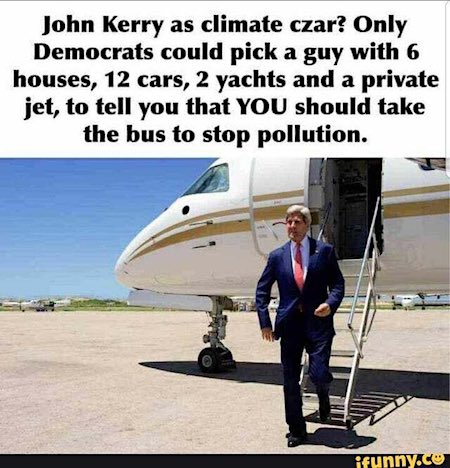

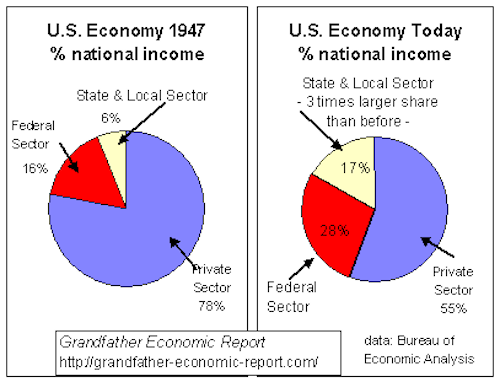

Pablo Picasso The old fisherman 1895

Wall-E after Ever Given

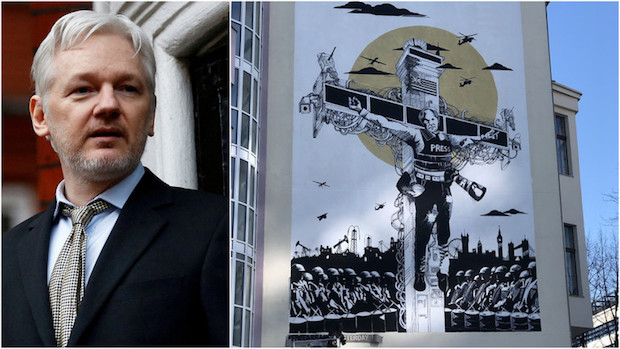

Collateral Crucifixion. See video at the bottom of this post.

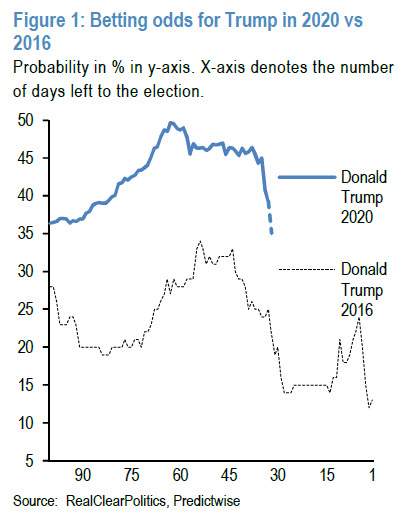

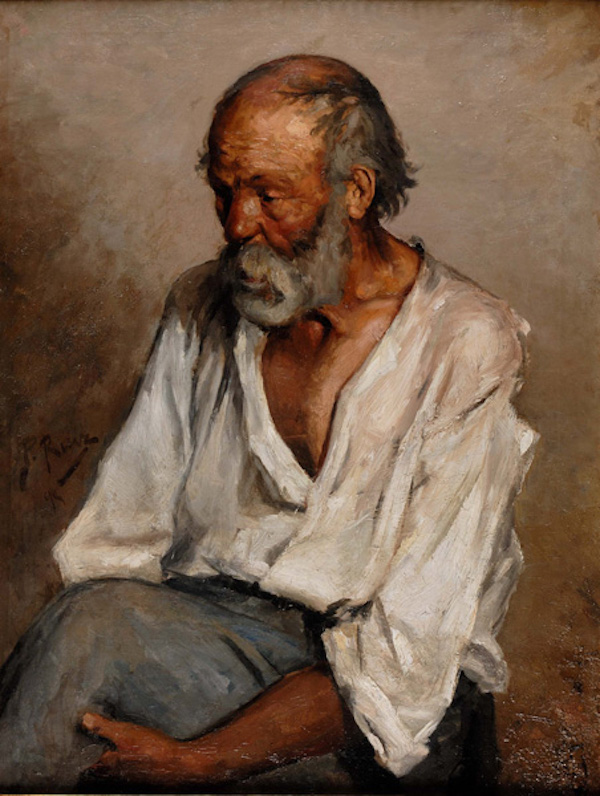

Lacy Hunt

"Many people who remember Prof. Friedman's words think we should have inflation, but they don't remember his algebra…" #DrLacyHunt and #DiMartinoBooth via RealVision@Quillintel https://t.co/kRKqczObBT pic.twitter.com/OxTl2J5pUy

— Danielle DiMartino Booth (@DiMartinoBooth) March 30, 2021

An army to protect Bezos.

• Amazon’s Twitter Army Was Handpicked For “Great Sense Of Humor” (IC)

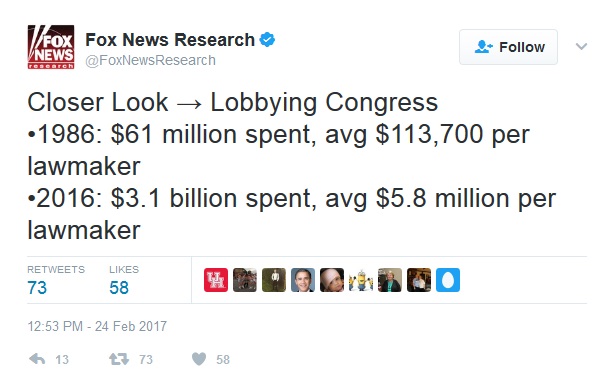

Amazon’s small twitter army of “ambassadors” was quietly conceived in 2018 under the codename “Veritas,” which sought to train and dispatch select employees to the social media trenches to defend Amazon and its CEO, Jeff Bezos, according to an internal description of the program obtained exclusively by The Intercept. Amazon ambassadors drew attention this week as they responded to a wave of online criticism for the company’s treatment of workers amid a union drive at an Amazon warehouse in Bessemer, Alabama. Anticipating criticisms of worker conditions at their fulfillment centers in particular, Amazon designed Veritas to train fulfillment center workers chosen for their “great sense of humor” to confront critics — including policymakers — on Twitter in a “blunt” manner.

The document, produced as part of the pilot program in 2018 and marked “Amazon.com Confidential,” also includes examples of how its ambassadors can snarkily respond to criticisms of the company and its CEO. Several examples involve Sen. Bernie Sanders, a longtime critic of the $1 trillion firm who has been targeted by it in recent days. It also provides examples of how to defend Bezos. “To address speculation and false assertions in social media and online forums about the quality of the FC [Fulfillment Center] associate experience, we are creating a new social team staffed with active, tenured FC employees, who will be empowered to respond in a polite—but blunt—way to every untruth,” the project description reads. “FC Ambassadors (‘FCA’) will respond to all posts and comments from customers, influencers (including policymakers), and media questioning the FC associate experience.”

Kelly Nantel, an Amazon spokesperson, said via email: “FC Ambassadors are employees who work in our fulfillment centers and choose to share their personal experience — the FC ambassador program helps show what it’s actually like inside our fulfillment centers, along with the public tours we provide.” In 2018, Amazon admitted that the ambassadors were employees paid to “honestly share the facts” about what working in its fulfillment centers is like. Many Twitter users had at first believed the ambassadors were automated “bot” accounts due to the nearly identical format of their account bios, all of which feature the Amazon smile logo and begin with the handle “@AmazonFC.” But that format was specifically mandated by Amazon, The Intercept’s document shows. “We could also add an emoji to the username to give personality, for example a small box emoji,” the document suggests.

And Amazon is not alone: this is what the Twitter “Great Sense Of Humor” army does.

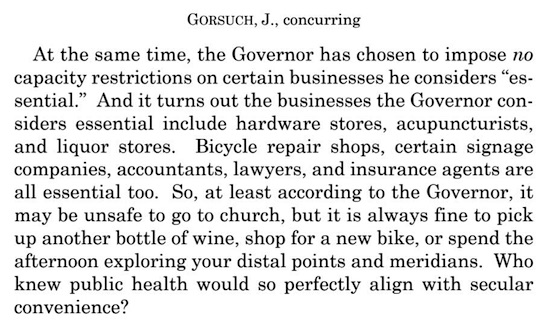

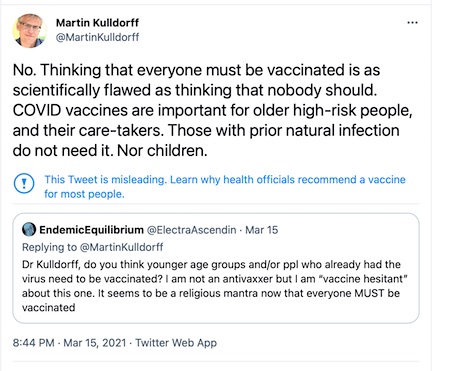

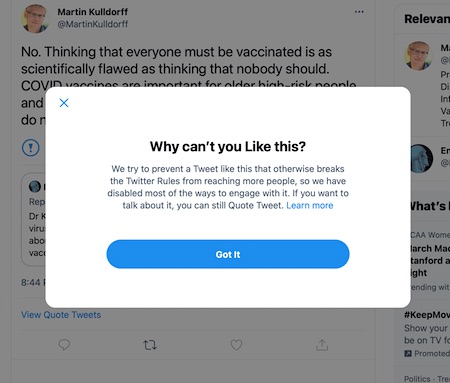

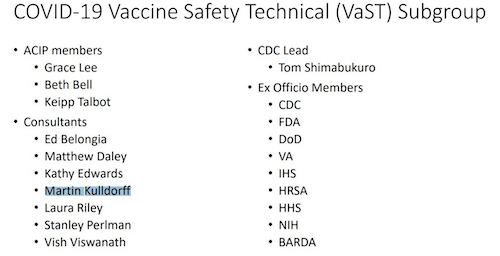

• Twitter Censors Famed Epidemiologist Martin Kulldorff (AIER)

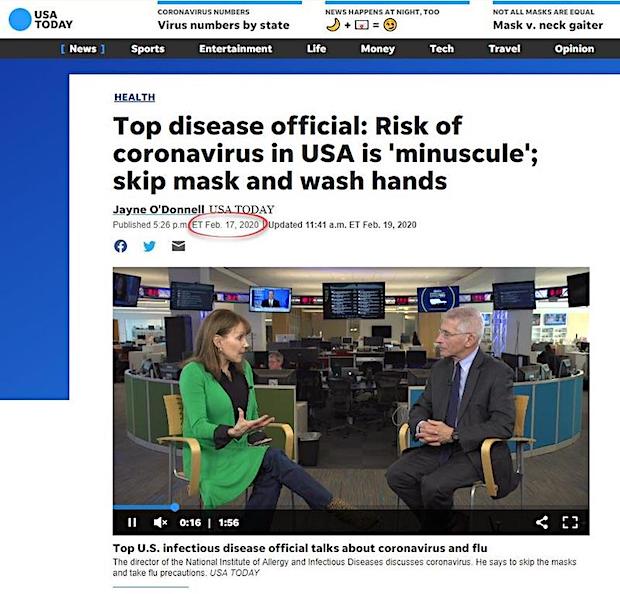

We’ve been witness to Twitter censorship for more than a year, beginning with obviously objectionable extremists then gradually moving to silence people based on merely having an opinion that contradicts lockdown orthodoxy. There have been days when I wondered whether I would cross the invisible line and even whether AIER would itself be silenced. Stanford public health expert Scott Atlas has been censored, and Naomi Wolf, visiting senior fellow at AIER, was put in Twitter jail for a week for landing on the wrong side of the high priests of allowable content. Well, a new line has been crossed. Harvard Professor Martin Kulldorff and co-creator of the Great Barrington Declaration, one of the most cited epidemiologists and infectious -disease experts in the world (latest count of citations: 25,290) has been censored by Twitter. His tweet on how not everyone needs a vaccine against SARS-CoV-2 was not taken down. He had a warning slapped on it and users have been prevented from liking or retweeting the post.

Keep in mind, too, that Dr. Kulldorff serves on the Covid-19 vaccine safety subgroup that the CDC, NIH, and FDA rely upon for technical expertise on this very subject..

So here we have some geeks at Twitter curating science, in areas totally outside the specialization of web nerds, in a way that skews public understanding of the scientific debate. Dr. Kulldorff’s censorship directly coincides with Anthony Fauci making a political push to retain social distancing and mask restrictions and forced separation for children until they are vaccinated. He was all over Sunday TV shows doing that. This attempt to silence accredited experts completely distorts the process of scientific inquiry, discovery, and public opinion. And to what end? Twitter has generally been biased in a lockdown direction. If you want to be cynical about it, you could observe that everyone who works there can get by on laptops and houseshoes for the duration.

Its stock price has more than doubled in the course of lockdowns and user engagement has risen dramatically. It would appear that with this latest act of censorship – we are not talking about political extremism or anything else that violates normal terms of use – we have entered into a new realm. Twitter is now curating the scientific debate in ways that exclude alternative points of view, particularly those that raise doubts about the need for universalized vaccines and vaccine passports. To be sure, Dr. Kulldorff is not an anti-vaxxer (why should I have to say that?) but instead has a nuanced position in light of his professional understanding of the demographics of risk of this virus.

Zeynep Tufekci with an unabashed promo piece on vaccines. She says 100 million Americans may have been infected, and therefore developed the same antibodies a vaccination might provide, but let’s inject them all regardless.

• The Fourth Surge Is Upon Us. This Time, It’s Different. (Atl.)

the United States has had one of the largest outbreaks in the world. This has caused us immense suffering and loss, but it also means that we are now less vulnerable to future waves. So far, 30 million people in the United States have had a confirmed SARS-CoV-2 infection, although the real (unmeasured) number is perhaps as high as 100 million. As expected, those people retain some level of immunity for a substantial amount of time. It’s hard to know exactly how long, because the virus is so new, but for SARS (the related coronavirus that almost sparked a pandemic in 2003), people who were infected retained an antibody response, and thus protection, for an average of two years. Though amazingly, the vaccines appear to provide better immunity than natural infection, those previously infected also gain defenses.

Carefully done studies on large populations show a very low rate of reinfection for this coronavirus: less than 1 percent. Plus, many documented reinfections tend to be mild or asymptomatic, an unsurprising outcome given that in these cases the virus is no longer totally novel for the immune system, and thus not as catastrophic in its consequences. It’s pretty clear that large numbers of people in the U.S. already are, or will soon be, protected from COVID-19’s more severe outcomes, such as death and hospitalization, which the vaccines reduce so close to zero that clinical trials have reported hardly any such cases. And it gets better: Yesterday, the CDC released real-life data showing that, just two weeks after even a single dose, the two mRNA vaccines were 80 percent effective in preventing infection. The effectiveness rose to 90 percent after the second, booster dose.

People in the study were routinely tested regardless of whether they had symptoms, so we know that vaccines prevented not just symptomatic illness—the vaccine-efficacy rate reported in the trials—but any infection. People who are not infected by a virus cannot transmit it at all, and even people who have a breakthrough case despite vaccination have been shown to have lower viral loads compared with unvaccinated people, and so are likely much less contagious. All of this doesn’t mean that there will be zero deaths or illnesses among the vaccinated. The elderly, who tend to have weaker immune systems, are especially prone to having vaccines fail. In nursing homes, even the common cold can cause deadly outbreaks. But for the vaccinated, the risk from COVID-19 clearly has become comparable to “baseline risk”—it’s not zero, but just like the risks presented by the flu and other viruses, it’s not something for which most of us would put our lives on hold.

How do we square all this good news with what happened during a White House briefing yesterday, when CDC Director Rochelle Walensky interrupted the flow, saying, “I’m going to lose the script,” and talked of “the recurring feeling I have of impending doom.” She was visibly emotional and her voice cracked as she said was “scared,” and pleaded with Americans to “hold on a little longer.” I can’t read her mind, but if I were Walensky, I’d be scared because those who are not protected through vaccination or past infection are still at grave risk, a fact that may be overshadowed by all the good news. Even as our vaccines continue to work very well against it, the particular variant we’re facing in this surge is both more transmissible and more deadly for the unvaccinated.

Has been for a long time.

• It’s Time To Talk About Ivermectin (NC)

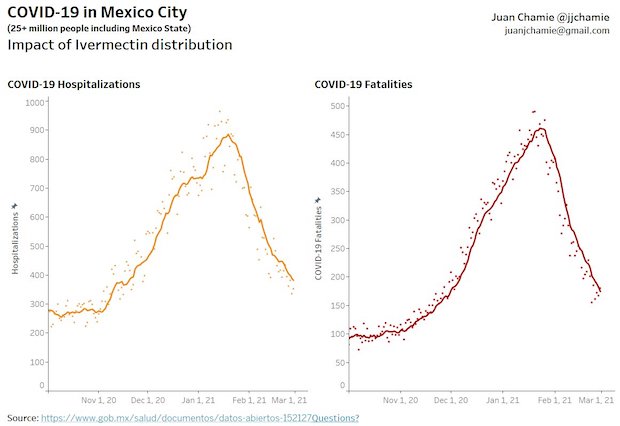

On December 29th of last year, Mexico’s Institute of Socal Security (IMSS) allowed ivermectin to be prescribed to outpatients with Covid. On the same day the Secretariat of Health of Mexico City and the State of Mexico decided to adopt a protocol in which anyone testing positive at any one of the city’s 250 rapid testing sites would be given ivermectin. As you can see in the graphs below, courtesy of Juan Chamie, a data scientist from EAFIT University in Colombia, based on data provided by Mexico City authorities, the number of hospitalizations due to Covid and excess deaths peaked shortly after the New Year and have been falling sharply ever since. They are now almost back to their prior base line.

Mexico City is the first major global city to adopt what amounts to a test-and-treat approach to covid-19 involving ivermectin. But it was the largely indigenous southern state of Chiapas that led the way last summer. In July 2020, as Mexico was buckling under its first wave of the pandemic, the state decided to distribute ivermectin as a Covid-19 treatment, having already deployed the medicine in its battle against mosquito-borne RNA viruses such as Zika and Chikungunya. Since October Chiapas has consistently occupied the lowest risk level on the federal government’s coronavirus stoplight map. Thanks to ivermectin’s apparent success in Chiapas, IMSS allowed the medicine to be prescribed nationwide. It also helped launch the pilot program in Mexico City, for which it received a barrage of criticism.

An official group of health experts argued that there’s no scientific evidence that the drug is effective, and called for the immediate repeal of its use. To their credit, both the Secretariat and IMSS have stuck to their guns. Of course, there’s no way of definitively proving that the rapid falloff in hospitalizations and deaths, first in Chiapas and then Mexico City, is due to the use of ivermectin. Correlation, as we well know, is not causation. It’s also true that Mexico City authorities have introduced tougher social distancing measures and travel restrictions since December. But similar dramatic drop offs have been witnessed in other regions and countries where ivermectin has been used widely, including across the length and breadth of Peru and Iran as well as parts of Brazil, Paraguay, Bolivia, the Dominican Republic and India.

“You can positive-PCR-test a pawpaw fruit … but you might want to be careful who you tell if you do that.”

• The “Unvaccinated” Question (CJ Hopkins)

Here in Germany, the government is considering banning us from working outside our homes. We are already banned from flying on commercial airlines. (We can still use the trains, if we dress up like New Normals.) In the village of Potsdam, just down the road from Wannsee (which name you might recall from your 20th-Century history lessons), we are banned from entering shops and restaurants. (I’m not sure whether we can still use the sidewalks, or whether we have to walk in the gutters.) In Saxony, we are forbidden from attending schools. At the Berliner Ensemble (the theater founded by Bertolt Brecht and Helene Weigel, lifelong opponents of totalitarianism and fascism), we are banned from attending New Normal performances.

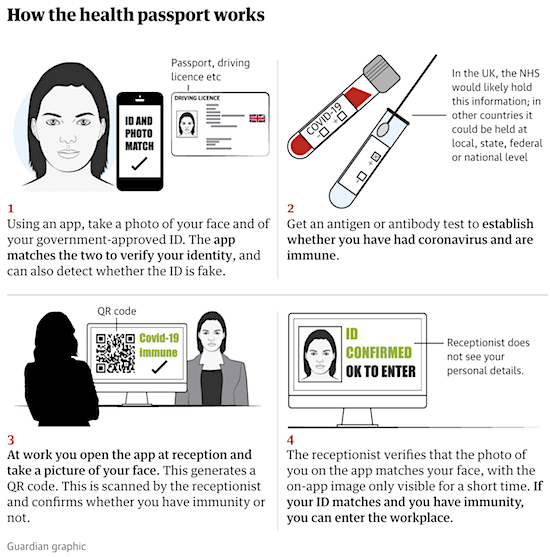

In the USA, we are being banned by universities. Our children are being banned from public schools. In New York, the new “Excelsior Pass” will allow New Normals to attend cultural and sports events (and patronize bars and restaurants, eventually) secure in the knowledge that the Unvaccinated have been prevented from entering or segregated in an “Unvaccinated Only” section. The pass system, designed by IBM, which, if history is any guide, is pretty good at designing such systems (OK, technically, it was Deutsche Hollerith Maschinen Gesellschaft, IBM’s Nazi-Germany subsidiary), was launched this past weekend to considerable fanfare. And this is only the very beginning. Israel’s “Green Pass” is the model for the future, which makes sense, in a sick, fascistic kind of way. When you’re already an apartheid state, what’s a little more apartheid?

OK, I know what the New Normals are thinking. They’re thinking I’m “misleading” people again. That I’m exaggerating. That this isn’t really segregation, and certainly nothing like “medical apartheid.” After all (as the New Normals will sternly remind me), no one is forcing us to get “vaccinated.” If we choose not to, or can’t for medical reasons, all we have to do is submit to a “test” — you know, the one where they ram that 9-inch swab up into your sinus cavities — within 24 hours before we want to go out to dinner, or attend the theater or a sports event, or visit a museum, or attend a university, or take our children to school or a playground, and our test results will serve as our “vaccine passports!” We just present them to the appropriate Covid Compliance Officer, and (assuming the results are negative, of course) we will be allowed to take part in New Normal society just as if we’d been “vaccinated.”

Either way, “vaccine” or “test,” the New Normal officials will be satisfied, because the tests and passes are really just stage props. The point is the display of mindless obedience. Even if you take the New Normals at their word, if you are under 65 and in relatively good health, getting “vaccinated” is more or less pointless, except as a public display of compliance and belief in the official Covid-19 narrative (the foundation stone of the New Normal ideology). Even the high priests of their “Science” confess that it doesn’t prevent you spreading the “plague.” And the PCR tests are virtually meaningless, as even the WHO finally admitted. (You can positive-PCR-test a pawpaw fruit … but you might want to be careful who you tell if you do that.)

Canada: under 55. Germany: under 60. How many people will now say: thanks, but no, thank you?

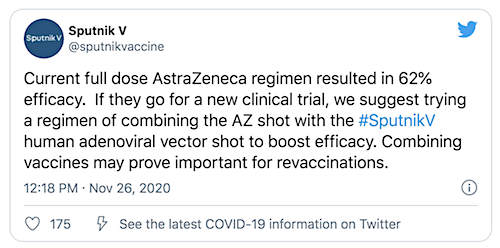

• In Germany, AstraZeneca Vaccine Only For People Over 60 After 9 Deaths (RT)

Germany has restricted the use of AstraZeneca’s Covid-19 vaccine as a precautionary measure amid reports the jab is being linked to more cases of suspected adverse effects, some resulting in death. The country’s Standing Vaccination Commission recommended on Tuesday that AstraZeneca’s Vaxzevria only be given to men and women over the age of 60, or in exceptional cases. The decision was made due to “available, albeit limited, evidence” concerning the drug’s safety. The commission announced its recommendation hours after the city of Berlin introduced an identical policy. Earlier, two state-owned clinics in the city halted AstraZeneca shots for women under 55 years of age. Munich followed suit with its own rule banning the shot for people under 60.

Health Minister Jens Spahn was scheduled to speak with regional counterparts about the AstraZeneca drug later on Tuesday, a ministry spokesperson announced. Germany had suspended emergency use of the AstraZeneca shot earlier this month, but then lifted the temporary ban after EU regulators deemed it to be safe. The latest restrictions placed on the drug come after Germany’s vaccine regulator, the Paul Ehrlich Institute, disclosed that as of March 29, the country has recorded 31 cases of cerebral sinus vein thrombosis (CSVT), nine of which resulted in death, after people were given the Vaxzevria injection. CSVT is a rare form of blood clot that forms in the brain.

Of the 31 cases of CSVT, all except two involved women between the ages of 20 and 63. Before the new guidelines were issued in Berlin, a district in North Rhine-Westphalia state suspended shots for women under 55 after two women suffered from blood clots. Nearly 2.7 million first doses of Vaxzevria have been administered in Germany. According to official figures, women under the age of 70 make up two-thirds of those vaccinated with the AstraZeneca drug. It’s believed that more women than men have received the shot because nurses were among the first group in Germany to take the jab.

“Two months earlier, the WHO chief praised China’s response to the pandemic..”

• ‘Concerns’ Over Lack Of Data In WHO Report on Covid-19 Origins (RT)

Fourteen countries including the US and UK have expressed “concerns” over a new report into the origins of Covid-19 by the World Health Organization (WHO) after the agency’s own chief also highlighted data-access issues. “It is equally essential that we voice our shared concerns that the international expert study on the source of the SARS-CoV-2 virus was significantly delayed and lacked access to complete, original data and samples,” a joint statement from the nations read. The signatories included the governments of Australia, Canada, the Czech Republic, Denmark, Estonia, Israel, Japan, Latvia, Lithuania, Norway, South Korea, Slovenia, the UK and US. The statement also called for a further analysis of the outbreak of Covid-19 that is “transparent”,”free from interference” and “unimpeded.”

A spokesperson for the Chinese Foreign Ministry said that China had “offered necessary facilitation for the team’s work”, and warned against “politicizing” efforts to identify the origins of Covid-19. The joint statement echoes comments made by WHO Director-General Tedros Adhanom Ghebreyesus, who said that the UN health agency’s scientists had trouble “accessing raw data” while in China. “I expect future collaborative studies to include more timely and comprehensive data sharing,” he said during a news briefing on Tuesday, adding he did not believe the report was “extensive enough.” Two months earlier, the WHO chief praised China’s response to the pandemic, adding that President Xi Jinping had “encouraged and impressed” him with his knowledge of the coronavirus.

The 120-page WHO report was published on Tuesday after a team of international scientists visited the Chinese city of Wuhan between January 14 and February 10, 2021. The scientists visited the Huanan Seafood Wholesale Market, where the virus is believed to have spread from. The team did not find the source of Covid-19, but their report effectively ruled out its origin from a laboratory accident, saying it was “extremely unlikely,” while the virus’s introduction through frozen food chains was considered “possible.”

Jeremy Loffredo and Whitney Webb on a virtually unknown Covid story.

• Tanzania’s Late President Magufuli: ‘Science Denier’ or Threat to Empire? (UH)

Less than 2 weeks ago, Tanzanian Vice President Samia Suluhu Hassan delivered the news that her country’s president, John Pombe Magufuli, had died of heart failure. President Magufuli had been described as missing since the end of February, with several anti-government parties circulating stories that he had fallen ill with COVID-19. During his presidency, Magufuli had consistently challenged neocolonialism in Tanzania, whether it manifested through the exploitation of his country’s natural resources by predatory multinationals or the West’s influence over his country’s food supply. In the months leading up to his death, Magufuli had become better known and particularly demonized in the West for opposing the authority of international organizations like the WHO in determining his government’s response to the COVID-19 crisis.

However, Magufuli had spurned many of the same interests and organizations angered by his response to COVID for years, having kicked out Bill Gates-funded trials of genetically-modified crops and more recently angering some of the most powerful mining companies in the West, companies with ties to the World Economic Forum and the Forum’s efforts to guide the course of the 4th industrial revolution. Indeed, more threatening than his recent COVID controversies was the threat Magufuli posed to foreign control over the world’s largest, ready-to-develop nickel deposit, a metal essential to electric car batteries and thus the current effort to usher in an electric, autonomous vehicle revolution. For instance, just a month before he disappeared, Magufuli had signed an agreement to begin developing that nickel deposit, a deposit that had been previously co-owned by Barrick Gold and Glencore, the commodity giant deeply tied to Israel’s Mossad, until Magufuli revoked their licenses for the project in 2018.

Running afoul of the most powerful corporate and banking cartels followed then by the mysterious onset of sudden regime change would normally garner considerable coverage from anti-imperialist independent media outlets, which recently covered similar events in Bolivia that led to the removal of Evo Morales from power. However, the very outlets that have extensively covered Western-backed regime change efforts for years have been entirely silent on the very convenient death of Magufuli. Presumably, their silence is related to Magufuli’s flouting of COVID-19 narrative orthodoxy, as these same outlets have largely promoted the official narrative of the pandemic.

[..] In contrast to Magufuli, who routinely stood up to predatory corporations and imperialist designs on his country, Samia Suhulhu and Tanzanian opposition politician Tundu Lissu are poised to offer up their country’s resources, and their population, on the altar of the Western elite-driven 4th industrial revolution.

Google translate. It’s not just the US. “..minimum hourly wage to 14 euros. Now that is 9.72 euros (40-hour working week) or 10.80 euros (for 36 hours)”

• New Minimum Wage Legislation: Millions Of Europeans Will Earn More (AD)

At least 24 million employees in 25 of the 27 EU member states will earn more in one punch in two years at the latest. That’s because all of Europe will have a decent minimum wage by then. The two largest groups in Europe, of Christian and Social Democrats, have reached an agreement on this, which they are sending to the rest of the European Parliament today. The Member States, led by the Portuguese socialist António Costa, are also in a hurry. Prime Minister Costa wants to align the member states before handing over his presidency to his Slovenian colleague, the conservative Janez Jansa, on 1 July. The two Parliament rapporteurs, Agnes Jongerius (PvdA) and her German colleague Dennis Radtke (EPP), assume a minimum wage that meets a double threshold across Europe: at least 60 percent of the median (half is lower, half higher) and 50 percent of the average wage.

For the Netherlands, according to Jongerius, this means an increase of the minimum hourly wage to 14 euros. Now that is 9.72 euros (40-hour working week) or 10.80 euros (for 36 hours). The intervention must end a period of thirty years in which the minimum wage has only deteriorated. “Costa has already shown after the banking crisis that the economy will benefit if you increase the minimum wage,” says Jongerius. “Greece went the other way under pressure from Europe and only got extra misery.” She wants a minimum wage “of which you can normally support your family with the occasional extra: a laptop for the children or a vacation”. But we are still a long way from that.

In at least nine Member States, minimum wages fall through the poverty threshold, in many more Member States entire groups are excluded. Jongerius: ,, Corona has made that even worse, especially in low-paid sectors such as retail and tourism. The youths who kept running for us in supermarkets were grossly underpaid. “”

“The measure could include as much as $3 trillion in new taxes and $4 trillion in new spending.”

• A Fourth Stimulus Check? Momentum Grows For Recurring Payments (Fox32)

A growing number of Democrats are calling on President Joe Biden to send recurring stimulus checks for low-income Americans as part of his sweeping infrastructure package, arguing the cash payments are necessary until the U.S. economy fully recovers from the pandemic. In a Tuesday letter addressed to the president, 21 senators – led by Ron Wyden of Oregon – asked the administration to automatically extend unemployment insurance benefits and send recurring direct checks that would be tied to certain economic conditions. Text of the letter first emerged at the beginning of March, but the lawmakers waited until they had received additional support to officially send it to the White House.

In the span of one month, the coalition secured the backing of another 11 Democrats, including Sen. Majority Whip Dick Durbin and moderates like Sens. Debbie Stabenow, D-Mich., Gary Peters, D-Mich., and Jack Reed, D-R.I. “This crisis is far from over, and families deserve certainty that they can put food on the table and keep a roof over their heads,” the lawmakers wrote. “Families should not be at the mercy of constantly-shifting legislative timelines and ad hoc solutions.” The senators did not mention many specifics, including the size and frequency of the payments, the income eligibility level for recipients or the economic conditions that would cause the federal government to cut off the money.

The proposal garnered the support of Democrats across the ideological spectrum, including Sens. Elizabeth Warren, D-Mass., Bernie Sanders, I-Vt., Michael Bennet, D-Colo., Cory Booker, D-N.J., Ed Markey, D-Mass., Kirsten Gillibrand, D-N.Y., Sherrod Brown, D-Ohio, and Tammy Baldwin, D-Wis. The expanded financial assistance would be part of Biden’s “Build Back Better” plan, a wide-ranging plan that aims to make massive investments in infrastructure, revive domestic manufacturing and combat climate change, among other issues. Biden is planning to unveil details of the first part of the package on Wednesday in Pittsburgh, including how he intends to pay for it. The measure could include as much as $3 trillion in new taxes and $4 trillion in new spending.

The senators are pairing their request with a grassroots push from the left-leaning Progressive Change Institute and Economic Security Project, which is calling on other lawmakers to sign the proposal. “These 21 senators have joined the overwhelming majority of the American people in calling for more checks,” Greg Nasif, a spokesperson with Humanity Forward, said in a statement to FOX Business. “This is about more than giving families the support they need. This is about protecting our economy and securing an equitable future.”

Only $2 trillion?

• Biden To Unveil $2 Trillion Infrastructure Proposal (Hill)

President Biden will unveil a $2 trillion infrastructure package on Wednesday as he prepares to pitch his next big-ticket agenda item. Details of the forthcoming plans were shared with lawmakers during a conference call with White House staff on Tuesday. The plan will be funded by raising the corporate tax rate to 28 percent from the current level of 21 percent as well as creating a global tax on corporate earnings, a source familiar with the call confirmed to The Hill. Biden will travel to Pittsburgh on Wednesday to formally unveil the plan, which is expected to include funding for roads, bridges and broadband, as well addressing manufacturing, among other things. The plan is part of a larger two-part package.

White House press secretary Jen Psaki told Fox News Tuesday that Biden will unveil the second part, which will deal with child care and health care, in April. “What the American people will hear from him this week is that part of his plan — the first step of his plan towards recovery — which will include an investment in infrastructure. We shouldn’t be 13th in the world; I don’t think anyone believes that [of] the wealthiest, most innovative country in the world,” Psaki said. Though infrastructure attracts broad bipartisan support, Republicans are likely to balk at raising corporate taxes to pay for a plan. Democrats have said they want the final product to be bipartisan, but have acknowledged that they are likely to have to go it alone through reconciliation, a budget process that allows certain bills to bypass the 60-vote filibuster in the Senate.

Senate Majority Leader Charles Schumer (D-N.Y.) is exploring if Democrats could use the Congressional Budget Act to pass at least three bills under reconciliation, instead of the two Democrats expect to be limited to. They’ve already used one of their opportunities to pass the $1.9 trillion coronavirus plan. Schumer’s staff recently made a case to the Senate parliamentarian that they could use Section 304 of the Congressional Budget Act, which green lights the use of reconciliation, to tee up passing at least a third bill this year by a simple majority, an aide for the New York Democrat confirmed on Monday. “Schumer wants to maximize his options to allow Senate Democrats multiple pathways to advance President Biden’s Build Back Better agenda if Senate Republicans try to obstruct or water down a bipartisan agreement,” the majority leader’s aide said.

“..as long as the people who are trying to express their view do not engage in violence, misdemeanors may be more appropriate than felonies.”

• Many Capitol Rioters Unlikely To Serve Jail Time (Pol.)

Americans outraged by the storming of Capitol Hill are in for a jarring reality check: Many of those who invaded the halls of Congress on Jan. 6 are likely to get little or no jail time. While public and media attention in recent weeks has been focused on high-profile conspiracy cases against right-wing, paramilitary groups like the Oath Keepers and the Proud Boys, the most urgent decisions for prosecutors involve resolving scores of lower-level cases that have clogged D.C.’s federal district court. A POLITICO analysis of the Capitol riot-related cases shows that almost a quarter of the more than 230 defendants formally and publicly charged so far face only misdemeanors. Dozens of those arrested are awaiting formal charges, even as new cases are being unsealed nearly every day.

In recent days, judges, prosecutors and defense attorneys have all indicated that they expect few of these “MAGA tourists” to face harsh sentences. There are two main reasons: Although prosecutors have loaded up their charging documents with language about the existential threat of the insurrection to the republic, the actions of many of the individual rioters often boiled down to trespassing. And judges have wrestled with how aggressively to lump those cases in with those of the more sinister suspects. “My bet is a lot of these cases will get resolved and probably without prison time or jail time,” said Erica Hashimoto, a former federal public defender who is now a law professor at Georgetown.

“One of the core values of this country is that we can protest if we disagree with our government. Of course, some protests involve criminal acts, but as long as the people who are trying to express their view do not engage in violence, misdemeanors may be more appropriate than felonies.” The prospect of dozens of Jan. 6 rioters cutting deals for minor sentences could be hard to explain for the Biden administration, which has characterized the Capitol Hill mob as a uniquely dangerous threat. Before assuming office, Biden said the rioters’ attempt to overturn the election results by force “borders on sedition”; Attorney General Merrick Garland has called the prosecutions his top early priority, describing the storming of Congress as “a heinous attack that sought to disrupt a cornerstone of our democracy, the peaceful transfer of power to a newly elected government.”

What an insane story.

• Matt Gaetz Claims Former DOJ Lawyer Was Extorting Him (CTH)

Two people inside the DOJ leaked a story about Matt Gaetz (R-FL) being under DOJ/FBI investigation to the New York Times. The essential elements of the article are that Gaetz had a relationship with a 17-year-old woman, and paid for her to travel; ergo the DOJ/FBI is investigating “sex trafficking.” Presumably AG Bill Barr opened the investigation. However, Matt Gaetz vehemently denies everything about the claims, and instead says the FBI and DOJ were recently conducting a sting operation -with his cooperation- against a former DOJ lawyer named David McGee who was extorting Gaetz for $25 million. According to Gaetz his father was contacted by McGee in March of this year and told he would release the details of a relationship with the woman if Gaetz did not pay $25 million.

Gaetz contacted the FBI, and his father wore a wire in his conversation with McGee where the FBI were recording the extortion attempt. Now that someone has leaked the erroneous background of the investigation to the New York Times, Gaetz is demanding the DOJ release the tapes of the extortion attempt. Tonight Matt Gaetz appeared on Tucker Carlson to discuss the details of the situation. Apparently there was an FBI sting operation underway which included a payment tomorrow. The New York Times article tipped-off McGee to the sting. Congressman Gaetz denies any wrongdoing, legal or otherwise, and denies paying for a minor to cross state lines to meet him. When Carlson asked Gaetz who was the former DOJ official attempting extortion, Gaetz named David McGee, a former DOJ lawyer currently working for Beggs and Lane lawfirm.

We try to run the Automatic Earth on donations. Since ad revenue has collapsed, you are now not just a reader, but an integral part of the process that builds this site. Thank you for your support.

Collateral Crucifixion

Support the Automatic Earth in virustime. Click at the top of the sidebars to donate with Paypal and Patreon.