Herri met de Bles c1510-after 1555 Saint Jerome medidating

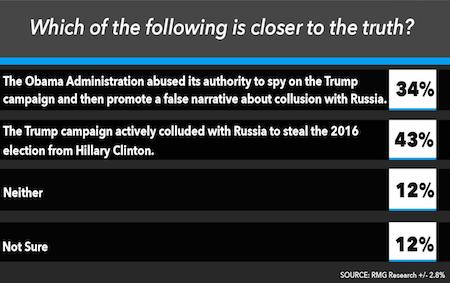

Tucker fraud poll

About one in five mail-in ballots in the last election was fraudulent, handing Biden the presidency. We know this because the people who committed the fraud have admitted it in a new poll. pic.twitter.com/fxHL9hT4sw

— Tucker Carlson (@TuckerCarlson) April 26, 2024

“The Wrong Guy is in the White House” — Donald Trump Really won all 6 of the Swing States in the 2020 Election

• Even if mail-in Ballot fraud were equal between Democrats and Republicans, if you take the data and apply it to the 2020 election— Donald Trump would win all 6 of… pic.twitter.com/aiWamcYSW4

— MJTruthUltra (@MJTruthUltra) April 27, 2024

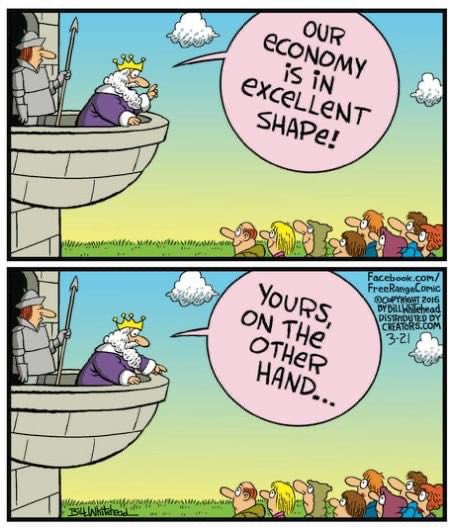

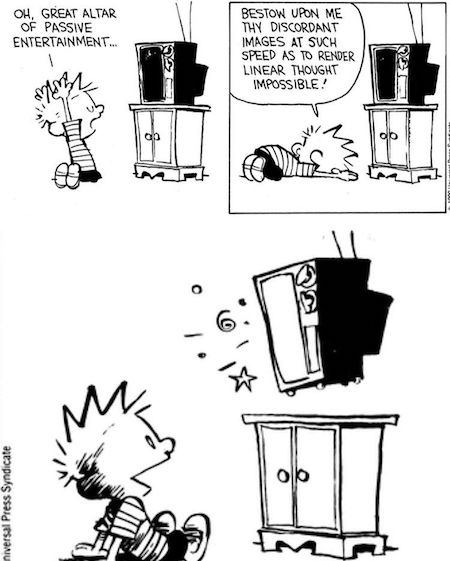

Trump ad

The Trump campaign should run this ad nonstop from now until November 🤣 pic.twitter.com/ct2nWH8CX7

— Benny Johnson (@bennyjohnson) April 26, 2024

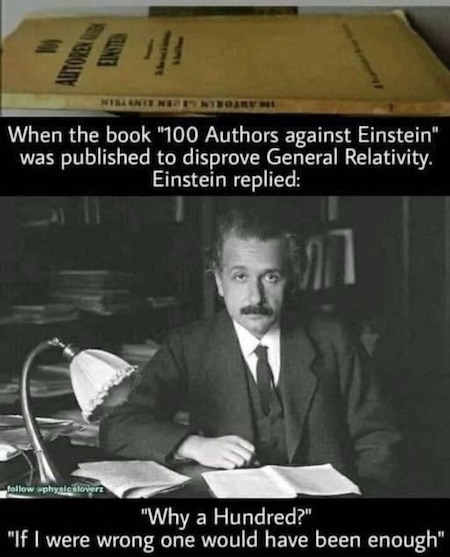

Rogan Tucker Dumb

Tucker Carlson about Alexandria Ocasio-Cortez and Karine Jean-Pierre: "The marriage of ineptitude and high self-esteem is really the marker of our time. I've nothing against dumb people at all. My dogs are dumb and I love my dogs….I'm not attacking her for being dumb but the… pic.twitter.com/aL9PyyWyyf

— Camus (@newstart_2024) April 26, 2024

Watters Five Eyes

New evidence shows that the CIA set up the entire Russia Hoax.

Former CIA Director, Brennan, targeted Trump. He identified 26 Trump associates to be targeted by the Five Eyes Intelligence Agencies.

The details of this entire top-secret operation were stored in a "secret… pic.twitter.com/QfLU4nrEZI

— .*Funkytown™*. (@01Funkytown) April 26, 2024

“..the former president “had no idea what [he] was talking about” when he asked about reimbursing Mr. Cohen.”

• Trump Responds to Main ‘Hush Money’ Trial Witness’s Claims (ET)

Former President Donald Trump praised the first witness in his New York City “hush money” trial, former National Enquirer publisher David Pecker, as he is scheduled to deliver more testimony in the case on Friday. “He’s been very nice. David’s been very nice. He’s a nice guy,” President Trump said on Thursday, responding to a question about Mr. Pecker’s testimony over the past week or so. During cross-examinations Thursday, Mr. Pecker detailed how he obtained potentially damaging stories about the candidate and paid out tens of thousands of dollars to keep them from the public eye. But when it came to the seamy claims by adult performer Stormy Daniels, whose real name is Stephanie Clifford, the former National Enquirer publisher said he put his foot down.

“I am not paying for this story,” he told jurors Thursday at President Trump’s trial, recounting his version of a conversation with President Trump’s former lawyer Michael Cohen about attempts to suppress allegations that prosecutors claim amounted to election interference in the 2016 campaign. Mr. Pecker said that he remembers saying he “didn’t want to be involved in this.” President Trump has maintained he is not guilty of any of the charges, and says the stories that were bought and squelched were false. “There is no case here. This is just a political witch hunt,” he said before court in brief comments to reporters on Thursday. Ms. Daniels was eventually paid by Mr. Cohen to not speak about her claim of a 2006 sexual encounter with President Trump. The ex-president denies it happened, while his lawyers have said that she is using the claims to make money and bolster her fame.

Although he did not buy her story, Mr. Pecker told Mr. Cohen that someone should make a move to suppress the claims from going public. “I said to Michael, ‘My suggestion to you is that you should buy the story, and you should take it off the market because if you don’t and it gets out, I believe the boss will be very angry with you,’” he said. Later, Trump defense attorney Emil Bove opened his cross-examination by asking Mr. Pecker about his recollection of specific dates and meanings. He appeared to be laying further groundwork for the defense’s argument that any dealings President Trump had with the National Enquirer publisher were intended to protect himself, his reputation, and his family, not his campaign.

At one point on Thursday, Mr. Pecker said that when he spoke to President Trump about the former president reimbursing Mr. Cohen for paying Ms. Clifford, the former president told him that he had no idea what Mr. Pecker was referring to. He specifically testified that the former president “had no idea what [he] was talking about” when he asked about reimbursing Mr. Cohen. He also said that he purchased the rights to former model Karen McDougal’s story as well but he stipulated that President Trump never told him to purchase that story—only that he and Mr. Cohen were concerned about the McDougal story from emerging.

Hot potato.

• Immunity for Me but Not for Thee (Woodruff)

“Whether and if so to what extent does a former President enjoy presidential immunity from criminal prosecution for conduct alleged to involve official acts during his tenure in office?” That is the question the Supreme Court will answer when it hears oral argument in Trump v. U.S. on April 25, 2024. Legacy media and the ladies of “The View” nearly lost their collective minds when the Court agreed to hear Trump’s appeal of the D.C. Circuit’s decision denying him immunity for his actions surrounding the events of Jan. 6, 2021. However, even Jack Smith, the Special Counsel prosecuting the case, argued that it was of “imperative public importance” that the Court resolve the immunity question before trial. But forget about Trump for the moment. The issue is bigger than Trump and his legal woes. As the partisan divide between the left and the right grows larger, there is a real risk that the criminalization of policy differences could raise our current state of “lawfare” to a new level.

Several retired four-star generals and admirals, as well as former cabinet officials, have filed an amicus brief with the Supreme Court arguing that granting immunity to former presidents for actions within the outer perimeter of their official duties would raise questions about the ability of the United States to peacefully transfer power from one administration to another, and thereby pose a grave risk to national security. The retired officials’ brief also argues that granting immunity would undermine civilian control of the military and undermine trust and confidence in the military as an institution. The “parade of horribles” in the retired officials’ brief assumes that a future president would instruct subordinate military officers to carry out illegal orders for which they, but not the president, would be criminally liable. The brief also suggests that an unrestrained incumbent would use the military to retain power and, thus, destabilize America’s diplomatic and military standing among nations. Of course, none of the hypotheticals feared by the brief writers occurred in the case pending before the Court. Apparently, they are afraid not of Donald Trump but of some unidentified future president. To analyze the pros and cons of immunity, however, there is no need to speculate about what some future president might do. We need only look at actual events from our recent history.

Situation #1. President Obama ordered a drone strike in Yemen to kill Anwar al-Awlaki, an American citizen and Islamic Imam critical of American foreign policy in the Middle East. Before releasing the drones that killed al-Awlaki and two others, the White House sought and received a Memorandum from the Department of Justice providing legal justification for the attack. Several questions come to mind. Should the memo from DoJ authorizing the killing of an American citizen abroad without judicial due process immunize President Obama for violating the federal criminal statute that imposes criminal penalties for the extra territorial killing of an American citizen? Could a subsequent President, a member of the opposing political party, direct a new Attorney General to investigate whether the killing of the U.S. citizen by drone attack in Yemen violated federal criminal law? If an indictment is returned against the now former President for that killing, should President Obama be allowed to claim immunity or be forced to stand trial?

Situation #2. President Biden revoked many of President Trump’s Executive Orders addressing border security when he took office. He also halted construction of physical barriers intended to secure the southern border and stem the flow of illegal border crossings and the smuggling of dangerous drugs. The number of illegal border crossings skyrocketed. Instead of remaining in Mexico until asylum claims were adjudicated, migrants were “paroled” into the interior of the United States and given a court date for their asylum claim years into the future. The quantity of illegal drugs, and the deaths of American citizens from accidental drug overdoses smuggled across the southern border, escalated astronomically. Federal law imposes criminal penalties on those who enter the United States illegally. It also punishes conspiracies to violate federal law. So, if the White House switches parties when President Biden leaves, should the new president’s Attorney General seek an indictment against Biden for conspiring with the Secretary of Homeland Security to violate U.S. immigration laws by facilitating the illegal entry of millions of migrants into the United States? Or should those policy choices be protected by a cloak of immunity?

Situation #3. Eager to deliver on a campaign promise, President Biden announced a policy to “forgive” billions of dollars in student loan debt. The Supreme Court struck down the President’s plan and held that Congress had not authorized the Executive to unilaterally forgive student loan debt. Instead of seeking legislative authority, President Biden reworked his plan to rely upon a different statute for authority. Assume the courts dismissed lawsuits challenging Biden’s “Plan B” because the plaintiffs lacked standing to sue. “Plan B” went forward and billions of dollars in federal student loans became “grants” instead of loans that had to be repaid. The federal Anti-deficiency Act imposes criminal penalties on anyone who authorizes the expenditure of federal funds without a valid congressional appropriation. When President Biden leaves office, can he be indicted and tried because his “Plan B” loan scheme violated federal law?

“..Alvin Bragg is the very personification of the danger immunity is meant to avoid..”

• Justices Signal a Desire to Avoid Both Cliffs on Presidential Immunity (Turley)

Writer Ray Bradbury once said, “Living at risk is jumping off the cliff and building your wings on the way down.” In Thursday’s case before the Supreme Court on the immunity of former President Donald Trump, nine justices appear to be feverishly working with feathers and glue on a plunge into a constitutional abyss. It has been almost 50 years since the high court ruled presidents have absolute immunity from civil lawsuits in Nixon v. Fitzgerald. The court held ex-President Richard Nixon had such immunity for acts taken “within the ‘outer perimeter’ of his official responsibility.” Yet in 1974’s United States v. Nixon, the court ruled a president is not immune from a criminal subpoena. Nixon was forced to comply with a subpoena for his White House tapes in the Watergate scandal from special counsel Leon Jaworski. Since then, the court has avoided any significant ruling on the extension of immunity to a criminal case — until now.

There are cliffs on both sides of this case. If the court were to embrace special counsel Jack Smith’s arguments, a president would have no immunity from criminal charges, even for official acts taken in his presidency. It would leave a president without protection from endless charges from politically motivated prosecutors. If the court were to embrace Trump counsel’s arguments, a president would have complete immunity. It would leave a president largely unaccountable under the criminal code for any criminal acts. The first cliff is made obvious by the lower-court opinion. While the media have largely focused on extreme examples of president-ordered assassinations and coups, the justices are clearly as concerned with the sweeping implications of the DC Circuit opinion. Chief Justice John Roberts noted the DC Circuit failed to make any “focused” analysis of the underlying acts, instead offering little more than a judicial shrug.

Roberts read its statement that “a former president can be prosecuted for his official acts because the fact of the prosecution means that the former president has acted in defiance of the laws” and noted it sounds like “a former president can be prosecuted because he is being prosecuted.” The other cliff is more than obvious from the other proceedings occuring as these arguments were made. Trump’s best attorney proved to be Manhattan District Attorney Alvin Bragg. If the justices want insight into the implications of denying any immunity, they just need to look north to New York City. The ongoing prosecution of Trump is legally absurd but has resulted in the leading presidential candidate not only being gagged but prevented from campaigning.

Alvin Bragg is the very personification of the danger immunity is meant to avoid. With cliffs to the left and the right, the justices are looking at a free-fall dive into the scope of constitutional and criminal law as they apply to presidential conduct. They may be looking not for a foothold as much as a shorter drop. Some of the justices are likely to be seeking a third option where a president has some immunity under a more limited and less tautological standard than the one the DC Circuit offered. The problem for the court is presidential privilege and immunity decisions are meant to give presidents breathing room by laying out bright lines within which they can operate. Ambiguity defeats the purpose of such immunity. So does a test that turns on the motivation of an official act.

Turley

Jonathan Turley: “Trump Trial collapsing on its own weight. You just have to stand back and watch it fall”.

Don’t ya just love it? pic.twitter.com/ROZPORjNg4

— Juanita Broaddrick (@atensnut) April 26, 2024

“Whichever way the verdict goes in the Alvin Bragg case, epic looting and rioting will commence..”

So far, the spring rioting has mostly been fun for the rioters. Unlike the J-6-21 “paraders,” locked up in the putrid DC jail for years pending trial, the Hamas frolickers are at near-zilch risk of any serious consequences. Few will even be suspended from school. They are doing exactly what the schools trained them up for: destroying Western Civ, one acanthus leaf at a time. According to the shadowy stage-managers behind “Joe Biden,” this will save our democracy.

That and stuffing Donald Trump in jail for the rest of his natural life. Alas, the lawfare cases cooked up toward that end appear defective to a spectacular degree. It really says something about the true authors of these beauties brought by Alvin Bragg, Letitia James, Fani Willis, and Jack Smith. I speak of the behind-the-scene blob lawfare ninjas Norm Eisen, Andrew Weissmann, Matt Colangelo, and Mary McCord, who wrote the scripts for all four of this year’s big elephant trap cases against the former president. You have to wonder how that bunch made it through their law boards. The current extravaganza in Manhattan that centers on alleged book-keeping errors in furtherance of an unstated federal offense is due to go on a few more weeks. The howling errors of both the prosecution and Judge Juan Merchan are so extravagant that the proceeding looks like it was cribbed from the pages of Lewis Carroll.

Yet, there is near unanimous sentiment that the Trump-deranged New Yawk jury will convict, no matter how much more idiotic the case turns out to be. By then, we will be verging on summer. The college campuses will be shuttered and the youth-in-revolt action will necessarily move to the regular streets. Whichever way the verdict goes in the Alvin Bragg case, epic looting and rioting will commence. Sometime this summer, I predict, the Mar-a-Lago documents case will get tossed on something like malicious prosecution. Jack Smith’s DC case, kneecapped by SCOTUS, won’t start before the November election (or maybe ever) and ditto the Fani Willis fiasco in Atlanta. George and Alex Soros will pour millions into box lunches for the kids burning down what’s left of the cities and the demure gals of the Ivy League Left will find plenty of love in the ruins.

The two major party conventions in July (Republican) and August (Democrat) are sure to out-do the 1968 lollapalooza in Chicago (I was there) in mayhem and property damage. “Joe Biden” — really the blob behind him — will ache to declare a national emergency, perhaps even a second emergency after the recently unveiled “climate emergency” supposedly pending any day. The USA will be in an historic horror movie you could call Emergency-O-Rama. If you think the financial system, and the US economy that has become the tail on the finance dog, can survive all this, you will be disappointed. The army may have to step in and put an end to these shenanigans. Don’t think it can’t happen.

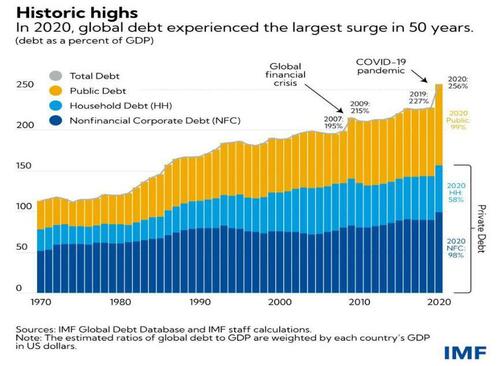

“I would not allow countries to go off the dollar because when we lose that standard, that will be like losing a revolutionary war..”

]

Sorry, but that train has sailed.

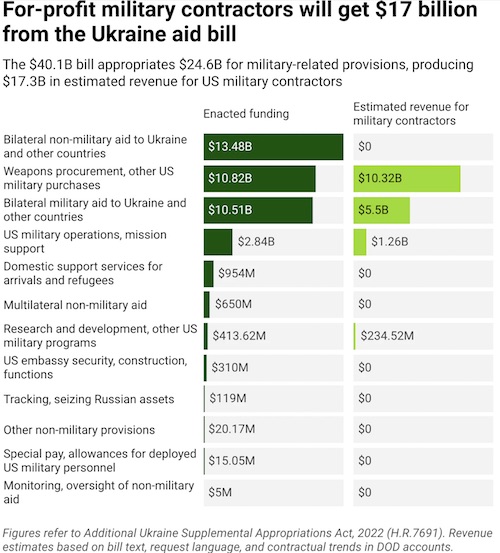

• Trump Plans To Sanction Countries For Refusing To Use Dollar – Bloomberg (RT)

Economic aides to former US President Donald Trump are looking for options to stop countries from shifting away from the US dollar as it faces a growing challenge from emerging markets, including BRICS nations, Bloomberg reported on Friday. The presumptive Republican nominee for the November presidential election and his team are discussing penalties against both allies and adversaries who seek to divert their trade from the greenback to other currencies. The options could include export controls, currency manipulation charges, and tariffs, the outlet said, citing people familiar with the matter. The global trend toward using national currencies in trade instead of the dollar gained significant momentum after Russia was cut off from the Western financial system and had its foreign reserves frozen in 2022, as part of Ukraine-related sanctions.

A bill with provisions authorizing the US to confiscate frozen Russian assets, which Biden signed on Wednesday, could further spur de-dollarization, financial experts have warned. The so-called REPO Act, which was incorporated in the $61 billion military aid package for Kiev, authorized the US president to seize Russian state assets held in American banks. As quoted by Bloomberg, Trump warned on Thursday that with US President Joe Biden, “you’re going to lose the dollar as the standard. That’ll be like losing the biggest war we’ve ever lost.” According to the news agency, Trump’s economic advisers and his campaign team have specifically considered curbing de-dollarization efforts by BRICS countries.

The group – which recently expanded and now comprises Brazil, Russia, India, China, South Africa, Ethiopia, Iran, Egypt – is boosting the use of national currencies in mutual trade. It has even signaled the possibility of introducing a new single currency in the coming years. Trump has repeatedly said that he wants the dollar to remain the world’s reserve currency. “I hate when countries go off the dollar,” Trump told CNBC in March. “I would not allow countries to go off the dollar because when we lose that standard, that will be like losing a revolutionary war,” he said, adding that it would be a “hit” for the US.

“..there’s no mileage in predicting success when Blinken boards a plane for the great “out there.”

• The Impotence of Antony Blinken (Patrick Lawrence)

Antony Blinken is now in China for his second such journey as secretary of state and his third encounter with senior Chinese officials: This is our news as April marches toward May. I have to say, it is a stranger state of affairs than I can figure when the State Department and the media that clerk for it tell us in advance that America’s top diplomat is going to fail to get anything done as he sets out for the People’s Republic. “I want to make clear that we are realistic and clear-eyed about the prospects of breakthroughs on any of these issues,” an unnamed State Department official said when briefing reporters last week on Blinken’s agenda. This is how State warns in advance that the secretary will be wasting his time and our money during his encounters in Shanghai and Beijing. What is this if not an admission of our secretary of state’s diplomatic impotence? Or do I mean incompetence? Or both?

This is the man, after all, who arrived in Israel five days after the events of last Oct. 7 to announce, “I come before you as a Jew.” Does this guy understand diplomacy or what? The media followed the State Department’ lead, naturally, in advising us of the pointlessness of Blinken’s sojourn in China—this at both ends of the Pacific. CNBC: “Washington is realistic about its expectations on Blinken’s visit in resolving key issues.” Japan Times: “While crucial for keeping lines of communication open, the visit is unlikely to yield major breakthroughs.” Matt Lee, the very able diplomatic correspondent at The Associated Press, got it righter than anyone in his April 22 report: The point of Blinken’s three days of talks with top Chinese officials, he reported, is to have three days of talks with top Chinese officials. “The mere fact that Blinken is making the trip might be seen by some as encouraging,” Lee wrote, “but ties between Washington and Beijing are tense and the rifts are growing wider.”

This is our Tony. As the record makes pitifully clear, there’s no mileage in predicting success when Blinken boards a plane for the great “out there.” This is unequivocally so in his dealings with the western end of the Pacific. There is a long list of the topics Blinken was set to raise with Chinese officials, notable among these Foreign Minister Wang Yi. Taiwan and the South China Sea, military-to-military contacts, artificial intelligence applications, illicit drug traffic, human rights, trade: These are standards on the American menu when a U.S. official addresses Chinese counterparts. The last is especially contentious just now, given the Biden regime’s disgraceful determination to subvert those Chinese industries with which the U.S. cannot compete. With plans to block imports of Chinese-made electric vehicles already afoot, last week President Biden announced new tariffs on imports of Chinese steel. And it is now “investigating” China’s shipping and shipbuilding industries, which sounds to me like prelude to yet more measures to undermine China’s admirable economic advances.

Imagine you’re mini-me and the CEO of China is persuaded to receive you. What do you do then? Well, you insult him, of course…

• Blinken Threatens China Over Russia Ties (RT)

Washington is ready to introduce more sanctions against China over its alleged transfer of dual-use goods and components, which it claims can be used by the Russia, US Secretary of State Antony Blinken said on Friday. Speaking at a press conference in Beijing following a meeting with Chinese President Xi Jinping, the US official recalled that Washington has already imposed sanctions against more than 100 Chinese entities and is “fully prepared to act” and “take additional measures.” Blinken claimed that China’s alleged support for the Russian defense industry raises concerns not only about the situation in Ukraine, but also about a “medium to long-term threat that many Europeans feel viscerally that Russia poses to them.” Earlier this week, the Wall Street Journal also reported that the US was drafting sanctions that could cut off some Chinese banks from the global financial system unless Beijing severs its economic ties with Russia.

The outlet claimed that US officials believe trade with China has allowed Russia to rebuild its military industrial capacity and could help it defeat Ukraine in a war of attrition. Beijing, in turn, has accused the US of hypocrisy for providing billions of dollars in assistance to Ukraine while “unreasonably criticizing the normal trade and economic relations between Russia and China.” “This is a very hypocritical and irresponsible approach,” Chinese Foreign Ministry spokesman Wang Wenbin told reporters on Friday in response to Blinken’s concerns about Beijing’s support of Moscow. China has also vehemently rejected accusations leveled by NATO Secretary-General Jens Stoltenberg of “fueling” the Ukraine conflict. Beijing has instead blamed NATO for instigating the crisis by continuing its expansion in Europe and refusing to respect Russian national security concerns. Following his meeting with Blinken, Xi suggested that the US and China “should be partners, not rivals” and should strive towards achieving “mutual success and not harm each other.”

“I proposed three major principles: mutual respect, peaceful coexistence, and win-win cooperation. They are not only a summary of past experience, but also a guide to the future,” the Chinese leader was quoted as saying. Beijing has maintained a policy of neutrality on the Ukraine conflict, with Chinese officials repeatedly stating that the country is not selling weapons to either Russia or Ukraine. Earlier this month, Chinese Foreign Ministry spokesman Ma Ning insisted that China “regulates the export of dual-use articles in accordance with laws and regulations,” urging “relevant countries” not to “smear or attack the normal relations between China and Russia.” In December last year, US President Joe Biden issued a decree which enabled sanctions on foreign financial institutions that continue to deal with Russia. It targeted lenders outside US and EU jurisdictions that help Russia source sensitive items, which reportedly include semiconductors, machine tools, chemical precursors, ball bearings, and optical systems.

TikTok.

• Here’s What Makes Blinken’s Job In China So Difficult (Blankenship)

US Secretary of State Antony Blinken arrived in China on Wednesday to kick off a three-day trip. It is reported that he will speak with his Chinese counterpart and potentially with President Xi Jinping. As the New York Times reported, quoting officials privy to the visit, one of the main topics will be China’s alleged support of Russia, which includes the supposed sale of weapon components and dual-use products. It also comes at a time of increased tensions. Relations have shown a flicker of warmth since US President Joe Biden and Xi’s encounter at the 30th Asia-Pacific Economic Cooperation summit in San Francisco last year. However, this visit comes sandwiched between significant moves by the Biden administration. On the one hand, Biden recently signed off on a hefty military aid package for Ukraine, Taiwan, and Israel, coupled with a divest-or-ban provision for the Chinese social media juggernaut, TikTok.

On the other, a historic trilateral summit involving the US, Japan, and the Philippines hints at potential formal military collaborations down the road, with the US deploying medium-range missiles in the Philippines, a move with unmistakable implications for China. Blinken’s trip also follows closely on the heels of Russian Foreign Minister Sergey Lavrov’s recent visit to China, which coincided with US Treasury Secretary Janet Yellen’s presence in the country. Lavrov’s visit underscored the enduring bond between Russia and China, while Yellen’s seemed to foreshadow potential trade tensions over what Beijing perceives as baseless accusations of “overcapacity.” Behind the diplomatic niceties lies a deeper agenda: the concerted effort by the US and some of its allies to curb China’s economic and technological ascent. This was laid bare when EU officials on Tuesday executed unannounced raids on the offices of a Chinese company in Poland and Denmark.

The European Commission said that its “unannounced inspections” are based on “indications that the inspected company may have received foreign subsidies that could distort the internal market pursuant to the Foreign Subsidies Regulation.” Despite this explanation, it appears the EU is mirroring Washington’s growing scrutiny of and hostility against Chinese firms. The EU’s alignment with the US on trade policy, particularly regarding China, signals a loose front aimed at constraining China’s global economic reach. The issue of Russia is also another excuse to limit China. The bilateral partnership has been extraordinarily beneficial for both sides: their trade reached a record $240.1 billion in 2023, and Russia’s economy grew by 3.6% the same year despite Western sanctions. The International Monetary Fund (IMF) predicts Russia’s economy will grow faster than all advanced economies in 2024.

This is due in no small part to trade with China, the world’s second-largest economy, but it’s also due to the fact that many other large countries, such as Brazil and India, have not joined Western sanctions on Russia – they just aren’t trading in strategic sectors of the economy like China is. But even in those sectors, the US and its allies have never revealed evidence that Beijing is directly helping Russia’s war effort in Ukraine.

🔥🚨BREAKING: Secretary Anthony Blinken announced : We have proof China is trying to influence US elections,’ says Blinken after warnings Beijing will use AI to sow chaos

Chinese cyber groups have posted about American racial politics, drug issues and immigration in an attempt… pic.twitter.com/YMYeql2t2z

— Dom Lucre | Breaker of Narratives (@dom_lucre) April 26, 2024

“Imagine them [China] looking at Elon Musk and saying that you need to sell Tesla or else,” suggested Thomas. “It’s just astonishing stuff.”

• Facade of Diplomacy Masks US Efforts to ‘Smear, Isolate, Suppress’ China (Sp.)

Secretary of State Antony Blinken’s second visit to China in less than a year this week signifies the importance the Biden administration places on Sino-US relations in addressing various global challenges, according to Chinese commentator Anna Ge. “The United States aims to sustain dialogue with China and collaborate on addressing some of the world’s most pressing issues and also domestic issues,” said the CGTN Radio host, who frequently discusses China-related issues in mainstream media in South Africa, India, and Central Asia. But the US maintains its own motives in such discussions, according to Ge, frequently using China as a scapegoat for its own geopolitical and economic difficulties. The political commentator joined Sputnik’s Fault Lines program Friday to discuss the issue. “It is interesting to see how China-US relations develop today,” said Ge as host Jamarl Thomas noted the often chaotic nature of diplomacy between the two countries in recent years.

US President Joe Biden referred to Chinese President Xi Jinping as a “dictator” the last time the two met in the United States, a gaffe judged to have damaged relations between the two countries. “We are left with a contradiction [between] messages and reality,” she said. “On the one hand, we hear relations are more stable with the personal diplomacy of [Janet] Yellen and Blinken in attending cultural events, etcetera. in line with the increase of flights and other types of people-to-people exchanges. These were impossible last year when the weather balloon lies and provocation in Taiwan and the South China Sea were edging towards a military confrontation.” “On the other hand we have become accustomed to anticipating negative developments shortly after high level US officials depart, often leading to any positive outreach being subsequently retracted or modified by the American side… Washington has been testing China’s limits unilaterally,” the commentator highlighted.

Biden signed a bill likely banning the Chinese-owned social media app TikTok shortly after Blinken arrived in Shanghai this week, an unprecedented measure. TikTok CEO Shou Chew, a Singaporean businessman, has vowed to oppose pressure to sell the social media platform to an American owner, which would result in the application being banned unless the company succeeds in launching a judicial challenge. US politicians have cast TikTok as a threat to US security and Americans’ privacy, but a raft of concessions won by former US President Donald Trump resulted in all data associated with the platform being hosted in the United States, with periodic auditing from US-based companies. Critics have claimed the strongarm tactic is merely a strategy to undermine competition from a successful Chinese competitor, as when the United States pressured European allies to ban 5G technology from the Shenzhen-based Huawei. “Imagine them [China] looking at Elon Musk and saying that you need to sell Tesla or else,” suggested Thomas. “It’s just astonishing stuff.”

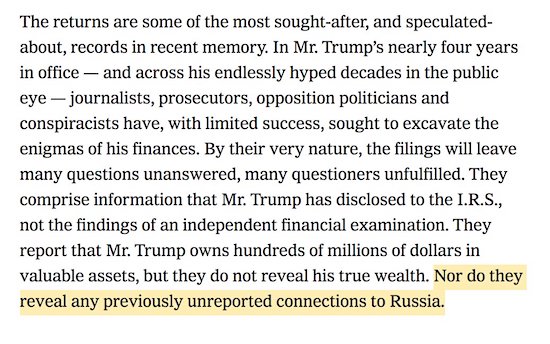

They do not.

• Russia Must Fear NATO – Poland (RT)

Russia should fear clashing with NATO because such a war would end in “inevitable defeat” for Moscow, Polish Foreign Minister Radoslaw Sikorski said in parliament on Thursday, claiming that the US-led military bloc has several times more troops and resources. Sikorski’s comments come as a number of European leaders have raised concerns that Russia may attack an EU member state if it is allowed to defeat Ukraine on the battlefield. “It is not we, the West, who should fear a clash with Putin, but the other way around,” he insisted, adding that “it is worth reminding [people] about this” to show that an attack by Russia on any NATO member would end in Moscow’s defeat. “Putin’s only hope is our lack of determination,” he stated. The minister said the US-led military bloc remains a “defensive pact,” but nevertheless boasted that it has three times as many military personnel, three times the aerial resources, and four times as many ships as Russia.

Polish Prime Minister Donald Tusk had previously also warned that Europe is in a “pre-war era,” while President Andrzej Duda has expressed the country’s readiness to host US nuclear weapons under NATO’s nuclear-sharing program. The move would place the bloc’s nuclear arsenal on the border of Belarus – a key Russian ally. Moscow has responded by stating that its military would take “all necessary countermeasures” to ensure its security if US nuclear weapons were deployed to Poland. Russian Foreign Ministry spokeswoman Maria Zakharova has also slammed Warsaw’s statements as a “provocation” and an attempt to “snuggle up” to Washington with its “deeply hostile policy towards Russia.” Russian President Vladimir Putin has repeatedly stated that Moscow has no plans to attack any US “satellites” in Eastern Europe, and insists that claims of a potential Russian invasion are merely government propaganda aimed at scaring citizens “to extract additional expenses from people, to make them bear this burden [of funding Ukraine] on their shoulders.”

So-so tanks.

• Congress Panics Over Ukraine as Russian Drones Kill Abrams Battle Tanks (Sp.)

The rush to fast-track $6 billion in military aid to Ukraine on Friday reflects the panic felt by the Biden administration and in Congress that the Zelensky regime’s forces are collapsing, veteran UK diplomat, former ambassador and political commentator Peter Ford told Sputnik. Reports that Russia’s unmanned aerial vehicles (UAVs) are now proving successful at targeting and destroying US-supplied Abrams Main Battle Tanks causes a lot of concerns among the Biden administration and Congress, according to Ford. “The haste to release billions of dollars of funds for Ukraine betrays US alarm at the dire situation facing its client state on the battlefront,” he said on Friday. On Tuesday, the US Senate passed a $95 billion bill containing approximately $61 billion in Ukraine-related funding, including via a loan. US President Joe Biden signed the bill into law on Wednesday.

The US Department of Defense later unveiled a $1 billion military aid package for Kiev, including cluster munitions and air defense supplies. In addition, the Pentagon announced on Friday its largest-ever $6 billion military aid package that will include interceptors for Ukraine’s Patriot and NASAMS systems, more counter-drone systems, significant amounts of artillery ammunition, and air-to-ground munitions. However, the move came amid reports that the Ukrainian armed forces moved Abrams tanks from the frontlines due to threats from Russian drones. Ford observed that the rush to send so many more advanced weapons systems to Ukraine came hard on the heels of these reports. “The announcement coincides with reports that the Ukrainians are withdrawing US Abrams tanks from the front because they have shown themselves to be vulnerable to drone attack,” the analyst highlighted.

However, the main US defense contractors were oblivious to the multiple failures of their weapons systems on the battlefields of Ukraine and were only interested in further expanding their already enormous profit margins, the ex-diplomat emphasized. “Never mind, the main aims are being achieved. Not to help Ukraine – how naive! – but to stuff billions of taxpayer dollars down the gullet of the arms manufacturers,” Ford clarified. The other purpose of the otherwise futile and too late new arms package was to give Biden domestic credibility before his re-election campaign against former President Donald Trump this fall, he explained. The $6 billion arms package was therefore meant “to make Biden look resolute and consistent as he positions himself for the presidential election campaign,” the analyst said. The people of Ukraine once again had become the victims of cynical and ruthless US political manipulations and intrigues, Ford stressed.

“..the former Ukrainian lawmaker estimates that about 1.5 million men of military age are currently on the run across Ukraine.”

• Ukraine’s Deep Manpower Shortage Overshadows Arms Deliveries (Sp.)

New arms deliveries from the US cannot compensate for Ukraine’s deep manpower shortage and exhaustion, Volodymyr Oleynyk, a Ukrainian politician and former member of the Verkhovna Rada, told Sputnik.

Although the lack of ammunition has been alleviated to some extent by foreign aid, Ukraine’s main weakness is an acute shortage of soldiers, the Western press acknowledges. Since the beginning of the special military operation, the Armed Forces of Ukraine (AFU) have lost nearly 500,000 servicemen, according to the Russian Defense Ministry. To make matters worse, Ukraine has been “plagued by draft dodging,” with young men evading conscription and failing to register as required, Politico reported in March. “Many [Ukrainian] commanders say that their combat units suffer from a 30-40% deficit in manpower,” Volodymyr Oleynyk told Sputnik.“Entire brigades break the law, violate orders and arbitrarily leave combat positions. Some of them are elite brigades. One of them was disbanded – the one that included the Right Sector*, which is considered very ‘patriotic’.” In recent months, there has been a significant increase in the number of Ukrainian troops using the special “Volga” 149.200 radio frequency to communicate their desire to disarm, according to Sputnik’s sources. The frequency was set up by Russian forces for Ukrainian troops wishing to surrender. Oleynyk quoted the head of the Ivano-Frankovsk regional military commissar as saying last month that some 30,000 potential conscripts were in hiding in the region. By 2020, Frankovshchyna will have a population of only 1.3 million. Doing the math, the former Ukrainian lawmaker estimates that about 1.5 million men of military age are currently on the run across Ukraine.

In addition, Ukrainian military personnel are increasingly deserting, Oleynyk added. “I’ve analyzed the situation for the first quarter of this year: about 20,000 criminal cases related to desertion have been opened over the past three months,” he said. “In general, it is believed that about 100,000 deserters are on the run. How many cases have been sent to court? Over these three months only 80 criminal cases were sent to court. This shows that even the judicial system does not want to consider these cases, because officials are afraid of later revenge by those convicted.”

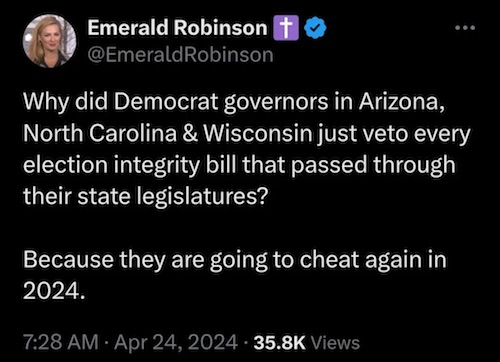

“..trying to blame Moscow for a wave of pro-Palestinian protests across the country..“

• Pelosi Insulting Americans – Zakharova (RT)

Former US House Speaker Nancy Pelosi is insulting American voters by trying to blame Moscow for a wave of pro-Palestinian protests across the country, Russian Foreign Ministry spokeswoman Maria Zakharova said on Friday. The senior Democrat has linked pro-Palestinian protests in the US with alleged foreign influence on multiple occasions, most recently in an interview with Irish public broadcaster Raidio Teilifis Eireann (RTE) this week. Pelosi also took issue with the ‘Genocide Joe’ nickname that US President Joe Biden has been branded with over his failure to pressure Israel into showing more restraint in its military campaign in Gaza. Pelosi acknowledged that pro-Palestinian sentiment could impact Biden’s support during the US presidential vote in November, and claimed that Russian President Vladimir Putin wanted the presumptive Republican candidate, Donald Trump, to be elected.

“It’s in Putin’s interest for – what’s his name? – to win. And therefore I see some encouragement on the part of the Russians of some of what is going on,” she alleged of the demonstrations. Pro-Palestinian activists are genuine in their feelings, she conceded, but “some of it has a Russian tinge to it.” Responding to Pelosi’s remarks in a social media post, Zakharova said they “can only be taken as an insult to the Americans and a disregard for democracy.”

In January, the former House speaker called on the FBI to investigate the financing of pro-Palestinian groups, claiming that their demands for a ceasefire in Gaza were “Putin’s message.” Pelosi was also caught on camera lashing out at hecklers outside her home, telling them to “go back to China,” supposedly where their “headquarters” were located. Biden’s approval ratings have taken a hit among Democratic voters over his pro-Israeli stance, although Pelosi insisted that the president has been “the biggest advocate for humanitarian assistance to Palestinians” amid the conflict in Gaza. “The groups outside with their protest lay some blame at his doorstep, when he is the only one advocating at that level,” she added.

This week, local authorities across the US used force to disperse pro-Palestinian rallies at university campuses, with mass arrests reported in some cases. Protesters were targeted at Yale, Harvard, the University of Texas at Austin, the University of Southern California, and other institutions. Israeli Prime Minister Benjamin Netanyahu has welcomed the US crackdown, branding the activists “anti-Semitic mobs” and comparing them to Nazi sympathizers in the 1930s. Putin has publicly stated that he would be more comfortable with “predictable” and “old-school” Biden than Trump as the next US president.

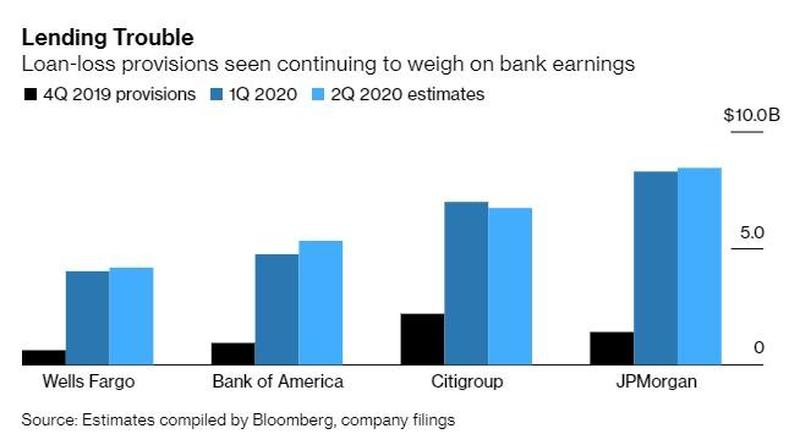

Your bank spies on you…

• US Congress Probing 13 Banks For January 6 ‘Collusion’ (RT)

Republicans in the House of Representatives have sent letters to 13 financial institutions they suspect of colluding with the FBI and the Treasury Department to spy on Americans without a warrant in relation to the 2021 Capitol riot. Supporters of then-President Donald Trump had stormed the legislature just as Republican lawmakers were starting to register objections to certifying the 2020 election in favor of Joe Biden. Democrats labeled the unrest as an “insurrection” and sought to arrest over 1,000 people involved in any way. Some of these people were apparently targeted by financial institutions working with the FBI and Treasury’s Financial Crimes Enforcement Network (FinCEN), according to the House Select Subcommittee on the Weaponization of the Federal Government, led by the Judiciary Committee chair Jim Jordan (R-Ohio).

“The Committee and Select Subcommittee remain concerned about how and to what extent federal law enforcement and financial institutions continue to spy on Americans by weaponizing backdoor information sharing and casting sprawling classes of transactions, purchase behavior, and protected political or religious expression as potentially ‘suspicious’ or indicative of ‘extremism’,” said a letter from Jordan, which the Daily Mail obtained exclusively on Thursday. Jordan has pointed to evidence that the FBI and FinCEN instructed banks to look for purchases of Bibles or search terms such as “Trump” or “MAGA,” the acronym for the 45th president’s campaign slogan, “Make America Great Again.” Congress was already investigating Bank of America, Chase, US Bank, Wells Fargo, Citi Bank and Truist. Thursday’s letter was sent to Charles Schwab, HSBC, Mitsubishi UFJ Financial Group, PayPal, Santander, Standard Chartered and Western Union. That makes 13 banks or financial institutions potentially involved in the dragnet.

Bank of America alone sent data on 211 individuals to the FBI and FinCen by January 17, 2021. However, its Suspicious Activity Report (SAR) was sent after the federal agencies asked banks to look for “extremist” purchases. Four of the 211 were tagged for a follow-up and visited by FBI agents. None of them ended up being charged with anything. “This kind of warrantless financial surveillance raises serious concerns about the federal government’s respect for Americans’ privacy and fundamental civil liberties,” Jordan wrote in a separate letter to Treasury Secretary Janet Yellen, also obtained by the Daily Mail. Since 2021, the FBI has targeted “radical-traditionalist Catholics” as well as parents who spoke up at school board meetings – on issues such as mask mandates or critical race theory – as potential domestic terrorists. Both programs were officially denounced after being revealed by whistleblowers.

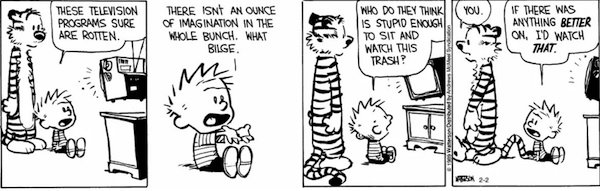

” What future can such a collection of morons have?”

• Biden: White Americans Are the Threat (Paul Craig Roberts)

The Main Goal of the Biden Regime Is to Sell-out the Majority White American Population and to declare them as a menace. Tucker Carlson points out that president Biden, illegitimately in office due to the theft of the 2020 election, has as president of the United States defined America’s majority white population as the major cause of racism and a threat to national unity. Note: it is the majority that is the threat. Yet, tens of millions of dumbshit white Americans designated as America’s worst threat by Biden vote for him. What future can such a collection of morons have?

A white heterosexual who votes for Biden is expressing a death wish. It is the US whose Democrat Government is alienated from its own white majority population that intends to fight wars against Russia, Iran, and China. This is insanity. Who is going to fight these wars for Biden? The answer is Europeans and the immigrant-invaders into America thanks to Biden’s open border policy. Like Rome in its own self-inflicted decay, the US will be dependent on troops from the immigrant-invaders overrunning its own borders to fight its wars abroad in defense of the borders of foreign countries.

There is no discussion of this whatsoever.

Ep. 98 There is systemic racism in the United States, against whites. Everyone knows it. Nobody says it. How come? pic.twitter.com/hSrU9BPVb4

— Tucker Carlson (@TuckerCarlson) April 24, 2024

Swan

Swan coming to a smooth, stompy landing on a lake pic.twitter.com/ootjEnNYjC

— Nature is Amazing ☘️ (@AMAZlNGNATURE) April 25, 2024

Tokyo

If you feel sad remember this dog owns a shop in Tokyo pic.twitter.com/KlIVmS5t9s

— non aesthetic things (@PicturesFoIder) April 25, 2024

Fukuoka Imaya Hamburger

The cheapest and most delicious long-established hamburger shop in Japan run by a grandfather for 50 years.

[📍 Fukuoka Imaya Hamburger West Park]

[📹 harapeko_kc]pic.twitter.com/chtyA0K1HM— Massimo (@Rainmaker1973) April 26, 2024

70 meters

A 19th-century building in Jinan, Shandong Province, China, was moved over 70 meters horizontally

pic.twitter.com/k3ztkPzDnW— Science girl (@gunsnrosesgirl3) April 26, 2024

Tusk

It looks a lot like a Mammoth.

The largest tusked Elephant.

Amboseli National Park, Kenya.pic.twitter.com/w7rFcalFpD— Figen (@TheFigen_) April 25, 2024

Rope

Kindness pic.twitter.com/wfOs56aAcP

— The Best (@ThebestFigen) April 26, 2024

Drink of water

A man noticed that his neighbor’s cats were coming to his property to drink water so he set up a camera to see who else was drinking water… pic.twitter.com/alTi4IWCJt

— Nature is Amazing ☘️ (@AMAZlNGNATURE) April 26, 2024

Support the Automatic Earth in wartime with Paypal, Bitcoin and Patreon.