence to confirm Trump’s claims that the Obama administration had wiretapped him or the Trump Tower in New York. The House Intelligence Committee will hold a hearing on Monday on allegations of Russian meddling in the U.S. election. Federal Bureau of Investigation Director James Comey and National Security Agency Director Mike Rogers will testify and are expected to field questions on Trump’s wiretap claim. Leaders of both the House and Senate intelligence committees, including from Trump’s Republican Party, have said they have found no evidence to substantiate Trump’s claims that Obama ordered U.S. agencies to spy on Trump or his entourage. The White House has publicly offered no proof of the allegation.

What an insane story this is. How did the media get all their info?

• Secret Service Says Laptop Stolen From Agent’s Car In New York (R.)

The U.S. Secret Service said on Friday a laptop was stolen from an agent’s car in New York City but that such agency-issued computers contain multiple layers of security and are not permitted to contain classified information. The agency said in a statement that it was withholding additional comment while an investigation continues. ABC News, citing law enforcement sources, said the laptop contained floor plans for Trump Tower, details on the criminal investigation of Hillary Clinton’s use of a private email server and other national security information. The New York Daily News, citing police sources, said authorities had been searching for the laptop since it was stolen on Thursday morning from the agent’s vehicle in the New York City borough of Brooklyn.

Some items stolen with the laptop, including coins and a black bag with the Secret Service insignia on it, were later recovered, the newspaper reported. CBS News, also citing law enforcement sources, said that some of the documents on the computer included important files on Pope Francis. The agent also told investigators that while nothing about the White House or foreign leaders is stored on the laptop, the information there could compromise national security, the Daily News reported. “There’s data on there that’s highly sensitive,” a police source told the newspaper, adding: “They’re scrambling like mad.”

Jim was interviewed by Tucker Carlson about this, hope the video shows below (embedding Fox doesn’t always work). Really, Jim, Fox? I know, who else is left?

• A Bad Week and Getting Badder Bigly Fast (Jim Kunstler)

[..] it also looks a bit as though the Golden Golem of Re-Greatification has wandered into a political minefield so dense with booby traps that he’s already out of moves. First there’s the debt ceiling problem — which has so far received almost no attention from the Kardashianized collective news media. As David Stockman has pointed out on his blog, the US Treasury amassed a “war chest” of nearly half a trillion dollars last fall (via various book-keeping shenanigans) in expectation that President Hillary would need it to ride out some fiscal bad weather early in her reign. Then, the truly inconceivable happened and Hillary won bigly in the wrong states and not bigly enough in the right ones, and, well….

Immediately, with Trump ascendant, the Treasury and its handmaidens at the Federal Reserve engineered a rapid burn-through of the war chest at a rate of about $90-billion a month since November, so that now there remains only about a month’s worth of walking-around money to run the US Government. With the old debt ceiling truce expired, congress would have to resolve to raise it, to legally enable the Treasury to resume its massive borrowing operations, or else the government won’t be able to pay invoices or issue pension checks or meet any obligations. It could even default on its “no risk” bonds. Those dangers are theoretical for the moment, especially since there is always more accounting fraud to resort to when all else fails. But the longer a debt ceiling stalemate goes on in congress, the more trapped President Trump will be.

The cherry on top is the Federal Reserve’s move to raise interest rates the same day the debt ceiling truce expired. That will thunder through the system, making many loans more expensive to repay, dampening the real estate markets (at a time when commercial real estate is already tanking), and draining all kinds of other mojo (however falsely engineered) from the Potemkin economy. As if being trapped in a political minefield isn’t bad enough, the remaining safe patch Trump is stranded on turns out to be the LaBrea Tar Pit of health care reform. At this point, the crusade is doing worse than going nowhere — it’s getting sucked into the primordial bitumen where the mastodons and camelops sleep.

Watch out, Merkel, Trump, NATO. You’re playing with fire.

• Athens Sees Turk Effort To Dispute Greek Sovereignty In Aegean (K.)

In what is seen in Athens as an effort by Ankara to push through its message that Greece has limited sovereignty in the area of the Eastern Mediterranean surrounding the island of Kastelorizo, Turkish forces have in recent days maintained a steady presence in the region, either through military exercises or with the dispatch of research vessels. According to a navigational telex (navtex) issued by Turkey, the Piri Reis oceanographic vessel will remain in the area south of Kastelorizo until Monday. Furthermore, according to another two navigational telexes, Turkey is planning to conduct exercises with live ammunition in areas west and east of Kastelorizo (within Turkish territorial waters).

Moreover, Ankara has already announced that it will conduct hydrocarbon explorations in the Eastern Mediterranean next month. It remains to be seen exactly what part of the Eastern Mediterranean Turkey plans to explore. In Athens, Turkey’s moves are seen to be clearly linked to the decision by Cyprus to move ahead, in spite of Ankara’s objections, with the extraction of natural gas from drilling block 11 in its exclusive economic zone (EEZ). In an interview with CNN Greece, which will be broadcast Friday, Cyprus President Nicos Anastasiades again expressed his concerns over the tensions that may be further fueled in the period stretching “from now until the Turkish referendum (on April 16),” and by the ongoing effort to create “an atmosphere of fanaticism within Turkish society.”

The Erdogan referendum is one month from now. Much more important to him till then than international relations.

• Turkey Threatens To Send Europe ‘15,000 Refugees A Month’ (AFP)

Turkey’s Interior Minister Suleyman Soylu has threatened to “blow the mind” of Europe by sending 15,000 refugees a month to EU territory, in an intensifying dispute with the bloc. Ankara and Brussels almost a year ago on March 18 signed a landmark deal that has substantially lessened the flow of migrants from Turkey to Europe. But the accord is now hanging in the balance due to the diplomatic crisis over the blocking of Turkish ministers from holding rallies in Europe. “If you want, we could open the way for 15,000 refugees that we don’t send each month and blow the mind” of Europe, Soylu said in a speech late Thursday, quoted by the Anadolu news agency. Foreign Minister Mevlut Cavusoglu has already indicated that Turkey could rip up the deal and said Turkey was no longer readmitting migrants who crossed into Greece.

The crisis was sparked when the Netherlands and Germany refused to allow Turkish ministers to campaign in a April 16 referendum on expanding President Recep Tayyip Erdogan’s powers, prompting the Turkish strongman to compare them with Nazi Germany. Soylu, a hardliner considered close to Erdogan, accused The Hague and Berlin of involvement in June 2013 anti-Erdogan protests, October 2014 pro-Kurdish riots and the July 15, 2016 failed coup attempt. “They are trying to complete the work that they did not finish. Who is doing this work? It’s the Netherlands and Germany,” Soylu said. He accused Europe of failing to help Turkey enter the bloc and of not helping with its fight against terror. “Europe, do you have that kind of courage…? Let us remind you that you cannot play games in this region and ignore Turkey,” he added.

There were supposed to be 160,000. And this is less than one month of what Turkey threatens to send over.

• Over 10,000 Refugees Relocated, IOM Says (K.)

More than 10,000 asylum seekers from Syria, Iraq and Eritrea have been relocated from Greece to other European Union states since the launch of the bloc’s relocation program in 2015, according to the International Organization for Migration, which is implementing the scheme. Since the beginning of March, 367 people have left Greece for Belgium, Estonia, Germany, Malta, Portugal, Slovenia and Spain, bringing the total number of people relocated from Greece to 10,004, IOM said on Friday. Over the same period, another 475 people were relocated from Italy. The total number of people relocated from Greece and Italy since the program was launched in October 2015 now stands at 14,439, the organization said.

“We have seen a steady increase of pledges and acceptance from participating EU countries in the past few months. At this rate, there will be a further 15,000 to 18,000 relocations from Greece by the end of the program,” said Eugenio Ambrosi, director of IOM’s Regional Office for the EU, Norway and Switzerland. The numbers are short of the original target as 66,400 places had been allocated for relocation from Greece and 39,600 from Italy. “We cannot rest at ease because the overall numbers are too low given the needs in Greece and the commitments that were made. We continue to encourage EU member-states to follow through fully on their commitments,” Ambrosi said.

Home › Forums › Debt Rattle March 18 2017