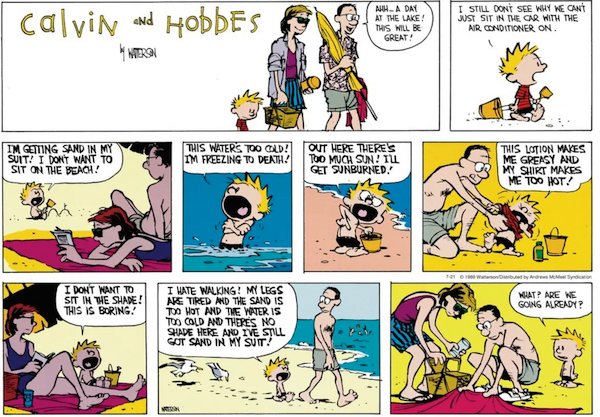

Henri Matisse Harmony in red 1908

GVB

https://twitter.com/i/status/1608247624544526336

Anecdotals

https://twitter.com/i/status/1608529574286999553

“Ukraine is losing soldiers at a rate 141 TIMES that of U.S. losses in Vietnam.”

• We’ve Reached Peak Zelensky. Now What? (Freeman)

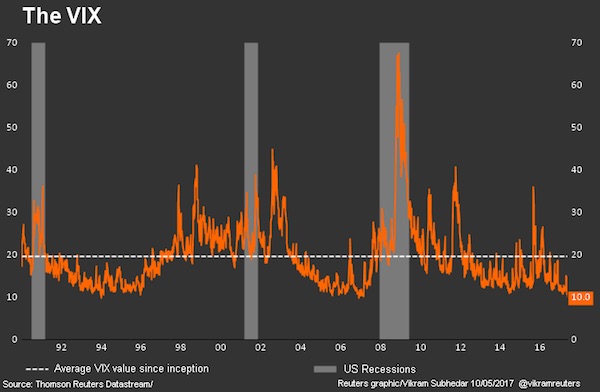

When the president of the poorest, most corrupt nation in Europe is feted with multiple standing ovations by the combined Houses of Congress, and his name invoked in the same breath as Winston Churchill, you know we’ve reached Peak Zelensky. It’s a farcical, almost psychotic over-promotion, probably surpassed only by the media’s shameful, hyperbolic railroading of the country into war with Iraq, in 2003. Paraphrasing Gertrude from Hamlet, “Methinks the media doth hype too much.” Let’s remember that before ascending to his country’s presidency, Volodymyr Zelensky’s greatest claim to fame was that he could play the piano with his penis. I’m not joking. And he ran on a platform to unite his country for peace, and for making amends with Russia. Again, I’m not joking.

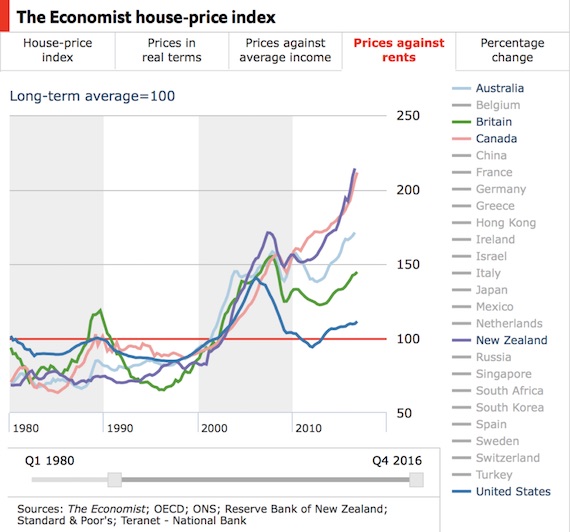

Now, he’s Europe’s George Washington, FDR and Douglas MacArthur all rolled into one and before whom the mighty and powerful genuflect. Please. The only place to go from here is down. And, that is surely coming. Soon. Consider some inconvenient facts that the fawning media, which is essentially the public relations arm of the weapons industry, doesn’t want you to know. The European Commission president, Ursula von der Leyen, recently let slip that the Ukrainian army has lost more than 100,000 troops in the eight months since the beginning of the war. Over the nine-year span of the Vietnam War, the U.S. with a population six times that of Ukraine, lost a total of 58,220 men. In other words, on a per day, per capita basis, Ukraine is losing soldiers at a rate 141 TIMES that of U.S. losses in Vietnam.

The U.S. lost the public on Vietnam when middle class white boys began coming home in body bags. Does anybody with half a brain believe such losses in Ukraine are sustainable? Does anybody have another plan to avert such slaughter? Von der Leyen is shrewdly laying the predicate for Western withdrawal from Ukraine and ending the war. If you look at the facts on the ground, not the boosterish propaganda ladled out by the media, you can understand why. In a matter of weeks, Russia, with its hypersonic missiles, destroyed half of Ukraine’s electrical power infrastructure. This, as winter is coming on. It can just as easily take out the other half, effectively bombing Ukraine back into the Stone Age. Is that what anybody wants?

The startling, indeed, terrifying part of this is that neither Ukraine nor the West have any defense against these hypersonic missiles. They travel so fast, and on variable trajectories, they cannot be shot down, even by the most advanced Western systems. They represent one of the greatest asymmetries in deliverable destructive power in the history of warfare, probably dwarfed only by the U.S.’s possession of atomic bombs at the end of World War II. Again, there is no effective defense against them. The Russians have them. The Ukrainians don’t. Game over. Can you understand why leaders in the West are beginning to wake up?

Churchill

When Zelensky visited the US, establishment media and political voices lined up to declare him the new Winston Churchill: (via the Tucker Carlson Show) pic.twitter.com/lOMF5IbWh8

— Aaron Maté (@aaronjmate) December 29, 2022

“..Russia is similar to Nazi Germany and has to be defeated militarily..”

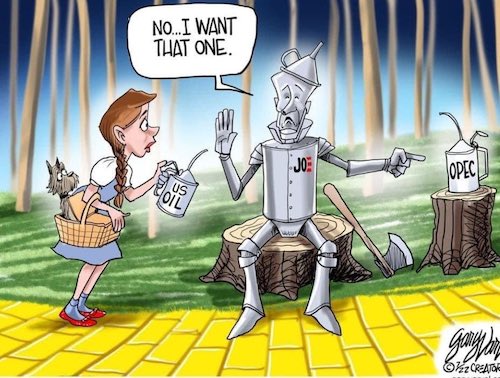

• World Could Reach ‘Critical Mass’ At Any Moment – Ex-Polish President (RT)

The world is in chaos and could reach “critical mass” anytime, former Polish President Aleksander Kwasniewski has warned, citing the turbulence created by the Ukrainian crisis. The conflict has put an end to the old world order, the former head of state said during a TV interview on Thursday. “In short, we are in a time of dangerous chaos,” he concluded. “If we add further unrest, such as on the Serbian border, the critical mass may be easily exceeded.” The very fact that the possibility of a new world war is now being discussed is terrifying, he believes. Kwasniewski started his political career in Soviet times as a Polish youth organizer, and after the fall of communist rule, was elected to lead the country for two terms between 1995 and 2005.

He blamed Russia for the crisis in Ukraine and praised US President Joe Biden for leading Western nations in opposition to Moscow. The former politician claimed that Russia “turned out to be not so strong.” Poland, in turn, “is doing what it can do” to help Ukraine and the effort is being appreciated, he said. Kwasniewski cited a letter he received from former Ukrainian President Leonid Kuchma as evidence, in which he called Poles “true friends of Ukraine.” The Polish government has been one of the most vocal supporters of Kiev and has spared no words in accusing Russia of various misdeeds. Prime Minister Mateusz Morawiecki has claimed that Russia is similar to Nazi Germany and has to be defeated militarily. Warsaw has also offered to host US nuclear weapons on its soil, but Washington has said it has no plans for such a deployment.

Moscow sent its troops into Ukraine in late February, citing what it calls NATO’s creeping expansion into the country as one of the main reasons. Russia has accused Western nations of torpedoing peace talks with Kiev. The US and its allies want to hurt Russia as much as possible and are using Ukrainians as “cannon fodder” Russian President Putin has declared.

Long history.

• On the Influence of Neo-Nazism in Ukraine (Lauria)

The U.S. relationship with Ukrainian fascists began after the Second World War. During the war, units of the Organization of Ukrainian Nationalists (OUN-B) took part in the Holocaust, killing at least 100,000 Jews and Poles. Mykola Lebed, a top aide to Stepan Bandera, the leader of the fascist OUN-B, was recruited by the C.I.A. after the war, according to a 2010 study by the U.S. National Archives. The government study said, “Bandera’s wing (OUN/B) was a militant fascist organization.” Bandera’s closest deputy, Yaroslav Stetsko, said: ““I…fully appreciate the undeniably harmful and hostile role of the Jews, who are helping Moscow to enslave Ukraine…. I therefore support the destruction of the Jews and the expedience of bringing German methods of exterminating Jewry to Ukraine….”

The study says: “At a July 6, 1941, meeting in Lwów, Bandera loyalists determined that Jews ‘have to be treated harshly…. We must finish them off…. Regarding the Jews, we will adopt any methods that lead to their destruction.’” Lebed himself proposed to “’cleanse the entire revolutionary territory of the Polish population,’ so that a resurgent Polish state would not claim the region as in 1918.” Lebed was the “foreign minister” of a Banderite government in exile, but he later broke with Bandera for acting as a dictator. The U.S. Army Counterintelligence Corps termed Bandera “extremely dangerous” yet said he was “looked upon as the spiritual and national hero of all Ukrainians….” The C.I.A. was not interested in working with Bandera, pages 81-82 of the report say, but the British MI6 was.

“MI6 argued, Bandera’s group was ‘the strongest Ukrainian organization abroad, is deemed competent to train party cadres, [and] build a morally and politically healthy organization….’” An early 1954 MI6 summary noted that, “the operational aspect of this [British] collaboration [with Bandera] was developing satisfactorily. Gradually a more complete control was obtained over infiltration operations…” Britain ended its collaboration with Bandera in 1954. West German intelligence, under former Nazi intelligence chief Reinhard Gehlen, then worked with Bandera, who was eventually assassinated with cyanide dust by the KGB in Munich in 1959. Instead of Bandera, the C.I.A. was interested in Lebed, despite his fascist background. They set him up in an office in New York City from which he directed sabotage and propaganda operations on the agency’s behalf inside Ukraine against the Soviet Union.

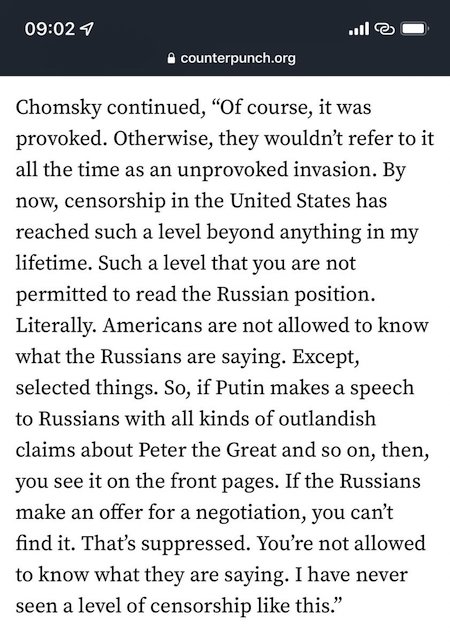

No doubt.

• Lavrov Suggests ‘Hundreds’ Of US Troops Are In Ukraine (RT)

Russian Foreign Minister Sergey Lavrov has alleged that “hundreds” of American servicemen are deployed to Ukraine, claiming that US soldiers, military advisers and intelligence officers have long been direct participants in the conflict. Sitting down with Russia’s Channel One for an interview on Wednesday, Lavrov spoke at length about Washington’s deep involvement in the hostilities in Ukraine, which has steadily grown despite repeated assurances from American leaders that US personnel would have no role in the fighting. “Dozens, maybe even hundreds of American troops are in Ukraine, they were there even before the coup,” the FM said, referring to the 2014 ouster of Ukrainian President Viktor Yanukovich by nationalist formations and pro-Western activists. “CIA officers occupied at least one floor in the Security Service of Ukraine.”

Lavrov also claimed that the US military attache based in Kiev has provided significant advice to Ukrainian authorities, saying “Military specialists are obviously engaged not only in making visits to the Ministry of Defense of Ukraine, but, of course, in one way or another they provide direct advisory, and maybe even more than advisory, services.” He noted that a separate team of US specialists has traveled to Ukraine to monitor the flow of Western arms to the country, created after American lawmakers demanded a more robust mechanism for tracking billions in lethal aid. Given that “Ukraine is receiving more and more and better Western weapons,” the FM said Russian forces are now formulating plans to disrupt the arms shipments, adding that “Railway lines, bridges and tunnels” are being considered as targets to “make these deliveries more difficult or, ideally, stop them altogether.”

Lavrov went on to argue that Western states declared “war” on Russia nearly a decade ago, soon after the 2014 Euromaidan revolution, which was soon followed by US and NATO military support to the post-coup government. “The collective West, which is headed by a nuclear power – the United States – is at war with us,” he said. “This war was declared on us quite a long time ago, after the coup d’etat in Ukraine that was orchestrated by the United States and, in fact, backed by the European Union.” So far this year, Washington has authorized more than $20 billion in direct military aid to Ukraine, not counting the separate ‘Ukraine Security Assistance Initiative’ and billions more in economic and humanitarian assistance. US officials have indicated those policies are set to continue, having pledged to supply Kiev with as much aid as needed for “as long as it takes.”

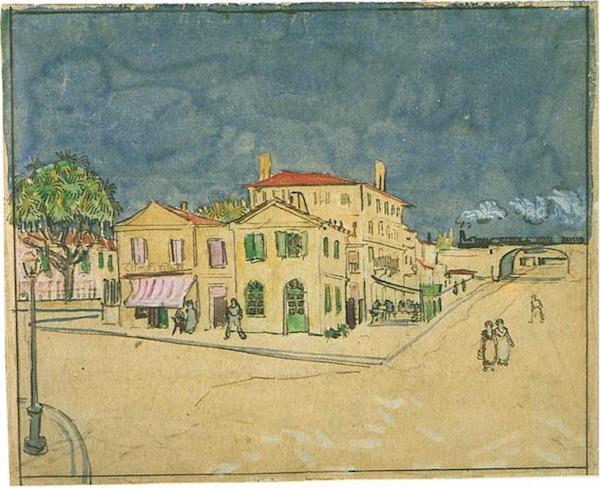

“The statue of Catherine II was restored by the citizens of Odessa themselves, back in 2007..”

• Ukraine Falsifying History And ‘Replacing’ Memory – Moscow (RT)

With its campaign of removing monuments and erasing Russian culture, the government in Kiev is attempting to rewrite Ukraine’s history and forcibly alter the memory of its own population, Russian Foreign Ministry spokeswoman Maria Zakharova said on Thursday. She was commenting on the removal of the statues of Empress Catherine the Great and General Alexander Suvorov from the port city of Odessa. Local authorities ordered the monument to Catherine to be taken down “under the cover of night, like criminals,” Zakharova said, accusing Ukraine of “falsifying its own history, and destroying and replacing the historical memory of its people.”

“In their futile attempt to abolish Russian culture, to ban speaking and even thinking in Russian, Ukrainian authorities are trying to wipe off the face of the earth any objects that could awaken in the large Russian-speaking population of the country the awareness of what they are trying to take from them,” Zakharova noted. Part of that process is removing the monuments their own ancestors put up, she explained. The statue of Catherine II was restored by the citizens of Odessa themselves, back in 2007, to replace the 1900 monument taken down by the Bolshevik revolutionaries in 1920. Suvorov commanded Russian troops that took the Ottoman fort of Khadjibey in 1791. Three years later, by imperial decree, Catherine II established the city that would be named Odessa in 1795. The port ended up becoming the Russian Empire’s “pearl by the sea.” Some nationalists in Ukraine have called these facts “myths” imposed by “Russian occupiers” and urged the removal of monuments to Catherine, Suvorov and other Russians.

President Vladimir Zelensky’s government created a special task force for “de-Russification, de-Communization and decolonization” in June, expanding the policy of removing Soviet-era names and monuments adopted after the US-backed coup in 2014. Zelensky himself endorsed the removal of the Odessa monument in July, though he stopped short of approving a petition to replace the empress with a statue to American porn actor Billy Herrington. Two statues to Suvorov, in the city of Odessa and nearby Izmail, were also taken down in recent days. “The history of these places, like the entire history of Ukraine, is inseparable from Russian history, and any attempts of the Kiev regime to rewrite it are doomed to failure,” said Zakharova, vowing that the removed monuments will be restored to their place of honor once Ukraine is no longer under “the yoke of aggressive radical nationalists” and everything “returns to normal.”

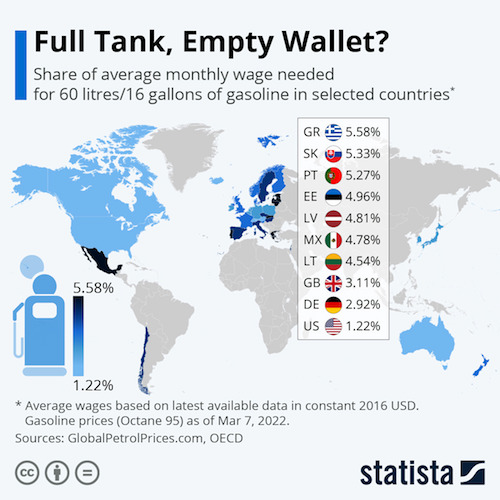

Erdogan thrives on his neutral stance, but still has some 90% inflation.

• Türkiye Warns Greece Against Expansion In Aegean Sea (RT)

Türkiye will not give Greece a single mile of territorial waters in the Aegean Sea, Turkish Foreign Minister Mevlut Cavusoglu said on Thursday, warning that Ankara will use all means at its disposal to protect its interests. “We will not allow the expansion of [Greek] territorial waters by even one mile in the Aegean, let alone 12,” Cavusoglu was quoted as saying by the state-run Anadolu Agency. His comments came in response to reports that Athens plans to extend its territorial waters around the island of Crete to 12 nautical miles. Cavusoglu recalled a 1995 Turkish parliamentary decision that states that if Greece increases its territorial waters in the Aegean beyond six miles, the parliament would provide the government with “all powers,” including military ones, in order to defend Türkiye’s national interests. The minister went on to warn Greece not to “get into sham heroism by trusting those who might have your back.”

“Don’t seek adventurism. It won’t end well for you!” Cavusoglu warned. Last week, the Greek government announced that it plans to extend its territorial waters to the south and west of Crete in March, citing favorable international and regional developments, according to the online news outlet In.Gr, which cited sources from the presidential administration. The move puts further strain on the already fraught relations between Ankara and Athens. Back in May, Erdogan officially cut ties with Greek Prime Minister Kyriakos Mitsotakis and closed all other communication channels between the countries. Although the two nations are NATO partners, they have a long history of rivalry and are entwined in a number of ongoing disputes, including over control of several Aegean islands, as well as about drilling rights in the Mediterranean, and the status of Cyprus.

Coordinated.

• SBF Met With Senior White House Officials Shortly Before FTX Collapse (ZH)

FTX founder and accused crypto-crook Sam Bankman-Fried met with senior White House officials on at least four occasions in the months leading up to his firm’s massive implosion, Bloomberg reports. On Sept. 8, SBF met with senior Biden adviser Steve Ricchetti in a previously unreported encounter, White House officials familiar with the matter said. The meeting was “the latest in a handful of sessions,” according to the report. “Bankman-Fried had at least three others previously disclosed in White House visitor logs. They include one April 22 and another May 12, each with Ricchetti, and one a day later, on May 13, with Bruce Reed, another senior Biden aide, officials confirmed. The final meeting is recorded in logs as two meetings held back-to-back, but was one meeting, officials said. Some of the prior White House meetings included others from FTX. -Bloomberg”

What’s more, Bankman-Fried’s brother, Gabriel, held a March meeting of his own and was also at the May 13 meeting – bringing the total number up to five meetings that involved one or both brothers. According to one source, “politics” were not discussed despite SBF being a Democrat megadonor credited as a major factor in President Biden’s 2020 win. Instead, the brothers allegedly talked about general matters related to the ‘crypto industry and exchanges,’ as well as “pandemic prevention related to the foundation, Guarding Against Pandemics, run by Gabe Bankman-Fried,” according to an official. SBF now faces several criminal charges related to the collapse of FTX. His ties to Washington have come under the microscope since the collapse of his exchange – as Bankman-Fried gave millions of dollars to Democratic politicians – becoming the party’s second-largest individual donor in the 2022 session.

One person familiar with the meetings, speaking on condition they not be identified, said that politics was not discussed at the White House meetings. “While Bankman-Fried, or SBF as he’s known, lived in the Bahamas, he made frequent trips to Washington — testifying before Congress and meeting with key regulators, including the Securities and Exchange Commission and the Commodity Futures Trading Commission, as well as with White House officials. -Bloomberg”. According to US prosecutors, SBF allegedly conspired with others to use corporate funds and shadow donors for political contributions, and illegally commingled billions of dollars of customers’ funds lent to his trading arm, Alameda Research.

“I have a very busy day job running a $6 billion institute. I don’t have time to worry about things like the Great Barrington Declaration.”

• Integrity Lost and Regained (Malone)

Human beings can be characterized by exhibiting integrity or its opposites, hypocrisy and deceit. Buildings can have structural integrity, or they can be unsound, a danger to inhabitants. Organizations can have integrity, or can be corrupt. And a Nation can have integrity, or be divided against itself. Ed Dowd, Tom Lewis and their Maui colleagues diagnosed loss of integrity as a core problem contributing to the Covid crisis across virtually all governmental and corporate “verticals” and developed a solution which they (generously) named the “Malone Doctrine.” Subsequent events have validated their assessment. One needs look no further than the latest headlines. Election integrity has become one of the most trending of hashtags (in USA, Brazil, and so many other places).

Nord Stream (NS) and Nord Stream 2 (NS2) have been sabotaged, most certainly not by either Russia or Germany, but fearing retaliation no one dares even whisper the name of the culprit all know to be responsible. The deep corruption associated with the Biden family is being revealed, as is the role of corporate media in trying to keep it from impacting elections. The omniscient Anthony Fauci has followed in the footsteps of Hillary Clinton and so many others in deploying the “I cannot remember” defense, but with a new wrinkle of belligerent defiance; recently testifying that “I have a very busy day job running a $6 billion institute. I don’t have time to worry about things like the Great Barrington Declaration.”

Clear and compelling evidence released to Blaze Media under FOIA request document otherwise. During the Covid crisis, both CDC director Rochelle Walensky and Deborah Birx resorted to substituting “hope” for data in making major public health decisions, and then enforcing these decisions via deployment of highly refined psychological operations techniques against objecting United States Citizens. And then we have the cascading collapse of corruption known as the FTX scandal. Just to highlight some of the most recent examples. I argue that the Imperial Administrative State which the United States Federal Government has been transformed into has clearly lost any semblance of integrity.

The stories on IgG4 keep coming..

• Study Finds Worse Antibodies After mRNA Boosters (JTN)

IgG4 antibodies, known for their noninflammatory properties, constituted just 0.04% of all IgG subclasses shortly after the second mRNA dose, the German study says. The fourth subclass started ramping up several months after the full series and reached a high of 19.27% “late after the third vaccination.” “Importantly, this class switch was associated with a reduced capacity of the spike-specific antibodies to mediate antibody-dependent cellular phagocytosis [ingesting and eliminating pathogens] and complement deposition,” the study’s introduction says. Serum samples taken after the booster and “normalized to the amount of anti-spike antibodies yielded significant[ly] lower phagocytic scores than sera from the same donors after two immunizations,” the study found.

The increased IgG4 “might result in longer viral persistence in case of infection,” according to the researchers, most of whom are associated with the University of Erlangen-Nuremberg. The findings “may have consequences for the choice and timing” of mRNA vaccine regimens, including subsequent boosters. Co-author Kilian Schober wrote in a tweet thread that the 1-in-5 proportion of IgG4 after boosting jumped to 40-80% of antibodies after subsequent breakthrough infections, which is “very unusual.” While the researchers “saw improved antibody avidity [accumulated binding] and cross-neutralization after 3rd vs. 2nd vaccination,” he said, the “fragment crystallizable” antibody functions on cell receptors “are indeed deteriorated (!).” But Schober also cautioned against the view “among some anti-vax circles,” prompted by the paper’s preprint release this summer, that mRNA vaccines are inducing “tolerance” to infection rather than fighting it.

The study didn’t answer whether “the class switch [is] irrelevant in terms of consequences on subsequent infections,” he said. It is “conceivable” that the noninflammatory IgG4 response prevents “immunological over-activation while virus is still being neutralized [blocked from entering] via high-avidity antibody variable regions.” The IgG4 subclass is associated with increased COVID-related mortality, according to a letter by Italian researchers published in Elvesier’s European Journal of Internal Medicine a year ago. “Because anti-spike IgG4 have shown poor in vitro neutralizing capacity compared to IgG1, IgG2, and IgG3 antibodies, a first possibility is that hosts with prominent IgG4 immune responses might be more permissive to SARS-CoV-2 infection,” according to those San Raffaele Scientific Institute researchers.

“They feel betrayed by the very government agencies that once fed their craving for fear.”

• The New Yorker Promotes “People’s CDC” And Mask Mandates Forever (ZH)

When the science no longer supports the establishment narrative, the science no longer matters. This is the lesson we have learned time and time again over the course of the past few years when it comes to covid mandates and vaccine cultism. Americans in particular have been whipped with incessant claims since 2020 that the “science is settled” when it comes to mask restrictions, lockdowns, mRNA technology, etc. Yet, as time passes, every “conspiracy theory” asserted by the anti-mandate crowd turns out to be true. This, however, is not stopping the covid cult (made up mostly of political leftists) from blindly marching forward as they cling to the sweet taste of ultimate power they experienced from 2020 – 2021. They just can’t let it go.

The pandemic world is their ideal world, and they continue to reveal their addiction in a steady outcry for ongoing restrictions. The New Yorker has recently joined the trend for perpetual medical tyranny with an article titled ‘The Case For Wearing Masks Forever’ in which they promote the concept of a new politicized version of the CDC, called the People’s CDC, which ignores the actual science and enables the irrational fears of covid obsessives. The People’s CDC is made up of academics, doctors, activists, and artists who believe that the government has left them to fend for themselves against Covid-19. They believe the CDC’s data and guidelines have been distorted by powerful forces with vested interests in keeping people at work and keeping anxieties about the pandemic down.

This is a fascinating juxtaposition of previous narratives. Two years ago, anti-mandate movements argued the exact opposite – That data and guidelines had been distorted by powerful forces vested in keeping the public afraid and under control. As it turns out, the anti-mandate crowd was right about everything. The public was being lied to about the effectiveness of the masks, the effectiveness of the lockdowns and the effectiveness of the vaccines. Establishment institutions have been forced by the wider dissemination of scientific data to admit this reality.

And now, leftists are livid. They feel betrayed by the very government agencies that once fed their craving for fear. The People’s CDC admits they don’t really know what their larger goal is, only that they are seeking to provide an “alternative source of information”, one that essentially reinforces their ideological assumptions. It should be noted that when conservatives and liberty activists tried to share scientific information that was contrary to the establishment narrative, it was these same leftists that cried for censorship and called anti-mandate groups “dangerous”.

No new mutations at all.

• Half of Chinese Arrivals to Italy Carrying COVID-19 Virus – All Omicron (CTH)

Yesterday Italian officials announced that half the airline passengers arriving from China tested positive for COVID-19. However, in a follow-up today Italian Prime Minister Giorgia Meloni said so far all of the testing shows the omicron variant, no new sub-variants of the virus. The Biden administration CDC announced yesterday that effective January 5, 2023, all passengers traveling to the U.S. from China will be required to show a negative COVID-19 test prior to arrival.

(Bloomberg) — “Italy didn’t find any new concerning Covid-19 mutations among recent arrivals from China who tested positive for the virus, a relief for officials worried about fresh health threats. Prime Minister Giorgia Meloni said Italy already sequenced half of the samples tested in Milan and they all show the omicron strain of the coronavirus. “This is quite reassuring,” she said at a press conference Thursday. “The situation in Italy is under control, and there are no immediate concerns.” China has scrapped its strict lockdown measures in recent weeks, leading to a surge in infections in the country. While the exact numbers are unclear, the rapid spread has led to concerns around the world about new strains emerging. The US and Italy on Wednesday joined an increasing number of nations demanding Covid tests for travelers from China, after Japan and Taiwan unveiled similar measures.”

It seems odd that with all this time passed, China is still struggling with COVID-19 mitigation and treatment while the rest of the world seems to have moved beyond it. Perhaps this is an outcome of China’s zero covid approach.

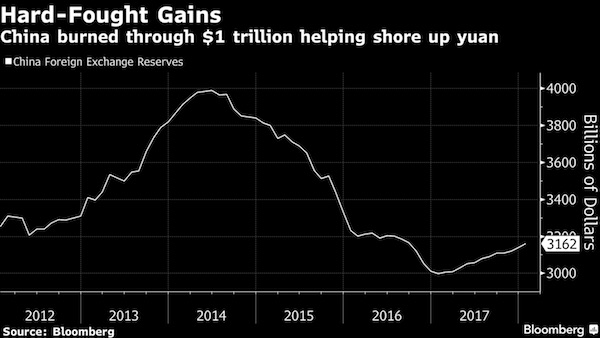

Only $138 billion left..

• Elon Musk’s Net Worth Collapse Is Biggest Loss Of Wealth In Modern History (Ind.)

Elon Musk‘s net worth has plummeted by more than $200bn over the past 13 months, the biggest loss of wealth in recent history. The tech tycoon lost more than half of his fortune between November 2021 and December this year, according to the Bloomberg Billionaires Index, largely due to the collapse of Tesla stock during that time. The $208bn wiped from Mr Musk’s net worth is roughly equivalent to the GDP of Greece. The amount lost is also more than the net worth of the world’s richest person, Bernard Arnault. After topping the rich list for most of the year, Mr Musk lost his place to the French business magnate earlier this month, although he remains ahead of other US tech billionaires that have dominated the list in recent years.

Mr Musk’s net worth peaked at $338bn in November 2021, according to Bloomberg, coinciding with the fortunes of Tesla. The electric car maker has lost roughly 70 per cent of its value in 2022 following production delays in China, vehicle recalls, and concerns among investors that its CEO has been distracted by his new role as head of Twitter. Tesla’s market cap is down by nearly $900bn since November 2021, causing it to drop out of the top 10 most valuable companies. Despite the losses, Tesla remains the world’s most valuable car maker by a distance, with its losses over the last year equivalent to the combined market cap of all other automakers.

“- UK renewable power hit a peak;

– the UK experienced its ‘warmest’ year; and

– the UK experienced its worst energy crisis in 40+ years.

So renewables didn’t solve the ‘problem’ they were supposed to, but instead caused a crisis.”

• Britain’s Renewable Power Hits New Peak, Fossil Fuel Also Rises (R.)

Renewable power sources generated 40% of Britain’s electricity in 2022, up from 35% in 2021, while the share of fossil fuel in the energy mix also rose, a report by academics from Imperial College London for Drax Electric Insights showed on Thursday. Overall generation from renewables has more than quadrupled over the last decade. Wind, solar, biomass and hydro are the main sources of renewable power. Fossil fuel still has a larger share, providing 42% of Britain’s power in 2022, which was its biggest contribution to the country’s fuel mix since 2016. Iain Staffell of Imperial College London, and lead author of the report, said 2022 had been “a year like no other for the energy industry”.

Although renewables provide “more cheap, green energy than ever before,” he said, the public is feeling the pain of gas prices, which surged in response to supply disruption linked to Russia’s invasion of Ukraine in February. Britain, in common with other European countries, extended the life of coal-fired power units to try to ensure adequate supplies during winter peak demand as Britain’s power imports dropped to zero in 2022, compared with 8% of supplies in 2021, Drax said. The country has significantly reduced its reliance on coal, the most carbon-intensive form of power generation. The National Grid said 0.7% of generation came from coal in November compared with 11.3% at the same time in 2017. On one day in May, renewables provided almost 73% of power to the grid, the report said.

The rise of renewable power cut Britain’s carbon emissions by 2.7 million tonnes compared to the previous year, according to Thursday’s report. Another report by Drax, once heavily reliant on coal and now Britain’s biggest renewable power generator by output, said that between 2010-19, Britain cut its carbon emissions from its power grid further and faster than any other major economy.

Spud the beaver

https://twitter.com/i/status/1608278905886216192

Smallest cat

The black-footed cat is the deadliest wildcat in the world. Though they weigh only 2 – 6 pounds, they take down more prey in a single night than a leopard does in 6 months. pic.twitter.com/7Gh8U2Lco2

— Fascinating (@fasc1nate) December 29, 2022

Lions

Lions don’t lose sleep over the opinion of sheep pic.twitter.com/0LATfuH2QC

— Rita Panahi (@RitaPanahi) December 28, 2022

Deer jumping

Beautiful video by Dave Mott of a deer leaping at Poole Harbour at dawn. pic.twitter.com/yWRUzAJMOi

— Fascinating (@fasc1nate) December 29, 2022

Support the Automatic Earth in virustime with Paypal, Bitcoin and Patreon.