Rembrandt van Rijn Head of a Bearded Man c1630

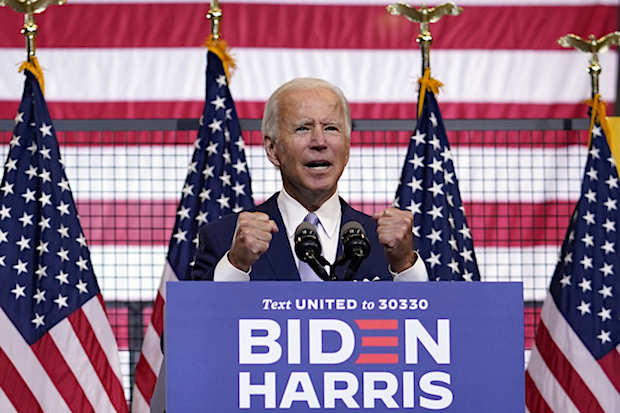

Biden 100 years

Inspiring. Must watch. pic.twitter.com/koA1VKHpuo

— Brandon Darby (@brandondarby) August 31, 2020

Trump Rittenhouse

Here is #DictatorTrump accusing the press of having their own armed militias while defending Kyle Rittenhouse.#ModernFascism #BidenCalm pic.twitter.com/bxoCmWvq5F

— Trev Ken but higher↙️ (@trevken) August 31, 2020

The polls indicated Biden had to be dragged out of his basement to start blaming Trump for the riots and violence. Looks like a hard sell. Certainly when you won’t even allow for Trump to say “riot”.

For months, the national media has largely ignored the sustained violent activism plaguing Democrat-run cities. When they do cover these events, it’s portrayed the same way Democratic lawmakers—and the Biden campaign—have chosen to describe them: as “peaceful protests.” But after four effective days of coverage from the Republican National Convention (RNC), shining a spotlight on what’s actually happening, suddenly Democrats are striking a different tone. Now, the Biden-Harris ticket, along with their surrogates, claim the violence in Portland, Kenosha, Seattle, Chicago and the nation’s capital are President Donald Trump’s fault. This is happening, they argue, in “Trump’s America.” The leftists in national media, of course, happily forward the very same dishonest talking point. It will gloriously backfire.

On NBC’s Meet the Press, host Chuck Todd finally tackled the rioting after a deadly night in Portland that left dead someone who appears to be a Trump supporter. He asked Trump’s chief of staff, Mark Meadows, if Trump should bear responsibility: “This in Donald Trump’s America. How much responsibility should voters be giving the president for his inability to…keep the streets safe?” Over at CNN, they do much the same. Struggling to make his point, perhaps because he knows how dishonest it is, host Anderson Cooper stumbled his way through the same “this is Trump’s America” talking point. He then used the same talking point the following morning to set up a softball question to Biden, who responded that the “video [of violence] being played is video being played in Donald Trump’s America.”

This talking point is transparently dishonest and offensively dumb. Literally all of the sustained rioting and other violence has occured in Democrat-run cities. The federal government does not have jurisdiction to always send in the feds to wander rioting streets and quell the civil unrest. If Trump did always have such authority and if he acted upon it, he’d be called a fascist. Indeed, Democrats already call him just that. Trump has offered help many times to cities and states that are dealing with these issues. In Portland, feckless Mayor Ted Wheeler bragged about smugly rejecting Trump’s assistance in an August 28 letter that he posted to Twitter. He told the president, “We don’t need your politics of division and demagoguery.”

That night, activists gained entry into Wheeler’s condo, where they occupied the lobby. The next night, after trying to forcibly stop Trump supporters from protesting, a man in a conservative Patriot Front hat was shot to death. This is Trump’s fault? After the president’s RNC speech, mobs of far-left activists harassed and assaulted cops and conservatives leaving the White House. Other mobs spent Saturday night harassing D.C. diners who are supporting restaurants struggling to stay open amidst a pandemic. This is Trump’s doing? Trump has not just been rebuffed by progressive mayors. His offers of help have been met with insidious claims that Trump is really just practicing a dry-run for martial law, in the event he were to lose the election. And the media has been there to dutifully forward that dangerous claim.

“.. the majority of citizens believe that the media actively misrepresents facts. Roughly half view the media as biased. This is why. Of course, this is looting and rioting.”

• Chris Cillizza Blasts President Trump For Using The Word “Riots” (Turley)

We have previously discussed how some media organizations told their journalists not to call violence after the death of George Floyd “riots,” including the recently much mocked headline of CNN calling the looting and violence in Kenosha “fiery but mostly peaceful.” Now, Chris Cillizza, an editor-at-large for CNN, is under fire for criticized President Donald Trump for labeling the violence in places like Kenoska “riots.” Critics have noted that the picture posted by Cillizza with this tweet shows a building engulfed in flames. Lawyers notoriously parse terms in ways that often deny their obvious meaning but this effort by some in the media would make a Philadelphia lawyer blush. Cillizza tweeted “Trump’s efforts to label what is happening in major cities as ‘riots’ speaks at least somewhat to his desperation, politically speaking, at the moment.”

I do not deny that both sides are using these riots for political purposes. Trump is using the violence to reinforce a law-and-order theme while Democratic politicians are blaming him for the violence and calling for the 2020 election to be a referendum on racial justice. It is the parsing of the term that intrigues me. In Portland, the Portland police have reportedly declared 13 riots in 80 days. Newspapers in these cities have referred to rioting from Portland to Minneapolis to Kenosa. David Brown, the Chicago Police superintendent, said, “This was not an organized protest, rather, this was an incident of pure criminality.” The coverage of recent looting and rioting has been uneven with networks like CNN spending comparatively limited time reporting on the violence while Fox is covering it exhaustively.

Other outlets like NPR have run segments on how the word “rioting” has racist roots. Whether there are riots depends on what news outlet you use. It is the new reality of echo-journalism. Of course, this dispute turns on a noun that is clearly defined as “public violence, tumult, or disorder.” [..] We have been discussing the concern by many that networks like CNN shape the news to fit a narrative. Fox and MSNBC have been accused of the same practice. Many in the public do not know where to turn for unbiased reporting on the left or the right, according to various polls. Even in acknowledging the importance of the media to our system, the majority of citizens believe that the media actively misrepresents facts. Roughly half view the media as biased. This is why. Of course, this is looting and rioting.

This was advertized as a “campaign rally”. He was flown out to Pennsylvania for the event, first time he left Delaware in a long time.

• The Puppet Candidate in Two Pictures (CT)

This is the image the mainstream media portray:

This is the image that actually reflects the event:

Any questions?…

In the US today, an Appeals Court can reverse a decision by the DOJ, which all the judges in the court in the end work for. DOJ, prosecution, and defense all agreed the case should be dropped. Months ago.

• Appeals Court Denies Flynn Request To Dismiss Case (ZH)

Michael Flynn’s request to force a judge to immediately dismiss his case was shot down by a federal appeals court on Monday. In an 8-2 ruling, the DC Circuit Court of Appeals struck down Flynn’s petition to force Judge Emmett Sullivan to accept the Justice Department’s motion to drop charges without holding a hearing, according to The Hill. Flynn’s request that Sullivan be forced to recuse himself was also struck down, after his legal team argued that the judge acted improperly when he appointed a partisan outside attorney to argue against the DOJ’s decision to drop the case, and that it was inappropriate to ask the full circuit court to revisit an earlier decision by a three-member panel of the DC Circuit to drop the case.

Unless Flynn’s lawyers appeal to the Supreme Court, Sullivan will be able to move forward with a hearing about the DOJ’s unusual reversal in the case, before deciding whether to allow the Trump administration to withdraw its charges against the president’s former close aide. Flynn had pleaded guilty in 2017 to lying to the FBI about his conversations with the Russian ambassador to the U.S. and agreed to cooperate with the special counsel’s investigation into Russian interference in 2016 election.” -The Hill. The DOJ filed a motion to drop the case against Flynn in May, after it was revealed that the FBI engaged in a ‘perjury trap’ against the former Trump National Security Adviser.

“After producing documents revealing that the FBI set out to entrap Flynn, had no valid cause to interview him in the first place, and the prosecutors improperly extorted him into a plea by threatening to charge his son, the Justice Department moved to drop all charges.”

• Russiagate Won’t End: US Appeals Court Reverses Decision To End Flynn Case (RT)

A full-bench US federal appeals court has reversed an earlier decision to dismiss the ‘Russiagate’ case against former National Security Advisor Michael Flynn, returning it to the judge who refused to let the charges be dropped. In a 8-2 ruling on Monday, the DC Circuit Court of Appeals sided with Judge Emmet Sullivan, and sent the case back to him for review. Sullivan had been ordered by a three-judge panel in June to drop the case against Flynn immediately, but hired an attorney and asked for an en banc hearing instead. [..] The former top lawyer for the Barack Obama administration, Neal Katyal, hailed the decision as “an important step in defending the rule of law” and argued the case should not be dismissed because Flynn had pleaded guilty.

Sidney Powell

https://twitter.com/SidneyPowell1/status/1300472878585065477

Flynn had indeed pleaded guilty to one charge of lying to the FBI, but Powell moved to dismiss the charges due to the failure of his previous attorneys – a law firm with ties to the Democrats – and the government to disclose evidence that could set him free. After producing documents revealing that the FBI set out to entrap Flynn, had no valid cause to interview him in the first place, and the prosecutors improperly extorted him into a plea by threatening to charge his son, the Justice Department moved to drop all charges. Sullivan had other ideas, however. In a highly unusual move, he appointed a retired judge – who had just written a diatribe about the case in the Washington Post – to be amicus curiae and argue the case should not be dropped. It was at this point that Powell took the case to the appeals court, citing Fokker, a recent Supreme Court precedent that Sullivan was violating.

Ignoring the fact that Sullivan had appointed the amicus and sought to prolong the case after the DOJ and the appeals court both told him to drop it, the en banc panel argued the proper procedure means he needs to make the decision before it can be appealed. One of the judges, Thomas Griffith, actually argued in a concurring opinion that it would be “highly unusual” for Sullivan not to dismiss the charges, given the executive branch’s constitutional prerogatives and his “limited discretion” when it came to the relevant federal procedure, but said that an order to drop the case is not “appropriate in this case at this time” because it’s up to Sullivan to make the call first.

[..] With Mueller failing to find any evidence of “collusion” between President Donald Trump’s campaign and Russia, Democrats have latched onto Flynn’s case as proof of their ‘Russiagate’ conspiracy theory. The latest argument is that the effort to drop the charges against Flynn is politically motivated and proof of Attorney General Bill Barr’s “corruption.” Barr is currently overseeing a probe by US attorney John Durham into the FBI’s handling of the investigation against Trump during and after the 2016 election, with the evidence disclosed during the Flynn proceedings strongly implicating not just the senior FBI leadership but senior Obama administration figures as well.

“Neither the Democratic party nor the Republican party survives a defeat this November in anything close to their current form. I think several people are starting to think about that. But here’s what’s also true: Neither the Democratic party nor the Republican party survives a victory this November. And no one is thinking about that.”

Four years ago, when I wrote that I thought Trump would defeat Clinton, I said that Trump breaks us by turning every one of our domestic political games from a coordination game – where cooperation in the national interest is at least possible – into a pure competition game where that potential cooperation is impossible. He did. That’s exactly what happened. So today, neither the Trump campaign nor the Biden campaign can see the United States through anything other than the lens of a pure competition game.

Neither campaign or party will take the necessary steps to defuse the growing violence in American cities, like Biden calling for Democratic mayors to request National Guard support or like Trump doing anything to accommodate the voices of nonviolent protesters, because they both think that to do so would place them at a competitive disadvantage in the November election. Neither campaign or party is appropriately afraid of this comet hitting the United States, because they both think that they’ll do just fine in a post-comet world.

They both think that they can handle the aftermath of this comet strike after November 4th. They both are listening to their institutional Ego rather than to the Narrator. They are both sowing the wind. And they will both reap the whirlwind. Neither the Democratic party nor the Republican party survives a defeat this November in anything close to their current form. I think several people are starting to think about that. But here’s what’s also true: Neither the Democratic party nor the Republican party survives a victory this November. And no one is thinking about that.

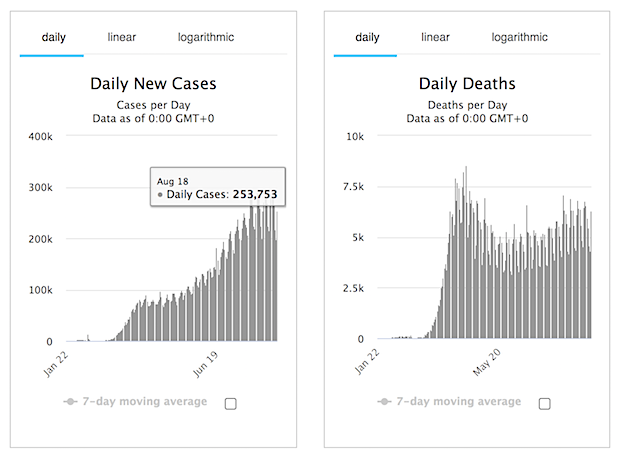

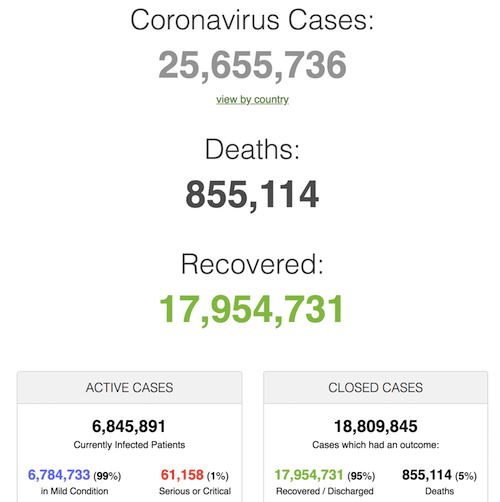

That 6% figure from the CDC that so many are touting is not what it seems.

• No One Wants to Solve Real Problems (Geraghty)

The president of the United States retweeted a link to a post on Gateway Pundit, asserting that the real death toll from COVID-19 is merely 9,000, and that the other roughly 178,000 deaths were because of other factors. That was a pretty egregious misinterpretation of the CDC’s data; the CDC stated, “For 6 percent of the deaths, COVID-19 was the only cause mentioned [on the death certificate]. For deaths with conditions or causes in addition to COVID-19, on average, there were 2.6 additional conditions or causes per death.” The list of conditions is long and varied: diabetes, various heart-related conditions including hypertension, cardiac arrest, ischemic heart disease (hardening of the arteries), cardiac arrhythmia and heart disease, chronic kidney disease, chronic obstructive pulmonary disease, chronic lower respiratory diseases, obesity, an immunocompromised state from an organ transplant, coronary art disease, or sickle cell disease.

None of the conditions listed above are death sentences by themselves. With treatment and medication, most people diagnosed with those conditions can live long and happy lives. No one with the slightest understanding of human health can look at someone with one of those conditions listed above dying from COVID-19 and conclude, “that person was going to die soon anyway.” And if your takeaway from this data is that SARS-CoV-2 is only a risk to those with one of those conditions . . . great, now we just have to worry about the 100 million or so Americans with diabetes or prediabetes, the roughly 100 million Americans with high blood pressure, the one in three American adults at risk for chronic kidney disease, the 16 million to 24 million Americans believed to be at risk for chronic obstructive pulmonary disease, the 1 in 500 adults who have cardiomyopathy, the millions of Americans either being treated for cancer or who have recovered from cancer, the roughly 100,000 Americans with sickle cell disease, the nearly 49,000 Americans who had an organ transplant last year, and the slightly smaller number of transplant recipients this year.

There are some overlaps among those groups, but we have plenty of Americans who have one or more comorbidities and who would be at risk if they caught SARS-CoV-2.

6%

6% of people died from covid19 while having no KNOWN comorbidities. 94% died from covid19 IN CONJUNCTION WITH extant comborbidities.

That means, if they hadn't caught covid19, they wouldn't have died.

Meaning THEY DIED FROM COVID.

This shit is why we need data ethics standards

— Damien P. Williams, MA, MSc, Tired. (@Wolven) August 30, 2020

Well, we’re all going to be cleaner anyway.

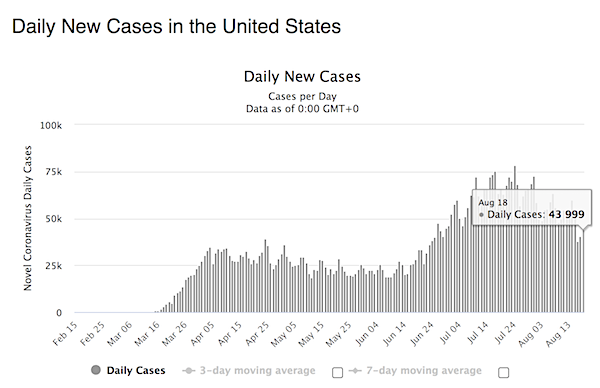

• Coronavirus May Survive On Outdoor Surfaces For Longer In Autumn (SCMP)

As the northern hemisphere heads into autumn, the coronavirus may be able to survive on outdoor surfaces for much longer, according to a new US study. Researchers found that in lower temperatures and humidity, the virus could, for example, remain on a hiker’s jacket if it was outside for a week – and remain infectious for that time – whereas in summer its lifespan was estimated to be one to three days. The prolonged survival of the virus on surfaces in autumn could “potentially contribute to new outbreaks”, the team led by Juergen Richt, professor of veterinary microbiology at Kansas State University, wrote in a non-peer-reviewed paper posted on preprint website bioRxiv.org on Monday. They believed the virus would also survive for longer indoors in colder and less humid conditions.

The study found it had an average half-life – or rate of decay – of nearly eight hours on a stainless steel doorknob, or nearly 10 hours on a window, which was about to twice the duration in summer. The coronavirus, which causes the disease Covid-19, has adapted well to humans. But to survive outside its human hosts – it spreads through respiratory droplets and contaminated surfaces – the pathogen is believed to prefer lower temperatures and humidity. For the study, Richt’s team used climate data from America’s Midwest to recreate artificial seasons in biosafety chambers. Temperature was controlled at 13 degrees Celsius and 66 per cent relative humidity for spring and autumn, while for summer it was kept at 25 degrees and 70 per cent. The virus was then applied to the surface of 12 materials people come into contact with every day, such as cardboard, concrete, rubber, gloves and N95 masks.

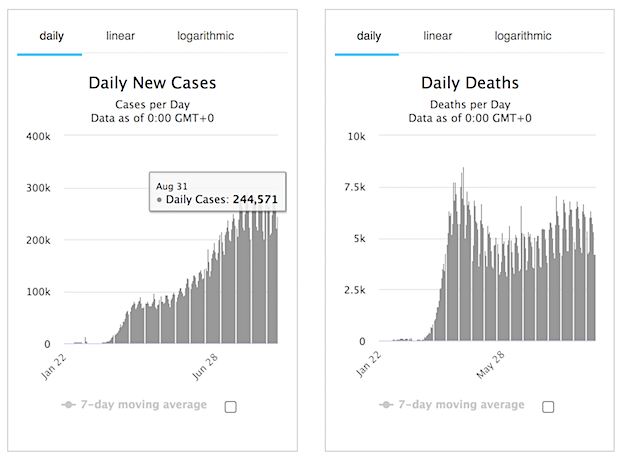

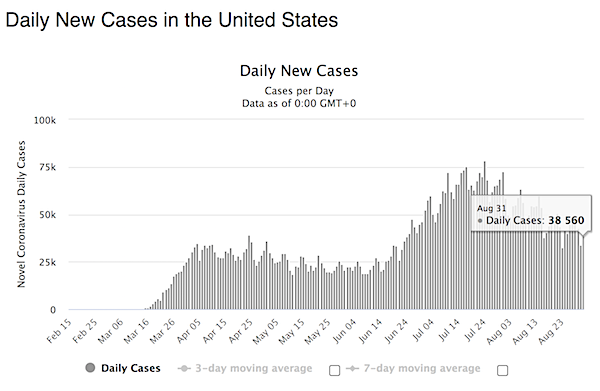

The aim was to find out if the viability of the virus changed with the season. Earlier in the pandemic, the research community had hoped the spread of the virus would slow in summer, believing it would be less likely to stay in the air in warmer weather. But the resurgence of infections in many areas – especially the United States, the worst-hit country where more than 80,000 cases per day were recorded at the peak of summer – raised the question of whether there was any seasonal impact at all. The result of the Midwest study “clearly demonstrates that the virus survives longer under spring/fall not summer conditions”, the researchers said in the paper. That trend was observed on all materials tested, to varying degrees. Out of all of them, the virus survived longest on Tyvek, a synthetic material used in everything from home insulation to personal protective equipment and outdoor wear, with a half-life of up to 45 hours.

So try it on all patients?

• Inhaled Nitric Oxide Therapy Benefits Pregnant COVID19 Patients (Harvard)

Inhaled nitric oxide (NO) can be a valuable adjunct respiratory therapy for pregnant women with severe and critical COVID-19, a team of researchers from Massachusetts General Hospital (MGH) has found. The delivery of the therapeutic gas to six COVID-19 pregnant patients admitted to MGH, as described in a paper in Obstetrics & Gynecology, resulted in a rapid and sustained improvement in cardiopulmonary function and decreased inflammation. The resolution of viral infection within 22 days was observed in five of the six patients, findings that could have important implications for treating viruses like Severe Acute Respiratory Syndrome Coronavirus 2 (SARS-CoV-2). The study is the first to investigate the role of inhaled NO in pregnant people with COVID-19.

The patients experienced rapid relief from breathlessness, a lower respiratory rate, and better oxygenation after mask administration of high concentration NO, according to Lorenzo Berra in the Department of Anaesthesia, Critical Care and Pain Medicine at MGH. Berra also reported no negative side effects. “In addition, inflammatory markers showed a rapid decrease after breathing NO and five of the six patients in our study showed viral clearance from nasopharyngeal swabs by 22 days after COVID-19 diagnosis,” Berra, corresponding author of the study, added. “All patients were discharged in stable condition from the hospital. We found these results to be very encouraging.”

Inhaled NO increases oxygenation by dilating or opening constricted blood vessels, especially in more well-ventilated areas of the lung, thereby improving intrapulmonary shunt fraction, or the percentage of blood put out by the heart that is not completely oxygenated. A recent report from the Centers for Disease Control and Prevention (CDC) suggests that pregnant women with COVID-19 are more likely to be hospitalized, are at increased risk of being admitted to the intensive care unit, and more often require mechanical ventilation compared to nonpregnant women.

“I’m against them heart and soul, and I no longer care what my old friends think about it.”

• Bill of Particulars (Jim Kunstler)

RussiaGate was, in the strict sense of the word, a conspiracy to overthrow a president carried out by a coordinated effort of high-ranking government employees across many agencies, who knew exactly what they were doing. It was an exercise in perfidy, bad faith, and lawlessness run by the very Department of Justice entrusted with enforcing federal law, including attorney Andrew Weissmann’s clean-up crew fronted by the dishonorable figurehead Robert Mueller. It remains unresolved due to the tensions in that department and the obdurate resistance of the federal courts — for example in the three-year persecution of General Flynn. The eventual day that the hammer comes down on the perps of RussiaGate, if ever it does come, will be a moment of historic moral and ethical clarification in this sore-beset country.

The 2019 impeachment fiasco was a parallel ruse run by Representative Adam Schiff, former Department of Justice lawyer Mary McCord, and Lawfare warrior Daniel S. Goldman, with help from Resistance intriguers in the National Security Council, Eric Ciaramella and Alexander Vindman, and Hillary Clinton’s holdover confederates in the State Department. Mr. Ciaramella’s pretense to be acting as a “whistleblower” was a nakedly false act, illegally abetted by Intel Community Inspector General Michael Atkinson, himself a former DOJ RussiaGate player. It is amazing that neither of these two has been indicted for sedition.

Add to these matters the associated misdeeds in the FISA courts, the ridiculous, scurrilous charges against Supreme Court Justice nominee Brett Kavanaugh by the mendacious Christine Blasey Ford, the ongoing schemes of House Speaker Nancy Pelosi and Senate Minority Leader Charles Schumer to rig the vote with unverifiable mail-in ballots, and the wholesale acts against the public interest by Democratic mayors and governors such as Ted Wheeler, Kate Brown, Bill de Blasio, Andrew Cuomo, Lori Lightfoot, J.B. Pritzker, Ralph Northam, Jacob Frey, Tim Walz, Muriel Bowser, Eric Garcetti, Gavin Newsom, Tony Evers and a wider rogues’ gallery of other Democratic Party subalterns such as Minnesota AG Keith Ellison and NYC education Chancellor Richard Carranza and you have a nearly complete picture of this odious faction.

Finally, add the cherry-on-top: Democratic candidate for president, Joe Biden. Does anybody still believe he is a plausible chief executive — even in his own degenerate party? I doubt it. Why they engineered his nomination may remain one of the great mysteries of human existence. Except perhaps to speculate that their sadism has turned inward and become a suicidal death-wish. They are finally so miserably contemptible that they just want to end it all. Personally, I don’t want to see any of these people anywhere near the levers of power in this country. Quite a few of them deserve to be in jail, and I believe before Mr. Trump’s second term is up, they will be — if they don’t try to wreck the United States altogether with new treasons in the November election. I’m against them heart and soul, and I no longer care what my old friends think about it.

As someone tweeted earlier: all we have to do now is wait for Tesla to buy Berkshire Hathaway.

• Just Put Your Brain on Tesla Autopilot and Believe in It (WS)

Let’s get this straight: Tesla is led by a CEO who is regularly seen walking on water, and its shares are a supernatural phenomenon. Today, those shares, trading for the first time after the 5-for-1 split, surged from $442.61 at the open to $498.32 at the close and then on to $514.74 after-hours at the moment. That’s a 16.3% ride in one day, following weeks of supernatural moves into the heavens. Below is my Triple-WTF Chart of the Year because it just blew away and annihilated my WTF-Chart of the Year of February 4 and my Double-WTF Chart of the Year of July 1 (stock prices via YCharts):

The stock split did the job, based on the logic that a five-dollar bill broken into five ones makes each of those ones suddenly worth $1.16 — or $1.87 if you start counting since the announcement of the split on August 11. I mean, it’s just pure supernatural, and if you don’t get it, too bad, it’s a sign that you just don’t have the right stuff. Back on July 1, Tesla surpassed Toyota as the most valuable automaker in the world. At the time, Tesla traded at $226 a share ($1,130 pre-split). Since that propitious date two months ago, Tesla has skyrocketed another 127%.

At the time when it blew past Toyota, the value that the market put on Tesla (outstanding shares times share price) was $210 billion, which was – and I mean was – a huge number. Now, after-hours, Tesla’s market capitalization, according to YCharts, is $476 billion. Today alone, Tesla’s market cap soared by $64 billion in eight hours, including after hours. That’s $8 billion in “value created” per hour. If you have to ask, “value created by doing what,” then you don’t have the right stuff. Simple as that.

I can see how trawling is a problem, but how does that mean there is no point in cleaning it up? How about a different method?

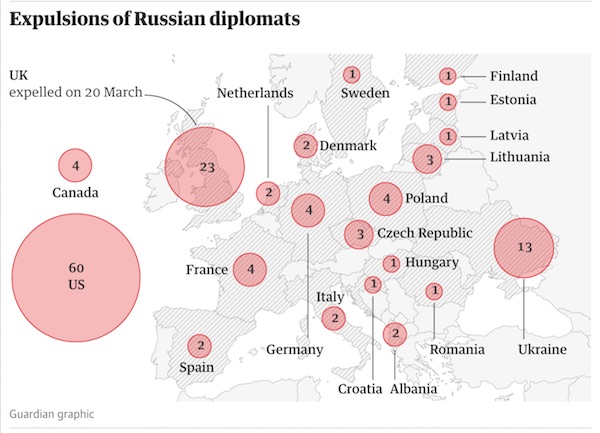

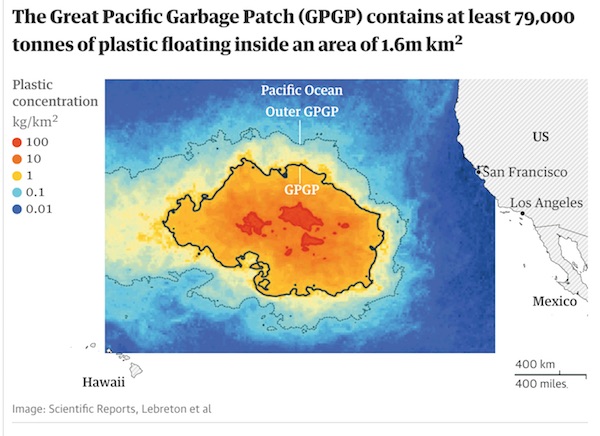

• Norwegian Researchers Call Against Cleansing Seas Of Plastic Waste (RT)

Cleaning floating plastic from the sea is a “lost cause” and trying to remove it can actually do more harm than good, new research suggests. Instead, clean-up efforts should focus on rubbish washed ashore. Trying to clean up plastic pollution from the open seas is a “waste of time and resources,” researchers with the Norwegian-based SALT company have concluded. “The rubbish in the sea is a lost cause, there is no point in cleaning it up,” the team said in a newly released research paper. Assorted plastic, that is floating around the seas is way too scattered to be easily removed, the researchers argued. Attempting to trawl it out is not only disproportionately costly and time-consuming, but it can also do more harm than good.

Trawling large areas will catch “too much fish and wildlife compared with the amount of rubbish,” the research team noted. “In addition, rubbish is often found in marine life and organic material that is important for the ecosystems and animals that live there. In the worst case, we risk doing more harm than good by trawling over the areas,” lead author of the research paper Jannike Falk-Andersson told broadcaster NRK. Instead of wasting time and recourses on the high seas clean-ups, people should focus on hand-picking trash washed ashore, which is a far more gentle and effective method. “There, you pick one thing at a time. You do not drag large objects across the beach that kills everything it comes across, in an attempt to clean up,” Falk-Andersson explained.

The research has been praised by Norway’s Climate and Environment Minister Sveinung Rotevatn, who, at the same time, described the plastic pollution as a rapidly escalating problem that must be tackled with a broad international effort. “It is very good that a critical spotlight is placed on clearing plastic in the sea. We have long pointed out that cleaning in the sea areas starts at the wrong end and that there is a risk of damage to life in the sea when trawling for plastic,” Rotevatn told NRK. Over the past years, plastic pollution has become one of the main environmental problems with the amount of waste floating around the oceans growing at alarming rates. According to various estimates, some 15 tons of plastic gets into the planet’s seas every minute.

How many British people realize they have no justice system left? Doesn’t that worry you?

• Waiting for the Old Bailey: Julian Assange (OffG)

On September 7, Julian Assange will be facing another round of gruelling extradition proceedings, in the Old Bailey, part of a process that has become a form of gradual state-sanctioned torture. The US Department of Justice hungers for their man. The UK prison authorities are doing little to protect his health. The end result, should it result in his death, will be justifiably described as state-sanctioned murder. This picture was not improved upon by a prison visit from his partner, Stella Morris, accompanied by their two children. Almost six months had passed since the last meeting. Physical distancing was practised during the twenty-minute meeting in Belmarsh Prison.

Morris and Assange wore face masks and visors, a state of affairs curious given the conspicuous lack of protective wear that has been given to Assange during the pandemic. A prohibition on touching was observed. “We had to keep social distancing and Julian was told he would have to self-isolate for two weeks if he touched the children.” Were officials being careful and considerate? Not according to Assange, who claimed it was the first time he had received a mask “because things are very different behind the doors.” Morris noted a prevailing thinness, a yellow armband to indicate prisoner status, and the fact that he was “in a lot of pain.”

What awaits Assange next month promises to be resoundingly ugly. He will have to ready himself for more pain, applied by Judge Vanessa Baraitser. Throughout her steering of proceedings, Baraitser has remained chillingly indifferent to Assange’s needs, a model of considered cruelty. Keen followers of justicia will be crestfallen: limiting access to legal counsel by keeping him caged behind a glass screen; ignoring his health considerations in refusing emergency bail during the COVID-19 pandemic. Her behaviour has been in keeping with that of Chief Magistrate Lady Emma Arbuthnot, who has done her precious bit to soil the citadel of British justice in previous rulings on Assange. With a family well and truly embedded in the British intelligence and military establishment, it was alarming to even see her name allocated to the Assange case.

We try to run the Automatic Earth on donations. Since ad revenue has collapsed, your support is now an integral part of the process.

Thank you for your ongoing support.

Three miles north of purgatory – one step from the great beyond

I prayed to the cross, and I kissed the girls, and I crossed the Rubicon

– Bob Dylan

Support the Automatic Earth in virustime.