Salvador Dalí Living still life 1956

Enough to make you nervous?!

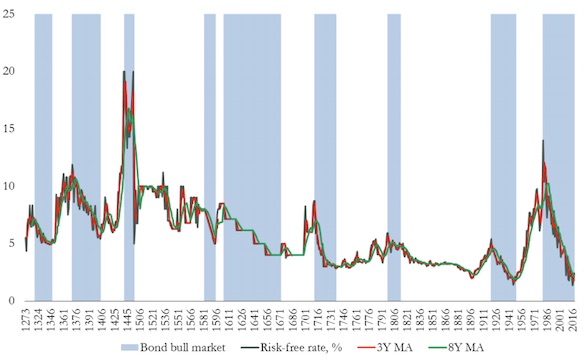

• The Current Bond Bull Market Is The Longest In More Than 500 Years (BI)

We’re currently living through the second longest bond bull market in recorded history, and the longest since the 16th century, according to a new research paper from the Bank of England. Written by Paul Schmelzing, a Harvard PhD candidate currently working with the bank, the paper, titled “Eight centuries of the risk-free rate: bond market reversals from the Venetians to the ‘VaR shock’” — explores hundreds of years of data around real rates and bonds. “This paper presents a new dataset for the annual risk-free rate in both nominal and real terms going back to the 13th century. On this basis, we establish for the first time a long-term comparative investigation of ‘bond bull markets’,” Schmelzing writes.

The paper — which started out as an entry on the Bank of England’s staff blog, Bank Underground — argues that the current bull market in bonds is only surpassed by one longer period of growth in recorded history. “The average length of bond bull markets stands at 25.8 years, and the range falls between 61 years (1451-1511) and 12 years (1718-1729). Our present real rate bond bull market, at 34 years, is already the second longest ever recorded,” Schmelzing writes. Here’s the chart (note that blue shaded areas represent periods of bull markets):

“If US growth slows down markedly … equity valuation and share prices will start falling.”

• Get Ready For A ‘Substantial’ Slowdown In The US Economy – Natixis (CNBC)

One investment bank is urging investors to prepare for the U.S. economy to roll over as early as 2018. “The US economy will in all likelihood slow down substantially: there is a limit to the rise in the participation rate and the employment rate; real wages are slowing down,” wrote Patrick Artus, chief economist at Natixis, on Tuesday. “Investors should therefore prepare for the consequences.” Consequences of this slowdown, notes Artus, include a brief rise in interest rates, a market sell-off and a depreciating dollar. Natixis is a French corporate and investment bank headquartered in Paris. Natixis Global Asset Management oversees roughly $950 billion, according to its website. The analyst also called the current level of corporate investment “abnormally high” and suggested a downward correction.

To be sure, the more mainstream investment banks on Wall Street are not nearly as pessimistic. Wall Street foresees a positive 2.5% change in GDP in the third quarter year over year, according to the consensus estimate collected by Thomson Reuters. The Bureau of Economic Analysis will release GDP number on Friday before the bell. And none of the major banks see a recession on the horizon. The American people are even more bullish. According to CNBC’s All-American Economic Survey, optimism about the economy hit an all-time high earlier this month. Forty-three% of the public believes the economy is in excellent or good condition while the four-quarter average for every major economic metric in the poll is at a record 10-year high.

Goldman Sachs is probably the most bearish on the U.S. economy among major firms, predicting 3.9% annual global growth through 2020, but that U.S. growth will decelerate to just 1.5% annually over that time. [..] Natixis has a warning for clients in the note, “If US growth slows down markedly … equity valuation and share prices will start falling.”

Time to get things out into the open.

• America is in Worse Financial Shape than Russia or China – Kotlikoff (SMN)

America’s 2017 fiscal gap will come in near $6 trillion, nine times higher than the $666 billion deficit announced by the US Department of the Treasury last week, says Laurence Kotlikoff, an economics professor at Boston University. “Our country is broke,” says Kotlikoff, who estimates total US government debts at more than $200 trillion, when unfunded liabilities are included. “We are in worse shape than Russia, China or any developed nation.” Worse, says Kotlikoff, who has testified before Congress, government officials are well-aware that many of America’s debts and accruing liabilities are being written off the books. However, for the most part, they are keeping their mouths shut.

The upshot is a de facto “two-tier” financial reporting system, in which politicians and insiders have access to key data buried in footnotes about unfunded liabilities, which indicate that there are huge problems in the economy. The public, on the other hand, in slews of Presidential and Congressional Speeches and publications, is led to believe that while things are tough, overall everything is OK. According to Kotlikoff, a long-time activist for fiscal rectitude, the problem stems in large part from the fact that the US government has been spending almost all of Americans’ approximately $795 billion in social security payroll taxes to pay current bills, rather than investing them to fund retirees’ benefits. The upshot is that on a net basis, the US government has no money to pay all the benefits that have been promised. Politicians know that defaults will occur, they just haven’t figured out how to finesse this.

Kotlikoff, unlike most, has a solution. He believes that the US government should adopt what he calls “fiscal gap accounting”, which involves putting all future receipts and expenditures on its books. The idea is that if Americans knew about all the money that their politicians were borrowing and spending, they would be able to make better decisions as to the usefulness of those policies. If the US government produced a financial statement that listed the $200 trillion in unfunded liabilities that Kotlikoff says it owes, workers might make different decisions about how much they will save for retirement. Sadly, current de facto US government practice – inspired by Keynesian thinkers such as Paul Krugman – is for governments to spend, tax, borrow and print as much money as possible, in an effort to keep the economy perpetually running at full steam. The idea is to leave future generations to deal with the problems.

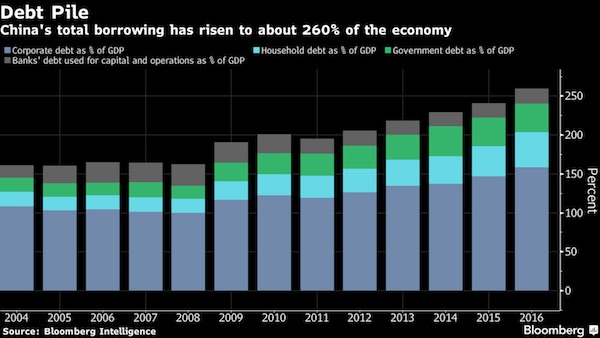

“Today Xi is celebrated in media reports, but when future historians look back, he will be blamed for recklessly building the Chinese economy on a foundation of sand..”

• Xi Has Built Chinese Economy On ‘Foundation Of Sand’ – Kyle Bass (BBG)

Hedge fund manager Kyle Bass, who has been betting against the yuan and warning of a collapse in China’s banking system, said the nation will one day come to regret handing Xi Jinping more power than any leader in decades. “Today Xi is celebrated in media reports, but when future historians look back, he will be blamed for recklessly building the Chinese economy on a foundation of sand,” Bass, founder of Hayman Capital Management, said in an email Wednesday. “Xi desperately seeks credibility, but true developed economies do not impose severe capital controls or move short-term rates hundreds of basis points overnight in attempts to manipulate their own currency.”

At a twice-a-decade congress in Beijing, China’s ruling Communist Party enshrined President Xi’s policies alongside those of former leaders Mao Zedong and Deng Xiaoping. Xi, who has sought to turn China into a global economic power and was the architect of the Belt-and-Road infrastructure drive, had his theories on “socialism with Chinese characteristics for a new era” included in China’s guiding charter. Yet, some foreign investors have been less than impressed as China’s currency has remained sheltered behind exchange restrictions and curbs on foreign investment. They’ve also pointed to China’s ever-growing pile of debt, with borrowing swelling to 260% of GDP at the end of 2016, Bloomberg Intelligence data show. Moody’s and S&P both downgraded the nation this year on risks from soaring debt.

Bass, who has called for a 30% drop in the Chinese currency, said in an interview earlier this month that he expects the government to relax its grasp on the exchange rate after the National Party Congress. He said he believed once Xi consolidates power, he’ll allow natural economic forces to play out within the banking system. “China remains an emerging backwater when it comes to global currency settlements,” he said Wednesday.

Tech.

• China US Buying Spree Prompts Move to Toughen Deal Reviews (BBG)

Lawmakers in Washington, spurred by Chinese acquisitions of American firms, are moving to broaden the government’s authority to scrutinize overseas investment in the U.S. with bi-partisan legislation set to be proposed in the coming days, according to people familiar with the matter. The bill would expand the power of a national security panel to review investments by foreigners to include joint ventures and minority stakes in companies, according to documents detailing the legislation obtained by Bloomberg. Lawmakers say the current framework for reviews conducted by the Committee on Foreign Investment in the U.S., or CFIUS, misses deals that pose national security risks because the panel focuses primarily on full acquisitions of American companies even though foreigners conduct a range of deal types in the U.S.

“Many Chinese investments are coordinated state-driven efforts to target critical American infrastructure and disrupt our defense supply-chain requirements,” said Republican Congressman Robert Pittenger of North Carolina, one of the sponsors of the legislation. “Our bi-partisan bill strengthens and modernizes CFIUS to give the government the necessary tools to better track and evaluate Chinese investments.” The Defense Department has raised concerns about Chinese investors financing American start-ups that are developing leading-edge technology in sectors with military applications like artificial intelligence, augmented reality and robotics. Those types of investments generally avoid CFIUS scrutiny because they’re not full acquisitions.

The proposal follows a drumbeat of concerns from lawmakers about recent Chinese deals in U.S. technology, agriculture and financial services. Chinese acquisitions and minority investments in the U.S. peaked in 2016 at $45.9 billion, up from $17.7 billion in 2015, according to Bloomberg data. Chinese deals in 2017 so far are behind 2016’s pace at $23.6 billion. Several Chinese deals have fallen apart this year after encountering objections from CFIUS, an interagency panel that reviews foreign acquisitions of U.S. companies for national security risks. The panel is led by the Treasury Department and includes officials from the Defense, State and Justice departments among others. While CFIUS can impose changes to deals, only the president can block them.

Wonder where Britain will be in 5 years, 10.

• S&P: Britain’s £200 Billion Consumer Debt Boom Is ‘Unsustainable’ (BI)

Double-digit growth in UK consumer debt this year should alarm British lenders, according to credit rating agency Standard and Poor’s. S&P said in a report on Tuesday that consumer credit — which constitutes borrowing like car finance and credit cards — has climbed over £200 billion this year in a low-interest rate market, and warned that losses from lenders could lead to ratings agencies downgrading UK lenders. The agency added that while near-term credit risk remains low, “the recent double-digit annual growth rate in U.K. consumer credit would be unsustainable if it continued at the same pace.” The report also highlighted the Bank of England’s concern over consumer credit levels, which have grown by 10% this year while household income growth has grown by only 2%.

“The Bank of England’s recent assessment of stressed losses on consumer credit lending, brought forward as part of its annual stress test results, also indicates that the regulator is concerned that the resilience of these portfolios may be reducing,” it said. S&P Global Ratings credit analyst Joseph Godsmark said lenders had not been seriously tested on their ability to pull back lending since the 2008 financial crisis. “Although we consider that near-term credit risk remains low, past experience shows that lenders find it hard to avoid inherent cyclicality in consumer credit, and the impact can be severe,” he said.

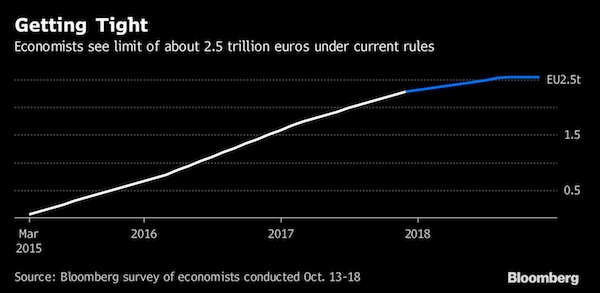

End of an era.

• Mario Draghi Is Preparing For His Final Act As ECB President (BBG)

Mario Draghi is preparing for the final act in his dramatic tenure as ECB president. The ECB’s meeting on Thursday to discuss how and when it should bring large-scale bond purchases to an end is one of the most keenly anticipated by investors and economists since early 2015 when the program was unveiled. The decision will be announced at 1:45 p.m. in Frankfurt and Draghi will speak 45 minutes later. It’s something of a crossroads for the ECB chief, who faced down the sovereign-debt crisis and near-deflation in the euro area but may end his term in October 2019 without reaching the central bank’s inflation goal or raising interest rates. The Governing Council looks likely to cut monthly asset purchases from 60 billion euros ($71 billion) and stretch them out for as long as capacity allows while it waits for consumer-price growth to pick up.

The president won’t want to repeat the mistake of his predecessor Jean-Claude Trichet who raised interest rates twice in his final months in charge in 2011, only for Draghi to reverse the hikes shortly after taking office. Economists in a Bloomberg survey foresee a nine-month extension of quantitative easing at around 30 billion euros a month, starting in January. There are a range of potential outcomes though – with some officials pushing for QE to end sooner, Bloomberg economists expect a six-month extension at €40 billion. Most commentators expect the ECB to keep its pledge to extend the program further if needed. The central bank is also considering highlighting a related measure: the reinvestment of the proceeds of bond holdings as they mature. That additional spending, which will average about €15 billion a month in 2018 and could run for years, could work as a shock absorber amid any market concerns about the pullback in stimulus.

Economists don’t expect any change to the forward guidance that interest rates will remain unchanged until “well past” the end of net asset purchases. They foresee a rate hike, which would be the first under Draghi’s presidency, only in the first half of 2019 at the earliest. A critical factor for the ECB is the amount of debt still available under its own rules. Some officials see room for little more than €200 billion of purchases in 2018, which would bring total holdings to around €2.5 trillion.

It’s happening. It’ll be painful.

• Sydney Apartment Market Has Cracked (Aus.)

As readers know I have been warning the nation that our banking industry is undertaking a property credit squeeze on a scale not seen for decades. For the most part the regulators and the bankers are inexperienced and are operating in silos so have not understood the combined power of the weapons they are using. Many will be shocked at the results of their actions and by what is to come. In putting numbers to the extent of the fall readers need to understand that the cracking process has been sudden and parts of the Sydney apartment market and other Sydney residential property markets have yet to receive the impact. Many will not fall as much as the big Sydney apartment estate markets, which also led the rise. If you want a headline figure, apartments sold as used apartments in the big Sydney apartment estates have fallen by at least 20%.

The fall rate for individual sales can rise to 25%. These are huge declines by any measure although in Melbourne 18 months after the 1987 share crash falls of 50% were common. However the price fall in new apartments bought either off the plan or as the developer sells a completed apartment are down in the vicinity of 12%. As I will describe later there are good reasons for the difference. And so a hypothetical apartment bought by an investor or a residential buyer for, say, $1 million in the boom (most two bedroom apartments were selling for between $1.2 million and $1.4 million) is now selling for $800,000 — a 20% decline. If I want to buy that hypothetical $1 million apartment off the plan or as a completed unit it would cost about $880,000 — a 12% decline.

She has to amend TPP to get it done.

• New Zealand To Ban Foreign Buyers Snapping Up Existing Homes (G.)

New Zealand is planning to ban foreign buyers from purchasing existing homes in an attempt to tackle a housing crisis by halting a trend among the world’s wealthy to snap up property in the country. The restrictions announced by the prime minister-designate, Jacinda Ardern, are likely to be closely watched by other countries around the world also facing housing shortages and price rises driven by foreign investors. At 37, Ardern has become New Zealand’s youngest leader for 150 years. New Zealand has become a destination for Chinese, Australian and Asian buyers and has gained a reputation as a bolthole for the world’s wealthy – who view it as a safe haven from a potential nuclear conflict, the rise of terrorism and civil unrest, or simply as a place to get away from it all.

The country has become a hotspot for wealthy Americans seeking an escape from political upheaval elsewhere, who view it as a stable nation with robust laws and far from potential conflict zones. Peter Thiel, the co-founder of PayPal and a Facebook board member and donor to Donald Trump’s campaign, is among those to have purchased property in New Zealand. Global financiers have been increasingly snapping up properties in the country. Speaking at the annual gathering of the world’s elite in Davos, Robert Johnson, the president of the Institute for New Economic Thinking, said: “I know hedge-fund managers all over the world who are buying airstrips and farms in places like New Zealand because they think they need a getaway.”

Reports by Bloomberg and the New Yorker have suggested dozens of Silicon Valley futurists are secretly preparing for doomsday, acquiring boltholes in the country. Jack Ma, the man behind Alibaba, China’s answer to Amazon and its richest man, is also reported to have shown interest in buying a home there. Land sales to foreign buyers are booming in New Zealand, with 465,863 hectares (1.16m acres) bought in 2016, an almost sixfold increase on the year before. That is the equivalent to 3.2% of farmland in a country of 4.7 million people.

The price of freedom. Pray for peace.

• Almost 1,400 Companies Have Left Catalonia Since October 2 (ZH)

A total of 1,394 companies moved their headquarters from Catalonia to other regions of Spain between 2 and 23 October, according to data from the Association of Commercial Registrars of Spain. On Monday, a total of 92 companies emerged, after recording highs at the end of last week. As El Economista reports, the vast majority (1,255) of the companies that left Catalonia had their headquarters in the province of Barcelona, while 25 left Gerona, 57 moved from Lleida and 57 did so from Tarragona. In the period between 2 and 9 October, the number of companies leaving Catalonia was 219 entities, while this figure rose to 551 companies until day 11, to 700 companies until October 16, to 805 until day 17, 917 until Wednesday 18, 1,185 until Thursday 19 and 1,302 until Friday 20. With the departures of Monday 23, there are already 1,394 companies.

The days with the greatest number of transfers of headquarters of Catalonia were 19 of October, with 268; on October 9, with 212 outgoing entities, and on October 10, with 177 companies. After the rebound experienced from day 16 (68 transfers), when the trend was that each day increased the number of exits, to the maximum of 19 (268 transfers), on Friday decreased the number of companies that changed their registered office outside of the community (117), a decline that continued this week (92 on Monday). Without taking into account weekends or holidays, every 15 minutes and a half leaves a company from Catalonia. For its part, a total of 55 companies from outside Catalonia moved their headquarters to the region between 2 and 23 October, 48 of them to the province of Barcelona. We wonder how that ratio will change after today…

They’ve been in the same government for years. Gabriel should have spoken out sooner.

• ‘Schaeuble Has Reduced Europe To Rubble’ – German Foreign Minister (Tel)

Germany’s foreign minister launched an extraordinary attack on the country’s outgoing finance minister on Tuesday, exposing deep divisions within Angela Merkel’s government of the last four years. On the day Wolfgang Schäuble was elected speaker of the German parliament, Sigmar Gabriel accused him of “reducing Europe to a pile of rubble which has to put back together by others”. In an interview with several German newspapers, Mr Gabriel said the former finance minister had “succeeded in turning almost all EU member states against Germany” with his hardline stance against Eurozone bailouts. What made the outburst more remarkable was that Mr Gabriel served alongside Mr Schäuble as economy minister and vice-chancellor for much of the period he was describing.

Mr Schäuble has long been a divisive figure in European politics. As Mrs Merkel’s long-serving finance minister, he is feted in Germany for presiding over a period of economic strength. But he is hated in countries like Greece for his deep-seated aversion to bailing out the poorer performing economies of southern Europe. The foreign minister’s outburst is the first sign that Mr Schäuble’s policies were disliked much closer to home — within Mrs Merkel’s government. Mr Gabriel led his Social Democrats (SPD) into coalition with Mrs Merkel’s Christian Democrats (CDU) in 2013 — only for his party to suffer its worst ever defeat in last month’s election. Although the SPD has announced it is going into opposition, Mr Gabriel and other ministers are staying on in a caretaker government while Mrs Merkel holds talks on putting together a new coalition with the pro-business Free Democrats (FDP) and the Greens.

The 75-year-old Mr Schäuble agreed to become speaker to free up the finance ministry, which the FDP is widely expected to demand as the price for its support. He was elected unopposed in Tuesday’s first sitting of the newly elected parliament. But in a sign that Mr Gabriel had spoken for many in his party, his nomination was not applauded from the SPD benches, against tradition.

Home › Forums › Debt Rattle October 26 2017