Banksy June 2020

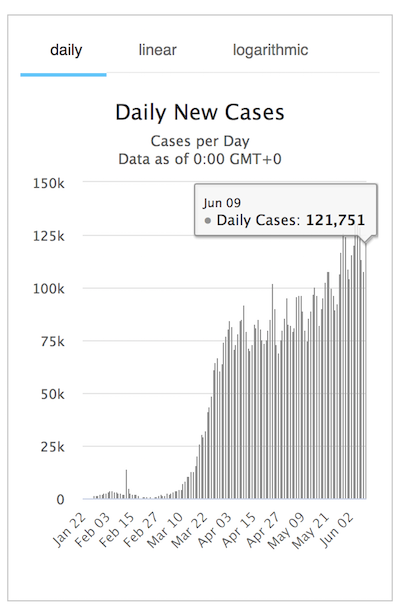

Worldometer has global new cases for June 8 (midnight to midnight GMT+0) at + 121,751.

My count from about 6 am EDT to 6 am EDT is about + 125,033 cases.

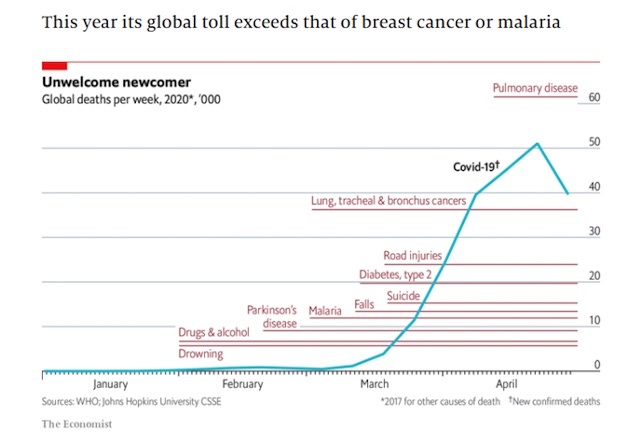

The decrease we saw for a few days did not last. New deaths also rose from 2,599 yesterday back up to 5,032.

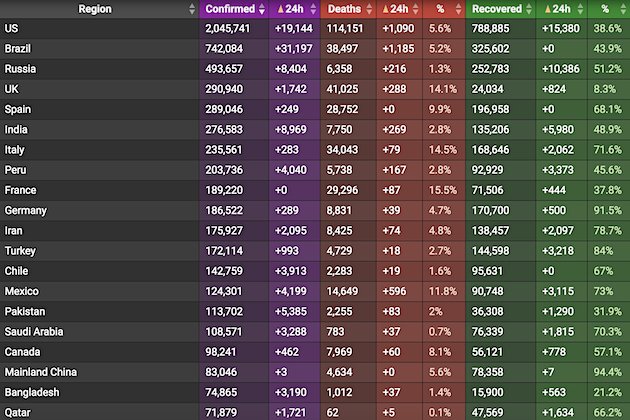

New cases past 24 hours in:

• US + 19,056

• Brazil + 30,197

• Russia + 8,595

• India + 9,548

• Pakistan + 5,385

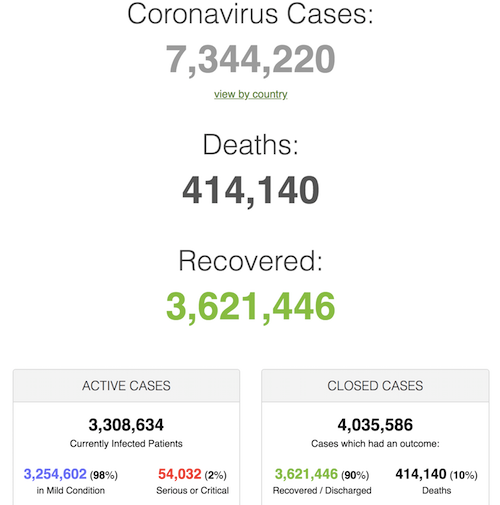

• Cases 7,344,220 (+ 125,033 from yesterday’s 7,219,187)

• Deaths 414,140 (+ 5,032 from yesterday’s 409,108)

From Worldometer yesterday evening -before their day’s close-:

From Worldometer:

From COVID19Info.live:

Stock of 5 biggest companies

Amazon: record high

Apple: record high

Facebook: record high

Microsoft: record high

Google: 5% below record highSmall businesses this year

22% have closed

Revenue is down 40%We're seeing a massive wealth transfer from small biz to conglomerates

— Dan Price (@DanPriceSeattle) June 10, 2020

Plausible. That makes it the MABU – Mother of all Bubbles#Winning https://t.co/axf2kNOlDq

— Danielle DiMartino Booth (@DiMartinoBooth) June 10, 2020

The WHO keeps on piling on “mistakes”. If it isn’t China, it’s HCQ, and if not that, it’s asymptomatic patients.

• WHO Walks Back Claim On Asymptomatic Transmission Of Coronavirus (RT)

The World Health Organization has qualified its bombshell claim that asymptomatic people rarely infect others with Covid-19, scrambling to explain how its earlier statement was misinterpreted and based on a “misunderstanding.” WHO coronavirus lead Maria Van Kerkhove attempted on Tuesday to clear up controversy around her previous claim that asymptomatic transmission was “very rare,” insisting she had been speaking based on the results of just “two or three” studies. To claim asymptomatic transmission is rare globally would be a “misunderstanding,” she explained.

“I was just responding to a question, I wasn’t stating a policy of WHO or anything like that,” she backpedaled, explaining that asymptomatic transmission estimates come from dubiously-accurate models. “That’s a big open question, and that remains an open question.” Some 16 percent of infected people may be asymptomatic, she said, citing studies – while some scientific models claim as much as 40 percent of global transmission may come from asymptomatic individuals. Given that sloppy disease modeling has been responsible for some of the most disastrous overreactions to the pandemic, Van Kerkhove’s reluctance to include these supposedly scientific speculations in the previous day’s briefing could be forgiven, but WHO emergency director Mike Ryan acknowledged his colleague’s words were likely “misinterpreted.”

[..] Harvard Global Health Institute had flat-out refused to accept Van Kerkhove’s claim, declaring “all of the best evidence suggests that people without symptoms can and do readily spread SARS-CoV-2” in a statement on Tuesday. The institute warned that “communicating preliminary data…without much context can have tremendous negative impact” on public and government responses to the pandemic, and indeed, Van Kerkhove’s comments had touched off a chain-reaction of second-guessing, pearl-clutching, and general existential crises among lockdown proponents as the number of confirmed Covid-19 cases continues to climb.

A.k.a. the exact moment they should start taking hydroxychloroquine.

• Coronavirus Patients Most Infectious When They First Feel Unwell: WHO (R.)

Studies show people with the coronavirus are most infectious just at the point when they first begin to feel unwell, World Health Organization (WHO) experts said on Tuesday. This feature has made it so hard to control spread of the virus that causes COVID-19 disease, but it can be done through rigorous testing and social distancing, they said. “It appears from very limited information we have right now that people have more virus in their body at or around the time that they develop symptoms, so very early on,” Maria van Kerkhove, a WHO epidemiologist and technical lead on the pandemic, told a live session on social media. Preliminary studies from Germany and the United States suggest that people with mild symptoms can be infectious for up to 8-9 days, and “it can be a lot longer for people who are more severely ill”, she said.

Earlier, some disease experts questioned her statement on Monday that transmission of COVID-19 by people with no symptoms is “very rare”, saying this guidance could pose problems for governments as they seek to lift lockdowns. Van Kerkhove, citing disease-modelling studies, clarified on Tuesday that some people do not develop symptoms, but can still infect others. “Some estimates of around 40 percent of transmission may be due to asymptomatic (cases), but those are from models. So I didn’t include that in my answer yesterday but wanted to make sure that I made that clear,” she said.

Dr. Mike Ryan, WHO’s top emergencies expert, said that the novel coronavirus lodges in the upper respiratory tract, making it easier to transmit by droplets than related viruses such as SARS or MERS, which are in the lower tract. “Now as we look at COVID-19, we have an infectious pathogen that is present in the upper airway for which the viral loads are peaking at the time you are just beginning to get sick,” he said. “That means you could be in the restaurant feeling perfectly well and start to get a fever, you are feeling ok, you didn’t think to stay home, but that’s the moment at which your viral load could be actually quite high,” he said.

You try getting 212 million people on a second lockdown.

• WHO Urges Pakistan To Return To Lockdown As Hospitals Struggle (GH.)

The World Health Organization has taken the unusual step of urging Pakistan to return to lockdown, suggesting the country implement restrictions in a cycle of two weeks on, two weeks off. While Pakistan has relatively low testing rates, one in four people who are tested return a positive result, the WHO said in a letter to Punjab’s provincial health minister, Yasmin Rashid. Prime Minister Imran Khan has resisted a national lockdown, arguing the country cannot afford it, and provinces have instead introduced patchwork lockdowns. Last week Khan said these would be lifted. But, with 108,317 known cases and 2,172 confirmed deaths, hospitals across the south Asian country say they are at or near capacity, with some turning Covid-19 patients away. Globally, the WHO confirmed the biggest ever one-day rise in confirmed cases this week, with 136,000 cases in 24 hours, according to director general Tedros Adhanom Ghebreyesus. Most were from south Asia and the Americas.

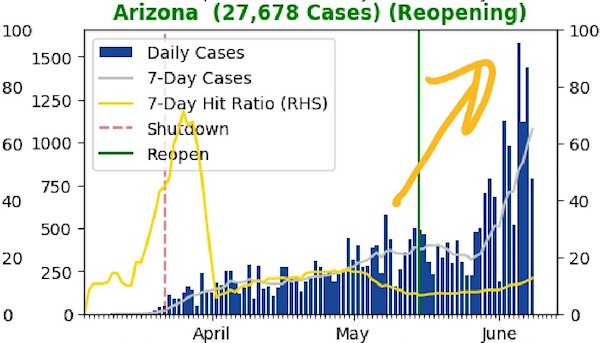

[..] Dr Anthony Fauci, the top infectious diseases expert in the US, warned on Tuesday the pandemic was “far from over,” and that he was surprised at how “rapidly it just took over the planet”. Speaking in a videotaped discussion at a Biotechnology Innovation Organization conference, Fauci said: “I mean, Ebola was scary. But Ebola would never be easily transmitted in a global way.” He added: “HIV, as important as it is, was drawn out over an extended period of time.” He warned that the world was still at the start of seeing the coronavirus pandemic’s effects. “Oh my goodness,” Fauci said. “Where is it going to end? We’re still at the beginning of it.” On Tuesday, 21 US states reported weekly increases in new cases. Arizona, Utah and New Mexico all posted rises of 40% or higher for the week ending Sunday, compared with the prior seven days, according to a Reuters analysis.

“21 U.S. states reported weekly increases [..] Arizona, Utah and New Mexico all posted rises of 40% or higher for the week..”

• California, Southwest Face New Coronavirus Woes As US Economy Reopens (R.)

Coronavirus cases and hospitalizations are spiking in parts of California and the U.S. Southwest, prompting Arizona to reactivate its emergency plan for medical facilities and California to place counties where half its population lives on a watch list. The uptick in cases, which could lead authorities to reimpose or tighten public health restrictions aimed at slowing the virus’ spread, complicates efforts to reopen the U.S. economy, which has been devastated by shelter-at-home rules. New Jersey, one of the states hit hardest by the pandemic, with over 12,000 deaths, lifted its stay-at-home order on Tuesday. More than 18 million of California’s 39 million residents live in counties now on the watch list, which includes Los Angeles, Santa Clara and Fresno, a Reuters analysis showed.

“Many of the cases that are showing up in hospitals are linked to gatherings that are taking place in homes – birthday parties and funerals,” said Olivia Kasirye, public health director of Sacramento County, one of the nine counties on the state watch list that may eventually require them to roll back reopening efforts. Arizona was among the first states to reopen in mid-May and its cases have increased 115% since then, leading a former state health chief to warn that a new stay-at-home order or field hospitals may be needed. According to a Reuters tally, there were 1,983,825 coronavirus cases in the United States and 111,747 deaths as of Tuesday. On Tuesday, 21 U.S. states reported weekly increases in new cases of COVID-19.

[..] Arizona, Utah and New Mexico all posted rises of 40% or higher for the week ended Sunday, compared with the prior seven days, according to a Reuters analysis. Some of the new cases are linked to better testing. But many stem from loosened public health restrictions that have allowed people to gather in groups and go inside stores to shop, said public health officers in two California counties. Health officials believe other cases have been passed along by people not following social-distancing recommendations. It is too soon to see whether cases will also spike after protests swept the country [..]

“The government previously predicted the pandemic would peak in early May, and under U.S. pressure, has begun reopening its carmaking industry..”

• Mexico’s Coronavirus Peak Still Weeks Off, 600 New Deaths In One Day (R.)

New coronavirus cases in Mexico are expected to keep rising, a top health official said on Tuesday, even as the government pushes a gradual reopening of the economy launched at the beginning of this month. “We still haven’t reached the maximum point,” Deputy Health Minister Hugo Lopez-Gatell told a morning news conference. “For several more weeks, we will keep announcing there are more cases today than yesterday.” His assessment was largely echoed by officials from the World Health Organization and its Pan American Health Organization during a webcast news conference later in the day. While Mexico has yet to reach peak infections, they said, officials should boost testing before any wide-scale economic reopening and stick to safety measures, including social distancing.

Government figures released on Tuesday night showed nearly 600 deaths added to the official count as total infections rose to 124,301. Overall, reported deaths stood at 14,649. In recent weeks, Latin America has emerged as the epicenter of the pandemic, with a spike in cases even as the tide of infection recedes elsewhere. Mexican officials have gradually raised the projections of total fatalities and now forecast up to 35,000 deaths through October. A study by the Institute for Health Metrics and Evaluation at the University of Washington last week forecast up to 75,516 deaths by August. The government previously predicted the pandemic would peak in early May, and under U.S. pressure, has begun reopening its carmaking industry, which has since been deemed essential. But plans to further relax social-distancing measures were put on hold as infection rates continued to rise.

That this is studied at all tells you how insane the west is. Asians don’t waste money on that, they just wear them.

• Widespread Mask-Wearing Could Prevent COVID19 Second Waves (R.)

Population-wide facemask use could push COVID-19 transmission down to controllable levels for national epidemics and could prevent further waves of the pandemic disease when combined with lockdowns, according to a UK study published Wednesday. The research, led by scientists at the Britain’s Cambridge and Greenwich Universities, suggests lockdowns alone will not stop the resurgence of the new SARS-CoV-2 coronavirus, but that even homemade masks can dramatically reduce transmission rates if enough people wear them in public. “Our analyses support the immediate and universal adoption of facemasks by the public,” said Richard Stutt, who co-led the study at Cambridge.

He said the findings showed that if widespread mask use were combined with social distancing and some lockdown measures, this could be “an acceptable way of managing the pandemic and re-opening economic activity” long before the development and public availability of an effective vaccine against COVID-19, the respiratory illness caused by the coronavirus. The study’s findings were published in the “Proceedings of the Royal Society A” scientific journal. The World Health Organization updated its guidance on Friday to recommend that governments ask everyone to wear fabric face masks in public areas where there is a risk to reduce the spread of the disease.

In this study, researchers linked the dynamics of spread between people with population-level models to assess the effect on the disease’s reproduction rate, or R value, of different scenarios of mask adoption combined with periods of lockdown. The R value measures the average number of people that one infected person will pass the disease on to. An R value above 1 can lead to exponential growth. The study found that if people wear masks whenever they are in public it is twice as effective at reducing the R value than if masks are only worn after symptoms appear. In all scenarios the study looked at, routine facemask use by 50% or more of the population reduced COVID-19 spread to an R of less than 1.0, flattening future disease waves and allowing for less stringent lockdowns.

But the Dems like the protests! Stopping them would be interfering with the election!

• DC National Guard Members Test Positive After Protests Response (McC)

Members of the D.C. National Guard who were responding to protests in the nation’s capital over the death of George Floyd have tested positive for COVID-19, a spokeswoman said on Tuesday. The service members were part of the 1,300 D.C. National Guard members called up to help law enforcement respond initially to rioting on May 31, that was followed by days of peaceful protests. A Guard spokeswoman did not identify how many positive tests the unit has recorded. “We can confirm that we have had COVID-19 positive tests with the DCNG,” said D.C. National Guard spokeswoman Air Force Lt. Col. Brooke Davis. “The safety and security of our personnel is always a concern, especially in light of the COVID-19 era.”

The news follows reports that two members of the Nebraska National Guard who were activated in response to protests in Lincoln, Neb., have also tested positive. The D.C. National Guard was supported by approximately 3,900 additional Guardsmen from Florida, Idaho, Indiana, Maryland, Missouri, Mississippi, New Jersey, Ohio, South Carolina, Tennessee and Utah to protect national monuments and ensure peaceful demonstrations as tens of thousands of protesters took to district streets last week. In the largest protest Saturday, participants squeezed past each other, some with masks, some not, as they chanted and sang near the White House.

“Trump is Hitler” died about 3 years ago. The MSM have brought it back.

• Chicago Professor Removes Post That Appeared To Call For A Military Coup (Turley)

Figures from Glenn Greenwald to Tucker Carlson have raised the recent posting by University of Chicago Professor Brian Leiter saying that military leaders should “depose” President Donald Trump and jail him. The posting was either a poor attempt at a coup or comedy. The real problem is that in today’s environment it was unclear and, worse yet, unremarkable. On Reddit, readers were directed to “Brian Leiter (UoC professor) calls for a military coup: “Trump should be deposed and jailed” Leiter removed the statement and blamed the lack of a sense of humor on those who objected. He was not calling for a coup d’état, just musing about the possibility of a coup d’état.

On his site, Leiter discussed the criticism of Trump by General Mattis and stated that Mattis now “needs to encourage his military colleagues who share his respect for American democracy and the rule of law to do what he should have done while in office: Trump should be deposed and jailed.” Leiter later removed the statement with an addendum reading: “I’ve removed my little joke about a military coup in favor of VP Pence. I have, it appears, more faith in the U.S. military, and its commitment to the rule of law, than most readers.” The incident however raises a more concerning problem. Many could not tell. It is now routine for academics to make sweeping and irresponsible statements about how to deal with Trump and his Administration.

This is not a reference to the distortion of the criminal code to declare a host of criminal acts that are unsupportable under controlling case law. It is superheated rhetoric of professors denouncing the Trump Administration as a fascist regime and even endorsing violent protests as a form of speech. Harvard Professor Lawrence Tribe retweeted a comparison of Trump to Hitler engaging in similar gestures and calling it “horrifying,” He later took done the tweet and said “I’m not saying Trump is becoming Hitler, so don’t bother tweeting the distinctions.” Many are still making the comparison. Indeed, I have had other professors make the same comparison in conversations.

A professor who said that he teaches a course on fascism insisted that the comparison to fascism is apt and that violence is warranted, including the attack on journalist Andy Ngo: “I don’t have a problem with it. There are children dying of lack of medication in concentration camps in the U.S. If one fascist gets a milkshake thrown at him… And beaten up. I don’t have a problem with it.” This is why people do not get the joke because many academics are not joking. Indeed, we have discussed cases where faculty have been physically attacked and intimidated.

Let them eat shit.

• Tory Minister Says Eating Chlorinated Chicken Should Be Up To Consumer (Ind.)

A minister has stoked fears that low-welfare American meat could soon be on its way to British supermarkets and cafeterias after suggesting that the government would “trust the consumer” on whether to buy it or not. In the latest exchange in parliament on the issue, Cabinet Office minister Penny Mordaunt refused to say a ban would remain on chlorinated chicken, hormone-fed beef and other US imports after an upcoming trade deal with Donald Trump. The minister said she believed “we should be trusting the consumer” on the issue and suggested some people did not want to “put their faith in government” regulations. Despite the talk of consumer choice, in reality many meat products, such as in restaurants, hospitals, and school cafeterias, do not have a country of origin label, making it impossible for consumers to differentiate.

Where such labelling does currently exist, the US also regards it as an illegitimate barrier to its exports and pushes to have the practice banned as part of trade agreements it signs with other countries. US negotiators have made clear that opening the door to American agricultural exports, which are produced to much lower welfare standards than their European counterparts, is their primary demand in talks with the UK. While the government’s own best-case scenario shows an agreement with the US would lead to a tiny boost to the UK economy of just 0.16 per cent of GDP, failing to sign such a deal would be highly politically embarrassing for Boris Johnson, who has presented such an arrangement as part of the alternative to EU membership.

[..] As recently as January, Theresa Villiers, then environment secretary, reiterated that “we will not be importing chlorinated chicken” – but since then US trade chiefs have put pressure on the UK to change its position, leading the government to change tack. American meat factories use chlorine to wash chickens so that they can operate a less sanitary production environment otherwise, an approach which saves money and allows them to undercut other producers. [..] If US food exports do make it to the UK, British consumers may be denied information about which products are American to help them get a foothold in the market. The US government’s “Foreign Trade Barriers” document for 2019 catalogues policies in countries around the world the US wants ended.

We now blame the virus for everything. Next up: corona causes climate change.

• World Faces Worst Food Crisis For At Least 50 Years – UN (G.)

The world stands on the brink of a food crisis worse than any seen for at least 50 years, the UN has warned as it urged governments to act swiftly to avoid disaster. Better social protections for poor people are urgently needed as the looming recession following the coronavirus pandemic may put basic nutrition beyond their reach, the UN secretary general, António Guterres, said on Tuesday. “Unless immediate action is taken, it is increasingly clear that there is an impending global food emergency that could have long-term impacts on hundreds of millions of children and adults,” he said. “We need to act now to avoid the worst impacts of our efforts to control the pandemic.”

Although harvests of staple crops are holding up, and the export bans and protectionism that experts feared have so far been largely avoided, the worst of the impacts of the pandemic and ensuing recession are yet to be felt. Guterres warned: “Even in countries with abundant food, we see risks of disruption in the food supply chain.” About 50 million people risk falling into extreme poverty this year owing to the pandemic, but the long-term effects will be even worse, as poor nutrition in childhood causes lifelong suffering. Already, one in five children around the world are stunted in their growth by the age of five, and millions more are likely to suffer the same fate if poverty rates soar.

Guterres laid out a three-point plan to repair the world’s ailing food systems and prevent further harm. These are: to focus aid on the worst-stricken regions to stave off immediate disaster, and for governments to prioritise food supply chains; to strengthen social protections so that young children, pregnant and breastfeeding women and other at-risk groups – including children who are not receiving school meals in lockdown – receive adequate nutrition; and to invest in the future, by building a global recovery from the pandemic that prioritises healthy and environmentally sustainable food systems.

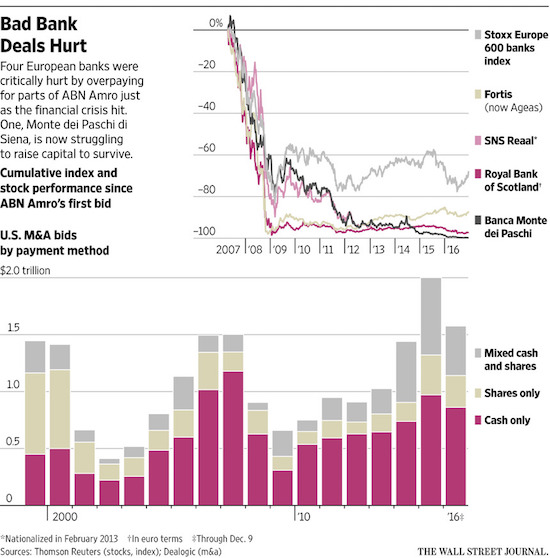

The ECB is there ONLY for the banks, not at all for anyone else. The bad bank issues bonds with bad loans as collateral, banks buy those, and hand them to the ECB as … collateral. Circle jerk.

“The bad bank would then issue bonds which commercial banks would buy in exchange for portfolios of unpaid loans, neutralising the virus shock for Europe’s lenders. The banks could then lodge those bonds with the ECB as collateral for central bank funding.. “

• ECB Prepares ‘Bad Bank’ Plan For Wave Of Coronavirus Toxic Debt (R.)

European Central Bank officials are drawing up a scheme to cope with potentially hundreds of billions of euros of unpaid loans in the wake of the coronavirus outbreak, two people familiar with the matter told Reuters. The project, which comes as Europe mobilises trillions of euros to bolster the region’s economy, is aimed at shielding commercial banks from any second fallout from the crisis, if rising unemployment chokes off the income needed to repay loans. One of the people familiar with the plan said the ECB had set up a task force to look at the idea of a “bad bank” to warehouse unpaid euro debt and that work on the scheme had accelerated in recent weeks. The amount of debt in the euro zone that is considered unlikely to ever be fully repaid already stands at more than half a trillion euros, including credit cards, car loans and mortgages, according to official statistics.

That is set to rise as the COVID-19 outbreak squeezes borrowers and could even double to one trillion euros, weighing on already fragile banks and hindering new lending, the people familiar with the ECB plans said. While the idea for a euro zone bad bank was discussed and shelved over two years ago, the ECB, under its new President Christine Lagarde, has consulted banks and EU officials about a scheme in recent weeks, one of the people said. As the euro zone’s most powerful institution, ECB backing for the project is critical but it would also require the blessing of Germany, the bloc’s biggest economy. Berlin has long opposed schemes that accept shared responsibility for debts in other countries although it recently had an unexpected change of heart, agreeing to pool EU borrowing for a coronavirus recovery fund.

One blueprint under discussion would involve the European Stability Mechanism, an EU institution which can provide financial assistance to euro zone countries or lenders, standing in as guarantor for the bad bank, the people said. The bad bank would then issue bonds which commercial banks would buy in exchange for portfolios of unpaid loans, neutralising the virus shock for Europe’s lenders. The banks could then lodge those bonds with the ECB as collateral for central bank funding, one of the people said. Major European commercial banks could be called on to join forces to underpin the scheme, the second person said.

There are calls for Jay Powell to stop supporting the stock markets, because he’s helping Trump.

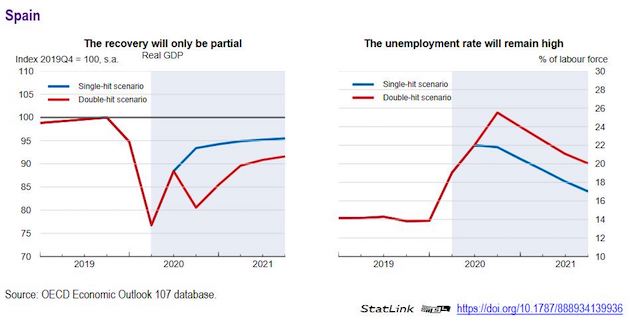

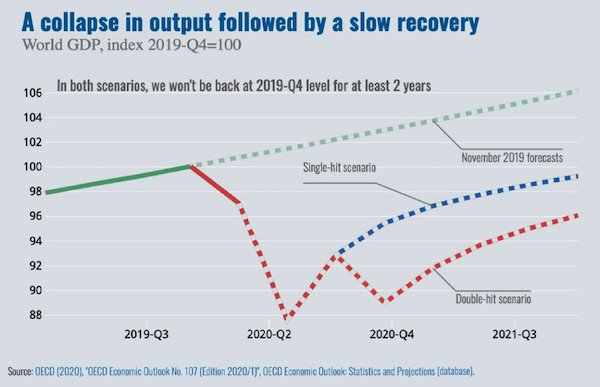

• The Illusion of a Rapid US Recovery (Galbraith)

Furman, Krugman, and the CBO share a mental model. They regard the pandemic as an economic shock, like an earthquake or the 9/11 terrorist attacks. It is a disruption to a solid structure, a deviation from normal growth. To get America moving again, what is mainly needed is confidence, perhaps aided by stimulus. If consumers channel their pent-up demand into new spending, this “shock-stimulus” model dictates, then businesses will revive investment, and soon enough, all will be well once again.This is how mainstream center-left economists and policymakers have thought about recessions and recoveries since at least the 1960s, when President John F. Kennedy and his successor, Lyndon B. Johnson, pushed through tax cuts. But it ignores three major changes in the US economy since then: globalization, the rise of services in consumption and employment, and the impact of personal and corporate debts.

In the 1960s, the US had a balanced economy that produced goods for both businesses and households, at all levels of technology, with a fairly small (and tightly regulated) financial sector. It produced largely for itself, importing mainly commodities. Today, the US produces for the world, mainly advanced investment goods and services, in sectors such as aerospace, information technology, arms, oilfield services, and finance. And it imports far more consumer goods, such as clothing, electronics, cars, and car parts, than it did a half-century ago. And whereas cars, televisions, and household appliances drove US consumer demand in the 1960s, a much larger share of domestic spending today goes (or went) to restaurants, bars, hotels, resorts, gyms, salons, coffee shops, and tattoo parlors, as well as college tuition and doctor’s visits.

Tens of millions of Americans work in these sectors.Finally, American household spending in the 1960s was powered by rising wages and growing home equity. But wages have been largely stagnant since at least 2000, and spending increases since 2010 were powered by rising personal and corporate debts. House values are now stagnant at best, and will likely fall in the months ahead. Mainstream economics pays little attention to such structural questions. Instead, it assumes that business investment responds mostly to the consumer, whose spending is dictated equally by income and desire. The distinction between “essential” and “superfluous” does not exist. Debt burdens are largely ignored.

But demand for many US-made capital goods now depends on global conditions. Orders for new aircraft will not recover while half of all existing planes are grounded. At current prices, the global oil industry is not drilling new wells. Even at home, though existing construction projects may be completed, plans for new office towers or retail outlets won’t be launched soon. And as people commute less, cars will last longer, so demand for them (and gasoline) will suffer.Faced with radical uncertainty, US consumers will save more and spend less. Even if the government replaces their lost incomes for a time, people know that stimulus is short term. What they do not know is when the next job offer – or layoff – will come along.

“To lose one parent, Mr. Worthing, may be regarded as a misfortune; to lose both looks like carelessness.”

-Oscar Wilde, “The Importance of Being Earnest”

• Misfortune vs. Carelessness (Ben Hunt)

Back in 2013 – in some of my very first Epsilon Theory notes – I wrote about how unemployment data was chronically misreported during Barack Obama’s first term, with an outrageous bias towards making the employment news flow in the United States look much better in narrative than it was in fact. [..] the skinny is this: for a period of some years in the aftermath of the Great Financial Crisis, initial unemployment claims were systematically undercounted. Amazingly enough, this systematic misreporting in unemployment data stopped after Obama was re-elected for a second term.

Was this an intentional act of malfeasance and corruption by the Obama-era Bureau of Labor Statistics (BLS), who at the time weren’t even responsible for collecting the weekly initial unemployment claims data? Nope. Did the Obama-era BLS recognize the systematic error and direction of bias in the initial unemployment claims data? Absolutely. Could the Obama-era BLS have fixed the systematic error and direction of bias in the initial unemployment claims data if they had wanted to? In a heartbeat.

It’s exactly the same thing with the Trump-era Bureau of Labor Statistics and the reporting of weekly and monthly employment data. The measurement error we’ve seen in the monthly jobs report – and keep in mind that it is exactly the SAME ERROR being made for the past THREE MONTHS – is not an intentional mistake. But the failure to correct these errors – the conscious effort required to allow known and obvious errors to persist and create a market-moving and election-moving cartoon – well, I think that IS intentional.

Accidents happen. Misfortune occurs. Mistakes are made. But when the same accident happens over and over again, in exactly the same way and with exactly the same bias … What’s happening with the Bureau of Labor Statistics – and of course it’s not only the Bureau of Labor Statistics – is an intentional carelessness. It is an intentional, political carelessness that supports status quo cartoons of control, regardless of which political party happens to be championing the status quo today. It’s not a Democrat thing and it’s not a Republican thing. It’s a power thing.

I see a global industry emerging.

• Banksy Reveals Plan For Bristol’s Toppled Colston Statue (CB)

Protests in support of the Black Lives Matter movement have been taking place across the world over the last few weeks, after the death of George Floyd at the hands of Minneapolis police officers. In one of the most symbolic images from this weekend’s protests, the statue of 18th century slave trader Edward Colston was toppled in Bristol, and pushed into the harbour. As debate rages over whether the statue should be reinstated, left in the harbour, or pulled out and put in the city’s museum, the mysterious Bristol-based street artist Banksy has proposed a solution (below) to keep “everyone happy”. He suggests putting the statue back on its plinth, but with the addition of other life-size statues of the protestors pulling it down.

“What should we do with the empty plinth in the middle of Bristol? Here’s an idea that caters for both those who miss the Colston statue and those who don’t. We drag him out the water, put him back on the plinth, tie cable round his neck and commission some life size bronze statues of protestors in the act of pulling him down. Everyone happy. A famous day commemorated.”

These people are certifiably nuts. The first Black woman to win an Oscar was Hattie McDaniel for Gone With The Wind. Now her work is removed from view in the name of being anti racist? https://t.co/HjQTQT1eJK

— Robby Starbuck (@robbystarbuck) June 10, 2020

We try to run the Automatic Earth on people’s kind donations. Since their revenue has collapsed, ads no longer pay for all you read, and your support is now an integral part of the interaction.

Thank you.

The amazing changing world of Dr. Fauci. NO Asymptomatic transmission of COVID…

— James Hirsen (@thejimjams) June 10, 2020

Support the Automatic Earth in virustime.