Dorothea Lange Grocery store in Widtsoe, Utah 1936

More incentives for the Fed to trigger a crisis.

• Trump’s Mistake In Taking Ownership Of The Stock Market Bubble (LR)

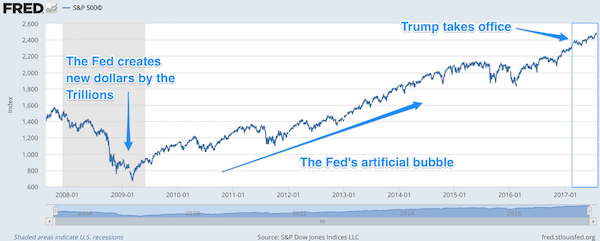

Let’s start at the beginning. Bubbles and Busts are both created by The Federal Reserve. Presidents are merely along for the ride. They like to credit themselves for the bubbles, and then look for scapegoats, usually the (non-existent) free market during the busts. But it is The Fed that creates them both. President Trump has made a big (yet understandable) mistake. He’s tried to portray himself as the cause of the current bubble in the stock market. He wants credit where credit is due. In this case, credit is not due. As we already mentioned, the Fed created the current bubble, and did so a long time ago. One look at a chart of the S&P 500 says it all:

Chances are, Trump realizes that most people won’t look at a chart of the stock market and he just wants some good PR. The president wants people to think that he is the reason for the stock market bubble. This is a big mistake. The Fed is the premier member of the so-called “Deep State”. In fact, without The Fed, there would hardly be a “Deep State” to speak of. The Fed sits at the top of the Deep State. They have the ultimate power (that no human beings should ever have) to create new money out-of-thin-air. In case Trump hasn’t figured it out yet, the Deep State does not like him. Should a major decline in the stock market occur during Trump’s Administration, guess who will take the blame? President Trump. After all, he took ownership of the bubble!

Should the market tumble, the mainstream media (that also despises Trump) will have plenty of his quotes, YouTubes, and Tweets to use against him. The economic woes will be pinned on Trump. Will Trump deserve the blame? No, but it’ll be too late. This is not to say that a major decline will occur during Trump’s tenure. Bubbles can take on a life of their own, and this one may last during Trump’s full term. But that’s a risky gamble to make. This bubble is going on almost 10 years now without a serious decline. Should we see a major selloff, Trump has very few friends in the major power centers that will come to his aid. As Peter Schiff points out in this fantastic clip below: The Fed now has their fall guy:

A curious move. An ultimate power game.

• Congress Checkmates Trump (And The American People) (LR)

Yesterday, the US Senate passed HR 3364, the Countering America’s Adversaries Through Sanctions Act by a massive 98 yeas to two nays. Opposing the bill were Sens. Bernie Sanders (I-VT) and Rand Paul (R-KY). The bill passed in the House by 419-3 on Tuesday, with Reps Massie (R-KY), Amash (R-MI), and Duncan (R-TN) opposing. The new sanctions bill ties President Trump’s hands on foreign policy, as he will be forced to ask Congress for permission to ease the measures. Speaking in favor of the legislation, Sen. Bob Menendez (R-NJ) cited the need to send Russia a message that it cannot meddle in US elections, that it cannot annex Crimea, that it cannot invade Ukraine, and that it cannot indiscriminately kill women and children in Syria.

Those of us living in the actual real world recognize that the first count remains unproven and the remaining counts are simply fatuous, fact-free bluster by Washington’s uninformed, group-thinking, foreign policy elites. Fueled by the millions coming in to the military-industrial complex. The House and Senate passed “Countering America’s Adversaries Through Sanctions Act” now goes to President Trump’s desk, where he faces a damned if he does and damned if he doesn’t scenario. A veto would certainly be over-ridden, handing the president a bitter bi-partisan blow that would likely end whatever aspirations he may retain to keep his campaign promises to get along better with Russia.

Similarly, signing the bill signs a death warrant for any foreign policy different than the one served up by the neocons for decades: create enemies; push war propaganda; collect massive checks from military industrial complex; demonize any American refusing to go along; repeat, adding bombs as necessary. Checkmate, President Trump.

Over 600 would have to leave. Question: why does the US have over 6000 more staff in Russia than vice versa?

• Russia Hits Back Over Sanctions, Orders US Diplomats To Leave (R.)

Russia told the United States on Friday that some of its diplomats had to leave the country in just over a month and said it was seizing some U.S. diplomatic property as retaliation for what it said were proposed illegal U.S. sanctions. Russia’s response, announced by the Foreign Ministry, came a day after the U.S. Senate voted to slap new sanctions on Russia, putting President Donald Trump in a tough position by forcing him to take a hard line on Moscow or veto the legislation and anger his own Republican Party. President Vladimir Putin had warned on Thursday that Russia had so far exercised restraint, but would have to retaliate against what he described as boorish and unreasonable U.S. behaviour. Relations between the two countries, already at a post-Cold War low, have deteriorated even further after U.S. intelligence agencies accused Russia of trying to meddle in last year’s U.S. presidential election, something Moscow flatly denies.

The Russian Foreign Ministry said on Friday that the United States had until Sept. 1 to reduce its diplomatic staff in Russia to 455 people, the same number of Russian diplomats it said were left in the United States after Washington expelled 35 Russians in December. It said in a statement that the decision by Congress to impose new sanctions confirmed “the extreme aggression of the United States in international affairs.” “Hiding behind its ‘exceptionalism’ the United States arrogantly ignores the positions and interests of other countries,” said the ministry. “Under the absolutely invented pretext of Russian interference in their “Under the absolutely invented pretext of Russian interference in their domestic affairs the United States is aggressively pushing forward, one after another, crude anti-Russian actions. This all runs counter to the principles of international law.”

[..] An official at the U.S. embassy in Moscow, who declined to be named because they were not allowed to speak to the media, said there were around 1,100 U.S. diplomatic staff in Russia. That included Russian citizens and U.S. citizens. Most staff, including around 300 U.S. citizens, work in the main embassy in Moscow with others based in outlying consulates. The Russian Foreign Ministry said it was also seizing a Moscow dacha compound used by U.S. diplomats to relax from Aug. 1 as well as a U.S. diplomatic warehouse in Moscow.

Confidence spelled backwards. How to cause a bank run in 3 easy lessons.

• EU Explores Account Freezes To Prevent Runs At Failing Banks (R.)

European Union states are considering measures which would allow them to temporarily stop people withdrawing money from their accounts to prevent bank runs, an EU document reviewed by Reuters revealed. The move is aimed at helping rescue lenders that are deemed failing or likely to fail, but critics say it could hit confidence and might even hasten withdrawals at the first rumors of a bank being in trouble. The proposal, which has been in the works since the beginning of this year, comes less than two months after a run on deposits at Banco Popular contributed to the collapse of the Spanish lender. It also come amid a bitter wrangle among European countries over how to deal with troubled banks, roughly a decade after a financial crash that required the ECB to print billions of euros to prevent a prolonged economic slump.

Giving supervisors the power to temporarily block bank accounts at ailing lenders is “a feasible option,” a paper prepared by the Estonian presidency of the EU said, acknowledging that member states were divided on the issue. EU countries which already allow a moratorium on bank payouts in insolvency procedures at national level, like Germany, support the measure, officials said. “The desire is to prevent a bank run, so that when a bank is in a critical situation it is not pushed over the edge,” a person familiar with German government’s thinking said. To cover for savers’ immediate financial needs, the Estonian paper, dated July 10, recommended the introduction of a mechanism that could allow depositors to withdraw “at least a limited amount of funds.”

Banks, though, say it would discourage saving. “We strongly believe that this would incentivize depositors to run from a bank at an early stage,” Charlie Bannister of the Association for Financial Markets in Europe (AFME), a banking lobby group, said. The Estonian proposal was discussed by EU envoys on July 13 but no decision was made, an EU official said. Discussions were due to continue in September. The plan, if agreed, would contrast with legislative proposals made by the European Commission in November that aimed to strengthen supervisors’ powers to suspend withdrawals, but excluded from the moratorium insured depositors, which under EU rules are those below 100,000 euros ($117,000).

Price discovery.

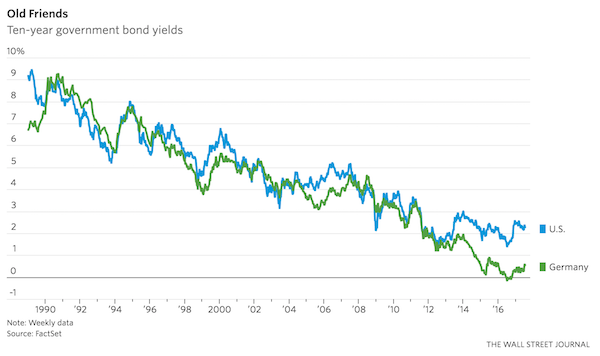

• The Great Transatlantic Bond Divergence Unwind (WSJ)

Many of the trades embraced by markets after President Donald Trump’s election have been slowly unwinding in 2017. Here’s an important one that could have further to go: the gap between U.S. and German government bond yields. The spread between 10-year Treasurys and bunds ballooned after Mr. Trump’s November victory to a level not seen since before the fall of the Berlin Wall, around 2.3 percentage points by the end of 2016. U.S. yields rose sharply on the idea of reflation and stimulus, while Europe appeared stuck in a rut. At 1.75%age points, the gap is close to its pre-election level. But even that is unusual by historical standards. Between 1990 and 2014, the spread was only rarely wider than one percentage point, and over that period averaged just 0.2 point, according to data from FactSet.

Such a tight relationship between German and U.S. bonds reflected the long global bull market for bonds in the glory years of globalization. Relatively synchronized monetary policy meant yields fell on both sides of the Atlantic together. The Fed’s 2013 taper, followed by signals of coming European Central Bank bond buying helped set the bond markets apart. That both helped weaken the euro and encouraged a rush of bond issuance by U.S. companies in European markets as borrowing costs fell. Where policy goes now is key. Markets doubt how far the Fed might get with its tightening, and seem unflustered by the prospect of the central bank shrinking its balance sheet. Investors may be too relaxed, but in the absence of fiscal stimulus and inflation, much higher yields for Treasurys might be hard to achieve in the near term.

But they rule Germany. So yeah, some fines etc., but the culture just goes on.

• Top German Automakers Sued in US Over Two-Decade ‘Cartel’ (BBG)

German’s major automakers were accused in a U.S. lawsuit of acting as a cartel, colluding for nearly two decades to limit the pace of technological advances in their vehicles and stifle competition – allegations that widen the scope of the latest scandal to hit the nation’s auto industry. BMW AG, Daimler AG, Volkswagen AG and its Audi and Porsche brands shared competitive information about vehicle technologies with one another from 1996 through at least 2015 in violation of antitrust laws, according to a complaint filed Friday in San Francisco federal court. “These coordinated actions enabled the manufacturer defendants — the self-named ‘Fünfer-Kreise,’ or Circle of Five — to impose a German automobile premium on consumers premised on superior German engineering, while secretly stunting incentives to innovate,” the suit alleges.

The suit, which seeks class-action status on behalf of U.S. drivers, says the companies agreed to limit the development of vehicle systems, including emissions control. The arrangement allegedly led to the development of so-called “defeat devices” used by Volkswagen to cheat on pollution tests. Plaintiffs claim the operation of convertible roofs, body design, brakes and electronic systems were also part of the “technological innovations inhibited” by the pacts. The supplier of VW’s cheat software, Robert Bosch Gmbh, was also named as a defendant in the lawsuit.

“The added cost of insurance pushed 274,000 customers into delinquency..”

Elizabeth Warren has called on the Fed to remove Wells Fargo board members. I think if your legal system does not allow you to put these people behind bars, maybe you should look there first. Many of these people should be put before a judge and Wells Fargo should be forced to close. Institutions like that are diseases in a society.

• Wells Fargo Faces Angry Questions After New Sales Abuses Uncovered (R.)

New revelations that Wells Fargo spent years enrolling unknowing borrowers in costly auto insurance has put the bank under new pressure to answer for a months-long scandal over sales practices that have harmed millions of Americans. The latest news that 800,000 Wells Fargo auto borrowers were improperly charged for insurance rattled investors yet again, and sent its stock down 2.6% on Friday. Shareholders, analysts, lawmakers and consumer advocates demanded answers about how the situation manifested, and why Wells Fargo did not disclose the problems sooner, given existing turmoil over phony deposit and credit card accounts opened in customers’ names without their permission.

“This is a full-blown scandal — again,” said New York City Comptroller Scott Stringer, who oversees public pension funds that hold roughly 11.6 million Wells Fargo shares. “It’s unbelievable, outrageous, sad, and yet quintessential Wells Fargo. This isn’t just a corporate debacle. It’s caused real human harm.” Stringer called on the bank to install a new independent chair and “immediately” disclose more information. Wells Fargo first became aware of potential problems a year ago, when the auto lending business began receiving an unusually high number of complaints, Franklin Codel, head of consumer lending, said in an interview. The auto insurance program was quickly suspended, and the problem escalated to senior management, the board and regulators, he said.

Wells Fargo planned to delay public disclosure until it could notify affected customers and reimburse them. “The problem with disclosing to the marketplace today or several months ago is customers start calling and asking when they’re going to get their money,” he said. “It’s not a great customer experience to say, ‘Yeah, we’ll get back to you.'” [..] Wall Street analysts expect the financial damage to go beyond the $80 million in reimbursements. In a note on Friday, Piper Jaffray’s Kevin Barker predicted the true cost would be “multiples” of that figure, with lawsuits and further customer remediation. The added cost of insurance pushed 274,000 customers into delinquency, and led to at least 20,000 wrongful repossessions, according to the Times.

“Community bank” and Wells Fargo in one sentence. Take out the ones that are most guilty and go on as you were.

• Wells Fargo Cuts 70 Senior Managers in Retail Bank After Accounts Scandal (BBG)

Wells Fargo, the lender struggling to overcome a fake-accounts scandal in its community bank, said the division’s new leader is cutting about 70 senior executive jobs. The lender will reduce the number of regional and area presidents to 91, Mary Mack, head of the retail bank, said Friday in a memo to staff, a copy of which was obtained by Bloomberg. Bank spokeswoman Bridget Braxton confirmed the contents of the memo and said employees whose positions are eliminated will remain staff members for 60 days until further steps are decided. Most of the remaining managers will be re-titled as region bank presidents with direct responsibility for more employees than before, in a move aimed at reducing management levels across the branch network, Mack wrote.

Across its 10 geographical divisions, Wells Fargo previously employed 160 regional and area presidents. “Change is hard, yet change is necessary to make sure we are well positioned for the future,” Mack wrote. “In order to truly be better, we must put the right structure in place,” she added. The community-banking division, which houses the retail bank, has generated weaker profit since September when Wells Fargo was fined $185 million because employees had been opening accounts for more than a half decade without customers’ permission. This week, the firm’s consumer operations revealed another scandal, announcing that the bank had charged as many as 500,000 customers for auto insurance they didn’t need.

“..Bill Gates who heads the largest digital technology company is on occasion second fiddle to Bezos who heads an online Sears or Macy’s.”

• What Explains amazon.com’s Share Price? (PCR)

“Here are today’s top stories on Bloomberg” “Jeff Bezos briefly overtook Bill Gates as the world’s richest person. A surge in Amazon shares Thursday morning in advance of its earnings report gave Bezos a net worth of $92.3 billion, surpassing the Microsoft founder’s $90.8 billion fortune. In afternoon trading, Bezos remains ranked second on the Bloomberg Billionaires Index. Gates has held the top spot since May 2013.” Amazon’s stock closed yesterday at $1,046 per share. Amazon’s profits do not support this extraordinary price. Apple, a very profitable company, has a share price of $150.56, an overprice itself. What or who is making Bezos so rich from an online sales company? Note, amazon.com is just sales. It is not some new manufacturing technology that produces valuable output at low cost.

amazon.com is what Walmart, Sears, and Macy’s do, the difference being that amazon.com is online and Walmart, Sears, and Macy’s are in physical locations where real merchandise can be experienced hands on and tried on for fit. In other words, online purchases are convenient, but you don’t know what you are getting. Does it fit? What is the quality? And so forth. How many times do you send it back before you get what you want? There are two answers to the question about who is making Bezos rich. One is that Wall Street is betting that the collapse of US anti-trust law and regulatory authority—it is still on the books but not enforced, just look at the Big Banks—and the ability of Bezos to use his ownership of the Washington Post, the newspaper of the country’s capital, to support those who support him, ensure that amazon.com will be an online monopoly.

Once this is put in place, amazon’s prices and profits will rise, and the extraordinary amazon.com P/E ratio will come into line with reality. Another is that Bezos’ cooperation with Washington’s spy network over all Americans is paid for by the CIA’s many front companies driving up the price of amazon.com’s stock. As the price of amazon.com rises, so does Bezos’ wealth. I don’t know that either of these answers is correct. What I notice is that Bill Gates who heads the largest digital technology company is on occasion second fiddle to Bezos who heads an online Sears or Macy’s.

Just in case you’re thinking things are a mess where you are. His brother is rumored to succeed him.

• Panama Leaks and the Fall of Pakistan’s Prime Minister (Niaz)

On July 28, 2017, the Supreme Court of Pakistan (SCP) rendered a unanimous verdict by a five-member bench that disqualified Prime Minister Nawaz Sharif from holding public office. This outcome was the result of the Panama Leaks, which revealed that the premier and his family owned assets disproportionate to their known sources of income. The opposition Pakistan Tehreek-i-Insaf (PTI), led by Imran Khan, seized on this issue and managed to compel Pakistan’s normally apathetic state institutions to take notice. For over a year, the premier and his family failed to explain how they acquired upscale properties in London. The ruling family dug themselves even deeper into the hole in their effort to establish some kind of cover for their acquisitions by being deliberately inaccurate before the SCP and even forging documents.

Surrounded by sycophants, the premier was evidently badly advised at each step and he and his family have paid a very high political price and could well face jail time. Pakistan has a long tradition of dragging its civilian chief executives over the coals. No prime minister has completed a regular term in office, their tenures cut short by assassination, civilian or military coups, judicial intervention, and intra-party machinations. Many premiers have been overthrown or dismissed for alleged abuse of power, mal-administration, and corruption. Nawaz Sharif and his family, in being unable to account for their wealth, and in their crude attempts at a cover up, have demonstrated that they are evidently crooks.

This said, the Pakistan Muslim League-Nawaz (PML-N) has done a better job of delivering on its campaign promises than any political party in Pakistan’s democratic experience. Pakistan’s energy crisis has eased, the economy is headed towards 6% annual growth, FDI is the highest in a decade, per capita income has risen perceptively, major cities have seen considerable investment in their infrastructure, and the gross level of terrorist violence has declined. Given that the ruling party won in 2013 with as many votes as the next two largest parties combined, its victory in 2018 seemed all but assured.

[..] Since 1947, Pakistan state elites have presided over a massive privatization of public wealth. Entitlements in the form of plots, perks, benefits, are part of an elaborate system of bureaucratically induced shortages that breed systemic corruption and undermines governance. Pakistani private and public sector corporations and entrepreneurs guzzle subsidies and thrive only in a cartelized environment. Any attempt by a government to rationalize the economy or improve productivity is met with howls of protest and demands for more subsidies. Pakistani professionals, be they lawyers, doctors, engineers, educators, behave like mafias, seeking to avoid ethical checks while relentlessly pursuing self-aggrandizement.

We’ll eat our own crap yet. Garbage in, garbage out.

• Plastic Microparticles Found In Flesh Of Fish Eaten By Humans (Ind.)

Plastic microparticles are getting into the flesh of fish eaten by humans, according to a new study. A team of scientists from Malaysia and France discovered a total of 36 tiny pieces of plastic in the bodies of 120 mackerel, anchovies, mullets and croakers. They warned that as plastic attracts toxins in the environment, these poisons could be released into people’s bodies after they ate the fish. The plastics found included nylon, polystyrene and polyethylene. Writing in the journal Scientific Reports, the researchers said: “The widespread distribution of microplastics in aquatic bodies has subsequently contaminated a diverse range of aquatic biota, including those sold for human consumption such as shellfish and mussels.

“Therefore, seafood products could be a major route of human exposure to microplastics. “Microplastics were suggested to exert their harmful effects by providing a medium to facilitate the transport of other toxic compounds such as heavy metals and persistent organic pollutants to the body of organisms. Upon ingestion, these chemicals may be released and cause toxicity.” They suggested people eating the fish examined in this study, which are often dried and sold across Malaysia and neighbouring countries, could consume up to 246 pieces of microplastic a year. However, they added: “The majority of the tested fish in this study did not contain microplastics. Therefore, it is less likely that an individual would ingest the suggested maximum number of microplastics per annum.”

Home › Forums › Debt Rattle July 29 2017