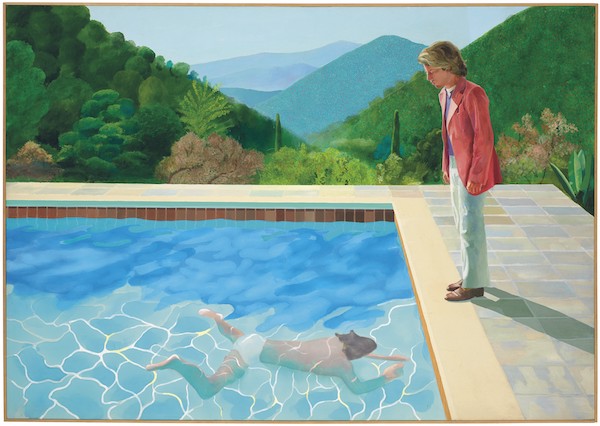

David Hockney Portrait of an Artist (Pool with Two Figures) 1972

Every single news outlet seems to carry a piece on this, and not a single one of them has bothered to do due diligence. They all just stick to the narrative, even if it’s been exposed as false. Every story mentions Mueller and Russia (some even mention terrorism), though it’s crystal clear that Mueller has nothing that links Assange to Russia, least of all that he got files from Russians. Fabricating an Assange-Russia link is needed for US intelligence and media lest the entire collusion story falls to bits. Mueller issued indictments against Russians he knew would never show up to deny or confirm, and he didn’t even have the guts to mention WikiLeaks, but labeled them Company 1. As Mueller knew Assange was safely incommunicado, and wouldn’t be able to deny or confirm. Mueller’s a liar and a coward. A common profile at the FBI, it seems. And the media; they stand up for Khashoggi and let Assange rot.

• Julian Assange Has Been Charged, Prosecutors Reveal Inadvertently (WaPo)

WikiLeaks founder Julian Assange has been charged under seal, prosecutors inadvertently revealed in a recently unsealed court filing — a development that could significantly advance the probe into Russian interference in the 2016 election and have major implications for those who publish government secrets. The disclosure came in a filing in a case unrelated to Assange. Assistant U.S. Attorney Kellen S. Dwyer, urging a judge to keep the matter sealed, wrote that “due to the sophistication of the defendant and the publicity surrounding the case, no other procedure is likely to keep confidential the fact that Assange has been charged.” Later, Dwyer wrote the charges would “need to remain sealed until Assange is arrested.”

Dwyer is also assigned to the WikiLeaks case. People familiar with the matter said what Dwyer was disclosing was true, but unintentional. Joshua Stueve, a spokesman for the U.S. attorney’s office in the Eastern District of Virginia, said, “The court filing was made in error. That was not the intended name for this filing.” Federal prosecutors in the Eastern District of Virginia have long been investigating Assange and, in the Trump administration, had begun taking a second look at whether to charge members of the WikiLeaks organization for the 2010 leak of diplomatic cables and military documents that the anti-secrecy group published. Investigators also had explored whether WikiLeaks could face criminal liability for the more recent revelation of sensitive CIA cybertools.

Horse, barn.

• IMF Issues Stark Warning On Leveraged Loans (F.)

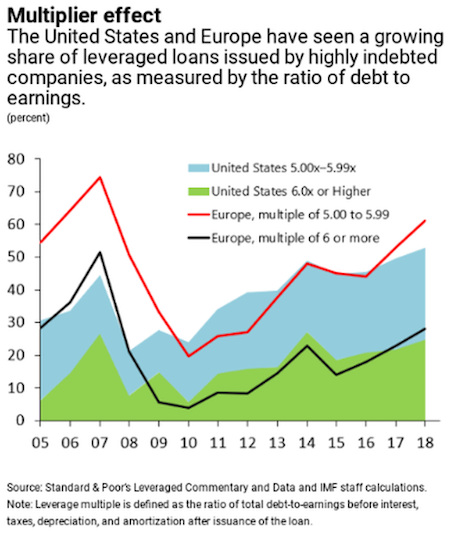

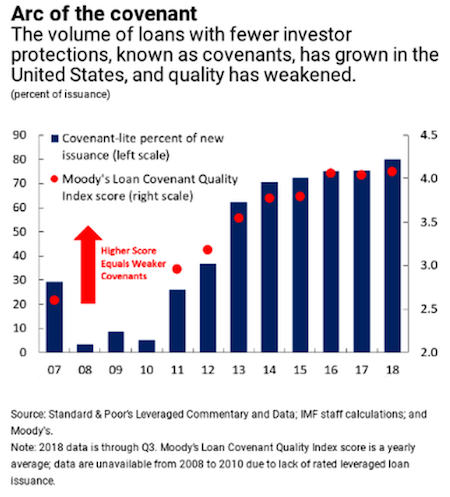

An unusually blunt warning about the massive market in leveraged loans from a normally-circumspect IMF should give investors pause at a time of rising concern about global financial stability. Fund economists Tobias Adrian, Fabio Natalucci and Thomas Piontek have published a new blogpost highlighting some fairly alarming trends. “We warned in the most recent Global Financial Stability Report that speculative excesses in some financial markets may be approaching a threatening level. For evidence, look no further than the $1.3 trillion global market for so-called leverage loans, which has some analysts and academics sounding the alarm on a dangerous deterioration in lending standards. They have a point.

“This growing segment of the financial world involves loans, usually arranged by a syndicate of banks, to companies that are heavily indebted or have weak credit ratings. These loans are called ‘leveraged’ because the ratio of the borrower’s debt to assets or earnings significantly exceeds industry norms.” Adrian, a former New York Fed economist and now Director of the Monetary and Capital Markets Department, alluded to some of these risks during a presentation at the CATO Institute’s 36th Annual Monetary Conference held on Thursday in Washington.

“With interest rates extremely low for years and with ample money flowing though the financial system, yield-hungry investors are tolerating ever-higher levels of risk and betting on financial instruments that, in less speculative times, they might sensibly shun,” Adrian and his colleagues write. “Speculative-grade companies have been eager to load up on cheap debt. Globally, new issuance of leveraged loans hit a record $788 billion in 2017, surpassing the pre-crisis high of $762 billion in 2007. The United States was by far the largest market last year, accounting for $564 billion of new loans.”

Why speak out now? She’s had 10 years to do it.

• Elizabeth Warren Says Fed Makes Same Mistakes As Before The Crisis (CNBC)

Ahead of the financial crisis, a buildup of leverage on bank balance sheets that went largely undetected by regulators helped cause the worst downturn since the Great Depression. Sen. Elizabeth Warren is afraid the same thing is happening again a decade later. The Massachusetts Democrat said Thursday that she thinks the Federal Reserve and its fellow watchdogs of the financial system are overlooking a dangerous buildup of loans going to companies that are already deeply in debt. The so-called leveraged loans helped undermine the financial system before and are building up again, now totaling $1.1 trillion. In a face-to-face hearing with Fed Governor Randal Quarles, vice chairman of supervision and thus the central bank’s leading bank regulator, Warren said she is worried about a lack of oversight.

“I’m not sure that I see much distinction between what you’re doing now and what the Fed was doing in pre-2008, and I think that’s deeply worrisome,” she said. “I’m very concerned that the Fed dropped the ball before and they may be dropping it one more time.” Leveraged lending actually has declined in 2018 from its blistering pace the year before. Total volume in the third quarter hit $177 billion, a 40 percent slide compared with the record pace of the same period in 2017, according to Thomson Reuters. Issuance so far this year is tracking at $930 billion, which is a 12 percent decline from a year ago. Institutional share of leveraged loans edged lower to 58 percent in the third quarter, against 60 percent from 2017.

Yeah, we can never have enough cars.

• Global Auto Industry Collapse Continues (ZH)

The outlook for the global automobile market has been increasingly dire lately, especially after a third quarter that saw sales drop in many major markets across the globe, including China. Now, the latest data from Europe suggests that the difficulties may be nowhere close to over despite optimistic fourth quarter guidance by companies like Volkswagen and Daimler AG. Deliveries of new passenger cars were down 7.4% in the EU and the European Free Trade Association in October from the year prior. This adds to a 23% drop that occurred during September according to data from the European Automobile Manufacturers Association, and which was so acute it led to the first negative GDP print for Germany since 2015.

Despite the ongoing sales weakness, which many attribute to one-time events, some analysts – like those at EY Consultancy – still expect the market to turn around in the fourth quarter. They argue that new emissions testing cited by many companies as the reason for disappointing sales, will only have a temporary effect. At the same time, Citigroup analyst Angus Tweedie thinks the downside is not over for companies like BMW and Daimler AG, according to Bloomberg. In a note titled “The Golden Age Ends With a Crash”, Tweedie wrote that “Heading into 2019 we see few remaining avenues of maneuver, and with volume growth slowing in most markets believe the scale of pressures will become obvious.”

Lots of Brexit stories again today. May has left open an open vote for her allies.

• Brexit Poll: Remain Takes Big Lead Over Leave, 60% Back 2nd Referendum (Ind.)

A growing majority of voters would back the UK remaining in the European Union if a fresh referendum was held, a poll suggests. Support for the UK staying in the bloc was at 54 per cent, according to a YouGov survey carried out after Theresa May’s withdrawal agreement text was published on Wednesday night. The poll found 46 per cent would back the Leave side – down two percentage points compared with a survey conducted in August. Almost six in ten (59 per cent) also backed holding a fresh referendum – once “don’t knows” were discounted – the poll, commissioned by the People’s Vote and published in the Evening Standard, found. If Ms May’s deal is voted down by MPs, that gap widened to 64 per cent to 36 per cent, excluding don’t knows.

She’s going to face a confidence vote. And then another.

• Theresa May Braced For More Cabinet Resignations After Day Of Chaos (Ind.)

Theresa May is braced for further cabinet resignations that would spark a challenge to her premiership, after a day of drama that left her Brexit strategy on the verge of collapse. Michael Gove was considering whether to quit, after apparently refusing to take the job of Brexit secretary – dramatically vacated by Dominic Raab – when the prime minister rejected his demands. The environment secretary is believed to have called for Ms May’s draft agreement to be ripped up and renegotiated, and for the cancellation of the 25 November summit with the EU which is intended to seal the deal. Mr Gove left a meeting with the prime minister without an appointment being made – with Penny Mordaunt, the international development secretary, also thought to be still considering quitting.

A defiant Ms May staged a press conference at which she vowed to fight any vote of no confidence in her, saying: “Am I going to see this through? Yes.” Likening herself to the famously stubborn England batsman Geoffrey Boycott, her cricketing hero, she told reporters: “What do you know about Geoffrey Boycott? Geoffrey Boycott stuck to it and he got the runs in the end.”Earlier, Jacob Rees-Mogg, the leading Tory Brexiteer, announced he had submitted a letter of no confidence in the prime minister – creating an expectation that the trigger point of 48 letters would be reached.

However, the threshold was not breached, putting off a vote of no confidence by all 314 other Conservative MPs until Monday at the earliest. Although Ms May is still expected to win such a contest, a large number of Tories rejecting her leadership – perhaps 100 – might still damage her fatally. His position was rocked by seven resignations, with Esther McVey, the work and pensions secretary, quickly following Mr Raab out of the cabinet. Two junior ministers, two unpaid aides and a trade envoy also quit.

Once people begin to understand how deep the hole is that the UK is in, the pound will really be pounded.

• Pound Tumbles As UK Markets Suffer Brexit Deal Volatility (G.)

Britain’s financial regulator has been in contact with City firms as a raft of resignations over Theresa May’s Brexit deal hit markets, sending the pound lower and putting UK housebuilders on track for their worst one-day drop since 2016. The Financial Conduct Authority (FCA) is understood to have been in touch with stock exchanges, bigger banks, and asset management companies regarding market volatility. An FCA spokesman said: “As you would expect in this type of situation we have regular contact with firms and will continue to engage with them.” Investors were offloading shares in FTSE-quoted companies with large domestic businesses and UK currency holdings in an effort to reduce their exposure to the British economy.

Royal Bank of Scotland was the biggest faller on the FTSE 100, with shares closing down 9.6% at 224p. The market value of the bank, still 62% owned by the government, fell by £2.8bn in Thursday’s sell-off. Housebuilders Persimmon, Taylor Wimpey and Barratt Developments all closed down more than 7%, with Berkeley Group falling more than 6%. The four FTSE 100 housebuilders lost £1.6bn collectively from their market capitalisations. The pound also took a tumble against major international currencies, dropping from above $1.30 to less than $1.28 against the US dollar by Thursday afternoon, a drop of 1.9%. Against the euro, sterling fell by 2% to just under €1.13.

Excellent and scary Brexit background. The stupid idea of empire just won’t die. Britain is either an empire or a colony. There’s nothing in between.

• The Paranoid Fantasy Behind Brexit (Fintan O’Toole)

Before the narrative of Len Deighton’s bestselling thriller SS-GB begins, there is a “reproduction” of an authentic-looking rubber-stamped document: “Instrument of Surrender – English Text. Of all British armed forces in United Kingdom of Great Britain and Northern Ireland including all islands.” It is dated 18 February 1941. After ordering the cessation of all hostilities by British forces, it sets down further conditions, including “the British Command to carry out at once, without argument or comment, all further orders that will be issued by the German Command on any subject. Disobedience of orders, or failure to comply with them, will be regarded as a breach of these surrender terms and will be dealt with by the German Command in accordance with the laws and usages of war.”

Written amid the anxieties of Britain’s early membership of the European Communities and published in 1978, Deighton’s thriller sets up two ideas that will become important in the rhetoric of Brexit. Since there is no sense that Deighton has a conscious anti-EU agenda, the idea seems to arise from a deeper structure of feeling in England. One is the fear of the Englishman turning into the “new European”, fitting himself into the structures of German domination. His central character is a harbinger of the “rootless cosmopolitan” who cannot be trusted to uphold English independence and English values, and who therefore functions as the enemy within, the quisling class of pro-Europeans. This is the treason of the elite, the puppet politicians and sleek mandarins who quickly accommodate themselves to the new regime.

Deighton was building on real historical memories of the appeasers whose prewar conduct makes the notion that they would have quickly become collaborators in the event of a defeat to the Nazis highly credible. This idea of a treacherous elite would later ferment into a heady and intoxicating brew of suspicion that the Brexiteers would both dispense to the masses and consume themselves. The other crucial idea here is the vertiginous fall from “heart of Empire” to “occupied colony”. In the imperial imagination, there are only two states: dominant and submissive, coloniser and colonised. This dualism lingers. If England is not an imperial power, it must be the only other thing it can be: a colony.

More of the idiotic empire stuff. Just give back what you’ve stolen, you morons. Yeah, the Parthenon marbles too. You stole them from a European Union member. Put your Stonehenge thingy in the British Museum, not other people’s rightful possessions. Bunch of ordinary thieves.

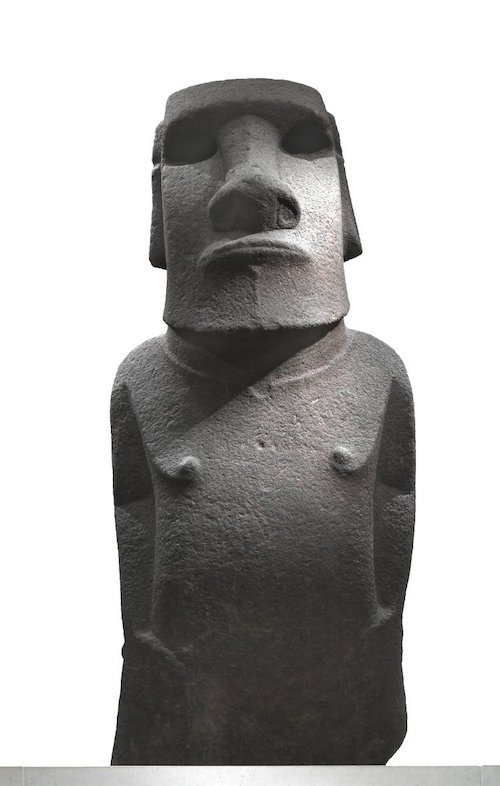

• Easter Island People To Head To London To Request Statue Back (G.)

Towering at the entrance of the British Museum’s Wellcome gallery is a 2.5-metre basalt statue from Easter Island. For indigenous Rapa Nui islanders, such statues – known as moai – carry the spirit of prominent ancestors and are considered the living incarnation of their relatives. Next week, a delegation from the island – which has been part of Chile since 1888 and is officially known as Rapa Nui – will travel to London to request the moai’s return, emboldened by the backing of the Chilean government and the museum’s willingness to engage in talks for the first time since it acquired the statue in 1869.

“We want the museum to understand that the moai are our family, not just rocks. For us [the statue] is a brother; but for them it is a souvenir or an attraction,” says Manutomatoma, who serves on the island’s development commission. “Once eyes are added to the statues, an energy is breathed into the moai and they become the living embodiment of ancestors whose role is to protect us.” Having spent 150 years away from its home, the statue – known as Hoa Hakananai’a –has become the focal point of a movement to return the moai which has steadily gathered momentum since August, when the island’s mayor, Pedro Edmunds, wrote to the museum requesting the statue’s return. Among the proposals the delegation will bring to the table is the idea of a replica statue being carved by artisans on the island to take the place of Hoa Hakananai’a.

Hoa Hakananai’a (‘lost or stolen friend’) c. 1000-1200 AD

Brexit is playing out in a 3rd world nation. That explains a lot. But it doesn’t explain why Jeremy Corbyn doesn’t lead in the polls.

• It Took A UN Envoy To Hear How Austerity Is Destroying Lives (G.)

Over the weekend, I asked Alston whether he heard any echoes between British experiences and the testimonies he heard last December while investigating Donald Trump’s US. “In many ways, you in the UK are far ahead of the US,” he said. He thinks “the Republicans would be ecstatic” to have pushed through the kind of austerity that the Tories have inflicted on the British. Like others at the Guardian, I have been writing on the debacle of austerity Britain for years now. Rather than the goriest details, what strikes me is how normalised our country’s depravities have become over the course of this decade. Ordinary people speak in ordinary voices about horrors that are now quite ordinary.

They go to food banks, which barely existed before David Cameron took office. Or they go days without food even in London, the city that has more multi-millionaires than any other. They spend their wages to rent houses that have mice or cockroaches or abusive landlords. Any decent society would see these details are shocking; yet they no longer shock anyone in that hall. What will remain with me of that afternoon is the sheer prosaic weight of the abuse being visited on ordinary people who could be my friends or family. Alston has heard so many stories about the toxic failings of universal credit and the malice that is the disability benefits assessment scheme that he is in no doubt about the truth.

The question for McVey, who is due to meet the UN party this week, will be how she responds to the weight of people’s lived experience. None of those giving evidence this afternoon want victim status. They are, as Trinity says, “survivors”. What they want is to be heard – and after that they want remedies. [..] the government, like most of the press, didn’t want the truth to be acknowledged – because then it would be compelled to act. This is what Britain has been reduced to: hoping that a foreigner has the stomach and integrity to hear and record our decade of shame.

This is the rage that Corbyn should be talking about 24/7. Instead of giving interviews on how Brexit can’t be stopped.

• Rage Against The Cruelty Of So-Called Austerity (G.)

Outrage, anger, despair, shame, impotence [..] The truths consequent on the savage, unnecessary, uncaring cuts to public services are not hidden away but confront us daily. Welfare benefits slashed, millions dependent on food banks. Libraries, museums, childcare centres, youth clubs, swimming pools consigned to the scrapheap; road repairs and park budgets cut, bus routes terminated. In Darley Dale a helpful notice tells us that the lavatory is closed and the nearest one is 2.1 miles away. The true story is that of a government that has chosen private profit over civic services, while it wreaks an assault on the services that make towns and communities good places to live.

In a 2015 Guardian article about benefits, sanctions and food banks, Ken Loach called for “public rage” and spoke about “conscious cruelty”. The word “austerity” has allowed the government to disguise both intent and outcome. In its original meaning “austerity” suggests plainness and simplicity, a cosy view of cutting back, perhaps a mythical wartime pulling together. “Austerity” is now a weasel word used to promote the Tory rhetoric that there is no alternative, that anaesthetises public anger as we are led to believe that there is no choice. There must be a new script. We should ban the word.

Want to lose credibility? This is an excellent way. Assange and Gülen turned into trade objects.

• US Studying Turkey’s Demands To Extradite Preacher Gülen (AFP)

The United States is studying Turkey’s demands for the extradition of preacher Fethullah Gulen, who is accused by Ankara of orchestrating a failed 2016 coup attempt, the State Department said Thursday. But spokeswoman Heather Nauert rejected the allegation in an NBC report that the White House is seeking a way to extradite Gulen — who reportedly has a US Green Card — in a bid to reduce Turkish pressure on Saudi Arabia over the murder of a dissident journalist. “We have received multiple requests from the Turkish government… related to Mr Gulen,” Nauert said.

“We continue to evaluate the material that the Turkish government presents requesting his extradition,” she said. But Nauert insisted that “there is no relation” between the Gulen extradition issue and Turkish pressure on Saudi Arabia over the murder of journalist Jamal Khashoggi at the kingdom’s consulate in Istanbul. The White House “has not been involved in any discussions related to the extradition of Fetullah Gulen,” she said. NBC, citing four anonymous sources, reported that Trump administration officials had asked law enforcement agencies about “legal ways of removing” Gulen, 77, from the US to persuade Turkey’s president “to ease pressure on the Saudi government.”

9,300 more lawsuits to go. Better combine a few.

• California Judge Orders Next Monsanto Weed-Killer Cancer Trial For March (R.)

A California judge on Thursday granted an expedited trial in the case of a California couple suffering from cancer who sued Bayer AG’s Monsanto unit, alleging the company’s glyphosate-containing weed killer Roundup caused their disease. The order by Superior Court Judge Ioana Petrou in Oakland, California, comes on the heels of a $289 million verdict in the first glyphosate trial in San Francisco, in which a jury found Monsanto liable for causing a school groundskeeper’s cancer. Damages were later reduced to $78 million, and Bayer, which denies the allegations, said it would appeal the decision. Its share price, however, has dropped nearly 30 percent since the Aug. 10 jury verdict and the company faces some 9,300 U.S. glyphosate lawsuits.

Petrou’s ruling clears the way for the second California jury trial over glyphosate, the world’s most widely used weed killer. The trial of California residents Alva and Alberta Pilliod is scheduled to begin on March 18, 2019, according to a court filing. Glyphosate jury trials will ramp up next year. The company is scheduled to face jurors in a Missouri state court in St. Louis, where the first trial was set to begin in early February. That date, however, was vacated by a judge, Bayer said, and the trial is likely to be postponed to later in 2019. A trial in San Francisco federal court, where federal Roundup lawsuits are consolidated, is scheduled to begin at the end of February.

If it wasn’t clear yet what a worthless piece of dung John Kerry has always been: it’s not the climate that drives African to Europe, it’s US warfare, interventions and arms sales.

• John Kerry: Europe Must Tackle Climate Change Or Face Migration Chaos (G.)

Europe faces even deeper political turmoil and the possibility of mass migration from Africa unless the world urgently addresses the threat of climate change, the former US secretary of state John Kerry said on Thursday. Speaking at a Guardian Live event, he said he was deeply disturbed at how issues such as climate change, cyber wars and the future of the oceans were not ballot box issues, admitting it was hard to translate these issues into an acceptable set of choices for voters. Kerry said: “We are heading for catastrophe unless we respond to some life-threatening challenges very rapidly. We have a climate-denying president that pulls us out of the the Paris climate change agreement at a time when literally every day matters.

“Europe is already crushed under this transformation that is taking place due to migration. In Germany Angela Merkel is weakened. Italian politics is significantly impacted. “Well, imagine what happens if water dries up and you cannot produce food in northern Africa. Imagine what happens if Nigeria hits its alleged 500 million people by the middle of the century … you are going to have hordes of people in the northern part of the Mediterranean knocking on the door. I am telling you. If you don’t believe me, just go read the literature.” The former secretary of state for the Obama administration reminded his audience that climate change scientists had just warned that historically unprecedented steps were needed to prevent an extra 0.5C (32.9F) degrees increase.