Edward Hopper The barber shop 1931

Nap/Macgregor

Using NATO to forcibly transform the world

Col. Doug Macgregor#nato #globalist

see full vid: https://t.co/O5XANjGlD4 pic.twitter.com/PN6lKfIyXi— Judge Napolitano (@Judgenap) March 9, 2023

Arestovich

Former adviser to Zelensky, Alexey Arestovich — "The west deceived Russia. They promised not to push NATO to the east, and they did. They turned Ukraine into a huge anti-Russian country.

If I was in Russia's shoes, I would have done the exact same thing." pic.twitter.com/UmQvvorCt5— Maria (@real1maria) March 10, 2023

Shaman

Very intelligent statement from Jacob Chansley. Watch.

— Juanita Broaddrick (@atensnut) March 10, 2023

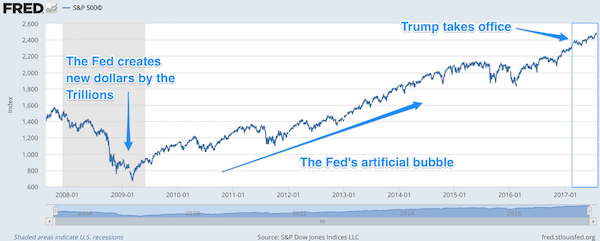

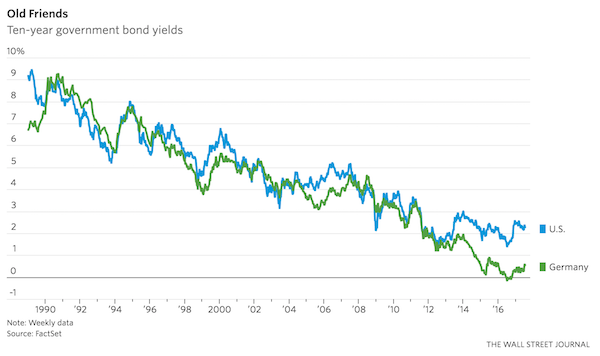

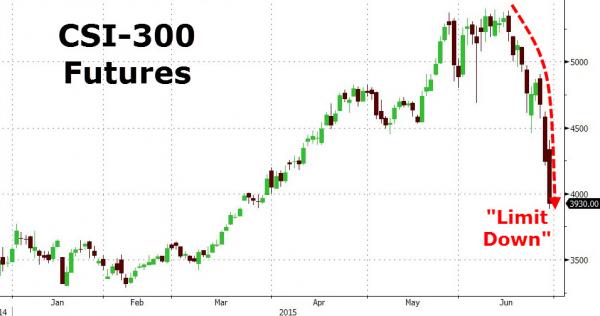

And nobody saw anything coming?

• Banking Rout Rattles Global Markets (RT)

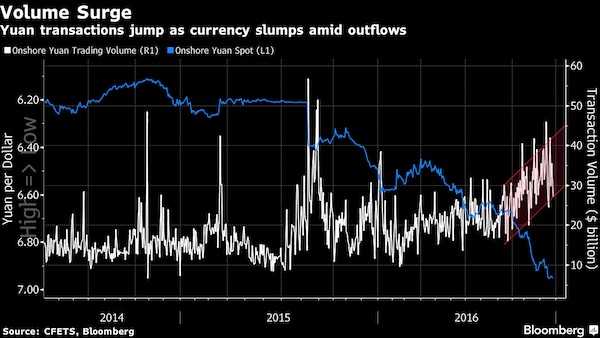

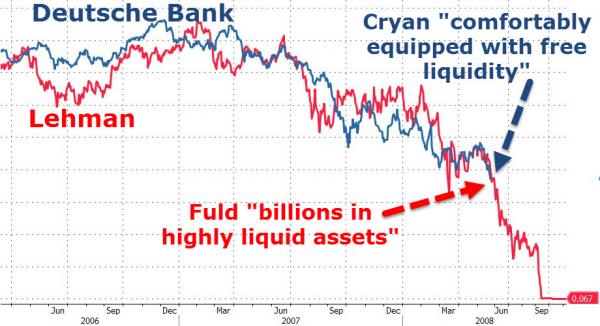

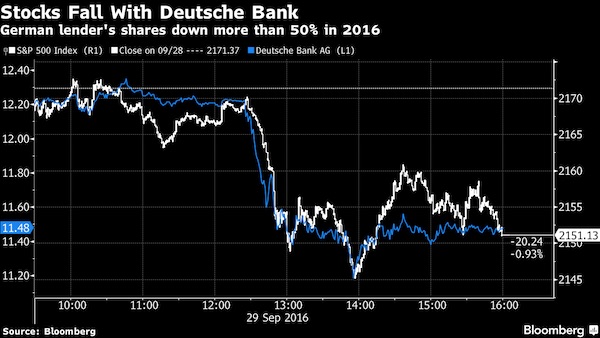

European and Asian stock markets plummeted on Friday, following a rout in US equities amid liquidity concerns in the banking sector. The meltdown was triggered by US bank SVB Financial, known as Silicon Valley Bank (SVB), which plunged 60% on Thursday after revealing that it needed to raise more than $2 billion in capital to offset losses from bond sales. The announcement rocked financial stocks, with Euro Stoxx Banks index on Friday on pace for its worst day since June, led by a decline of more than 8% for Deutsche Bank. Societe Generale, HSBC, ING Group and Commerzbank all tumbled more than 5%. Asian stocks suffered their worst day in five months, with Hong Kong’s Hang Seng index plummeting 3% on losses in heavyweight technology stocks. The Shanghai Composite dropped 1.4%, while Japan’s Nikkei 225 index fell 1.67%.

Investors started offloading US bank stocks on Thursday after SVB, a major lender to the tech industry, announced aggressive measures to support its balance sheet. The bank had reportedly been forced to sell all of its available-for-sale bonds at a $1.8 billion loss as its startup clients withdrew deposits. The news, which follows the collapse of the crypto-focused bank Silvergate, led to another wave of deposit withdrawals, people familiar with the matter told CNBC. All of this led to the four largest US banks – JPMorgan Chase, Bank of America, Wells Fargo, and Citigroup – seeing their stock prices lose a cumulative $52 billion in a single day.

SVB, which had a market value of $16.8 billion to end last week, was worth $6.3 billion as of Thursday. “The issues at SVB have been like a cold shower and with the Fed having just countenanced the idea of faster hikes once again, the potential for a very unhappy equity market should the jobs data surprise on the upside is very real indeed,” James Athey, investment director at global investment company Abrdn, told Bloomberg. “It has always been the case that the sort of hikes we have seen from the Fed were going to cause problems somewhere,” he added.

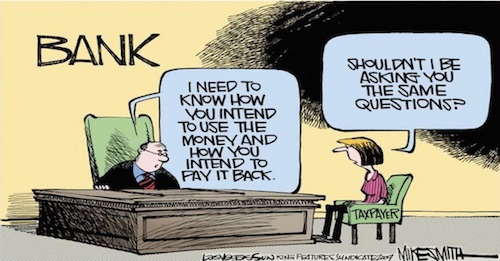

FDIC guarantees up to $250k. Over 90% of SVB accounts held more than that. “About 37,000 customers accounted for nearly $157 billion or 74% of the bank’s assets with an average account size of over $4 million….at the end of 2022, 87% of the bank’s $173 billion in deposits were uninsured.”

Trying to find some stuff in between all the graphs ad stats. Here’s two threads ZH picked up on:

• The Real-World Impact Of SVB’s Failure (ZH)

Brad Hargreaves explains in a brief thread how SVB’s closure & receivership is going to have a massive impact on the tech ecosystem. “SVB was not just a dominant player in tech but were highly integrated in some nontraditional ways. A few things we’ll see in the coming days / weeks… One, SVB was incredibly integrated into the lives of many founders. Not just their startup’s bank & lender, but also provided personal mortgages and other financial services. A whole mess for FDIC (or the eventual buyer) to unwind. Two, any “uninsured” balances at SVB – those above $250K – are in jeopardy. FDIC plans to pay them out “as it sells the assets of SVB”. Lots of startups exclusively banked with SVB as *this was a covenant of their debt*!

CEOs yesterday faced a hard choice: Pull your deposits and go into default on your venture debt or risk losing everything if the bank failed. Many chose to hold tight as SVB’s outright failure seemed outlandish. Now they may not be able to make payroll next week. Unpaid wages pierce the corporate veil, so boards are *incredibly* sensitive to employing workers they may not be able to pay. Expect mass layoffs later today, Monday at latest. And given the weak fundraising environment, a number of startups have been reliant on venture lenders – e.g., SVB – not aggressively pursuing amortization of debt or triggering default for covenant foot faults (e.g., cash balances). How will the FDIC handle this? Mass defaults?

Having run a startup through the GFC, this is the first thing I’ve seen since that is even vaguely reminiscent of that time. Total clusterfuck. One more thing: SVB also offered *wealth management services* to many of its founders. So your corporate lender, corporate bank, personal mortgage lender, and family’s wealth manager is… all one bank, which is now in FDIC receivership. Fun. JPow got his fucking debt crisis alright.”

[..] Garry Tan, the CEO of YCombinator echoes what we said just two days ago, namely that “this is an *extinction level event* for startups and will set startups and innovation back by 10 years or more” and warns that “30% of YC companies exposed through SVB can’t make payroll in the next 30 days.”

“The most important thing the FDIC and the US Government can do right now is *make the receivership as short as possible* There are thousands of US startups that banked at SVB, often as their *sole bank*. $250K per account is not going to last long. The #1 pressing issue for these startups is *payroll* – you can’t have people work if you can’t pay them. This means mass furlough. It might mean thousands of startups die before the FDIC gets through its receivership process and releases the funds. From what I hear, there are venture debt options coming from providers like Brex, but we’re going to need *a lot* of options in order to avoid a mass shutdown of all American startups in the next few weeks.

This is an *extinction level event* for startups and will set startups and innovation back by 10 years or more. BIG TECH will not care about this. They have cash elsewhere. All little startups, tomorrow’s Google’s and Facebooks, will be extinguished if we don’t find a fix. 30% of YC companies exposed through SVB can’t make payroll in the next 30 days. If you or your company are affected, I recommend that you reach out to your local congressman to get this on their radar TODAY. Now.

Pomboy

https://twitter.com/i/status/1634364937072959492

50 feet is a nice sized boat. But how do you get 6 people to sit and sleep on it, along with tons of equipment?!

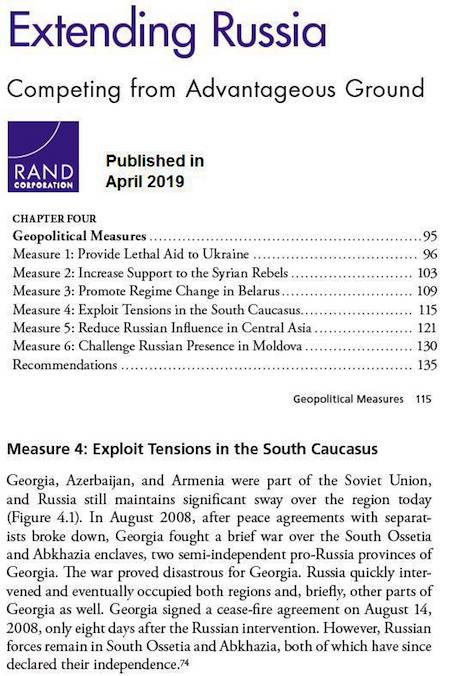

• The US Opts For Ham Handed Political Gestures (Larry Johnson)

In theory, a covert operation is supposed to be elegant, sophisticated and smart. But that is not the case with the United States these days. Ham-fisted and clumsy are more apt descriptors. Yesterday’s simultaneous release of a new account of who destroyed the Nordstream pipeline in the New York Times, Die Zeit and a London paper placing the blame on shadowy pro-Ukrainians was not a coincidence. This was a coordinated information operation and the media reaction to this news is quite telling. The same news outlets that strenuously ignored Sy Hersh’s explosive, detailed revelation that it was a U.S. operation with help from Norway stumbled over themselves to breathlessly report that an unidentified pro-Ukrainian group was the guilty party.

Bavaria Cruiser 50 – Sailing yacht Andromeda. Image: Spiegel

Die Zeit provided the most hilarity with their fantastic tale of six people on a private yacht carrying out the deed. Looks to me like Die Zeit was channeling a Gilligan’s Island episode. We had Ginger and Mary Ann, accompanied by the Professor, the Skipper, Thurston Howell and Gilligan. They set to sea with a 1000 pounds of high explosive and used their snorkel gear to plant the charge. I bet you it was Ginger and Mary Ann who planted the bomb, of course, was built by the crafty Professor. Take a look at Moon of Alabama’s detailed breakdown of the nonsense:

“No. You do not dive down to 80+ meter for an industrial size job, involving the placement of hundreds of pounds of explosives in eight individual charges on very sturdy pipelines, from a sparsely manned boat. Such deep dives require special gases, special breathing equipment, special training, a decompression chamber for emergencies and lots of well trained people to maintain all that stuff. All three articles neglected to point out that you cannot dive in regular scuba gear to 200 feet in an arctic sea. You need a dry suit (as my friend Mark says, you look like the Stay Puft marshmallow man). That suit requires some specialized support equipment that does not fit on a yacht. This is a desperate, juvenile attempt to shift the blame from the United States. I cannot wait to see what happens when Sy drops a new story on Nordstream.”

A competent intelligence service would have prepared a detailed story that was plausible and contained enough details to create doubt in the minds of those who accepted Sy’s account. Instead of releasing the same skimpy story in three different media outlets on the same day, the release should have been spread out over a few days or a week. This bungled attempt to shift the blame to Ukraine is just one more piece of evidence that America does not have a competent intelligence service.

China yesterday brokered a peace deal between Iran and Saudi Arabia. China wants the fighting to stop, to safeguard the Belt and Road.

• US Must Pull Troops Out Of Syria, Stop Marauding – China (TASS)

China calls on the US to withdraw its troops from Syria and to stop plundering that country, Chinese Foreign Ministry spokesperson Mao Ning told a news briefing on Friday. “The United States has illegally intervened in military activities related to the Syrian crisis, which has led to the death of a large number of innocent civilians and a serious humanitarian disaster,” Mao said. “We call on the United States to sincerely respect the sovereignty, independence and territorial integrity of other countries, and to immediately stop its illegal military presence and marauding in Syria,” she said. Mao called on the US authorities to lift “illegal unilateral sanctions” against Syria and to stop actions that aggravate the humanitarian situation in the country.

According to the Chinese Foreign Ministry spokesperson, during the years of the Syrian crisis in the country at least 350,000 people have lost their lives to the military conflict, and 14 million are in dire need of humanitarian assistance. The House of Representatives of the US Congress on Wednesday failed to pass a resolution according to which the Washington administration should withdraw all US troops from Syria. The initiative was introduced in February by Republican Matt Gaetz, from Florida. He stressed that Congress had not given permission to use US forces in combat operations on Syrian territory. On March 4, the chairman of the US Joint Chiefs of Staff, General Mark Milley, visited Syria, where he claimed that the US military presence in the country was of critical importance to the security of both the United States and its allies.

“The China-Russia axis is the biggest cause for concern for Washington because of “their shared threat perceptions of the US”..”

• Russia And China Dominate Washington’s Mindset (Gupta)

A top US intelligence official has expressed concern that the Chinese government – under its powerful President Xi Jinping, who started his historic third term this week – could emerge as the most potent force on the global stage in alliance with Russia to weaken Washington’s influence. Earlier this week, Avril Haines, the director of national intelligence in the administration of US President Joe Biden, appeared before a Senate committee to present the annual threat assessment report. Asia Editor Joydeep Sen Gupta decodes the key pressure points of the report, which identifies Beijing as a ‘near-peer competitor’ in a changing world order, The report dwells on China-Russia bonhomie as one of the high points of the annual review, which seldom gets a makeover from year to year.

Significantly, the section on China is much more elaborate this year than in recent times. It reinforces the Biden administration’s growing focus on Asia’s biggest economy, which is seen as punching above its weight in its bid to challenge the US’ military might. The report makes reference to China’s “capability to directly attempt to alter the rules-based global order in every realm and across multiple regions,” while acknowledging Beijing’s exalted status. The report identifies Beijing as a “near-peer competitor” for its ability to threaten its neighbors (read India). Simultaneously, it takes note of Russia’s “unprovoked full-scale invasion of Ukraine” that “has emerged as a defining characteristic of the current era.” The China-Russia axis is the biggest cause for concern for Washington because of “their shared threat perceptions of the US” in diverse fields largely pertaining to defense and security.

Haines singles out the Ukraine conflict “as a tectonic event that is reshaping Moscow’s relationships with the West and China,” and warns of potential conflict between Russia and the West that may lead to dire consequences. However, the report strikes a contradictory note when it cites Moscow’s dwindling influence because of a “range of constraints,” despite noting its prowess in military, security, malign influence, cyber, and intelligence tools. Russia’s interests in the oil-and-natural resources-rich Middle East and North Africa (MENA) region for “military access rights and economic opportunities” at Washington’s expense finds special mention. It also names the Central African Republic, Libya, Mali, and Syria in the Levant, where Russia “will present itself as an indispensable mediator and security partner.”

It predicts that both Russia and Iran will improve their “bilateral economic and defense cooperation” in a bid to circumvent Western sanctions. Similarly, it rings alarm bells regarding Russia’s overtures in Latin America in “countries that Moscow sees as key players or close partners, including Argentina, Brazil, Cuba, Nicaragua, and Venezuela” to amplify its influence. “Russia will continue to use energy as a foreign policy tool to try to coerce cooperation and weaken Western unity on Ukraine,” the report says.

The focal point of the report is China’s strengthening of its military and its expanded operations in the Indo-Pacific region, which is being countered by a grouping consisting of the US, Japan, Australia, and India known as the Quad. A substantial part of the report is devoted to the Chinese Communist regime’s efforts to press Taiwan on unification and whether Beijing will attack the island nation. The Chinese military, according to the report, is working towards meeting Xi’s goal – to become powerful enough by 2027 to ward off any US-led intervention in the event of an armed conflict over Taiwan. It warns that China will avoid signing nuclear arms agreements with either the US or Russia because of an inadequate arsenal that needs to be modernized.

As the west loses itself, the south is taking shape.

• Moveable Multipolarity in Moscow: Ridin’ the ‘Newcoin’ Train (Escobar)

[..] please allow me to introduce one such technical blueprint for the newcoin. Let me start by saying that it should be partially (I suggest a share of at least 40% of value) backed by gold, for reasons that will soon become clear. The remaining 60% of the newcoin would be composed of the basket of currencies of the participating countries. Gold would provide the “external money” anchor to the structure and the basket of currencies element would allow the participants to retain their sovereignty and monetary flexibility. There would clearly be a need to create a Central Bank for the newcoin, which would emit new currency. This Central Bank could become a counterparty to cross-swaps, as well as provide clearing functions for the system and enforce the regulations. Any country would be free to join the newcoin on several conditions.

First, the candidate country needs to demonstrate that it has physical unencumbered gold in its domestic storage and pledge a certain amount in exchange for receiving corresponding amount of newcoin (using the 40% ratio mentioned above). Economic equivalent of this initial transaction would be a sale of the gold to the “gold pool” backing the newcoin in exchange for proportional amount of the newcoin backed by the pool. The actual legal form of this transaction is less important, as it is necessary simply to guarantee that the newcoin that is being emitted is always backed by at least 40% in gold. There is no need to even publicly disclose the gold reserves of each country, as long as all participants can be satisfied that sufficient reserves are always present. An annual joint audit and monitoring mechanism may be sufficient.

Second, a candidate country would need to establish a gold price discovery mechanism in its domestic currency. Most likely, one of the participating precious metals exchanges would start physical gold trading in each of the local currencies. This would establish a fair cross-rate for the local currencies using “external money” mechanism to set and adjust them over time. The gold price of the local currencies would drive their value in the basket for the newly-emitted newcoins. Each country would remain sovereign and be free to emit as much of local currency as they choose to, but this would eventually adjust the share of their currency in the newcoin’s value. At the same time, a country would only be able to obtain additional newcoin from the central bank in exchange for a pledge of additional gold. The net result is that the value of each component of newcoin in gold terms would be transparent and fair, which would translate into the transparency of newcoin’s value as well.

Finally, emissions or sales of newcoin by the central bank would be allowed only in exchange for gold for anyone outside the newcoin zone. In other words, the only two ways external parties can obtain large amounts of newcoin is either receiving it in exchange for physical gold or as a payment for goods and services provided. At the same time, the central bank would not be obliged to purchase newcoin in exchange for gold, removing the risk of the “run on the bank.”

“The pontiff has repeatedly said that his visit to Kiev, on which the Ukrainian authorities have been insisting, is only possible if he is also able to make a trip to Moscow.”

• Pope Francis Sees Countries’ ‘Imperial Interests’ In Ukraine Conflict (TASS)

Pope Francis believes that “the imperial interests” of various countries are shining through in the Ukraine conflict, the Vatican News writes, citing the pontiff’s interview for the Italian Swiss Radio and Television. “In a little over a hundred years, there have been three world wars: in 1914-1918, in 1939-1945, and this one, which is a world war. It started in bits and pieces and now no one can say it is not worldwide. The great powers are all caught up in it. The battlefield is Ukraine. Everyone is fighting there,” Pope Francis said, as cited by the Vatican News. “There are imperial interests there, not only of the Russian empire, but of empires elsewhere. It is typical of the empire to put nations in second place,” he added.

The pope confirmed his readiness to meet with Russian President Vladimir Putin, “an educated man.” Pope Francis noted that right after the start of Russia’s special military operation in Ukraine, he went to the Russian Embassy at the Holy See to say that he was willing to go to Moscow if the Russian authorities gave him “a window to negotiate.” “[Russian Foreign Minister Sergey] Lavrov wrote to me, saying thank you but now is not the time,” Pope Francis said. The pontiff has repeatedly said that his visit to Kiev, on which the Ukrainian authorities have been insisting, is only possible if he is also able to make a trip to Moscow. He previously echoed this sentiment on his way back from an apostolic journey to Africa in early February. The pope said at that time that he was open to meet with the presidents of both Ukraine and Russia. Pope Francis has met with Putin before, with the Russian leader’s last trip to the Vatican taking place in July 2019.

“..the West is loath to listen to Russia’s criticism of its attempts to “live at the expense of others” in the post-colonial era.”

• West Was Seeking Pretext To ‘Get Its Claws Into’ Russia – Lavrov (TASS)

The West was looking for some sort of pretext to “get its claws into” Russia after Moscow had come to be seen as too independent a player in the international arena, Russian Foreign Minister Sergey Lavrov said on Friday. “[The West] was waiting for a pretext to get its claws into Russia. They were waiting for a chance to do this because they had begun to see Russia as too independent a player, which, if perhaps not building up as much economic power as China or India, was nevertheless among the leading world economies and holds rather weighty moral and political stances in the international arena, advocating from a position of justice on those issues that are of critical importance for the developing countries,” he said in an interview with the “Bolshaya Igra” (“The Great Game”) public affairs program on Russia’s Channel One television. According to the top Russian diplomat, the West is loath to listen to Russia’s criticism of its attempts to “live at the expense of others” in the post-colonial era.

“We had no plans. They had plans – to abandon Russian gas. They survived the winter, but how much did it cost the government and the taxpayers? They are not very eager to tell..”

• Lavrov: Western Media Version Of Nord Stream Events ‘Incoherent Babble’ (TASS)

Russian Foreign Minister Sergey Lavrov called the latest reports in the Western media about the alleged involvement of a “Ukrainian oligarch” in the explosions on the Nord Stream and Nord Stream 2 gas pipelines “incoherent babble.” “When they threw in the last wave of stories in the American and to some extent in the German press regarding a new version [about the causes of the emergency on gas pipelines] – about “the Ukrainian oligarch, who had better confess himself,” [and that they] “did not want to talk about Ukraine’s involvement, because it could spoil German-Ukrainian relations” and all that jazz: this is incoherent babble,” he said. In an interview with “The Great Game” program on Channel One, the Russian top diplomat noted that even if one accepts the rationale about the “Ukrainian fingerprint” mentioned in the media, it will raise some questions in Germany.

“The burghers will wonder: why do I need this Ukraine at all, if they blow us up, whoever he (the saboteur – TASS) may be – an agent of Kiev, paid for by someone from abroad, or just a lone ranger, why do I need to send Leopards there, why do I need to admit this country into NATO?” Lavrov said. “Yes, now [German Chancellor Olaf] Scholz is boasting: “We survived the winter, Russia’s plan did not work.” We had no plans. They had plans – to abandon Russian gas. They survived the winter, but how much did it cost the government and the taxpayers? They are not very eager to tell,” Lavrov said. He also called the coverage of the incident in the Western media frivolous, citing as an example their information about the establishment of a “Ukrainian connection” in the emergencies on the gas pipelines.

“There was information in the Wall Street Journal, if I’m not mistaken, where they said that back in June and July, the CIA warned the secret services of Germany and other European countries about a “Ukrainian trail” for the plot. And in September, after the attack took place, The Times said that a week after the explosion it was established that the trail was Ukrainian. So, in June they warned that there would be [a Ukrainian trace] and in September it was established that it was. Anyway, they look at it in a very juvenile way, not the way an adult should,” he concluded.

What Lavrov talked about.

• CIA Issued Advance Nord Stream Warning To Allies – WSJ (RT)

The CIA warned allies in the EU about a potential attack by a pro-Ukrainian group on the Nord Stream gas pipelines, the Wall Street Journal reported on Wednesday, citing intelligence officials. According to the report, around June and July of last year, the CIA informed Germany’s Federal Intelligence Service (BND) and other European agencies that three Ukrainian nationals were trying to rent out ships in states around the Baltic Sea, including Sweden, in preparation to target the pipelines, which were eventually attacked in September. As early as one month after the blasts, CIA Director William Burns and the White House’s national security adviser, Jake Sullivan, were said to have been considering the possibility that Kiev had orchestrated the sabotage on the route built to deliver Russian gas to Germany.

The report comes after the New York Times cited US officials on Tuesday as saying that an unidentified “pro-Ukrainian group” may have carried out the bombing. The WSJ said this assessment by US intelligence officials “isn’t definitive” and that they claimed they saw “no indication” that the alleged perpetrators had ties to the Ukrainian government. German news organizations reported this week that investigators were looking at a yacht operated by a Polish-based company that was “apparently” owned by two Ukrainians, in a possible connection with the sabotage. The German authorities later confirmed that they had searched the vessel in January, but did not disclose details about any items seized.

The new reports about alleged Ukrainian involvement contradict last month’s investigation by veteran journalist Seymour Hersh, who cited a source as claiming that the bombing was carried out by the US with help from Norway. The US and Ukraine have both denied any involvement, and the White House dismissed Hersh’s claims as “utterly false.” Kremlin spokesman Dmitry Peskov suggested on Wednesday that the reports about a Ukrainian link were an attempt to divert attention from the real perpetrators and absolve NATO countries. “Obviously, this is a coordinated media hoax campaign,” Peskov said. Moscow has argued that the West is not really interested in a comprehensive international investigation of the incident.

..But waitagoshdarnminnit!..

• Everything, All at Once (Kunstler)

The defining moment of the week was the White House ceremony with Dr. Jill Biden and her side-piece, Tony Blinken, presenting an International Women of Courage award to Ms. Alba Rueda of Argentina, a biological man. But, of course! Kisses all around. Mattias Desmet, author of The Psychology of Totalitarianism, pointed out some time ago that a psychotic political regime would require the people to swallow ever-greater absurdities as things played out in its death-wish drive toward national nullity. But was that little scene more absurd than the regime’s campaign in Ukraine to do… uh, to do what, exactly? To punish Vladimir Putin, or something like that. Or is it nuclear war they’re really after? A war, they’re telling themselves, that we would surely win, as if being a continent-sized ashtray is winning.

Meanwhile, our Intel Community has discovered that it was… well might have been… Ukraine, after all, who blew up the Nord Stream pipelines — with help from some outside parties (namely, America’s Intel Community). But waitagoshdarnminnit! How does that get anybody off-the-hook for the costly caper? NATO supposedly backs Ukraine, right? And Germany is the European leader of NATO, right? So you’re telling me Ukraine blew up a systemically-important asset of a leading country that supports Ukraine? Something doesn’t add up in that-there rebus puzzle. I’ll spare you the mental labor. The US Spook Industrial Complex is just laying another trip on you. And the “you” includes poor bamboozled Germany, led by arguably the biggest sap ever elected by a supposedly advanced nation, Olaf Scholz, whose name will evermore ring through history as a synonym for “chump.”

Sooner or later, one or both of the following must happen: the German people will dump this chump and / or his replacement will find a way to bow out of Germany’s commitment to America’s foolish proxy war against Russia, leading post-haste to the disintegration of NATO, and leaving America’s army of vaccine-injured transsexuals to reconquer the Donbas and Crimea, led by Tony Blinken in an off-the-shoulder cocktail dress. Anyway, by the time that hallucination comes to pass, all the other things that are happening at once will be so vividly in America’s face that the epic sleepwalk of the Walking Woke ends with a jolt like unto a cattle prod upside the brain-pan. For instance, the implosion of our financial markets along with a sudden, shocking expiration of the US dollar as a credible currency. The mighty “woosh” heard from sea to shining sea will be the sound of capital going up in a vapor. The event will halt all that jabber about debt ceilings, budgets, and billions for Ukraine. A nauseated silence spreads across the land. Then, what?

“A whole range of European nations have much more strict regulations in this field..”

• Lavrov Likens Protests In Georgia To 2014 Kiev Coup (RT)

The massive protests Georgia has been facing over the past week closely resemble the 2014 Maidan coup in Ukraine, Russian Foreign Minister Sergey Lavrov said on Friday. Backed by external powers, these protests are just another plot attempt, he told the ‘Great Game’ show on Russia’s Channel 1. Over the last week, thousands of people have gathered by the Georgian parliament in Tbilisi in order to protest a bill that would have required individuals and organizations with foreign funding to register as “agents of foreign influence.”The demonstrators hit the streets after the bill, which was introduced by the ‘Georgian Dream’ party, passed its first reading. The protests quickly spiraled out into clashes with the police in which several officers were injured and dozens of demonstrators were detained.

“[That] closely resembles Kiev’s ‘Maidan’ [coup],” Lavrov said, adding that, “There is no doubt that … the bill was nothing but a pretext for essentially launching a coup attempt.” According to the minister, the bill introduced by the Georgian lawmakers “pales” in comparison to how noncommercial organizations are regulated in the US, France, or Israel. The protests in Georgia have been “orchestrated” from abroad, the Russian minister believes, adding that their real goal is to create another “irritating” situation on Russia’s borders. In pursuing its goals, the West is attempting to sacrifice Georgia’s national interests and close economic ties with Russia, he added. Lavrov also blasted the EU over what he called a “hypocritical” stance on the issue. “A whole range of European nations have much more strict regulations in this field,” the minister insisted, adding that EU top diplomat Josep Borrell still claimed “without batting an eye” that the Georgian bill “contradicts European values” and deprives Georgia of the prospect of joining the bloc.

“The hypocrisy is obvious,” the minister added. Earlier this week, Borrell’s office issued a statement that blasted the bill as “incompatible with EU values and standards” and going “against Georgia’s stated objective of joining the European Union.” The statement also warned of “serious repercussions” for relations between Tbilisi and Brussels if the bill was passed. The Russian minister also pointed out the striking differences in how the EU and the US treated the protests in Georgia and Moldova. While backing demonstrations in Tbilisi, Washington and its allies still condemned similar actions in Moldova, which saw months of protests over a surge in cost of living and energy prices, Lavrov said. His words came as Georgian MPs have rejected the controversial bill during the second reading, despite it being previously withdrawn by its authors. The procedure was necessary for it to be officially squashed. The nation’s authorities have also announced they would be releasing all of the people who had been detained during the protests.

Korybko

https://twitter.com/i/status/1633813474139619330

“The Global South is not on board with helping this proxy war persist, because it makes no sense..”

• Irish MEP Blasts West’s ‘Criminal’ Approach To Ukraine (RT)

Irish MEP Mick Wallace has condemned the EU’s continued military support for Kiev, saying Brussels is not taking the option of peace talks seriously and arguing that Ukraine is being “sacrificed” for the geopolitical “obsessions” of the US. During a speech in the European Parliament, a clip from which Wallace posted to Twitter, he insisted that the EU, led by Washington, was refusing to “take the option of Peace seriously” amid the ongoing conflict with Russia. Instead, Wallace said, the EU was standing by and watching “the slaughter and devastation” continue. “The Global South is not on board with helping this proxy war persist, because it makes no sense,” Wallace said, adding that it is “increasingly clear that Ukraine is being sacrificed for the obsessions of the US establishment.”

The Irish MEP said the only people benefiting from the conflict were “weapons manufacturers and Western corporations,” which he claimed were “buying up Ukraine now for a pittance.” “The Russian invasion is criminal, but the manner in which the West has been dealing with this has also been criminal,” he concluded. Russia has repeatedly said it is open to talks with Ukraine if its leaders accept what the Kremlin calls the “reality on the ground,” referring to the status of the Donetsk and Lugansk People’s Republics, as well as Kherson and Zaporozhye Regions, which voted to join Russia in public referendums last autumn. Ukrainian President Vladimir Zelensky has floated a ten-point “peace formula” that would require Moscow to withdraw all of its troops from the territory Kiev claims as its own. However, Russia has rejected that proposal as unrealistic.

A 12-point peace plan put forward by China was met with a cool response from the West, with NATO Secretary General Jens Stoltenberg saying Beijing does not have “much credibility” in the issue. US State Secretary Antony Blinken, however, admitted that the plan included some “positive elements.” Last week, Wallace also called the September 2022 sabotage of the Russian-German Nord Stream pipelines “a premeditated terrorist attack on critical European infrastructure.” Fellow Irish MEP Clare Daly said it was “jaw-dropping” that the EU was not investigating potential US and Norwegian links to the attack after a report by Pulitzer Prize-winning journalist Seymour Hersh alleged Washington was behind the sabotage.

Sanctions failed. Here’s what’s next: your money.

• Borrell: EU To Increase Financial & Military Support To Ukraine (Az.)

The EU has nearly exhausted its options for punitive measures against Russia and the bloc’s attention needs to shift to financial and military support for Ukraine, the EU’s chief diplomat Josep Borrell told EURACTIV in an exclusive interview, Report informs. “There is not much more to do from the point of view of sanctions, but we can continue to increase financial and military support,” Borrell told EURACTIV in Stockholm, following a meeting of EU defense ministers. “It would be strange that one year after the invasion began, there would be much more options left. We have been using our step-by-step process, and we have been incremental – maybe sometimes too incremental,” he added. Over the past year, the EU has approved 10 rounds of sanctions against Moscow meant to make financing the war more difficult and starve Russia of tech equipment and spare parts for arms to be used against Ukraine.

“But indeed, one year after the invasion, we’re getting to the end of the ladder,” Borrell admitted when asked about the next potential steps the bloc could take in response to Russia’s invasion of Ukraine. “The answer is always the same – to continue supporting Ukraine. Ukraine needs a lot of money just to keep the machinery working, a state at war has a lot of financial needs – this will require a lot of effort from our side – so sanctions and military support are not everything.”. Borrell said battlefield operations were “up to Ukraine to decide” but Europe’s responsibility “is to support them, also by providing arms and ammunition.”

Crazy story competition.

“France’s first lady is actually her own transgender brother..?!

• France’s First Lady Fails In Transgender Lawsuit (RT)

A Paris judge has thrown out Brigitte Macron’s case against two women who claimed in a YouTube show that France’s first lady is actually her own transgender brother. President Emmanuel Macron’s wife had a case for public defamation, but not for invasion of privacy and violation of image, the judge ruled. The video, posted on December 10, 2021, advanced a “completely outlandish” theory that Brigitte Macron was actually the trangender identity of her brother, Jean-Michel Trogneux. The video received hundreds of thousands of views, and the transgender rumor trended on Twitter for several days. The first lady filed a lawsuit in February 2022, almost two months after the video was posted, claiming it violated her “right to image” and invaded her brother’s privacy.

The hours-long video described the surgeries Macron allegedly underwent, denied she had given birth to three children, and publicized personal information about Trogneux, according to the lawsuit. The video was also said to have used “retouched, enlarged and recolored”photographs. Brigitte Macron’s separate lawsuit against the two women, for public defamation, was actually filed two weeks earlier, on January 31, 2022. That case is still pending. The first lady’s official biography says she was born Brigitte Marie-Claude Trogneux to a family of chocolatiers from Amiens. She married a banker named Andre-Louis Auziere in 1974 and had three children. In 1993, when she was 40 and teaching at La Providence Jesuit high school in Amiens, she met Emmanuel Macron – who was 15 at the time, and a classmate of her daughter Laurence.

Brigitte divorced Auziere in 2006 and married Macron in 2007. She is widely reported to have been key to his victory in the 2017 presidential election. Macron had planned to create an official “first lady” position for Brigitte using the American model, complete with a budget and staff, but changed his mind after popular backlash. The transgender rumor about the first lady appeared ahead of France’s 2022 presidential elections and quickly gained traction online. Macron ended up easily winning re-election.

Capuchin bird

The capuchin bird Inhales air which is stored in sacks on either side of its neck, when it’s finished breathing in,

it leans back and give this unexpected callpic.twitter.com/u0w2lOhv9K

— Science girl (@gunsnrosesgirl3) March 10, 2023

Robin Hood

Absolutely heartwarming ♥️ pic.twitter.com/Uiwbgw5uqH

— istanbulmu9 ❦ (@istanbulmu9) March 9, 2023

Father and son

Elephant feet

Elephants' feet are flat because of a large pad of gristle under each heel which acts as a shock absorber and helps them walk quietly. Moreover, they can actually hear with they feet.pic.twitter.com/xct79ng0Mo

They can pick up on noises via their feet, which register low-frequency… https://t.co/Amsc05sPEy— Massimo (@Rainmaker1973) March 10, 2023

Tarantula

https://twitter.com/i/status/1634130152622895108

Animals: Opossum FAQ pic.twitter.com/8sJVaVoROY

— Ben Proj (@ben_proj) March 10, 2023

Support the Automatic Earth in virustime with Paypal, Bitcoin and Patreon.